Global Surfactants Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4766

December 2024

99

About the Report

Global Surfactants Market Overview

- The global surfactants market is valued at USD 60.70 billion, driven by increasing demand from multiple industries, including personal care, household cleaning, and industrial applications. The growth is largely attributed to the rising awareness of eco-friendly cleaning solutions and the shift towards sustainable products in industries. According to data from industry sources, the market is witnessing a surge due to the expansion of bio-based surfactants, which are replacing synthetic variants, catering to both environmental regulations and consumer preferences.

- North America and Europe continue to dominate the surfactants market, with the United States, Germany, and France being key players. The dominance of these regions can be attributed to their well-established industrial sectors, significant investments in research and development, and stringent environmental regulations that encourage the use of bio-based and sustainable surfactants. Additionally, Asia-Pacific countries like China and India are emerging as strong contenders, owing to their expanding manufacturing industries and increasing consumer awareness regarding personal and household care products.

- The European Unions REACH regulations have a significant impact on surfactant manufacturers operating in the region. As of 2023, more than 20,000 substances, including surfactants, had been registered under REACH . Companies failing to comply with REACH face penalties, which amounted to EUR 1 billion in fines across the EU in 2022 . This regulatory framework pushes the industry towards safer and more sustainable chemical production.

Global Surfactants Market Segmentation

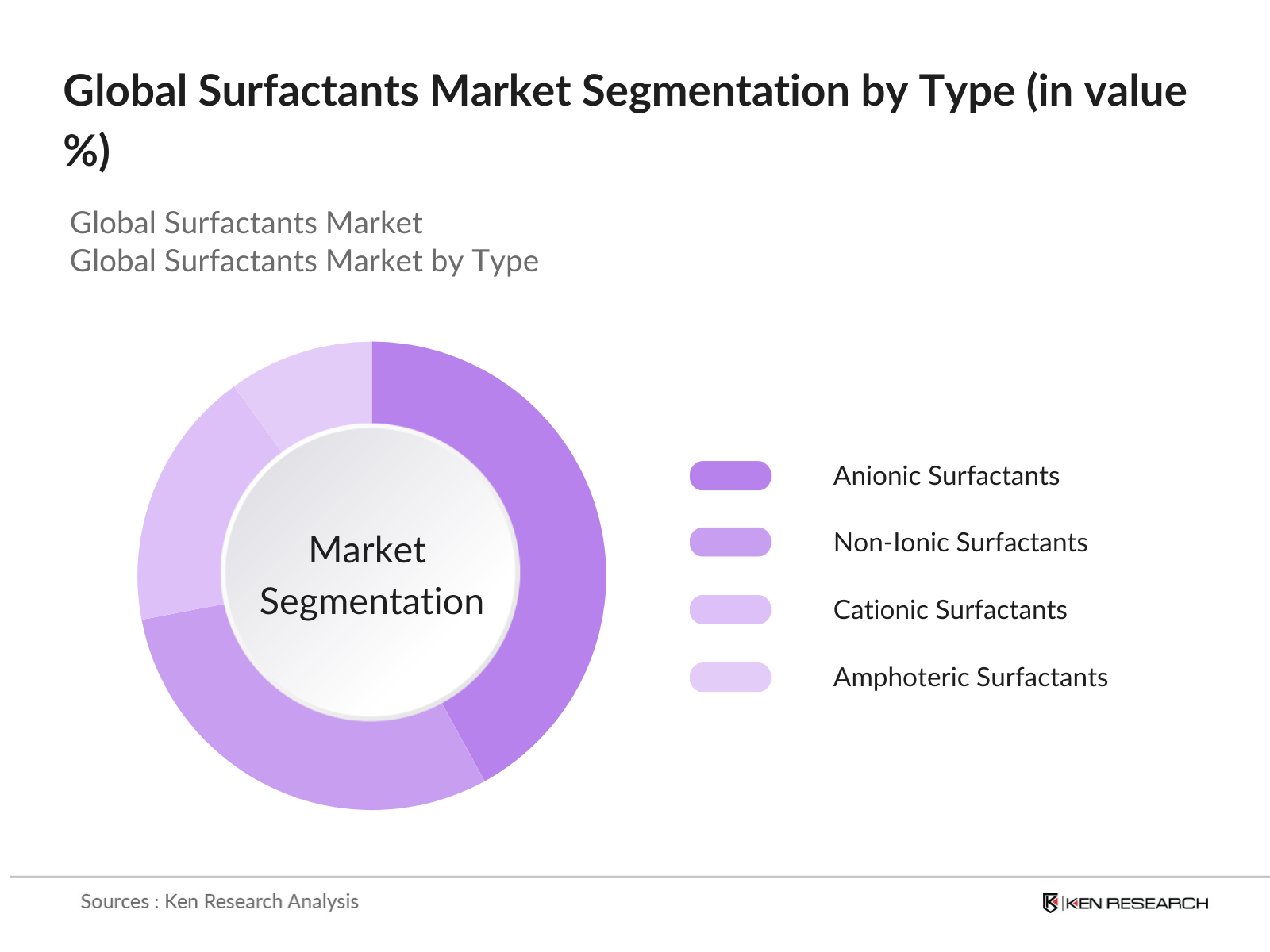

By Type: The global surfactants market is segmented by type into anionic surfactants, non-ionic surfactants, cationic surfactants, and amphoteric surfactants. Anionic surfactants have a dominant market share due to their widespread use in household detergents and industrial cleaning products. Their cost-effectiveness and efficiency in removing dirt and oil contribute to their popularity in various applications. The anionic surfactant segment is further supported by the growing demand for products such as laundry detergents and dishwashing liquids.

