Global Sparkling Water Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD10466

December 2024

92

About the Report

Global Sparkling Water Market Overview

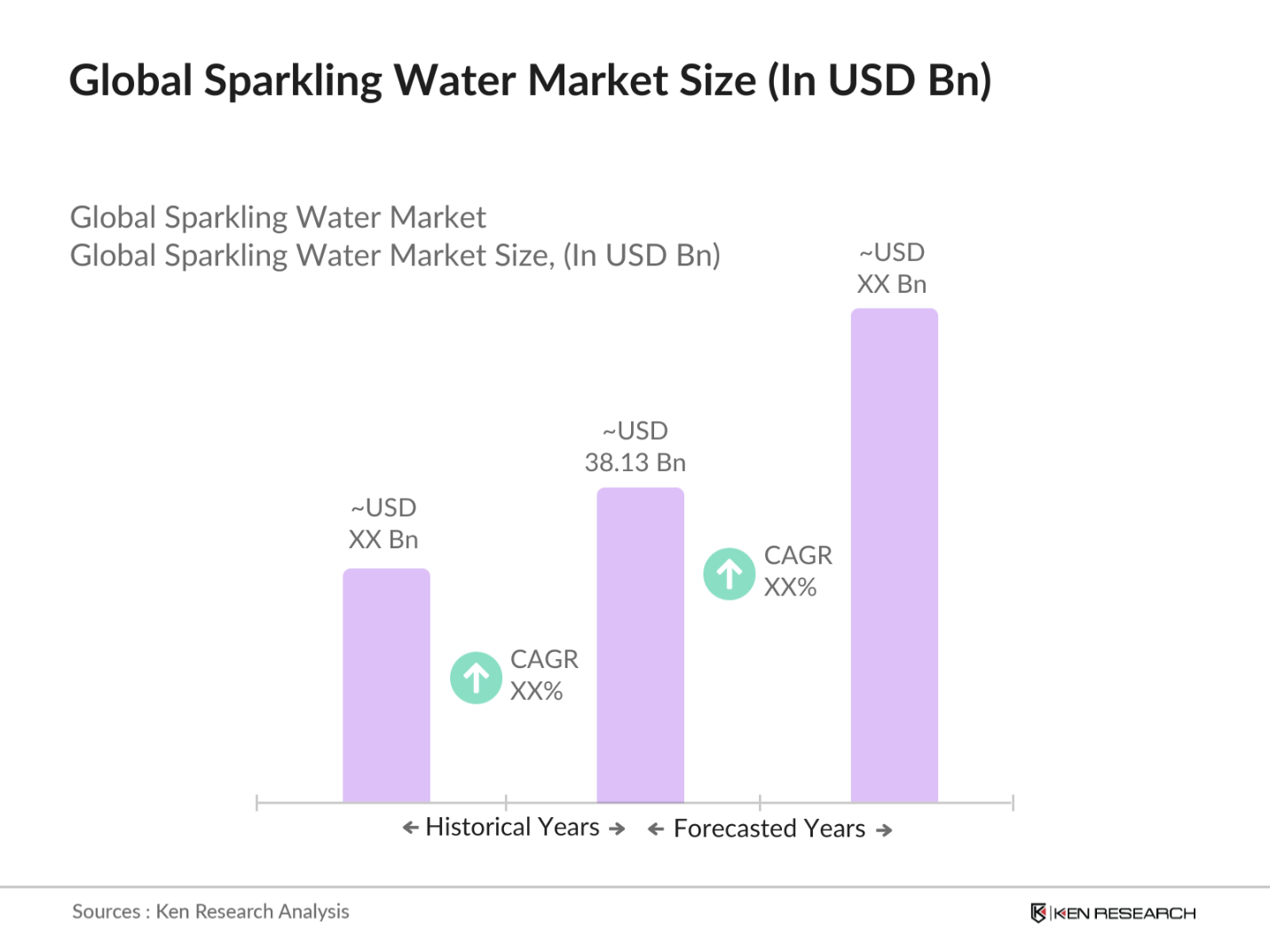

- The global sparkling water market is valued at USD 38.13 billion, according to five-year historical analysis, driven by increasing health consciousness and a shift from sugary carbonated beverages to healthier alternatives. The demand for sparkling water has surged due to its perception as a healthier option, free from sugar and artificial additives, appealing to consumers focused on wellness and clean eating.

