Global Vegan Dips Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD9390

December 2024

88

About the Report

Global Vegan Dips Market Overview

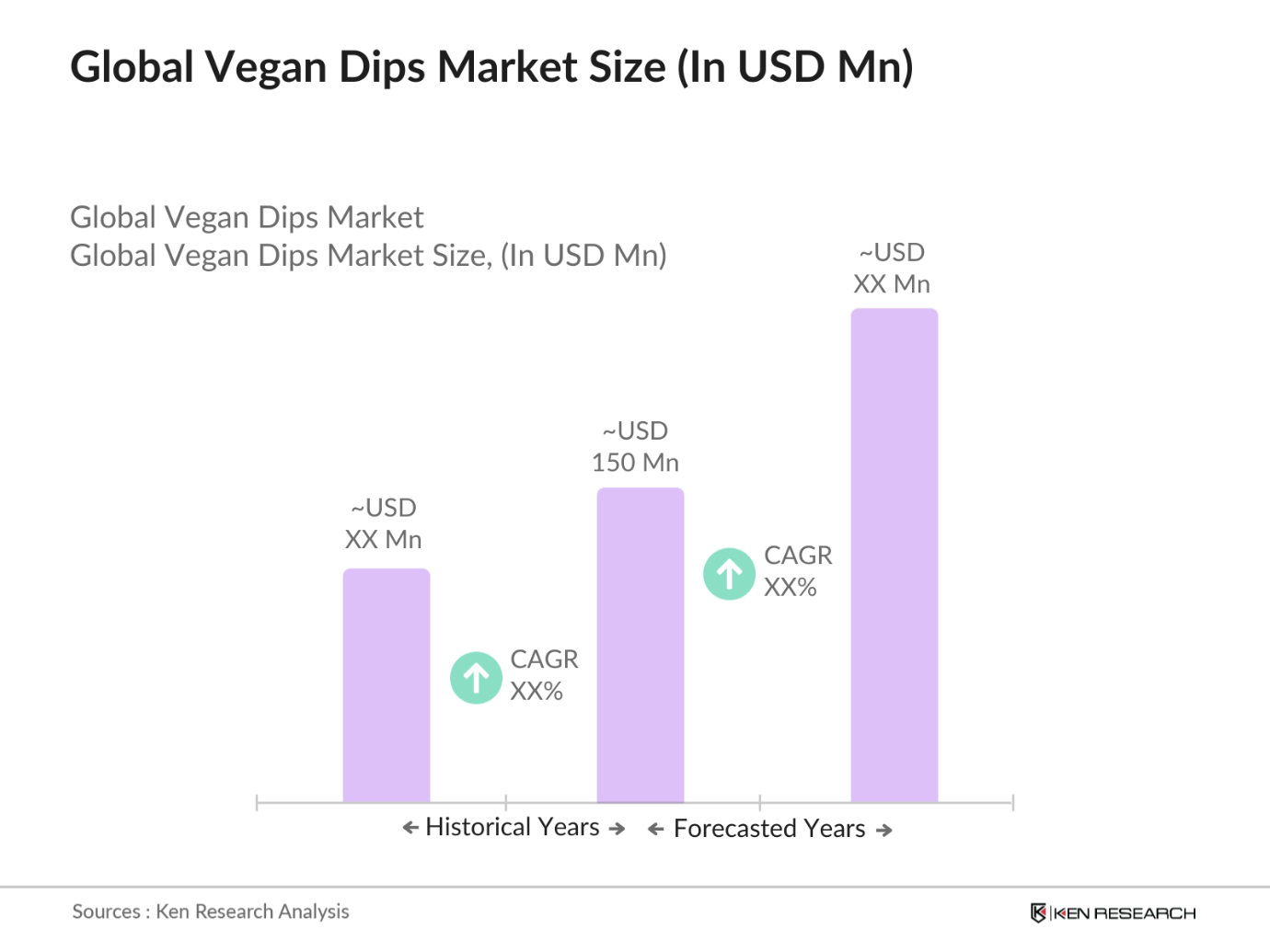

- The Global Vegan Dips market is valued at USD 150 million, according to a five-year historical analysis. This growth is largely driven by increased consumer awareness of health benefits associated with plant-based diets. A surge in veganism, especially among younger demographics, and the trend towards clean-label products have further fueled demand, leading to a steady rise in consumption globally. Key players focus on innovative flavors and health-oriented ingredients, keeping the market growth dynamic and consumer-oriented.

