Global Synbiotics Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD7652

December 2024

95

About the Report

Global Synbiotics Market Overview

- The global synbiotics market is valued at USD 875 million based on a five-year historical analysis, driven by increasing demand for gut health improvement and functional foods. Synbiotics, which combine probiotics and prebiotics, are gaining traction due to rising consumer awareness about digestive health and the role these products play in enhancing immunity and overall wellness.

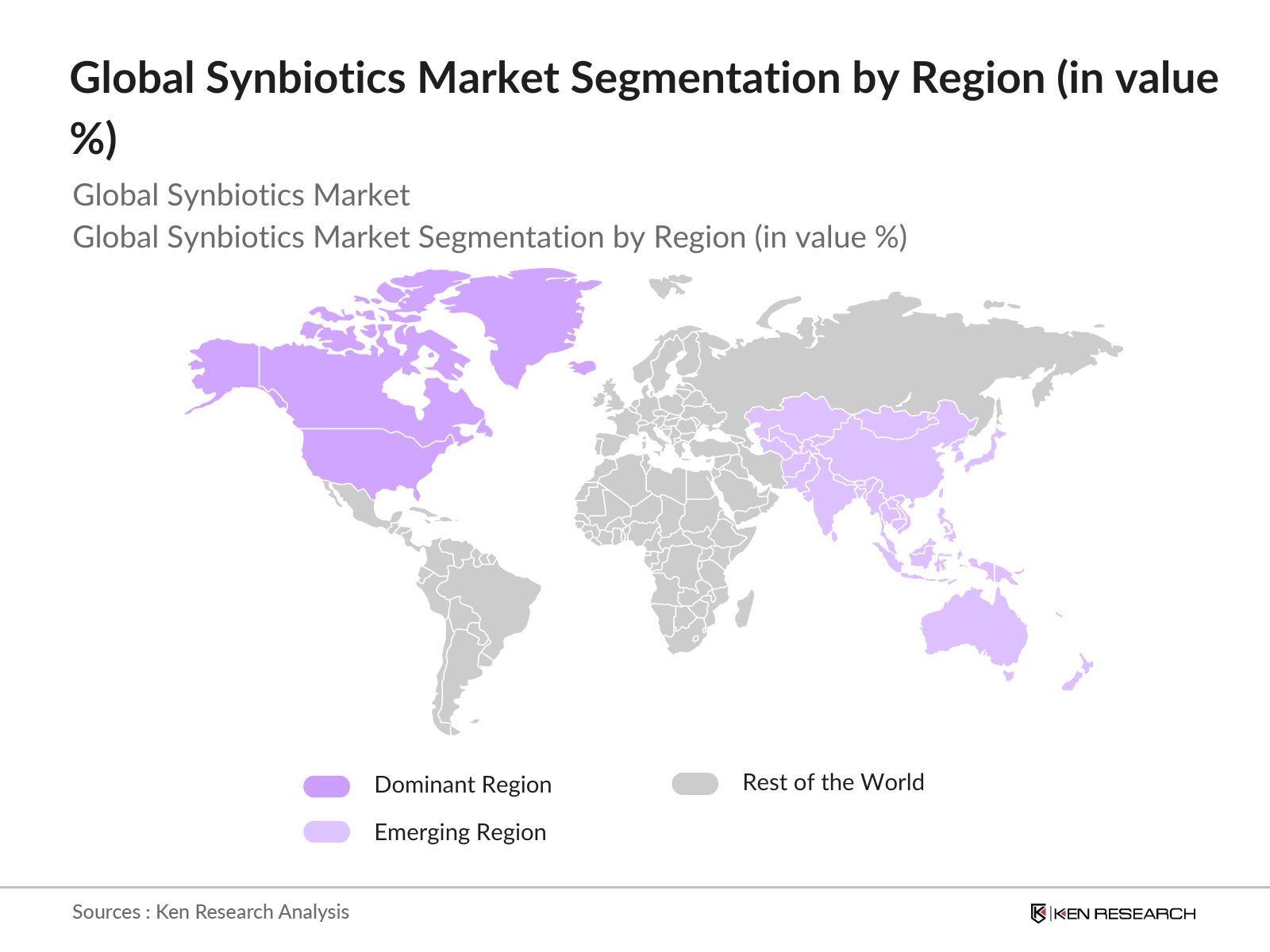

- North America is one of the dominant regions in the market, with a strong presence of pharmaceutical and food industries. Countries like the United States lead due to the high demand for dietary supplements and functional foods. Additionally, a well-established regulatory framework and increasing consumer focus on preventive healthcare drive market dominance in this region.

- In 2024, the U.S. government allocated over $300 million in grants to research institutions and universities to explore the potential benefits of synbiotics and other gut health-related products. This funding has accelerated clinical trials and the development of new synbiotic formulations, helping companies to bring innovative products to market faster.

