Global Video Doorbell Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4430

December 2024

99

About the Report

Global Video Doorbell Market Overview

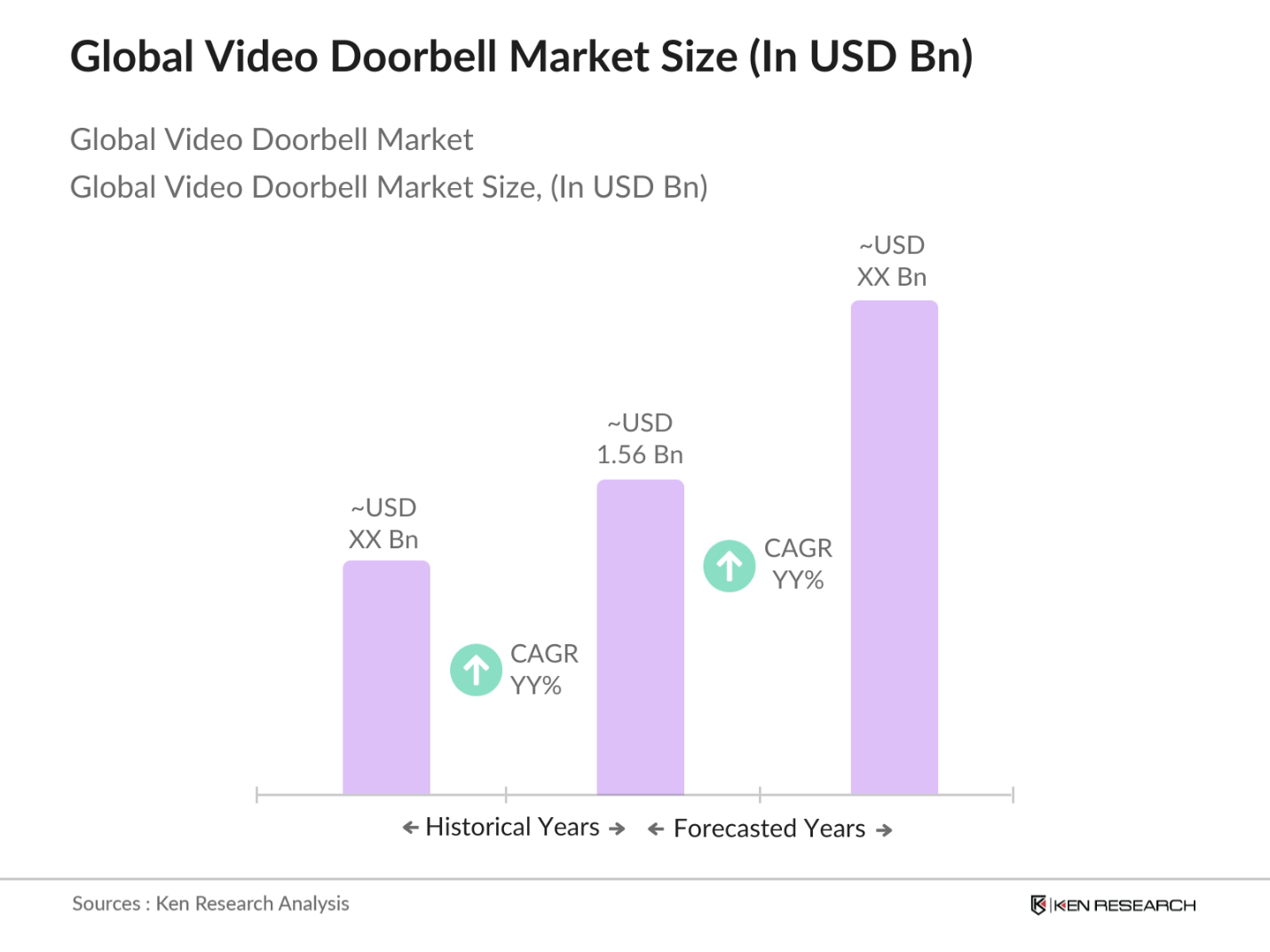

- The global video doorbell market reached a valuation of approximately USD 1.56 billion, driven by the rising demand for smart home solutions and security technologies. These devices offer features like real-time surveillance, night vision, and motion detection, which address security needs in urban areas and are increasingly appealing due to their ease of installation and integration with other smart home devices. The markets growth is also propelled by innovations in AI and cloud-based solutions that facilitate better home security.

