Global Variable Air Volume (VAV) Systems Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD8643

December 2024

95

About the Report

Global Variable Air Volume (VAV) Systems Market Overview

- The global Variable Air Volume (VAV) systems market was valued at USD 15.5 billion based on an in-depth analysis of its five-year history. The market has been driven by the growing demand for energy-efficient HVAC systems, which help in reducing energy consumption in large commercial and industrial buildings. Stringent environmental regulations promoting energy efficiency and sustainability have further accelerated the adoption of VAV systems.

- Major markets for VAV systems include the United States, China, and Germany, with the U.S. dominating due to the significant number of large commercial buildings and the advanced infrastructure of the HVAC industry. In China, rapid urbanization and industrialization have led to increased demand for VAV systems in new construction projects. Germany has also seen growth driven by its commitment to energy-efficient building standards, supported by government regulations.

- Many countries have set ambitious emission reduction targets, driving demand for energy-efficient HVAC solutions like VAV systems. In 2024, the U.S. committed to reducing carbon emissions by 50%, in line with the Paris Agreement, which includes energy efficiency measures in commercial buildings. Similarly, the European Union aims to achieve carbon neutrality by 2050, with stricter emission regulations for new and existing buildings. VAV systems, which can significantly reduce energy consumption and emissions, are becoming a key solution to meet these targets in both new constructions and retrofits.

