Global Used Two Wheeler Market Outlook to 2030

Region:Global

Author(s):Rebecca

Product Code:KROD-029

June 2025

90

About the Report

Global Used Two Wheeler Market Overview

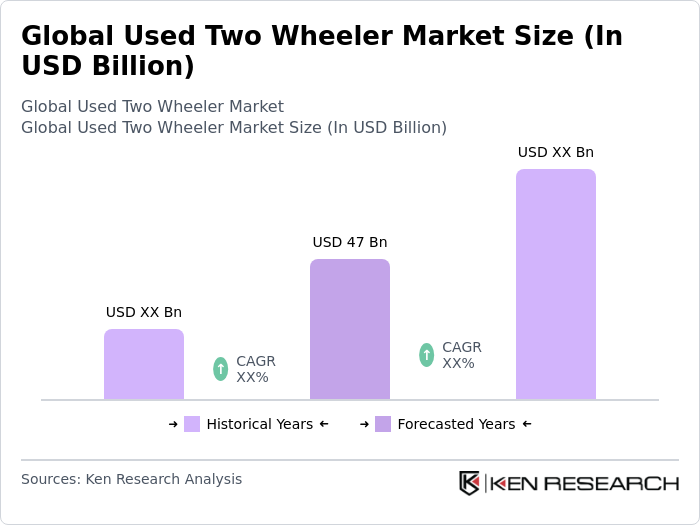

- The Global Used Two Wheeler Market was valued at USD 47 billion, based on a five-year historical analysis, reflecting robust demand driven by increasing urbanization, rising fuel prices, and a growing preference for cost-effective transportation solutions. The market continues to see significant growth as consumers seek affordable mobility options, particularly in densely populated regions where traffic congestion is prevalent.

- Countries such as India, China, and Indonesia remain dominant in the market due to their large populations and rising disposable incomes. These nations have a strong cultural affinity for two-wheelers, making them a preferred mode of transport for daily commuting, especially in urban areas where space is limited and traffic is heavy.

- In response to environmental concerns, several governments have implemented regulations to promote the use of electric two-wheelers. India’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme provides incentives for electric two-wheeler purchases, aiming to reduce pollution and dependence on fossil fuels. The rise of electric models and regulatory support is accelerating the transition towards more sustainable mobility solutions in the used two-wheeler segment.

