Region:Global

Author(s):Rebecca

Product Code:KRAD0315

Pages:97

Published On:August 2025

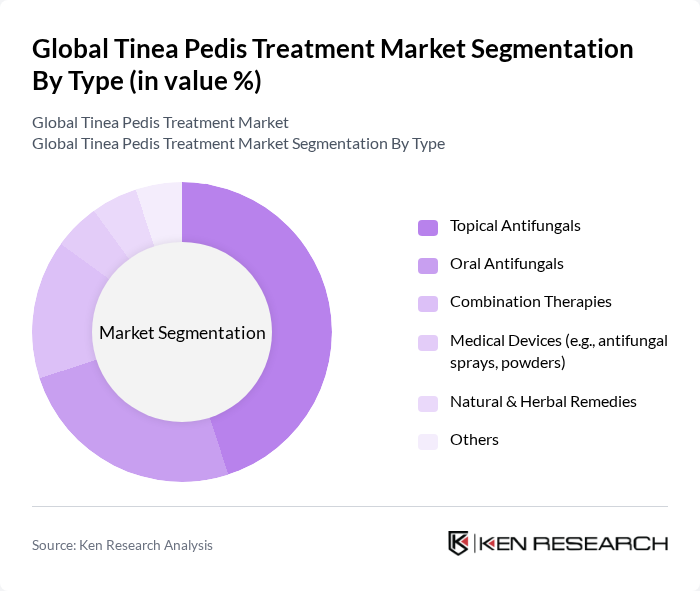

By Type:The market is segmented into various types of treatments, including topical antifungals, oral antifungals, combination therapies, medical devices, natural & herbal remedies, and others. Among these, topical antifungals are the most widely used due to their ease of application, cost-effectiveness, and effectiveness in treating localized infections. Oral antifungals are increasingly utilized for more severe or persistent cases. Combination therapies are gaining popularity as they offer a comprehensive approach to treatment, improving efficacy and reducing recurrence rates. Medical devices such as antifungal sprays and powders provide convenient application, while natural and herbal remedies appeal to consumers seeking alternative options, though their efficacy may be variable.

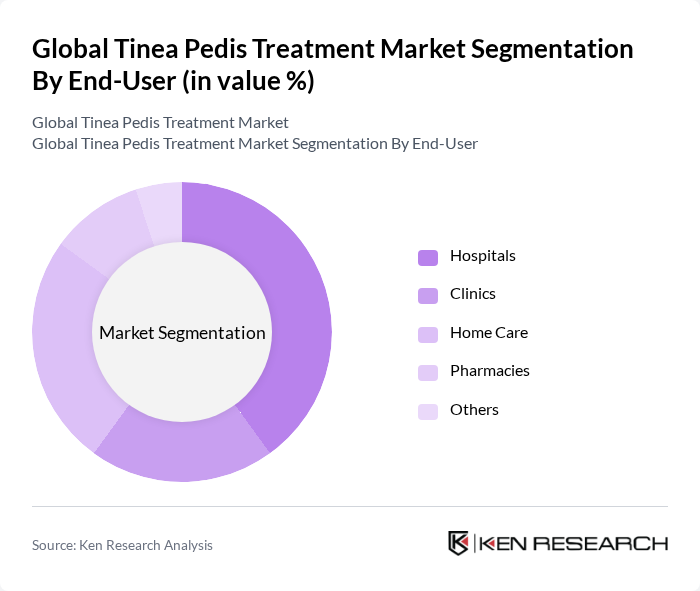

By End-User:The end-user segmentation includes hospitals, clinics, home care, pharmacies, and others. Hospitals and clinics are the primary users of antifungal treatments, providing specialized care for patients with severe or complicated infections. Home care is increasingly significant due to the rise in self-medication and the convenience of over-the-counter products, especially for mild and moderate cases. Pharmacies play a crucial role in distributing these treatments, making them readily accessible to consumers through retail channels.

The Global Tinea Pedis Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Bayer AG, Sanofi S.A., Abbott Laboratories, Astellas Pharma Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Amgen Inc., Sandoz International GmbH, Sun Pharmaceutical Industries Ltd., Perrigo Company plc, Reckitt Benckiser Group plc, Galderma S.A., Bausch Health Companies Inc., Kerasal (Moberg Pharma AB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Tinea Pedis treatment market appears promising, driven by ongoing innovations in treatment modalities and a growing emphasis on preventive care. As healthcare systems increasingly adopt telemedicine, patients will have greater access to consultations and treatment options. Furthermore, the trend towards personalized medicine is expected to enhance treatment efficacy, catering to individual patient needs and improving overall outcomes in managing Tinea Pedis effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Topical Antifungals Oral Antifungals Combination Therapies Medical Devices (e.g., antifungal sprays, powders) Natural & Herbal Remedies Others |

| By End-User | Hospitals Clinics Home Care Pharmacies Others |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospital Pharmacies Supermarkets & Hypermarkets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Age Group | Children Adults Elderly |

| By Treatment Duration | Short-term Treatments Long-term Treatments |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 100 | Dermatologists, Nurse Practitioners |

| Pharmacies and Drugstores | 70 | Pharmacists, Pharmacy Managers |

| Patient Focus Groups | 50 | Patients with a history of tinea pedis |

| Healthcare Providers | 90 | General Practitioners, Podiatrists |

| Market Analysts | 40 | Healthcare Market Researchers, Analysts |

The Global Tinea Pedis Treatment Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the increasing prevalence of fungal infections and rising public awareness about foot hygiene and effective treatment options.