Global Synthetic Fuel Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD1381

November 2024

90

About the Report

Global Synthetic Fuel Market Overview

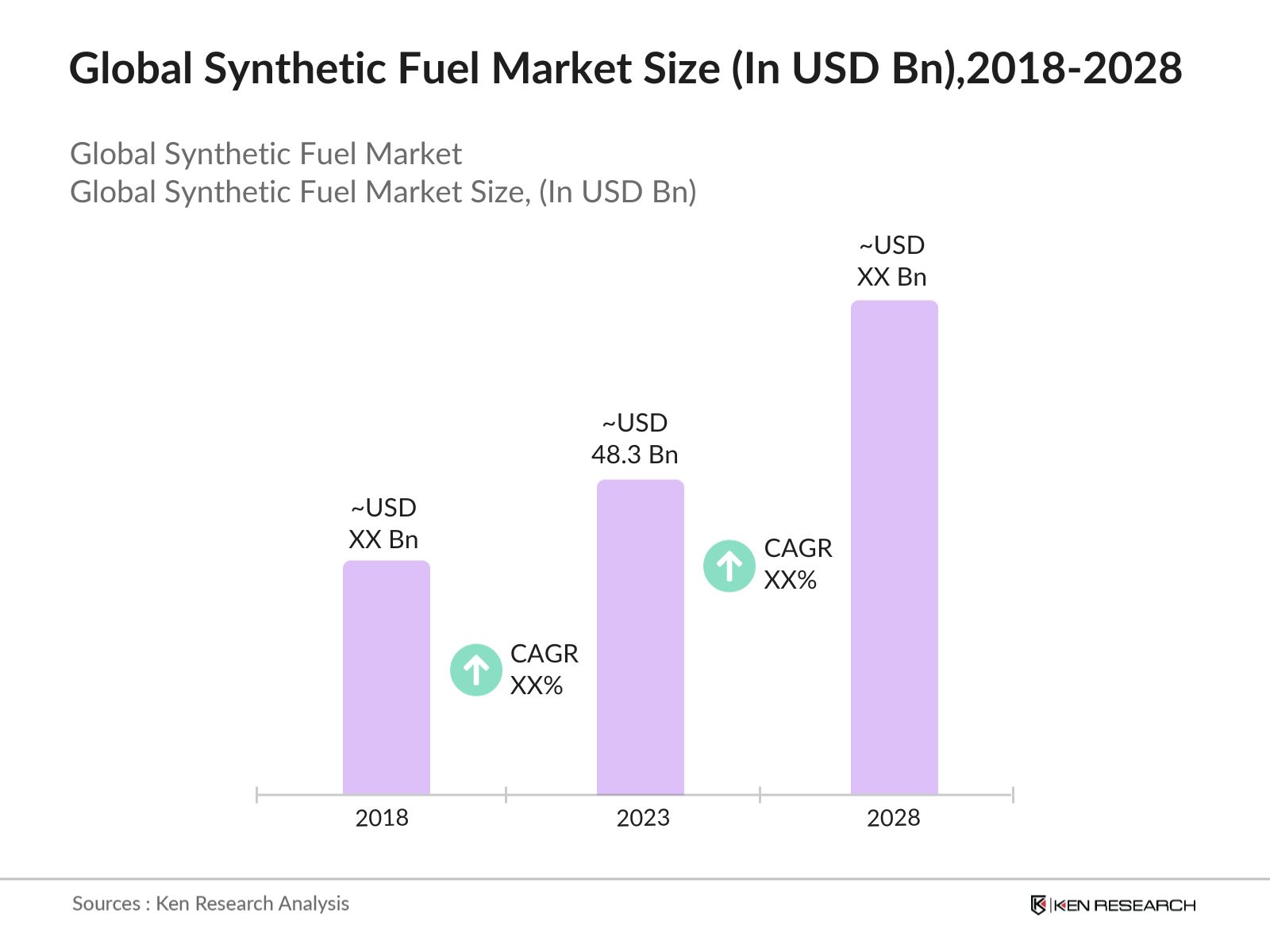

- The Global Synthetic Fuel Market has experienced notable growth, reaching a valuation of USD 48.3 billion in 2023. This growth is driven by advancements in technology and increasing environmental regulations. The growing need for cleaner energy alternatives has propelled investments in synthetic fuel production, supported by both private and public sectors.

- Prominent players in the global synthetic fuel market include Sasol Ltd., ExxonMobil Corporation, Shell Global, Velocys plc, and Fulcrum BioEnergy, Inc. These companies are leading the charge in developing and commercializing synthetic fuels. Sasol, for instance, has extensive experience in gas-to-liquids (GTL) technology, while Shell is pioneering the development of synthetic aviation fuels.

