Global Tuna Fish Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD5466

December 2024

82

About the Report

Global Tuna Fish Market Overview

- Global Tuna Fish Market is valued at USD 40 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for protein-rich diets across the world. Tuna, being a staple protein source for many households, has seen growth in both developed and emerging economies. The growth is also propelled by expanding global supply chains, advancements in preservation and processing technologies, and the rising demand for ready-to-eat seafood products such as canned tuna.

- The dominance in the global tuna fish market is primarily held by countries such as Japan, the USA, and Spain, which are known for their strong fishing industries and efficient processing capabilities. Japan, in particular, leads the market due to its high domestic demand for fresh tuna, especially for sushi and sashimi, while the USA and Spain have well-established canned tuna production and export capabilities.

- Governments around the world are tightening regulations to ensure the sustainability of tuna stocks. In 2023, the ICCAT imposed a global fishing quota of 1.3 million tons for Atlantic bluefin tuna to combat overfishing. Similarly, the Western and Central Pacific Fisheries Commission has introduced regulations limiting the number of fishing vessels operating in tuna-rich regions. These policies are designed to maintain ecological balance and prevent overexploitation of tuna resources, ensuring long-term market stability.

Global Tuna Fish Market Segmentation

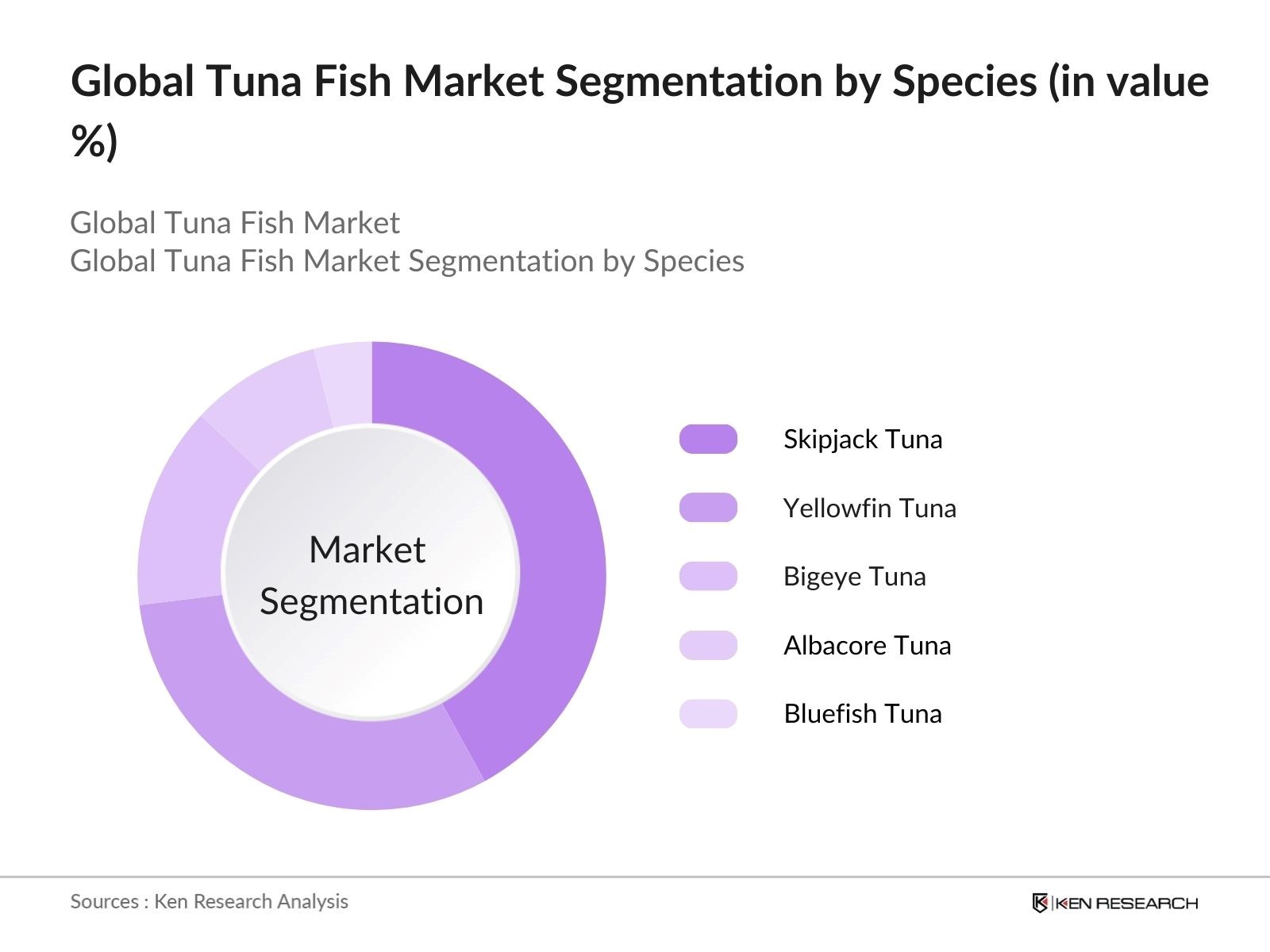

By Species: The global tuna fish market is segmented by species into Yellowfin Tuna, Skipjack Tuna, Bigeye Tuna, Albacore Tuna, and Bluefin Tuna. Recently, Skipjack Tuna has a dominant market share under the species segmentation due to its widespread use in canned tuna production. Skipjack Tuna is favored because of its high availability, relatively lower cost, and demand for canned products in markets such as North America and Europe. Additionally, its short reproductive cycle makes it a sustainable option, further boosting its dominance in global fisheries.

