Global Soil Moisture Sensor Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD6481

December 2024

93

About the Report

Global Soil Moisture Sensor Market Overview

- The global soil moisture sensor market is valued at USD 371 million, based on a five-year historical analysis. The growth of this market is primarily driven by the increasing need for precision agriculture and the rising awareness of water conservation techniques, especially in regions facing water scarcity. Moreover, advancements in sensor technology and the integration of Internet of Things (IoT) systems in agricultural practices are supporting the adoption of soil moisture sensors. Continuous innovation in sensor accuracy and cost reduction is also propelling the market forward.

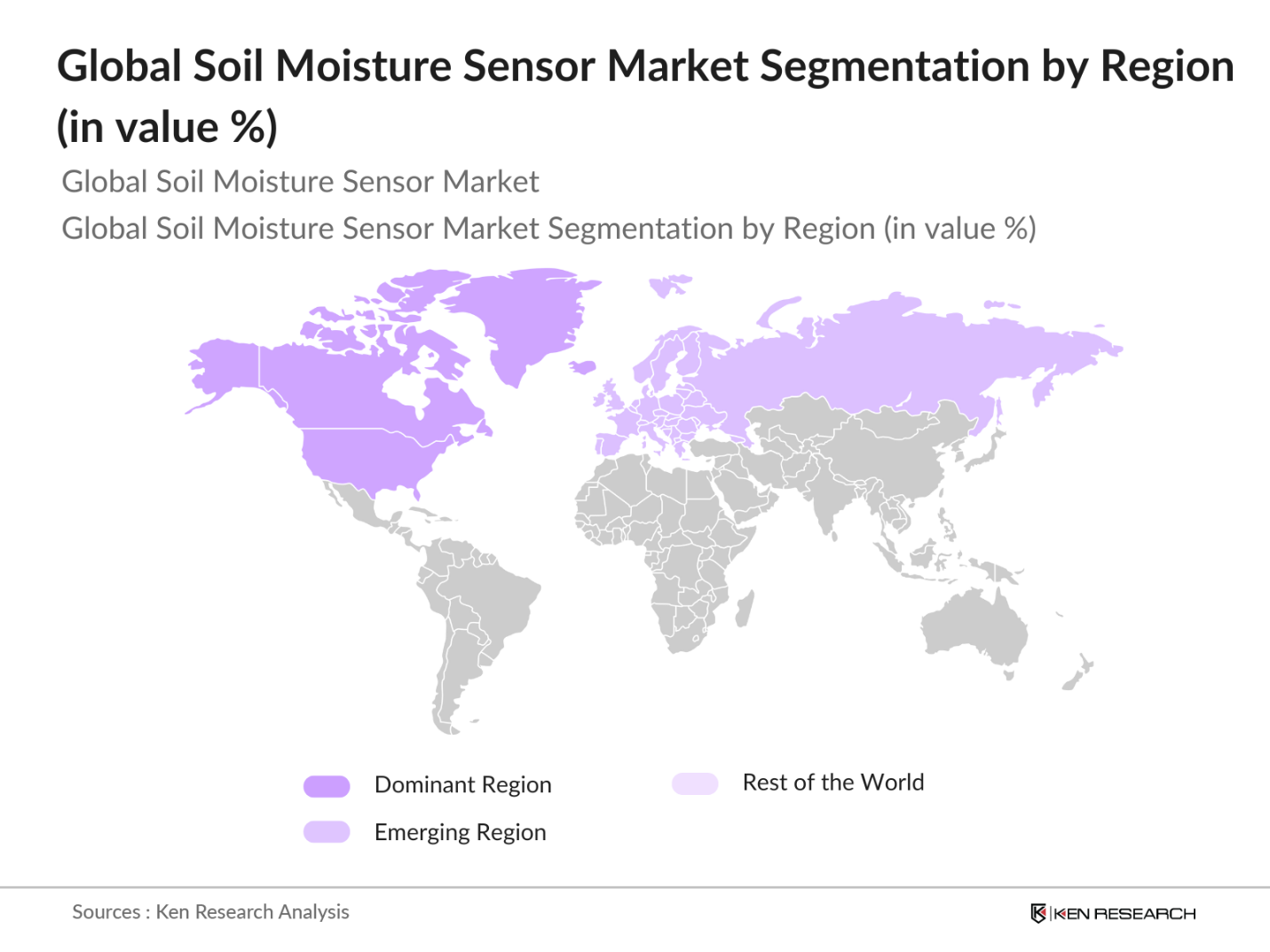

- North America and Europe dominate the global soil moisture sensor market due to their well-established agricultural infrastructure and higher adoption rates of precision farming techniques. The United States, in particular, leads due to the vast agricultural industry and strong government initiatives promoting sustainable farming practices. Meanwhile, in Europe, countries like Germany and the Netherlands excel due to their advanced technological solutions and proactive environmental regulations that encourage resource-efficient farming methods.

- Governments are implementing stricter environmental regulations, requiring agricultural operations to comply with soil and water usage reporting standards. According to the Environmental Protection Agency (EPA), new regulations in the U.S. mandate that farms over a certain size report their water usage annually. Soil moisture sensors are crucial for meeting these compliance requirements by providing accurate data on water consumption.