By Region: The global surfactants market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific holds a dominant market share, primarily driven by the expanding industrial base in countries like China and India. The growing demand for personal and household care products, alongside industrial cleaners, has fueled the region's growth. Additionally, the increasing presence of multinational companies and the development of local surfactant manufacturing facilities have strengthened the market position in the region, particularly in segments such as personal care and household detergents.

Global Surfactants Market Competitive Landscape

The global surfactants market is dominated by a few key players that have established themselves through extensive R&D, strategic mergers and acquisitions, and strong brand portfolios. Companies like BASF SE, Dow Chemical Company, and Croda International Plc have consistently invested in eco-friendly surfactants and have a strong presence across multiple applications, from household care.

|

Company Name |

Year of Establishment |

Headquarters |

R&D Expenditure |

Sustainability Initiatives |

Key Product Categories |

Market Reach |

Recent M&A Activity |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||

|

Dow Chemical Company |

1897 |

Midland, Michigan, USA |

|||||

|

Croda International Plc |

1925 |

Snaith, UK |

|||||

|

Clariant AG |

1995 |

Muttenz, Switzerland |

|||||

|

Evonik Industries |

2007 |

Essen, Germany |

Global Surfactants Market Analysis

Market Growth Drivers

- Increasing Demand from Personal Care Industry (Consumer Preference): The personal care industry is experiencing increased demand for surfactants as consumer preferences shift towards high-quality products. In 2023, over 1.9 billion consumers globally purchased personal care products containing surfactants. This growth is fueled by expanding middle-class populations in Asia, particularly in China and India. These countries have seen a combined rise in disposable income of over $1.2 trillion from 2022 to 2024. The demand for multifunctional, mild surfactants is driving product innovation in shampoos, soaps, and skincare products. Surfactants play a vital role in enhancing the texture and feel of these products.

- Surfactants in Agricultural Applications (Agricultural Sector): The global agricultural sector has increasingly integrated surfactants into herbicides and pesticides. In 2023, the agricultural industry consumed over 2.3 million tons of surfactants. The African and South Asian markets have been key growth areas, with India's agricultural sector employing surfactants across 140 million hectares of arable land. Surfactants enhance the effectiveness of agrochemicals by improving their spreadability and adhesion on plant surfaces, ultimately boosting crop yields. As of 2023, agriculture contributed over $5 trillion to global GDP, showing significant opportunities for surfactant application in developing regions.

