Global Specialty Chemicals Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2213

December 2024

83

About the Report

Global Specialty Chemicals Market Overview

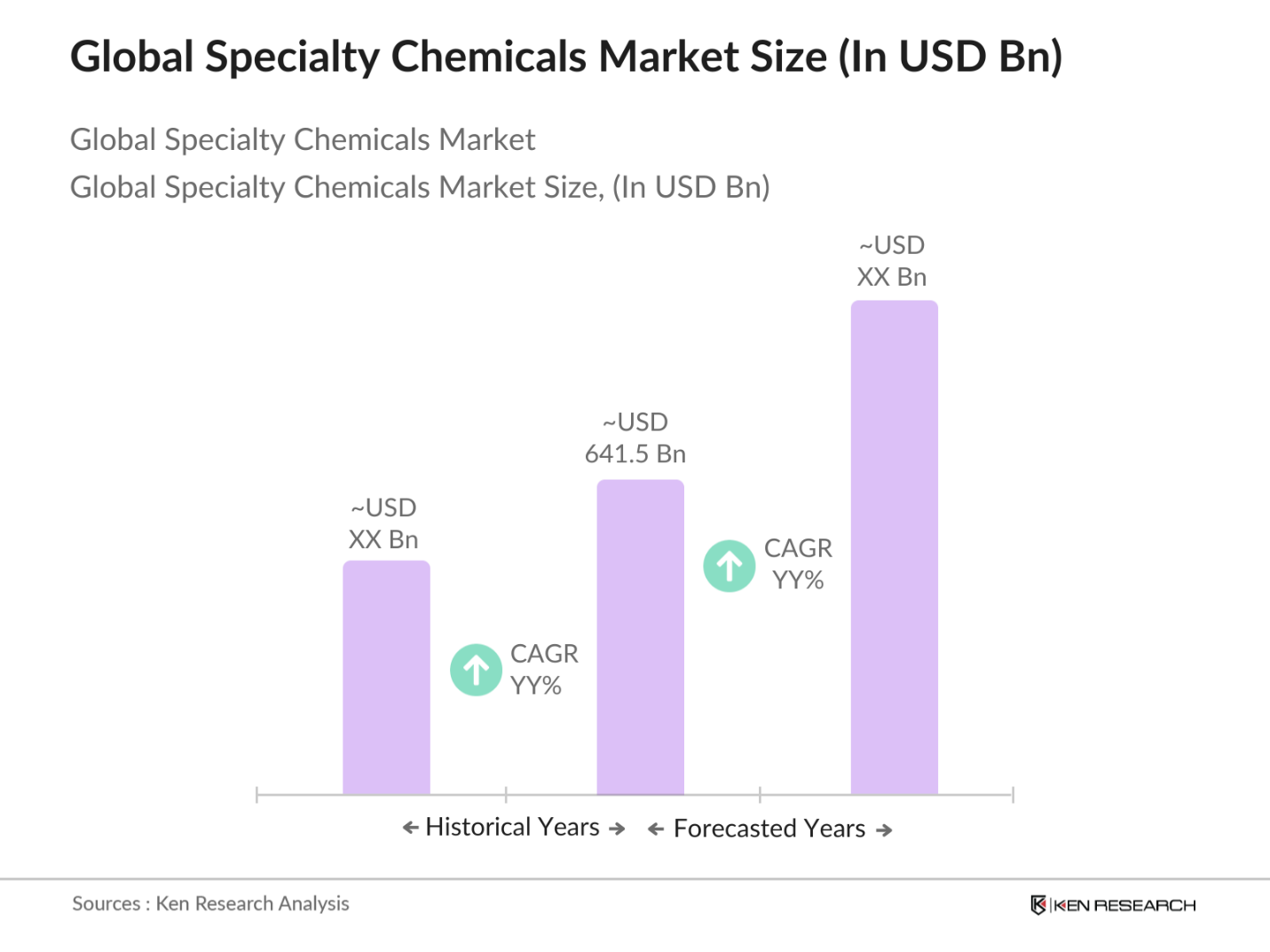

- The global specialty chemicals market is valued at approximately USD 641.5 billion. The market is primarily driven by high demand across several industries such as automotive, construction, agriculture, and healthcare. Technological advancements in chemical formulations and manufacturing processes have led to enhanced performance of specialty chemicals, driving their application in niche sectors like electronics and pharmaceuticals. The industry's growth is also fueled by strict regulations demanding environmentally safe and sustainable products, leading to increased innovation in bio-based specialty chemicals.

