Global Tools Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3108

November 2024

89

About the Report

Global Tools Market Overview

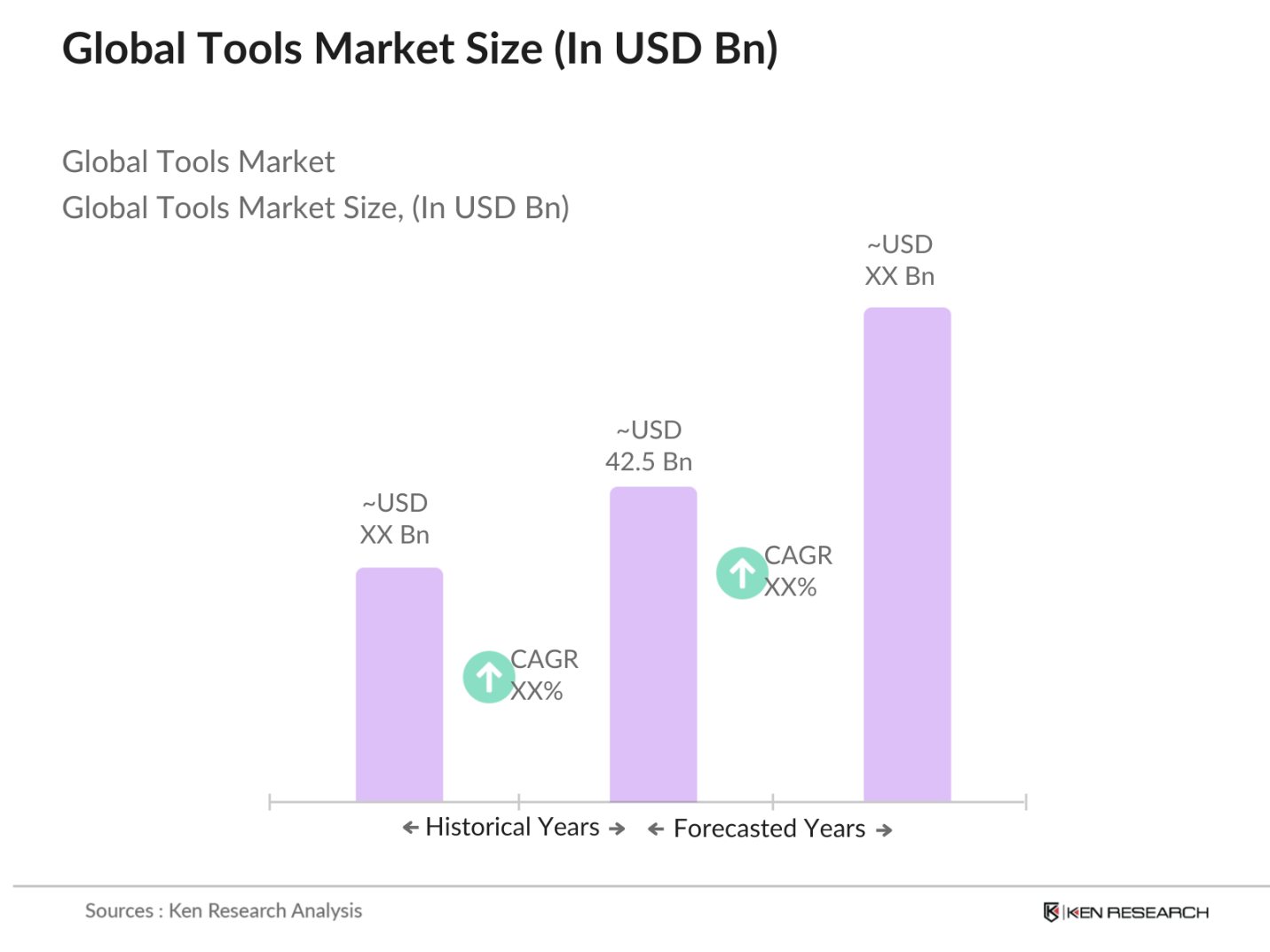

- The Global Tools Market is valued at USD 42.5 billion, driven by robust demand across construction, automotive, and industrial sectors. Increasing infrastructure investments and advancements in technology are primary factors propelling this growth, with a significant contribution from expanding do-it-yourself (DIY) projects globally. Notably, the demand for electric tools has surged, aligning with the push toward energy efficiency and ergonomic designs to improve user experience.