- Countries such as the United States, Germany, and France dominate the sparkling water market due to their well-established beverage industries, high per capita consumption, and strong consumer preference for premium bottled water. These regions also benefit from the presence of major players such as PepsiCo and Nestl Waters, which have substantial brand loyalty, robust distribution networks, and frequent product innovations tailored to local tastes and sustainability preferences.

- Government regulations concerning food safety, particularly labeling and additive standards, have a direct impact on the sparkling water market. According to the European Commissions 2023 food safety report, strict labeling regulations for non-alcoholic beverages, including water quality standards, are enforced across the EU. These regulations ensure transparency and quality control, safeguarding consumer health and encouraging trust in sparkling water products. Such standards are essential in both developed and emerging markets.

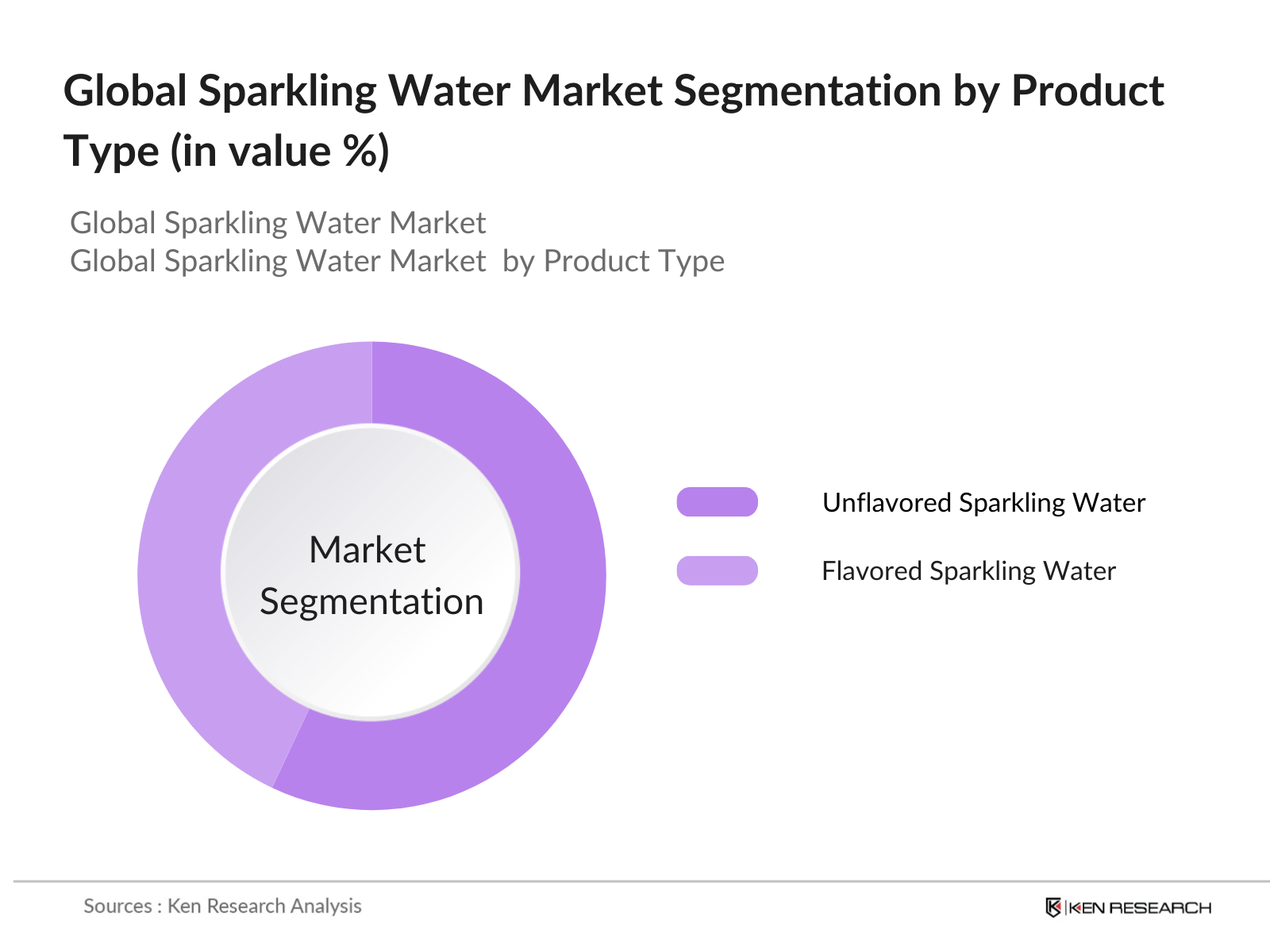

Global Sparkling Water Market Segmentation

By Product Type: The global sparkling water market is segmented by product type into flavored sparkling water and unflavored sparkling water. Unflavored sparkling water dominates the segment due to its broad appeal as a healthy, zero-calorie beverage option. Many consumers perceive unflavored sparkling water as a close alternative to plain water, which fits into hydration needs without added sugars or artificial ingredients. In regions such as North America and Europe, where health-consciousness is on the rise, unflavored sparkling water continues to outperform due to its clean label and minimalist composition.

