Global Specialty Foods Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD11270

December 2024

90

About the Report

Global Specialty Foods Market Overview

- The global specialty foods market is valued at $230 billion, driven by evolving consumer preferences for unique and premium products. Factors such as increased health consciousness, demand for natural ingredients, and the expansion of e-commerce platforms have significantly contributed to this growth. Additionally, the influence of culinary tourism and exposure to global cuisines have further propelled market expansion.

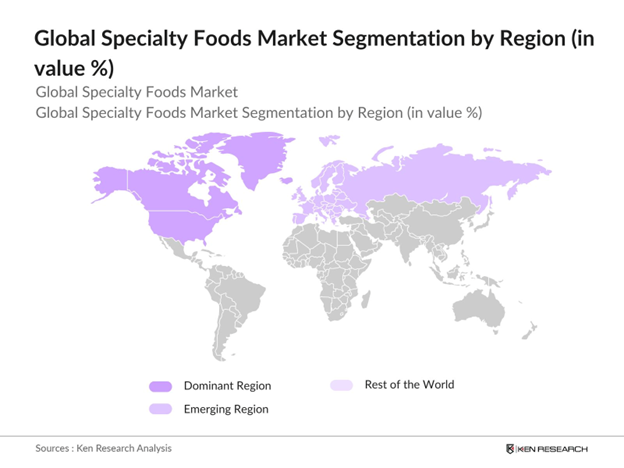

- North America and Europe dominate the specialty foods market due to their established food industries and high consumer demand for diverse and premium food products. The presence of major market players and a strong distribution network in these regions also contribute to their dominance. Additionally, the growing trend of health-conscious eating and the popularity of organic and natural foods have bolstered market growth in these areas.

- Governments worldwide are implementing stringent food labeling regulations to ensure consumer safety and informed choices. In the United States, the Food and Drug Administration (FDA) mandates comprehensive nutritional labeling on packaged foods, including calorie counts and ingredient lists. The European Union's Food Information to Consumers Regulation requires detailed allergen information and origin labeling for certain products. Compliance with these regulations is essential for specialty food producers to maintain market access and consumer trust.

Global Specialty Foods Market Segmentation

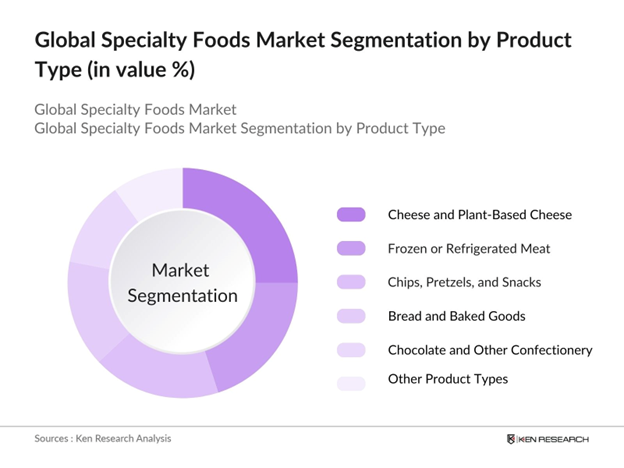

By Product Type The specialty foods market is segmented by product type into cheese and plant-based cheese, frozen or refrigerated meat, poultry, and seafood, chips, pretzels, and snacks, bread and baked goods, chocolate and other confectionery, and other product types. Cheese and plant-based cheese hold a dominant market share due to their widespread popularity and versatility in various cuisines. The increasing demand for plant-based alternatives has also contributed to the growth of this segment.

By Region: The specialty foods market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America leads the specialty foods market, attributed to a well-established food industry and high consumer demand for diverse and premium products. The presence of major market players and a strong distribution network further bolster the region's dominance. Additionally, the growing trend of health-conscious eating and the popularity of organic and natural foods have contributed to market growth in this area.