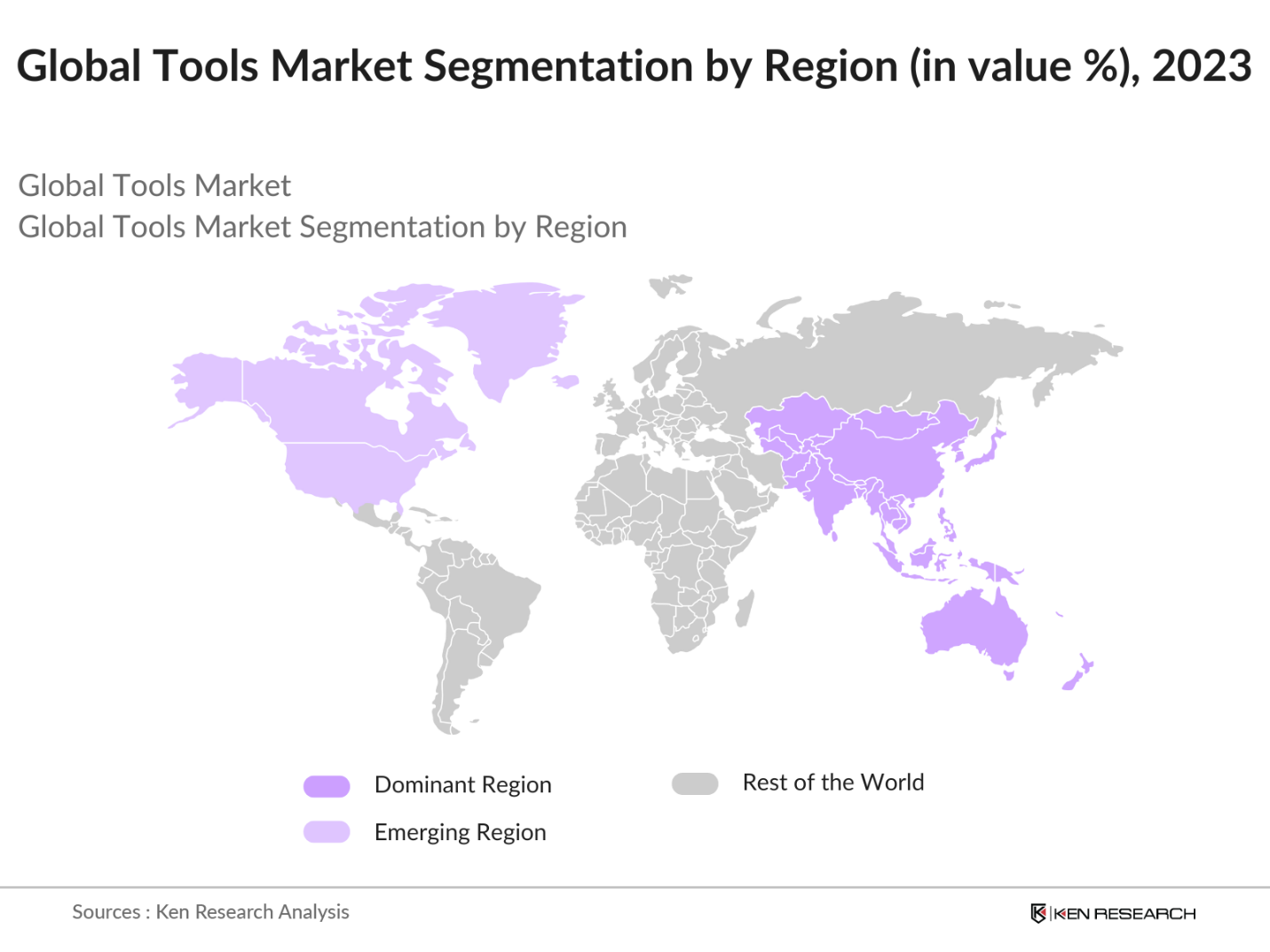

- Regions such as North America and Asia-Pacific dominate the tools market due to their expansive industrial bases and rapid urbanization. North America holds a significant position, fueled by high consumer spending on DIY products and innovation in cordless power tools. Meanwhile, Asia-Pacific is experiencing robust growth due to increasing industrialization, a large construction sector, and rising investments in infrastructure development.

