Global Supply Chain Analytics Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4206

December 2024

91

About the Report

Global Supply Chain Analytics Market Overview

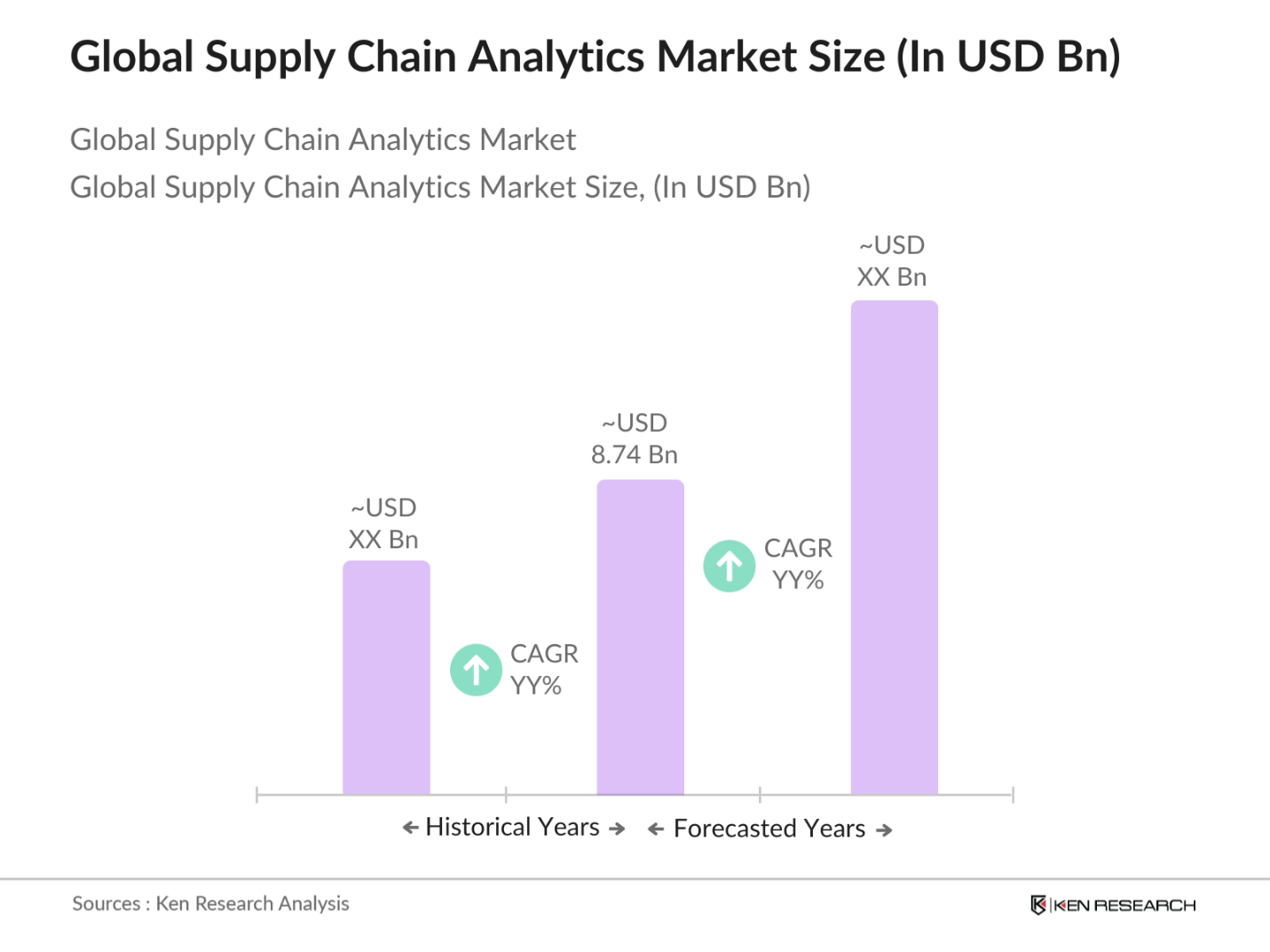

- The global supply chain analytics market is valued at USD 8.74billion, based on a five-year historical analysis. This market growth is driven by the widespread adoption of real-time data solutions and the increasing use of artificial intelligence (AI) and machine learning (ML) to streamline supply chain processes. As businesses seek to optimize decision-making and improve operational efficiency, analytics have become critical in managing complex supply chains, particularly in industries like manufacturing, retail, and logistics.

