Global Sparkling Tea Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD9232

December 2024

86

About the Report

Global Sparkling Tea Market Overview

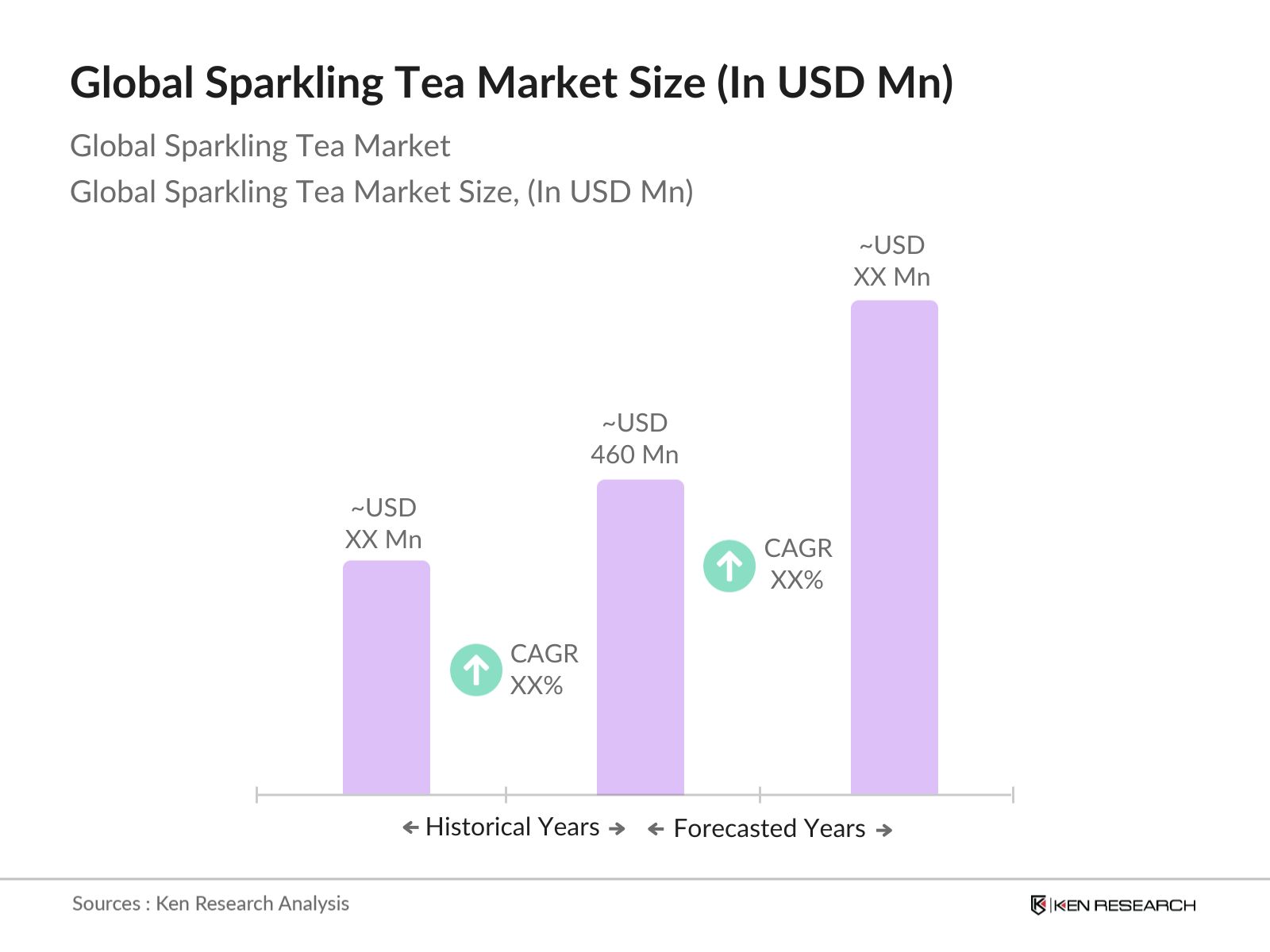

- The global sparkling tea market is valued at USD 460 million, based on a five-year historical analysis. This market valuation is largely driven by a growing consumer inclination toward non-alcoholic, healthy beverage alternatives. As awareness about health benefits increases, sparkling tea has become a preferred choice for consumers seeking a refreshing, low-calorie beverage. The trend is reinforced by an increased focus on natural ingredients, supporting sustainable production and packaging methods, which add further value to the markets expansion.