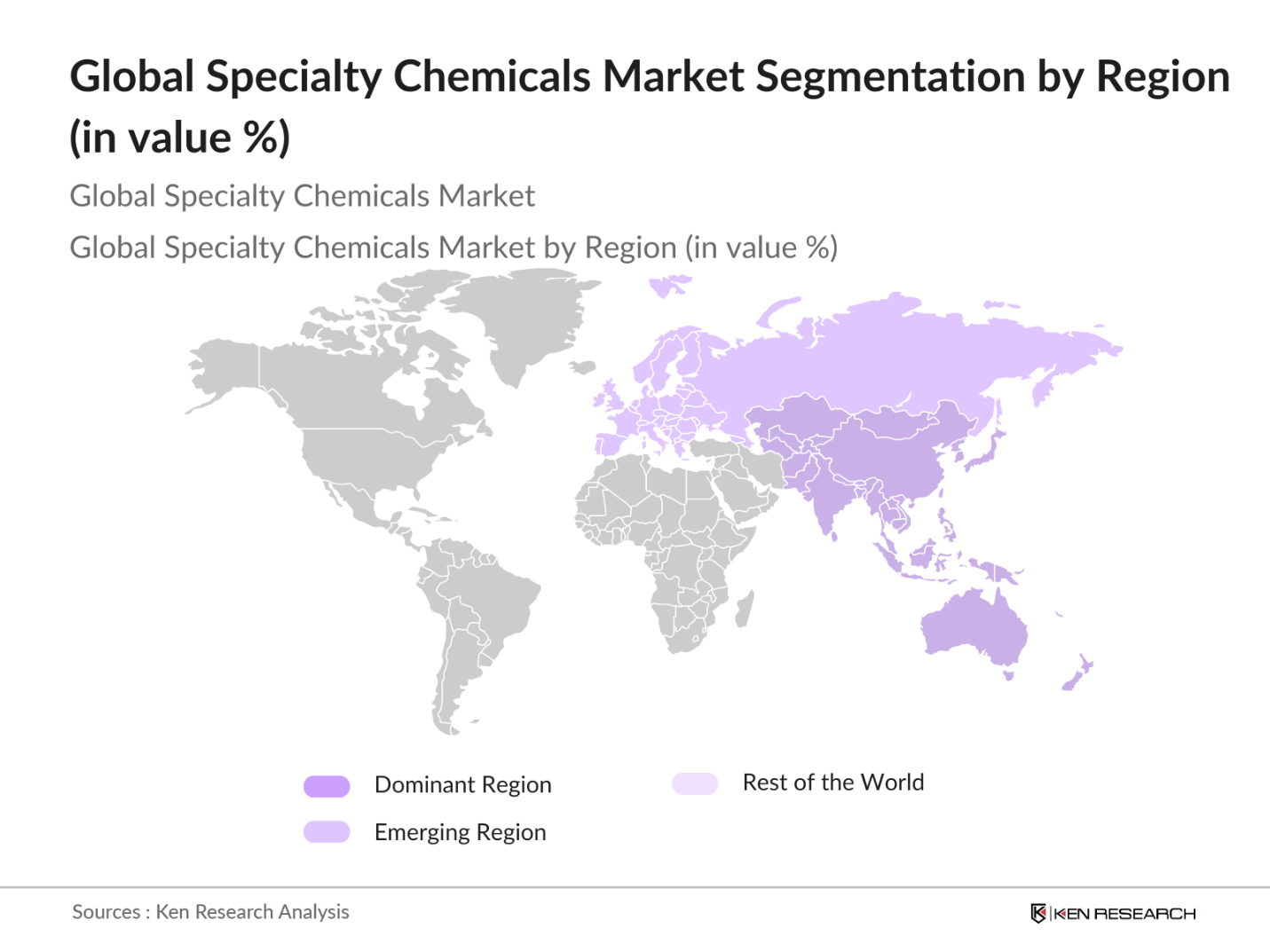

- Countries in the Asia-Pacific region, such as China and India, are leading players in the global specialty chemicals market. China's dominance stems from its large manufacturing base, low production costs, and the government's focus on expanding chemical manufacturing capabilities. Meanwhile, India benefits from rapid industrialization and growing demand across key sectors like construction and pharmaceuticals. The United States and Germany also play significant roles due to their advanced R&D infrastructure and established chemical industries, which support constant product innovation and high-value applications.

