Global Solar Panel Recycling Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD6741

October 2024

89

About the Report

Global Solar Panel Recycling Market Overview

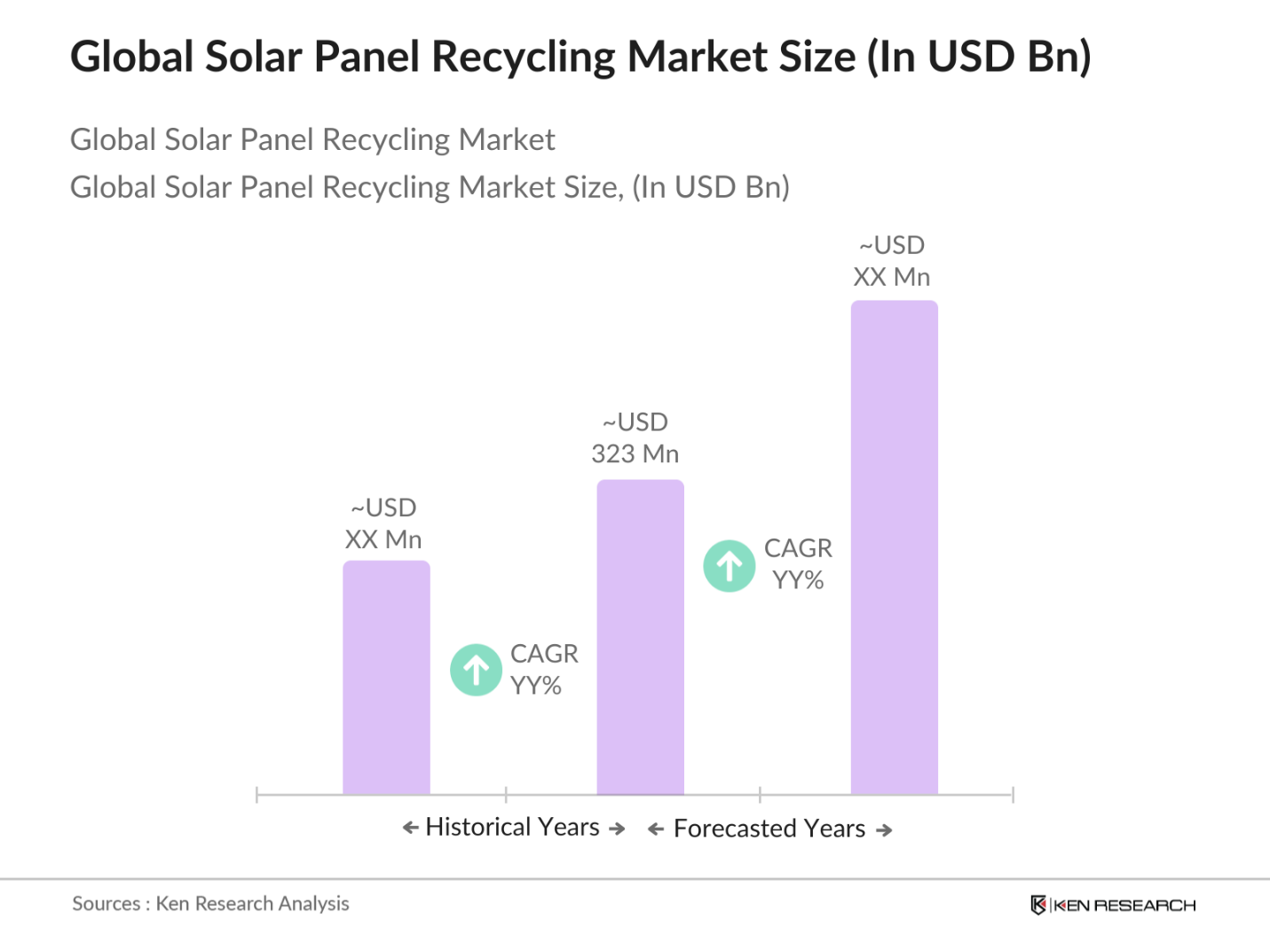

- The global solar panel recycling market is valued at USD 323 million, driven by the increasing demand for renewable energy and the surge in solar installations worldwide. The rising issue of solar panel waste, combined with government regulations enforcing the proper disposal and recycling of electronic waste, has boosted the recycling sector.

