Global Stock Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-005

June 2025

88

About the Report

Global Stock Market Overview

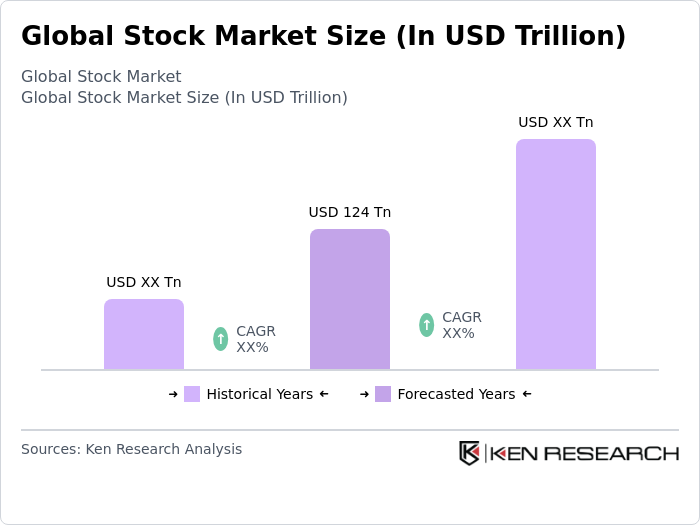

- The Global Stock Market was valued at USD 124 trillion, based on a five-year historical analysis. This substantial market size is driven by factors such as increased global investment, rapid technological advancements in trading platforms, and a surge in retail investor participation. The market has seen significant fluctuations influenced by economic conditions, geopolitical events, and monetary policies across various regions.

- The United States, China, and Japan remain dominant players in the Global Stock Market. The U.S. leads with largest market share underpinned by its robust financial infrastructure, diverse investment options, and the largest number of high-value publicly traded companies. China’s expanding economic influence and ongoing market liberalization have positioned it as a key global player, while Japan’s technological prowess and strong corporate governance support its significant market presence.

- In 2023, the U.S. Securities and Exchange Commission (SEC) introduced new regulations to enhance transparency in stock trading. These regulations require trading firms to disclose more detailed information about their order execution and trading practices, aiming to foster fairer trading conditions and protect investors from potential market manipulation.

Global Stock Market Segmentation

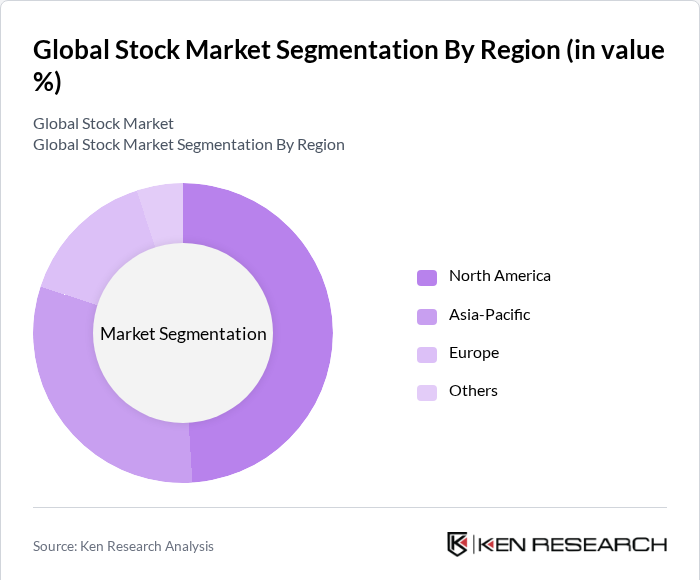

By Region: The Global Stock Market is segmented by region into North America, Asia-Pacific, Europe, and others. North America, led by the United States, dominates with nearly half of the global market capitalization, owing to its mature financial markets, high liquidity, and concentration of institutional investors. The Asia-Pacific region is significant, driven by the economic growth of China, Japan, and India, and marked by increasing retail and institutional investor participation. Europe remains a key player, with major exchanges in the UK, Germany, and France contributing to its market presence.