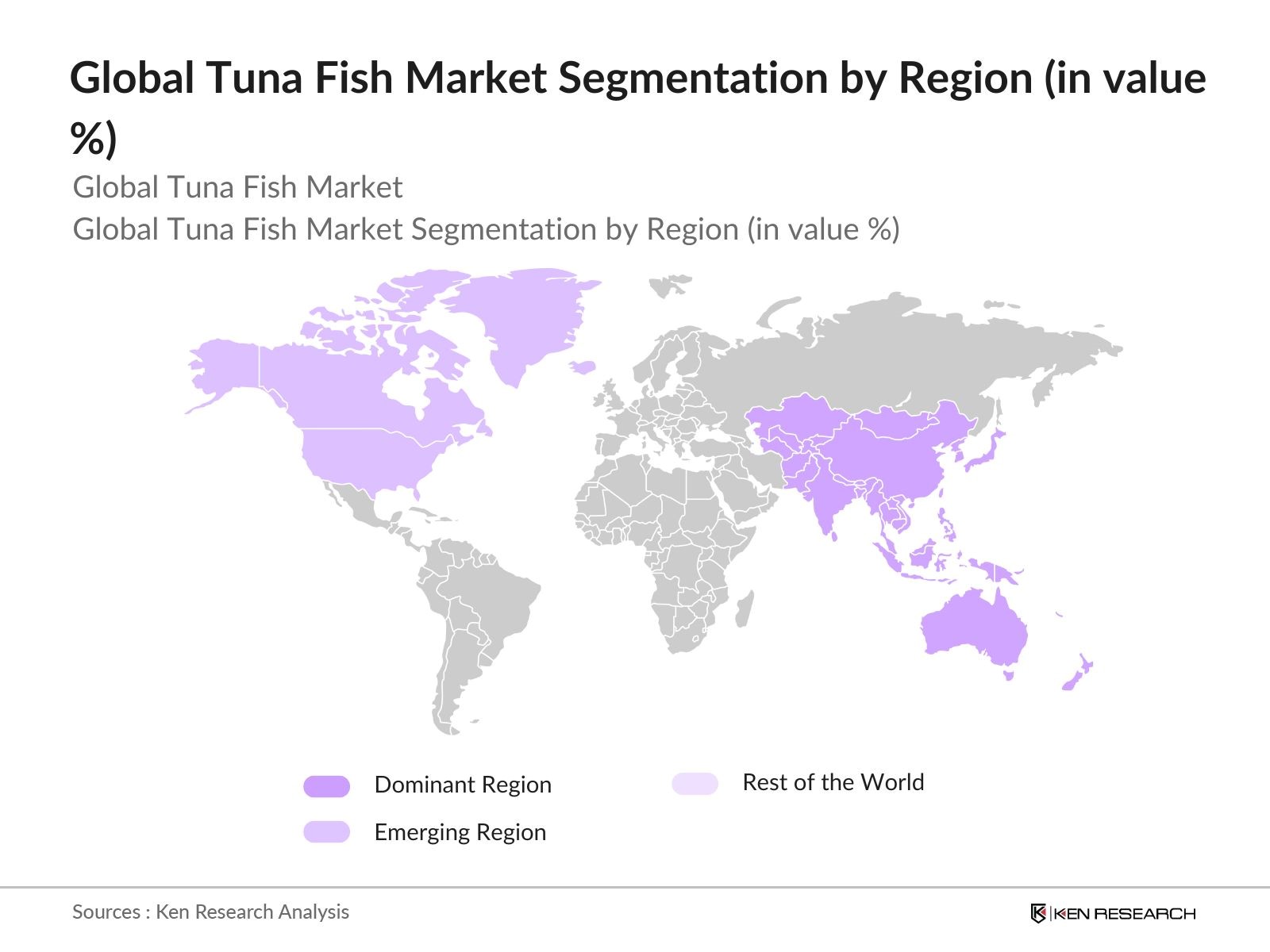

By Region: The global tuna fish market is segmented by region into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific dominates the market share under the regional segmentation, driven by high domestic consumption in countries like Japan and Thailand, which are key consumers and producers of fresh and canned tuna. Additionally, the region's proximity to rich tuna fishing grounds in the Pacific Ocean further enhances its dominance in the global tuna trade.

By Product Type: The global tuna fish market is segmented by product type into Canned Tuna, Frozen Tuna, Fresh Tuna, and Tuna Fillets and Steaks. Canned Tuna holds the largest market share due to its convenience, long shelf life, and affordability. Consumers in North America and Europe drive this segment, where tuna is widely used in various dishes. Additionally, the growing trend of ready-to-eat meals has further fueled the demand for canned tuna, solidifying its dominance within the product type segmentation.

Global Tuna Fish Market Competitive Landscape

The global tuna fish market is characterized by the presence of major players that dominate both in terms of production capacity and global distribution networks. The industry is fairly consolidated, with large players leveraging their well-established supply chains, fishing fleets, and sustainability initiatives. These companies also focus on strategic collaborations and product innovations to maintain a competitive edge.

|

Company Name |

Established |

Headquarters |

Production Capacity |

Fishing Fleet Size |

Sustainability Certifications |

Geographic Presence |

Processing Facilities |

Product Range |

|

Thai Union Group PCL |

1977 |

Thailand |

- |

- |

- |

- |

- |

- |

|

Bumble Bee Foods, LLC |