By Consumer Generation The market is segmented by consumer generation into Gen-Z (ages 9-24), Millennials (ages 25-40), Gen-X (ages 41-56), and Baby Boomers (ages 57-75). Millennials (ages 25-40) are the dominant consumer generation in the specialty foods market. Their preference for unique, health-conscious, and convenient food options drives demand. This generation's willingness to explore new flavors and cuisines, coupled with higher disposable incomes, contributes significantly to the market's growth.

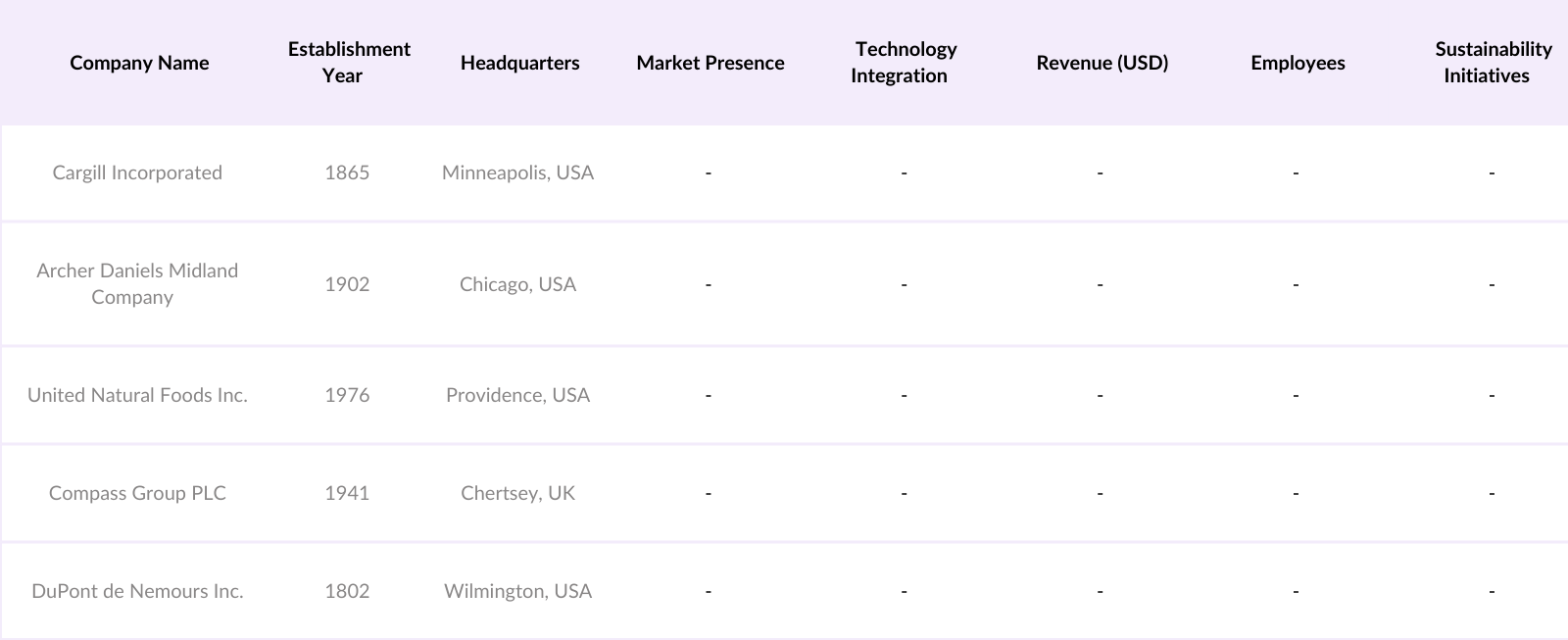

Global Specialty Foods Market Competitive Landscape

The global specialty foods market is characterized by the presence of several key players who contribute to its competitive landscape. These companies have established strong market positions through extensive product portfolios, strategic initiatives, and a focus on innovation.

