Global Textile Chemicals Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD3008

December 2024

97

About the Report

Global Textile Chemicals Market Overview

- The Global Textile Chemicals market is valued at USD 26 billion, driven by the increasing demand for functional and sustainable textiles. Key applications like technical textiles, home textiles, and apparel are pushing the growth of the market. Moreover, innovations in textile technology, such as waterless dyeing techniques and bio-based chemicals, have accelerated demand from manufacturers focused on reducing environmental impact. The market is supported by the growing awareness of sustainable fashion and stringent environmental regulations aimed at reducing chemical pollution in the textile industry.

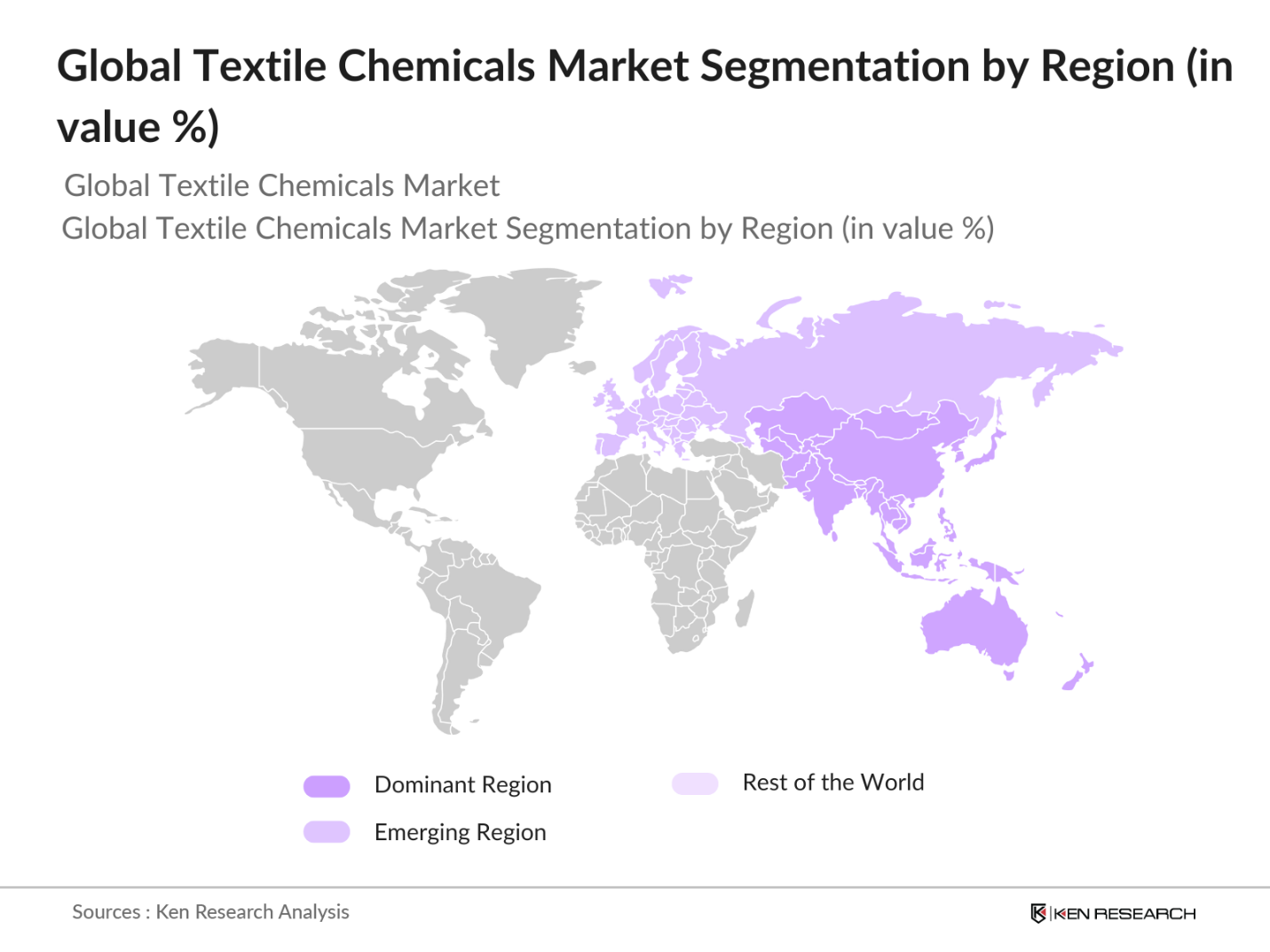

- The Asia Pacific (APAC) region dominate the textile chemicals market due to their strong textile manufacturing infrastructure and cost-effective labor. APAC, particularly nations like China, India, and Bangladesh, leads the market owing to its large-scale production capabilities, availability of raw materials, and government support for textile exports. The region's dominance is further bolstered by rapid industrialization, technological advancements in textile production, and substantial investments in sustainable practices.

- The European Union's REACH regulations are among the most stringent in the world, banning over 200 hazardous chemicals from textile production. In 2023, over 1,000 companies were audited under REACH, leading to fines exceeding $2 billion for non-compliance. The regulations are particularly focused on ensuring that chemicals used in textiles do not harm human health or the environment.

