Global Tire Market Outlook to 2030

Region:Global

Author(s):Vanshika and Nishika

Product Code:KENGR003

October 2024

84

About the Report

Global Tire Market Overview

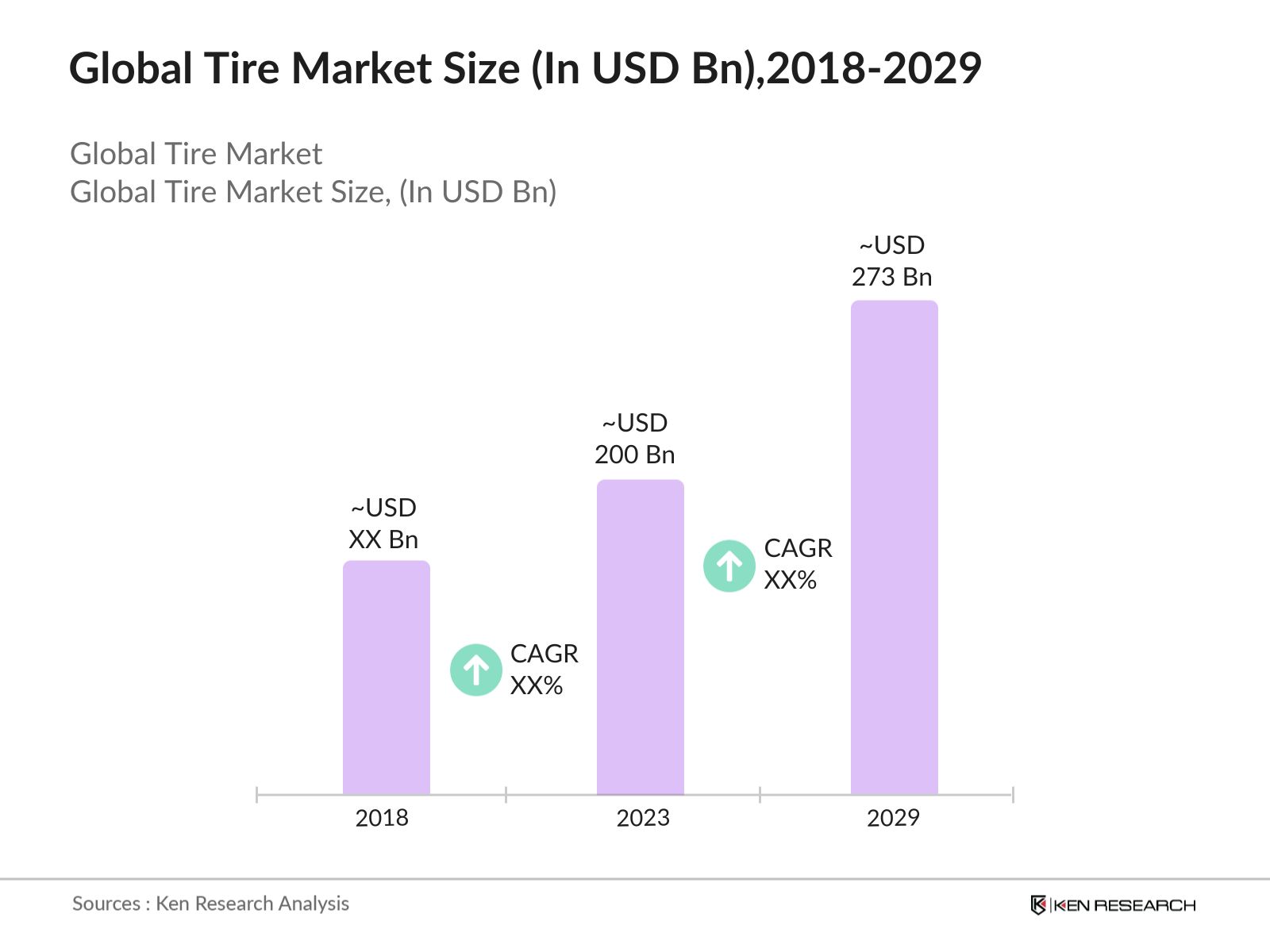

- Global Tire Market was valued at USD 200 Bn in 2023, driven by the increasing vehicle production and sales, the growing demand for replacement Tires and advancements in Tire technology. The rise in disposable income, particularly in developing economies, has also contributed to higher automobile sales, which in turn boosts the Tire market.