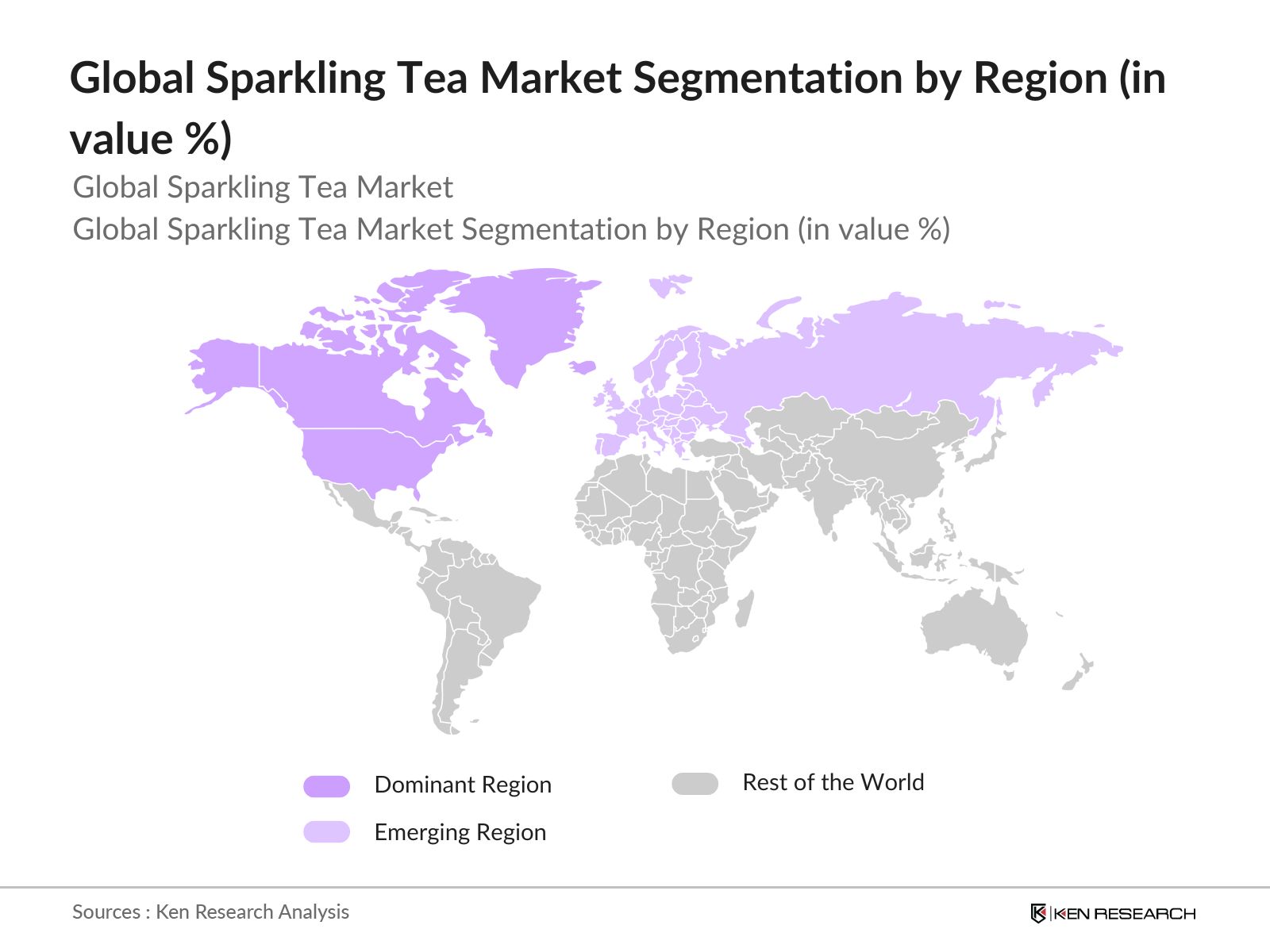

- The leading regions in the sparkling tea market include North America and Europe, attributed to their established wellness beverage sectors. North Americas dominance stems from its strong demand for organic, wellness-oriented products. Europe, with its historical tea culture and emphasis on premium and innovative beverage options, also holds a notable share. Additionally, Asia-Pacific, driven by its evolving market for functional beverages, showcases robust growth in consumer interest, particularly for teas infused with herbal and traditional ingredients.