- In January 2024, Fulcrum BioEnergy announced the completion of its Sierra BioFuels Plant in Nevada, USA, a milestone in commercial-scale production of synthetic fuel from municipal solid waste. This facility aims to convert approximately 175,000 tons of household garbage into 11 million gallons of synthetic crude oil annually.

- Cities like Houston, Texas, and Rotterdam, Netherlands, dominate the synthetic fuel market due to their established infrastructure and strong industrial base. Houston is home to several leading synthetic fuel producers and research facilities, benefiting from its proximity to raw materials and a skilled workforce.

Global Synthetic Fuel Market Segmentation

The global Synthetic Fuel Market is divided into the following segments:

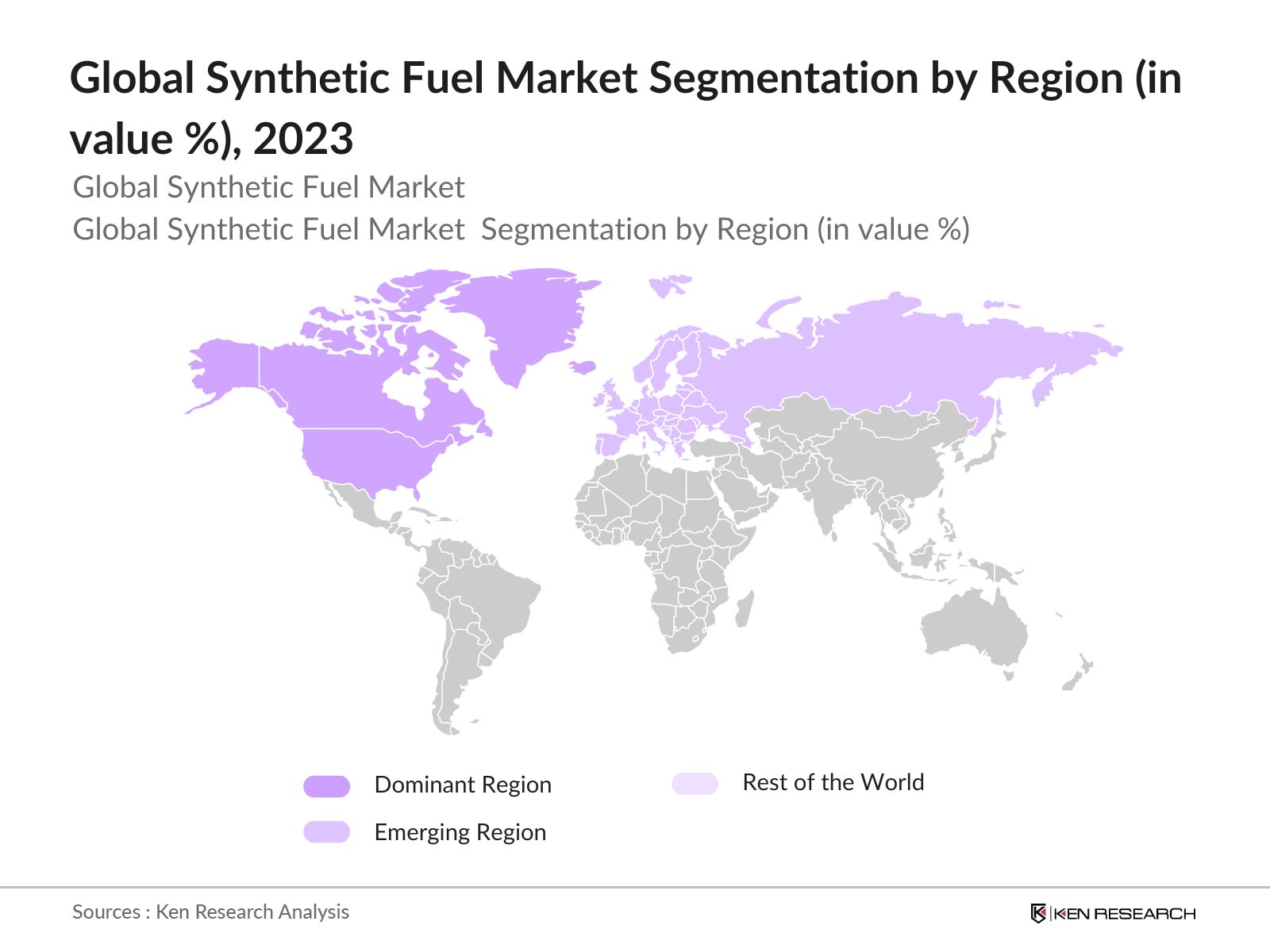

- By Region: The synthetic fuel market is segmented regionally into North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa (MEA). In 2023, North America dominated the market due to its significant investments in synthetic fuel research and production. With supportive government policies and substantial funding, the U.S. leads in technological advancements and commercial deployment of synthetic fuels.