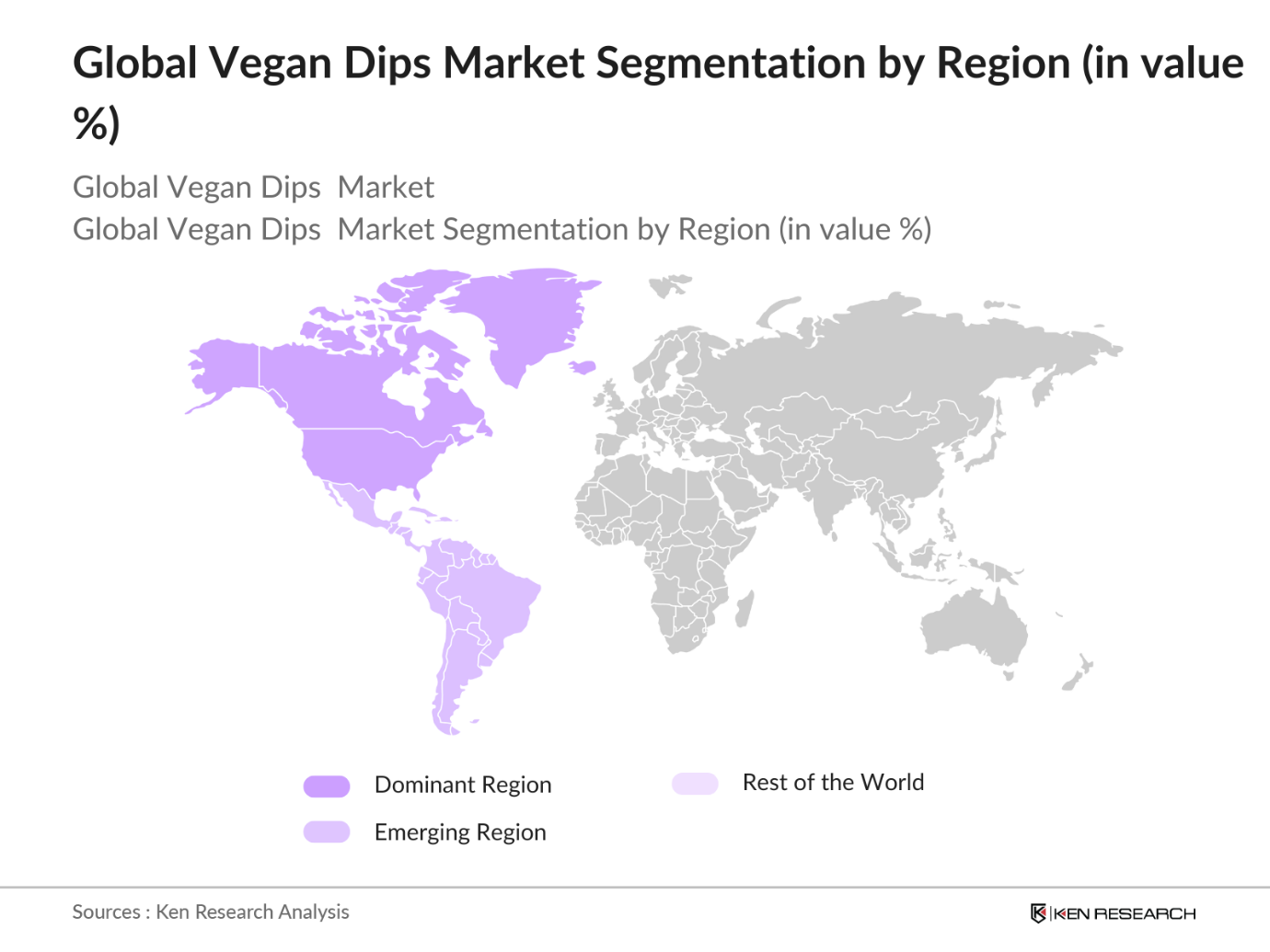

- The United States, Germany, and the United Kingdom are key players in the vegan dips market, owing to their well-developed vegan food infrastructure, high consumer purchasing power, and established retail distribution channels. The growing health-conscious populations in these countries, combined with supportive regulations around plant-based foods, have positioned them as dominant regions. Additionally, rising concerns about environmental sustainability and animal welfare resonate strongly with consumers in these areas, supporting continued market leadership.

- Governments across various regions have implemented stringent food safety standards that vegan dips must comply with to ensure consumer safety. For instance, the U.S. Food and Drug Administration (FDA) requires that all food products, including vegan dips, adhere to specific labeling, ingredient disclosure, and safety regulations. Compliance with these regulations is essential for companies to maintain market access and consumer trust. As the market for vegan products expands, regulatory bodies are likely to continue developing guidelines that address food safety, nutritional content, and labeling transparency.