- Expansion in Industrial and Institutional Cleaning Applications (Industrial Demand): The global industrial cleaning industry recorded an output of 7 million tons of chemical formulations, heavily utilizing surfactants for their emulsifying properties. The U.S. saw a significant increase in industrial production from 2022 to 2024, leading to higher demand for surfactants in institutional cleaning products. Industrial cleaning accounted for $780 billion in annual spending globally, with surfactants playing a crucial role in the chemical composition used in manufacturing, maintenance, and cleaning equipment across various sectors. This trend is particularly notable in fast-growing economies like Brazil and Mexico.

Market Challenges

- Stringent Environmental Regulations (Compliance): Environmental regulations on chemical use and waste management have become more stringent, particularly in regions like Europe and North America. The European Unions REACH regulation now covers over 30,000 substances, including surfactants, and mandates comprehensive environmental compliance . In 2023 alone, businesses in the chemical industry famounting to over EUR 800 million for non-compliance . These regulations push manufacturers to adopt greener alternatso increase production costs.

- Limited Biodegradability of Synthetic Surfactants (Sustainability Issues): One of the significant challenges facing the surfactants market is the environmental impact of synthetic surfactants. Non-biodegradable surfactants contribute to water pollution and soil contamination. In 2023, it was reported that over 8 million metric tons of synthetic chemicals, including surfactants, were discharged into global water systems . This issue has led to growing pressure from regulatory bodies to reduce synthetic surfactant use and invest in biodegradable alternatives.

Global Surfactants Market Future Outlook

Over the next several years, the global surfactants market is expected to grow steadily, driven by several key factors. Increasing consumer awareness regarding eco-friendly products, coupled with stringent environmental regulations, will continue to push the market toward bio-based and sustainable surfactants. The demand for personal care and household detergents will further fuel growth, especially in emerging markets such as Asia-Pacific and Latin America. Technological advancements in formulation and production processes will also play a crucial role in expanding product applications and enhancing performance across industries.

Market Opportunities:

- Shift Towards Natural Ingredients (Consumer Preferences): Natural ingredients are increasingly favored in personal care and cleaning products due to growing consumer awareness. As of 2024, consumer spending on natural personal care products surpassed USD 200 billion globally . This shift has prompted manufacturers to focus on formulating surfactants derived from natural oils and plant extracts, which are perceived to be safer for the environment and human health.

- Increased Focus on High-Performance Surfactants (Product Innovation): The demand for high-performance surfactants has grown, particularly in industrial applications that require robust cleaning agents or emulsifiers. In 2023, high-performance surfactants used in industrial applications generated revenue exceeding USD 10 billion globally . These surfactants are critical in industries like oil and gas, where they improve the efficiency of extraction and refining processes.

Scope of the Report

|

By Type |

Anionic Surfactants Non-Ionic Surfactants Cationic Surfactants Amphoteric Surfactants |

|

By Application |

Household Detergents Personal Care Industrial and Institutional Cleaning Agriculture Chemicals Pharmaceuticals |

|

By Source |

Synthetic Surfactants Bio-based Surfactants |

|

By End-Use Industry |

Household Industrial Personal Care Agriculture |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Personal Care Product Manufacturers

Household Detergent Producers

Industrial and Institutional Cleaning Companies

Agricultural Chemical Manufacturers

Pharmaceutical Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., REACH, EPA)

Bio-based Chemical Manufacturers

Companies

Players Mention in the Report

BASF SE

Dow Chemical Company

Croda International Plc

Clariant AG

Evonik Industries

Huntsman Corporation

Solvay S.A.

Stepan Company

Aarti Industries Ltd.

Arkema Group

Kao Corporation

Lion Specialty Chemicals Co.

Sasol Limited

Galaxy Surfactants Ltd.

AkzoNobel N.V.

Table of Contents

01. Global Surfactants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Surfactants Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Surfactants Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from Personal Care Industry (Consumer Preference)

