Global Tongue Cleaner Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8585

December 2024

94

About the Report

Global Tongue Cleaner Market Overview

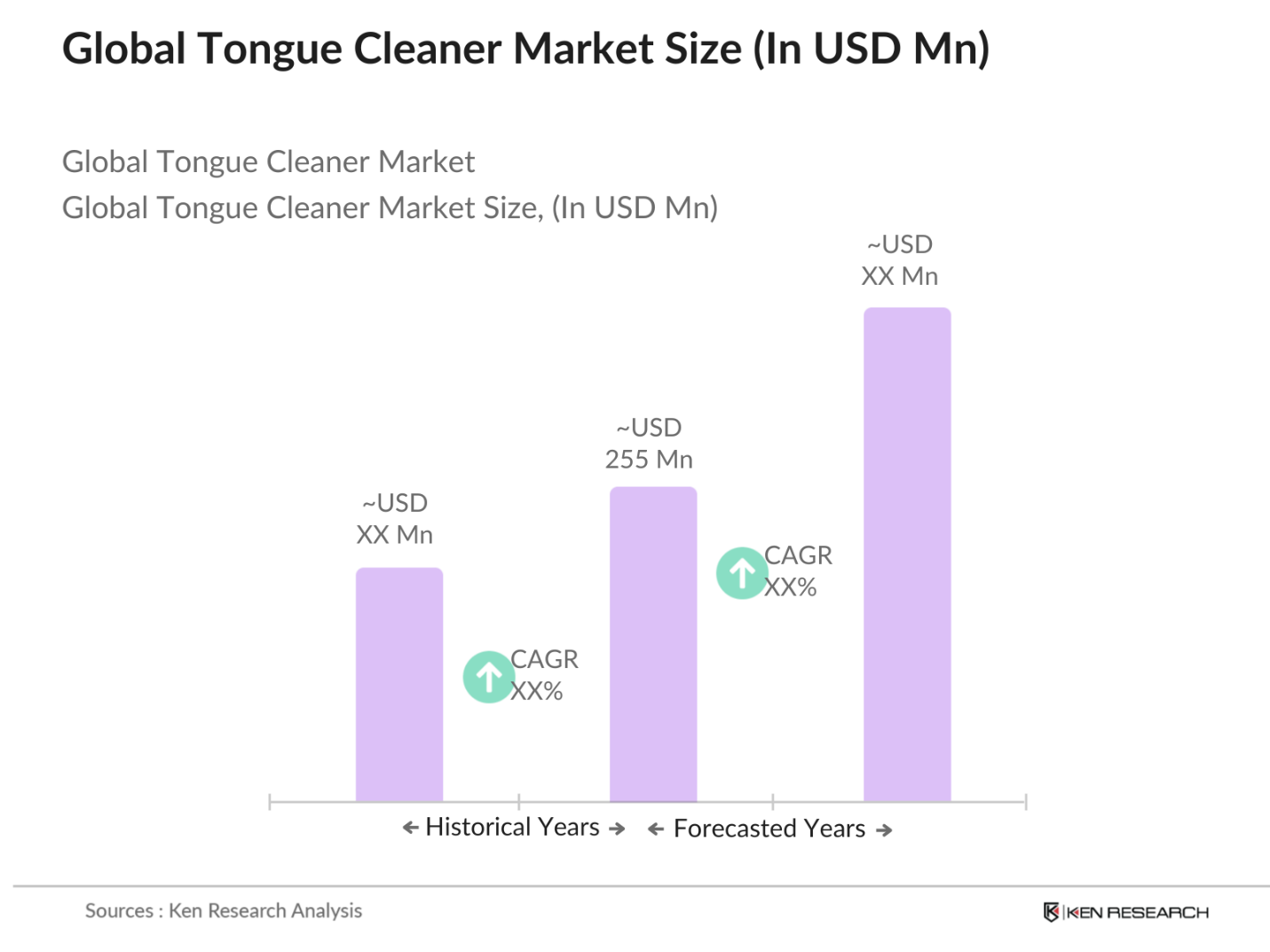

- The global tongue cleaner market is valued at approximately USD 255 million, driven by increased oral hygiene awareness and consumer demand for effective dental care solutions. According to industry research, the market has grown steadily due to rising consumer awareness of oral health's role in overall wellness, supported by endorsements from dental health organizations. Growth has been propelled by a marked shift in consumer behavior towards preventative oral care, particularly in urban areas where the influence of social media and marketing campaigns has been significant.

