Global Truck Market Outlook to 2030

Region:Global

Author(s):Shubham Kashyap

Product Code:KROD2002

June 2025

80

About the Report

Global Truck Market Overview

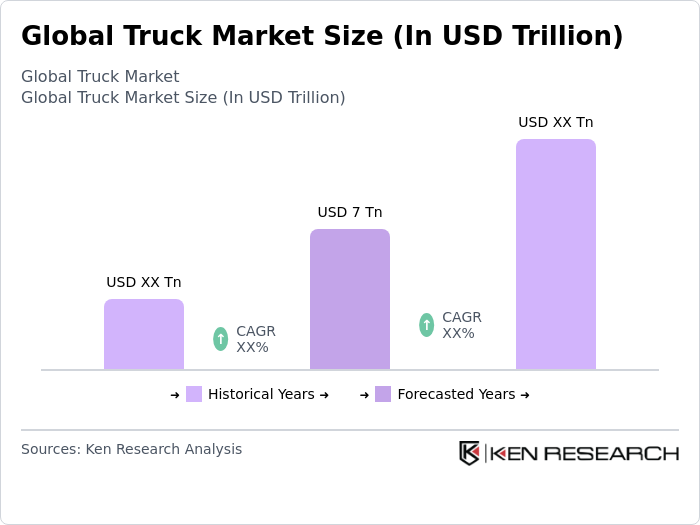

- The Global Truck Market was valued at USD 7 trillion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for freight transportation, urbanization, and the expansion of e-commerce. The rise in logistics and supply chain activities has significantly contributed to the market's expansion, as businesses seek efficient transportation solutions to meet consumer demands.

- Key players in this market include the United States, China, and Germany. The United States dominates due to its extensive road infrastructure and high freight demand, while China benefits from rapid industrialization and urban growth. Germany's strong automotive industry and focus on innovation in truck manufacturing also contribute to its market leadership.

- In 2023, the European Union implemented stricter emissions regulations for heavy-duty vehicles, mandating a 15% reduction in CO2 emissions by 2025. This regulation aims to promote the adoption of cleaner technologies in the trucking industry, encouraging manufacturers to invest in electric and hybrid trucks to comply with the new standards.

Global Truck Market Segmentation

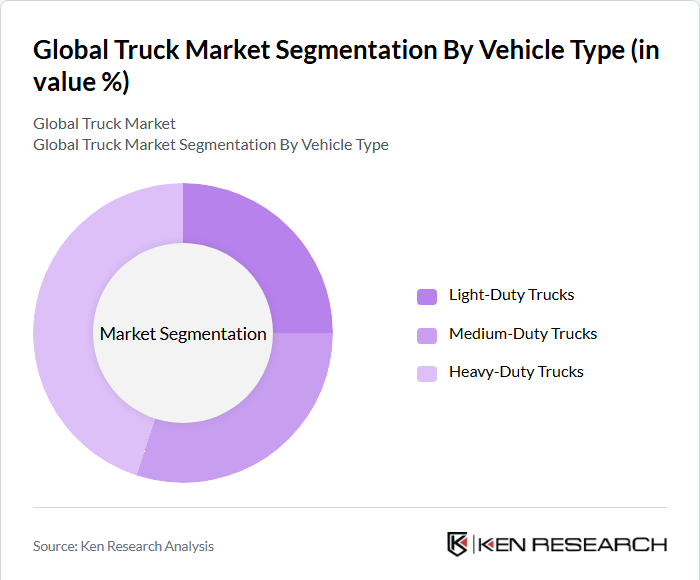

By Vehicle Type: The truck market is primarily segmented into light-duty trucks, medium-duty trucks, and heavy-duty trucks. Among these, heavy-duty trucks dominate the market due to their essential role in long-haul transportation and logistics. The increasing demand for freight transport, coupled with the growth of e-commerce, has led to a surge in the use of heavy-duty trucks. These vehicles are preferred for their higher payload capacity and efficiency in transporting goods over long distances, making them indispensable in the supply chain.

