Global TPU Material Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD422

October 2024

80

About the Report

Global TPU Material Market Overview

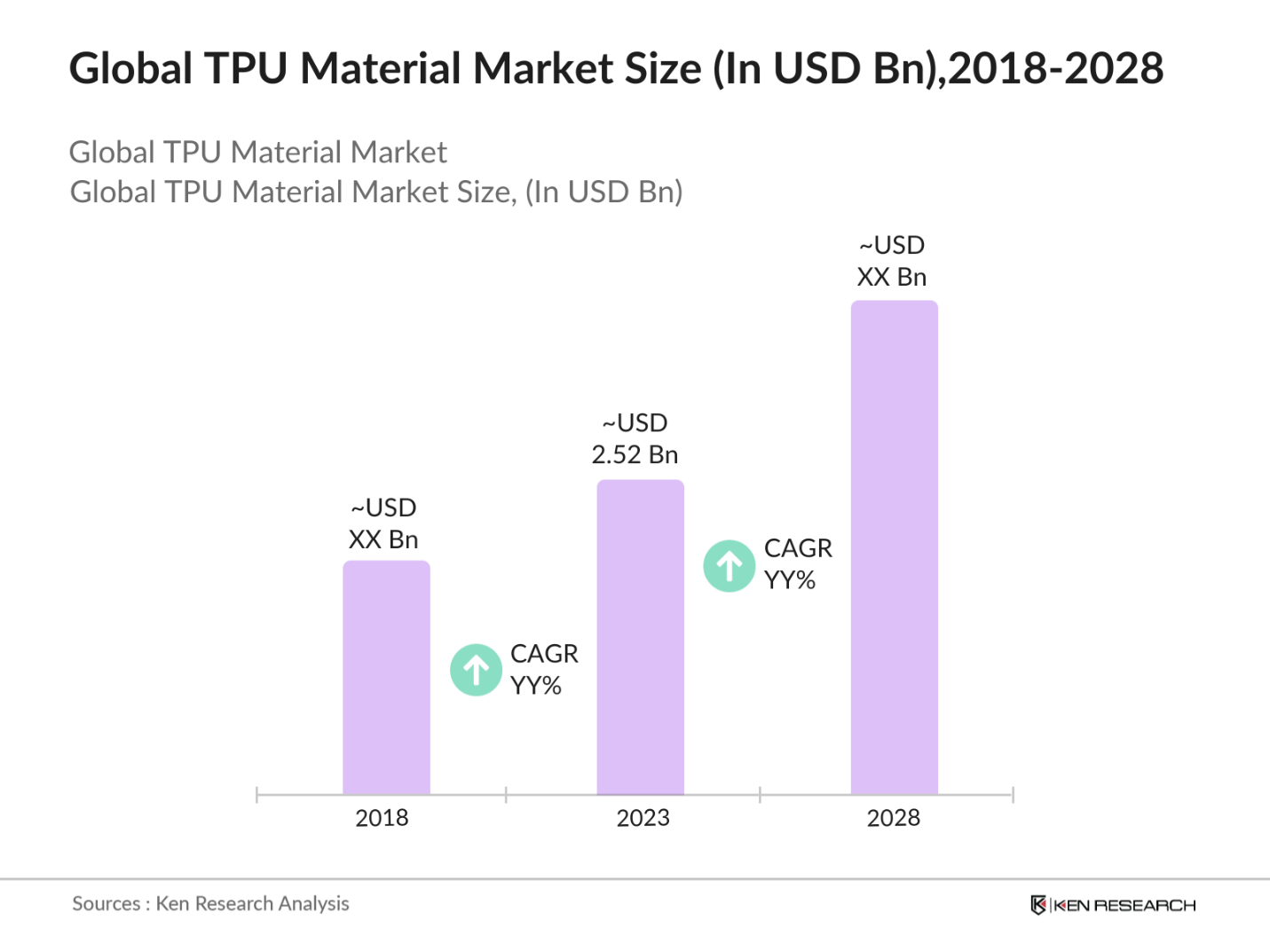

- The global TPU (Thermoplastic Polyurethane) material market has experienced significant growth, with the market size reaching USD 2.52 billion in 2023, driven by increased demand across various industries such as automotive, footwear, and electronics. The versatility of TPU in offering excellent mechanical properties, elasticity, and resistance to oil and abrasion has made it a preferred choice in these sectors. The markets expansion is primarily driven by the rising application of TPU in manufacturing lightweight automotive parts and sustainable footwear.