Global Variable Air Volume (VAV) Systems Market Segmentation

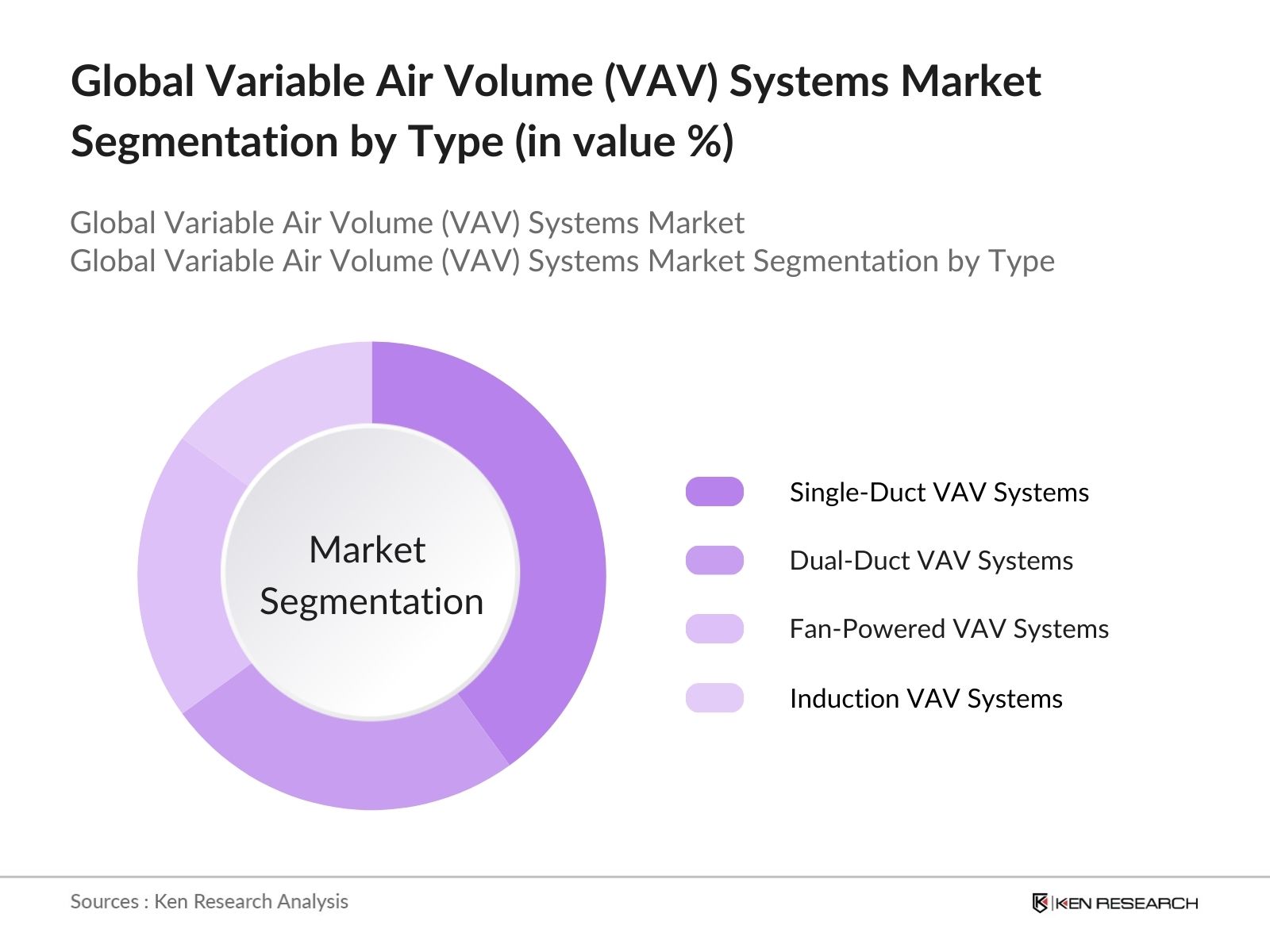

By Type: The global Variable Air Volume systems market is segmented by type into single-duct VAV systems, dual-duct VAV systems, fan-powered VAV systems, and induction VAV systems. Among these, single-duct VAV systems hold the dominant market share in 2023. This is due to their widespread usage in large-scale commercial and industrial projects where energy efficiency and cost-effectiveness are primary concerns. Single-duct VAV systems are preferred because they offer a simpler and less expensive solution while still providing excellent zone-level control of air distribution.

By Region: The regional segmentation includes North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2023, North America leads the market for VAV systems due to strict energy-efficiency regulations and a large number of high-rise commercial buildings. The regions advanced construction and HVAC industries, alongside significant retrofitting initiatives for older buildings, contribute to its leadership in the market.

By Application: The VAV systems market is also segmented by application into commercial buildings, industrial buildings, residential buildings, and healthcare facilities. Commercial buildings dominate the market in 2023, particularly large office buildings, retail spaces, and educational institutions. The reason for this dominance is the higher need for energy-efficient HVAC systems in large commercial spaces to ensure regulatory compliance with energy efficiency mandates and optimize cost savings over long-term usage.

Global Variable Air Volume (VAV) Systems Market Competitive Landscape

The VAV systems market is dominated by a few major players that offer comprehensive HVAC solutions, including both product manufacturing and after-sales services. These companies often invest in R&D to introduce more energy-efficient systems that meet evolving global standards. They also engage in strategic collaborations and acquisitions to expand their market reach. The competitive landscape of the market underscores the dominance of established players who are focusing on innovative HVAC systems, partnerships, and sustainability efforts to cater to evolving market demands.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Number of Employees |

Product Range |

R&D Expenditure |

Geographic Reach |

Sustainability Initiatives |

Recent Mergers/Acquisitions |

|

Carrier Corporation |

1915 |

Palm Beach, Florida |

- |

- |

- |

- |

- |

- |

- |

|

Trane Technologies |

1913 |

Dublin, Ireland |

- |

- |

- |

- |

- |

- |

- |

|

Johnson Controls International |

1885 |

Cork, Ireland |

- |

- |

- |

- |

- |

- |

- |

|

Daikin Industries, Ltd. |

1924 |

Osaka, Japan |

- |

- |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Munich, Germany |

- |

- |

- |

- |

- |

- |

- |

Global Variable Air Volume (VAV) Systems Market Analysis

Growth Drivers

- Rising Energy Efficiency Regulations: Energy efficiency regulations, such as LEED, BREEAM, and Energy Star, are driving the demand for Variable Air Volume (VAV) systems. In 2024, the U.S. Department of Energy (DOE) mandates energy-efficient HVAC systems in commercial buildings under the Energy Policy Act, promoting VAV systems as a solution to optimize energy consumption. Energy Star-certified buildings in the U.S. saved $6 billion in energy costs in 2023 alone, with VAV systems playing a significant role in these savings. VAV systems are crucial to achieving these standards, ensuring both energy efficiency and indoor air quality compliance.

- Integration with Building Automation Systems: In 2023, BAS-enabled buildings with VAV systems saw energy consumption reductions by up to 30% in commercial spaces, according to a report by the U.S. Green Building Council. The U.S. Energy Information Administration (EIA) states that more than 70% of new commercial buildings constructed in 2024 are equipped with BAS, enabling seamless control over HVAC systems like VAV, contributing to energy efficiency and operational cost reductions.

- Focus on Occupant Comfort and Indoor Air Quality: VAV systems play a vital role in enhancing occupant comfort and improving indoor air quality (IAQ), which has become a priority in many countries. In March 2024, Washington state allocated $45 million for grants specifically aimed at improving school IAQ and energy efficiency, prioritizing schools with inadequate HVAC systems and documented IAQ issues. These systems allow precise control of airflow, ensuring that buildings meet stringent IAQ standards, especially post-COVID-19, where demand for improved ventilation in public buildings has surged.