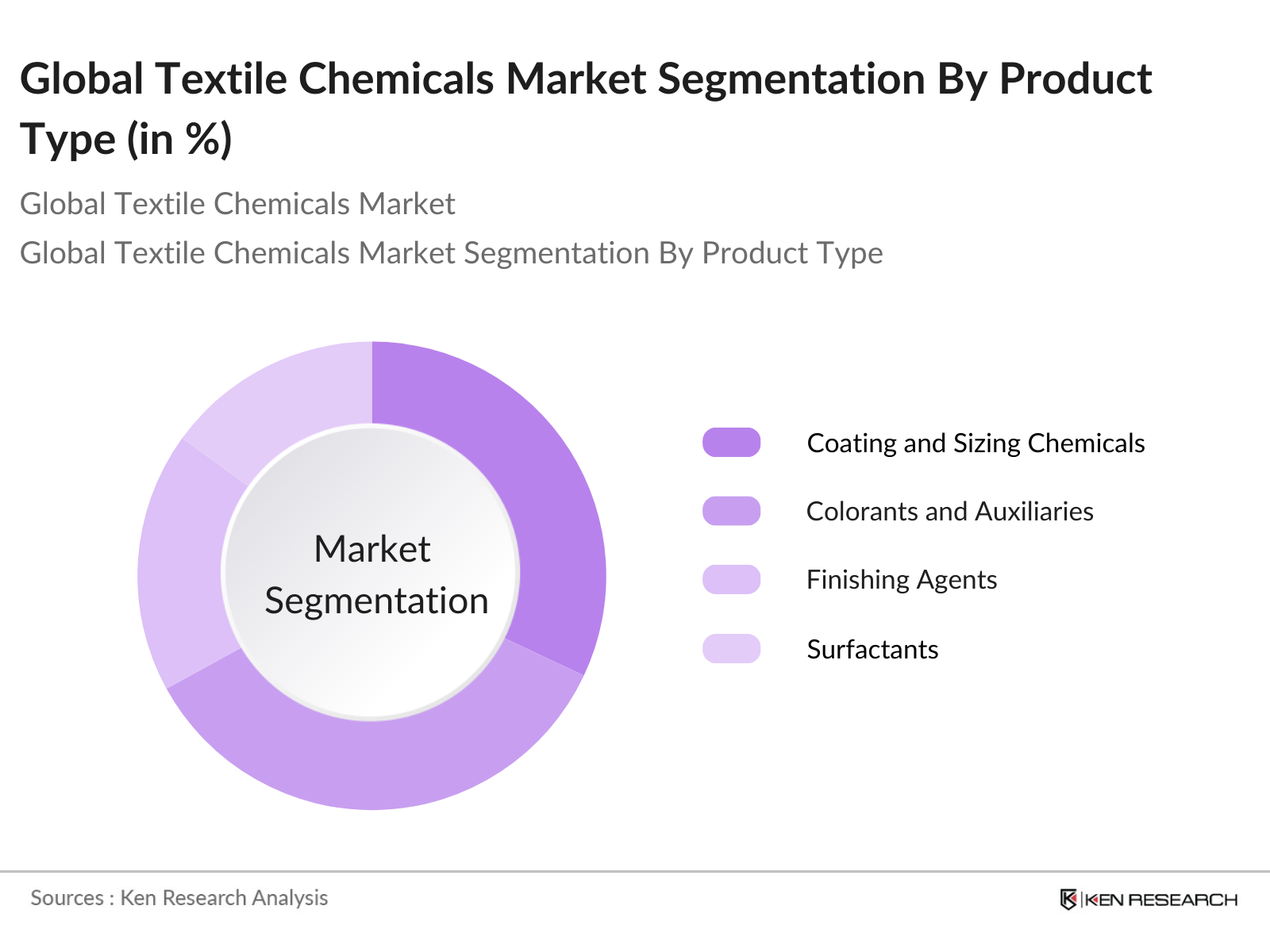

Global Textile Chemicals Market Segmentation

By Product Type: The market is segmented by product type into coating and sizing chemicals, colorants and auxiliaries, finishing agents, surfactants, and desizing agents. Recently, colorants and auxiliaries have a dominant market share within the product type segmentation, primarily due to the growing demand for vibrant and long-lasting dyes in fashion and home textiles.

By Application: The textile chemicals market is segmented by application into apparel, home textiles, technical textiles, and industrial textiles. Among these, the apparel segment holds the largest share due to the global rise of fashion-forward consumerism. The demand for comfortable, durable, and sustainable clothing materials has led to increased usage of textile chemicals in the apparel sector.

By Region: The market is segmented by region into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. Asia Pacific dominates the global market, with countries like China and India leading the regions growth due to their extensive textile production capacity and cost advantages. China's strong industrial infrastructure and technological advancements in textile manufacturing continue to support its dominance.

Global Textile Chemicals Market Competitive Landscape

The Global Textile Chemicals market is dominated by major international players, who hold significant influence over the market through innovation, strategic partnerships, and mergers. Key players include BASF SE, Huntsman Corporation, and Wacker Chemie AG. These companies are recognized for their focus on sustainable chemical solutions, large-scale manufacturing capabilities, and strong research and development activities.

Global Textile Chemicals Market Analysis

Growth Drivers