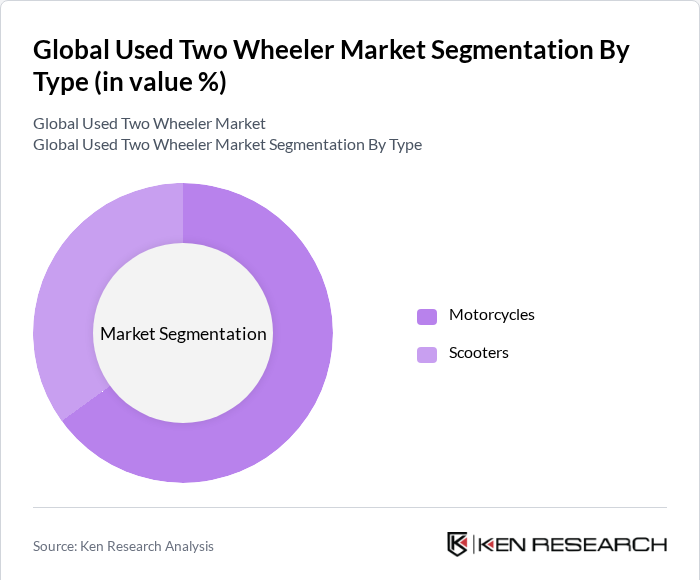

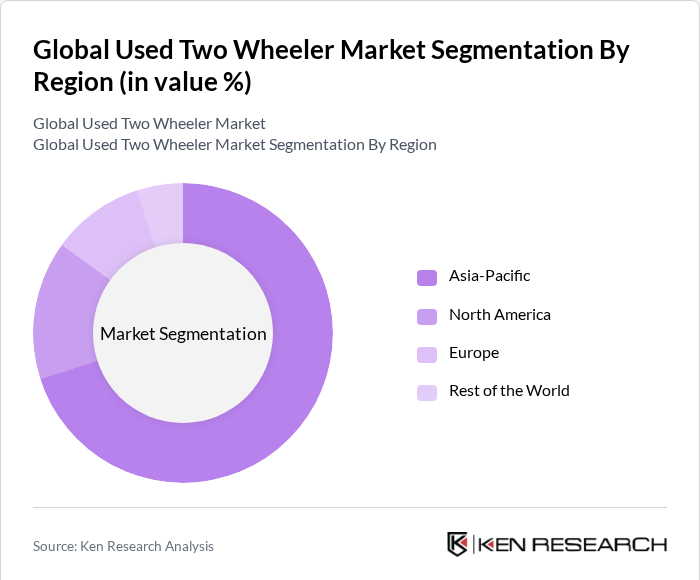

Global Used Two Wheeler Market Segmentation

By Type: The used two-wheeler market can be segmented into motorcycles and scooters. Motorcycles continue to dominate the market, accounting for a larger share due to their versatility, performance capabilities, and appeal to both daily commuters and recreational riders. The growing popularity of adventure and leisure riding, as well as the increasing number of motorcycle enthusiasts, sustains demand for used motorcycles. Additionally, motorcycles often serve as a status symbol in many regions, further driving their popularity.

By Region: The market can also be segmented by region, with Asia-Pacific being the leading segment. This region is characterized by a high population density and a growing middle class, which drives the demand for affordable transportation. Countries like India and China have a significant number of used two-wheelers due to their established manufacturing bases and a culture that favors two-wheeled vehicles. The increasing urbanization in these regions further fuels the demand for used two-wheelers as a practical commuting solution.

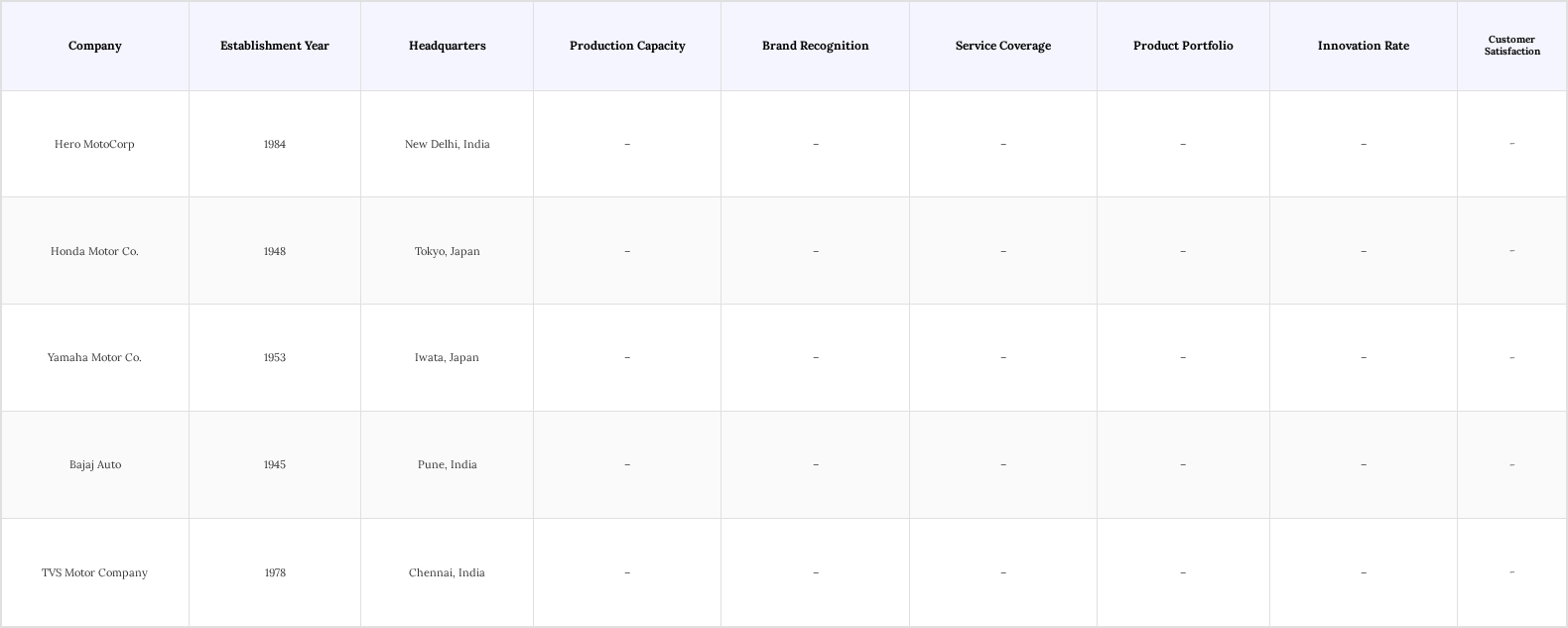

Global Used Two Wheeler Market Competitive Landscape

The Global Used Two Wheeler Market is characterized by a competitive landscape with several key players, including Hero MotoCorp, Honda Motor Co., Yamaha Motor Co., Bajaj Auto, and TVS Motor Company. These companies are recognized for their extensive product portfolios and strong brand recognition, contributing to their market presence. Competition is driven by product innovation, customer service, and the ability to adapt to evolving consumer preferences.