- Countries such as Germany and Japan lead the global solar panel recycling market due to their stringent e-waste regulations and established recycling frameworks. Germany, with its robust waste management policies, and Japan, with its technological advancements in recycling processes, have created a favorable environment for the recycling industry. These regions are also at the forefront of solar energy adoption, making them dominant players in this sector.

- In 2022, the U.S. Department of Energy launched the Solar Energy Technologies Office (SETO) initiative to focus on recycling and end-of-life management for solar panels. This initiative includes funding of $10 million to develop new technologies for efficient recycling and material recovery. The office is also working on strategies to create a nationwide solar panel recycling program. In addition, the government is incentivizing businesses through tax credits and grants for investing in solar recycling infrastructure.

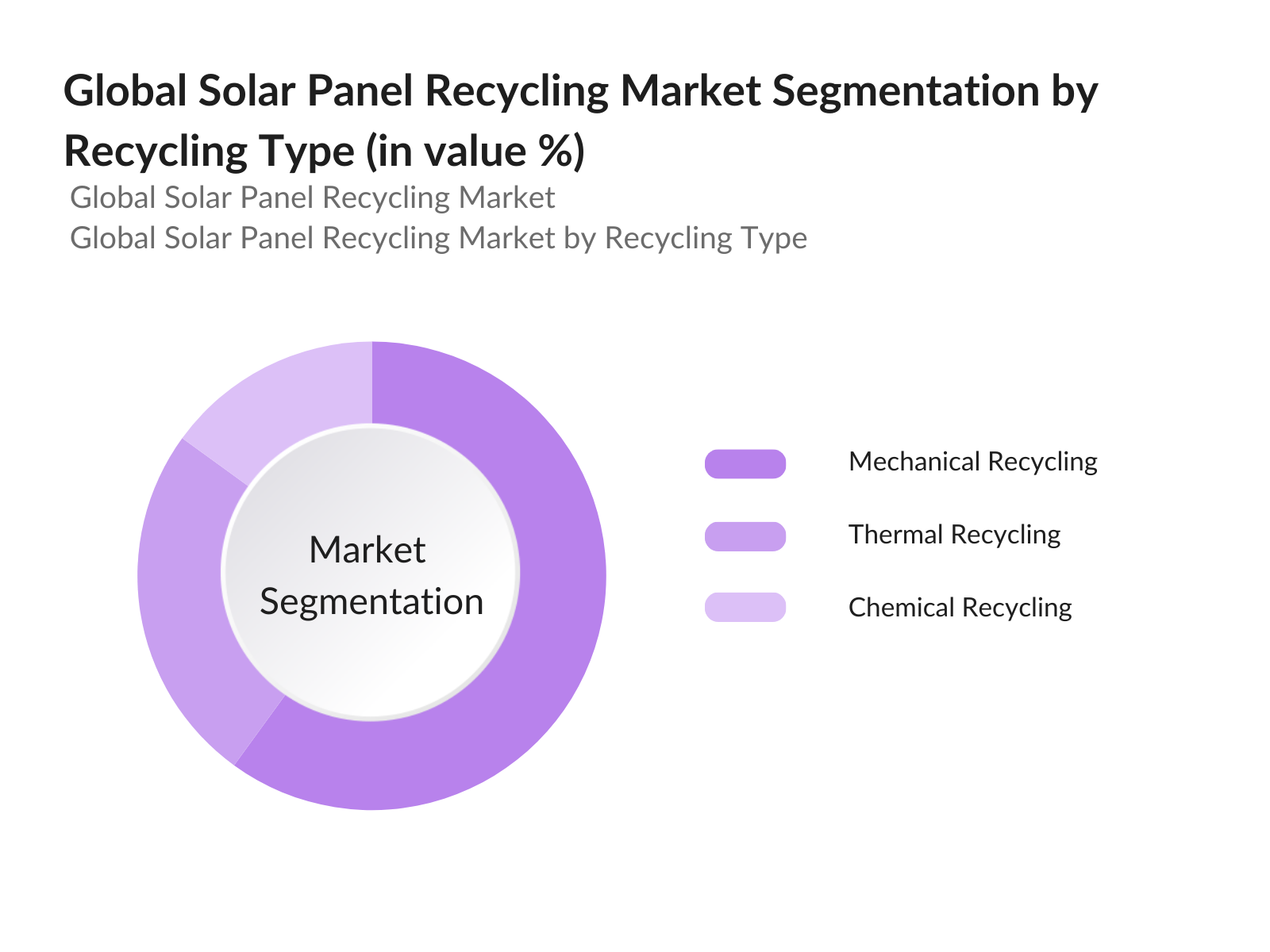

Global Solar Panel Recycling Market Segmentation

By Recycling Type: The global solar panel recycling market is segmented by recycling type into mechanical, thermal, and chemical recycling. Mechanical recycling holds the largest market share due to its cost-effectiveness and widespread adoption. Mechanical processes are preferred because they allow for easy separation of materials such as glass and aluminum, which are then reused in the manufacturing of new panels. This dominance is expected to continue as recycling technologies advance.