- Rising Demand for Technical Textiles (Industry Adoption): Technical textiles have seen a substantial surge in demand, driven by the rapid industrial growth in sectors such as healthcare, construction, and automotive. In 2024, global demand for technical textiles exceeded 35 million tons, with significant uptake in countries like China, India, and the US due to infrastructural and healthcare investments.

- Increasing Use of Sustainable Chemicals (Sustainability Metrics): The transition toward eco-friendly chemicals in textile manufacturing is accelerating due to regulatory pressure and consumer awareness. In 2024, approximately 40% of chemical inputs in textile manufacturing are bio-based, particularly in Europe and North America, where sustainable practices are heavily incentivized by governments.

- Fast-Fashion Trends in Apparel (Market Dynamics): The fast-fashion sector continues to push for high-volume production, driving significant demand for textile chemicals. In 2023, global textile production reached 120 million metric tons, largely fueled by the fast-fashion industrys need for quick turnaround times and low-cost production. Countries like Bangladesh, Vietnam, and India have become major production hubs due to their cost-effective labor and infrastructure, accounting for over 40% of global fast-fashion output.

Market Challenges

- Volatility in Raw Material Prices (Cost Sensitivity): Raw material price fluctuations remain a significant challenge for the textile chemicals market. For instance, the price of petrochemical-based raw materials, such as naphtha, surged in 2023 due to geopolitical tensions and energy crises, impacting global supply chains. The average cost of crude oil, a major input for synthetic textile chemicals, reached $85 per barrel in 2023, a significant increase from previous years.