- The European Unions REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations play a critical role in governing the specialty chemicals market. In 2023, the EU reported that over 25,000 chemicals were registered under REACH, with manufacturers required to provide comprehensive safety data. Non-compliance with these regulations results in significant fines and product bans. This stringent regulatory landscape encourages chemical companies to develop safer, compliant products, spurring demand for specialty chemicals that meet regulatory standards.

Global Specialty Chemicals Market Segmentation

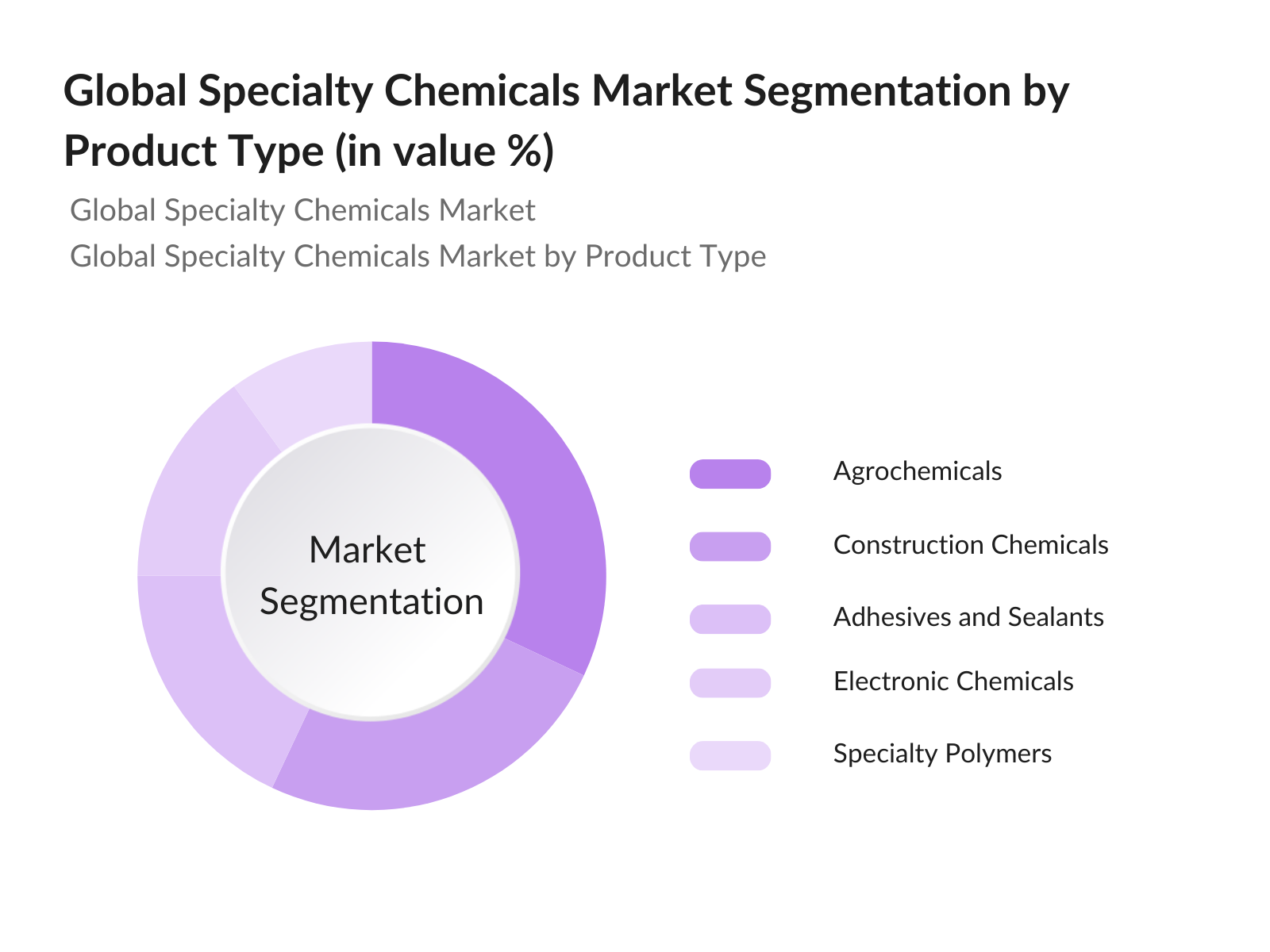

By Product Type: The global specialty chemicals market is segmented by product type into Agrochemicals, Construction Chemicals, Electronic Chemicals, Adhesives and Sealants, and Specialty Polymers. Agrochemicals dominate the product type segmentation, driven by the growing need for increased agricultural productivity to meet the food demands of a growing population. Agrochemicals, including fertilizers, pesticides, and herbicides, have a significant role in improving crop yields, which is critical in regions with limited arable land.