- Countries such as the United States, Japan, and India are notable leaders in the tongue cleaner market. The U.S. market's dominance is attributed to higher disposable incomes and strong consumer interest in wellness products. Meanwhile, in Japan and India, traditional practices and cultural emphasis on oral hygiene significantly boost the adoption of tongue cleaning products. In India, the practice has deep cultural roots, often integrated into daily routines, while Japans market emphasizes cleanliness and personal care.

- The trend toward biodegradable materials in personal care products is becoming more prominent, especially in North America and Europe, where regulatory bodies promote environmental sustainability. For instance, in 2024, nearly 15% of personal care products in these regions contained biodegradable components. The adoption of eco-friendly materials in tongue cleaners aligns with this trend, appealing to environmentally-conscious consumers and reducing ecological footprints.

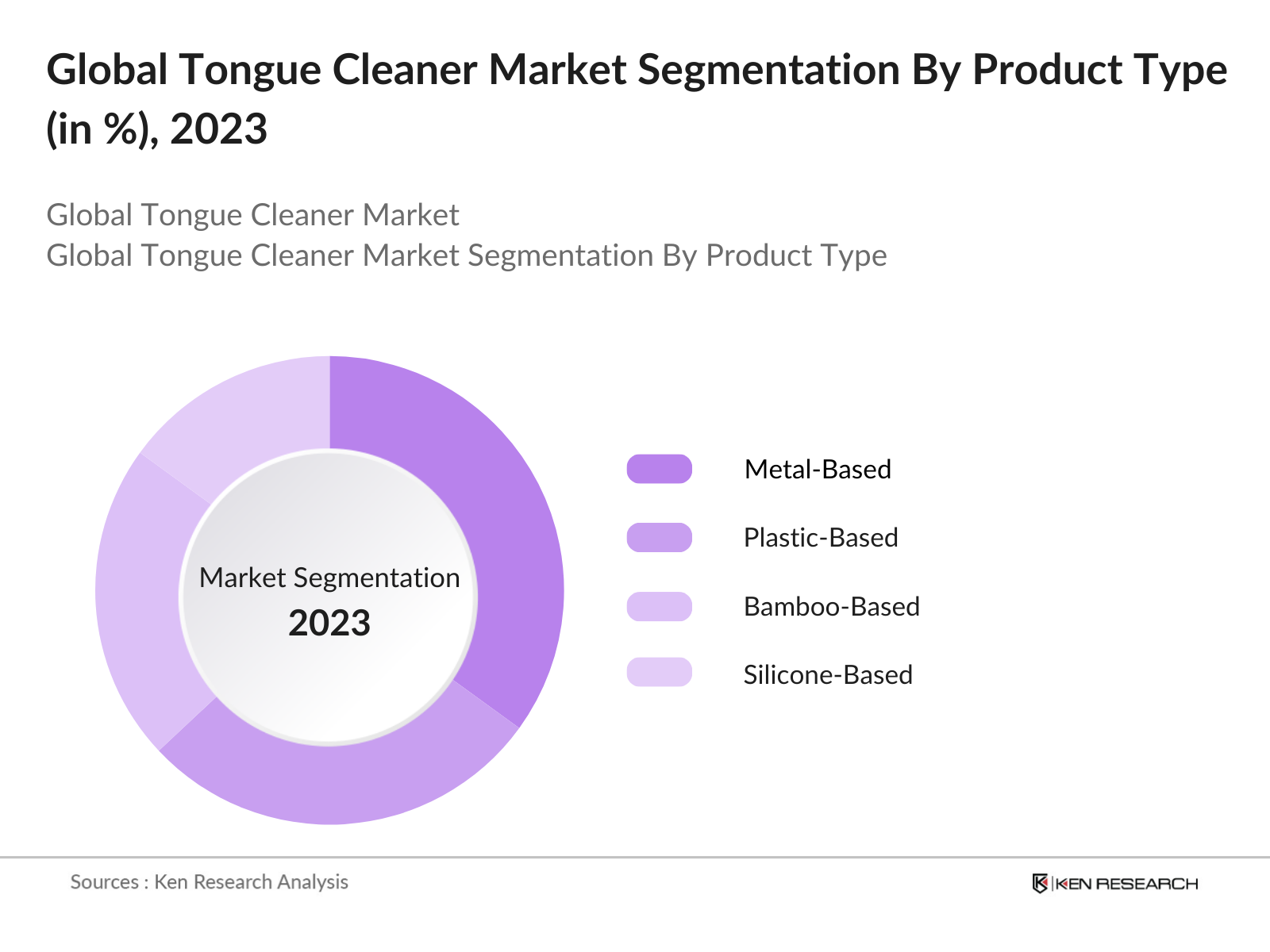

Global Tongue Cleaner Market Segmentation

By Product Type: The tongue cleaner market is segmented into metal-based, plastic-based, bamboo-based, and silicone-based products. Metal-based cleaners currently hold a dominant position due to their durability, ease of cleaning, and cultural association in regions like South Asia. This segments popularity is bolstered by consumer preference for long-lasting products that can be sanitized easily, particularly among health-conscious individuals. Additionally, companies have innovated to improve ergonomics and aesthetics, making metal cleaners a favored choice.