- Key players in the TPU material marketinclude BASF SE, Covestro AG, Huntsman Corporation, Wanhua Chemical Group, and The Lubrizol Corporation. Additionally, American Polyfilm, Inc., Epaflex Polyurethanes SpA, COIM Group, Mitsui Chemicals, Inc., and Avient Corporation are also recognized as important contributors to the industry. These companies have established themselves as industry leaders due to their extensive product portfolios, innovation in TPU grades, and global distribution networks.

- In 2023, theCircular Plastics Alliance (CPA)was indeed launched as part of the EU's strategy to promote a circular economy for plastics, with the goal of increasing the use of recycled plastics in new products. The initiative aims to boost the EU market for recycled plastics to10 million tonnes by 2025. This involves efforts to improve the design of plastic products for recyclability, enhance waste collection and sorting, and establish a reliable monitoring system for recycled plastics.

- Cities like Shanghai, Shenzhen, and Frankfurt dominate the TPU market due to their robust manufacturing industries and strong demand for TPU in automotive, electronics, and footwear sectors. These cities serve as major production and innovation hubs, driving the market forward through technological advancements and a high concentration of leading TPU manufacturers.

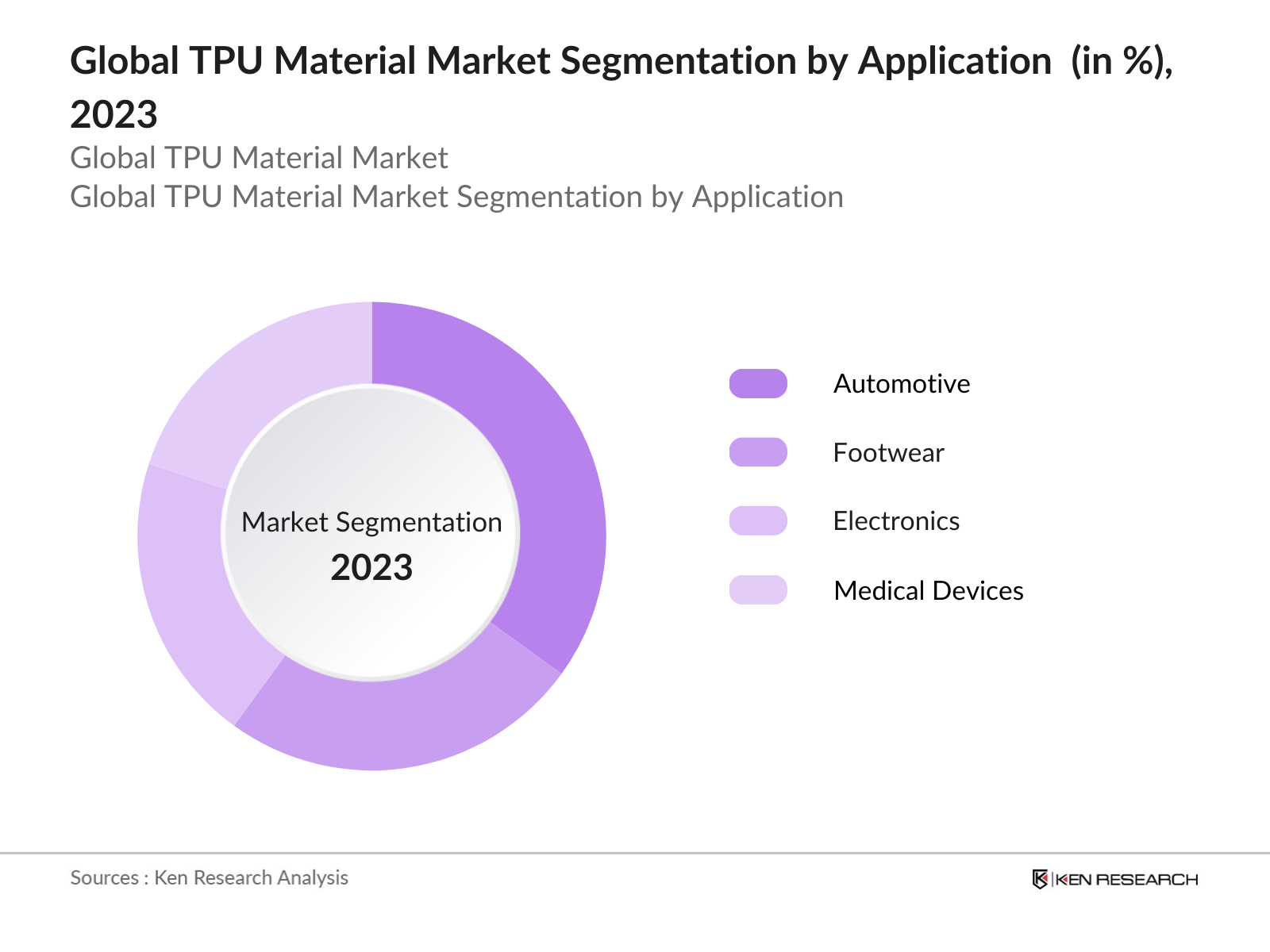

Global TPU Material Market Segmentation

By Application: The global TPU material market is segmented by application into automotive, footwear, electronics, and medical devices. In 2023, the automotive segment holds the dominant market share due to the increasing demand for lightweight and durable materials in vehicle manufacturing. TPUs properties, such as high elasticity and resistance to oil and abrasion, make it ideal for automotive applications, particularly in the production of seals, gaskets, and other components.