Challenges

- High Initial Capital Expenditure: In 2024, installation costs for VAV systems in large commercial buildings range from $1.5 million to $3 million, according to the U.S. DOE. These high costs often deter building owners from adopting VAV systems, particularly in smaller markets. Additionally, the annual maintenance of these systems can cost up to $100,000 for large-scale projects, impacting the overall adoption rate, particularly in emerging economies .

- Limited Awareness in Emerging Economies: In emerging economies, the lack of awareness and training in the benefits of VAV systems has slowed market adoption. According to the International Energy Agency (IEA), in 2024, less than 10% of commercial buildings in Southeast Asia implemented VAV systems due to inadequate knowledge about their energy-saving potential. Training programs and educational initiatives in countries like India and Vietnam are limited, further exacerbating this challenge.

Global Variable Air Volume (VAV) Systems Market Future Outlook

Global Variable Air Volume Systems Market is expected to experience significant growth driven by the increased implementation of green building regulations, which mandate energy-efficient solutions in construction. Advancements in IoT-based HVAC control systems will also drive the market forward, as real-time air distribution control becomes a critical factor in building management. As awareness of energy efficiency and sustainable construction continues to rise, emerging markets such as India and Southeast Asia are expected to witness robust demand for VAV systems.

Future Market Opportunities

- Expansion of Smart Building Projects: In 2023, the global market for IoT-enabled building technologies was valued at $75 billion, driven by demand for energy-efficient solutions. Smart VAV systems that integrate with IoT platforms offer advanced features such as real-time monitoring and energy optimization, which are becoming increasingly popular in commercial buildings. The U.S. Smart Buildings Initiative has allocated $2.5 billion for integrating IoT in HVAC systems, including VAV, making this a promising opportunity .

- Growing Demand in Healthcare and Education Sectors: Healthcare and education sectors have specific HVAC requirements, driving demand for VAV systems. The U.S. healthcare construction market grew by $40 billion in 2023, with hospitals and clinics increasingly adopting VAV systems to meet stringent air quality and ventilation standards. Similarly, in the education sector, over 15,000 new schools in the U.S. installed VAV systems in 2023, funded by government grants aimed at improving IAQ.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type |

Single-Duct VAV Systems Dual-Duct VAV Systems Fan-Powered VAV Systems Induction VAV Systems |

|

By Application |

Commercial Buildings Industrial Buildings Residential Buildings Healthcare Facilities |

|

By Component |

VAV Terminals Ducts and Dampers Control Systems and Sensors Air Filters and Purifiers |

|

By End-User |

HVAC Contractors Facilities Management Companies Government and Municipal Buildings Infrastructure Development Firms |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

HVAC System Manufacturers

Building Automation Companies

Commercial Real Estate Developers

Facilities Management Companies

Energy Efficiency Regulators (U.S. DOE, European Energy Commission)

HVAC Contractors and Installers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agency)

Companies

Players Mentioned in the Report

Carrier Corporation

Trane Technologies

Johnson Controls International

Daikin Industries, Ltd.

Siemens AG

Honeywell International Inc.

Mitsubishi Electric Corporation

Schneider Electric

Lennox International

Ingersoll Rand

Table of Contents

Global Variable Air Volume (VAV) Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Growth Rate (HVAC Market, Building Management Systems)

1.4. Key Market Drivers (Energy Efficiency, Regulatory Requirements, Occupant Comfort)

1.5. Market Segmentation Overview

Global Variable Air Volume (VAV) Systems Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Milestones and Developments in the Market