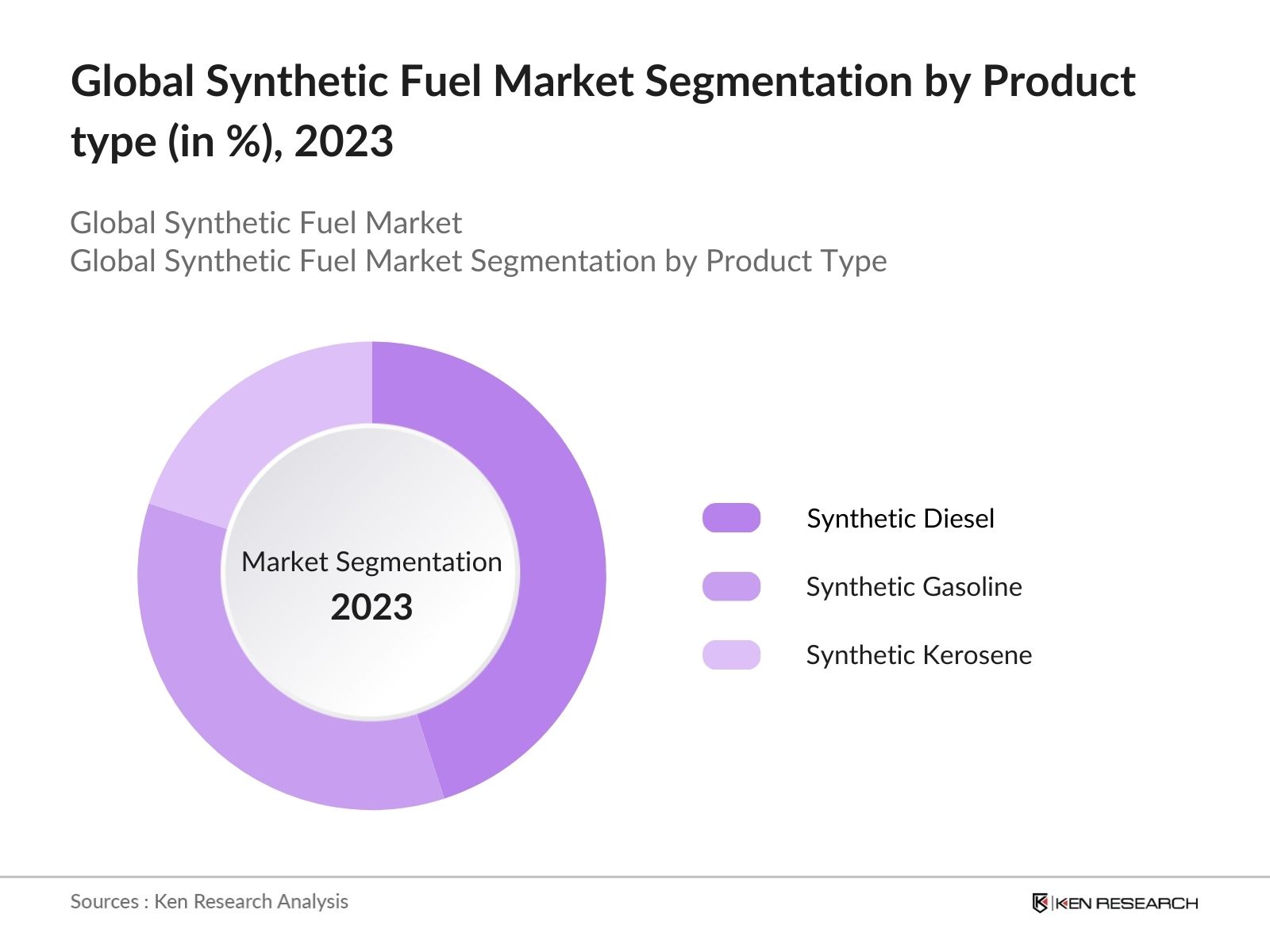

- By Product Type: The global synthetic fuel market is segmented by product type into synthetic diesel, synthetic gasoline, and synthetic kerosene. In 2023, synthetic diesel held a dominant market share due to its widespread use in heavy-duty transportation and industrial applications.