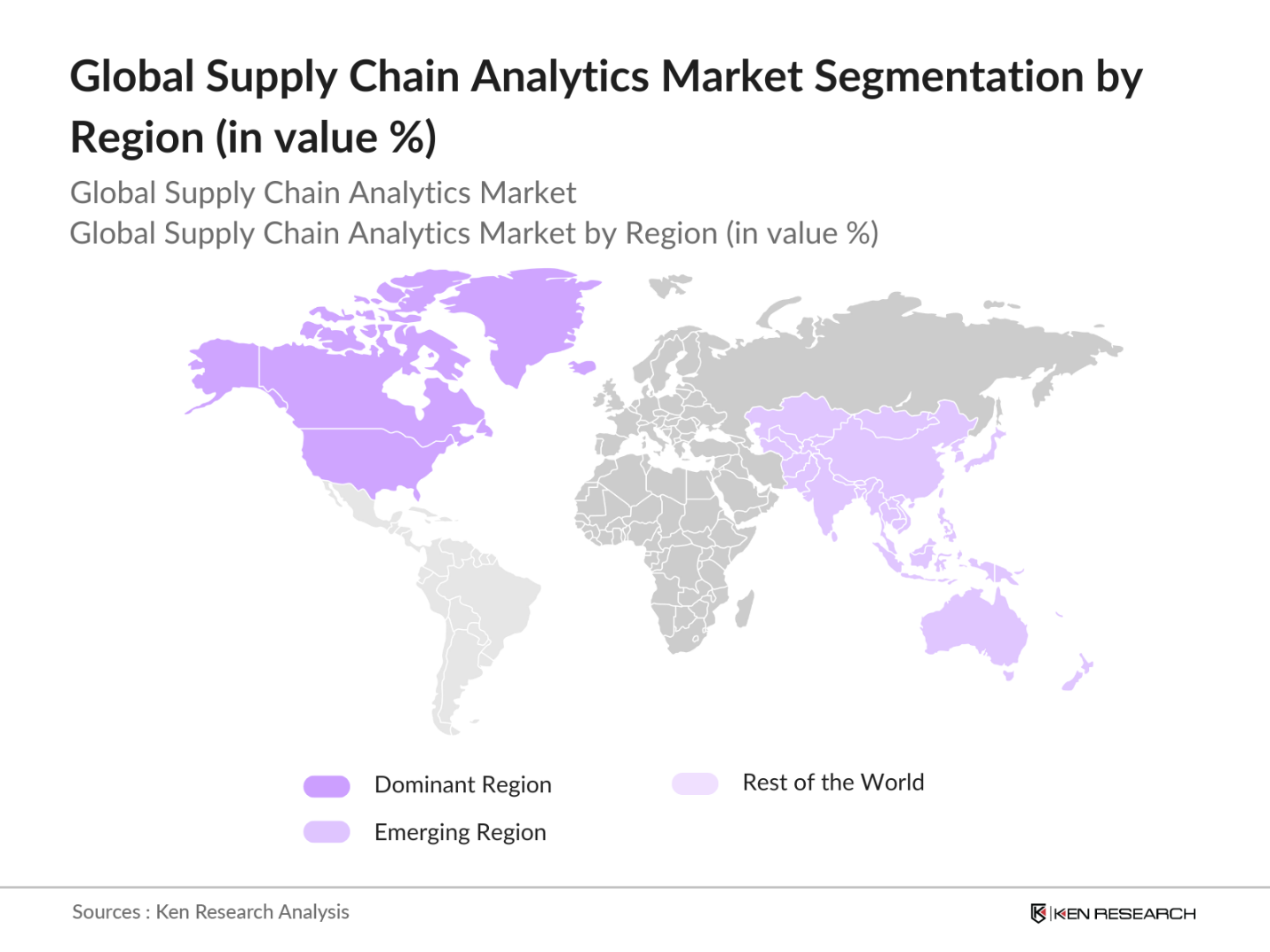

- Geographically, North America and the Asia Pacific dominate the global supply chain analytics market. North America's dominance is attributed to the advanced technological infrastructure and the significant presence of major supply chain software providers such as Oracle and IBM. The Asia Pacific region, particularly countries like China and India, is rapidly growing due to the expansion of e-commerce and manufacturing sectors that require real-time supply chain visibility and optimization.

