Global Utility Communication Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD10901

November 2024

89

About the Report

Global Utility Communication Market Overview

- The Global Utility Communication Market is valued at USD 20.5 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for efficient and secure communication networks that support critical infrastructure, particularly for electricity, water, and gas utilities. Enhanced digitalization efforts and investments in smart grids are key factors propelling growth, enabling utilities to optimize network performance and reliability.

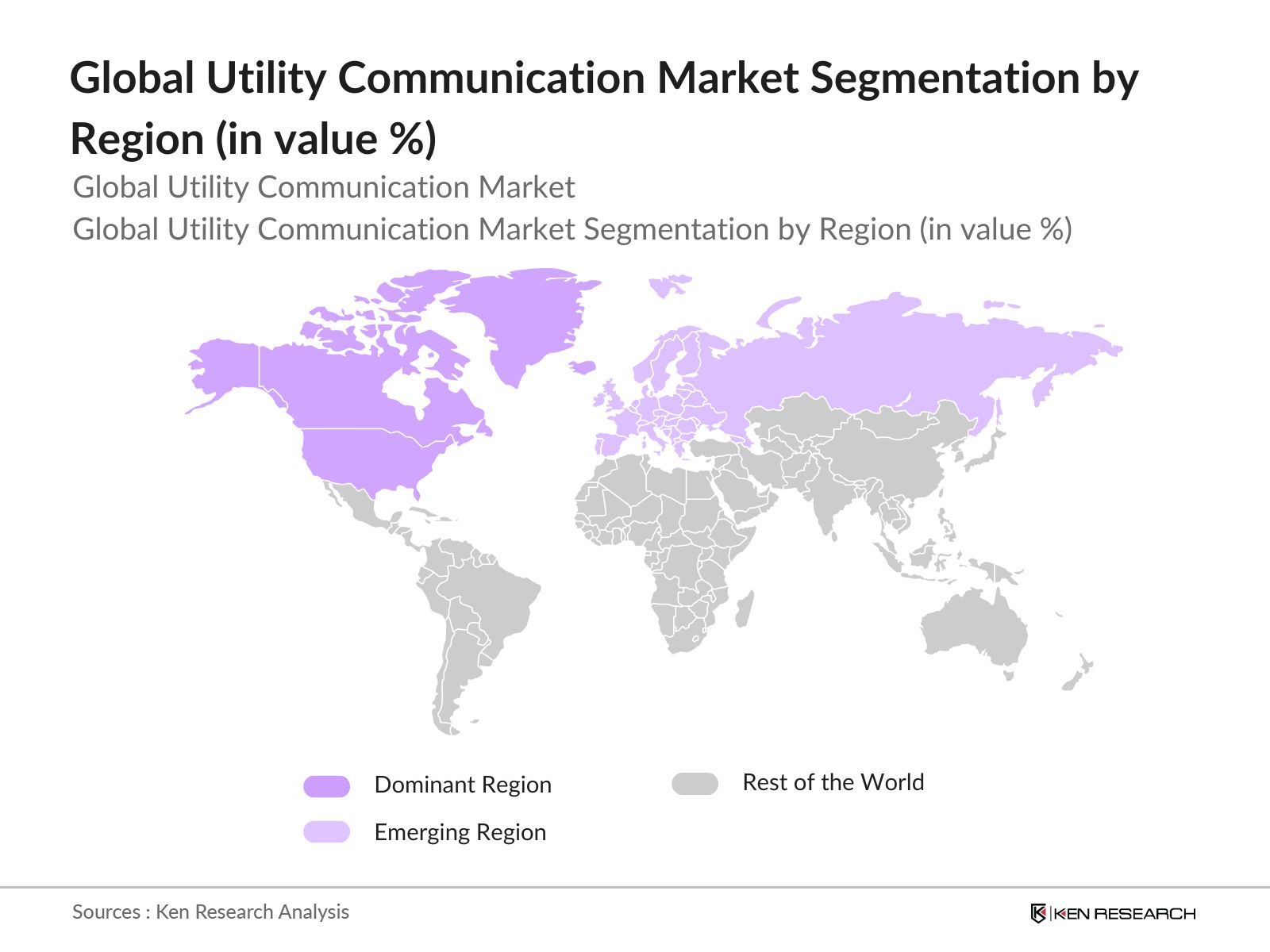

- North America and Europe lead the Global Utility Communication Market due to robust infrastructure and a high adoption rate of smart grid technology. These regions are characterized by supportive government policies promoting technological upgrades in utility services, along with significant investment in advanced digital solutions to enhance operational efficiency and data security.

- In 2024, several leading utility companies have launched new IoT-enabled communication platforms, aiming to enhance data sharing across utility networks. These platforms are projected to streamline operations, reducing annual maintenance costs by nearly 10 billion units globally.

Global Utility Communication Market Segmentation

By Communication Type: The Global Utility Communication Market is segmented by communication type into wired communication and wireless communication. Recently, wireless communication has dominated due to the flexibility it offers in remote monitoring and control applications. Wireless technologies, including cellular networks and LPWAN, provide utilities with cost-effective options, especially in challenging terrains where wired solutions may be costly or impractical.