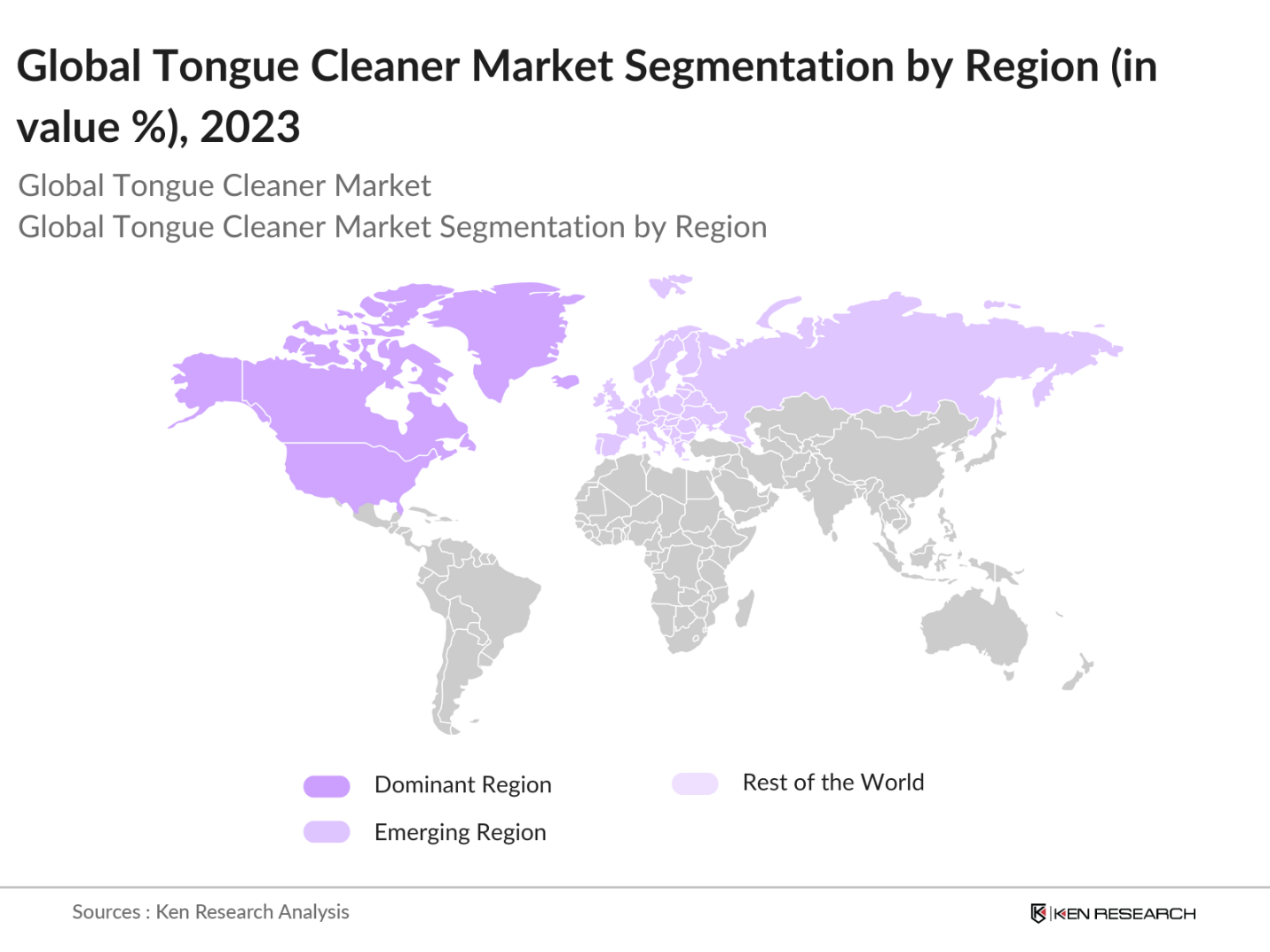

By Region: Geographically, the market includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the global market, reflecting strong demand for advanced and eco-friendly oral care products. High purchasing power and awareness of oral hygiene in the U.S. support this trend. Asia-Pacific also represents a significant portion of the market due to traditional practices and rising disposable incomes, particularly in India and Japan.

By Distribution Channel: Distribution channels for tongue cleaners include retail pharmacies, online retail, supermarkets/hypermarkets, and specialty stores. Online retail has taken a lead due to the rising preference for e-commerce, driven by convenience and broader product variety. E-commerce giants have leveraged promotions and easy return policies to attract buyers, particularly during health and wellness campaigns. Additionally, reviews and comparisons available on online platforms significantly influence consumer buying behavior.