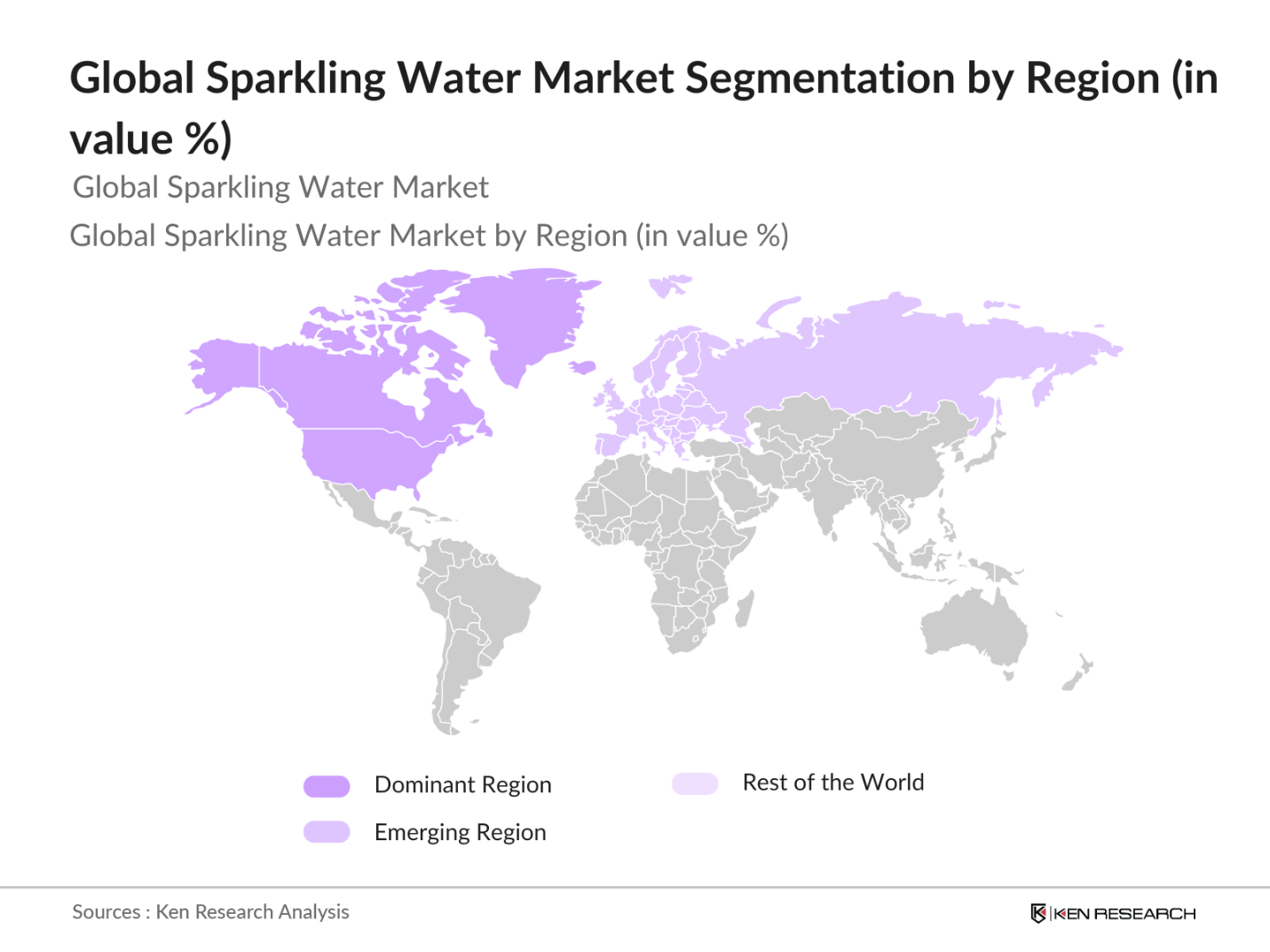

By Region: The global sparkling water market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to a combination of high consumer demand for premium beverages, well-established distribution channels, and strong consumer awareness about the health benefits of sparkling water. Brands such as LaCroix and Spindrift have solidified their dominance in the U.S. market by targeting wellness trends and offering a variety of natural and refreshing flavors.

Global Sparkling Water Market Competitive Landscape

The global sparkling water market is characterized by the presence of several key players that have established strong market positions through extensive product portfolios, innovative marketing strategies, and diverse distribution networks. The market is dominated by both multinational beverage giants and emerging local players. Leading companies include The Coca-Cola Company, PepsiCo, and Nestl Waters, which consistently invest in product innovation and sustainability efforts to cater to evolving consumer preferences.

|

Company Name |

Establishment Year |

Headquarters |

Market Parameters |

|

The Coca-Cola Company |

1892 |

Atlanta, U.S. |

|

|

PepsiCo Inc. |

1965 |

New York, U.S. |

|

|

Nestl Waters |

1992 |

Vevey, Switzerland |

|

|

Talking Rain Beverage Co. |

1987 |

Washington, U.S. |

|

|

National Beverage Corp. |

1985 |

Florida, U.S. |

Global Sparkling Water Market Analysis

Market Growth Drivers