By Region: The market is segmented regionally into North America, Europe, Asia Pacific, and Latin America. North America dominates the regional segmentation due to early adoption of smart grid technologies and significant government initiatives that support advanced utility communication solutions, fostering rapid digital transformation in the utility sector.

By Network Technology: Network technology segmentation includes fiber optics, Ethernet, cellular networks, and RF mesh. Fiber optics is a leading segment due to its high bandwidth capacity and immunity to electromagnetic interference, which is critical in supporting real-time data transfer and reliability. This technology is preferred for applications requiring large data handling, such as smart grid communications and substation automation.

Global Utility Communication Market Competitive Landscape

The Global Utility Communication Market is characterized by a few major players with established reputations in technology and service excellence. Key companies include ABB Ltd., Siemens AG, and General Electric, which have significant influence over the market through their extensive R&D investments and innovations in utility communication solutions.

Global Utility Communication Market Analysis

Growth Drivers

- Increasing Demand for Reliable Utility Communication Networks: With rising population and urban migration, the need for reliable, uninterrupted utility communication networks has surged. In 2024, global urban centers require about 10 billion cubic meters of water daily, emphasizing the need for efficient utility networks to manage resources effectively. Data from the International Energy Agency highlights that over 2 billion smart meters are operational worldwide, with more than 20% in North America, ensuring communication reliability. Backing this demand, in 2024 alone, investments in communication networks have topped 60 billion units, underlining the critical nature of robust infrastructure.

- Integration with Smart Grid Infrastructure: Global smart grid initiatives are expanding rapidly, with data showing over 500 million households adopting smart grids. Countries like the U.S. have invested more than 30 billion units in smart grid communications by 2024, enhancing efficiency and service continuity. Utility providers are increasingly deploying advanced smart grid tools, including automated distribution and fault detection, supported by sophisticated communication networks for real-time data sharing. The World Bank supports these initiatives, noting the integration of 5 million smart devices annually across Asia-Pacific, necessitating seamless utility communication networks.

- Rising Investment in Digitalization of Utilities: As digitalization advances, utility companies are seeing exponential growth in digital solutions, requiring communication networks to manage energy, water, and waste services. In 2024, global investments in digital utility solutions reached 75 billion units, with North America accounting for nearly a third of this figure. Digital platforms and applications that monitor resource usage, detect system failures, and ensure efficient service are prioritized. Key players are deploying automated communication tools, reducing operational costs by over 25 billion units in maintenance alone, strengthening the case for continued digital investment.

Market Challenges

- High Initial Infrastructure Costs: Establishing a comprehensive utility communication network is cost-intensive, requiring over 70 billion units annually for infrastructure setup globally. Rural regions especially face a cost burden, with installation costs up to three times higher than urban areas, reaching nearly 20 billion units. These high upfront costs limit new players entry and restrict utility providers' expansion to underserved regions, impacting overall market growth.

- Data Security and Cybersecurity Threats: The 2024 data from cybersecurity agencies indicates over 1 billion units in cyber losses specifically in utility sectors due to breaches. With utilities managing sensitive customer and operational data, the potential financial impact of a cybersecurity incident remains a significant risk. Reports suggest over 80% of utility companies are investing in cybersecurity solutions to mitigate these risks, with allocations of more than 15 billion units specifically for data security protocols, underscoring the critical nature of cybersecurity challenges in the industry.

Global Utility Communication Market Future Outlook

Over the next five years, the Global Utility Communication Market is expected to witness substantial growth, driven by advancements in 5G technology, an increasing emphasis on grid modernization, and an escalating need for cybersecurity in utility infrastructures. This market growth aligns with global trends toward sustainable energy solutions and digital transformation across utility sectors.

Market Opportunities

- Advancements in IoT-Enabled Utility Solutions: IoT adoption in the utility sector is opening significant market opportunities. In 2024, IoT sensors and devices deployed in utilities reached over 500 million globally, enabling detailed data analytics for predictive maintenance and resource management. IoT-enabled devices in smart grids, supported by advanced communication networks, are expected to reduce operational costs by nearly 15 billion units annually, creating ample growth potential for providers who adopt these innovations.

- Expansion in Rural and Underserved Regions: The demand for utility communication networks in underserved regions is on the rise, as access to reliable infrastructure becomes a priority for governments. In 2024, about 1 billion units have been allocated by governments worldwide for utility expansion in rural areas. Countries in Africa and Asia-Pacific have initiated partnerships to connect over 100 million people with improved utility services, offering significant growth prospects for utility communication providers.

Scope of the Report

|

By Communication Type |

Wired Communication |

|

By Network Technology |

Fiber Optics |

|

By Utility Type |

Electric Utility |

|

By Component |

Hardware |

|

By Application |

Transmission and Distribution |

Products

Key Target Audience

Utility Companies and Energy Providers

Smart Grid and IoT Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

Communication Technology Providers

Renewable Energy Companies

Cybersecurity Firms

Telecommunications Companies

Companies

Players Mentioned in the Report:

ABB Ltd.