Global Used Two Wheeler Market Industry Analysis

Growth Drivers

- Urbanization and Traffic Congestion: Rapid urbanization, with urban populations nearing 60% by 2024, is driving traffic congestion and boosting demand for affordable transportation. Used two-wheelers, priced between $1,500 and $3,000, offer a cost-effective, efficient solution for navigating crowded cities. This makes them increasingly popular among urban consumers seeking mobility and savings, fueling steady growth in the used two-wheeler market across densely populated regions.

Rising Fuel Prices: The global increase in fuel prices, which saw an average rise of 15% in 2023, is pushing consumers towards more economical transportation alternatives. In None, where fuel costs are projected to remain high, the affordability of used two-wheelers becomes increasingly attractive. Consumers are likely to turn to these vehicles, which typically offer better fuel efficiency than cars, with average fuel consumption rates of 70-100 miles per gallon, significantly reducing overall transportation costs. - Environmental Awareness: Growing global environmental awareness is driving a significant shift toward sustainable transportation, boosting the used electric two-wheeler market worldwide. Governments are setting ambitious targets to increase electric vehicle adoption by around 25% by 2025, supported by incentives and infrastructure development. This has led to a 30% rise in demand for used electric two-wheelers, as consumers increasingly prioritize eco-friendly, cost-effective mobility solutions amid urbanization and stricter emission norms.

Market Challenges

- Regulatory Hurdles: The resale of used two-wheelers in None faces significant regulatory challenges, including stringent compliance requirements for emissions and safety standards. In 2023, majority of used vehicle transactions were delayed due to regulatory issues, impacting market fluidity. These hurdles can deter potential buyers, as navigating the compliance landscape often requires additional time and resources, ultimately affecting sales and market growth.

- Fluctuating Market Prices: The used two-wheeler market is susceptible to price volatility, influenced by factors such as economic conditions and consumer demand. In None, the average resale value of used two-wheelers has fluctuated by 10% over the past year, creating uncertainty for buyers and sellers alike. This instability can lead to hesitance in purchasing decisions, as consumers may wait for more favorable pricing conditions, thereby slowing market growth.

Global Used Two Wheeler Market Future Outlook

The future of the used two-wheeler market in None appears promising, driven by increasing urbanization and a growing preference for sustainable transportation. As consumers become more environmentally conscious, the demand for used electric two-wheelers is expected to rise significantly. Additionally, the expansion of online platforms for buying and selling used vehicles will enhance market accessibility, allowing for greater consumer engagement and potentially increasing sales volumes in the coming years.

Market Opportunities

- Online Marketplaces Expansion: The growth of digital platforms for buying and selling used two-wheelers presents a significant opportunity. In None, online sales of used vehicles have increased by 25% in the last year, indicating a shift in consumer behavior towards e-commerce. This trend allows for broader market reach and convenience, potentially increasing transaction volumes and enhancing customer satisfaction.

- Refurbished and Certified Pre-Owned Demand: There is a growing market for refurbished and certified pre-owned two-wheelers, driven by consumer desire for quality assurance. In None, the demand for certified pre-owned vehicles has surged by 20% in 2023, as buyers seek reliable options at lower prices. This trend offers a lucrative opportunity for dealers to cater to quality-conscious consumers while expanding their inventory.

Scope of the Report

| By Product Type |

Motorcycles Scooters |

| By Region |

Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Engine Capacity |

Below 100cc 100cc - 200cc 200cc - 400cc Above 400cc |

| By Fuel Type |

Petrol Diesel Electric |

| By Age of Vehicle |

Less than 1 year 1-3 years 3-5 years More than 5 years |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Transportation, Environmental Protection Agency)

Manufacturers and Producers

Distributors and Retailers

Automotive Trade Associations

Insurance Companies

Financial Institutions

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report:

Hero MotoCorp

Honda Motor Co.

Yamaha Motor Co.

