Global Space Equipment Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD11247

December 2024

82

About the Report

Global Space Equipment Market Overview

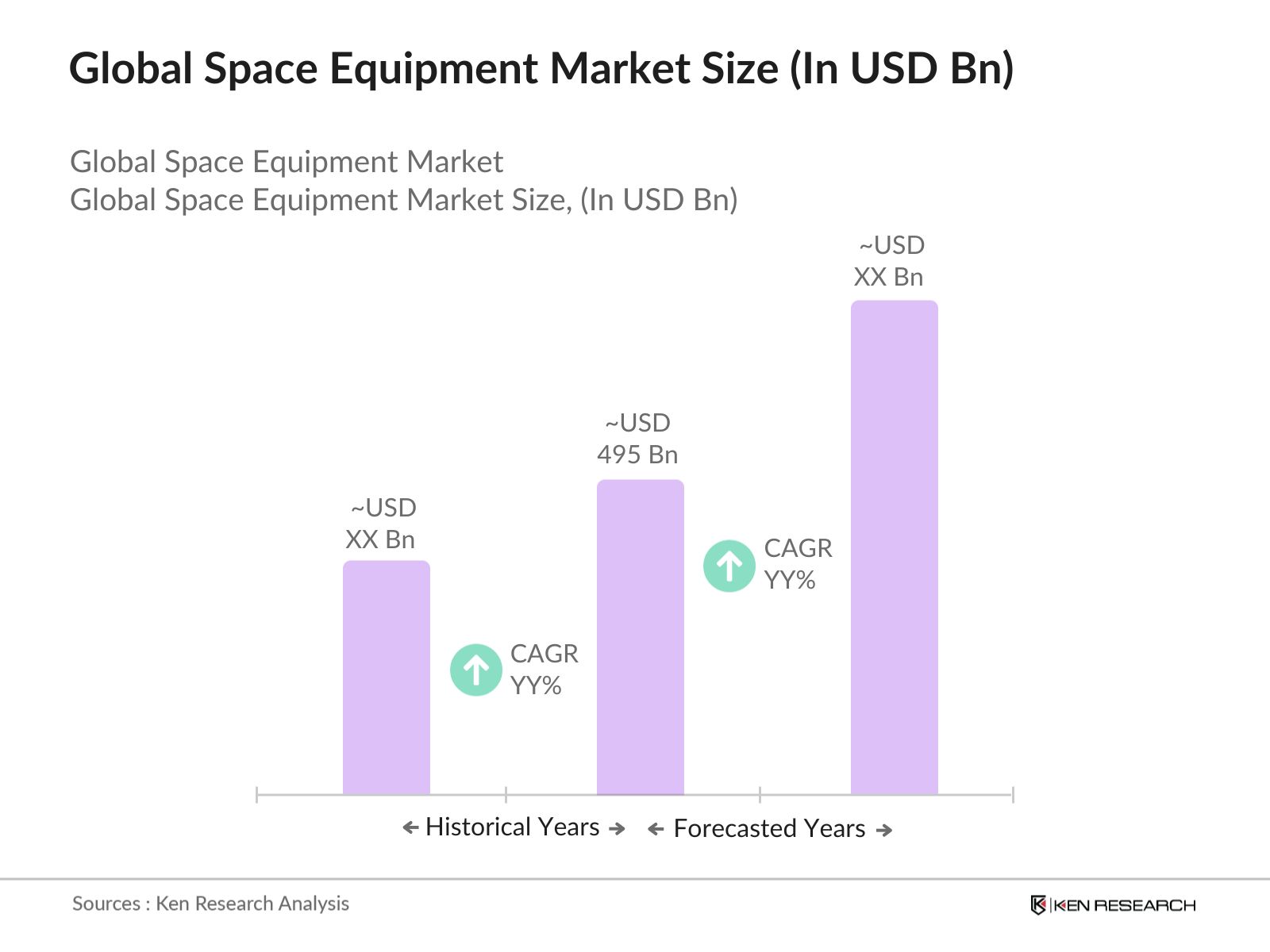

- The global space equipment market is valued at USD 495 billion, driven by advancements in satellite technology and increased investment in space exploration from both government and private sectors. Leading players have been focusing on the development of reusable and cost-effective equipment, fostering market growth. The demand for smaller, cost-effective, and high-performance equipment, particularly in satellite communications, earth observation, and scientific exploration, is expected to propel the market further.