- Government-mandated safety standards ensure tool quality and performance. For example, U.S. Occupational Safety and Health Administration (OSHA) standards require specific quality checks for hand and power tools, ensuring user safety. In 2023, OSHA recorded compliance rates among U.S. tool manufacturers exceeding 95%, emphasizing the role of regulation in maintaining product integrity and preventing workplace accidents.

Global Tools Market Segmentation

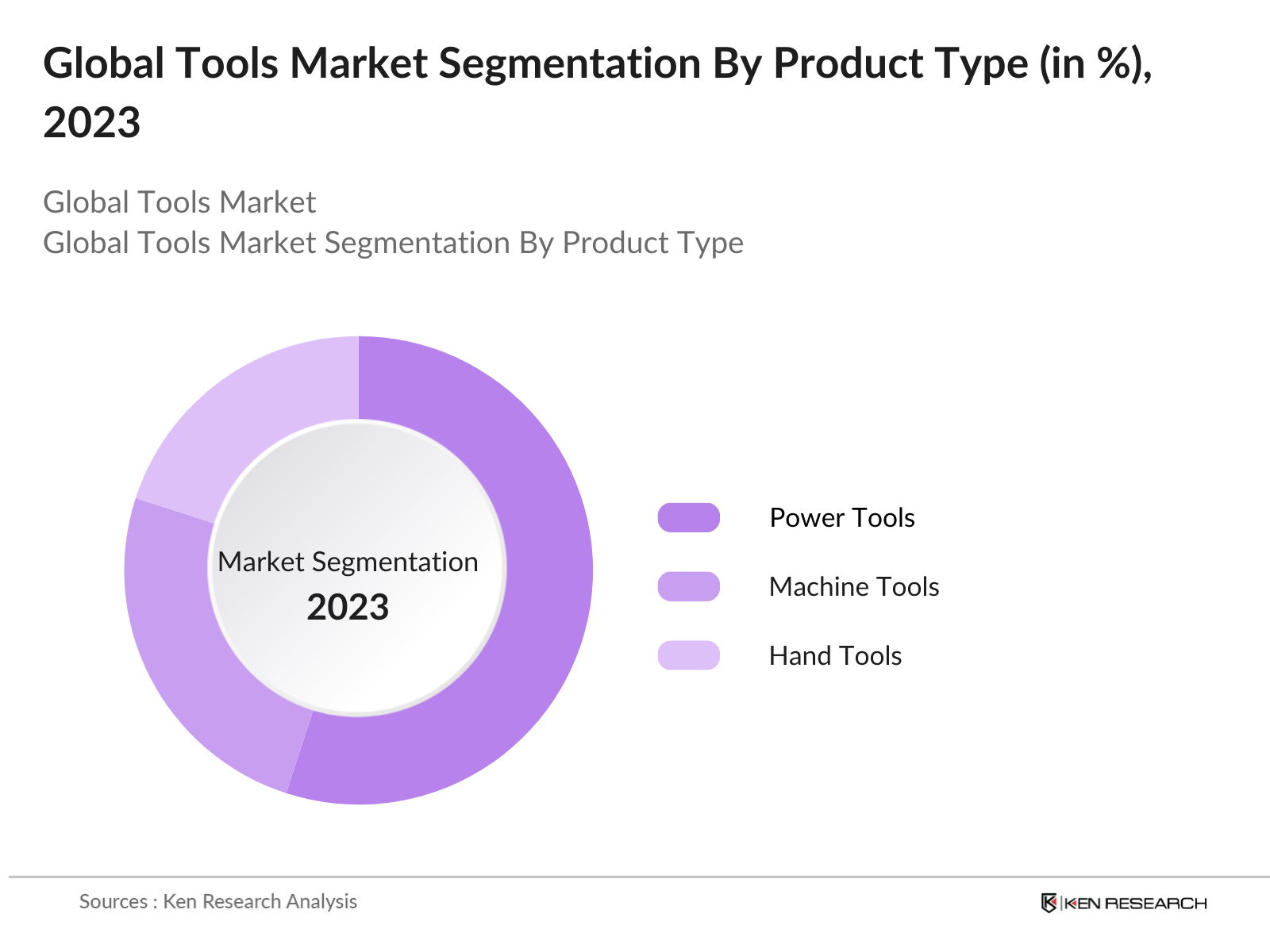

By Product Type: The Global Tools Market is segmented by product type into Hand Tools, Power Tools, and Machine Tools. Power tools have a dominant market share due to their extensive application across industries and enhanced productivity. The high demand for cordless, battery-powered tools, particularly in automotive and construction sectors, has been a driving force behind their popularity.