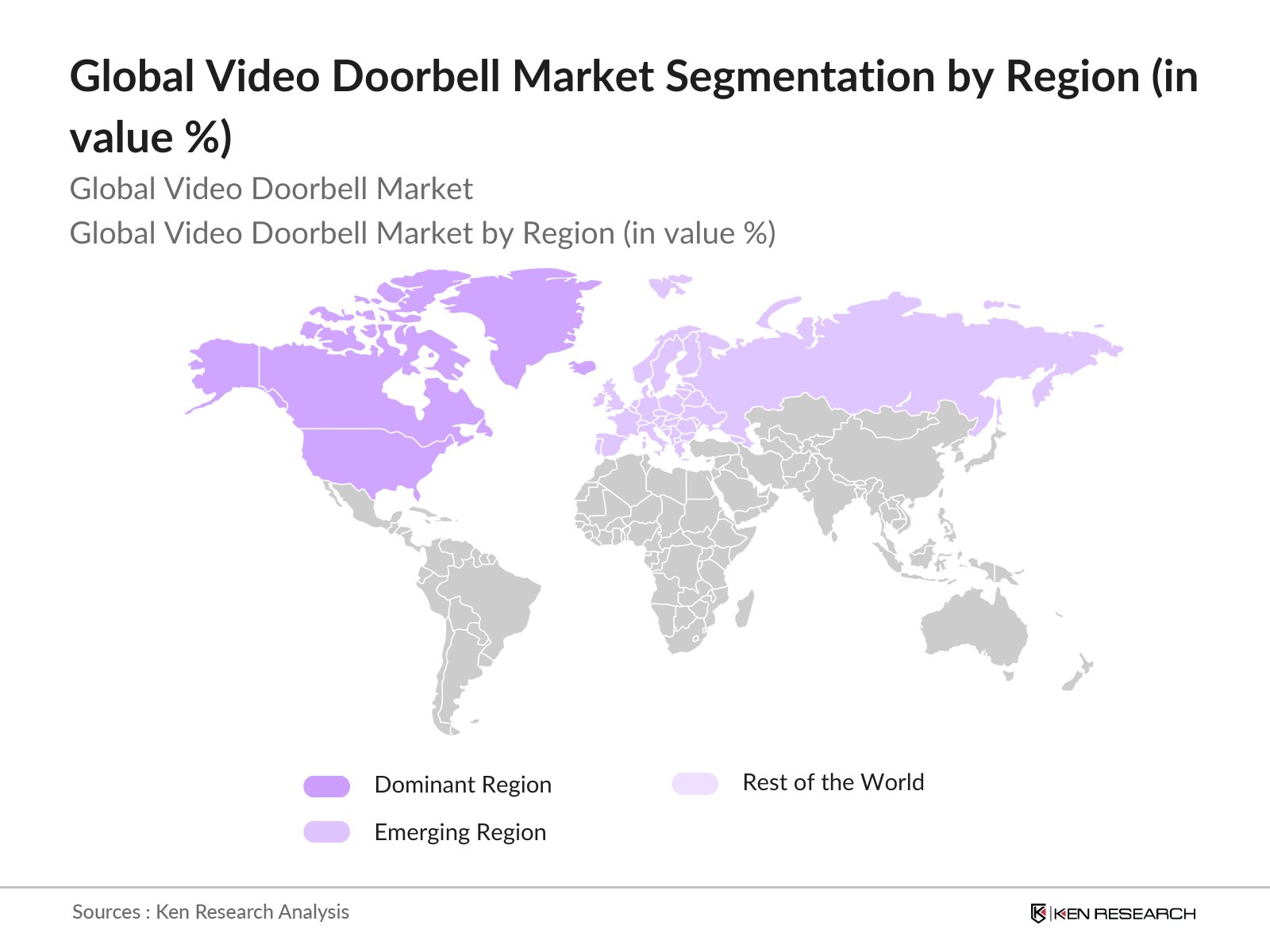

- Major markets for video doorbells include the United States, China, and the United Kingdom, attributed to advanced digital infrastructure, high rates of smart home adoption, and substantial disposable income among consumers. Additionally, increasing urbanization and high property crime rates in these regions drive the need for enhanced home security systems, making these countries leading adopters of video doorbell technologies.