Siemens AG

General Electric Company

Schneider Electric

Cisco Systems, Inc.

Nokia Networks

Motorola Solutions, Inc.

Fujitsu Ltd.

Ericsson

Huawei Technologies Co., Ltd.

Table of Contents

1. Global Utility Communication Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Utility Communication Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Utility Communication Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Reliable Utility Communication Networks

3.1.2 Integration with Smart Grid Infrastructure

3.1.3 Rising Investment in Digitalization of Utilities

3.1.4 Government Initiatives for Enhanced Connectivity

3.2 Market Challenges

3.2.1 High Initial Infrastructure Costs

3.2.2 Data Security and Cybersecurity Threats

3.2.3 Limited Interoperability Between Devices

3.2.4 Regulatory Compliance Complexity

3.3 Opportunities

3.3.1 Advancements in IoT-Enabled Utility Solutions

3.3.2 Expansion in Rural and Underserved Regions

3.3.3 Collaborative Public-Private Partnerships

3.3.4 Integration of Renewable Energy Sources

3.4 Trends

3.4.1 Emergence of 5G in Utility Communications

3.4.2 Shift Towards Cloud-Based Communication Systems

3.4.3 Increased Use of AI and ML for Predictive Maintenance

3.4.4 Transition to Low-Power Wide-Area Networks (LPWANs)

3.5 Government Regulation

3.5.1 Communication Compliance Standards

3.5.2 Data Privacy and Cybersecurity Regulations

3.5.3 Emission Reduction Targets for Utilities

3.5.4 Utility Communication Reliability Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. Global Utility Communication Market Segmentation

4.1 By Communication Type (in Value %)

4.1.1 Wired Communication

4.1.2 Wireless Communication

4.2 By Network Technology (in Value %)

4.2.1 Fiber Optics

4.2.2 Ethernet

4.2.3 Cellular Networks

4.2.4 RF Mesh

4.3 By Utility Type (in Value %)

4.3.1 Electric Utility

4.3.2 Water Utility

4.3.3 Gas Utility

4.4 By Component (in Value %)

4.4.1 Hardware

4.4.2 Software

4.4.3 Services

4.5 By Application (in Value %)

4.5.1 Transmission and Distribution

4.5.2 Advanced Metering Infrastructure

4.5.3 Substation Automation

4.5.4 Demand Response

5. Global Utility Communication Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ABB Ltd.

5.1.2 Siemens AG

5.1.3 General Electric Company

5.1.4 Schneider Electric

5.1.5 Cisco Systems, Inc.

5.1.6 Nokia Networks

5.1.7 Motorola Solutions, Inc.

5.1.8 Fujitsu Ltd.

5.1.9 Ericsson

5.1.10 Huawei Technologies Co., Ltd.

5.1.11 Landis+Gyr

5.1.12 Itron Inc.

5.1.13 Trilliant Networks

5.1.14 RAD Data Communications

5.1.15 OSIsoft LLC

5.2 Cross Comparison Parameters (Headquarters, R&D Expenditure, Product Portfolio Breadth, Regional Presence, Market Strategy, Revenue, Employee Count, Inception Year)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Utility Communication Market Regulatory Framework

6.1 Communication Standards for Utilities

6.2 Compliance Requirements for Data Transmission

6.3 Certification Processes for Communication Equipment

7. Global Utility Communication Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Utility Communication Future Market Segmentation

8.1 By Communication Type (in Value %)

8.2 By Network Technology (in Value %)

8.3 By Utility Type (in Value %)

8.4 By Component (in Value %)

8.5 By Application (in Value %)

9. Global Utility Communication Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial stage involves mapping the ecosystem within the Global Utility Communication Market, identifying all significant stakeholders and data sources. Extensive desk research is conducted to define critical variables, with a focus on credible secondary databases and proprietary information.

Step 2: Market Analysis and Construction

Historical data for the Global Utility Communication Market is compiled and analyzed to assess trends in market penetration, technological adoption, and revenue distribution. This stage ensures an accurate understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are formulated and validated through interviews with industry professionals, using computer-assisted telephone interviews (CATI). Expert input is incorporated to refine and confirm findings, providing a robust base for the analysis.

Step 4: Research Synthesis and Final Output

In this final stage, direct engagements with utility communication providers enable a detailed assessment of product and service offerings, customer preferences, and technological advancements, ensuring a validated, comprehensive report.

Frequently Asked Questions

1. How big is the Global Utility Communication Market?

The Global Utility Communication Market is valued at USD 20.5 billion, driven by increasing digitalization in the utility sector and an emphasis on reliable and secure communication networks.

2. What are the challenges in the Global Utility Communication Market?

The market faces challenges like high infrastructure costs, data privacy concerns, and regulatory compliance requirements, all of which necessitate robust solutions to meet industry standards.

3. Who are the major players in the Global Utility Communication Market?

Key players include ABB Ltd., Siemens AG, and General Electric, among others, known for their technological innovations and expansive global presence.

4. What are the growth drivers of the Global Utility Communication Market?

The market is propelled by advancements in smart grid infrastructure, government support for digitalization, and an increasing focus on cybersecurity within utility sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.