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific holds the largest market share, with growing industrialization and substantial investments in infrastructure projects. The rise of manufacturing hubs in countries like China and India has further bolstered this region's dominance.

By Application: The tools market is categorized by application into Construction, Automotive, and Manufacturing sectors. The construction segment dominates this market, mainly due to increased residential and commercial building projects worldwide. The need for durable, efficient, and advanced tools for both small-scale and large-scale projects is pushing demand within this segment.

Global Tools Market Competitive Landscape

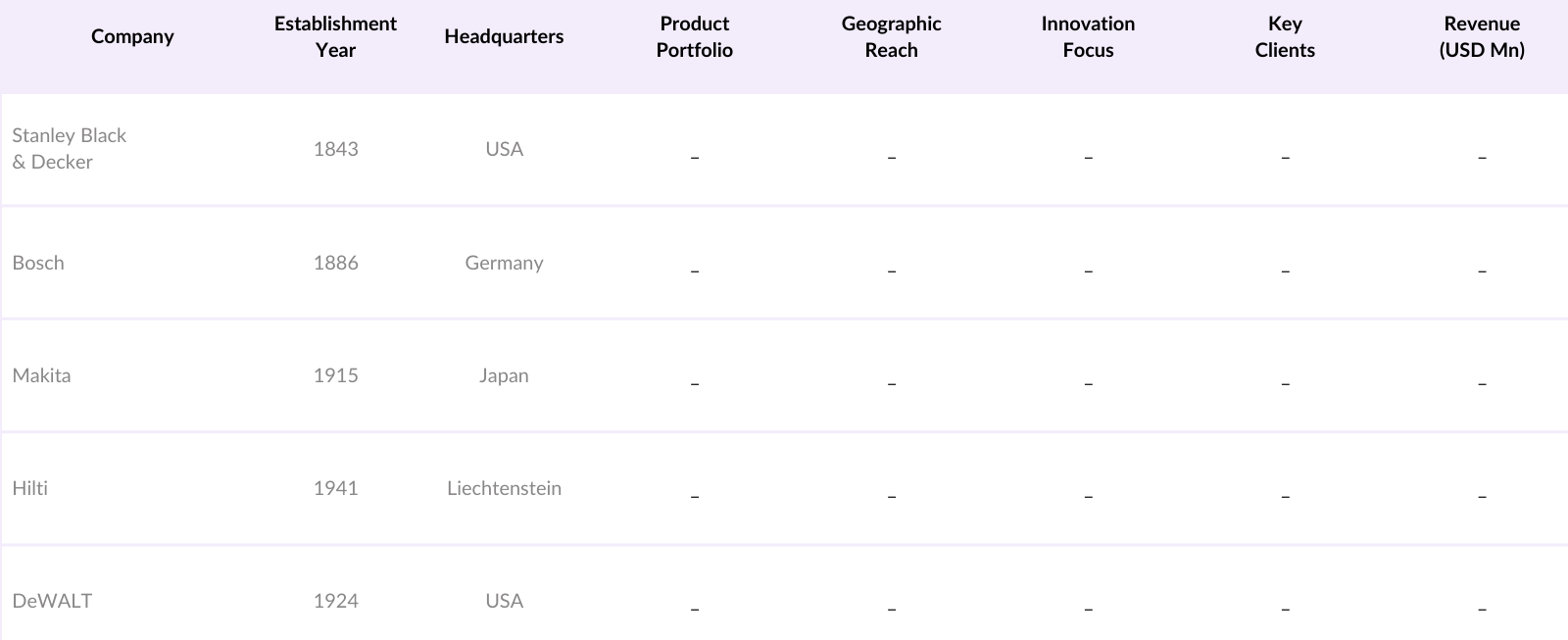

The Global Tools Market is dominated by a few major players who drive innovation and maintain significant influence due to their vast distribution networks and diverse product offerings. The market is led by established players such as Stanley Black & Decker and Bosch, who continually invest in research and development to introduce advanced power tools. Additionally, companies like Makita and Hilti have carved significant market shares by focusing on innovation and quality, particularly in cordless tool technology and ergonomics.