1899 |

USA |

- |

- |

- |

- |

- |

- |

|

Dongwon Industries Co., Ltd |

1969 |

South Korea |

- |

- |

- |

- |

- |

- |

|

Starkist Co. |

1917 |

USA |

- |

- |

- |

- |

- |

- |

|

Trimarine International |

1972 |

Singapore |

- |

- |

- |

- |

- |

- |

Global Tuna Fish Market Analysis

Growth Drivers

- Rising Demand for Protein-Rich Food Products: The global population reached 8 billion in 2022, with increasing focus on nutritional needs driven by demographic changes. According to the World Bank, global protein consumption is on the rise, especially in urban regions where middle-income households prioritize health-conscious dietary habits. With a 40% increase in per capita fish consumption between 1990 and 2023, tuna remains a central component of high-protein diets.

- Expanding Aquaculture and Fishing Industries: The global fishing industry produced around 223 million metric tons of fish in 2022, with aquaculture accounting for nearly 46% of total output. Aquaculture production is expanding rapidly, driven by demand for high-value species like tuna. With key producing regions such as the Asia Pacific accounting for over 50% of global tuna catch, the tuna fishing industry benefits from advancements in sustainable aquaculture practices.

- Globalization of Food Supply Chains: Globalization has facilitated increased trade of fish products, with tuna being a key component of international seafood trade. According to the World Trade Organization (WTO), the global fish trade was valued at $151 billion in 2022, and tuna accounted for approximately 9% of the volume. Efficient supply chains have allowed tuna products to reach distant markets like North America and Europe, where consumption levels have surged due to increased importation.