- Rising Health Consciousness: The increasing awareness of health benefits associated with low-calorie, sugar-free beverages has significantly contributed to the growth of the sparkling water market. According to the World Bank, lifestyle-related diseases such as obesity have led to a rise in global healthcare expenditures, with the economic burden of obesity-related illnesses estimated at USD 2 trillion globally. Consumers are turning to healthier alternatives like sparkling water, driving demand. In 2023, health-driven choices are shaping beverage consumption patterns, and governments are promoting healthier alternatives to sugary drinks through public health campaigns and regulations.

Shift Away from Sugary Beverages: The global shift away from sugary beverages is a key driver of the sparkling water market. In 2022, the World Health Organization (WHO) estimated that approximately 422 million people globally suffer from diabetes, a number partly linked to excessive sugar consumption. Government-imposed sugar taxes, such as the soft drink industry levy in the UK, have incentivized consumers to switch to healthier beverages like sparkling water, contributing to market expansion. Moreover, the USDA reports an increased demand for sugar-free and reduced-calorie beverages, especially in North America and Europe. - Expansion of Beverage Product Portfolios: Major beverage companies are diversifying their product offerings by expanding into the sparkling water segment. In 2023, the Food and Agriculture Organization (FAO) reported that global beverage portfolios have increasingly integrated sparkling water, including flavored and functional varieties. This diversification caters to health-conscious consumers seeking alternatives to sugary drinks. Beverage giants are focusing on innovative product lines that appeal to various consumer segments, contributing to the robust growth of the sparkling water market.