- The U.S. government has been actively investing in upgrading the nation's digital supply chain infrastructure. In 2022, the U.S. Department of Transportation announced a $1.2 trillion infrastructure investment, a portion of which is allocated to modernize logistics and supply chain systems. This includes the development of smart ports, the integration of digital tracking technologies, and improved transportation logistics to increase efficiency. These initiatives are aimed at reducing delays, optimizing the movement of goods, and enhancing supply chain visibility across the country.

Global Supply Chain Analytics Market Segmentation

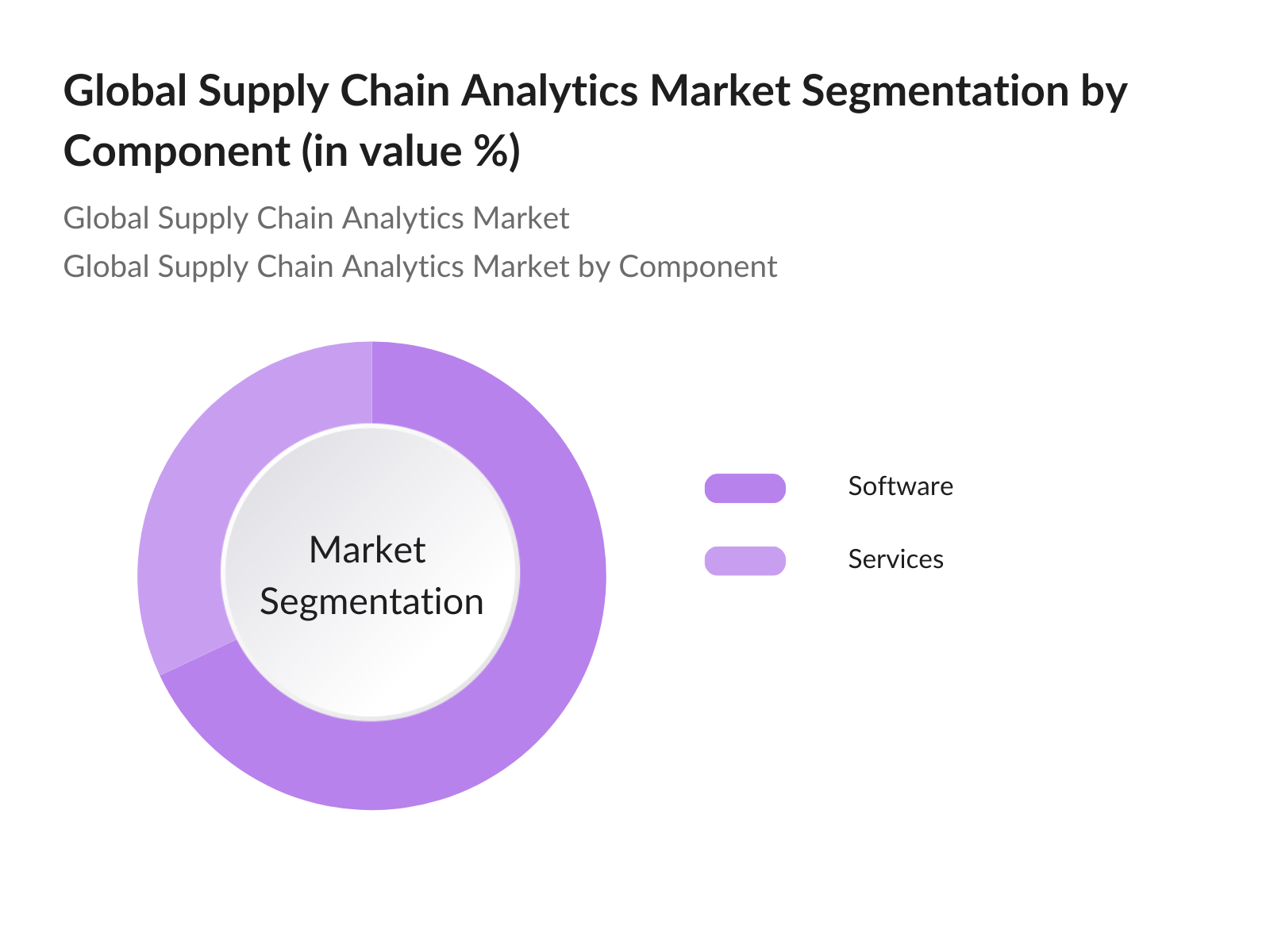

By Component: The global supply chain analytics market is segmented by component into software and services. Software solutions dominate the market due to the increasing demand for advanced analytics platforms that provide end-to-end supply chain visibility. Businesses use these platforms to analyze supplier performance, inventory levels, and logistics efficiency. Services, including consulting and support, are critical for ensuring proper implementation and optimization of software solutions.

By Region: The global supply chain analytics market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. North America, driven by high adoption rates of supply chain analytics solutions, leads the market. Major factors include the presence of industry giants like SAP and the increasing adoption of AI and IoT in supply chain management. The Asia-Pacific region, particularly China and India, has shown the fastest growth rate due to rising industrialization and the rapid adoption of e-commerce.

Global Supply Chain Analytics Market Competitive Landscape

The global supply chain analytics market is highly competitive, with both established players and new entrants contributing to market growth. The market is dominated by key players like SAP, Oracle, and IBM, which have strong global presences and vast portfolios of supply chain solutions. These companies invest heavily in R&D to enhance their analytics capabilities through AI and machine learning integration. Smaller players and startups are gaining traction by offering niche analytics services tailored to specific industries like healthcare and manufacturing.

|

Company Name |

Year of Establishment |

Headquarters |

Revenue (2023) |

Global Presence |

Product Range |

AI Integration |

Client Base |