- Environmental Concerns and Compliance (Environmental Impact): Environmental regulations have increased compliance costs for textile chemical manufacturers, particularly in Europe and North America. In 2023, textile factories were fined over $2 billion globally for non-compliance with emission regulations, with 70% of these fines originating from Europe. The global textile industry is responsible for approximately 1.2 billion metric tons of CO2 emissions annually, creating a significant environmental burden that governments are keen to address.

Global Textile Chemicals Market Future Outlook

Over the next five years, the Global Textile Chemicals market is expected to show significant growth, driven by continuous advancements in sustainable textile manufacturing, increasing consumer demand for eco-friendly materials, and government initiatives focusing on environmental sustainability. As the market shifts towards bio-based and non-toxic chemicals, manufacturers will have to adapt their processes to comply with strict environmental regulations, creating further demand for innovations in textile chemical formulations.

Market Opportunities

- Growth in Emerging Economies (Regional Expansion): Emerging economies such as India, Brazil, and Vietnam represent significant growth opportunities for the textile chemicals market. India, for instance, saw a 7% growth in textile production in 2023, fueled by government initiatives like the Production Linked Incentive (PLI) scheme, which allocated $1.4 billion to the textile sector. Brazils textile industry generated over $50 billion in revenue in 2023, driven by growing domestic consumption and export demand, particularly to the US and Europe.

- Technological Innovations in Smart Textiles (Technology Adoption): The rise of smart textiles is creating new demand for specialized chemicals. In 2023, the global smart textiles market was valued at over $5 billion, with the US and Europe being the largest adopters. Innovations such as conductive textiles, which require specialized chemicals for durability and performance, are driving the need for advanced chemical formulations. Governments in the US and EU are investing heavily in R&D for smart textiles, with over $500 million allocated to innovation programs in 2023.

Scope of the Report

|

By Product Type |

Coating and Sizing Chemicals, Colorants, Finishing Agents, Surfactants, Desizing Agents |

|

By Application |

Apparel, Home Textiles, Technical Textiles, Industrial Textiles |

|

By Fiber Type |

Natural Fibers, Synthetic Fibers, Blended Fibers |

|

By End-Use Industry |

Clothing, Automotive, Construction, Healthcare |

|

By Region |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Products

Key Target Audience

Textile Manufacturers

Chemical Suppliers

Apparel and Fashion Brands

Technical Textile Companies

Government and Regulatory Bodies (REACH, EPA)

Investment and Venture Capitalist Firms

Environmental Sustainability Organizations

Textile Technology Providers

Companies

Players Mentioned in the Report

BASF SE

Huntsman Corporation

Wacker Chemie AG

Archroma

Evonik Industries

Solvay S.A.

Kiri Industries

Dystar Group

Lubrizol Corporation

Akzo Nobel N.V.

Table of Contents

1. Global Textile Chemicals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Textile Chemicals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Textile Chemicals Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Technical Textiles (Industry Adoption)

3.1.2. Increasing Use of Sustainable Chemicals (Sustainability Metrics)

3.1.3. Fast-Fashion Trends in Apparel (Market Dynamics)

3.1.4. Government Regulations on Chemical Use (Regulatory Compliance)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (Cost Sensitivity)

3.2.2. Environmental Concerns and Compliance (Environmental Impact)

3.2.3. Shift to Bio-Based Chemicals (Sustainability Transition)

3.3. Opportunities

3.3.1. Growth in Emerging Economies (Regional Expansion)

3.3.2. Technological Innovations in Smart Textiles (Technology Adoption)

3.3.3. Circular Economy Initiatives (Sustainability Initiatives)

3.4. Trends

3.4.1. Integration of Nanotechnology (Technology Innovation)

3.4.2. Shift Toward Waterless Dyeing Techniques (Process Innovation)

3.4.3. Growth in High-Performance Textiles (Segment Growth)

3.5. Government Regulation

3.5.1. REACH Regulations (Compliance Framework)

3.5.2. Emission Reduction Targets (Environmental Impact)

3.5.3. Chemical Management Initiatives (Safety Protocols)

3.5.4. Green Certification for Chemicals (Sustainability Standards)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stake Ecosystem (Supply Chain Analysis, Key Stakeholders)