Market Challenges

- High Costs of Premium Sparkling Water: The cost of premium sparkling water remains a significant barrier to its widespread adoption, particularly in emerging markets. According to the International Monetary Fund (IMF), household disposable incomes in developing economies have grown by less than 5% annually between 2022 and 2024, making premium products less accessible to middle- and lower-income groups. This has hampered the growth of premium sparkling water in these regions, as affordability remains a key challenge.

- Consumer Awareness and Misconceptions: Despite growing health consciousness, consumer awareness about the benefits of sparkling water versus sugary beverages remains limited. According to the Food and Drug Administration (FDA), as of 2024, misconceptions around the acidity levels of sparkling water and its effects on dental health continue to deter some consumers from making the switch. Such misconceptions can limit market penetration, particularly in regions where public health education campaigns are less robust.

Global Sparkling Water Market Future Outlook

Over the next few years, the global sparkling water market is expected to witness significant growth, driven by the increasing shift towards healthier beverage alternatives, advancements in product development, and rising consumer preference for environmentally sustainable packaging. Major players are anticipated to focus more on natural ingredients, innovative flavors, and functional benefits, while continuing to explore eco-friendly packaging solutions to align with the growing demand for sustainable products.

Market Opportunities:

- Introduction of Functional Sparkling Water: The introduction of functional sparkling water, which includes added vitamins, minerals, and probiotics, has gained momentum. According to the Food and Agriculture Organization (FAO), in 2023, functional beverages saw an increase in consumption by 9% globally. This trend is aligned with consumer preferences for health-boosting products, particularly among millennials and Gen Z. Functional sparkling water offers a unique value proposition in the competitive beverage landscape, blending hydration with additional health benefits.

- Sustainable Packaging Solutions: Sustainable packaging is becoming a major trend within the sparkling water market, driven by environmental concerns and government regulations. According to the United Nations Environment Programme (UNEP), over 300 million tons of plastic waste are generated annually, prompting consumers and brands to seek recyclable and eco-friendly packaging. Sparkling water brands are adopting sustainable materials like aluminum cans and plant-based bottles to reduce their environmental footprint, aligning with consumer demand for greener products.

Scope of the Report

|

By Product Type |

Flavored Sparkling Water Unflavored Sparkling Water |

|

By Display Technology |

Supermarkets and Hypermarkets Online Retail Specialty Stores Convenience Stores |

|

By Application |

Glass Bottles PET Bottles Aluminum Cans |

|

By End-User |

Residential Consumers HoReCa (Hotels, Restaurants, Cafes) |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Beverage Manufacturers

Supermarkets and Hypermarkets

Online Retailers

HoReCa (Hotels, Restaurants, Cafes)

Packaging Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Drug Administration, Environmental Protection Agency)

Importers and Distributors

Companies

Players Mention in the Report

The Coca-Cola Company

PepsiCo Inc.

Nestl Waters

Danone S.A.

Talking Rain Beverage Company

National Beverage Corp.

Keurig Dr Pepper Inc.

Sanpellegrino S.p.A.

LaCroix Sparkling Water

A.G. Barr p.l.c.

Perrier

Gerolsteiner Brunnen GmbH & Co.