Market Challenges

- Overfishing and Sustainability Concerns: The global tuna stock is under immense pressure, with the FAO reporting that 33.1% of global fish stocks were overfished in 2022. Tuna species, especially bluefin tuna, are particularly vulnerable. In the Western and Central Pacific, over 4.8 million tons of tuna were caught in 2022, raising concerns about the long-term sustainability of the species. The impact of overfishing has prompted governments to implement stricter fishing quotas, with the International Commission for the Conservation of Atlantic Tunas (ICCAT) reducing tuna catch limits by 20% in 2023 to preserve fish populations.

- High Processing and Cold Chain Costs: Tuna requires extensive cold chain management to maintain freshness and quality, particularly in export markets. The FAO estimates that nearly 50% of the cost associated with fish processing is due to cold chain logistics. In 2022, energy prices soared globally, contributing to higher costs for cold storage and transportation of tuna. In regions like the Middle East and Southeast Asia, the lack of infrastructure for cold chain logistics remains a critical barrier to market growth.

Global Tuna Fish Market Future Outlook

Over the next five years, the global tuna fish market is expected to witness steady growth driven by rising consumer demand for protein-rich foods, expanding global supply chains, and increasing health consciousness among consumers. Sustainability will play a crucial role in the future growth of the market, with consumers and governments alike demanding stricter regulations on fishing practices and sustainability certifications. The market will also see further innovation in product offerings, such as organic and eco-friendly canned tuna, as well as an increasing focus on convenience and ready-to-eat products.

Market Opportunities

- Growth in Organic and Sustainable Tuna Products: Consumer preferences are shifting towards sustainably sourced and organic products. The demand for organic seafood, including tuna, grew by 8 million metric tons globally in 2023. According to the FAO, 75% of consumers in North America and Europe are willing to pay a premium for sustainably sourced tuna, reflecting a growing market for eco-friendly products. Organic tuna production, particularly in regions like Japan and Australia, has expanded significantly due to environmentally conscious consumer behavior.

- Innovations in Packaging and Preservation: New technologies in packaging, such as vacuum sealing and modified atmosphere packaging (MAP), are driving the growth of the tuna fish market. In 2022, the global demand for eco-friendly and recyclable packaging materials surged by 1.2 million metric tons. Major markets like the EU and the US have adopted new packaging regulations, mandating reduced plastic use in food products, further encouraging innovation in sustainable packaging for tuna.

Scope of the Report

|

By Segments |

Sub-Segments |

|

By Species |

Yellowfin Tuna Skipjack Tuna Bigeye Tuna Albacore Tuna Bluefin Tuna |

|

By Product Type |

Canned Tuna Frozen Tuna Fresh Tuna Tuna Fillets Steaks |

|

By End Use |

Retail Foodservice (Restaurants, Hotels) Institutional |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Channels |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

.

Products

Key Target Audience

Tuna Fish Processors and Manufacturers

Fishing Companies

Foodservice Providers (Restaurants, Hotels)

Seafood Processing Companies

Packaging and Logistics Companies

Logistics and Supply Chain Firms

Government and Regulatory Bodies (e.g., Marine Stewardship Council, Food and Agriculture Organization)

Investors and Venture Capitalist Firms

Companies

Major Players

Thai Union Group PCL

Bumble Bee Foods, LLC

Dongwon Industries Co., Ltd.

Starkist Co.

Trimarine International, Inc.

Ocean Brands GP

Mitsui & Co., Ltd.

Century Pacific Food, Inc.

Wild Planet Foods, Inc.

FCF Co., Ltd.

Table of Contents

1. Global Tuna Fish Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Tuna Fish Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Tuna Fish Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Protein-Rich Food Products

3.1.2. Expanding Aquaculture and Fishing Industries

3.1.3. Increasing Health Consciousness Among Consumers

3.1.4. Globalization of Food Supply Chains

3.2. Market Challenges

3.2.1. Overfishing and Sustainability Concerns

3.2.2. Regulatory and Certification Challenges

3.2.3. High Processing and Cold Chain Costs

3.3. Opportunities

3.3.1. Growth in Organic and Sustainable Tuna Products

3.3.2. Innovations in Packaging and Preservation

3.3.3. Emerging Markets in Asia Pacific and Latin America

3.4. Trends

3.4.1. Increasing Demand for Canned Tuna

3.4.2. Expanding Retail and E-Commerce Tuna Sales Channels

3.4.3. Focus on Eco-Friendly Fishing Practices

3.5. Government Regulation

3.5.1. Fishing Quotas and Sustainability Regulations

3.5.2. International Marine Conservation Agreements

3.5.3. Food Safety Standards for Processed Tuna

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Tuna Fish Market Segmentation