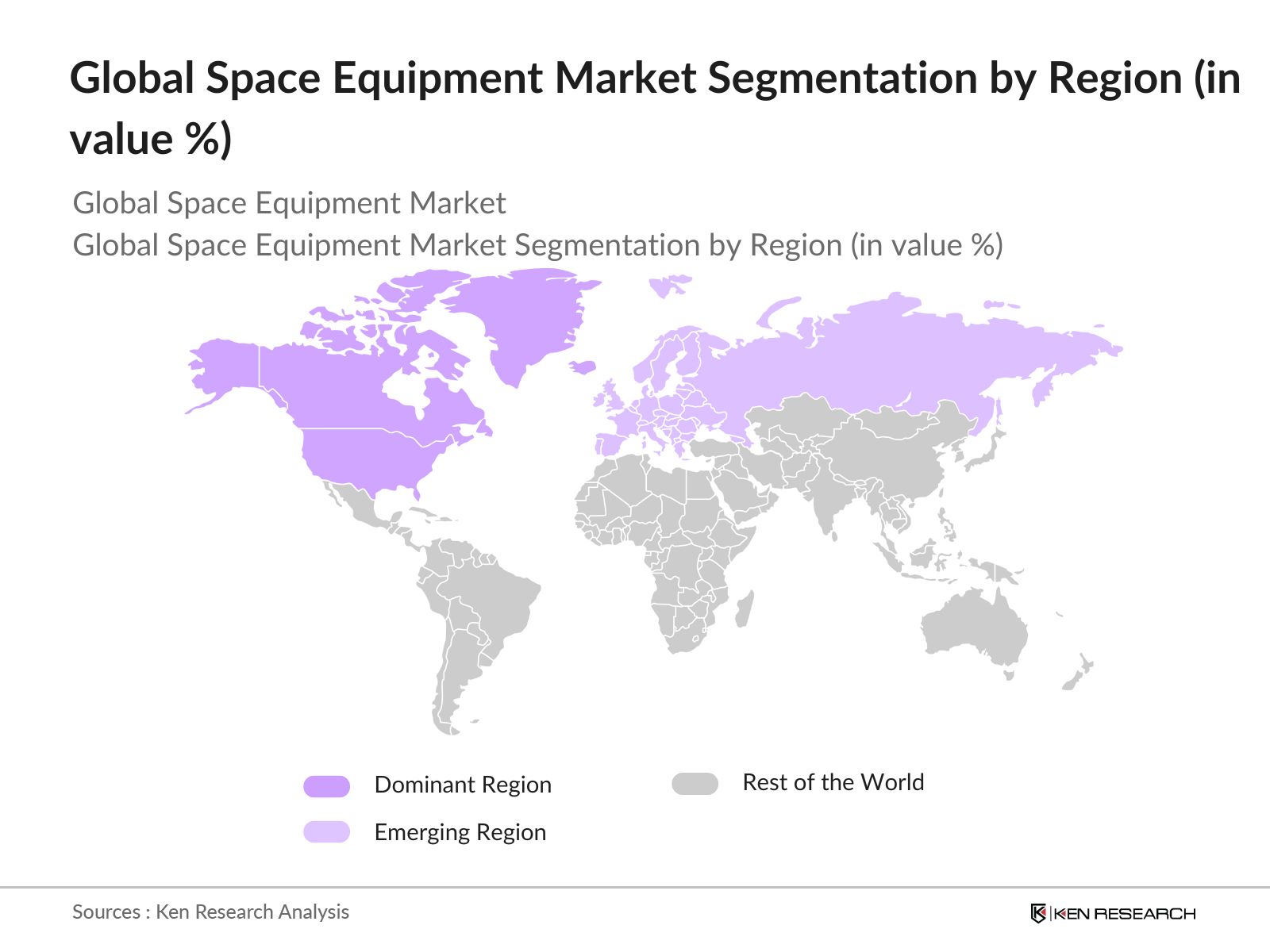

- North America, particularly the United States, dominates the market due to its extensive space exploration budget, advanced technology, and a high concentration of private and government-backed space programs. Other significant players include Europe and Asia-Pacific, with countries like China and India gaining influence. Chinas extensive state-sponsored space initiatives and Indias cost-efficient mission models make these regions increasingly prominent in the global market.

- In 2024, the U.S. Space Force allocated $15 billion for projects focused on defense equipment and satellite communication systems, aimed at strengthening national security in space. This initiative creates demand for advanced, resilient space equipment to protect assets against potential space-based threats.