By Region: The global specialty chemicals market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates the market with the largest share, mainly due to the region's expansive industrial base, favorable government regulations, and high demand from end-user industries such as electronics and construction. China and India lead the growth in this region, benefiting from low production costs and significant investments in chemical manufacturing.

By Region: The global specialty chemicals market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates the market with the largest share, mainly due to the region's expansive industrial base, favorable government regulations, and high demand from end-user industries such as electronics and construction. China and India lead the growth in this region, benefiting from low production costs and significant investments in chemical manufacturing.

Global Specialty Chemicals Market Competitive Landscape

The global specialty chemicals market is highly competitive, with a mix of large multinational corporations and smaller, specialized companies. Key players focus on extensive R&D investments, product innovations, and sustainability initiatives to maintain their market positions. Major companies are pursuing mergers and acquisitions to expand their product portfolios and enter new geographical markets. Additionally, strategic collaborations between manufacturers and end-users in industries such as automotive and electronics are shaping the competitive landscape.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD bn) |

Number of Employees |

R&D Spending (USD bn) |

Global Presence |

Product Portfolio |

Sustainability Initiatives |

M&A Activity |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

70.5 |

||||||

|

Dow Inc. |

1897 |

Midland, USA |

58.3 |

||||||

|

Solvay SA |

1863 |

Brussels, Belgium |

13.5 |

||||||

|

Clariant AG |

1995 |

Muttenz, Switzerland |

4.3 |

||||||

|

Evonik Industries AG |

2007 |

Essen, Germany |

15.0 |

Global Specialty Chemicals Market Analysis

Market Growth Drivers

- Increasing Demand from End-Use Industries: Industries such as automotive, electronics, and pharmaceuticals are key consumers of specialty chemicals. The global automotive sector, valued at approximately $2.86 trillion in 2022, is driving demand for coatings, adhesives, and polymers that are essential for lightweight and durable components. The pharmaceutical industry, with a global expenditure of over $1.42 trillion in 2023, is pushing the need for high-purity specialty chemicals, particularly in drug formulation and synthesis processes. The electronics market, driven by semiconductor demand, also accounts for significant consumption of specialty chemicals like photoresists.

- Stricter Environmental Regulations: The implementation of stringent environmental regulations worldwide is a key growth driver. Governments are enforcing stricter emissions standards and hazardous chemical handling protocols. For instance, the European Unions REACH regulation mandates the registration and evaluation of chemicals to ensure safety. In 2023, the U.S. Environmental Protection Agency (EPA) increased fines for non-compliance with hazardous material standards, which affected over 1,200 chemical companies. Compliance has led to a surge in the demand for eco-friendly specialty chemicals, which align with regulatory frameworks.

- Rising Awareness of Sustainable and Eco-Friendly Products: Consumer and industrial demand for sustainable and eco-friendly products has surged. In 2024, the World Bank highlighted a significant global shift toward greener alternatives, as industries seek to reduce the environmental footprint of their processes. For instance, the use of bio-based specialty chemicals has grown substantially as companies aim to meet sustainability goals. This transition is further supported by governmental subsidies promoting green technologies and eco-friendly products. In the U.S., the Department of Energy provides grants and tax incentives specifically for the development and adoption of biodegradable specialty chemicals.

Market Challenges:

- Volatility in Raw Material Prices: The specialty chemicals market is vulnerable to fluctuations in raw material prices, driven by global supply chain disruptions and geopolitical instability. According to the World Banks 2023 Commodity Markets Outlook, prices of key inputs like crude oil, a precursor for many chemicals, fluctuated between $70 and $100 per barrel throughout 2023, impacting chemical production costs. This price volatility adds uncertainty to the industrys cost structure and challenges profitability for chemical manufacturers.