- Market is dominated by several key players which includes Michelin, Bridgestone, Goodyear, Continental and Toyo due to their extensive R&D capabilities, widespread distribution networks, and strong brand recognition.

- In 2023 Michelin acquired UK-based simulation software company Canopy Simulation. This strategic acquisition strengthens Michelin's position as a technological leader and data-driven company in the automotive industry. Michelin currently has 117 production sites in 26 countries, a commercial presence in 170 countries, and 9 R&D centers globally.

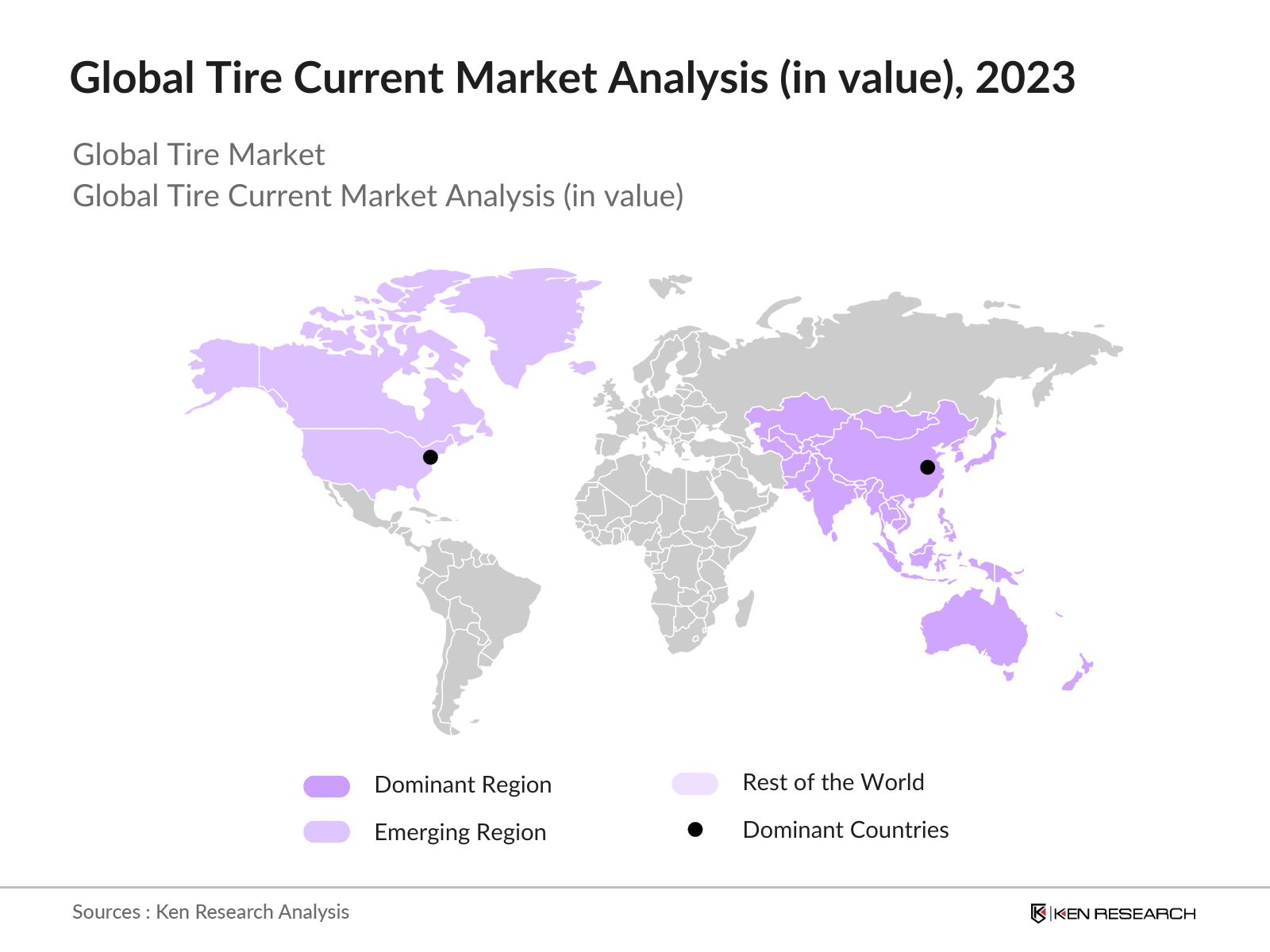

Global Tire Current Market Analysis

- APAC as dominant region: The Asia-Pacific region dominates the global tire market, driven by rapid urbanization exceeding 2.3 billion people in 2023 and automotive sales of 42.6 million passenger cars. China leads in tire production and consumption, with a 20% year-on-year increase in semi-steel tire exports, totaling 287 million units. The region's robust economic growth, accounting for 69.9% of global GDP growth over the past decade, coupled with rising disposable incomes and an expanding middle class of 500 million to 1 billion, propels market demand.

- North America as emerging region: North America is emerging as a pivotal player in the global tire market, driven by technological advancements like RFID chips and sensors, increased vehicle production (16.2 million in 2023), and a robust aftermarket sector. Innovation in sustainable and smart tire technologies positions the region at the forefront of industry growth. Strong economic frameworks and strategic investments, such as the $1.2 trillion Bipartisan Infrastructure Law, boost demand for tires. Rising consumer awareness about vehicle safety and stringent regulatory standards further support market expansion.

- China as dominant country: China dominates the global tire market due to its vast manufacturing capacity, competitive pricing, and robust domestic demand. In 2022, China's manufacturing output was USD 4975.61 billion, a 1.36% increase from 2021. December 2023 saw vehicle production and sales volumes reach 3.079 million and 3.156 million units, respectively. Leading tire manufacturers like Linglong Tyres benefit from economies of scale. China exported tires worth $21.33 billion in 2023, up from $18.87 billion in 2022, solidifying its global leadership.

Global Tire Market Segmentation

The Global Tire Market can be segmented based on several factors:

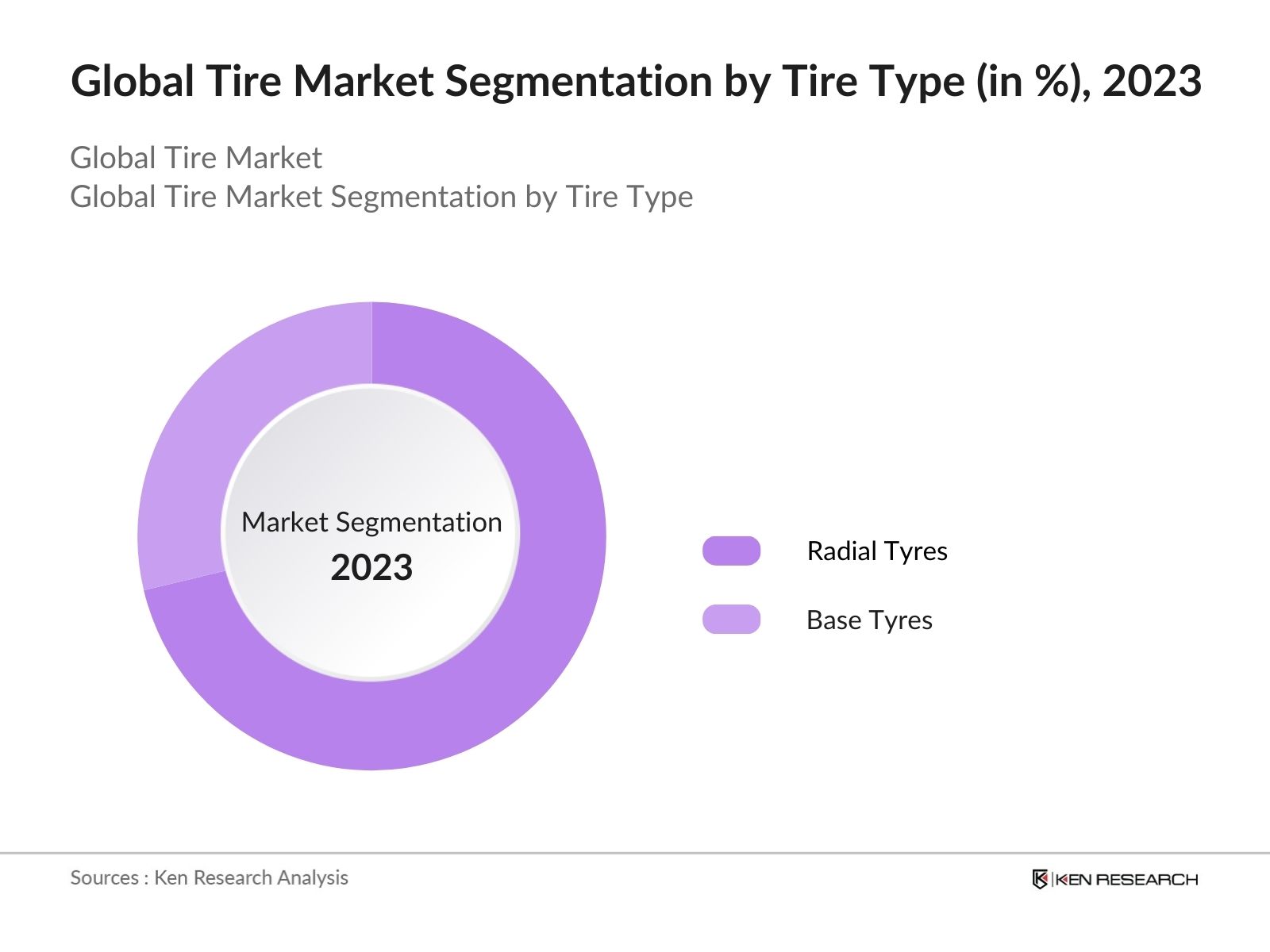

By Tire Type: Global tire market is segmented by tire type into radial tires & base tires. In 2023, Radial Tires are the most dominant sub-segment. Radial Tires offers fuel efficiency, beneficial for long distance vehicles like commercial vehicles. Their design makes them suitable for all seasons and their flexible sidewalls makes them suitable for passenger vehicles as well.