- Global internet users reached nearly 5 billion in 2023, according to the International Telecommunication Union (ITU). Increased internet penetration has enabled more homes to use IoT-enabled devices, including video doorbells. Several government initiatives support this connectivity. For example, Indias Digital India program has focused on expanding internet access and infrastructure in rural and urban areas, enhancing connectivity across all demographics. In the U.S., the Federal Communications Commissions (FCC) Rural Digital Opportunity Fund aims to bring high-speed internet to underserved areas, supporting IoT expansion.

Global Video Doorbell Market Segmentation

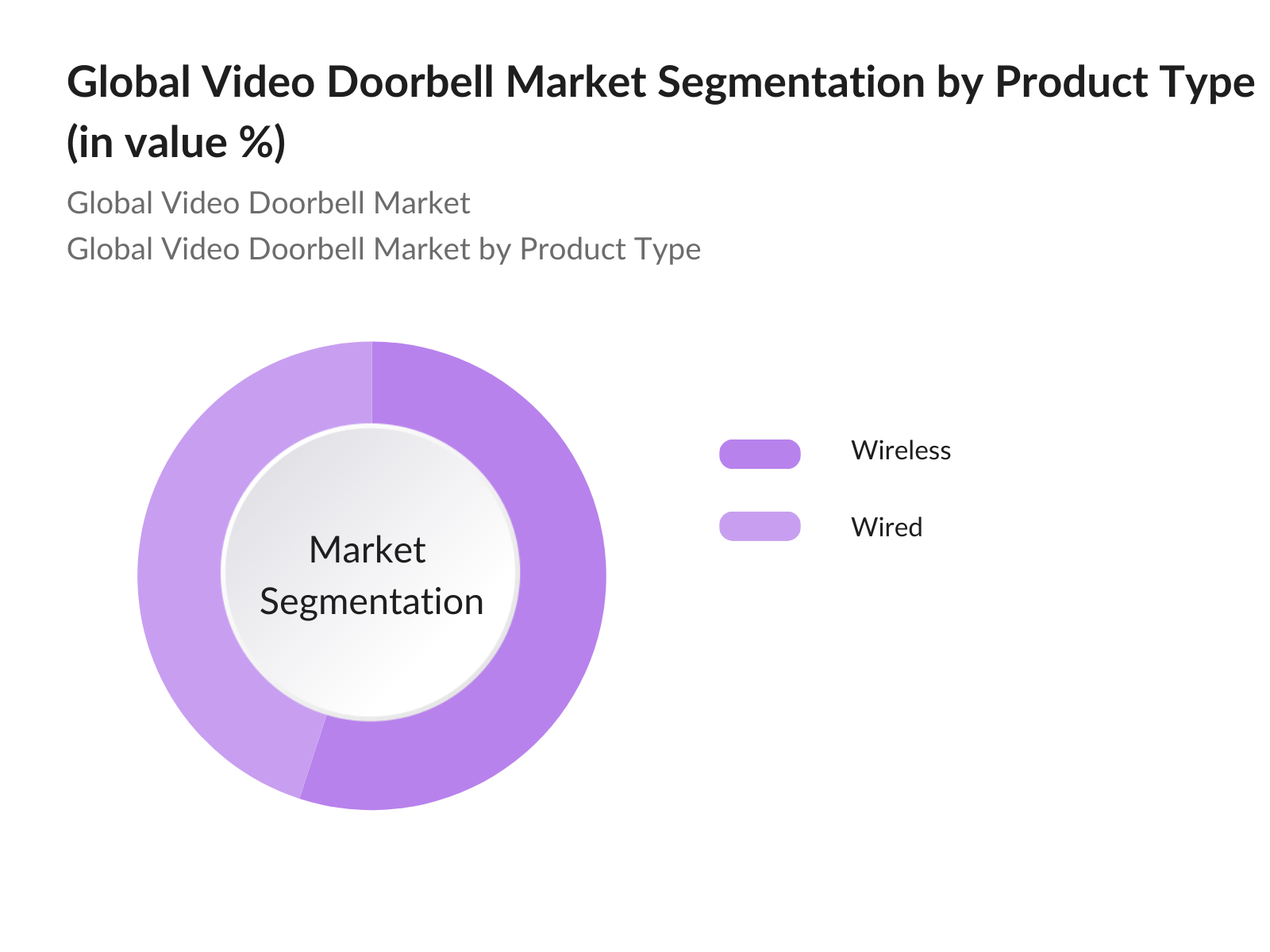

By Product Type: The video doorbell market is segmented by product type into wired and wireless video doorbells. Wireless video doorbells dominate this segment due to their convenience and easy installation, which appeals to both homeowners and renters. This flexibility allows them to be placed at any entry point without drilling, a key feature driving their adoption in urban apartments and rented properties. Their popularity is further enhanced by integrations with mobile devices for remote monitoring.

By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to widespread smart home adoption, high digital infrastructure development, and the presence of top industry players. A surge in smart home investments and awareness regarding home security across the U.S. and Canada contribute significantly to this segment's dominance.

Global Video Doorbell Market Competitive Landscape

The video doorbell market is competitive, with major players focusing on product innovation, security integration, and AI capabilities. Key companies leverage strong R&D capabilities, market presence, and partnerships with smart home ecosystems to maintain their competitive edge.

|

Company |

Establishment Year |

Headquarters |

Key Features |

Product Innovations |

Global Presence |

Security Features |

AI Capabilities |

Partnerships |

|

Ring |

2013 |

Santa Monica, USA |

Multi-Platform |

- |

- |

- |

- |

- |

|

Nest Labs |

2010 |

Palo Alto, USA |

Voice-Activated |

- |

- |

- |

- |

- |

|

SkyBell |

2013 |

Irvine, USA |

Motion Detection |

- |

- |

- |

- |

- |

|

Aiphone Corp |

1948 |

Nagoya, Japan |