Global Tools Industry Analysis

Growth Drivers

Technological Advancements: With the integration of AI and IoT in tools, the global tools market is experiencing a shift toward smarter functionalities. In 2024, IoT-connected tools in industrial applications are projected to reach 18 million units, supported by AI-driven analytics that enable predictive maintenance and operational efficiencies. According to the World Bank, over 60% of manufacturing firms in developed economies are integrating IoT-based tools to enhance productivity and reduce downtime, increasing their competitiveness globally. This trend aligns with the rise in global industrial output, recorded at 3.5 trillion USD in 2023.

Increasing Industrial Applications: Industries such as automotive, aerospace, and manufacturing are expanding their usage of tools for automation and precision, with a significant rise in demand for advanced power tools. For instance, the automotive industry alone reported the utilization of over 4 million units of power tools globally in 2023. The International Monetary Fund highlighted that manufacturing activities have contributed to 21% of GDP in emerging markets, fostering a higher demand for industrial-grade tools. The current emphasis on enhancing production efficiency drives these applications.

Expanding Construction and Renovation Sector: The construction sector is seeing steady growth in markets like North America and Asia-Pacific, where urban development initiatives have driven the sector's investment to nearly 4 trillion USD in 2024. Construction companies are increasingly purchasing durable and specialized tools to meet safety and efficiency standards. The World Bank notes that China alone completed construction projects worth 1.2 trillion USD in 2023, requiring significant quantities of high-quality tools for both large-scale and small-scale projects.

Market Challenges

- High Initial Investment: Adoption of advanced tools in industrial applications requires high upfront costs, with a single industrial-grade tool setup often costing over 20,000 USD. This cost barrier is particularly challenging for small businesses, which make up nearly 90% of enterprises worldwide, according to the World Bank. This high capital expenditure restricts smaller players' ability to compete and adopt the latest technologies, limiting market expansion potential.

- Fluctuations in Raw Material Prices: Raw materials, particularly metals like steel and aluminum, essential for tool production, have shown volatile price trends, impacting manufacturing costs. In 2024, steel prices hovered around 650 USD per metric ton, influenced by global trade policies and supply chain disruptions. The IMF reports that raw material price volatility reduces profit margins for tool manufacturers and may force price increases. These fluctuations have a cascading effect on overall manufacturing expenses.

Global Tools Market Future Outlook

The Global Tools Market is projected to experience steady growth, fueled by advancements in tool technology, particularly in battery-powered and smart tools. The trend toward eco-friendly, sustainable tools aligns with global environmental initiatives, which is expected to open new opportunities within the sector. Expansion into emerging markets, combined with increased automation, will be pivotal in driving future market growth.

Opportunities

-

Growth in Emerging Markets: Emerging markets, particularly in Southeast Asia and Africa, present growth potential for the tools market, supported by rising industrialization and infrastructure development. Southeast Asia alone reported industrial expansion of 1.1 trillion USD in 2023, fostering a high demand for professional tools. Government incentives and infrastructure investments in these regions support a robust market entry point for tool manufacturers.

- Innovations in Battery-Powered Tools: The global demand for battery-powered tools is increasing as industries transition to cordless solutions for greater mobility and efficiency. Sales of lithium-ion battery-powered tools exceeded 10 million units in 2023, reflecting the industry shift towards eco-friendly options. As per the International Energy Agency, advancements in battery technology have decreased charging times and increased tool longevity, making these tools highly desirable for construction and DIY applications.

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Tool Manufacturing Industries

Construction and Industrial Equipment Companies

Automotive OEMs and Aftermarket Provider Companies

Electrical and Electronics Companies

DIY Enthusiasts and Consumer Companies

Investment and Venture Capital Firms

Government and Regulatory Bodies (Occupational Safety and Health Administration, European Agency for Safety and Health at Work)

Trade Associations and Industries

Companies

Players Mentioned in the Report

Stanley Black & Decker

Bosch

Makita Corporation

Hilti Corporation

DeWALT

Snap-On

Techtronic Industries (TTI)

Koki Holdings (HiKOKI)

Apex Tool Group

Emerson Electric Co.