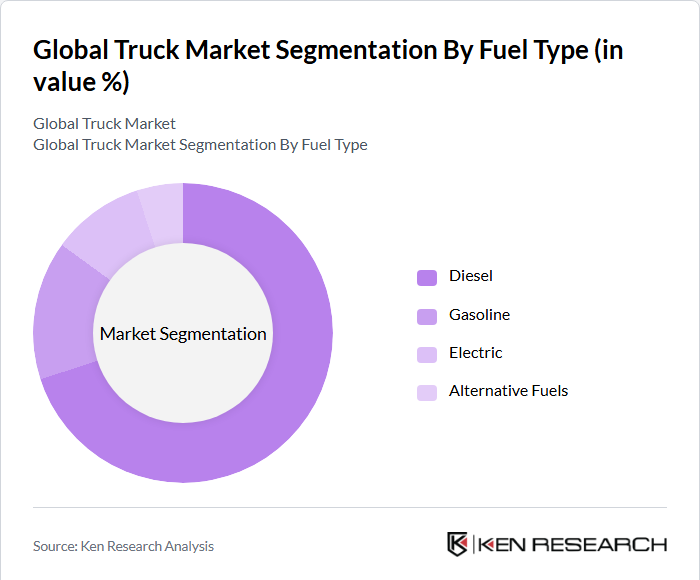

By Fuel Type: The market is segmented into diesel, gasoline, electric, and alternative fuels. Diesel trucks hold the largest market share due to their established infrastructure and efficiency in long-distance hauling. However, the electric segment is gaining traction as advancements in battery technology and government incentives promote the adoption of electric trucks. The shift towards sustainable transportation solutions is influencing consumer preferences, leading to increased investments in electric and alternative fuel technologies.

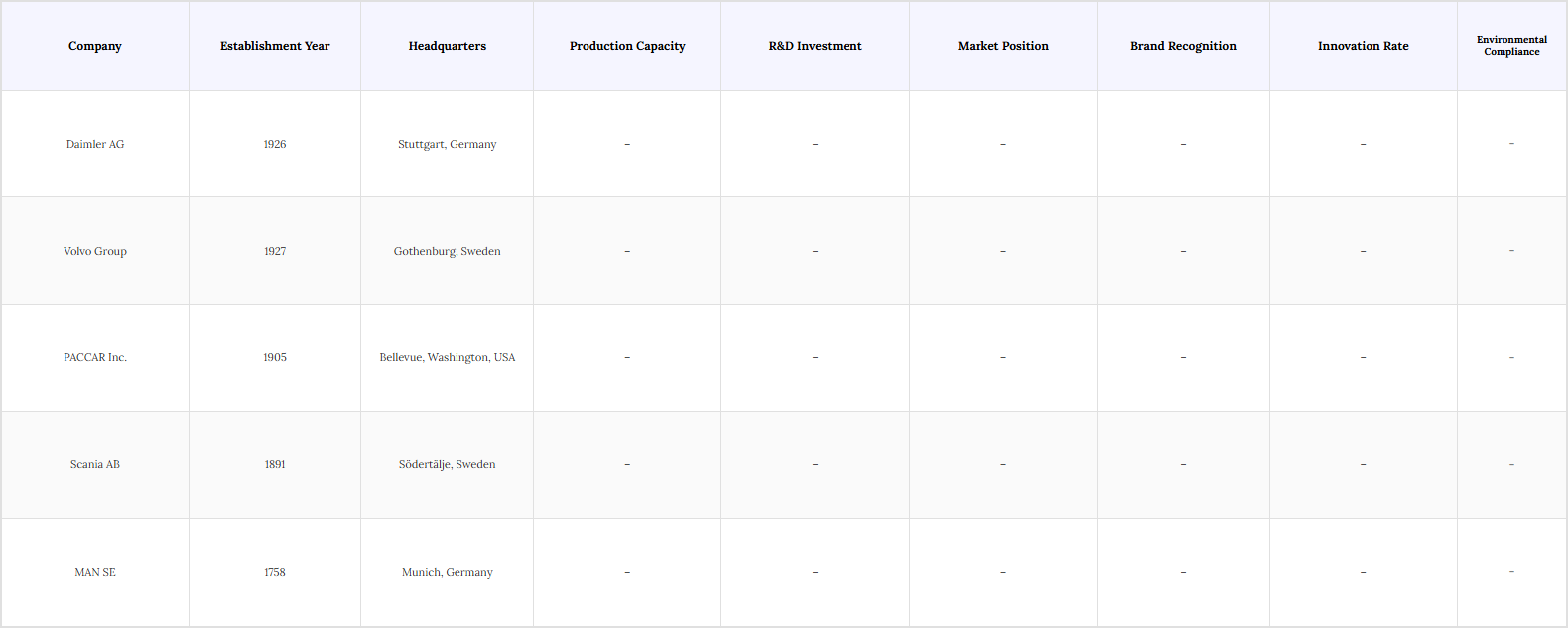

Global Truck Market Competitive Landscape

The Global Truck Market is characterized by intense competition among key players such as Daimler AG, Volvo Group, and PACCAR Inc. These companies are known for their innovation, extensive product portfolios, and strong brand recognition. The market is also witnessing the entry of new players focusing on electric and alternative fuel trucks, which is reshaping the competitive dynamics.