Global Specialty Foods Market Analysis

Growth Drivers

- Increasing Consumer Demand for Unique and Premium Products: In 2023, global consumer spending reached $63 trillion, reflecting a growing appetite for unique and premium products. This trend is evident in the specialty foods sector, where consumers are increasingly seeking artisanal cheeses, exotic spices, and gourmet chocolates. The rise of the middle class, particularly in emerging economies, has expanded the market for premium goods. For instance, China's middle class is projected to encompass 550 million individuals by 2025, significantly boosting demand for specialty foods. Additionally, the global tourism industry, valued at $1.7 trillion in 2023, has exposed consumers to diverse cuisines, further driving interest in unique food products.

- Rising Health Consciousness and Preference for Natural Ingredients: The global health and wellness industry was valued at $5.5 trillion in 2023, indicating a significant shift towards healthier lifestyles. This change is mirrored in the food sector, where consumers are increasingly opting for natural and organic ingredients. In the United States, organic food sales reached $60 billion in 2023, up from $50 billion in 2020. This health-conscious trend is driving the specialty foods market, as consumers seek products free from artificial additives and preservatives.

- Expansion of E-commerce Platforms Enhancing Product Accessibility: The global e-commerce market was valued at $6 trillion in 2023, facilitating unprecedented access to specialty foods. In the United States, online grocery sales reached $100 billion in 2023, accounting for 12% of total grocery sales. In China, e-commerce platforms like Alibaba's Tmall and JD.com have expanded their food and beverage offerings, contributing to the country's $1.5 trillion online retail market. This digital expansion allows consumers worldwide to access a diverse range of specialty foods, driving market growth.

Challenges

- High Production Costs Leading to Premium Pricing: Specialty foods often involve artisanal production methods and high-quality ingredients, leading to elevated production costs. For instance, producing Parmigiano-Reggiano cheese requires specific aging processes and raw materials, resulting in higher prices compared to mass-produced cheeses. Similarly, authentic saffron harvesting is labor-intensive, contributing to its status as one of the most expensive spices globally. These high costs can limit consumer accessibility, particularly in price-sensitive markets.

- Regulatory Compliance and Food Safety Standards: The global food industry is subject to stringent regulations to ensure safety and quality. In the European Union, the General Food Law Regulation mandates comprehensive traceability and safety assessments for all food products. Similarly, the United States enforces the Food Safety Modernization Act, requiring rigorous compliance from food producers. Navigating these complex regulatory landscapes can be challenging for specialty food producers, especially small-scale artisans, potentially hindering market entry and expansion.

Global Specialty Foods Market Future Outlook

Over the next five years, the global specialty foods market is expected to experience significant growth. Factors such as increasing consumer demand for unique and premium products, rising health consciousness, and the expansion of e-commerce platforms are anticipated to drive this growth. Additionally, the influence of culinary tourism and exposure to global cuisines will continue to propel market expansion.

Market Opportunities

- Innovation in Product Offerings and Flavor Profiles: The specialty foods market is ripe for innovation, with consumers seeking novel flavors and products. The global flavor and fragrance market was valued at $30 billion in 2023, reflecting a demand for diverse taste experiences. The Asia-Pacific region dominated the market in 2023, driven by rising disposable incomes and urbanization in countries like India, China, and Indonesia. Developing unique products like matcha-infused chocolates or turmeric-flavored beverages can capture consumer interest and drive market growth.

- Expansion into Emerging Markets: Emerging markets present significant growth opportunities for specialty foods. In 2023, Asia's middle class numbered 2 billion individuals, with increasing disposable incomes and a growing appetite for premium products. Africa's food and beverage market was valued at $313 billion in 2023, with projections indicating substantial growth. Expanding into these regions can tap into new consumer bases, especially as urbanization and globalization expose populations to diverse culinary experiences.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Cheese and Plant-Based Cheese |

|

Consumer Generation |

Gen-Z (Ages 9-24) |

|

Distribution Channel |

Food Service |

|

Region |

North America |

Products

Key Target Audience

Specialty Food Manufacturers

Food and Beverage Distributors

Retail Chains and Supermarkets

E-commerce Platforms

Culinary Tourism Operators

Health and Wellness Centers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration, European Food Safety Authority)

Companies

Players Mentioned in the Report

Cargill Incorporated

Archer Daniels Midland Company

United Natural Foods Inc.