3.1.2. Expansion in Industrial and Institutional Cleaning Applications (Industrial Demand)

3.1.3. Surfactants in Agricultural Applications (Agricultural Sector)

3.1.4. Rising Use in Pharmaceutical Formulations (Healthcare Demand)

3.2. Market Challenges

3.2.1. Stringent Environmental Regulations (Compliance)

3.2.2. Fluctuations in Raw Material Prices (Supply Chain Volatility)

3.2.3. Limited Biodegradability of Synthetic Surfactants (Sustainability Issues)

3.3. Opportunities

3.3.1. Growth in Bio-based Surfactants (Sustainability Innovation)

3.3.2. Emerging Markets in Asia and Africa (Geographical Expansion)

3.3.3. Increasing Research and Development in Formulation Technology (R&D Investment)

3.4. Trends

3.4.1. Green Surfactants and Sustainability (Eco-friendly Solutions)

3.4.2. Shift Towards Natural Ingredients (Consumer Preferences)

3.4.3. Increased Focus on High-Performance Surfactants (Product Innovation)

3.5. Government Regulation

3.5.1. REACH Regulations (Environmental Impact)

3.5.2. FDA Regulations on Pharmaceutical Surfactants (Healthcare Compliance)

3.5.3. EU Directives on Sustainable Surfactants (European Regulatory Framework)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Surfactants Market Segmentation

4.1. By Type (In Value %)

4.1.1. Anionic Surfactants

4.1.2. Non-Ionic Surfactants

4.1.3. Cationic Surfactants

4.1.4. Amphoteric Surfactants

4.2. By Application (In Value %)

4.2.1. Household Detergents

4.2.2. Personal Care

4.2.3. Industrial and Institutional Cleaning

4.2.4. Agriculture Chemicals

4.2.5. Pharmaceuticals

4.3. By Source (In Value %)

4.3.1. Synthetic Surfactants

4.3.2. Bio-based Surfactants

4.4. By End-Use Industry (In Value %)

4.4.1. Household

4.4.2. Industrial

4.4.3. Personal Care

4.4.4. Agriculture

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

05. Global Surfactants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Chemical Company

5.1.3. Croda International Plc

5.1.4. Clariant AG

5.1.5. Evonik Industries

5.1.6. Huntsman Corporation

5.1.7. Solvay S.A.

5.1.8. Stepan Company

5.1.9. Aarti Industries Ltd.

5.1.10. Arkema Group

5.1.11. Kao Corporation

5.1.12. Lion Specialty Chemicals Co.

5.1.13. Sasol Limited

5.1.14. Galaxy Surfactants Ltd.

5.1.15. AkzoNobel N.V.

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, R&D Spend, Sustainability Initiatives, M&A Activity, Market Share, Technological Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Surfactants Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Global Surfactants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Surfactants Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

09. Global Surfactants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying and mapping key variables affecting the global surfactants market. This step involves detailed desk research, where both primary and secondary data sources such as industry reports, government databases, and proprietary databases are used to define market dynamics and the influence of various stakeholders.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to surfactant demand across key industries is analyzed. This includes evaluating the adoption rates in personal care, detergents, and industrial applications. Revenue estimates are calculated based on market penetration and sales data, ensuring the accuracy and reliability of the final market size figures.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses formulated during the desk research phase are validated through consultations with industry experts. These experts, representing major companies in the surfactants industry, provide operational and financial insights that help refine the market data and provide a holistic view of the sector.

Step 4: Research Synthesis and Final Output

In the final phase, primary research data is combined with insights from industry leaders to produce a comprehensive analysis. This ensures that the final report provides accurate, actionable insights for business professionals in the surfactants market, covering all relevant segments and trends.

Frequently Asked Questions

1. How big is the Global Surfactants Market?

The global surfactants market was valued at USD 60.70 billion, driven by increased demand from industries such as personal care, household detergents, and industrial cleaning. The shift towards sustainable and eco-friendly products also contributes significantly to the markets growth.

2. What are the challenges in the Global Surfactants Market?

Challenges in the global surfactants market include fluctuating raw material prices, stringent environmental regulations, and the limited biodegradability of synthetic surfactants. Manufacturers face growing pressure to transition toward more sustainable and eco-friendly surfactant formulations.

3. Who are the major players in the Global Surfactants Market?

Major players in the surfactants market include BASF SE, Dow Chemical Company, Croda International Plc, Clariant AG, and Evonik Industries. These companies dominate the market due to their extensive product portfolios and strong focus on sustainability and innovation.

4. What are the growth drivers of the Global Surfactants Market?

The growth of the global surfactants market is driven by increasing demand from personal care, household cleaning, and industrial sectors. The shift towards bio-based and sustainable surfactants due to environmental regulations further propels market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.