Global Space Technology Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD9231

December 2024

84

About the Report

Global Space Technology Market Overview

- The global space technology market is valued USD 314 billion, driven by rapid advancements in satellite technology and increased investments from both governmental and private sector players. The market is buoyed by the growing demand for satellite communications, Earth observation systems, and exploration missions. Increasing global connectivity and the commercialization of space activities, including space tourism, are shaping the markets growth trajectory.

- North America continues to dominate the market due to strong government initiatives, such as NASA's Artemis program, and the rapid rise of private enterprises like SpaceX and Blue Origin. The regions leadership is further solidified by its advanced technological infrastructure and robust investment in space-related innovations.

- The U.S. governments continued investment in NASAs Artemis program, with $3.5 billion allocated for lunar missions in 2024, showcases a robust commitment to space exploration. The program aims to land astronauts on the Moon by 2025 and develop sustainable lunar exploration by 2030. Such initiatives are driving innovations in spacecraft technology, habitation modules, and in-situ resource utilization, which will contribute to market growth.

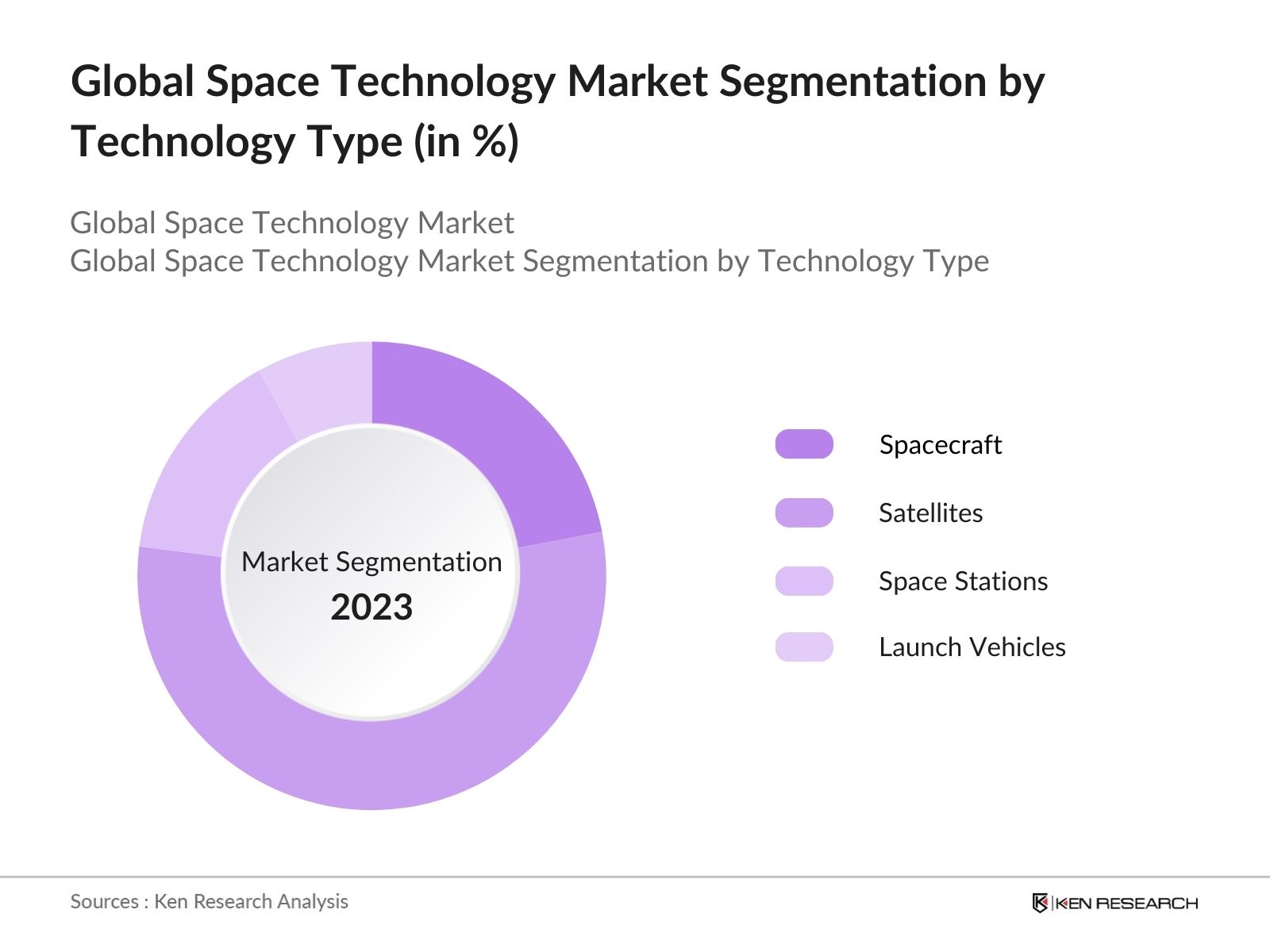

Global Space Technology Market Segmentation

By Technology Type: The market is segmented by technology type into spacecraft, satellites, space stations, and launch vehicles. Among these, satellites currently dominate the market, with their growing applications in telecommunication, Earth observation, and navigation systems. The increasing deployment of small satellites (CubeSats and nanosatellites) for commercial and military applications has made satellites a dominant segment in the space technology industry.

By End-User: The market is segmented by end-user into government, military, and commercial sectors. The government segment leads due to significant investments in space exploration, scientific missions, and national security applications. National space agencies, like NASA, ESA, and ISRO, invest heavily in satellite technology for various applications such as weather forecasting, Earth observation, and space exploration.