Bajaj Auto

TVS Motor Company

Royal Enfield

Suzuki Motor Corporation

KTM Sportmotorcycle AG

Piaggio & C. SpA

Kawasaki Heavy Industries

Table of Contents

1. Global Used Two Wheeler Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Used Two Wheeler Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Used Two Wheeler Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing urbanization and traffic congestion driving demand for affordable transportation

3.1.2. Rising fuel prices prompting consumers to seek cost-effective alternatives

3.1.3. Growing environmental awareness leading to a shift towards used electric two-wheelers

3.2. Market Challenges

3.2.1. Regulatory hurdles and compliance issues affecting the resale of used vehicles

3.2.2. Fluctuating market prices impacting consumer purchasing decisions

3.2.3. Limited availability of financing options for used two-wheelers

3.3. Opportunities

3.3.1. Expansion of online platforms for buying and selling used two-wheelers

3.3.2. Increasing demand for refurbished and certified pre-owned vehicles

3.3.3. Potential for growth in emerging markets with rising disposable incomes

3.4. Trends

3.4.1. Shift towards digital marketplaces and e-commerce for used two-wheelers

3.4.2. Growing popularity of subscription models for two-wheeler usage

3.4.3. Enhanced focus on sustainability and eco-friendly options in the used market

3.5. Government Regulation

3.5.1. Emission standards impacting the sale of older two-wheelers

3.5.2. Safety regulations mandating inspections and certifications for used vehicles

3.5.3. Incentives for electric two-wheeler purchases influencing market dynamics

3.5.4. Taxation policies affecting the resale value of used two-wheelers

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Used Two Wheeler Market Segmentation

4.1. By Product Type

4.1.1. Motorcycles

4.1.2. Scooters

4.2. By Region

4.2.1. Asia-Pacific

4.2.2. North America

4.2.3. Europe

4.2.4. Latin America

4.2.5. Middle East & Africa

4.3. By Engine Capacity

4.3.1. Below 100cc

4.3.2. 100cc - 200cc

4.3.3. 200cc - 400cc

4.3.4. Above 400cc

4.4. By Fuel Type

4.4.1. Petrol

4.4.2. Diesel

4.4.3. Electric

4.5. By Age of Vehicle

4.5.1. Less than 1 year

4.5.2. 1-3 years

4.5.3. 3-5 years

4.5.4. More than 5 years

5. Global Used Two Wheeler Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hero MotoCorp

5.1.2. Honda Motor Co.

5.1.3. Yamaha Motor Co.

5.1.4. Bajaj Auto

5.1.5. TVS Motor Company

5.1.6. Royal Enfield

5.1.7. Suzuki Motor Corporation

5.1.8. KTM Sportmotorcycle AG

5.1.9. Piaggio & C. SpA

5.1.10. Kawasaki Heavy Industries

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Product Offerings Comparison

5.2.3. Pricing Strategies

5.2.4. Distribution Channels

5.2.5. Customer Service Ratings

5.2.6. Brand Loyalty Metrics

5.2.7. Innovation and R&D Investment

5.2.8. Geographic Presence

6. Global Used Two Wheeler Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Used Two Wheeler Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Used Two Wheeler Market Future Market Segmentation

8.1. By Product Type

8.1.1. Motorcycles

8.1.2. Scooters

8.2. By Region

8.2.1. Asia-Pacific

8.2.2. North America

8.2.3. Europe

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. By Engine Capacity

8.3.1. Below 100cc

8.3.2. 100cc - 200cc

8.3.3. 200cc - 400cc

8.3.4. Above 400cc

8.4. By Fuel Type

8.4.1. Petrol

8.4.2. Diesel

8.4.3. Electric

8.5. By Age of Vehicle

8.5.1. Less than 1 year

8.5.2. 1-3 years

8.5.3. 3-5 years

8.5.4. More than 5 years

9. Global Used Two Wheeler Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Used Two Wheeler Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Used Two Wheeler Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Used Two Wheeler Market.

Frequently Asked Questions

01. How big is the Global Used Two Wheeler Market?

The Global Used Two Wheeler Market is valued at USD 47 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Used Two Wheeler Market?

Key challenges in the Global Used Two Wheeler Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Used Two Wheeler Market?

Major players in the Global Used Two Wheeler Market include Hero MotoCorp, Honda Motor Co., Yamaha Motor Co., Bajaj Auto, TVS Motor Company, among others.

04. What are the growth drivers for the Global Used Two Wheeler Market?

The primary growth drivers for the Global Used Two Wheeler Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.