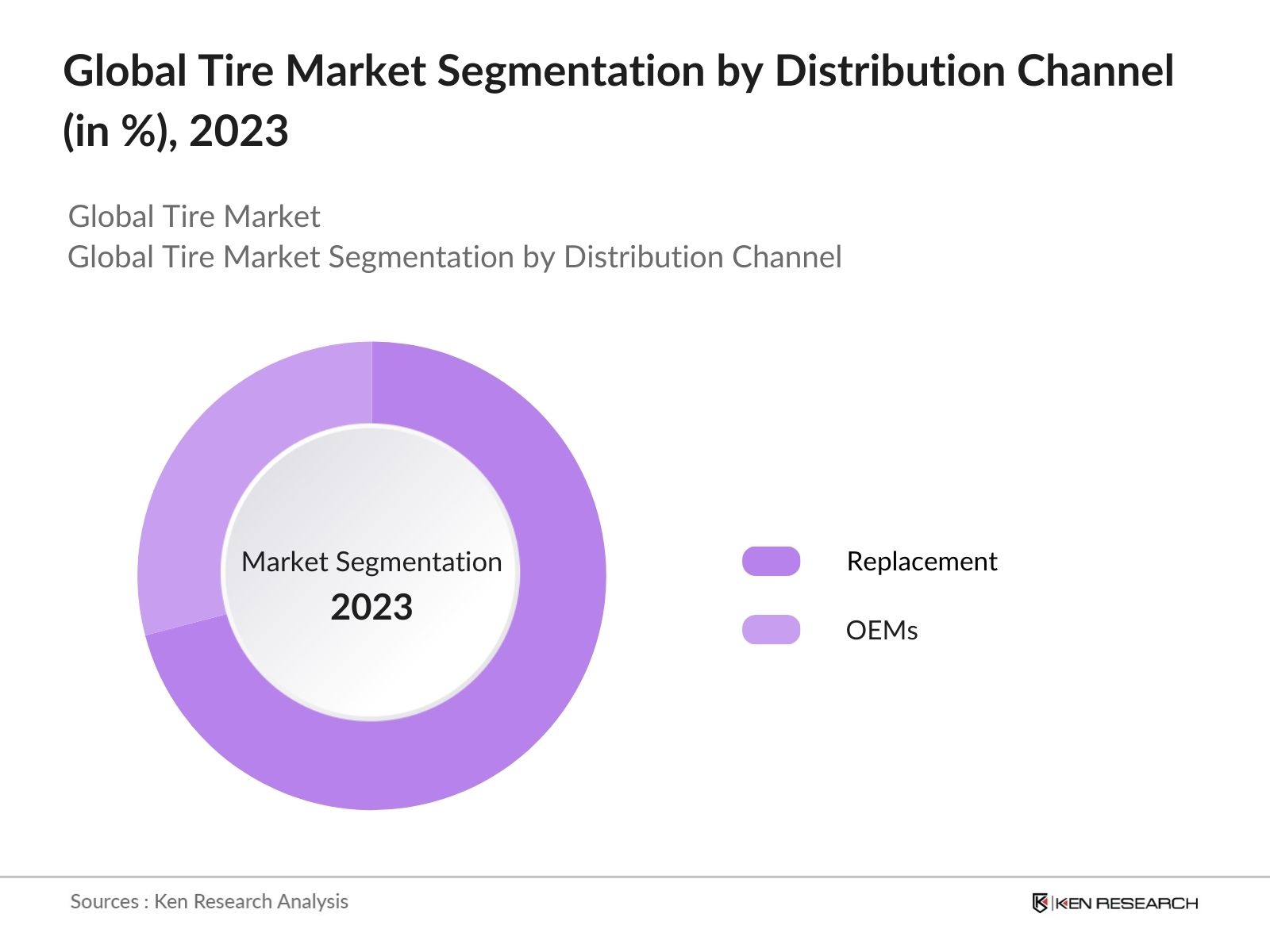

By Distribution Channel: Global tire market is segmented by distribution channel into replacement & OEM. In 2023, replacement channel dominates the market. As vehicles age, they require more frequent tire replacements to maintain safety and performance. Moreover, the high cost of buying new vehicles encourages many owners to keep their existing vehicles longer, resulting in more frequent tire replacements.

By Vehicle Type: Global tire market is segmented by vehicle type into passenger vehicles, commercial vehicles & others. In 2023, Passenger vehicles are dominating this segment. Passenger vehicle tires typically need to be replaced every few years due to wear and tear, ensuring a steady and recurring demand. Increasing vehicle ownership, particularly in emerging markets, contributes significantly to the demand for passenger vehicle tires.

Global Tire Market Competitive Landscape

|

Company |

Headquarters |

Establishment Year |

Geographical Presence |

Tire Manufacturing Plants |

|

Michelin |

Clermont-Ferrand, France |

1889 |

170 |

69 |

|

Brigestone |

Tokyo, Japan |

1931 |

150 |

73 |

|

The Goodyear Tire & Rubber Company |

Ohio, United States of America |

1898 |

23 |

55 |

|

Continental Group |

Hanover, Germany |

1871 |

56 |

20 |

|

Sumitomo Rubber Industries |

Hyogo, Japan |

1909 |

24 |

14 |

|

Pirelli |

Milan, Italy |

1872 |

160 |

18 |

|

Hankook Tire & Technology Co., Ltd. |

Pangyo, South Korea |

1941 |

160 |

8 |

|

Yokohama |

Kanagawa, Japan |

1917 |

120 |

32 |

- Lunar Rover Tire: In 2024, Bridgestone has introduced an innovative Lunar Rover Tire, set to be showcased at the 39th Space Symposium in Colorado Springs. The new tire utilizes a skeletal structure which includes thin metal spokes and a divided tread segment, enhancing durability and traction on the moon's rugged terrain.