By Region: The regional segmentation includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America remains the most dominant region, largely due to the advanced space infrastructure in the U.S., which is home to key players such as SpaceX, Lockheed Martin, and Boeing. The U.S. governments space initiatives, along with the presence of a robust private sector, provide this region with a substantial competitive advantage. Meanwhile, Asia-Pacific is experiencing rapid growth, driven by China's ambitious space program and India's significant investments in satellite technology.

3. Competitive Landscape

The global space technology market is highly competitive, with major players investing in technological advancements, partnerships, and space missions. These companies are heavily focused on innovations in reusable rockets, satellite miniaturization, and space tourism, making the market highly dynamic. Key players in the market include:

|

Company |

Establishment Year |

Headquarters |

Key Products |

Revenue (2023) |

No. of Employees |

Technological Advancements |

Notable Collaborations |

Global Reach |

|

SpaceX |

2002 |

Hawthorne, California |

||||||

|

Lockheed Martin |

1995 |

Bethesda, Maryland |

||||||

|

Boeing |

1916 |

Chicago, Illinois |

||||||

|

Blue Origin |

2000 |

Kent, Washington |

||||||

|

Airbus |

1970 |

Leiden, Netherlands |

Global Space Technology Market Analysis

Market Growth Drivers

- Growing Commercial Demand for Satellite Services: As of 2024, there are over 6,000 active satellites in orbit, supporting services like telecommunications, broadcasting, and earth observation. Companies like SpaceX, OneWeb, and Amazon's Kuiper are driving the demand for satellite-based internet services to underserved areas globally. The number of operational satellites is expected to increase by 1,500 annually, supporting industries such as defense, agriculture, and environmental monitoring, which in turn accelerates the growth of the space technology market.

- Rising Investments in Space Tourism: Commercial space tourism is witnessing an increasing inflow of private investments, with key players like SpaceX, Blue Origin, and Virgin Galactic raising billions of dollars. In 2024, Virgin Galactic alone sold over 800 tickets for its suborbital flights, generating revenue of approximately $300 million. These developments are driving advancements in spacecraft design and launch systems, further expanding the market for space tourism and associated technologies.