Global Space Equipment Market Segmentation

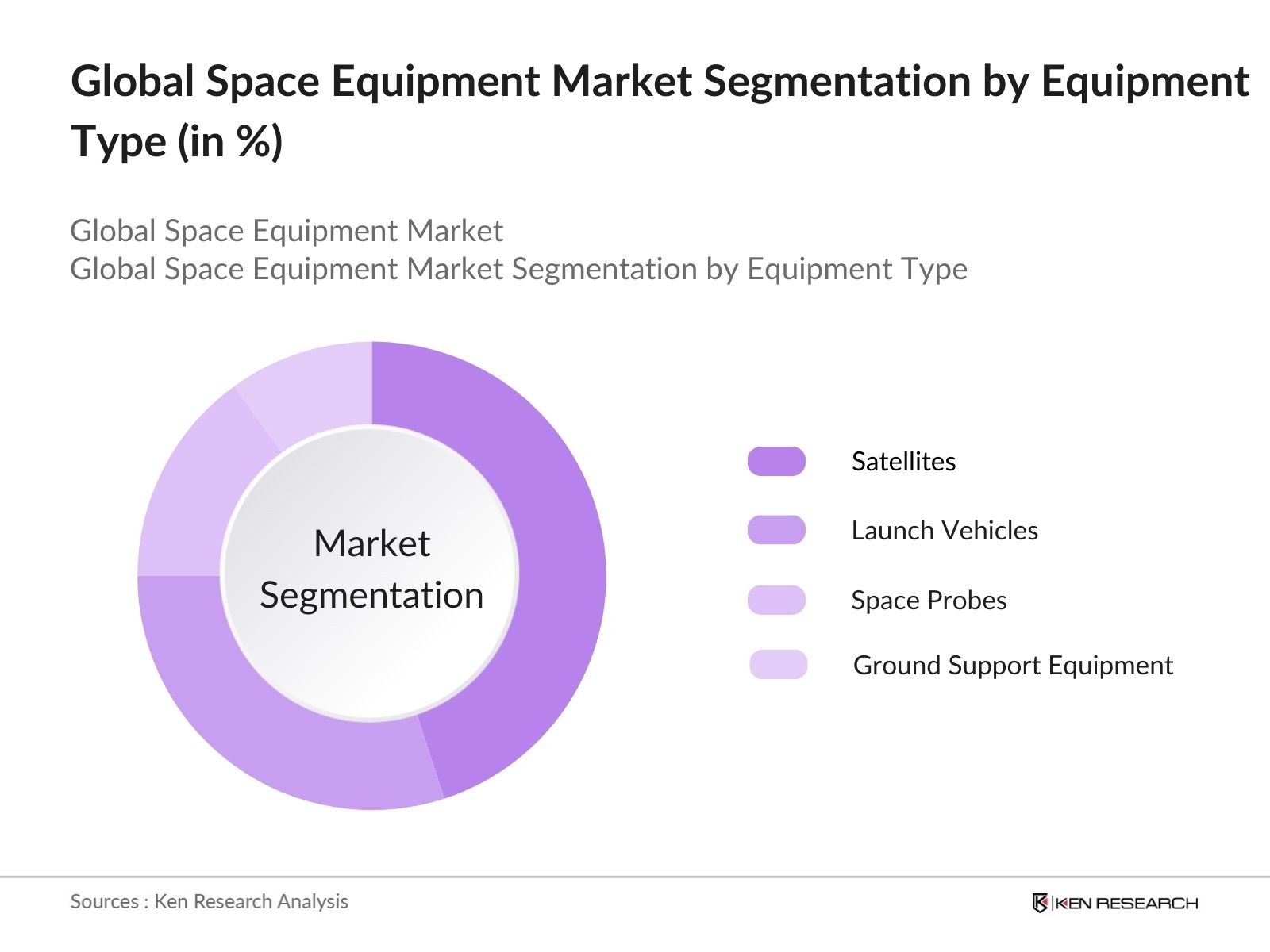

By Equipment Type: The market is segmented by equipment type into satellites, launch vehicles, space probes, and ground support equipment. Currently, satellites hold the dominant market share within this segment, driven by increased demand for high-speed data transmission, global positioning, and real-time surveillance applications. Small satellites, in particular, are widely utilized by both commercial and governmental bodies due to their lower launch costs and operational efficiencies, making them highly competitive in the market.

By Application: The market is further segmented by application into earth observation, communication, navigation, scientific exploration, and space tourism. Earth observation equipment dominates the segment due to its extensive applications in weather forecasting, agricultural monitoring, and environmental data collection. Governments and environmental agencies prioritize these functions for national security and environmental management, maintaining a strong demand for earth observation technology.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds a substantial share of the market due to its large number of established space equipment manufacturers, R&D investments, and ongoing government space missions. Asia-Pacific is also experiencing rapid growth due to increased government funding and private investment in satellite technology and launch capabilities, particularly in China and India.