Global Soil Moisture Sensor Market Segmentation

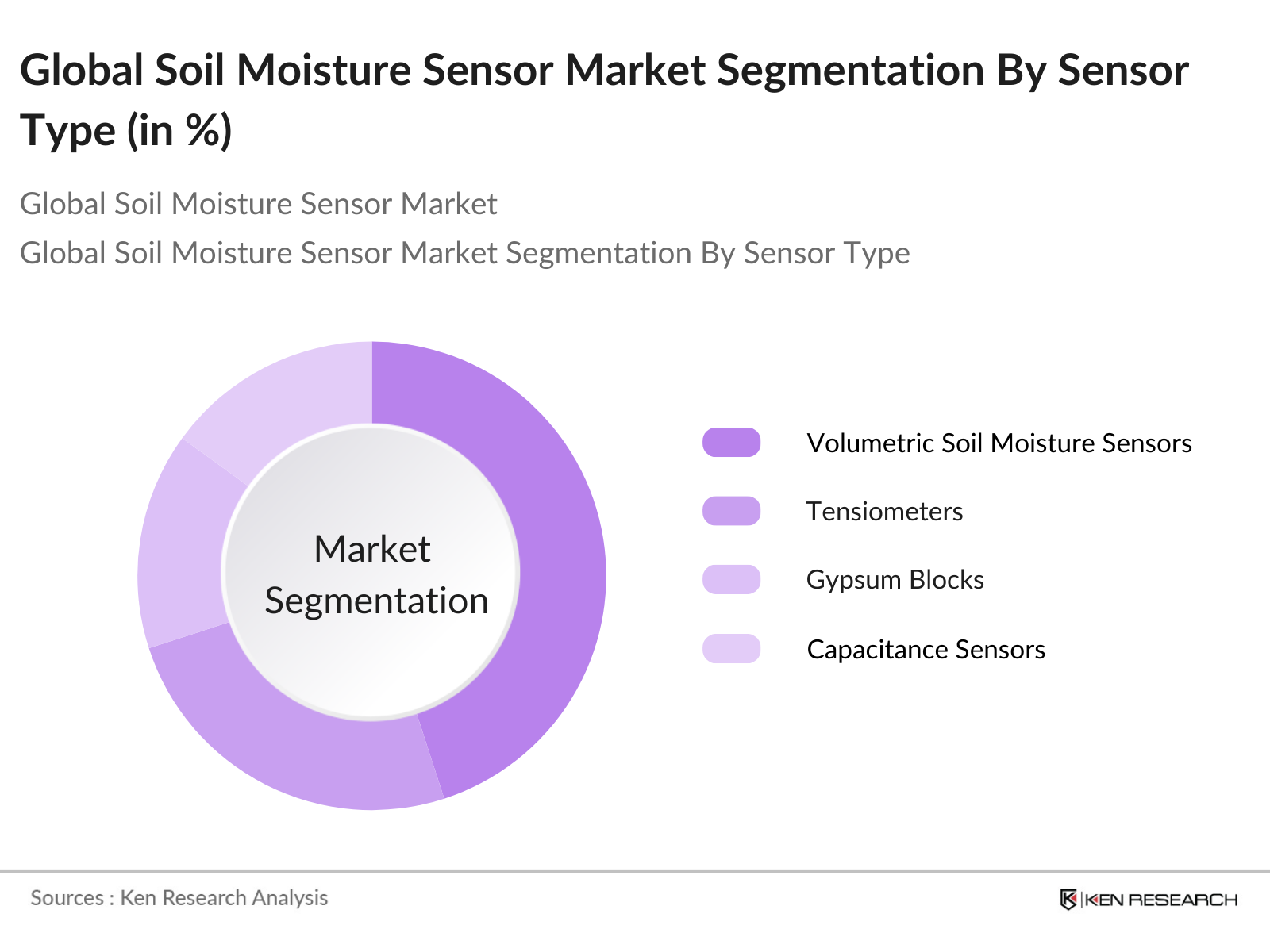

By Sensor Type: The soil moisture sensor market is segmented by sensor type into volumetric soil moisture sensors, tensiometers, gypsum blocks, and capacitance sensors. Recently, volumetric soil moisture sensors hold the dominant market share under this segmentation due to their higher accuracy and reliability in various agricultural applications. These sensors are preferred in precision agriculture due to their capability to provide real-time data on soil moisture content, leading to better water management and improved crop yields.

By Application: In terms of application, the market is segmented into agriculture, construction and landscaping, research and education, and environmental monitoring. Agriculture dominates the application segment due to the growing demand for precision farming technologies, especially in regions with water scarcity. Farmers are increasingly adopting soil moisture sensors to optimize irrigation, reduce water usage, and enhance crop yields, contributing to this segments growth.

By Region: The soil moisture sensor market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America holds the largest market share, primarily driven by the high adoption of precision agriculture and environmental monitoring initiatives in the United States and Canada. The presence of major market players in this region also plays a pivotal role in the market's dominance.

Global Soil Moisture Sensor Market Competitive Landscape