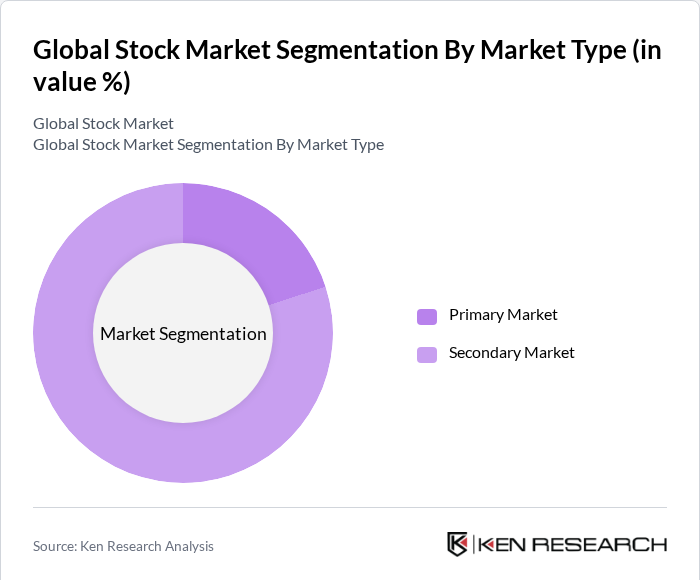

By Market Type: The market is further segmented into primary and secondary markets. The primary market, where new securities are issued, is vital for capital formation and is dominated by initial public offerings (IPOs). The secondary market, where existing securities are traded, is characterized by high liquidity and is heavily influenced by investor sentiment and global market trends. The secondary market accounts for the vast majority of trading volume, making it the focal point for both retail and institutional investors.

Global Stock Market Competitive Landscape

The Global Stock Market features a highly competitive landscape, with major stock exchanges and financial institutions as key players. Leading exchanges such as the New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), and Tokyo Stock Exchange (TSE) provide platforms for a vast array of securities. Prominent investment firms, including Goldman Sachs and Morgan Stanley, play significant roles in facilitating trading and providing market insights.

Global Stock Market Industry Analysis

Growth Drivers

- Increasing Global Investment Trends: In early 2025, global stock markets experienced heightened activity, with daily trading volumes rising by approximately 15% compared to the previous year. This surge is supported by growing disposable incomes and improved financial literacy, as evidenced by a 20% increase in individuals participating in stock trading over the past three years. The World Bank reports that global savings rates have climbed to 25% of GDP, reflecting a strong propensity for investment across diverse populations.

- Technological Advancements in Trading Platforms: In early 2025, global stock markets experienced heightened activity, with daily trading volumes rising by approximately 15% compared to the previous year. This surge is supported by growing disposable incomes and improved financial literacy, as evidenced by a 20% increase in individuals participating in stock trading over the past three years. The World Bank reports that global savings rates have climbed to 25% of GDP, reflecting a strong propensity for investment across diverse populations.

- Rising Participation of Retail Investors: In 2024, over 30 million new retail investor accounts were opened globally, reflecting a significant surge driven by the democratization of trading through online platforms and the influence of social media. Retail investors now account for approximately 25% of total trading volume, up from 15% in 2020, according to the Financial Industry Regulatory Authority (FINRA)

Market Challenges

- Economic Volatility and Uncertainty: Economic instability continues to pose a significant challenge to the stock market. Factors such as geopolitical tensions, inflationary pressures, and global economic slowdowns contribute to market uncertainty. This can result in increased volatility, discourage investment, and lead to unpredictable fluctuations in stock prices. As a result, investors are becoming more cautious, which can hinder both market growth and long-term stability.

- Regulatory Changes and Compliance Costs: The evolving regulatory landscape presents growing challenges for market participants. New regulations aimed at improving transparency and market integrity often lead to increased compliance burdens. These changes can strain smaller firms, limiting their ability to compete effectively. Additionally, the complexity and cost of compliance may deter new entrants, ultimately stifling innovation and reducing overall market dynamism.

Global Stock Market Future Outlook

The future of the stock market appears promising, driven by technological advancements and increasing investor engagement. As digital platforms continue to evolve, they will likely enhance trading efficiency and accessibility. Furthermore, the growing emphasis on sustainable investing is expected to reshape investment strategies, attracting a new wave of investors. Overall, the market is poised for growth, with innovations and changing investor preferences playing pivotal roles in its evolution.

Market Opportunities

- Expansion of Emerging Markets: Emerging markets continue to offer significant growth opportunities, driven by rapid economic expansion and structural transformation in regions such as Asia-Pacific and Africa. In early 2025, emerging market equities outperformed developed markets, with China’s technology sector and Brazilian commodities leading gains, reflecting renewed investor confidence amid improving macroeconomic conditions.

- Growth of Sustainable and Ethical Investing: The demand for sustainable investment options continues to rise sharply, reflecting growing investor awareness of social and environmental issues. By 2025, assets in ESG (Environmental, Social, and Governance) funds are projected to reach between $14 trillion and $19 trillion globally, with some forecasts estimating up to $30 trillion by 2030.