- Environmental and Safety Compliance Costs: Adhering to environmental and safety regulations has become increasingly costly for specialty chemicals manufacturers. The European Union's REACH program imposes substantial fees for the registration and testing of chemicals, driving up compliance costs for companies in the EU. As of 2024, these rising costs are significantly impacting profitability and requiring substantial investment in research to meet stringent safety and environmental standards. U.S. manufacturers are similarly affected, with the EPAs Toxic Substances Control Act mandating extensive safety data collection, further increasing operational costs for compliance.

Global Specialty Chemicals Market Future Outlook

Over the next five years, the global specialty chemicals market is expected to witness robust growth, driven by the increasing demand for high-performance chemicals across multiple industries. Factors such as heightened focus on sustainability, rapid industrialization in emerging markets, and continued advancements in chemical processing technologies are likely to contribute to this growth. Moreover, the rising need for bio-based and environmentally safe chemicals will drive innovation and diversification within the industry.

Market Opportunities:

- Green and Sustainable Chemicals: The demand for green chemicals is gaining momentum globally as industries increasingly seek eco-friendly alternatives. In 2023, the World Bank highlighted the growing adoption of green chemistry technologies, particularly in the production of solvents and polymers, among large-scale manufacturers. The push for sustainability is driving the transition to biodegradable materials in various sectors. This shift is further supported by government grants in regions such as Europe and North America, which are aimed at boosting eco-innovation and encouraging the adoption of sustainable chemical manufacturing practices.

- Growth in Bio-Based Specialty Chemicals: Bio-based specialty chemicals, derived from renewable feedstocks, are emerging as a viable alternative to petrochemicals. The global bio-based chemicals market saw an 8% increase in production volume in 2023, driven by strong demand from industries like packaging and agriculture. Government incentives in countries like the U.S. and Japan, aimed at reducing carbon footprints, have accelerated the production and consumption of bio-based chemicals, making them a central part of sustainability efforts.

Scope of the Report

|

By Product Type |

Agrochemicals, Construction Chemicals Electronic Chemicals Adhesives and Sealants Specialty Polymers |

|

By Display Technology |

Agriculture Construction Automotive Healthcare and Pharmaceuticals Consumer Goods |

|

By Functionality |

Catalysts Coatings Performance Additives Surfactants Dyes and Pigments |

|

By End-User Industry |

Healthcare, Automotive, Aerospace & Defense Entertainment and Media Education |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience for the Report

Specialty Chemicals Manufacturers

End-Use Industry Manufacturers (Automotive, Pharmaceuticals, Electronics)

Government and Regulatory Bodies (REACH, EPA)

R&D Organizations

Venture Capital and Private Equity Firms

Raw Material Suppliers

Sustainability Consultants

Distributors and Traders of Specialty Chemicals

Companies

Players Mention in the Report

BASF SE

Dow Inc.

Solvay SA

Clariant AG

Evonik Industries AG

Akzo Nobel N.V.

Huntsman Corporation

Albemarle Corporation

Ashland Global Holdings Inc.

PPG Industries

Croda International Plc

Mitsubishi Chemical Corporation

Lanxess AG

W.R. Grace & Co.

Linde plc

Table of Contents

01. Global Specialty Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Indicators (Production Volume, Capacity Utilization, Specialty Chemical Exports, Regulatory Approvals)

1.4. Market Segmentation Overview

02. Global Specialty Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Volume and Value)

2.3. Key Market Developments and Milestones (Product Launches, M&A, Regulatory Changes)

03. Global Specialty Chemicals Market Analysis

3.1. Growth Drivers (Technological Advancements, Regulatory Incentives, Industry-Specific Demand, Sustainable Manufacturing Practices)