- Government regulations on organic certifications are becoming increasingly stringent, impacting the production processes of sparkling tea brands. For instance, the USDA established more comprehensive organic certification protocols in 2023, requiring producers to comply with stricter criteria to maintain organic labeling. These regulations underscore the growing consumer demand for certified organic products and ensure sparkling tea brands adhere to high standards, aligning with the clean-label movement and health-conscious purchasing behaviour.

Global Sparkling Tea Market Segmentation

- By Product Type: The global sparkling tea market is segmented by product type into caffeinated sparkling tea and non-caffeinated sparkling tea. Non-caffeinated sparkling tea holds a dominant market share within this segmentation due to its appeal to health-conscious consumers who prioritize wellness over caffeine content. This segment has expanded rapidly, appealing to younger demographics and individuals seeking relaxation benefits. Additionally, non-caffeinated teas cater to wider consumer needs, including evening consumption.

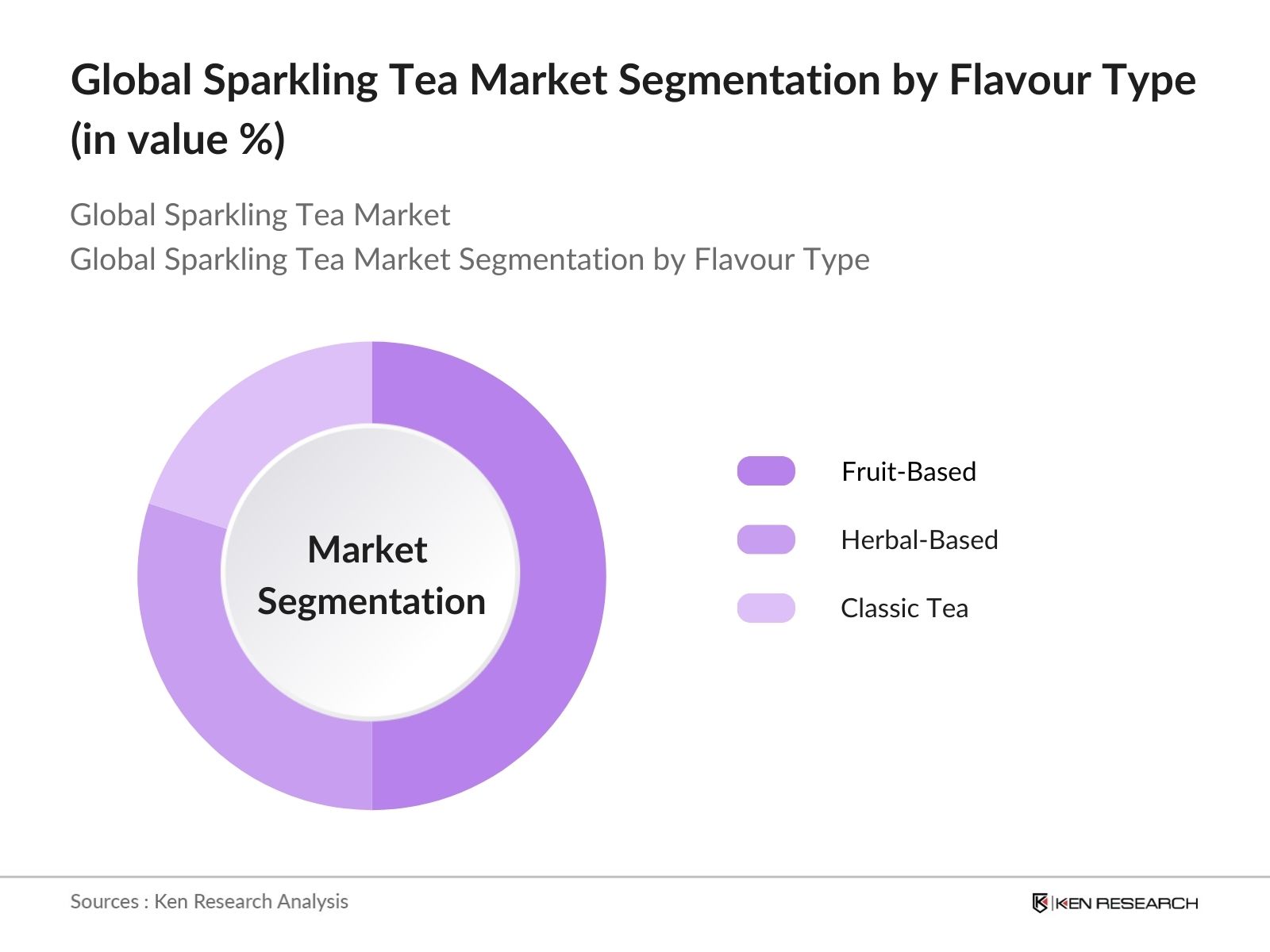

- By Flavour Type: In terms of Flavour, the market is segmented into fruit-based Flavours, herbal-based Flavours, and classic tea Flavours. Fruit-based Flavours dominate this segment, driven by the popularity of naturally infused beverages that combine tea with refreshing fruit tastes. These flavours offer a broader range of options to appeal to various consumer preferences, and their natural sweetness reduces the need for added sugars, aligning with the clean-label trend.

- By Region: The market segmentation by region includes North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America leads due to its high demand for wellness beverages and a well-established market for natural and organic products. European consumers, particularly in countries like Germany and the United Kingdom, show a strong preference for premium quality and innovative tea blends, further bolstering regional growth. Asia-Pacific, notably China and Japan, is quickly catching up due to its longstanding tea culture and increasing interest in healthy alternatives.

Global Sparkling Tea Market Competitive Landscape