Voice & Video |

- |

- |

- |

- |

- |

|

VTech |

1976 |

Hong Kong, China |

Video-First |

- |

- |

- |

- |

- |

Global Video Doorbell Market Analysis

Market Growth Drivers

- Demand for Smart Home Security (with Home Automation Integration): The rise in demand for smart home security systems is tied to the surge in urban households seeking enhanced safety features. Data from the U.S. Census Bureau (2023) shows an increase in household spending on smart home devices in metropolitan areas, with over 70 million households in the U.S. using smart devices for home automation. Integrating video doorbells with these devices meets the security demand as part of comprehensive home automation solutions, driven by homeowners interest in remote monitoring and digital control systems, which have been expanding across urban and suburban households due to rising safety concerns and convenience.

- Increased Internet Penetration and IoT Connectivity: Global internet users reached nearly 5 billion in 2023, according to the International Telecommunication Union (ITU). Increased internet penetration has enabled more homes to use IoT-enabled devices, including video doorbells. Connectivity in developed regions, such as North America and Europe, allows seamless integration of video doorbells with other smart home devices. IoT-based security solutions are expanding in low-to-middle-income countries as well, with a significant rise in household internet users in countries like India. Enhanced IoT networks foster interconnectivity among devices, making video doorbells an accessible, integral security solution across varied demographics.

- Convenience and Remote Monitoring Capabilities: Consumers value video doorbells for remote monitoring, allowing them to view live footage through connected devices. Data from the U.S. Bureau of Labor Statistics reveals that a substantial number of households with internet access have shown interest in remote monitoring services due to increased residential safety concerns. Video doorbells appeal to users who prefer mobile-enabled monitoring, particularly in households where family members or staff are present during the day. These capabilities also appeal to frequent travelers, contributing to increased demand for remote security solutions that support real-time monitoring and notification capabilities.