- Development of Satellite Constellations for Global Connectivity: Companies like SpaceX and Amazon are investing billions of dollars into building low Earth orbit (LEO) satellite constellations. In 2024, SpaceX's Starlink already operates 4,500 satellites, aiming to increase this number to 12,000 by 2028. These satellite constellations are essential for providing global broadband connectivity, improving disaster response capabilities, and enhancing defense operations, which are major growth drivers for the global space technology market.

Market Challenges

- Space Debris Management and Safety Concerns: With over 36,000 tracked objects larger than 10 cm orbiting the Earth in 2024, space debris presents a critical challenge to the safety of current and future satellite missions. Collisions with debris can cause damages exceeding millions of dollars, necessitating costly repairs and replacements.

- Regulatory Barriers and International Coordination: The lack of standardized regulations for space activities creates difficulties in international coordination. In 2024, numerous countries operate independently of global standards for satellite launches, space mining, and space traffic management.

Global Space Technology Market Future Outlook

The global space technology industry is expected to witness growth over the next five years, driven by technological advancements and the increasing role of private companies in space exploration.

Future Market Opportunities

- Expansion of Commercial Space Travel: Over the next five years, commercial space travel will become more accessible, with ticket prices expected to drop significantly as competition between companies like SpaceX, Blue Origin, and Virgin Galactic increases. By 2028, it is anticipated that over 1,000 commercial passengers will have flown to suborbital space, generating over $5 billion in annual revenues, spurring further innovations in reusable spacecraft and space tourism infrastructure.

- Proliferation of Mega-Constellations for 5G Networks: By 2029, the number of satellites supporting global 5G networks will reach over 15,000, with companies like SpaceX, Amazon, and OneWeb at the forefront of this movement. The deployment of these satellite constellations will drastically improve global connectivity, especially in remote areas, and create demand for satellite manufacturing, ground station technologies, and data analytics services.

Scope of the Report

|

By Type |

Spacecraft Satellites Space Stations Orbital Launch Vehicles |

|

By Application |

Satellite Communication Navigation Meteorology Disaster Management |

|

By End-User |

Government Military Commercial |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Satellite Operators

Government Agencies (NASA, ESA, ISRO, CNSA)

Private Space Companies

Banks and Financial Institution

Telecommunication Providers

Space Tourism Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FCC, ITU)

Companies

Players Mentioned in the Report:

SpaceX

Lockheed Martin

Boeing

Airbus

Blue Origin

Northrop Grumman

Thales Group

Honeywell International

Rocket Lab USA

Maxar Technologies

Table of Contents

1. Global Space Technology Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Driven by Space-Based Applications and Technological Advancements)

1.4 Market Segmentation Overview

2. Global Space Technology Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis (with a Focus on Reusable Rockets and CubeSat Proliferation)

2.3 Key Market Developments and Milestones

3. Global Space Technology Market Analysis

3.1 Growth Drivers (Government Space Programs, Increasing Private Investments, Advancements in Propulsion Technology)

3.1.1 Collaboration Between Public and Private Sectors (NASA, ESA, Private Players)

3.1.2 Cost Reduction through Reusable Rocket Systems (SpaceX, Blue Origin)

3.1.3 Increasing Demand for Satellite-Based Internet (Starlink, Project Kuiper)

3.2 Market Challenges (High Capital Investment, Regulatory Challenges, Space Debris)

3.2.1 Space Debris Mitigation and Removal Technologies

3.2.2 Compliance with International Space Regulations

3.3 Opportunities (Space Tourism, Satellite Constellations, Space-Based Manufacturing)

3.3.1 Growing Market for Space Tourism (Virgin Galactic, SpaceX)

3.3.2 Microgravity Manufacturing Applications

3.4 Trends (Advancements in AI and Robotics, Autonomous Space Systems)

3.4.1 Autonomous Space Missions

3.4.2 Integration of AI in Satellite Data Processing

3.5 Government Initiatives (NASA Artemis Program, China's Lunar Exploration)

3.5.1 Role of Public-Private Partnerships

3.5.2 National Space Programs and Policies (USA, China, India)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Global Space Technology Market Segmentation