Key Partnerships |

|

SAP SE |

1972 |

Walldorf, Germany |

$30B |

|||||

|

Oracle Corporation |

1977 |

Austin, USA |

$40B |

|||||

|

IBM Corporation |

1911 |

Armonk, USA |

$57B |

|||||

|

Kinaxis Inc. |

1984 |

Ottawa, Canada |

$0.35B |

|||||

|

JDA Software Group |

1985 |

Scottsdale, USA |

$0.45B |

Global Supply Chain Analytics Market Analysis

Market Growth Drivers:

- Real-time Supply Chain Visibility: Real-time supply chain visibility has become crucial in mitigating disruptions and improving decision-making. Global logistics firms manage over 55 million shipments daily, as reported by the World Bank in 2023, emphasizing the need for visibility across the supply chain. Real-time tracking solutions help companies monitor inventory, shipments, and demand patterns, reducing lead times and improving customer satisfaction. Advanced analytics tools provide critical insights that help businesses address supply chain bottlenecks. The U.S. logistics sector alone handled freight worth $20 trillion in 2022, highlighting the immense scale that requires real-time visibility solutions.

- Rise in Predictive Analytics Usage: Predictive analytics in supply chains helps businesses anticipate risks, forecast demand, and optimize processes. By 2024, the global trade volume is expected to reach $31 trillion, creating complexities in logistics management that demand predictive analytics for efficiency. Predictive analytics tools process vast datasets from IoT devices, GPS trackers, and RFID tags, enabling companies to anticipate delays, optimize routes, and reduce costs. In 2022, over 400 million sensors were deployed globally in logistics, contributing significantly to the adoption of predictive analytics for improved supply chain decision-making.

- E-commerce and Omnichannel Retailing: The increasing global adoption of e-commerce and omnichannel retailing is driving the need for advanced supply chain analytics. In 2023, the global e-commerce sales reached $5.7 trillion, a significant rise from $4.9 trillion in 2021, according to World Bank reports. Retailers are investing in supply chain analytics to manage the surge in online orders and to optimize inventory management, leading to greater efficiency in meeting customer demands. As of 2024, logistics companies are processing more than 3 billion parcels per year globally, necessitating real-time data analytics to streamline operations and meet delivery timelines.