Scope of the Report

| By Region |

North America Asia-Pacific Europe Others |

| By Market Type |

Primary Markets Secondary Markets |

| By Investor Type |

Institutional Investors Retail Investors |

| By Trading Platform |

Online Trading Platforms Traditional Brokerage Firms |

| By Asset Class |

Equities Fixed Income Derivatives Exchange-Traded Funds (ETFs) |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Securities and Exchange Commission, Financial Conduct Authority)

Stock Exchanges and Trading Platforms

Institutional Investors (e.g., Pension Funds, Mutual Funds)

Brokerage Firms and Financial Advisors

Hedge Funds and Asset Management Companies

Private Equity Firms

Financial Technology (FinTech) Companies

Companies

Players Mentioned in the Report:

New York Stock Exchange

Nasdaq

London Stock Exchange

Tokyo Stock Exchange

Goldman Sachs

Global Equity Exchange

Apex Market Solutions

Horizon Trading Group

Universal Stock Network

Capital Market Innovations

Table of Contents

1. Global Stock Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Stock Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Stock Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Investment Trends

3.1.2. Technological Advancements in Trading Platforms

3.1.3. Rising Participation of Retail Investors

3.2. Market Challenges

3.2.1. Economic Volatility and Uncertainty

3.2.2. Regulatory Changes and Compliance Costs

3.2.3. Market Manipulation and Fraud Risks

3.3. Opportunities

3.3.1. Expansion of Emerging Markets

3.3.2. Growth of Sustainable and Ethical Investing

3.3.3. Innovations in Financial Technology (FinTech)

3.4. Trends

3.4.1. Increasing Use of Artificial Intelligence in Trading

3.4.2. Shift Towards Passive Investment Strategies

3.4.3. Growth of Environmental, Social, and Governance (ESG) Investing

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies

3.5.2. Impact of Regulations on Market Operations

3.5.3. Compliance with International Standards

3.5.4. Future Regulatory Trends and Implications

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Stock Market Segmentation

4.1. By Region

4.1.1. North America

4.1.2. Asia-Pacific

4.1.3. Europe

4.1.4. Others

4.2. By Market Type

4.2.1. Primary Markets

4.2.2. Secondary Markets

4.3. By Investor Type

4.3.1. Institutional Investors

4.3.2. Retail Investors

4.4. By Trading Platform

4.4.1. Online Trading Platforms

4.4.2. Traditional Brokerage Firms

4.5. By Asset Class

4.5.1. Equities

4.5.2. Fixed Income

4.5.3. Derivatives

4.5.4. Exchange-Traded Funds (ETFs)

5. Global Stock Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. New York Stock Exchange

5.1.2. Nasdaq

5.1.3. London Stock Exchange

5.1.4. Tokyo Stock Exchange

5.1.5. Goldman Sachs

5.1.6. Global Equity Exchange

5.1.7. Apex Market Solutions

5.1.8. Horizon Trading Group

5.1.9. Universal Stock Network

5.1.10. Capital Market Innovations

5.2. Cross Comparison Parameters

5.2.1. Market Capitalization

5.2.2. Trading Volume

5.2.3. Number of Listed Companies

5.2.4. Average Daily Turnover

5.2.5. Price-to-Earnings Ratios

5.2.6. Dividend Yield

5.2.7. Market Liquidity

5.2.8. Investor Sentiment Indicators

6. Global Stock Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Stock Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Stock Market Future Market Segmentation

8.1. By Region

8.1.1. North America

8.1.2. Asia-Pacific

8.1.3. Europe

8.1.4. Others

8.2. By Market Type

8.2.1. Primary Markets

8.2.2. Secondary Markets

8.3. By Investor Type

8.3.1. Institutional Investors

8.3.2. Retail Investors

8.4. By Trading Platform

8.4.1. Online Trading Platforms

8.4.2. Traditional Brokerage Firms

8.5. By Asset Class

8.5.1. Equities

8.5.2. Fixed Income

8.5.3. Derivatives

8.5.4. Exchange-Traded Funds (ETFs)

9. Global Stock Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the essential components of the Global Stock Market, including key players, market segments, and regulatory frameworks. This step relies on extensive desk research, utilizing secondary data sources such as financial reports, market studies, and academic literature to identify and define the critical variables that impact market behavior and trends.

Step 2: Data Collection and Analysis

In this phase, we will gather quantitative and qualitative data from various sources, including stock exchanges, financial institutions, and market analysts. This data will be analyzed to identify trends, correlations, and anomalies within the Global Stock Market, focusing on trading volumes, price movements, and investor sentiment to build a comprehensive market profile.

Step 3: Hypothesis Development and Testing

Based on the insights gained from the data analysis, we will formulate hypotheses regarding market trends and investor behavior. These hypotheses will be tested through statistical methods and models, including regression analysis and time-series forecasting, to validate assumptions and draw meaningful conclusions about market dynamics.

Step 4: Reporting and Recommendations

The final phase involves synthesizing the research findings into a coherent report that outlines key insights, trends, and actionable recommendations for stakeholders. This report will be designed to inform investment strategies, policy decisions, and market entry approaches, ensuring that the analysis is both comprehensive and practical for various market participants.

Frequently Asked Questions

01. How big is the Global Stock Market?

The Global Stock Market is valued at USD 124 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Stock Market?

Key challenges in the Global Stock Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Stock Market?

Major players in the Global Stock Market include New York Stock Exchange, Nasdaq, London Stock Exchange, Tokyo Stock Exchange, Goldman Sachs, among others.

04. What are the growth drivers for the Global Stock Market?

The primary growth drivers for the Global Stock Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.