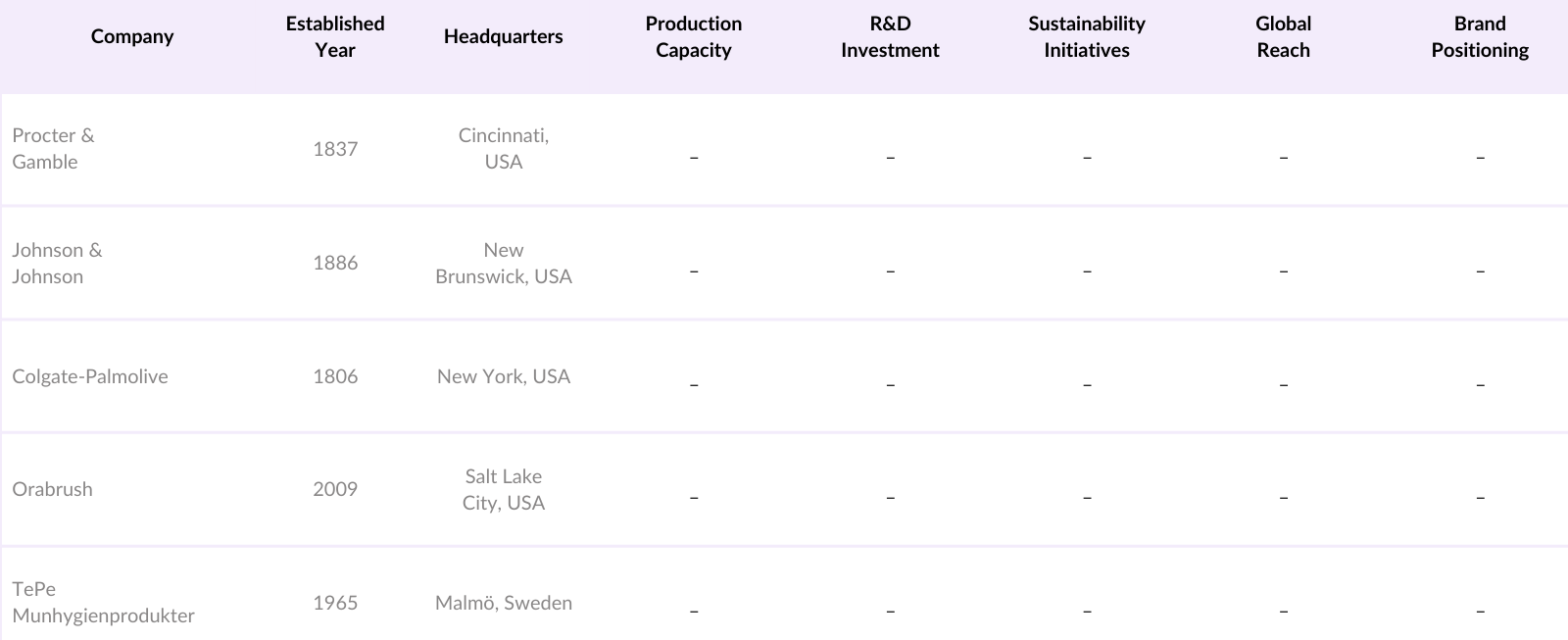

Global Tongue Cleaner Market Competitive Landscape

The tongue cleaner market is characterized by a mix of established personal care brands and specialized companies. Major players include Procter & Gamble, Johnson & Johnson, Colgate-Palmolive Company, and others who leverage their extensive distribution networks and branding power. Emerging brands focused on sustainability and eco-friendly products are also capturing market share, capitalizing on rising environmental concerns.

Global Tongue Cleaner Industry Analysis

Market Growth Drivers

- Rise in Oral Health Awareness: The global push for oral health is strongly supported by rising governmental and institutional investments, with health budgets growing globally. In 2024, governments of various countries allocated approximately $450 billion towards health awareness programs, with a significant focus on preventive care, including oral health. For example, the World Health Organization reports that countries in North America and Europe are increasingly promoting dental health programs, with tongue cleaning recommended as part of daily hygiene practices. This surge in health initiatives is fostering consumer awareness, creating a higher demand for tongue cleaners globally.

- Increasing Adoption of Personal Care Products: Macroeconomic stability in emerging markets has led to a steady increase in personal care expenditures. The IMF highlights that household spending on personal care products, including oral hygiene tools, rose by 10% in India and 8% in Brazil from 2022 to 2024. With rising disposable incomes, especially within the middle-class demographic, consumers are increasingly opting for comprehensive oral care routines, driving the demand for products like tongue cleaners. Higher awareness of personal grooming and hygiene standards is further intensifying this trend across developed economies.

- Expanding Middle-Class Demographics: The middle-class population is expanding significantly, with the World Bank estimating an additional 50 million middle-class consumers across Asia and Africa in 2024. This demographic shift is contributing to increased spending on healthcare and personal care products, including tongue cleaners. Particularly in urban areas of Asia, the middle class has a stronger purchasing power and prioritizes health and hygiene, creating a robust market for personal care items. Growing economic confidence and reduced poverty levels also

Market Challenges

- Limited Market Penetration in Rural Areas: Despite growing demand, the reach of tongue cleaners remains limited in rural regions. In many low-income countries, approximately 40% of the rural population lacks access to modern personal care products. The World Bank data for 2024 shows that rural disposable income in areas like Sub-Saharan Africa is significantly lower, leading to low adoption of tongue cleaners and other non-essential products. This creates a hurdle in achieving widespread market penetration, as rural consumers prioritize essential health products.