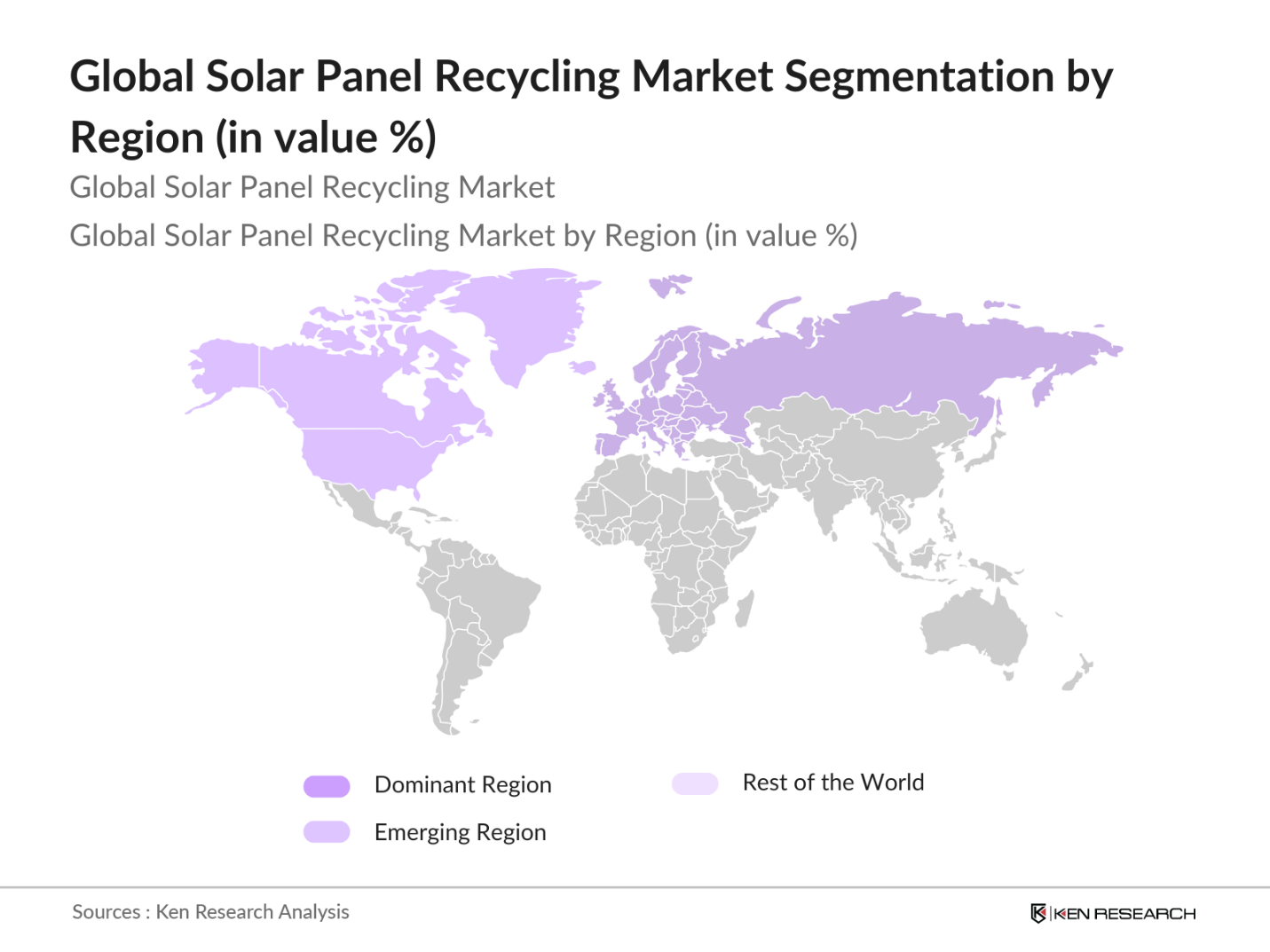

By Region: The global solar panel recycling market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Europe dominates the market due to its strong regulatory framework and high solar installation rates. The European Union has set ambitious recycling targets, promoting sustainability across industries. Asia-Pacific is growing rapidly due to rising solar panel installations and the increasing focus on sustainability in countries like China and India.

Global Solar Panel Recycling Market Competitive Landscape

The global solar panel recycling market is consolidated with several major players leading the industry. Companies are focused on expanding their recycling capacities, forming strategic partnerships, and investing in new technologies to improve recycling efficiency. The competition is intense, with key players dominating through their extensive recycling networks, technological advancements, and strategic initiatives.

|

Company |

Establishment Year |

Headquarters |

Recycling Capacity (tons) |

No. of Recycling Plants |

Technological Innovation |

Revenue from Recycling (USD mn) |

Sustainability Initiatives |

|

First Solar Recycling |

1999 |

Arizona, USA |

5000 |

10 |

Thin-film recycling |

250 |

Closed-loop recycling |

|

Veolia |

1853 |

Paris, France |

|||||

|

Envaris |

2009 |

Berlin, Germany |

|||||

|

Reclaim PV |

2014 |

Adelaide, Australia |

|||||

|

Silcontel |

2006 |

Tokyo, Japan |

Global Solar Panel Recycling Market Analysis

Market Growth Drivers

- Growth in Renewable Energy Investments: Global investments in renewable energy continue to rise, driven by increased demand for clean energy sources. In 2023, global renewable energy investments reached $490 billion, with a notable portion allocated to solar energy infrastructure. Countries like the U.S., China, and India have collectively spent over $230 billion on solar energy installations. This surge in solar