The global sparkling tea market is characterized by several key players, each influencing the market dynamics through unique product offerings, strong distribution channels, and a commitment to quality and sustainability. The sparkling tea market is dominated by brands that prioritize quality ingredients and sustainability, appealing to a health-conscious consumer base. Major players such as Tea Forte, Fentimans, and ITO EN are prominent in this space, with each company leveraging brand recognition, extensive distribution networks, and ongoing product innovation to secure their market position.

Global Sparkling Tea Market Analysis

Market Growth Drivers

- Consumer Shift towards Non-Alcoholic Beverages: As of 2024, consumption of non-alcoholic beverages has surged, with major regions like North America and Europe reporting a 15% increase in non-alcoholic beverage consumption per capita, a reflection of shifting consumer preferences. This trend is propelled by health-conscious demographics opting for alternatives such as sparkling tea, which offers a Flavourful yet alcohol-free experience. The U.S. Census Bureau notes a growing population segment aged 25-34 who prioritize healthier, alcohol-free beverages, making sparkling tea an appealing choice. Furthermore, global health campaigns underscore the potential of non-alcoholic options to address rising concerns over alcohol consumption.

- Health and Wellness Trends: The wellness industry continues its growth, valued at over $4.3 trillion in 2023 according to global economic indicators, with a strong emphasis on nutritionally beneficial products like sparkling tea. As governments encourage health-centered consumption patterns, consumers increasingly turn to beverages that offer antioxidants and other natural health benefits. The demand for sparkling tea, infused with health-boosting botanicals, aligns with the U.S. National Center for Health Statistics reporting a steady annual increase in health-focused beverage sales. This trend resonates in the Asia-Pacific region as well, where functional beverage consumption has doubled in the last decade, further boosting sparkling tea demand.

- Increasing Awareness of Natural Ingredients: The rising awareness of natural ingredients has fueled demand for beverages with clean labels and minimal processing, placing sparkling tea at an advantageous market position. In 2024, consumer preference for natural products surged by 18% in Europe, as indicated by the European Food Information Council, with a major shift towards beverages without artificial additives. This trend supports a growing awareness in emerging markets, where imports of natural tea-based ingredients for sparkling beverages have risen by 25% year-over-year. Such growth in ingredient demand is also propelled by regulatory support for clean-label products in multiple regions.