Market Challenges:

- Data Privacy and Cybersecurity Concerns: With the rise in smart home adoption, data privacy issues remain a critical challenge. The Cybersecurity & Infrastructure Security Agency (CISA) reported over 3 million cyber incidents targeting home security systems in 2023, highlighting security vulnerabilities associated with video doorbells. These incidents emphasize the need for better data protection mechanisms, as video doorbells capture sensitive residential data, necessitating compliance with evolving cybersecurity standards. The risks posed by potential data breaches have raised concerns among consumers, particularly as hackers target personal data from connected home devices, impacting the trust in adopting video doorbells.

- High Cost of Advanced Models: Advanced video doorbell models integrating AI features and cloud storage are often costly, limiting their accessibility to budget-conscious consumers. U.S. Bureau of Economic Analysis data (2023) indicates that households with incomes below $50,000 have a lower rate of adoption of these advanced security devices. Many households in emerging markets find it challenging to justify the expense for premium models, leading to slower adoption rates. Lower-cost alternatives lacking high-end features are more popular, as budget constraints impact the ability of consumers in low-income segments to invest in comprehensive security systems.

Global Video Doorbell Market Future Market Outlook

Over the coming years, the video doorbell market is expected to experience robust growth driven by advancements in AI-based security, rising awareness of home safety, and increased investment in digital infrastructure. Enhanced security features like facial recognition and cloud-based storage are expected to meet the growing consumer demand for reliable, user-friendly solutions. Expanding smart home adoption in emerging markets will further drive market penetration, creating numerous opportunities for market players to expand their reach.

Market Opportunities:

- Technological Advancements (Cloud Storage, AI-Based Analytics): Video doorbells are advancing with AI-based analytics for threat detection and behavior analysis. Cloud-based storage, offered by companies such as Amazon and Google, allows consumers to save video footage, creating a demand for higher-tier security options. According to the World Bank, investments in AI have reached $63 billion globally in 2024, facilitating the adoption of machine learning in consumer security. These advancements have made video doorbells capable of smart recognition features and cloud-enabled access, which attract consumers seeking sophisticated security options without the need for on-premise storage.

- Increased Adoption in Rental Properties: Rental property owners are investing in video doorbells to enhance security for tenants, especially in high-turnover regions like major U.S. and European cities. According to the U.S. Department of Housing and Urban Development (HUD), around 30 million rental units are projected to adopt security measures like video doorbells. This adoption in rental markets has been driven by tenant demand for safe living environments, as rental properties with video doorbells are often more attractive to renters seeking secure accommodations. The ease of installation and non-invasive setup of these devices has furthered their adoption in rental units.

Scope of the Report

|

By Product Type |

Wired Video Doorbells Wireless Video Doorbells |

|

By Distribution Channel |

Online Retailers Offline Retailers |

|

By End-Use |

Residential Commercial Properties Industrial Facilities |

|

By Technology |

Cloud Storage-Based Local Storage-Based |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Home Security System Manufacturers

Electronic Retailers and E-commerce Platforms

Smart Home Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Trade Commission, Communications Commission)

AI and Software Developers

IoT and Cloud Solution Providers

Real Estate Developers

Companies

Players Mention in the Report

Ring

Nest Labs (Google)

August Home

Aiphone Corporation

SkyBell

Eques Home

SmartThings (Samsung)

Smanos

AMOCAM Technology

Zmodo

Dbell

Remo+

VTech Communications

Vivint Smart Home

Netatmo (Legrand)

Table of Contents

01. Global Video Doorbell Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. Global Video Doorbell Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Video Doorbell Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Smart Home Security (with home automation integration)