3.1.1. Technological Innovation in Chemical Processes

3.1.2. Increasing Demand from End-Use Industries (Automotive, Pharmaceuticals, Electronics)

3.1.3. Stricter Environmental Regulations

3.1.4. Rising Awareness of Sustainable and Eco-Friendly Products

3.2. Market Challenges (High R&D Costs, Supply Chain Disruptions, Compliance with Stringent Regulations)

3.2.1. Volatility in Raw Material Prices

3.2.2. Environmental and Safety Compliance Costs

3.2.3. Limited Access to Skilled Labor

3.3. Opportunities (Emerging Markets, Circular Economy Adoption, Collaborative Research Initiatives)

3.3.1. Growth Potential in Emerging Markets

3.3.2. Strategic Alliances and M&A in Product Development

3.3.3. Circular Economy and Resource Efficiency

3.4. Trends (Nanotechnology Integration, Green Chemistry Solutions, Customization in Specialty Chemicals)

3.4.1. Green and Sustainable Chemicals

3.4.2. Growth in Bio-Based Specialty Chemicals

3.4.3. Increasing Focus on Digitalization and Automation in Production

3.5. Regulatory Landscape (Government Incentives, Industry Standards, Compliance Regulations)

3.5.1. Chemical Safety and Hazardous Substances Regulations

3.5.2. REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) Regulations

3.5.3. Emissions and Waste Control Standards

3.6. Value Chain Analysis (Raw Material Supply, Processing and Manufacturing, End-Use Distribution)

3.7. SWOT Analysis

3.8. Stakeholder Ecosystem (Suppliers, Manufacturers, Distributors, Regulatory Bodies)

3.9. Porters Five Forces Analysis (Supplier Bargaining Power, Buyer Bargaining Power, Competitive Rivalry)

04. Global Specialty Chemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Agrochemicals

4.1.2. Construction Chemicals

4.1.3. Electronic Chemicals

4.1.4. Adhesives and Sealants

4.1.5. Specialty Polymers

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Construction

4.2.3. Automotive

4.2.4. Healthcare and Pharmaceuticals

4.2.5. Consumer Goods

4.3. By End-User Industry (In Value %)

4.3.1. Electronics and Semiconductors

4.3.2. Textiles

4.3.3. Packaging

4.3.4. Personal Care and Cosmetics

4.3.5. Water Treatment

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Functionality (In Value %)

4.5.1. Catalysts

4.5.2. Coatings

4.5.3. Performance Additives

4.5.4. Surfactants

4.5.5. Dyes and Pigments

05. Global Specialty Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Inc.

5.1.3. Solvay SA

5.1.4. Clariant AG

5.1.5. Evonik Industries AG

5.1.6. Akzo Nobel N.V.

5.1.7. Huntsman Corporation

5.1.8. Albemarle Corporation

5.1.9. Ashland Global Holdings Inc.

5.1.10. PPG Industries

5.1.11. Croda International Plc

5.1.12. Mitsubishi Chemical Corporation

5.1.13. Lanxess AG

5.1.14. W.R. Grace & Co.

5.1.15. Linde plc

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation Initiatives, No. of Patents Filed, R&D Investment, Production Facilities, Sustainability Initiatives)

5.3. Market Share Analysis (Top 10 Companies)

5.4. Strategic Initiatives (Partnerships, Collaborations, Expansion)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Capital Expenditure, Major Projects)

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

06. Global Specialty Chemicals Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Global Specialty Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Sustainability Demand, Technological Advances, Policy Reforms)

08. Global Specialty Chemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Functionality (In Value %)

09. Global Specialty Chemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves identifying critical variables impacting the global specialty chemicals market, using in-depth desk research and databases. This includes mapping key stakeholders, such as manufacturers, distributors, and regulatory bodies, and analyzing their impact on market dynamics.

Step 2: Market Analysis and Construction

This step entails a comprehensive analysis of historical market data to understand market penetration, end-use industry demand, and supply chain dynamics. By analyzing these factors, we provide insights into revenue generation and market structure.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, hypotheses are developed based on market trends and tested through expert interviews with industry professionals. These interviews validate the accuracy of market data and provide additional insights into future growth trends.

Step 4: Research Synthesis and Final Output

The final phase integrates all collected data and insights to produce a comprehensive analysis of the specialty chemicals market. The report's conclusions are validated through primary and secondary research to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the global specialty chemicals market?

The global specialty chemicals market is valued at approximately USD 641.5 billion, with demand driven by industries like automotive, pharmaceuticals, and construction.

02. What are the challenges in the specialty chemicals market?

Key challenges include high R&D costs, stringent environmental regulations, and the volatility of raw material prices, which can significantly impact profitability.

03. Who are the major players in the specialty chemicals market?

Major players include BASF SE, Dow Inc., Solvay SA, Clariant AG, and Evonik Industries AG, all of whom lead the market through extensive R&D and innovative product offerings.

04. What are the growth drivers of the specialty chemicals market?

The market is driven by rising demand for high-performance chemicals, increasing industrialization in emerging markets, and technological advancements in chemical processing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.