- Michelin Lihtion 4: In 2023, Michelin has expanded its road cycling tire lineup with the introduction of two new products: the Michelin Lithion 4. It was designed to enhance performance and provide a smooth ride which emphasizes ease of use and reliability for cyclists. This tire is suitable for a variety of road conditions, making it a versatile choice for both casual and competitive riders.

- SportsRad & CrossRad: Ceat, a leading Tire manufacturer, has taken the performance of its two-wheeler SportsRad and CrossRad. This premium range of steel radial Tires is specially crafted to unleash the full potential of high-performance motorcycles. The Sportrad series is designed for high speed and cornering; while the Crossrad is a multi-terrain high grip Tire.

Global Tire Industry Analysis

Global Tire Market Growth Drivers:

- Artificial Intelligence in Tires: In 2023, JK Tires uses AI, ML technologies to cater to high-end car segment in India. AI has revolutionized the tire industry by customizing tire design, manufacturing, and selection through intricate algorithms that analyze driving patterns and road conditions, enhancing performance and safety across diverse terrains.

- Electric Vehicle Tires: Electric Vehicles are finding buying willingness among the consumers. In 2023, 40 million electric vehicles were sold across the globe. Leading players like Bridgestone & Michelin have launched have launched Tires for this category, focusing on durability and energy efficiency to meet the specific demands of electric vehicles.

- Resilient Demand for Premium Vehicles: The premium car segment is finding strong demand from developing countries. In 2023, luxury car sales in India reached a record high of 42,731 units, representing a 20% year-on-year increase because of changing lifestyle preferences, particularly among younger professionals, and rising disposable incomes.

Global Tire Market Challenges:

- Volatile Sell-in Demand: The sell-in demand, which represents manufacturers selling to dealers was more volatile than the sell-out demand, which is dealers selling to end-consumers. This volatility was due to inventory drawdowns across all dealer channels whose impact was observed in the passenger car, light truck, and truck tire markets.

- Raw Material Costs: The price of essential raw materials such as rubber and steel increased. In 2023, the cost of raw rubber rose to $1,750 per metric ton. As a result, manufacturers faced higher production costs, affecting profit margins and pricing strategies.