Global Synbiotics Market Segmentation

By Product Type: The market is segmented by product type into powder and liquid forms. Recently, powdered synbiotics have been dominating the market share as they offer easier storage, longer shelf life, and greater flexibility in formulation. Powdered synbiotics are commonly used in dietary supplements and functional food applications, catering to health-conscious consumers who prefer supplements that can be mixed into beverages or food.

By Application: Synbiotics are applied in various sectors such as food and beverages, pharmaceuticals, animal feed, and dietary supplements. The food and beverages segment holds a dominant position due to increasing consumer demand for fortified foods that improve digestive health. This segment is particularly strong in North America and Europe, where health-conscious consumers are adopting products such as yogurt and fermented drinks that contain synbiotics.

By Region: The market can be segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to high consumer awareness and a strong focus on preventive healthcare. In Europe, countries such as Germany and France are significant markets due to their advanced healthcare systems and focus on gut health. The Asia-Pacific region, particularly Japan and China, is growing rapidly, driven by increasing consumption of functional foods and dietary supplements.

Global Synbiotics Market Competitive Landscape

The market is dominated by both established players and emerging companies, showcasing a diverse competitive landscape. Companies are focusing on mergers and acquisitions, product innovation, and expanding their distribution networks to capture a larger market share.

|

Company Name |

Year Established |

Headquarters |

Product Range |

Key Focus |

Market Share (%) |

Strategic Initiatives |

Revenue (USD Mn) |

Employees |

|

Chr. Hansen Holding A/S |

1874 |

Denmark |

||||||

|

Danone |

1919 |

France |

||||||

|

Pfizer Inc. |

1849 |

USA |

||||||

|

Sabinsa Corporation |

1988 |

USA |

||||||

|

Yakult Pharmaceutical |

1935 |

Japan |

Global Synbiotics Market Analysis

Market Growth Drivers

- Increasing Awareness of Gut Health and Immunity: The demand for synbiotics is on the rise due to increasing awareness of their role in improving gut health and immunity. In 2024, several countries, including those in North America and Europe, have witnessed a sharp increase in hospital admissions related to gastrointestinal disorders. This rise in health issues has spurred consumer interest in synbiotics as a preventive health solution.

- Rise in Functional Foods and Beverages Consumption: In 2024, the functional foods and beverages sector has witnessed a shift towards incorporating synbiotics due to their potential health benefits. Major global food manufacturers have launched over 500 new products that incorporate synbiotics, particularly in categories such as yogurts, beverages, and snack bars.

- Expanding Geriatric Population with Digestive Issues: As of 2024, the global geriatric population has crossed 700 million, with a portion suffering from age-related digestive problems. Studies in Europe have indicated that over 30% of individuals aged 65 and above experience regular gastrointestinal discomfort, pushing demand for dietary solutions like synbiotics to support healthy digestion.

Market Challenges

- Lack of Consumer Awareness and Education: Although synbiotics offer numerous health benefits, many regions still face challenges in terms of consumer education. As of 2024, surveys conducted in Latin America indicate that nearly 60% of the population is unaware of the benefits of synbiotics, which has resulted in lower adoption rates in these areas.

- Regulatory Barriers and Complex Approval Processes: The market is hampered by varying regulatory frameworks across different regions. In 2024, the European Unions stringent regulations on probiotic and synbiotic health claims have led to the rejection of more than 200 product claims by manufacturers.

Global Synbiotics Market Future Outlook

Over the next five years, the global synbiotics industry is expected to experience growth driven by increased consumer awareness about the importance of gut health, rising demand for functional foods, and advancements in biotechnology.

Future Market Opportunities

- Expansion into Personalized Nutrition: Over the next five years, synbiotics will increasingly be integrated into personalized nutrition programs, driven by advancements in microbiome research. By 2029, it is expected that over 10 million consumers globally will adopt personalized synbiotic supplements tailored to their unique gut microbiota profiles.

- Growing Demand for Synbiotics in Functional Beverages: By 2028, the market will see growth in the functional beverages segment, with synbiotics being incorporated into drinks like kombucha, probiotic teas, and fortified water. Analysts predict that the global market for functional beverages containing synbiotics will exceed 500 million liters annually by 2027, fueled by consumer preference for convenient, health-boosting drinks.

Scope of the Report

|

Product Type |

Powder Liquid |

|

Application |

Food & Beverages Pharmaceuticals Animal Feed Dietary Supplements |

|

Distribution Channel |

E-Commerce Specialty Stores Pharmacies Supermarkets |

|

Form |

Powder Capsules Liquid |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Nutraceutical Manufacturers

Food & Beverage Companies

Pharmaceutical Companies

Animal Feed Producers

Banks and Financial Insitution

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Private Equity Firms

Companies

Players Mentioned in the Report:

Chr. Hansen Holding A/S

Danone

Pfizer Inc.

Sabinsa Corporation

Yakult Pharmaceutical Industry Co., Ltd.