installations directly contributes to the need for robust recycling facilities to manage end-of-life solar panels, aligning with national sustainability targets. According to the International Renewable Energy Agency (IRENA), by 2024, nearly 78 million metric tons of solar panels will be installed globally.

- Government Initiatives for Sustainable Energy: Governments globally are emphasizing sustainable energy solutions. The European Unions Green Deal, which allocates over $1 trillion towards climate actions, has a direct focus on sustainable recycling mechanisms, including solar panels. In China, the government announced a $150 billion investment in renewable energy, with solar panel recycling playing a significant role in minimizing waste. These initiatives provide essential regulatory frameworks that support the growth of solar panel recycling facilities, helping the market evolve.

- Decreasing Solar Panel Lifespan: With technological advancements and increased panel production, the lifespan of solar panels is declining. The average operational life of panels has reduced from 30 years to approximately 20 years. In 2023, global solar panel waste accounted for nearly 250,000 metric tons, which is expected to double by 2025 due to the shorter lifespan. This accelerates the need for recycling initiatives to manage the growing waste generated by obsolete panels, bolstering the demand for specialized solar recycling plants.

Market Challenges:

- Limited Skilled Workforce: The solar panel recycling industry requires a highly skilled workforce to manage the sophisticated technology involved in extracting valuable materials. However, in 2023, only 18,000 skilled workers were employed globally in this sector, concentrated mainly in Europe and North America. Countries like India and China, despite their large solar markets, face a shortage of trained personnel, limiting the speed at which new recycling plants can be set up and operated efficiently.

