Region:Global

Author(s):Geetanshi

Product Code:KRAC0117

Pages:98

Published On:August 2025

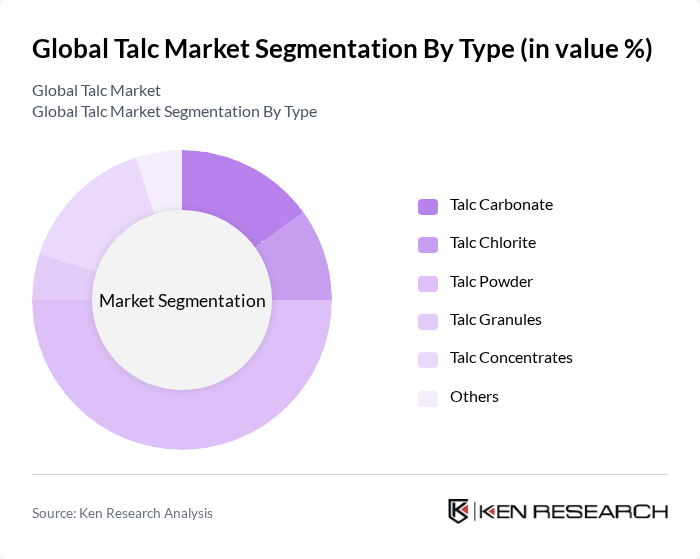

By Type:The talc market is segmented into various types, including Talc Carbonate, Talc Chlorite, Talc Powder, Talc Granules, Talc Concentrates, and Others. Among these, Talc Powder is the most dominant sub-segment due to its extensive use in industries such as cosmetics, pharmaceuticals, plastics, and paints. The fine particle size and excellent lubricating properties of talc powder make it a preferred choice for manufacturers. The demand for high-quality talc powder is further driven by the growing consumer preference for natural and safe products in personal care and industrial applications .

By Application:The talc market is also segmented by application, which includes Plastics, Paints and Coatings, Rubber, Pharmaceuticals, Cosmetics & Personal Care, Ceramics, Pulp & Paper, Agriculture, and Others. The Plastics segment holds the largest share due to the increasing use of talc as a filler in plastic products, which enhances strength, durability, and thermal resistance. Growth in the automotive and packaging industries further propels demand for talc in plastics, as manufacturers seek to improve product performance while reducing costs. Additionally, the personal care and cosmetics segment is experiencing robust growth due to the rising demand for talc-based products with moisture-absorbing and anti-caking properties .

The Global Talc Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., Magris Talc, Specialty Minerals Inc., Talc de Luzenac S.A., American Talc Company, Golcha Associated Ltd., Beihai Group, Xilolite S.A., Liaoning Aihua Group, Huber Engineered Materials, Xinyu Talc, Omya AG, Minerals Technologies Inc., Wolkem India Ltd., Nippon Talc Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the talc market appears promising, driven by ongoing innovations in processing techniques and a shift towards sustainable sourcing. As industries increasingly prioritize eco-friendly materials, talc producers are likely to invest in cleaner extraction methods and product development. Additionally, the expansion of the construction sector, particularly in emerging markets, will create new applications for talc, further enhancing its market potential. Overall, the industry is poised for growth, adapting to changing consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Talc Carbonate Talc Chlorite Talc Powder Talc Granules Talc Concentrates Others |

| By Application | Plastics Paints and Coatings Rubber Pharmaceuticals Cosmetics & Personal Care Ceramics Pulp & Paper Agriculture Others |

| By End-User | Automotive Construction Consumer Goods Industrial Food & Beverage Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, Italy, UK) Asia-Pacific (China, India, Japan, South Korea) Latin America (Brazil, Rest of LATAM) Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | Industrial Grade Food Grade Cosmetic Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics Industry Usage | 100 | Product Development Managers, Brand Managers |

| Plastics Manufacturing Insights | 80 | Procurement Managers, Production Supervisors |

| Paper and Coatings Sector | 70 | Quality Control Managers, R&D Specialists |

| Pharmaceutical Applications | 50 | Regulatory Affairs Managers, Formulation Scientists |

| Construction Materials Sector | 60 | Project Managers, Materials Engineers |

The Global Talc Market is valued at approximately USD 3.2 billion, driven by increasing demand across various industries such as plastics, ceramics, automotive, construction, and personal care products.