Global Tire Future Market Outlook

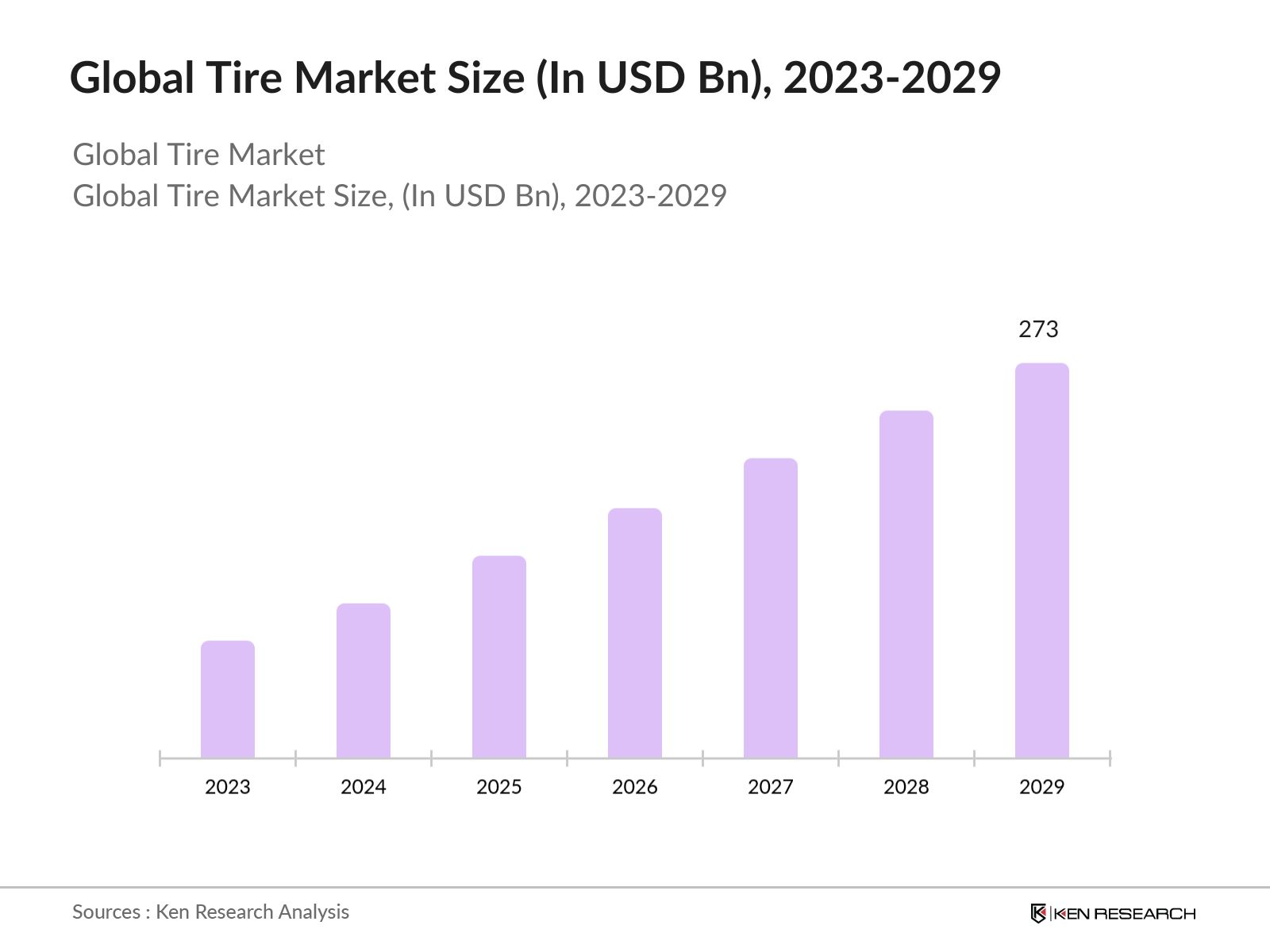

Global Tire Market is projected to continue its growth trajectory, reaching an estimated value of USD 273 Bn by 2029. This growth will be driven by factors such as increasing vehicle electrification, the adoption of advanced manufacturing technologies, and the rising demand for sustainable and eco-friendly Tires.

Future Market Trends

- Adoption of Advanced Tire Technologies: Over the next five years, the adoption of advanced Tire technologies, such as self-healing Tires and airless Tires, is expected to gain momentum. Vehicles will be equipped with self-healing Tires, which use advanced materials to automatically seal punctures and extend Tire lifespan. This trend will enhance vehicle safety and reduce maintenance costs for consumers.

- Growth in Electric Vehicle (EV) Tires Market: The increasing adoption of electric vehicles (EVs) will drive the demand for specialized EV Tires that offer low rolling resistance and high durability. This trend will create new opportunities for Tire manufacturers to innovate and develop EV-specific Tire solutions.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Tire Type |

Radial Bias |

|

By Distribution Channel |

Replacement OEM |

|

By Vehicle Type |

Passenger Vehicle Commercial Vehicle Others (Incl. Off -The Road, Aircraft Tires) |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Automotive Manufacturers

Tire Manufacturers

Automotive Aftermarket Suppliers

Fleet Operators

Transportation Companies

Raw Material Suppliers

Logistics Companies

Automotive Repair and Maintenance Services

Banks & Financial Institutions

Government & Regulatory Bodies (Indian Tire Technical Advisory Committee, ISO)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Michelin

Bridgestone

Goodyear Tire & Rubber Company

Continental Group

Sumitomo Rubber Industries

Pirelli

Hankook Technology & Tire Co Ltd.