Global Vegan Dips Market Segmentation

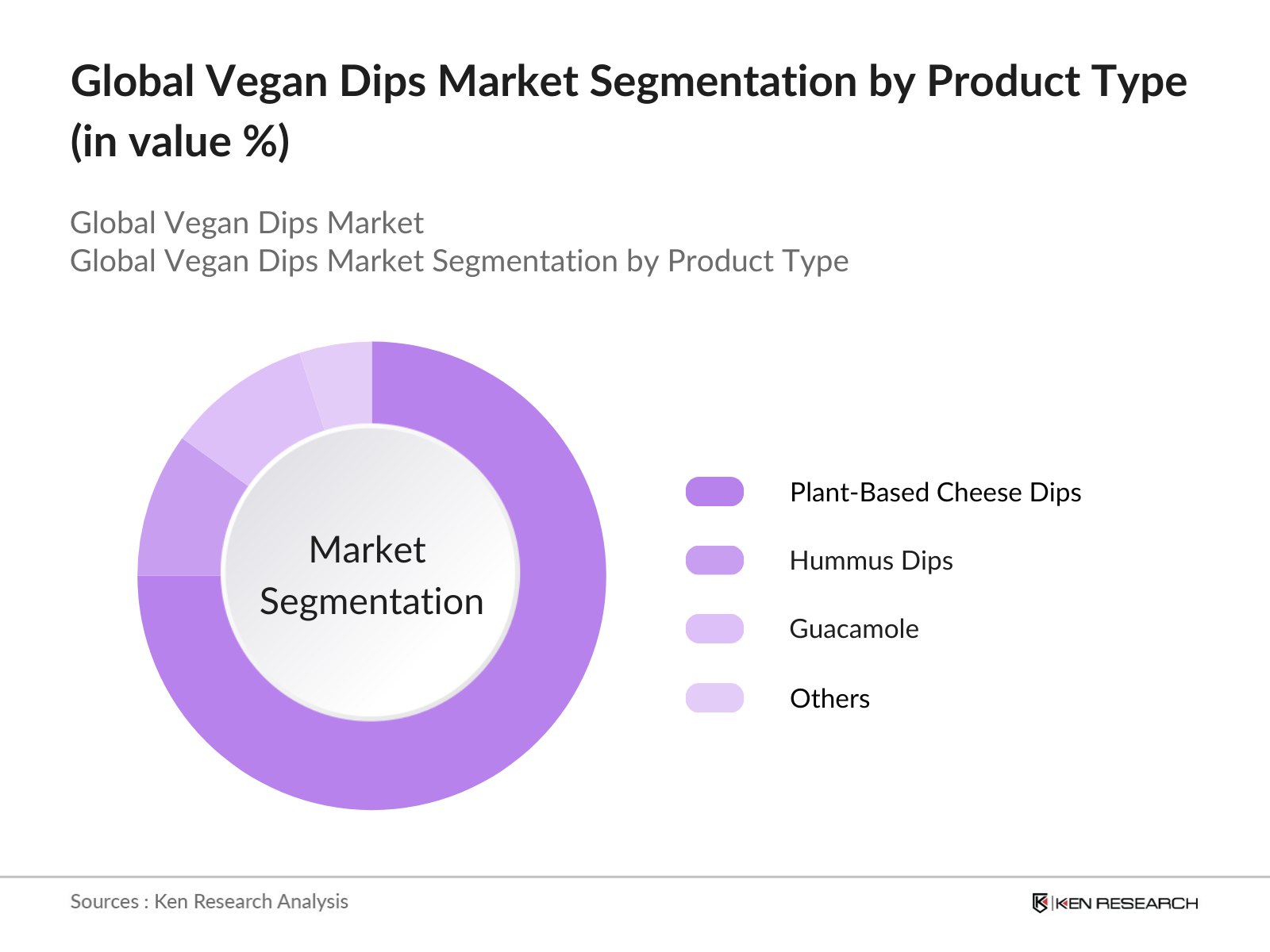

By Product Type: The Global Vegan Dips Market is segmented by product type into plant-based cheese dips, hummus dips, guacamole, and others. Recently, hummus dips have maintained a dominant market share, primarily due to their widespread popularity as a versatile, protein-rich snack option. The high nutritional value of hummus, combined with the increasing demand for Middle Eastern flavors, has led to a surge in its popularity among health-conscious consumers.

By Distribution Channel: The market is segmented into supermarkets & hypermarkets, online stores, and convenience stores. Online stores have emerged as the leading distribution channel, driven by the convenience of online shopping and the availability of a wide variety of vegan dips on e-commerce platforms. The growing number of digital consumers has also encouraged manufacturers to invest in online channels, offering promotions and discounts that appeal to a broader audience.

|

Distribution Channel |

Market Share (2023) |

|---|---|

|

Supermarkets & Hypermarkets |

35% |

|

Online Stores |

45% |

|

Convenience Stores |

20% |

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the largest market share due to a high prevalence of veganism, robust distribution networks, and a consumer base inclined towards plant-based diets. The growing awareness of ethical and environmental issues in the U.S. and Canada has reinforced the dominance of North America in the vegan dips market.

Global Vegan Dips Competitive Landscape

The Global Vegan Dips Market is dominated by several major players, reflecting a competitive landscape focused on innovative product launches, flavor diversity, and clean-label ingredients. This consolidation highlights the influence of established brands and emerging companies in shaping market trends.

Global Vegan Dips Market Analysis

Growth Drivers

- Rising Health Consciousness: As consumers become increasingly health-conscious, the demand for vegan dips has surged. According to the World Health Organization, global obesity rates have more than doubled since 1980, prompting many to shift towards healthier eating habits. With 55% of consumers actively seeking healthier snack options, the vegan dips market is poised for growth. This shift towards healthier lifestyles is complemented by a growing awareness of the nutritional benefits associated with plant-based diets, which emphasize fiber and lower saturated fat intake.

- Increasing Plant-Based Diet Adoption: The plant-based food sector is expanding rapidly, driven by consumer demand for sustainable and ethical food choices. The Good Food Institute reports that plant-based food sales in the U.S. alone reached $7 billion in 2021, marking a 27% increase since 2019. This trend reflects a growing consumer preference for plant-based products, which is driving the demand for vegan dips, positioning them as a preferred option for both snacking and meal accompaniments.