- High Initial Setup Cost for Recycling Facilities: The high cost of establishing recycling plants presents a significant challenge. Setting up a recycling facility for solar panels requires an investment of $25 million to $35 million for a mid-sized plant. In regions like Europe and North America, these costs are exacerbated by labor and environmental compliance costs. For instance, in 2023, solar panel recycling companies in Germany invested $40 million in infrastructure and technology to meet recycling demands, which increases barriers to entry for new players in the market.

Global Solar Panel Recycling Market Future Outlook

Over the next five years, the global solar panel recycling market is expected to experience substantial growth, driven by increased solar panel installations, regulatory push for waste management, and technological advancements in recycling processes. As the installed base of solar panels ages, the need for efficient recycling systems will become more pronounced. The demand for high-purity materials, such as silicon, recovered from recycled panels, is also anticipated to rise, contributing to market expansion.

Market Opportunities:

- Increase in Closed-Loop Recycling Systems: Closed-loop recycling systems are gaining popularity in the solar industry. In 2023, over 10 recycling plants in Europe and North America adopted closed-loop systems, which recycle materials from decommissioned panels to produce new panels. These systems help reduce waste and reliance on raw materials, aligning with global sustainability goals. As of 2024, companies using closed-loop systems are expected to recycle nearly 50,000 tons of solar waste annually, significantly reducing the environmental impact of solar energy production.

- Adoption of AI and Automation in Recycling Plants: Artificial intelligence (AI) and automation technologies are transforming the solar panel recycling industry. In 2023, AI-powered robots were deployed in recycling plants across Germany and Japan, enhancing the efficiency of material recovery processes. Automation reduces operational costs by streamlining the dismantling and sorting of solar panels, allowing for faster and more precise extraction of valuable materials. These technologies are expected to become more widespread as recycling facilities look for ways to improve productivity and lower costs in response to the growing volume of decommissioned solar panels.

Scope of the Report

|

By Type of Recycling |

Mechanical Recycling Thermal Recycling Chemical Recycling |

|

By Material Recovered |

Glass Aluminum Silicon Other Metals (Silver, Lead) |

|

By Application |

Industrial Commercial Residential |

|

By Technology |

Manual Dismantling Automated Recycling Technologies |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Solar Panel Manufacturers

Solar Installation Companies

E-Waste Management Firms

Government and Regulatory Bodies (EPA, European Commission)

Recycling Technology Providers

Environmental NGOs and Sustainability Advocates

Investment and Venture Capitalist Firms

Solar Energy Associations

Companies

Major Players

-

First Solar Recycling

Veolia

Envaris

Reclaim PV

Silcontel

SunPower

SMA Solar Technology AG

PV Cycle

Trina Solar Limited

Hanwha Q Cells

Canadian Solar

Jinko Solar

JA Solar Technology

GCL System Integration Technology Co. Ltd

Risen Energy

Table of Contents

1. Global Solar Panel Recycling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Solar Panel Recycling Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Solar Panel Recycling Market Analysis

3.1. Growth Drivers

3.1.1. Growth in Renewable Energy Investments

3.1.2. Government Initiatives for Sustainable Energy

3.1.3. Environmental Regulations on E-Waste Management

3.1.4. Decreasing Solar Panel Lifespan

3.2. Market Challenges

3.2.1. High Initial Setup Cost for Recycling Facilities

3.2.2. Lack of Awareness About Recycling Processes

3.2.3. Limited Skilled Workforce

3.2.4. Inconsistent Recycling Policies

3.3. Opportunities

3.3.1. Technological Advancements in Recycling Processes

3.3.2. Expansion of Recycling Capacity in Emerging Markets

3.3.3. Growing Collaboration Between Solar Manufacturers and Recyclers

3.3.4. Rising Global Demand for Recycled Materials

3.4. Trends

3.4.1. Increase in Closed-Loop Recycling Systems

3.4.2. Adoption of AI and Automation in Recycling Plants

3.4.3. Development of Eco-friendly Recycling Technologies

3.5. Regulatory Landscape

3.5.1. E-Waste Directives and Policies

3.5.2. Recycling Incentive Programs

3.5.3. International Environmental Agreements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Solar Panel Recycling Market Segmentation