Global Space Equipment Market Competitive Landscape

The market is dominated by a few major players, including industry giants such as Lockheed Martin, Northrop Grumman, and SpaceX. This consolidation underscores the dominance of well-established companies with advanced technology and extensive resources.

Global Space Equipment Market Analysis

Market Growth Drivers

- Increased Government Funding in Space Exploration: Governments worldwide have increased their financial commitment to space exploration. In 2024, NASA received $25 billion in federal funding, reflecting a significant push toward advancing technology and infrastructure for deep space exploration. Similarly, the European Space Agencys budget rose to $8 billion to support lunar and Mars missions, showing substantial backing for next-gen equipment and satellite development.

- Surge in Satellite Deployment for Communication and Surveillance: The demand for space equipment is propelled by an increase in satellite deployment. By mid-2024, over 2,000 satellites were launched globally, mainly to support communication networks and surveillance. The Starlink project by SpaceX, which alone has launched around 3,500 satellites as part of its satellite internet project, illustrates the high demand for space equipment to meet communication and defense needs, fueling growth in the space equipment market.

- Growing Space Missions in Emerging Economies: Emerging economies are joining the space race, enhancing demand for space equipment. Indias space organization, ISRO, saw a $1.6 billion government budget allocation in 2024 for lunar exploration and satellite launches. The UAE also announced plans to develop a Mars habitat prototype, with an allocated budget of $4 billion. Such advancements by emerging economies increase competition in the global market, driving the need for cost-effective and reliable space equipment.

Market Challenges

- High Initial Cost and Long Development Cycles: Developing space equipment involves immense costs and extended development timelines, making it challenging for smaller players to enter the market. For instance, developing a single satellite can cost up to $500 million, while delays due to stringent safety protocols can extend projects by years, impacting operational costs and market accessibility.

- Strict Regulatory Frameworks and Compliance Requirements: Space equipment companies must comply with rigorous international and national regulations. In 2024, it took an average of 18 months for companies to receive necessary approvals for satellite launches due to stringent protocols set by organizations like the FCC in the U.S. and ITU globally. These extended timelines and regulatory hurdles deter rapid market entry and innovation.

Global Space Equipment Market Future Outlook

Over the next five years, the global space equipment industry is anticipated to experience substantial growth, driven by increased demand for satellite internet services, scientific exploration, and government-led space programs.

Future Market Opportunities

- Increasing Demand for Satellite-Based Internet Access: Over the next five years, demand for satellite-based internet services will expand globally, particularly in underserved areas. Companies plan to launch an additional 8,000 satellites by 2029, creating a sustained need for equipment that supports high-speed, low-latency internet services globally.

- Expansion of Lunar and Martian Colonization Programs: By 2029, several space agencies aim to establish prototypes for lunar habitats, driving the development of equipment that can withstand extreme space environments. This trend is backed by projected government and private sector funding, totaling over $50 billion over the next five years, creating significant opportunities in the space equipment market.

Scope of the Report

|

Equipment Type |

Satellites (Micro, Small, Large) Launch Vehicles (Reusable, Non-Reusable) Space Probes and Rovers Ground Systems and Communication Equipment |

|

Application |

Earth Observation Communications Navigation and Positioning Scientific Exploration Space Tourism |

|

Technology |

Propulsion Systems (Chemical, Electric) Power Systems (Solar, Nuclear) Communication Systems (Optical, RF) |

|

Orbit Type |

Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) Beyond Earth Orbit (BEO) |

|

Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Satellite Manufacturing Companies

Launch Service Providers

Government and Regulatory Bodies (NASA, ESA, ISRO)

Defense Contractors

Aerospace and Avionics Companies

Investor and Venture Capitalist Firms

Telecommunications Companies

Environmental Monitoring Agencies

Companies

Players Mentioned in the Report:

Lockheed Martin Corporation

Northrop Grumman Corporation

SpaceX

Airbus Defence and Space

Thales Alenia Space

Boeing Space and Launch

Blue Origin

Raytheon Technologies

Sierra Nevada Corporation

Rocket Lab

Table of Contents

1. Global Space Equipment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Space Equipment Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Space Equipment Market Analysis