|

Application |

Market Share (2023) |

|

Automotive |

35% |

|

Footwear |

25% |

|

Electronics |

20% |

|

Medical Devices |

20% |

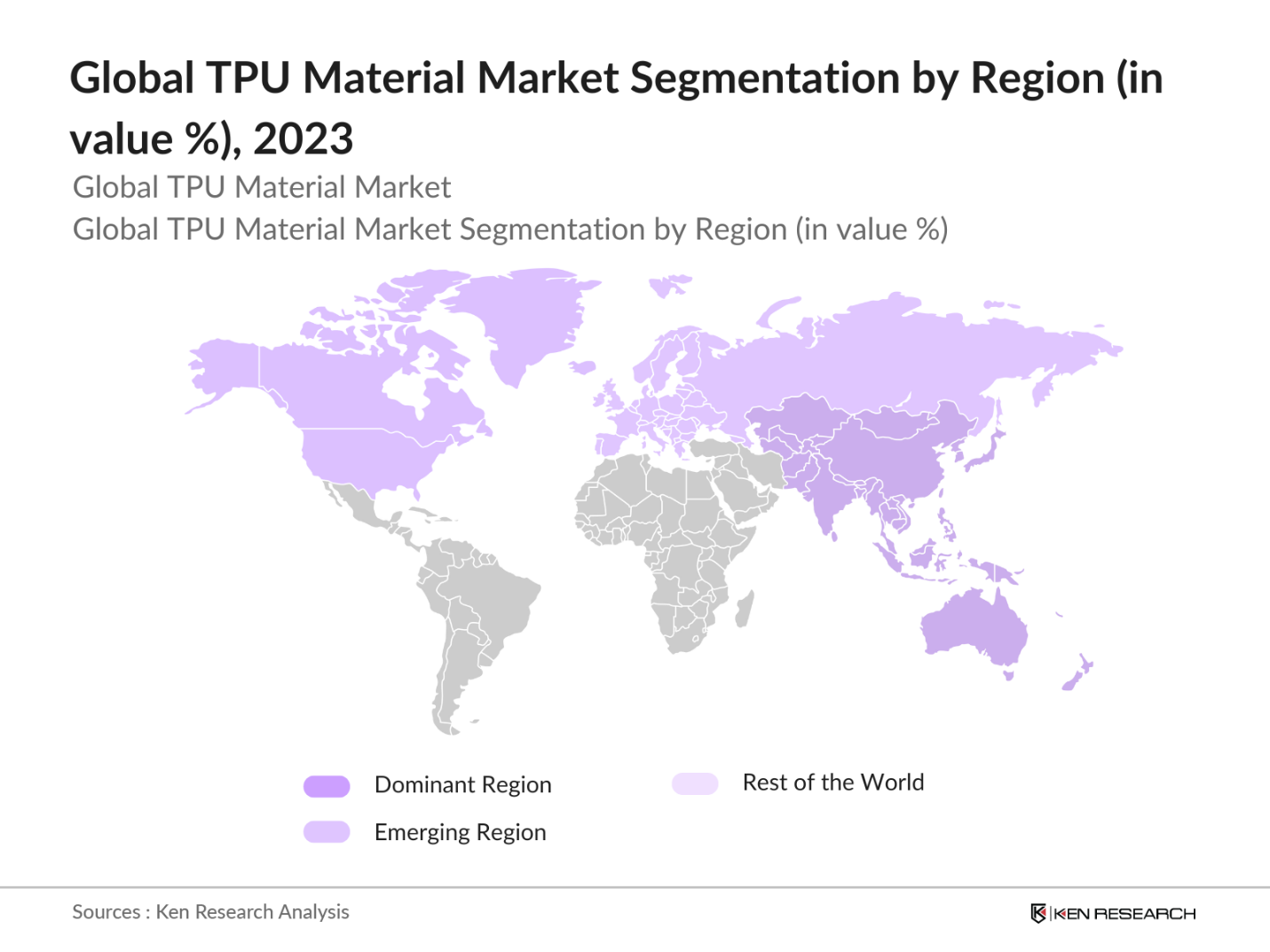

By Region: The global TPU material market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, Asia-Pacific holds the largest market share, driven by the strong manufacturing base in China and India. The regions dominance is attributed to rapid industrialization, growing automotive and electronics industries, and increasing investments in infrastructure. The availability of raw materials and favorable government policies further support the growth of the TPU market in the Asia-Pacific region.

|

Region |

Market Share (2023) |

|

Asia-Pacific |

45% |

|

North America |

25% |

|

Europe |

20% |

|

Latin America |

5% |

|

MEA |

5% |

By Grade: The TPU material market is segmented by grade into polyester-based TPU, polyether-based TPU, and polycaprolactone-based TPU. In 2023, polyester-based TPU dominates the market due to its widespread use in automotive and industrial applications. Its superior mechanical properties and chemical resistance make it the preferred choice for manufacturing automotive components and industrial parts. The durability and cost-effectiveness of polyester-based TPU contribute to its dominance in this segment.

|

Grade |

Market Share (2023) |

|

Polyester-based TPU |

40% |

|

Polyether-based TPU |

35% |

|

Polycaprolactone-based TPU |

25% |

Global TPU Material Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Covestro AG |

2015 |

Leverkusen, Germany |

|

Huntsman Corporation |

1970 |