The global soil moisture sensor market is dominated by a few major players, with companies leveraging innovation, strategic partnerships, and geographical expansion to maintain their competitive edge. These firms continue to invest heavily in research and development to improve the efficiency and accuracy of soil moisture sensors. The competition is further intensified by the presence of startups focusing on disruptive sensor technologies. This consolidation emphasizes the significant influence of these key companies, making it a highly competitive market.

Global Soil Moisture Sensor Industry Analysis

Growth Drivers

- Rising Need for Precision Agriculture: Precision agriculture is becoming essential as the global population is expected to reach 8.9 billion by 2030, driving the need for efficient farming techniques. According to the Food and Agriculture Organization (FAO), the global agricultural output needs to increase by 60% to meet food demands. Soil moisture sensors play a crucial role by optimizing water usage, reducing wastage, and increasing yield.

- Growing Environmental Monitoring Initiatives: Environmental monitoring is critical for mitigating climate change and managing resources. Governments worldwide have been increasingly focused on monitoring soil health, water usage, and agricultural emissions. According to the United Nations Environment Programme (UNEP), 40% of the world's land is degraded due to poor soil and water management. Soil moisture sensors are instrumental in monitoring water levels and soil health, providing real-time data for better environmental practices.

- Expansion of IoT in Agriculture: The Internet of Things (IoT) has seen rapid integration in agriculture, providing real-time data through connected devices like soil moisture sensors. The number of IoT devices globally is projected to surpass 29 billion in 2024, as reported by Statista, with agriculture accounting for a significant share. The push for IoT adoption is driven by the need for data-driven farming solutions to increase productivity and sustainability.