3.1 Growth Drivers

3.1.1 Increased Satellite Deployment (Commercial, Governmental, Scientific)

3.1.2 Demand for High-Resolution Imaging (Defense, Agriculture, Environmental Monitoring)

3.1.3 Growing Investment in Space Exploration (Private Sector Involvement)

3.1.4 Miniaturization of Space Equipment

3.2 Market Challenges

3.2.1 High Production and Launch Costs

3.2.2 Regulatory and Compliance Barriers

3.2.3 Space Debris Management

3.2.4 Long Development Cycles

3.3 Opportunities

3.3.1 Expansion of Space Tourism

3.3.2 Integration of AI and Advanced Data Analytics

3.3.3 Cross-border Collaborations in Space Missions

3.3.4 Increased Demand for CubeSats and SmallSats

3.4 Trends

3.4.1 Reusable Launch Technologies

3.4.2 Autonomous Spacecraft Systems

3.4.3 Commercialization of Low Earth Orbit (LEO) Operations

3.4.4 Integration of IoT in Space Equipment

3.5 Government and International Regulations

3.5.1 Space Sustainability and Debris Regulations

3.5.2 National Space Policies and Initiatives

3.5.3 Inter-Agency Space Collaboration Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape Ecosystem

4. Global Space Equipment Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Satellites (Micro, Small, Large)

4.1.2 Launch Vehicles (Reusable, Non-Reusable)

4.1.3 Space Probes and Rovers

4.1.4 Ground Systems and Communication Equipment

4.2 By Application (In Value %)

4.2.1 Earth Observation

4.2.2 Communications

4.2.3 Navigation and Positioning

4.2.4 Scientific Exploration

4.2.5 Space Tourism

4.3 By Technology (In Value %)

4.3.1 Propulsion Systems (Chemical, Electric)

4.3.2 Power Systems (Solar, Nuclear)

4.3.3 Communication Systems (Optical, RF)

4.4 By Orbit Type (In Value %)

4.4.1 Low Earth Orbit (LEO)

4.4.2 Medium Earth Orbit (MEO)

4.4.3 Geostationary Orbit (GEO)

4.4.4 Beyond Earth Orbit (BEO)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. Global Space Equipment Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Boeing Space and Launch

5.1.4 SpaceX

5.1.5 Airbus Defence and Space

5.1.6 Thales Alenia Space

5.1.7 Raytheon Technologies

5.1.8 Sierra Nevada Corporation

5.1.9 Blue Origin

5.1.10 Maxar Technologies

5.1.11 Rocket Lab

5.1.12 Virgin Galactic

5.1.13 OHB SE

5.1.14 RUAG Space

5.1.15 Planet Labs Inc.

5.2 Cross Comparison Parameters (Revenue, Number of Satellites Deployed, Launch Success Rate, Market Share, Innovation Index, R&D Investments, Contracts Secured, Global Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Contracts

5.9 Private Equity Investments

6. Global Space Equipment Market Regulatory Framework

6.1 International Space Law and Treaties

6.2 National Regulatory Bodies and Compliance Standards

6.3 Certification Processes

6.4 Space Debris Mitigation Guidelines

7. Global Space Equipment Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Space Equipment Market Future Market Segmentation

8.1 By Equipment Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By Orbit Type (In Value %)

8.5 By Region (In Value %)

9. Global Space Equipment Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Opportunity Matrix for Emerging Market Players

9.3 Customer and Vendor Alignment Strategies

9.4 Technological White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the global space equipment market, including key stakeholders such as satellite manufacturers, launch service providers, and government agencies. This is achieved through extensive desk research, leveraging secondary and proprietary databases to identify market-defining variables.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance is compiled and analyzed, including the deployment of satellites, growth in government spending, and technology adoption rates. This analysis establishes a reliable foundation for revenue and market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market dynamics and future growth trajectories are validated through interviews with industry experts. These consultations offer critical insights from industry leaders and practitioners, confirming data accuracy and relevance.

Step 4: Research Synthesis and Final Output

The final phase involves comprehensive synthesis of research findings, combining bottom-up data from market players with top-down analysis. This ensures a thorough, validated overview of the global space equipment markets current status and future prospects.

Frequently Asked Questions

01. How big is the Global Space Equipment Market?

The global space equipment market is valued at USD 495 billion, driven by demand for satellite deployment and increased government investment in space technology.

02. What are the major growth drivers in the Global Space Equipment Market?

Key drivers in the global space equipment market include advancements in satellite miniaturization, increased demand for satellite communication, and the rise of reusable launch technology, making space more accessible.

03. Which companies dominate the Global Space Equipment Market?

Major players in the global space equipment market include Lockheed Martin, Northrop Grumman, SpaceX, Airbus Defence and Space, and Thales Alenia Space, known for their innovation and extensive resources.

04. What are the primary applications of space equipment?

Space equipment is widely used in applications such as earth observation, telecommunications, navigation, and scientific research, supporting both commercial and government missions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.