- Expansion of Distribution Channels: The rise of e-commerce has significantly impacted the availability of vegan dips. A report by Statista highlights that online grocery sales are expected to reach $200 billion by 2025 in the U.S. This shift towards online shopping has allowed consumers greater access to niche products like vegan dips, contributing to their increased popularity and sales. Traditional retail channels are also adapting, with more health food stores and supermarkets expanding their offerings to include vegan options.

Market Challenges

- Limited Awareness Among Consumers: Despite the growth of the vegan dips market, a significant portion of consumers remains unaware of these products and their benefits. According to a survey conducted by the Plant-Based Foods Association, 40% of consumers reported being unfamiliar with vegan dips or unsure of how they differ from traditional dips. This lack of awareness is particularly pronounced in regions where plant-based diets have not yet gained traction, leading to slower adoption rates. To counter this challenge, companies need to invest in targeted marketing and educational initiatives that highlight the benefits and versatility of vegan dips.

- Perceived Taste Limitations: A common perception among consumers is that vegan dips do not taste as good as their traditional counterparts. A report by Nielsen indicates that taste is the primary factor influencing consumers purchasing decisions, and many perceive plant-based products as lacking in flavor. This perception can hinder the willingness of consumers to try vegan dips, particularly those who have not yet adopted a plant-based lifestyle. To address this challenge, manufacturers must focus on product development that enhances flavor profiles and creates appealing taste experiences that rival traditional dips.

Global Vegan Dips Market Future Outlook

Over the next five years, the Global Vegan Dips market is expected to exhibit significant growth, driven by an increasing shift towards plant-based diets, advancements in product formulation, and greater consumer awareness about health and sustainability. This trend will be supported by the expansion of distribution channels, innovative marketing strategies, and consistent consumer demand for ethical and clean-label food products. The market's growth potential is especially strong in emerging economies where plant-based lifestyles are gaining traction.

Market Opportunities

- Product Innovation and Flavor Development: The vegan dips market presents significant opportunities for product innovation, particularly in flavor development. As consumer preferences evolve, there is an increasing demand for unique and exciting flavor combinations that cater to diverse palates. Current trends show that consumers are eager to explore globally inspired flavors, with spices and ingredients from different cultures gaining popularity. According to Mintel, 52% of consumers express interest in trying new flavors in dips, indicating a clear opportunity for brands to expand their product offerings.

- Growing Demand for Clean Label Products: The clean label trend, characterized by transparency in ingredient sourcing and production methods, is reshaping consumer expectations. A survey by Label Insight revealed that 75% of consumers prefer food products with simple, recognizable ingredients. This trend is particularly relevant in the vegan dips market, where consumers are increasingly looking for products that align with their health and wellness goals. Companies that prioritize clean label practices can capitalize on this growing demand by developing dips that highlight natural ingredients and minimal processing.

Scope of the Report

|

Segment |

Sub-Segments |

|---|---|

|

By Product Type |

Hummus |

|

Guacamole |

|

|

Salsa |

|

|

Nut-Based Dips |

|

|

Bean-Based Dips |

|

|

By Ingredient Type |

Legumes |

|

Nuts |

|

|

Vegetables |

|

|

Herbs and Spices |

|

|

By Distribution Channel |

Supermarkets/Hypermarkets |

|

Online Retail |

|

|

Specialty Stores |

|

|

Convenience Stores |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East and Africa |

Products

Key Target Audience

Vegan Food Manufacturers

Supermarkets & Hypermarkets Chains

Health-Conscious Consumers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, EFSA)

Plant-Based Product Distributors

Organic and Natural Food Retailers

E-Commerce Platforms

Companies

Major Players

Hope Foods

Sabra Dipping Co.

Good Foods Group

Tribe Mediterranean Foods

Kite Hill

Califia Farms

Tofutti Brands, Inc.