Market Challenges

- High Production Costs of Organic Ingredients: Organic ingredient production remains costly due to stringent certifications and labor-intensive farming practices. For instance, organic tea leaves, a key ingredient in sparkling tea, require dedicated resources and strict cultivation practices that escalate costs. According to the USDA, organic farming costs for tea have increased by 12% in recent years, impacting overall beverage pricing in the non-alcoholic sector. This challenge is particularly pronounced in the U.S., where organic certification and compliance add up to the substantial operational expenses for beverage producers.

- Regulatory Constraints on Ingredients: Government regulations on ingredient transparency and labeling have intensified, especially concerning additives in sparkling teas. The European Union's Food Safety Authority mandates strict ingredient labeling, resulting in increased production compliance costs. In 2023, the EU implemented policies that limit certain preservatives in beverages, which require sparkling tea producers to reformulate products. This trend is echoed globally, with regions like North America following suit, thereby increasing operational costs for manufacturers aiming to comply with such regulations.

Global Sparkling Tea Market Future Outlook

Over the next five years, the sparkling tea market is poised to experience steady growth due to increasing consumer interest in health and wellness beverages, the rise of e-commerce distribution, and ongoing product innovation. Additionally, as awareness of the environmental impact of single-use plastics increases, brands in this space are expected to further innovate in sustainable packaging solutions. The expansion of functional ingredients and Flavours will continue to support consumer demand across multiple demographics, ensuring the growth trajectory for sparkling tea.

Market Opportunities

- Innovation in Flavours and Ingredients: Sparkling tea brands have a unique opportunity to expand their product lines by introducing diverse Flavours and functional ingredients. In 2024, global ingredient imports for Flavour infusions rose by 22%, as reported by the International Trade Centre, showcasing consumer demand for innovative beverage options. Markets in North America and Asia show strong acceptance of botanically enriched beverages, with consumers actively seeking non-traditional tea Flavours, like hibiscus and lemongrass, further validating this trend and opening avenues for brands to create unique offerings.

- Expansion in On-the-Go Packaging: The global market for on-the-go packaging has experienced a steady 9% annual increase in 2023, particularly for non-alcoholic beverages, driven by urbanization and changing consumer lifestyles. As people opt for portable beverage options, sparkling tea producers are adopting sustainable, convenient packaging formats. According to the World Economic Forum, 70% of consumers in urban areas report a preference for portable, eco-friendly options, further supported by cities mandating eco-conscious packaging in their regulatory guidelines. This trend emphasizes an opportunity for sparkling tea brands to meet these demands with innovative packaging solutions.

Scope of the Report

|

Product Type |

Caffeinated Sparkling Tea Non-Caffeinated Sparkling Tea |

|

Flavour Type |

Fruit-Based Flavours Herbal-Based Flavours Classic Tea Flavours |

|

Distribution Channel |

Online Retail Specialty Stores Supermarkets and Hypermarkets |

|

Packaging Type |

Bottled Canned Glass Packaging |

|

Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Health and Wellness Product Retailers

Beverage Distributors and Wholesalers

Specialty Tea and Beverage Boutiques

Hotels and Hospitality Chains

Banks and Financial Institutions

Organic Food and Beverage Retailers

Supermarkets and Hypermarkets

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, EU Organic Certification Bodies)

Companies

Players Mentioned in the Report

Tea Forte

Fentimans

Newby Teas

ITO EN, Ltd.

The Sparkling Tea Company

Pepsico Inc.