Compass Group PLC

DuPont de Nemours Inc.

International Flavors & Fragrances Inc.

Hormel Foods Corporation

Koninklijke DSM NV

Kerry Group PLC

Ingredion Incorporated

Table of Contents

1. Global Specialty Foods Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Specialty Foods Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Specialty Foods Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Consumer Demand for Unique and Premium Products

3.1.2 Rising Health Consciousness and Preference for Natural Ingredients

3.1.3 Expansion of E-commerce Platforms Enhancing Product Accessibility

3.1.4 Influence of Culinary Tourism and Exposure to Global Cuisines

3.2 Market Challenges

3.2.1 High Production Costs Leading to Premium Pricing

3.2.2 Regulatory Compliance and Food Safety Standards

3.2.3 Supply Chain Disruptions and Ingredient Sourcing Issues

3.3 Opportunities

3.3.1 Innovation in Product Offerings and Flavor Profiles

3.3.2 Expansion into Emerging Markets

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Growth of Plant-Based and Vegan Specialty Foods

3.4.2 Emphasis on Clean Label and Transparency

3.4.3 Adoption of Sustainable and Eco-Friendly Packaging

3.5 Government Regulations

3.5.1 Food Labeling and Nutritional Information Requirements

3.5.2 Import and Export Regulations Affecting Specialty Foods

3.5.3 Subsidies and Support for Local Artisanal Producers

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Global Specialty Foods Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Cheese and Plant-Based Cheese

4.1.2 Frozen or Refrigerated Meat, Poultry, and Seafood

4.1.3 Chips, Pretzels, and Snacks

4.1.4 Bread and Baked Goods

4.1.5 Chocolate and Other Confectionery

4.1.6 Other Product Types

4.2 By Consumer Generation (In Value %)

4.2.1 Gen-Z (Ages 9-24)

4.2.2 Millennials (Ages 25-40)

4.2.3 Gen-X (Ages 41-56)

4.2.4 Baby Boomers (Ages 57-75)

4.3 By Distribution Channel (In Value %)

4.3.1 Food Service

4.3.2 Retail

4.3.3 Online

4.4 By Region (In Value %)

4.4.1 North America

4.4.2 Europe

4.4.3 Asia-Pacific

4.4.4 Latin America

4.4.5 Middle East and Africa

5. Global Specialty Foods Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cargill Incorporated

5.1.2 Archer Daniels Midland Company

5.1.3 United Natural Foods Inc.

5.1.4 Compass Group PLC

5.1.5 DuPont de Nemours Inc.

5.1.6 International Flavors & Fragrances Inc.

5.1.7 Hormel Foods Corporation

5.1.8 Koninklijke DSM NV

5.1.9 Kerry Group PLC

5.1.10 Ingredion Incorporated

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, R&D Investment, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Specialty Foods Market Regulatory Framework

6.1 Food Safety and Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Global Specialty Foods Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Specialty Foods Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Consumer Generation (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Region (In Value %)

9. Global Specialty Foods Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global specialty foods market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global specialty foods market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple specialty food manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global specialty foods market.

Frequently Asked Questions

01. How big is the global specialty foods market?

The global specialty foods market is valued at $230 billion, driven by evolving consumer preferences for unique and premium products and the influence of culinary tourism.

02. What are the primary challenges in the global specialty foods market?

Challenges in global specialty foods market include high production costs, regulatory compliance, and supply chain disruptions. Additionally, meeting consumer demands for sustainability and transparency presents logistical difficulties for manufacturers.

03. Who are the major players in the global specialty foods market?

Key players in global specialty foods market include Cargill Incorporated, Archer Daniels Midland Company, United Natural Foods Inc., Compass Group PLC, and DuPont de Nemours Inc. These companies lead due to their extensive product portfolios, global reach, and strong distribution networks.

04. What factors are driving growth in the specialty foods market?

Growth in global specialty foods market is driven by rising consumer interest in health-conscious and natural foods, the influence of culinary tourism, and innovations in e-commerce which make specialty foods more accessible worldwide.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.