The Woodlands, USA |

|

Wanhua Chemical Group |

1998 |

Yantai, China |

|

Lubrizol Corporation |

1928 |

Wickliffe, USA |

- BASF SE: BASF announced it will cease the production of adipic acid, cyclododecanone (CDon), and cyclopentanone (CPon) at its Ludwigshafen site. This move is part of a broader strategy to streamline operations and focus on more profitable segments, including specialty chemicals that may impact the global TPU material market.

- Covestro AG: On August 2024, Covestro announced a collaboration with Carlisle Construction Materials to supply bio-circular attributed raw materials for the production of polyurethane building insulation. This initiative emphasizes sustainability in construction, aligning with the growing demand for eco-friendly materials in the TPU market.

Global TPU Material Market Growth Drivers

- Rising Application of TPU in Medical Devices: The use of TPU in medical devices is growing due to its biocompatibility and flexibility. In 2023, TPU played a significant role in the USD 640 billion global medical device market, particularly in catheters, tubing, and protective gear. Its ability to withstand sterilization while maintaining durability makes it a preferred material in healthcare.

- Adoption of TPU in 3D Printing: TPU's popularity in 3D printing has surged, especially for producing flexible and durable components. In 2023, TPU accounted for a significant share of the USD 4 billion global 3D printing materials market. Its flexibility and resilience make it ideal for custom footwear, medical devices, and prototypes, with continued adoption expected across industries.