Market Challenges

- High Initial Investment in Sensor Technology: One of the key barriers to the widespread adoption of soil moisture sensors is the high initial investment cost, particularly for small-scale farmers. According to the International Fund for Agricultural Development (IFAD), smallholders account for 70% of the world's farms but often lack the capital for advanced technologies. The cost of high-precision sensors ranges from $1,000 to $5,000 per unit, making them inaccessible for many.

- Limited Adoption in Developing Regions: Adoption rates for soil moisture sensors remain low in developing countries, primarily due to poor infrastructure and financial constraints. According to the World Bank, over 3.5 billion people live in rural areas in developing nations, with limited access to agricultural technology. This lack of access hinders the implementation of smart farming techniques, including soil moisture sensors.

Global Soil Moisture Sensor Market Future Outlook

Over the next five years, the global soil moisture sensor market is expected to witness substantial growth driven by the increasing adoption of precision agriculture, the need for efficient water management, and advancements in IoT-enabled smart farming technologies. Rising awareness about sustainable farming practices and government support for water conservation initiatives are also expected to fuel the market's growth trajectory.

Market Opportunities

- Integration with Smart Irrigation Systems: The integration of soil moisture sensors with smart irrigation systems presents a significant opportunity for enhancing water efficiency. According to the FAO, about 60% of the water used in agriculture is wasted due to inefficient irrigation techniques. Smart irrigation systems, guided by real-time data from soil moisture sensors, can reduce water usage by up to 30%.

- Growing Demand for Sustainable Agriculture: The demand for sustainable agricultural practices is on the rise as consumers and governments push for eco-friendly food production. According to the World Resources Institute (WRI), agriculture contributes to about 25% of global greenhouse gas emissions, with inefficient water use and soil degradation being significant factors. Soil moisture sensors help mitigate these issues by optimizing water usage, promoting soil health, and reducing emissions.

Scope of the Report

|

Sensor Type |

Volumetric Soil Moisture Sensors Tensiometers Gypsum Blocks Capacitance Sensors |

|

Application |

Agricultural Construction and Landscaping Research and Education Environmental Monitoring |

|

End-user |

Farmers Research Institutes Agronomists Government Bodies |

|

Technology |

Analog Soil Moisture Sensors Digital Soil Moisture Sensors |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Government Agencies and Regulatory Bodies (USDA, DEFRA, Ministry of Agriculture)

Farmers and Agribusinesses

Agronomists and Soil Scientists

Environmental Monitoring Organizations

Irrigation System Providers

Investors and Venture Capitalists Firms

Water Conservation Bodies

Companies

Players Mentioned in the Report

The Toro Company

Campbell Scientific, Inc.

Decagon Devices, Inc.

Delta-T Devices Ltd

Sentek Technologies

Stevens Water Monitoring Systems, Inc.

Irrometer Company, Inc.

Acclima Inc.

AquaCheck Pvt. Ltd.

METER Group, Inc. USA

Table of Contents

1. Global Soil Moisture Sensor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Sensor Type, Application, End-user, Geography)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Value Chain Analysis

2. Global Soil Moisture Sensor Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Technological Advancements, Major Investments)

3. Global Soil Moisture Sensor Market Analysis

3.1. Growth Drivers

3.1.1. Rising Need for Precision Agriculture

3.1.2. Growing Environmental Monitoring Initiatives

3.1.3. Government Support and Funding

3.1.4. Expansion of IoT in Agriculture

3.2. Market Challenges

3.2.1. High Initial Investment in Sensor Technology

3.2.2. Limited Adoption in Developing Regions

3.2.3. Data Accuracy and Calibration Issues

3.3. Opportunities

3.3.1. Integration with Smart Irrigation Systems

3.3.2. Growing Demand for Sustainable Agriculture

3.3.3. Research & Development in Advanced Sensing Technologies

3.4. Trends

3.4.1. Adoption of Wireless and Remote Monitoring Technologies

3.4.2. Use of Cloud-Based Data Analytics

3.4.3. Increased Penetration in Water Conservation Programs

3.5. Government Regulations

3.5.1. Environmental Compliance and Reporting Standards

3.5.2. Water Conservation Mandates

3.5.3. Agricultural Subsidies and Funding for Technological Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Soil Moisture Sensor Market Segmentation