3.1.2 Increased Internet Penetration and IoT Connectivity

3.1.3 Expansion of Urban Infrastructures (smart city initiatives)

3.1.4 Convenience and Remote Monitoring Capabilities

3.2 Market Challenges

3.2.1 Data Privacy and Cybersecurity Concerns

3.2.2 High Cost of Advanced Models

3.2.3 Dependence on Strong Network Connectivity

3.3 Opportunities

3.3.1 Technological Advancements (cloud storage, AI-based analytics)

3.3.2 Expansion in Emerging Economies

3.3.3 Customization and Integration with Security Ecosystems

3.4 Trends

3.4.1 Voice and Face Recognition Integration

3.4.2 Increased Adoption in Rental Properties

3.4.3 Integration with Home Assistant Devices (e.g., Alexa, Google Assistant)

3.5 Regulatory Framework

3.5.1 Data Protection Regulations

3.5.2 Installation Standards for Security Devices

3.5.3 Industry Compliance Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

04. Global Video Doorbell Market Segmentation

4.1 By Product Type

4.1.1 Wired Video Doorbells

4.1.2 Wireless Video Doorbells

4.2 By Distribution Channel

4.2.1 Online Retailers

4.2.2 Offline Retailers (Electronics Stores, Specialty Stores)

4.3 By End-Use

4.3.1 Residential

4.3.2 Commercial Properties

4.3.3 Industrial Facilities

4.4 By Technology

4.4.1 Cloud Storage-Based

4.4.2 Local Storage-Based

4.5 By Region

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

05. Global Video Doorbell Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Ring

5.1.2 August Home

5.1.3 Eques Home

5.1.4 SkyBell

5.1.5 Zmodo

5.1.6 Vivint Smart Home

5.1.7 Aiphone Corporation

5.1.8 SmartThings

5.1.9 ADT Inc.

5.1.10 Chui

5.1.11 Nest Labs (Google)

5.1.12 Dbell

5.1.13 AMOCAM Technology

5.1.14 Remo+

5.1.15 VTech Communications

5.2 Cross Comparison Parameters (Geographic Presence, Revenue, Innovation Rate, Market Share, Product Portfolio, Pricing Strategy, Partnership Networks, Customer Reviews)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Grants and Subsidies

06. Global Video Doorbell Market Regulatory Framework

6.1 Compliance Requirements

6.2 Data Security Standards

6.3 Cybersecurity Measures

6.4 Certification Processes for Device Compliance

07. Global Video Doorbell Market Future Size

7.1 Projected Market Size

7.2 Key Factors Driving Future Growth

08. Global Video Doorbell Market Analysts Recommendations

8.1 Total Addressable Market (TAM)/Serviceable Addressable Market (SAM) Analysis

8.2 Customer Segment Analysis

8.3 Targeted Marketing Strategies

8.4 White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves constructing an ecosystem map to identify critical stakeholders in the global video doorbell market. The process is informed by extensive desk research using secondary data sources to collect industry insights, focusing on factors that affect market growth, product demand, and regulatory considerations.

Step 2: Market Analysis and Data Construction

In this phase, historical data regarding video doorbell adoption, sales trends, and regional demand are analyzed to derive market penetration rates and revenue estimates. The analysis also includes evaluating customer satisfaction and security standards within the product landscape to establish reliability in the revenue models.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through structured interviews with key market players, including product managers and technology experts. This qualitative input refines and supports the quantitative market data, contributing to a more reliable understanding of industry dynamics.

Step 4: Research Synthesis and Report Generation

The final phase involves synthesizing data from direct interactions with manufacturers and industry experts, which provides insights into product trends, technological advancements, and regional market performance. This ensures that the report delivers a validated and comprehensive analysis of the global video doorbell market.

Frequently Asked Questions

01. How big is the global video doorbell market?

The global video doorbell market is valued at approximately USD 1.56 billion, driven by the rise in smart home installations and growing consumer focus on home security technologies.

02. What are the key growth drivers in the global video doorbell market?

The main growth drivers are rising concerns over home security, technological advancements in IoT and cloud storage, and the increasing adoption of smart homes, especially in developed regions.

03. Which regions dominate the global video doorbell market?

North America leads due to high digital infrastructure and substantial investment in smart homes. The regions technological infrastructure and consumer willingness to invest in security solutions play a key role in its dominance.

04. Who are the major players in the global video doorbell market?

Leading companies include Ring, Nest Labs, SkyBell, and Aiphone, leveraging robust product innovation and partnerships to maintain competitive advantage.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.