Global Variable Air Volume (VAV) Systems Market Analysis

3.1. Growth Drivers

3.1.1. Rising Energy Efficiency Regulations (LEED, BREEAM, Energy Star)

3.1.2. Integration with Building Automation Systems (BAS Integration)

3.1.3. Focus on Occupant Comfort and Indoor Air Quality (IAQ Standards)

3.1.4. Retrofit Demand in Existing Buildings (Energy Retrofitting Initiatives)

3.2. Market Challenges

3.2.1. High Initial Capital Expenditure (Installation and Maintenance Costs)

3.2.2. Complexity in System Design and Installation (Technical Skill Requirements)

3.2.3. Limited Awareness in Emerging Economies (Education and Training Gaps)

3.2.4. Compatibility Issues with Existing HVAC Systems (System Integration Barriers)

3.3. Opportunities

3.3.1. Expansion of Smart Building Projects (IOT Integration)

3.3.2. Growing Demand in Healthcare and Education Sectors (Specific HVAC Requirements)

3.3.3. Energy Consumption Optimization in Large-Scale Projects (Green Building Codes)

3.3.4. Emerging Markets for Energy-Saving Technologies (Developing Nations Adoption)

3.4. Trends

3.4.1. Integration with Renewable Energy Sources (Solar-Powered HVAC Systems)

3.4.2. Advanced Control Systems and Automation (Smart HVAC Controllers)

3.4.3. Demand for Flexible HVAC Systems (Modular and Customizable VAV Systems)

3.4.4. Integration with Advanced Air Filtration and Purification Systems (Air Quality Management)

3.5. Government Regulation

3.5.1. Energy Efficiency Standards (ASHRAE, DOE, EPBD)

3.5.2. Emission Reduction Targets (Carbon Neutrality Policies)

3.5.3. Building Energy Performance Codes (ZEB, Net-Zero Building Policies)

3.5.4. HVAC System Safety Standards (Safety Guidelines and Certifications)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Contractors, Distributors, Consultants)

3.8. Porters Five Forces Analysis

Global Variable Air Volume (VAV) Systems Market Segmentation

4.1. By Type (In Value %)

4.1.1. Single-Duct VAV Systems

4.1.2. Dual-Duct VAV Systems

4.1.3. Fan-Powered VAV Systems

4.1.4. Induction VAV Systems

4.2. By Application (In Value %)

4.2.1. Commercial Buildings

4.2.2. Industrial Buildings

4.2.3. Residential Buildings

4.2.4. Healthcare Facilities

4.3. By Component (In Value %)

4.3.1. VAV Terminals

4.3.2. Ducts and Dampers

4.3.3. Control Systems and Sensors

4.3.4. Air Filters and Purifiers

4.4. By End-User (In Value %)

4.4.1. HVAC Contractors

4.4.2. Facilities Management Companies

4.4.3. Government and Municipal Buildings

4.4.4. Infrastructure Development Firms

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

Global Variable Air Volume (VAV) Systems Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Carrier Corporation

5.1.2. Trane Technologies

5.1.3. Daikin Industries, Ltd.

5.1.4. Johnson Controls International

5.1.5. Siemens AG

5.1.6. Honeywell International Inc.

5.1.7. Mitsubishi Electric Corporation

5.1.8. Schneider Electric

5.1.9. Lennox International

5.1.10. Ingersoll Rand

5.2. Cross Comparison Parameters (Revenue, Headquarters, Product Range, Number of Patents, Research & Development Focus, Market Penetration, Sustainability Initiatives, After-Sales Support)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts and Grants

5.8. New Product Developments

Global Variable Air Volume (VAV) Systems Market Regulatory Framework

6.1. Energy Efficiency Regulations

6.2. Environmental Compliance Standards

6.3. Certification Processes (LEED Certification, Energy Star Certification)

Global Variable Air Volume (VAV) Systems Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Variable Air Volume (VAV) Systems Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Component (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

Global Variable Air Volume (VAV) Systems Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Acquisition Strategies

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying critical variables such as the types of VAV systems, key applications, and major growth drivers within the HVAC sector. This is done by reviewing industry white papers, government reports, and proprietary databases.

Step 2: Market Analysis and Construction

This phase involves the analysis of historical data and trends in the VAV systems market to establish current market dynamics. This includes evaluating the penetration of different VAV systems across sectors like healthcare, commercial, and industrial buildings.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading HVAC system manufacturers and building management companies are consulted through surveys and in-depth interviews. This validation process helps refine the market forecasts and verify critical trends observed during data analysis.

Step 4: Research Synthesis and Final Output

In the final step, we compile and synthesize the collected data, cross-referencing it with insights from industry leaders and government databases. This ensures the report is comprehensive, accurate, and aligned with market realities.

Frequently Asked Questions

01. How big is the Global Variable Air Volume (VAV) Systems Market?

The global VAV systems market was valued at USD 15.5 billion, driven by increased demand for energy-efficient HVAC solutions in commercial and industrial buildings.

02. What are the challenges in the Global VAV Systems Market?

Challenges in global VAV systems market include high initial installation costs, system complexity, and the limited adoption of advanced VAV systems in emerging markets due to a lack of awareness and skilled technicians.

03. Who are the major players in the Global VAV Systems Market?

Key players in global VAV systems market include Carrier Corporation, Trane Technologies, Johnson Controls International, Daikin Industries, Ltd., and Siemens AG. These companies dominate due to their established product portfolios and extensive global reach.

04. What are the growth drivers of the Global VAV Systems Market?

Growth in global VAV systems market is primarily driven by stringent energy efficiency regulations, the rise of smart buildings, and advancements in IoT-based HVAC systems, which enhance energy savings and occupant comfort.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.