Synbiotic Health

Probiotical S.p.A.

United Naturals

NUtech Ventures

Behn Meyer

Table of Contents

1. Global Synbiotics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Synbiotics Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Synbiotics Market Analysis

3.1. Growth Drivers (Synbiotic Supplements, Functional Foods, Prebiotic-Probiotic Synergy, Rising Health Consciousness)

3.1.1. Increasing Consumption of Nutritional Supplements

3.1.2. Growing Focus on Gut Health

3.1.3. Rise in Demand for Functional Beverages

3.1.4. Shift in Consumer Dietary Preferences

3.2. Market Challenges (Cost of Synbiotics, Regulatory Barriers, Consumer Education)

3.2.1. High Cost of Manufacturing Synbiotics

3.2.2. Regulatory Hurdles in Global Markets

3.2.3. Lack of Consumer Awareness

3.2.4. Limited Scientific Evidence for Health Benefits

3.3. Opportunities (Technological Advancements, Product Innovation, Emerging Markets)

3.3.1. Increasing R&D Investments in Synbiotics

3.3.2. Innovative Product Formulations (Synbiotics in Beverages and Infant Nutrition)

3.3.3. Expansion in Emerging Economies (Asia Pacific and Latin America)

3.3.4. Growth in E-Commerce Distribution Channels

3.4. Trends (Natural Ingredients, Personalized Nutrition, Clean Label Products)

3.4.1. Increasing Use of Natural Ingredients

3.4.2. Demand for Personalized Health Solutions

3.4.3. Shift Toward Clean Label Products

3.5. Government Regulations (Global Standards, FDA Guidelines, European Regulations)

3.5.1. Regulatory Framework in North America

3.5.2. EU Regulations for Synbiotic Products

3.5.3. Approval Processes in Asia-Pacific

3.5.4. Impact of Environmental Policies on Synbiotics Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Synbiotics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Powder

4.1.2. Liquid

4.2. By Application (In Value %)

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Animal Feed

4.2.4. Dietary Supplements

4.3. By Distribution Channel (In Value %)

4.3.1. E-Commerce

4.3.2. Specialty Stores

4.3.3. Pharmacies

4.3.4. Supermarkets

4.4. By Form (In Value %)

4.4.1. Powder

4.4.2. Capsules

4.4.3. Liquid

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Synbiotics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Danone

5.1.2. Sabinsa Corporation

5.1.3. Yakult Pharmaceutical Industry Co., Ltd.

5.1.4. Pfizer, Inc.

5.1.5. Chr. Hansen Holding A/S

5.1.6. Synbiotic Health

5.1.7. NUtech Ventures

5.1.8. Probiotical S.p.A.

5.1.9. United Naturals

5.1.10. Daflon Probiotics

5.1.11. Behn Meyer

5.1.12. Bio Pak Nutraceuticals

5.1.13. Skystone Feed

5.1.14. Malyas LLC

5.1.15. AZMABIOTEC Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Strategic Initiatives, R&D Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Synbiotics Market Regulatory Framework

6.1. Global Standards

6.2. Certification and Compliance Processes

6.3. Product Approval Mechanisms

7. Global Synbiotics Market Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Synbiotics Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Form (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Synbiotics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the ecosystem of the global synbiotics market. This process relies on extensive desk research using secondary and proprietary databases. The aim is to define the critical variables that influence market dynamics, including consumer behavior and distribution trends.

Step 2: Market Analysis and Construction

Next, we gather and analyze historical market data for synbiotics, including sales trends across various segments. This analysis includes studying market penetration and assessing the revenue impact of distribution channels such as e-commerce and specialty stores.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are validated through consultations with industry experts from major synbiotic manufacturers and distributors. Interviews and surveys provide real-world insights that help refine and validate the market estimates.

Step 4: Research Synthesis and Final Output

Finally, the data from the previous steps are synthesized to produce the final report, which includes verified statistics and an in-depth analysis of the synbiotics market. The report ensures accuracy by corroborating findings from multiple sources.

Frequently Asked Questions

How big is the global synbiotics market?

The global synbiotics market is valued at USD 875 million, driven by rising demand for digestive health supplements and functional foods.

What are the challenges in the synbiotics market?

Challenges in the global synbiotics market include high production costs, regulatory barriers in different regions, and lack of consumer awareness regarding the benefits of synbiotics.

Who are the major players in the synbiotics market?

Key players in the global synbiotics market include Chr. Hansen Holding A/S, Danone, Pfizer Inc., Sabinsa Corporation, and Yakult Pharmaceutical Industry Co., Ltd.

What drives the growth of the synbiotics market?

The growth in the global synbiotics market is driven by increasing consumer awareness of gut health, demand for functional foods, and advancements in synbiotic formulations.

What regions dominate the synbiotics market?

North America and Europe dominate the global synbiotics market due to high consumer awareness and a well-established pharmaceutical and food industry infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.