- Price Sensitivity in Emerging Markets: Emerging markets demonstrate high price sensitivity due to varying income levels. According to the World Economic Forum, the average household income in regions such as South Asia and Sub-Saharan Africa was under $5,000 in 2024, making cost-effective options more attractive. Products like tongue cleaners often fall into the non-essential category, leading to lower demand if prices are perceived as high. This cost sensitivity limits manufacturers ability to expand premium product lines in these regions.

Global Tongue Cleaner Market Future Outlook

Over the next five years, the global tongue cleaner market is expected to experience continued growth driven by increasing awareness of preventive health practices, growing adoption of sustainable products, and a shift towards eco-friendly materials. Rising incomes, particularly in emerging markets, will likely contribute to this expansion, as consumers prioritize comprehensive personal care. Additionally, e-commerce will play a significant role, enabling broader access to innovative products for various consumer demographics.

Opportunities

- Product Innovations: There is a growing opportunity to introduce eco-friendly and multi-material tongue cleaners. Consumers are increasingly interested in sustainability, with over 40% of European consumers reporting a preference for products with biodegradable components. The global movement towards eco-friendly personal care is growing, driven by heightened awareness of environmental issues and government initiatives for sustainable products, thereby presenting a lucrative opportunity for market expansion through innovation.

- Expansion in Emerging Markets: Emerging markets, especially in Asia and Africa, are poised for growth in the personal care sector. As these regions undergo rapid urbanization, the demand for oral care products, including tongue cleaners, is rising. In 2024, the World Bank reported that urban populations in these areas are growing by approximately 5 million annually, leading to a larger customer base with increased access to modern hygiene products. This shift presents an opportunity for tongue cleaner brands to penetrate these emerging markets.

Scope of the Report

|

Product Type |

Metal-Based Plastic-Based Bamboo-Based Silicone-Based Hybrid Materials |

|

End User |

Individual Users Dental Clinics Hospitals Online Health Stores |

|

Distribution Channel |

Retail Pharmacies Online Retail Supermarkets/Hypermarkets Specialty Stores |

|

Age Group |

Kids Adults Seniors |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Dental and Oral Care Product Manufacturing Companies

Retail Pharmacy and Supermarket Brands

E-commerce Platforms Specializing in Health and Wellness

Government and Regulatory Bodies (FDA, Environmental Protection Agencies)

Investment and Venture Capitalist Firms

Consumer Health Advocacy Companies

Medical and Dental Clinics

Companies

Players Mentioned in the Report

Procter & Gamble

Johnson & Johnson

Colgate-Palmolive Company

Orabrush

TePe Munhygienprodukter

Dr. Fresh LLC

DenTek Oral Care, Inc.

The Himalaya Drug Company

Church & Dwight Co., Inc.