- Expansion of TPU Recycling Initiatives: The TPU market is benefitting from global recycling initiatives, with the European Unions Circular Plastics Alliance targeting the recycling of 10 million tons of plastic by 2025. In 2023, recycled TPU is increasingly used in footwear, electronics, and automotive parts, driven by regulatory pressures and the shift towards sustainable manufacturing practices.

Global TPU Material Market Challenges

- Fluctuating Raw Material Prices: The TPU market faces challenges due to volatile raw material prices, particularly for isocyanates and polyols. This fluctuation impacts manufacturing costs, potentially leading to price increases for end-users. Manufacturers must manage these fluctuations while maintaining competitive pricing, as unpredictable raw material costs can affect profit margins and overall market competitiveness.

- Stringent Environmental Regulations: Increasingly stringent environmental regulations are impacting the TPU market, particularly in production and disposal processes. New guidelines require manufacturers to adopt cleaner technologies and sustainable practices, raising operational costs. Non-compliance with these regulations can result in significant penalties, affecting market dynamics.

Global TPU Material Market Government Initiatives

- European Union's Circular Plastics Alliance The European Union's Circular Plastics Alliance promotes the recycling and reuse of plastic materials, including TPU, with a target to recycle 10 million tons annually by 2025. This initiative is expected to drive demand for recycled TPU, fostering innovation in sustainable manufacturing and contributing to the overall growth of the TPU market.

- Chinas National Green Development Plan In 2022, the Chinese government unveiled its National Green Development Plan, which includes stringent regulations on the production and disposal of plastic materials, including TPU. The plan mandates a 30% reduction in industrial waste by 2025, encouraging companies to adopt eco-friendly materials and processes. TPU manufacturers are incentivized to invest in recycling technologies and reduce their carbon footprint, aligning with Chinas broader environmental goals. This initiative is set to influence the TPU market positively by promoting sustainable practices.

Global TPU Material Market Outlook

The Global TPU Material Market is set to experience transformative growth by 2028, driven by several emerging trends that align with technological advancements and global sustainability goals. As industries across various sectors continue to innovate and adapt to changing consumer demands, TPU (Thermoplastic Polyurethane) is poised to become an increasingly vital material due to its versatility, durability, and eco-friendly potential.

Future Trends:

- Increasing Integration of TPU in Wearable Technologies: Over the next five years, TPU integration in wearable technologies is expected to grow significantly. TPU will play a crucial role in developing flexible, durable, and comfortable devices as the global wearables market expands. Its biocompatibility and versatility will drive innovation in health monitoring and fitness tracking devices, making it a preferred material for manufacturers.

- Expansion of TPU Use in Renewable Energy Applications: The TPU market is set to expand in renewable energy applications, especially for components in solar panels and wind turbines. TPU's durability and resistance to environmental factors make it ideal for these uses. As the renewable energy sector grows, demand for high-performance materials like TPU will increase, supporting the market's long-term growth.

Scope of the Report

|

By Application |

Automotive Footwear Electronics Medical Devices |

|

By Grade |

Polyester-based TPU Polyether-based TPU Polycaprolactone-based TPU |

|

By Region |

Asia-Pacific Europe Asia-Pacific (APAC) Latin America Middle East & Africa (MEA |

|

By End-Use Industry |

Automotive Consumer Goods Industrial Sports & Leisure |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive manufacturers

Footwear manufacturers

Electronics manufacturers

Medical device manufacturers

TPU material suppliers

Investment and venture capitalist firms

Government and regulatory bodies (EPA)

Industrial component manufacturers

Consumer goods manufacturers

Renewable energy equipment manufacturers

Companies

Players Mentioned in the Report:

BASF SE

Covestro AG

Huntsman Corporation

Wanhua Chemical Group

Lubrizol Corporation

Arkema S.A.

Mitsui Chemicals, Inc.

PolyOne Corporation

Hexpol AB

Epaflex Polyurethanes S.p.A.

Miracll Chemicals Co., Ltd.