4.1. By Type of Recycling (In Value %) [Type of Panels, Recycling Process]

4.1.1. Mechanical Recycling

4.1.2. Thermal Recycling

4.1.3. Chemical Recycling

4.2. By Material Recovered (In Value %) [Material Recyclability, Value Recovery]

4.2.1. Glass

4.2.2. Aluminum

4.2.3. Silicon

4.2.4. Other Metals (Silver, Lead)

4.3. By Application (In Value %) [End-Use Industry, Utilization]

4.3.1. Industrial

4.3.2. Commercial

4.3.3. Residential

4.4. By Technology (In Value %) [Recycling Efficiency, Cost-Benefit]

4.4.1. Manual Dismantling

4.4.2. Automated Recycling Technologies

4.5. By Region (In Value %) [Regional Contribution, Key Market Growth]

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Solar Panel Recycling Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. First Solar Recycling

5.1.2. Veolia

5.1.3. Envaris

5.1.4. Silcontel

5.1.5. Reclaim PV

5.1.6. SunPower

5.1.7. SMA Solar Technology AG

5.1.8. PV Cycle

5.1.9. Trina Solar Limited

5.1.10. Hanwha Q Cells

5.1.11. Canadian Solar

5.1.12. Jinko Solar

5.1.13. JA Solar Technology

5.1.14. GCL System Integration Technology Co. Ltd

5.1.15. Risen Energy

5.2. Cross Comparison Parameters (Headquarters, Market Share, Recycling Capacity, No. of Recycling Plants, Technological Innovations, Revenue from Recycling, Strategic Partnerships, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Global Solar Panel Recycling Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Solar Panel Recycling Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Solar Panel Recycling Future Market Segmentation

8.1. By Type of Recycling (In Value %) [Efficiency, Process Innovation]

8.2. By Material Recovered (In Value %) [Recyclability Potential, Material Demand]

8.3. By Application (In Value %) [End-User Evolution]

8.4. By Technology (In Value %) [Future Recycling Methods]

8.5. By Region (In Value %) [Regional Focus, Future Growth Areas]

9. Global Solar Panel Recycling Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Future Marketing Initiatives

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables that influence the solar panel recycling market, including recycling processes, regulatory frameworks, and material recovery efficiency. Data is gathered through comprehensive desk research from proprietary databases and secondary sources.

Step 2: Market Analysis and Construction

In this step, we analyze historical data related to solar panel installations and recycling rates. Market penetration, recycling capacity, and revenue generation are assessed to provide a clear view of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market growth and technology advancements are validated through consultations with industry experts. This is conducted via phone interviews with stakeholders from leading solar manufacturers and recycling firms.

Step 4: Research Synthesis and Final Output

Finally, data is synthesized into actionable insights, validated by market experts. The final report includes a detailed analysis of the market, segmented by recycling type, material recovered, and regional growth trends.

Frequently Asked Questions

1 How big is the Global Solar Panel Recycling Market?

The global solar panel recycling market is valued at USD 323 million, driven by the increasing demand for sustainable energy solutions and the need for efficient disposal of end-of-life solar panels.

2 What are the challenges in the Solar Panel Recycling Market?

Key challenges include high initial setup costs for recycling facilities, lack of awareness about recycling options, and inconsistent policies across regions. These factors limit the expansion of recycling networks globally.

3 Who are the major players in the Solar Panel Recycling Market?

Major players include First Solar Recycling, Veolia, Envaris, Reclaim PV, and Silcontel. These companies dominate the market due to their advanced recycling technologies, extensive recycling networks, and strategic partnerships.

4 What are the growth drivers of the Solar Panel Recycling Market?

The market is propelled by increased solar panel installations, stringent e-waste regulations, technological advancements in recycling, and rising demand for high-purity materials recovered from solar panels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.