M+C Schiffer GmbH

Table of Contents

1. Global Tongue Cleaner Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Lifecycle Stage

1.4 Market Segmentation Overview

2. Global Tongue Cleaner Market Size (in USD Million)

2.1 Historical Market Size

2.2 Year-on-Year Growth Rate Analysis

2.3 Key Milestones and Developments

2.4 Contribution by Geographical Regions (in %)

3. Global Tongue Cleaner Market Analysis

3.1 Market Growth Drivers

3.1.1 Rise in Oral Health Awareness

3.1.2 Increasing Adoption of Personal Care Products

3.1.3 Expanding Middle-Class Demographics

3.1.4 Surge in E-commerce Sales for Oral Care

3.2 Market Challenges

3.2.1 Limited Market Penetration in Rural Areas

3.2.2 Price Sensitivity in Emerging Markets

3.2.3 Concerns Over Product Efficacy

3.3 Opportunities

3.3.1 Product Innovations (e.g., eco-friendly, multi-material)

3.3.2 Expansion in Emerging Markets

3.3.3 Partnerships with Health and Wellness Brands

3.4 Trends

3.4.1 Use of Biodegradable Materials

3.4.2 Increasing Product Customization

3.4.3 Rising Demand for Portable Tongue Cleaners

3.5 Regulatory Landscape

3.5.1 FDA Compliance for Personal Care Products

3.5.2 Global Standards for Oral Hygiene Products

3.5.3 Environmental Compliance and Sustainability Initiatives

3.6 SWOT Analysis

3.7 Value Chain and Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Overview

4. Global Tongue Cleaner Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Metal-Based

4.1.2 Plastic-Based

4.1.3 Bamboo-Based

4.1.4 Silicone-Based

4.1.5 Hybrid Materials

4.2 By End User (in Value %)

4.2.1 Individual Users

4.2.2 Dental Clinics

4.2.3 Hospitals

4.2.4 Online Health Stores

4.3 By Distribution Channel (in Value %)

4.3.1 Retail Pharmacies

4.3.2 Online Retail

4.3.3 Supermarkets/Hypermarkets

4.3.4 Specialty Stores

4.4 By Age Group (in Value %)

4.4.1 Kids

4.4.2 Adults

4.4.3 Seniors

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Tongue Cleaner Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Procter & Gamble

5.1.2 Johnson & Johnson

5.1.3 Colgate-Palmolive Company

5.1.4 Prestige Consumer Healthcare

5.1.5 Dr. Fresh LLC

5.1.6 DenTek Oral Care, Inc.

5.1.7 Orabrush

5.1.8 TePe Munhygienprodukter AB

5.1.9 The Himalaya Drug Company

5.1.10 Church & Dwight Co., Inc.

5.1.11 Ranir LLC

5.1.12 Koninklijke Philips N.V.

5.1.13 M+C Schiffer GmbH

5.1.14 Brush Buddies

5.1.15 Mouth Watchers

5.2 Cross Comparison Parameters (Production Capacity, Sustainability Initiatives, Innovation Capabilities, Distribution Reach, Regional Presence, Market Share, Brand Positioning, Product Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Collaborations)

5.5 Mergers & Acquisitions

5.6 Investment and Funding Analysis

5.7 Venture Capital Involvement

5.8 Government and Private Grants

6. Global Tongue Cleaner Market Regulatory Framework

6.1 Safety Standards for Oral Care Products

6.2 Certification Processes (ISO, FDA, CE)

6.3 Environmental Compliance in Production

6.4 Import/Export Regulations by Region

7. Global Tongue Cleaner Market Future Market Size (in USD Million)

7.1 Future Market Size Projections

7.2 Key Drivers for Future Growth

8. Global Tongue Cleaner Market Future Segmentation

8.1 By Product Type

8.2 By End User

8.3 By Distribution Channel

8.4 By Age Group

8.5 By Region

9. Global Tongue Cleaner Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Segment Analysis

9.3 Market Entry Strategies

9.4 White Space and Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the key stakeholders in the global tongue cleaner market. This includes desk research, using proprietary databases to collect comprehensive industry data, including historical sales and consumer trends.

Step 2: Market Analysis and Construction

In this phase, historical data on the tongue cleaner market is assessed. An analysis of product penetration, growth rate, and consumer preferences is conducted to determine revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on preliminary findings and validated through structured interviews with industry experts. These interviews provide insights into operational dynamics and recent trends.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data collected from manufacturers and retailers to verify sales figures, distribution trends, and consumer feedback, ensuring a comprehensive and accurate market analysis.

Frequently Asked Questions

01. How big is the global tongue cleaner market?

The global tongue cleaner market, valued at approximately USD 255 million, has grown due to heightened oral hygiene awareness and increasing disposable income, driving consumer demand for preventative dental care products.

02. What are the challenges in the global tongue cleaner market?

Challenges include consumer price sensitivity in developing regions and the availability of counterfeit products, which may impact consumer trust and market profitability.

03. Who are the major players in the global tongue cleaner market?

Key players include Procter & Gamble, Johnson & Johnson, Colgate-Palmolive Company, Orabrush, and TePe Munhygienprodukter, all of whom benefit from strong distribution networks and brand loyalty.

04. What are the growth drivers of the global tongue cleaner market?

The market is driven by increased awareness of oral hygiene, the growing popularity of sustainable products, and rising e-commerce sales for health and wellness products globally.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.