Yokohama

CEAT

Toyo Tires

Table of Contents

1. Executive Summary

1.1 Global Automotive Market

1.2 Global Tire Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Electric Vehicle Industry

2.3 Global Automotive (OEM, Aftermarket, Commercial, Electric Vehicle) Sales

3. Global Tire Market Overview

3.1 Global Tire Market Ecosystem

3.2 Global Tire Market Value Chain

4.Global Tire Market Size (in USD Bn), 2018-2023

5. Global Tire Market Segmentation (in value %), 2018-2023

5.1 Global Tire Market Segmentation by Region (in value %), 20182-23

5.2 Global Tire Market Segmentation by Tire Type (in value%), 2018-2023

5.3 Global Tire Market Segmentation by Distribution Channel (in value %), 2018-2023

5.4 Global Tire Market Segmentation by Vehicle (in value %), 2018-2023

6.Global Tire Market Competition Landscape

6.1Global Tire Market Share Analysis

6.2Global Tire Market Heat Map Analysis

6.3Global Tire Market Cross Comparison

6.4Global Tire Market Competitive Matrix

7.Global Tire Market Dynamics

7.1 Global Tire Market Growth Drivers

7.2 Global Tire Market Challenges

7.3 Global Tire Market Trends

8.Global Tire Future Market Size (in USD Bn), 2023-2029

9. Global Tire Future Market Segmentation (in value %), 2023-2029

9.1 Global Tire Future Market Segmentation by Region (in value %), 2023-2029

9.2 Global Tire Future Market Segmentation by Tire Type (in value%), 2023-2029

9.3 Global Tire Future Market Segmentation by Distribution Channel (in value %), 2023-2029

9.4 Global Tire Future Market Segmentation by Vehicle (in value %), 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Secondary Research

The initial phase involves gathering information from secondary sources, including government reports on road safety, vehicle regulations, transportation infrastructure, and tire-related regulations and trends. Additionally, insights are drawn from official company reports and press releases from major tire manufacturers like Michelin, Bridgestone, and Goodyear, providing details on product offerings, financial performance, and market strategies. Furthermore, data from public and proprietary databases such as F&S, Euromonitor, Statista, McKinsey, Tire Industry Association (TIA), and Rubber Manufacturers Association (RMA) are utilized for market sizing, industry analysis, and forecasts.

Step 2: Primary Research through Trade Desk Interviews

The next step involves validating the data through primary research, specifically trade desk interviews. These interviews are conducted with key stakeholders, including CEOs, Director-Operations, Supply Chain & Sales Managers, and Product Managers from manufacturers/suppliers, with a length of interview (LOI) of 40-45 minutes. Distributors, represented by Business Development Managers, Procurement Managers, and Category Managers, provide additional perspectives in interviews lasting 30-35 minutes. Industry experts, including tire manufacturing engineers, tire technology innovators, analysts, and C-suite employees, are interviewed for 30 minutes. Additionally, input is gathered from over 10 respondents from regulatory bodies, with an LOI of 25-30 minutes.

Step 3: Data Analysis and Proxy Modelling

In the final step, a top-bottom approach is employed to analyze the revenue of major players by examining their sales and pricing across various products. This step also includes disguised interviews with multiple managers to gather insights into operational and financial performance. This method helps ensure the accuracy of the data by cross-verifying information provided by top management.

Frequently Asked Questions

01 How big is Global Tire Market?

Global Tire Market was valued at USD 200 Bn in 2023, driven by growth in countries like China and India. Rising demand for automotive cars & government policies are key factors which ensure the markets growth.

02 What are the challenges in Global Tire Market?

Challenges include volatile sell in demand & raw material costs. These factors hinder the smooth growth and expansion of the market. This volatility was due to inventory drawdowns across all dealer channels whose impact was observed in the passenger car, light truck, and truck tire markets.

03 Who are major players in Global Tire Market?

Global Tire Market is dominated by several key players which includes Michelin, Bridgestone, Goodyear, Continental and Toyo due to their extensive R&D capabilities, widespread distribution networks, and strong brand recognition.

04 What are the growth drivers of the Global Tire Market?

The market is propelled by factors such as growing demand for electric vehicles, AI and machine learning and resilient demand for premium vehicles. AI has revolutionized the tire industry by customizing tire design, manufacturing & selection through intricate algorithms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.