Crystal Geyser Water Company

Spindrift

Waterloo Sparkling Water

Table of Contents

01. Global Sparkling Water Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Sparkling Water Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Sparkling Water Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Shift Away from Sugary Beverages

3.1.3. Expansion of Beverage Product Portfolios

3.1.4. Premiumization in Beverage Industry

3.2. Market Challenges

3.2.1. High Costs of Premium Sparkling Water

3.2.2. Competition with Low-Cost Alternatives

3.2.3. Consumer Awareness and Misconceptions

3.3. Opportunities

3.3.1. Growth of Online Distribution Channels

3.3.2. Increasing Demand for Flavored Sparkling Water

3.3.3. Expanding Vegan and Organic Beverage Market

3.4. Trends

3.4.1. Introduction of Functional Sparkling Water

3.4.2. Sustainable Packaging Solutions

3.4.3. Strategic Collaborations with Restaurants and Cafes

3.5. Government Regulation

3.5.1. Food Safety Standards (Labeling, Additives, Quality)

3.5.2. Packaging Regulations (Recyclability, Environmental Norms)

3.5.3. Taxation and Subsidies on Non-Alcoholic Beverages

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Sparkling Water Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Flavored Sparkling Water

4.1.2. Unflavored Sparkling Water

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Online Retail

4.2.3. Specialty Stores

4.2.4. Convenience Stores

4.3. By Packaging Type (In Value %)

4.3.1. Glass Bottles

4.3.2. PET Bottles

4.3.3. Aluminum Cans

4.4. By End-User (In Value %)

4.4.1. Residential Consumers

4.4.2. HoReCa (Hotels, Restaurants, Cafes)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Sparkling Water Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1. The Coca-Cola Company

5.1.2. PepsiCo Inc.

5.1.3. Nestl Waters

5.1.4. Danone S.A.

5.1.5. Talking Rain Beverage Company

5.1.6. National Beverage Corp.

5.1.7. Keurig Dr Pepper Inc.

5.1.8. Sanpellegrino S.p.A.

5.1.9. LaCroix Sparkling Water

5.1.10. A.G. Barr p.l.c.

5.1.11. Perrier

5.1.12. Gerolsteiner Brunnen GmbH & Co.

5.1.13. Crystal Geyser Water Company

5.1.14. Spindrift

5.1.15. Waterloo Sparkling Water

5.2 Cross Comparison Parameters (Market Share, Distribution Network, Product Portfolio, Market Penetration, Production Volume, R&D Investment, Innovation Index, Brand Recognition)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. Global Sparkling Water Market Regulatory Framework

6.1 Food and Beverage Safety Regulations

6.2 Packaging Compliance Standards

6.3 Certification Requirements

07. Global Sparkling Water Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Sparkling Water Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

09. Global Sparkling Water Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process starts with the identification of key variables in the sparkling water market, such as consumer preferences, price sensitivity, and market trends. This stage involves extensive desk research, reviewing proprietary databases, industry publications, and reports from credible institutions.

Step 2: Market Analysis and Construction

We analyze historical market data, focusing on production trends, sales volumes, and revenue generation across various regions. During this phase, we also assess the market penetration of different distribution channels and product types, helping to construct a comprehensive view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews conducted with industry professionals, distributors, and manufacturers. These insights allow us to refine our market data and confirm the trends observed through secondary research.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data into a cohesive report, integrating insights from expert consultations and ensuring the reliability and accuracy of the information. The report is validated through triangulation, combining top-down and bottom-up approaches to achieve a holistic market view.

Frequently Asked Questions

01. How big is the global sparkling water market?

The global sparkling water market, valued at USD 38.13 billion, is driven by increasing consumer demand for healthier beverage alternatives and premium water products.

02. What are the challenges in the global sparkling water market?

Challenges include the high cost of premium products, competition from low-cost alternatives, and consumer misconceptions regarding the health benefits of flavored sparkling water.

03. Who are the major players in the global sparkling water market?

Key players include The Coca-Cola Company, PepsiCo Inc., Nestl Waters, Danone S.A., and Talking Rain Beverage Company. These companies dominate the market due to their strong distribution networks and extensive product portfolios.

04. What are the growth drivers of the global sparkling water market?

The market is propelled by factors such as increased health consciousness, a shift away from sugary beverages, and innovations in flavor and packaging that cater to wellness-focused consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.