Market Challenges:

- Data Security and Privacy Concerns: With the rise of digital supply chain platforms, data security and privacy concerns have intensified. In 2023, global cybersecurity breaches in logistics systems led to losses exceeding $2 trillion, according to World Bank reports. Data privacy laws such as the EUs General Data Protection Regulation (GDPR) mandate strict data handling practices. Companies handling sensitive data are increasingly investing in cybersecurity solutions, yet many firms still report vulnerabilities in their systems. Protecting sensitive supply chain data from cyber-attacks remains a critical challenge as digital platforms expand globally, posing significant risks to businesses.

- High Implementation Costs: Implementing supply chain analytics solutions comes with high upfront costs, particularly for small and medium enterprises (SMEs). In 2022, the average cost for deploying advanced analytics solutions in supply chains exceeded $500,000 per company, with larger enterprises spending significantly more, as indicated by World Bank data. While the long-term benefits are clear, many businesses face budget constraints, especially when it comes to incorporating IoT devices, cloud platforms, and real-time analytics. The financial burden associated with these technologies has slowed adoption rates in some regions, particularly in developing economies.

Global Supply Chain Analytics Market Future Outlook

Over the next five years, the global supply chain analytics market is expected to witness significant growth, driven by rapid advancements in AI, machine learning, and IoT integration within supply chain systems. The increasing complexity of supply chains due to globalization and the rise of e-commerce will necessitate the adoption of advanced analytics to ensure efficiency and transparency. Furthermore, cloud-based solutions will continue to dominate, owing to their scalability and cost-effectiveness.

Market Opportunities:

- IoT Integration in Supply Chain: The Internet of Things (IoT) is revolutionizing supply chain management by enabling real-time tracking and data collection. In 2022, over 14 billion IoT-connected devices were in use globally, with a significant portion employed in logistics and supply chain operations. These devices provide real-time data on shipment locations, inventory levels, and environmental conditions, improving operational efficiency. The deployment of IoT in logistics significantly reduced delivery times in 2023, enhancing customer satisfaction and lowering operational costs. IoT integration continues to shape supply chain analytics by offering more precise control over logistics processes.

- Real-Time Tracking and Monitoring Solutions: Real-time tracking and monitoring solutions are becoming standard in supply chain management. By 2023, a significant number of global logistics firms had adopted real-time tracking technologies to monitor goods in transit. These solutions help mitigate risks associated with delays, theft, and product damage, leading to faster delivery times and enhanced customer experience. In the U.S., real-time tracking reduced inventory holding costs by approximately $25 billion annually in 2022. As companies strive to improve operational transparency, real-time tracking solutions will remain a critical tool for optimizing supply chain processes.

Scope of the Report

|

By Component |

Software Services |

|

By Deployment |

Cloud-based On-premise |

|

By Enterprise Size |

SMEs Large Enterprises |

|

By Industry Vertical |

Retail Manufacturing, Healthcare Transportation Others |

|

By Region |

North America Europe APAC MEA South America |

Products

Key Target Audience

Supply Chain Managers

Logistics and Transportation Companies

Manufacturers

Retail and E-commerce Companies

Government and Regulatory Bodies (U.S. Federal Trade Commission, European Commission)

Technology and Solution Providers

Investors and Venture Capitalist Firms

Procurement and Sourcing Managers

Companies

Players Mention in the Report

SAP SE

Oracle Corporation

IBM Corporation

Kinaxis Inc.

JDA Software Group

Manhattan Associates

SAS Institute Inc.

Teradata Corporation

TIBCO Software Inc.

Salesforce Inc.

Anaplan Inc.

Coupa Software Inc.

MicroStrategy Inc.