Miyokos Creamery

Forager Project

Hain Celestial

Follow Your Heart

Wildbrine

WayFare Foods

Primal Kitchen

Daiya Foods

Table of Contents

1. Global Vegan Dips Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Vegan Dips Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Vegan Dips Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Plant-Based Diet Adoption

3.1.3. Expansion of Distribution Channels

3.1.4. Technological Advancements in Food Production

3.2. Market Challenges

3.2.1. Limited Awareness Among Consumers

3.2.2. Perceived Taste Limitations

3.2.3. High Production Costs

3.3. Opportunities

3.3.1. Product Innovation and Flavor Development

3.3.2. Growing Demand for Clean Label Products

3.3.3. International Market Expansion

3.4. Trends

3.4.1. Rise of Online Retailing

3.4.2. Collaborations with Health and Wellness Brands

3.4.3. Sustainability and Eco-Friendly Packaging

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling Regulations for Plant-Based Products

3.5.3. Nutritional Guidelines

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Vegan Dips Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hummus

4.1.2. Guacamole

4.1.3. Salsa

4.1.4. Nut-Based Dips

4.1.5. Bean-Based Dips

4.2. By Ingredient Type (In Value %)

4.2.1. Legumes

4.2.2. Nuts

4.2.3. Vegetables

4.2.4. Herbs and Spices

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Retail

4.3.3. Specialty Stores

4.3.4. Convenience Stores

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East and Africa

5. Global Vegan Dips Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Wholly Guacamole

5.1.2. Sabra Dipping Company

5.1.3. Hummus & Pita Co.

5.1.4. Eat Well Embrace Life

5.1.5. Lantana Foods

5.1.6. Hope Foods

5.1.7. Dippin' Chips

5.1.8. The Good Bean

5.1.9. Organicville

5.1.10. 365 by Whole Foods Market

5.1.11. Kraft Heinz Company

5.1.12. Simply Natural Foods

5.1.13. Bodega

5.1.14. The Hummus Company

5.1.15. Suncore Foods

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Range, Market Share, Distribution Channels, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Vegan Dips Market Regulatory Framework

6.1. Food Safety Regulations

6.2. Labeling Requirements

6.3. Compliance Guidelines

7. Global Vegan Dips Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Vegan Dips Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

9. Global Vegan Dips Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with mapping the global ecosystem of vegan dips, considering producers, distributors, and consumers. Secondary data from industry reports and credible databases is used to establish key variables influencing market trends.

Step 2: Market Analysis and Data Collection

Historical data analysis is conducted to identify revenue patterns, market penetration levels, and changes in consumer preferences. Quantitative and qualitative data are analyzed to construct a comprehensive market model.

Step 3: Hypothesis Testing and Industry Expert Consultations

Hypotheses regarding market dynamics are validated through direct interviews and surveys with industry experts. Insights from these consultations help refine the data and support findings with operational perspectives.

Step 4: Synthesis and Final Output

A thorough synthesis of data is performed to ensure accuracy. The final report includes a balanced analysis of market segmentation, competitive dynamics, and growth opportunities, addressing all aspects of the vegan dips market.

Frequently Asked Questions

01. How big is the Global Vegan Dips Market?

The Global Vegan Dips Market is valued at USD 150 million, driven by health-conscious consumers and a rising interest in plant-based diets worldwide.

02. What are the growth drivers of the Global Vegan Dips Market?

Growth is fueled by the increasing popularity of plant-based diets, awareness of animal welfare, and the demand for natural, clean-label ingredients in food products.

03. Who are the major players in the Global Vegan Dips Market?

Key players include Hope Foods, Sabra Dipping Co., Good Foods Group, Tribe Mediterranean Foods, and Kite Hill, who dominate due to strong brand recognition and innovative product offerings.

04. What challenges does the Global Vegan Dips Market face?

Challenges include high production costs of organic ingredients, limited consumer awareness in certain regions, and competition from traditional dips.

05. What is the future outlook for the Global Vegan Dips Market?

The market is expected to grow steadily, with a surge in demand for sustainable and plant-based products, expansion into emerging markets, and increased innovation in flavor profiles and distribution strategies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.