Coim Group

RTP Company

Tosoh Corporation

Bayer MaterialScience

Table of Contents

1. Global TPU Material Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global TPU Material Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global TPU Material Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Automotive Applications

3.1.2. Rising Application of TPU in Medical Devices

3.1.3. Expansion of TPU Recycling Initiatives

3.2. Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Stringent Environmental Regulations

3.2.3. Competition from Alternative Materials

3.3. Government Initiatives

3.3.1. European Union's Circular Plastics Alliance

3.3.2. Chinas National Green Development Plan

3.3.3. U.S. Department of Energys Advanced Manufacturing Office

3.4. Recent Trends

3.4.1. Adoption of TPU in 3D Printing

3.4.2. Expansion of TPU Use in Electric Vehicles (EVs)

3.4.3. Growth in Sustainable TPU Products

3.5. Company-Specific Recent Developments

3.5.1. Wanhua Chemical Group Expands TPU Production in Asia

3.5.2. Lubrizol Corporation Launches New TPU Grade for Medical Devices

3.5.3. Hexpol AB Acquires Custom Rubber TPU Manufacturer

3.6. Future Trends

3.6.1. Increasing Integration of TPU in Wearable Technologies

3.6.2. Expansion of TPU Use in Renewable Energy Applications

3.6.3. Advancements in Bio-based TPU Production

3.7. SWOT Analysis

3.8. Stakeholder Ecosystem

3.9. Competitive Ecosystem

4. Global TPU Material Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Automotive

4.1.2. Footwear

4.1.3. Electronics

4.1.4. Medical Devices

4.2. By Grade (in Value %)

4.2.1. Polyester-based TPU

4.2.2. Polyether-based TPU

4.2.3. Polycaprolactone-based TPU

4.3. By Region (in Value %)

4.3.1. Asia-Pacific

4.3.2. North America

4.3.3. Europe

4.3.4. Latin America

4.3.5. Middle East & Africa (MEA)

4.4. By End-Use Industry (in Value %)

4.4.1. Automotive

4.4.2. Consumer Goods

4.4.3. Industrial

4.4.4. Sports & Leisure

4.5. By Processing Method (in Value %)

4.5.1. Extrusion

4.5.2. Injection Molding

4.5.3. Blow Molding

5. Global TPU Material Market Competitive Landscape

5.1. Major Market Players

5.1.1. BASF SE

5.1.2. Covestro AG

5.1.3. Huntsman Corporation

5.1.4. Wanhua Chemical Group

5.1.5. Lubrizol Corporation

5.1.6. Arkema S.A.

5.1.7. Mitsui Chemicals, Inc.

5.1.8. PolyOne Corporation

5.1.9. Hexpol AB

5.1.10. Epaflex Polyurethanes S.p.A.

5.1.11. Miracll Chemicals Co., Ltd.

5.1.12. Coim Group

5.1.13. Bayer MaterialScience

5.1.14. RTP Company

5.1.15. Tosoh Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global TPU Material Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global TPU Material Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global TPU Material Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global TPU Material Market Future Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Application (in Value %)

9.3. By Grade (in Value %)

9.4. By End-Use Industry (in Value %)

9.5. By Processing Method (in Value %)

10. Global TPU Material Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Global TPU Material Market Future Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global TPU Material Market Future Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple TPU Material and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from TPU Material.

Frequently Asked Questions

1 How big is the Global TPU Material Market?

The Global TPU Material Market was valued at USD 2.52 billion in 2023, driven by the rising demand across automotive, footwear, and electronics sectors due to TPU's versatile properties such as high elasticity, durability, and resistance to oil and abrasion.

2 What are the challenges in the Global TPU Material Market?

The Global TPU Material Market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and competition from alternative materials like thermoplastic elastomers (TPE) and silicone-based products.

3 Who are the major players in the Global TPU Material Market?

Major players in the Global TPU Material Market include BASF SE, Covestro AG, Huntsman Corporation, Wanhua Chemical Group, and Lubrizol Corporation. These companies lead the market due to their extensive product portfolios, innovation in TPU grades, and global distribution networks.

4 What are the growth drivers of the Global TPU Material Market?

The Global TPU Material Market is driven by the increasing demand for lightweight and durable materials in automotive applications, the rising use of TPU in medical devices, and the expansion of TPU recycling initiatives globally, which align with environmental sustainability goals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.