4.1. By Species (In Value %)

4.1.1. Yellowfin Tuna

4.1.2. Skipjack Tuna

4.1.3. Bigeye Tuna

4.1.4. Albacore Tuna

4.1.5. Bluefin Tuna

4.2. By Product Type (In Value %)

4.2.1. Canned Tuna

4.2.2. Frozen Tuna

4.2.3. Fresh Tuna

4.2.4. Tuna Fillets and Steaks

4.3. By End Use (In Value %)

4.3.1. Retail

4.3.2. Foodservice (Restaurants, Hotels)

4.3.3. Institutional

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Specialty Stores

4.4.3. Online Channels

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Tuna Fish Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thai Union Group PCL

5.1.2. Bumble Bee Foods, LLC

5.1.3. Dongwon Industries Co., Ltd.

5.1.4. Starkist Co.

5.1.5. American Tuna Inc.

5.1.6. Trimarine International, Inc.

5.1.7. Ocean Brands GP

5.1.8. Mitsui & Co., Ltd.

5.1.9. Century Pacific Food, Inc.

5.1.10. Wild Planet Foods, Inc.

5.1.11. FCF Co., Ltd.

5.1.12. Maruha Nichiro Corporation

5.1.13. Albacora S.A.

5.1.14. Frinsa del Noroeste, S.A.

5.1.15. Calvo Group

5.2. Cross Comparison Parameters (Production Capacity, Sustainability Certifications, Processing Facilities, Fishing Fleet, Product Range, Revenue, Geographic Presence, Export Volume)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Tuna Fish Market Regulatory Framework

6.1. Fishing Quotas and International Regulations

6.2. Eco-Labeling and Certification Standards (e.g., MSC, ASC)

6.3. Compliance with Food Safety Standards

6.4. Environmental Protection Regulations

7. Global Tuna Fish Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Tuna Fish Future Market Segmentation

8.1. By Species (In Value %)

8.2. By Product Type (In Value %)

8.3. By End Use (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Tuna Fish Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the global tuna fish market ecosystem, identifying all major stakeholders, including fishing companies, processing units, retailers, and regulatory bodies. Comprehensive desk research is conducted to understand the market's supply chain, product dynamics, and geographic distribution.

Step 2: Market Analysis and Construction

This step focuses on analyzing historical data, assessing global fishing capacity, consumption trends, and price fluctuations. Market penetration is measured across major regions, and the revenue impact of processed and fresh tuna products is calculated based on industry standards.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through in-depth interviews with key industry experts. Consultations with tuna fishing companies and sustainability organizations help validate assumptions and ensure accuracy in market estimates.

Step 4: Research Synthesis and Final Output

Data from industry reports, expert consultations, and proprietary databases are synthesized to create a comprehensive analysis. Detailed insights into product segments, sales performance, and sustainability trends provide a holistic view of the global tuna fish market.

Frequently Asked Questions

01. How big is the Global Tuna Fish Market?

The global tuna fish market is valued at USD 40 billion, driven by increased demand for protein-rich foods and expanding supply chains across key regions.

02. What are the challenges in the Global Tuna Fish Market?

Challenges of Global Tuna Fish Market include sustainability concerns, overfishing, and stringent regulations regarding fishing practices and environmental impact, which affect both the supply and cost of tuna.

03. Who are the major players in the Global Tuna Fish Market?

Key players of Global Tuna Fish Market include Thai Union Group PCL, Bumble Bee Foods, LLC, Dongwon Industries Co., Ltd., Starkist Co., and Trimarine International, among others.

04. What are the growth drivers of the Global Tuna Fish Market?

Global Tuna Fish Market is propelled by rising consumer demand for protein-rich diets, advancements in preservation technologies, and increasing health consciousness, particularly in North America and Asia Pacific.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.