Table of Contents

1. Global Tools Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Global Tools Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Tools Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements (AI, IoT Integration)

3.1.2 Increasing Industrial Applications

3.1.3 Expanding Construction and Renovation Sector

3.1.4 Rise in DIY Trends

3.2 Market Challenges

3.2.1 High Initial Investment

3.2.2 Fluctuations in Raw Material Prices

3.2.3 Skilled Workforce Shortage

3.3 Opportunities

3.3.1 Growth in Emerging Markets

3.3.2 Innovations in Battery-Powered Tools

3.3.3 Demand for Smart Tools

3.4 Trends

3.4.1 Rising Preference for Ergonomically Designed Tools

3.4.2 Shift Towards Environmentally Sustainable Tools

3.4.3 Integration of Automation in Tool Manufacturing

3.5 Government Regulations

3.5.1 Product Safety Standards

3.5.2 Environmental Compliance Requirements

3.5.3 Tax and Tariff Policies Impacting Imports/Exports

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Tools Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Hand Tools

4.1.2 Power Tools

4.1.3 Machine Tools

4.1.4 Garden Tools

4.1.5 Specialty Tools

4.2 By Application (In Value %)

4.2.1 Construction

4.2.2 Automotive

4.2.3 Manufacturing

4.2.4 DIY (Do-It-Yourself)

4.2.5 Maintenance & Repair Operations

4.3 By Technology (In Value %)

4.3.1 Corded

4.3.2 Cordless

4.3.3 Pneumatic

4.4 By Distribution Channel (In Value %)

4.4.1 Online Retail

4.4.2 Offline Retail

4.4.3 Wholesale

4.4.4 Direct Sales

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Tools Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Stanley Black & Decker

5.1.2 Bosch

5.1.3 Makita Corporation

5.1.4 Hilti Corporation

5.1.5 DeWALT

5.1.6 Snap-On

5.1.7 Techtronic Industries (TTI)

5.1.8 Koki Holdings (HiKOKI)

5.1.9 Apex Tool Group

5.1.10 Emerson Electric Co.

5.1.11 Husqvarna

5.1.12 Ingersoll Rand

5.1.13 Wurth Group

5.1.14 Atlas Copco

5.1.15 RIDGID (Emerson)

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Geographic Presence, Key Clients, R&D Investment, Strategic Partnerships, Technological Capabilities, Environmental Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Tools Market Regulatory Framework

6.1 Occupational Safety Standards

6.2 Environmental Compliance

6.3 Certification Processes for Tools

6.4 Trade and Export Regulations

7. Global Tools Future Market Size (In USD Mn)

7.1 Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Tools Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Cohort Analysis

8.3 Marketing Initiatives

8.4 White Space Opportunity Analysis

9. Global Tools Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We initiated by mapping all significant stakeholders within the Global Tools Market, involving extensive secondary research and proprietary databases to capture industry-level data. This helped us identify crucial variables impacting market dynamics.

Step 2: Market Analysis and Construction

Historical data analysis was conducted, assessing the distribution ratio of various tool types and their corresponding revenue contributions. We evaluated service quality benchmarks to ensure revenue estimates align with industry standards.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated and validated through CATI with industry experts. This provided operational insights from sector leaders, aiding in the refinement of data accuracy.

Step 4: Research Synthesis and Final Output

In the final phase, interactions with leading tool manufacturers and distributors provided deep insights into consumer preferences, product innovation trends, and market positioning. These findings supported our bottom-up approach to deliver a validated and comprehensive analysis of the tools market.

Frequently Asked Questions

01. How big is the Global Tools Market?

The Global Tools Market is valued at USD 42.5 billion, driven by increasing industrial applications, consumer DIY activities, and infrastructure investments globally.

02. What are the major growth drivers in the Global Tools Market?

Key drivers include technological advancements, increased demand from the construction sector, and the shift toward ergonomic, battery-powered tools that enhance user convenience.

03. Who are the leading players in the Global Tools Market?

Leading companies include Stanley Black & Decker, Bosch, Makita Corporation, Hilti Corporation, and DeWALT, known for their innovation and strong brand presence.

04. What challenges does the Global Tools Market face?

Challenges include fluctuating raw material costs, high initial investment requirements, and a shortage of skilled labor, impacting market growth and operational efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.