Global Synthetic Fuel Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Sasol Ltd. |

1950 |

Johannesburg, South Africa |

|

ExxonMobil Corporation |

1999 |

Irving, Texas, USA |

|

Shell Global |

1907 |

The Hague, Netherlands |

|

Velocys plc |

2006 |

Oxford, United Kingdom |

|

Fulcrum BioEnergy, Inc. |

2007 |

Pleasanton, California, USA |

- ExxonMobil Corporation: ExxonMobil completed the acquisition of Pioneer Natural Resources for approximately $60 billion in 2023.This acquisition, announced in October 2023, enhances ExxonMobil's position in the energy sector, particularly in West Texas' fracking operations in the Permian Basin.

- Shell Global: In 2023, Shell announced its commitment to invest in the development of synthetic fuels as part of its strategy to transition towards more sustainable energy sources. This includes a focus on producing low-carbon fuels that can help reduce emissions in hard-to-decarbonize sectors such as aviation and shipping.

Global Synthetic Fuel Industry Analysis

Global Synthetic Fuel Market Growth Drivers

- Energy Security Focus: Following the Russia-Ukraine conflict, the EU has significantly reduced its dependence on Russian gas from 150 bcm in 2021 to only 43 bcm in 2023 as part of its Repower EU plan to diversify energy sources and enhance security through domestic production and renewables.

- Increasing Demand for Cleaner Fuels: There is a growing global emphasis on reducing greenhouse gas emissions and transitioning to sustainable energy sources. Synthetic fuels, which can be produced from renewable feedstocks, are seen as a viable alternative to conventional fossil fuels, particularly in sectors that are hard to electrify, such as aviation and shipping.

- Investment in Research and Development: Increased funding and support for R&D in synthetic fuel technologies are driving their commercialization. Companies are exploring new methods to improve production efficiency and reduce costs, which are crucial for scaling operations. Rapid advancements in production technologies, such as water electrolysis for hydrogen generation and carbon capture for CO2 utilization, are key to this progress.

Global Synthetic Fuel Market Challenges

- High Production Costs: The high production costs and energy-intensive processes involved in synthesizing fuels make them less economically competitive compared to conventional fossil fuels. Establishing synthetic fuel production facilities, particularly those using advanced technologies like carbon capture, gasification, and Fischer-Tropsch synthesis, demands significant capital investment, resulting in higher prices for synthetic fuels.

- Feedstock Availability: The availability of suitable feedstocks, such as biomass or renewable energy sources, is limited, making accessibility challenging for the market. Using biomass as a feedstock raises environmental concerns related to land use changes, deforestation, and biodiversity loss, which runs against the goals of environmental conservation.

Global Synthetic Fuel Market Government Initiatives

- India's National Green Hydrogen Mission: On January 4, 2023, the Government of India launched the National Green Hydrogen Mission with an investment of 19,744 crores through FY 2029-30. The mission aims to establish India as a global hub for the production, use, and export of green hydrogen and its derivatives by 2030. Additionally, NTPC Limited has started blending up to 8% green hydrogen into the PNG network at its Kawas Township facility in Surat since January 2023.

- European Union Renewable Energy Directive II (RED II): The RED II establishes a legally binding target for the EU to achieve at least32%of its total energy consumption from renewable sources by2030.The discussions surrounding RED III are part of the broader "Fit for 55" package, which aims to align EU policies with its enhanced climate objectives. The legislative process is ongoing, with further negotiations expected to refine the details of the directive and its implementation across member states.

Global Synthetic Fuel Market Future Outlook

The global synthetic fuel market is set for substantial growth, driven by a combination of environmental imperatives, technological advancements, and market dynamics. However, addressing challenges related to production costs and resource availability will be crucial for realizing its full potential.

Future Market Trends

- Integration with Renewable Energy Sources: Future trends indicate a growing integration of synthetic fuel production with renewable energy sources. By 2028, advancements in renewable energy technologies, such as solar and wind power, will enable the production of green hydrogen, a key input for synthetic fuels.

- Expansion of Synthetic Fuel Applications: The applications of synthetic fuels are expected to expand beyond traditional sectors like transportation and aviation. By 2028, synthetic fuels will find increased usage in sectors such as marine, industrial heating, and power generation.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

Synthetic Diesel Synthetic Gasoline Synthetic Kerosene Synthetic Natural Gas |

|

By Fuel type |

Gas to Liquid Fuel (GTL) Methanol to Liquid Power to Liquid Fuel Others (BTL and CTL) |

|

By Application |

Gasoline Diesel Kerosene |

|

By End use |

Transportation Industrial Chemical Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Aviation Companies

Energy Producers

Environmental Organizations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies [U.S. Department of Energy (DOE), China's National Energy Administration (NEA)]

Research and Development Institutes

Waste Management Companies

Renewable Energy Companies

Companies

Players Mentioned in the Report:

Sasol Ltd.