Global Truck Market Industry Analysis

Growth Drivers

- Increasing Demand for Freight Transportation: The global freight transportation market is projected to grow remarkably, driven by the expansion of trade and e-commerce. In 2023, the volume of goods transported by trucks in the U.S. alone was around 11.5 billion tons, accounting for over 70% of all freight movement. This surge in demand is primarily attributed to the growth of online shopping, which has seen a substantial increase in sales year-over-year, necessitating a robust logistics network. Additionally, the World Bank reports that global trade is expected to grow by 4% in 2024, further fueling the need for efficient freight solutions. As businesses seek to optimize their supply chains, the reliance on trucks for last-mile delivery will continue to rise, solidifying their role in the transportation ecosystem.

- Technological Advancements in Truck Manufacturing: The truck manufacturing sector is witnessing significant technological innovations, particularly in automation and connectivity. In 2023, investments in advanced manufacturing technologies, such as robotics and AI, reached an updated figure, enhancing production efficiency and reducing costs. Furthermore, the integration of IoT in trucks has improved fleet management, with companies reporting a substantial reduction in operational costs due to real-time tracking and predictive maintenance. These advancements not only enhance the performance and safety of trucks but also align with the increasing demand for sustainable practices, as manufacturers focus on reducing emissions and improving fuel efficiency.

- Expansion of E-commerce and Logistics Sectors: Global e-commerce sales reached approximately USD 6 trillion in 2024, with projections to grow further. In the U.S., retail e-commerce sales totaled about USD 1.19 trillion in 2024, accounting for roughly 16% of total retail sales. The U.S. logistics sector has seen significant growth, with warehouse space expanding by around 25% in 2023, exceeding 1 billion square feet, driven largely by e-commerce fulfillment demands. This expansion fuels demand for versatile trucks to support faster delivery models such as same-day and next-day shipping, benefiting the trucking market as logistics providers adapt to evolving consumer expectations

Market Challenges

- Rising Fuel Prices Impacting Operational Costs: Fuel prices have been volatile, with the average U.S. diesel price around USD 3.63 per gallon in early 2025, down from about USD 3.76 per gallon in 2024. Trucking companies typically allocate roughly 30% of operating costs to fuel, making price fluctuations a significant challenge. The American Trucking Associations estimate that rising fuel costs could add approximately USD 10 billion in expenses for the industry in 2024. This volatility pressures companies to raise freight rates and complicates long-term budgeting for fleet operators

- Stringent Environmental Regulations: The trucking industry is facing increasing pressure from regulatory bodies to reduce emissions and improve fuel efficiency. In 2023, the European Union implemented new regulations mandating a 30% reduction in CO2 emissions from heavy-duty vehicles by 2030. Compliance with these regulations requires significant investment in cleaner technologies, which can be a barrier for smaller operators. The U.S. Environmental Protection Agency (EPA) has also proposed stricter emissions standards, which could require an investment of up to USD 20 billion for the industry to meet compliance by 2025. These regulations not only increase operational costs but also necessitate a shift in manufacturing practices, posing a challenge for companies that must balance compliance with profitability.

Global Truck Market Future Outlook

The future of the truck market is poised for transformation, driven by technological advancements and evolving consumer demands. As sustainability becomes a priority, the industry will likely see increased investments in electric and alternative fuel vehicles, alongside innovations in logistics and supply chain management.

Market Opportunities

- Growth in Electric and Alternative Fuel Trucks: The shift towards electric and alternative fuel trucks presents a significant opportunity for the market. In 2023, sales of electric trucks increased by an updated figure, with projections indicating that the market for electric commercial vehicles will grow rapidly by 2030. Governments worldwide are offering incentives for electric vehicle adoption, with the U.S. allocating USD 7.5 billion for EV infrastructure development. This transition not only aligns with global sustainability goals but also offers cost savings in fuel and maintenance for operators. As battery technology continues to improve, the range and efficiency of electric trucks will enhance their viability, making them an attractive option for fleet operators looking to reduce their carbon footprint.