4.1. By Sensor Type (In Value %)

4.1.1. Volumetric Soil Moisture Sensors

4.1.2. Tensiometers

4.1.3. Gypsum Blocks

4.1.4. Capacitance Sensors

4.2. By Application (In Value %)

4.2.1. Agricultural

4.2.2. Construction and Landscaping

4.2.3. Research and Education

4.2.4. Environmental Monitoring

4.3. By End-user (In Value %)

4.3.1. Farmers

4.3.2. Research Institutes

4.3.3. Agronomists

4.3.4. Government Bodies

4.4. By Technology (In Value %)

4.4.1. Analog Soil Moisture Sensors

4.4.2. Digital Soil Moisture Sensors

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Soil Moisture Sensor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. The Toro Company

5.1.2. Campbell Scientific, Inc.

5.1.3. Decagon Devices, Inc.

5.1.4. Delta-T Devices Ltd

5.1.5. Sentek Technologies

5.1.6. Stevens Water Monitoring Systems, Inc.

5.1.7. Irrometer Company, Inc.

5.1.8. Acclima Inc.

5.1.9. AquaCheck Pvt. Ltd.

5.1.10. METER Group, Inc. USA

5.1.11. SDEC France

5.1.12. IMKO Micromodultechnik GmbH

5.1.13. Spectrum Technologies, Inc.

5.1.14. E.S.I. Environmental Sensors Inc.

5.1.15. Dynamax Inc.

5.2. Cross Comparison Parameters (Revenue, Geographic Presence, Sensor Technology, Application Focus, Innovation Index, R&D Expenditure, Number of Patents, Client Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Soil Moisture Sensor Market Regulatory Framework

6.1. Environmental Standards

6.2. Agricultural Standards

6.3. Certification Processes

7. Global Soil Moisture Sensor Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Soil Moisture Sensor Future Market Segmentation

8.1. By Sensor Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-user (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Global Soil Moisture Sensor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategy

9.4. Strategic Partnerships and Alliances

9.5. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first step, an ecosystem map of all major stakeholders within the global soil moisture sensor market was constructed. Extensive desk research and secondary data sources were used to identify and define critical market variables, such as sensor technology adoption and regional market trends.

Step 2: Market Analysis and Construction

In this phase, historical data on the soil moisture sensor market was compiled, including sensor penetration rates and the revenue generation from different market segments. These statistics were assessed to ensure reliability and comprehensiveness, providing a solid foundation for market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through in-depth interviews with industry professionals using computer-assisted telephone interviews (CATI). Insights from these experts helped refine and corroborate the market analysis data.

Step 4: Research Synthesis and Final Output

In the final step, direct engagements with sensor manufacturers were carried out to acquire detailed insights into segment-specific sales and consumer preferences. The synthesized research outputs formed the basis of this comprehensive market report, ensuring accuracy and market relevance.

Frequently Asked Questions

01. How big is the global soil moisture sensor market?

The global soil moisture sensor market is valued at USD 371 million, based on a five-year historical analysis. The growth of this market is primarily driven by the increasing need for precision agriculture and the rising awareness of water conservation techniques, especially in regions facing water scarcity.

02. What are the challenges in the global soil moisture sensor market?

Key challenges include high initial investment costs and limited adoption in developing regions, where farming practices may not yet support high-tech solutions like moisture sensors.

03. Who are the major players in the global soil moisture sensor market?

Major players include The Toro Company, Campbell Scientific, Inc., Decagon Devices, Inc., Delta-T Devices Ltd, and Sentek Technologies, each driving market innovation through advanced sensor technology.

04. What are the growth drivers of the global soil moisture sensor market?

Growth drivers include the rise of precision farming, government support for water conservation, and technological advancements such as IoT integration with soil moisture sensors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.