3.8. Porters Five Forces (Competitive Landscape)

3.9. Competition Ecosystem (Competitive Positioning)

4. Global Textile Chemicals Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Coating and Sizing Chemicals

4.1.2. Colorants and Auxiliaries

4.1.3. Finishing Agents

4.1.4. Surfactants

4.1.5. Desizing Agents

4.2. By Application (In Value %)

4.2.1. Apparel

4.2.2. Home Textiles

4.2.3. Technical Textiles

4.2.4. Industrial Textiles

4.3. By Fiber Type (In Value %)

4.3.1. Natural Fibers

4.3.2. Synthetic Fibers

4.3.3. Blended Fibers

4.4. By End-Use Industry (In Value %)

4.4.1. Clothing

4.4.2. Automotive

4.4.3. Construction

4.4.4. Healthcare

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Textile Chemicals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Huntsman Corporation

5.1.3. Wacker Chemie AG

5.1.4. Archroma

5.1.5. Evonik Industries

5.1.6. Solvay S.A.

5.1.7. Kiri Industries

5.1.8. Dystar Group

5.1.9. Lubrizol Corporation

5.1.10. Akzo Nobel N.V.

5.1.11. Omnova Solutions

5.1.12. Tanatex Chemicals B.V.

5.1.13. DowDuPont Inc.

5.1.14. Archroma Management LLC

5.1.15. Croda International Plc

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Sustainability Initiatives, Technological Innovation, Market Share, Regional Presence, Supply Chain Resilience, Product Certification)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Textile Chemicals Market Regulatory Framework

6.1. REACH Compliance

6.2. Environmental Standards for Emissions

6.3. Global Textile Chemical Safety Protocols

6.4. Certification Processes for Bio-Based Chemicals

7. Global Textile Chemicals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Textile Chemicals Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Fiber Type (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Textile Chemicals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables influencing the Global Textile Chemicals market. Extensive desk research is conducted to map out major stakeholders, including textile manufacturers, chemical suppliers, and regulatory bodies. Proprietary databases and secondary sources are used to gather crucial industry-level information.

Step 2: Market Analysis and Construction

During this phase, historical data from the textile chemicals market is analyzed to evaluate market trends and dynamics. The market structure, including production capacity and technological penetration, is thoroughly assessed to estimate revenue and forecast future growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on initial data analysis and then validated through interviews with key industry experts. This phase includes consultations with manufacturers, distributors, and industry analysts, which helps refine market estimates and gain insights into emerging trends.

Step 4: Research Synthesis and Final Output

In the final step, the data collected is synthesized to generate a comprehensive report. The bottom-up approach is used to validate market statistics, ensuring accuracy and thoroughness in the final report. Direct engagement with industry players further enhances the reliability of the insights provided.

Frequently Asked Questions

01. How big is the Global Textile Chemicals Market?

The Global Textile Chemicals market is valued at USD 26 billion, driven by the increasing demand for technical textiles and sustainable chemicals, with significant contributions from key players in Asia Pacific and Europe.

02. What are the challenges in the Global Textile Chemicals Market?

Key challenges in the market include the volatility of raw material prices, strict environmental regulations, and the shift towards bio-based and sustainable chemical alternatives, which require heavy investment in R&D.

03. Who are the major players in the Global Textile Chemicals Market?

Major players in the market include BASF SE, Huntsman Corporation, Wacker Chemie AG, and Archroma. These companies dominate due to their large-scale production capabilities, strong R&D focus, and innovations in sustainability.

04. What are the growth drivers of the Global Textile Chemicals Market?

Growth drivers include the rising demand for functional and technical textiles, increased consumer awareness around sustainability, and advancements in textile manufacturing processes such as digital printing and waterless dyeing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.