- Expansion into Emerging Markets: Emerging markets present a lucrative opportunity for the truck industry, with regions such as Asia-Pacific and Latin America experiencing rapid economic growth. In 2023, the Asia-Pacific region accounted for over 40% of global truck sales, driven by increasing urbanization and infrastructure development. The International Monetary Fund (IMF) projects that GDP growth in these regions will exceed 5% annually through 2025, creating a higher demand for freight transportation. Companies that strategically invest in these markets can capitalize on the growing need for logistics solutions.

Scope of the Report

| By Vehicle Type |

Light-duty trucks Medium-duty trucks Heavy-duty trucks |

| By Fuel Type |

Diesel Gasoline Electric Alternative fuels |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application |

Freight transportation Construction Logistics Public transportation |

| By Technology |

Connected trucks Autonomous trucks Electric trucks |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Transportation, Environmental Protection Agency)

Truck Manufacturers and Producers

Logistics and Supply Chain Companies

Fleet Management Companies

Automotive Component Suppliers

Industry Associations (e.g., American Trucking Associations, International Truck and Bus Council)

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

Daimler AG

Volvo Group

PACCAR Inc.

MAN Truck & Bus

Scania AB

Navistar International Corporation

Hino Motors, Ltd.

Isuzu Motors Ltd.

Tata Motors Limited

Ashok Leyland Limited

Table of Contents

1. Global Truck Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Truck Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Truck Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for freight transportation

3.1.2. Technological advancements in truck manufacturing

3.1.3. Expansion of e-commerce and logistics sectors

3.2. Market Challenges

3.2.1. Rising fuel prices impacting operational costs

3.2.2. Stringent environmental regulations

3.2.3. Supply chain disruptions affecting production

3.3. Opportunities

3.3.1. Growth in electric and alternative fuel trucks

3.3.2. Expansion into emerging markets

3.3.3. Innovations in autonomous driving technology

3.4. Trends

3.4.1. Increasing focus on sustainability and eco-friendly solutions

3.4.2. Integration of IoT in truck operations

3.4.3. Shift towards digitalization in logistics management

3.5. Government Regulation

3.5.1. Emission standards and compliance requirements

3.5.2. Safety regulations for commercial vehicles

3.5.3. Incentives for electric vehicle adoption

3.5.4. Trade policies affecting import/export of trucks

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Truck Market Segmentation

4.1. By Vehicle Type

4.1.1. Light-duty trucks

4.1.2. Medium-duty trucks

4.1.3. Heavy-duty trucks

4.2. By Fuel Type

4.2.1. Diesel

4.2.2. Gasoline

4.2.3. Electric

4.2.4. Alternative fuels

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Application

4.4.1. Freight transportation

4.4.2. Construction

4.4.3. Logistics

4.4.4. Public transportation

4.5. By Technology

4.5.1. Connected trucks

4.5.2. Autonomous trucks

4.5.3. Electric trucks

5. Global Truck Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Daimler AG

5.1.2. Volvo Group

5.1.3. PACCAR Inc.

5.1.4. MAN Truck & Bus

5.1.5. Scania AB

5.1.6. Navistar International Corporation

5.1.7. Hino Motors, Ltd.

5.1.8. Isuzu Motors Ltd.

5.1.9. Tata Motors Limited

5.1.10. Ashok Leyland Limited

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. R&D Investment

5.2.6. Customer Satisfaction Ratings

5.2.7. Supply Chain Efficiency

5.2.8. Brand Reputation

6. Global Truck Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Truck Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Truck Market Future Market Segmentation

8.1. By Vehicle Type

8.1.1. Light-duty trucks

8.1.2. Medium-duty trucks

8.1.3. Heavy-duty trucks

8.2. By Fuel Type

8.2.1. Diesel

8.2.2. Gasoline

8.2.3. Electric

8.2.4. Alternative fuels

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East & Africa

8.4. By Application

8.4.1. Freight transportation

8.4.2. Construction

8.4.3. Logistics

8.4.4. Public transportation

8.5. By Technology

8.5.1. Connected trucks

8.5.2. Autonomous trucks

8.5.3. Electric trucks

9. Global Truck Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Truck Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Truck Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Truck Market.

Frequently Asked Questions

01. How big is the Global Truck Market?

The Global Truck Market is valued at USD 7 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Truck Market?

Key challenges in the Global Truck Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Truck Market?

Major players in the Global Truck Market include Daimler AG, Volvo Group, PACCAR Inc., MAN Truck & Bus, Scania AB, among others.

04. What are the growth drivers for the Global Truck Market?

The primary growth drivers for the Global Truck Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.