4.1 By Type (In Value %)

4.1.1 Spacecraft (Rover, Orbiter, Atmospheric, Lander, Flyby Spacecraft)

4.1.2 Satellites (Communication Satellites, Earth Observation, Navigation Satellites)

4.1.3 Space Stations

4.1.4 Orbital Launch Vehicles (Reusable and Non-Reusable Vehicles)

4.2 By Application (In Value %)

4.2.1 Satellite Communication

4.2.2 Navigation and Mapping

4.2.3 Meteorology

4.2.4 Disaster Management

4.3 By End-User (In Value %)

4.3.1 Government

4.3.2 Military

4.3.3 Commercial (Telecommunication, Earth Observation, Space Tourism)

4.4 By Region (In Value %)

4.4.1 North America

4.4.2 Europe

4.4.3 Asia-Pacific

4.4.4 Latin America

4.4.5 Middle East & Africa

5. Global Space Technology Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (Revenue, Product Portfolio, Key Developments)

5.1.1 Boeing

5.1.2 Lockheed Martin

5.1.3 SpaceX

5.1.4 Airbus

5.1.5 Blue Origin

5.1.6 Northrop Grumman

5.1.7 Thales Group

5.1.8 Honeywell International Inc.

5.1.9 Rocket Lab USA

5.1.10 Maxar Technologies

5.1.11 Sierra Nevada Corporation

5.1.12 Virgin Galactic

5.1.13 NEC Corporation

5.1.14 Viasat, Inc.

5.1.15 Leonardo SpA

5.2 Cross-Comparison Parameters (Inception Year, Revenue, Market Share, Global Reach, Number of Launches, Key Collaborations, Key Products)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Mergers, Acquisitions)

5.5 Investment Analysis

5.6 Government Contracts and Collaborations

5.7 R&D and Innovation Investments

6. Global Space Technology Market Regulatory Framework

6.1 International Space Law and Treaties (Outer Space Treaty, Moon Agreement)

6.2 National Regulatory Bodies and Compliance (USA, EU, China)

6.3 Licensing and Certifications for Satellite Operations

7. Global Space Technology Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Increased Satellite Connectivity, Space Tourism, Deep-Space Exploration)

8. Global Space Technology Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Region (In Value %)

9. Global Space Technology Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis (Total Available Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Go-to-Market Strategy Recommendations

9.3 White Space Opportunity Identification

9.4 Key Innovation Areas to Watch

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out the ecosystem of the space technology market, identifying key stakeholders such as governments, private companies, and investors. Extensive desk research was conducted, using proprietary databases and secondary sources, to pinpoint the variables influencing the market.

Step 2: Market Analysis and Construction

Historical data on space missions, satellite launches, and revenue generation from satellite communications were compiled. This included an analysis of product penetration rates and technological advancements, helping to forecast the revenue streams for the next five years.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through CATIS to validate the market projections. These consultations focused on gaining insights into industry trends, space mission timelines, and the role of public-private collaborations in shaping the future of the market.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data collected through primary and secondary research. The comprehensive analysis included input from government agencies, private companies, and industry stakeholders to ensure an accurate and detailed market report.

Frequently Asked Questions

How big is the global space technology market?

The global space technology market is valued at USD 314 billion, with significant contributions from satellite communications, Earth observation, and reusable rockets.

What are the challenges in the space technology market?

The global space technology market faces challenges like high capital costs, regulatory hurdles, and the growing issue of space debris, which threatens the safety and sustainability of space missions.

Who are the major players in the global space technology market?

Key players in the global space technology market include SpaceX, Lockheed Martin, Boeing, Airbus, and Blue Origin, all of which have been at the forefront of innovation and technological advancements in space exploration.

What are the growth drivers of the space technology market?

The global space technology market is driven by technological advancements in reusable rockets, increasing investments from private companies, and growing demand for satellite-based services like global broadband and Earth observation.

What is the future outlook for space technology?

The global space technology market is poised for strong growth over the next five years, with expanding commercial space ventures, government space programs, and increasing investments in deep space exploration missions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.