AIMMS BV

NTT DATA Corporation

Table of Contents

01. Global Supply Chain Analytics Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

02. Global Supply Chain Analytics Market Size (In USD Bn)

Historical Market Size (based on industry trends and macroeconomic data)

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03. Global Supply Chain Analytics Market Analysis

Growth Drivers

E-commerce and Omnichannel Retailing

Real-time Supply Chain Visibility

Rise in Predictive Analytics Usage

Market Challenges

Data Security and Privacy Concerns

Integration Complexities with Legacy Systems

High Implementation Costs

Opportunities

AI and Machine Learning Integration

Cloud-based Supply Chain Solutions

Procurement Analytics

Trends

IoT Integration in Supply Chain

Real-Time Tracking and Monitoring Solutions

Use of Big Data for Predictive Insights

Government Regulations

Trade Policies Impacting Supply Chain Analytics

Data Protection and Privacy Regulations

Compliance with International Trade Agreements

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

04. Global Supply Chain Analytics Market Segmentation

By Component (In Value %)

Software Solutions

Services (Consulting, Implementation, Support)

By Deployment (In Value %)

Cloud-based Solutions

On-premise Solutions

By Enterprise Size (In Value %)

Small and Medium Enterprises (SMEs)

Large Enterprises

By Industry Vertical (In Value %)

Retail

Manufacturing

Healthcare

Transportation and Logistics

Others

By Region (In Value %)

North America

Europe

Asia-Pacific

Middle East and Africa

South America

05. Global Supply Chain Analytics Market Competitive Analysis

Detailed Profiles of Major Companies:

SAP SE

Oracle Corporation

IBM Corporation

Kinaxis Inc.

Manhattan Associates Inc.

SAS Institute Inc.

Accenture PLC

JDA Software Group

Teradata Corporation

TIBCO Software Inc.

Anaplan Inc.

MicroStrategy Inc.

Salesforce Inc.

Coupa Software Inc.

AIMMS BV

Cross Comparison Parameters:

Number of Employees

Global Revenue

Inception Year

Key Customers

Product Offerings

Market Share

AI and Big Data Capabilities

Global Footprint

06. Global Supply Chain Analytics Market Regulatory Framework

Data Privacy and Protection Standards (GDPR, CCPA)

Compliance with International Trade Policies

Environmental and Sustainability Standards in Supply Chains

07. Global Supply Chain Analytics Future Market Size

Future Market Size Projections (USD Bn)

Factors Driving Future Growth (e.g., digitization and smart logistics)

08. Global Supply Chain Analytics Future Market Segmentation

By Component (In Value %)

By Deployment (In Value %)

By Enterprise Size (In Value %)

By Industry Vertical (In Value %)

By Region (In Value %)

09. Global Supply Chain Analytics Market Analysts Recommendations

TAM/SAM/SOM Analysis

Strategic Marketing Initiatives

Innovation and Technology Investment Areas

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves mapping the global supply chain analytics ecosystem. This includes identifying major players, industry stakeholders, and technological advancements that shape the market dynamics. Data collection is conducted through secondary research across databases and industry reports.

Step 2: Market Analysis and Construction

This phase focuses on historical data analysis for market growth trends, key product developments, and technological innovations in supply chain analytics. The goal is to create a baseline for understanding the markets progression over time.

Step 3: Hypothesis Validation and Expert Consultation

Primary research through interviews with supply chain experts, including SCM solution providers and industry consultants, will be conducted to validate market hypotheses and ensure data accuracy.

Step 4: Research Synthesis and Final Output

In the final stage, data from primary and secondary research are synthesized to produce accurate, actionable insights. This includes verifying findings with multiple stakeholders in the supply chain analytics space.

Frequently Asked Questions

01. How big is the Global Supply Chain Analytics Market?

The global supply chain analytics market is valued at USD 8.74billion, driven by technological advancements and the increasing need for real-time visibility in supply chain operations.

02. What are the key challenges in the Global Supply Chain Analytics Market?

Challenges include integration complexities with existing legacy systems, concerns over data security, and high implementation costs that deter small enterprises from adopting advanced analytics solutions.

03. Who are the major players in the Global Supply Chain Analytics Market?

Key players include SAP SE, Oracle Corporation, IBM Corporation, Kinaxis Inc., and JDA Software Group. These companies dominate the market due to their extensive portfolios and strong global presence.

04. What are the growth drivers of the Global Supply Chain Analytics Market?

Growth is propelled by the rising adoption of cloud-based analytics solutions, the increasing need for end-to-end supply chain visibility, and the integration of AI and IoT technologies to enhance decision-making processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.