Tetley Tea

Steaz (Healthy Beverage)

Mariage Frres

OSULLOC

Table of Contents

1. Global Sparkling Tea Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Sparkling Tea Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Sparkling Tea Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Shift towards Non-Alcoholic Beverages

3.1.2 Health and Wellness Trends

3.1.3 Increasing Awareness of Natural Ingredients

3.1.4 Rising Disposable Income in Emerging Markets

3.2 Market Challenges

3.2.1 High Production Costs of Organic Ingredients

3.2.2 Regulatory Constraints on Ingredients

3.2.3 Limited Awareness in Untapped Markets

3.3 Opportunities

3.3.1 Innovation in Flavours and Ingredients

3.3.2 Expansion in On-the-Go Packaging

3.3.3 Growth Potential in E-Commerce

3.4 Trends

3.4.1 Demand for Low-Calorie Sparkling Tea Options

3.4.2 Emphasis on Functional Benefits in Marketing

3.4.3 Increasing Penetration in Premium Outlets

3.5 Government Regulation

3.5.1 Organic Certification Standards

3.5.2 Labeling and Ingredient Transparency Requirements

3.5.3 Import and Export Restrictions on Raw Materials

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Global Sparkling Tea Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Caffeinated Sparkling Tea

4.1.2 Non-Caffeinated Sparkling Tea

4.2 By Flavour Type (In Value %)

4.2.1 Fruit-Based Flavours

4.2.2 Herbal-Based Flavours

4.2.3 Classic Tea Flavours

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Specialty Stores

4.3.3 Supermarkets and Hypermarkets

4.4 By Packaging Type (In Value %)

4.4.1 Bottled

4.4.2 Canned

4.4.3 Glass Packaging

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. Global Sparkling Tea Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tea Forte

5.1.2 Fentimans

5.1.3 Newby Teas

5.1.4 Long Jing Tea

5.1.5 ITO EN, Ltd.

5.1.6 Hain Celestial

5.1.7 Harney & Sons

5.1.8 Pepsico Inc.

5.1.9 Tetley Tea

5.1.10 Steaz (Healthy Beverage)

5.1.11 Mariage Frres

5.1.12 The Sparkling Tea Company

5.1.13 OSULLOC

5.1.14 Camellia Tea

5.1.15 Clean Cause

5.2 Cross Comparison Parameters (Revenue, Product Range, Distribution Network, Market Share, Headquarters, Innovation Initiatives, Certifications, Employee Count)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Product Development and Launches

5.7 Regional Footprint

5.8 Distribution Agreements

5.9 Investment and Partnership Activities

6. Global Sparkling Tea Market Regulatory Framework

6.1 Organic Standards for Tea Ingredients

6.2 Compliance Requirements for Beverage Labeling

6.3 Certification for Environmental Impact

7. Global Sparkling Tea Market Future Market Size (In USD Billion)

7.1 Factors Driving Future Growth

7.2 Emerging Regional Markets

8. Global Sparkling Tea Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Flavour Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Packaging Type (In Value %)

8.5 By Region (In Value %)

9. Global Sparkling Tea Market Analysts Recommendations

9.1 White Space Opportunity Analysis

9.2 Customer Cohort Analysis

9.3 Product Differentiation Strategies

9.4 Strategic Branding Opportunities

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the entire ecosystem of the global sparkling tea market, identifying major stakeholders, trends, and regulatory influences. This comprehensive analysis sets the foundation for in-depth market study.

Step 2: Market Analysis and Construction

The next step involves a detailed review of historical data to assess growth patterns, dominant segments, and market drivers. This data is sourced from proprietary databases, verified to ensure reliability, and structured for insights.

Step 3: Hypothesis Validation and Expert Consultation

To verify preliminary findings, structured interviews are conducted with industry experts and market stakeholders. These interviews yield insights into pricing strategies, market entry barriers, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from diverse sources, including company reports, industry publications, and expert consultations. The resulting report provides a validated, 360-degree view of the sparkling tea market.

Frequently Asked Questions

01. How big is the Global Sparkling Tea Market?

The global sparkling tea market is valued at USD 460 million, driven by rising consumer demand for healthier and non-alcoholic beverage alternatives with natural ingredients.

02. What are the challenges in the Global Sparkling Tea Market?

Challenges include the high cost of organic ingredients, stringent regulatory standards, and a competitive landscape dominated by both large brands and niche players.

03. Who are the major players in the Global Sparkling Tea Market?

Key players include Tea Forte, Fentimans, ITO EN, Newby Teas, and The Sparkling Tea Company, recognized for their extensive distribution networks and premium product offerings.

04. What are the growth drivers of the Global Sparkling Tea Market?

Growth drivers include increasing consumer interest in wellness products, innovative Flavour offerings, and sustainable packaging initiatives aligning with environmental awareness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.