ExxonMobil Corporation

Shell Global

Velocys plc

Fulcrum BioEnergy, Inc.

Red Rock Biofuels

Syntroleum Corporation

Coskata Inc.

Primus Green Energy

KiOR Inc.

INEOS

Virent, Inc.

LanzaTech

Joule Unlimited

Sundrop Fuels, Inc.Adobe Inc

Table of Contents

1. Global Synthetic Fuel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Synthetic Fuel Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Synthetic Fuel Market Analysis

3.1. Growth Drivers

3.1.1. Energy Security Focus

3.1.2. Increasing Demand for Cleaner Fuels

3.1.3. Investment in Research and Development

3.2. Restraints

3.2.1. High Production Costs

3.2.2. Feedstock Availability

3.3. Opportunities

3.3.1. Integration with Renewable Energy Sources

3.3.2. Expansion of Synthetic Fuel Applications

3.4. Trends

3.4.1. Technological Advancements

3.4.2. Expansion into New Applications

3.5. Government Initiatives

3.5.1. India’s National Green Hydrogen Mission

3.5.2. European Union Renewable Energy Directive II (RED II)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Synthetic Fuel Market Segmentation, 2023

4.1. By Region (in Value %)

4.1.1. North America

4.1.2. Latin America

4.1.3. Europe

4.1.4. Asia-Pacific

4.1.5. Middle East & Africa (MEA)

4.2. By Product Type (in Value %)

4.2.1. Synthetic Diesel

4.2.2. Synthetic Gasoline

4.2.3. Synthetic Kerosene

4.2.4. Synthetic Natural Gas

4.3. By Fuel Type (in Value %)

4.3.1. Gas to Liquid Fuel (GTL)

4.3.2. Methanol to Liquid

4.3.3. Power to Liquid Fuel

4.3.4. Others (BTL and CTL)

4.4. By Application (in Value %)

4.4.1. Gasoline

4.4.2. Diesel

4.4.3. Kerosene

4.5. By End Use (in Value %)

4.5.1. Transportation

4.5.2. Industrial

4.5.3. Chemical

4.5.4. Others

5. Global Synthetic Fuel Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Sasol Ltd.

5.1.2. ExxonMobil Corporation

5.1.3. Shell Global

5.1.4. Velocys plc

5.1.5. Fulcrum BioEnergy, Inc.

5.1.6. Red Rock Biofuels

5.1.7. Syntroleum Corporation

5.1.8. Coskata Inc.

5.1.9. Primus Green Energy

5.1.10. KiOR Inc.

5.1.11. INEOS

5.1.12. Virent, Inc.

5.1.13. LanzaTech

5.1.14. Joule Unlimited

5.1.15. Sundrop Fuels, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Synthetic Fuel Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Synthetic Fuel Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Synthetic Fuel Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Synthetic Fuel Market Future Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Product Type (in Value %)

9.3. By Fuel Type (in Value %)

9.4. By Application (in Value %)

9.5. By End Use (in Value %)

10. Global Synthetic Fuel Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

- Disclaimer

- Contact Us

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2029

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on synthetic fuel market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Synthetic Fuel market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple synthetic fuel providers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Synthetic Fuel providers.

Frequently Asked Questions

01. How big is Global Synthetic Fuel Market?

The global synthetic fuel market has seen significant growth, achieving a valuation of USD 48.3 billion in 2023. This expansion is fueled by technological advancements and tightening environmental regulations. The rising demand for cleaner energy alternatives has spurred investments in synthetic fuel production, backed by both private and public sector initiatives.

02. What are the challenges in Global Synthetic Fuel Market?

Challenges in the global synthetic fuel market include high production costs, limited infrastructure for distribution and storage, and competition from alternative fuels like biofuels and hydrogen, which can hinder market growth.

03. Who are the major players in Global Synthetic Fuel Market?

Key players in the global synthetic fuel market include Sasol Ltd., ExxonMobil Corporation, Shell Global, Velocys plc, and Fulcrum BioEnergy, Inc. These companies lead the market due to their advanced technologies and extensive production capacities.

04. What are the growth drivers of the Global Synthetic Fuel Market?

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.