Global Video Gaming Market Outlook to 2030

Region:Global

Author(s):Rishabh Verma

Product Code:KENGR012

October 2024

96

About the Report

Global Video Gaming Market Overview

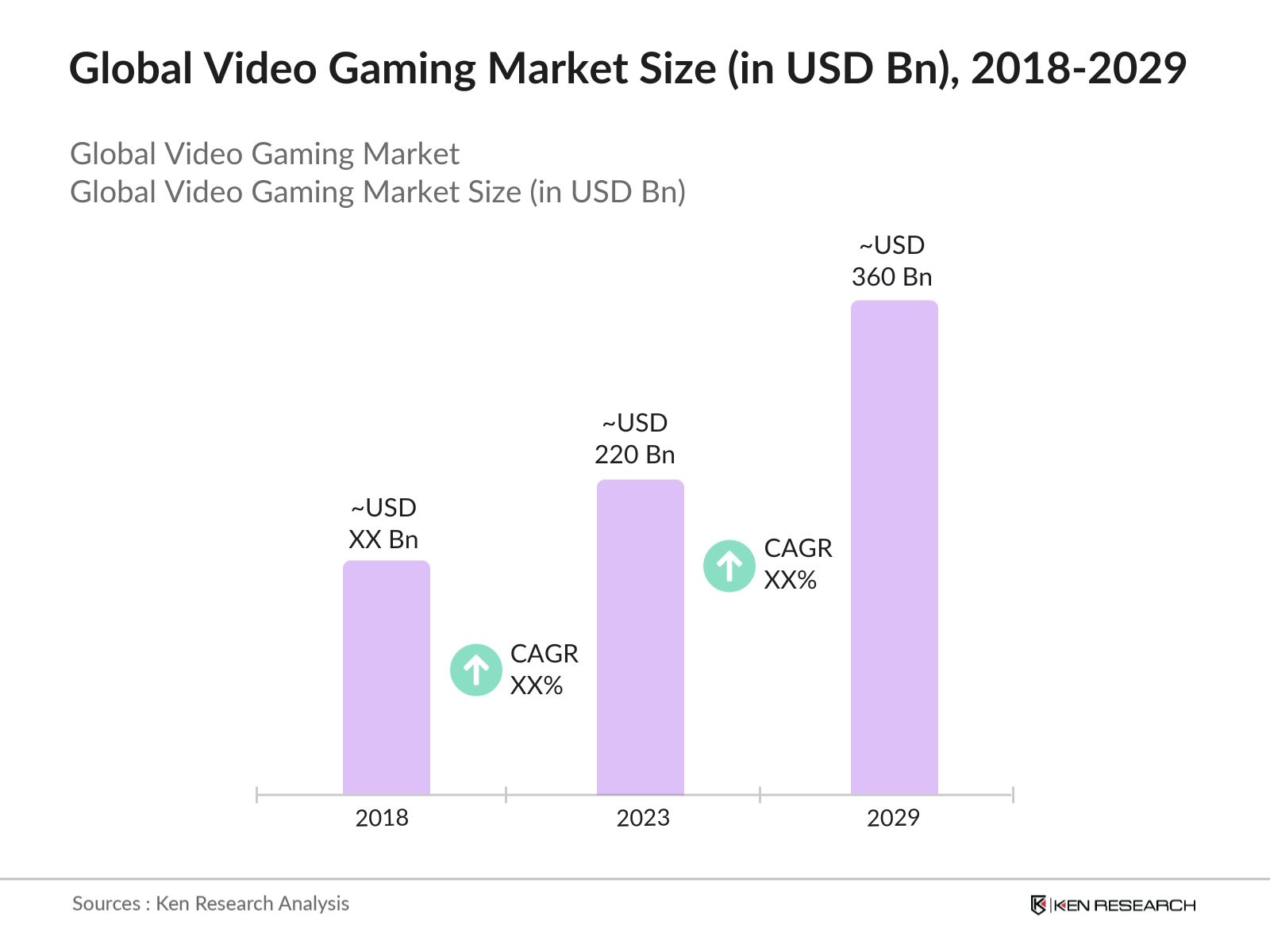

- The global video gaming market was valued at USD 220 Bn in 2023, is driven by increasing popularity of mobile and online gaming, advancements in gaming technology, and the expansion of the gamer demographic, including both casual and professional gamers.

- Key players in the market include Tencent Games, Sony Interactive Entertainment, Microsoft Xbox, Nintendo, and Electronic Arts (EA). These companies lead due to their strong portfolios, innovative technologies, strategic partnerships, and substantial market presence.

- In 2023, Tencent Holdings made significant strides in expanding its global market share and product lines. It acquired Japanese game developer Visual Arts, known for galgame and visual novels, and introduced new product lines under Level Infinite. Geographically, Tencent invested in Lighthouse Games, a UK-based AAA studio from Playground Games, to support its forthcoming title.

Global Video Gaming Current Market Analysis

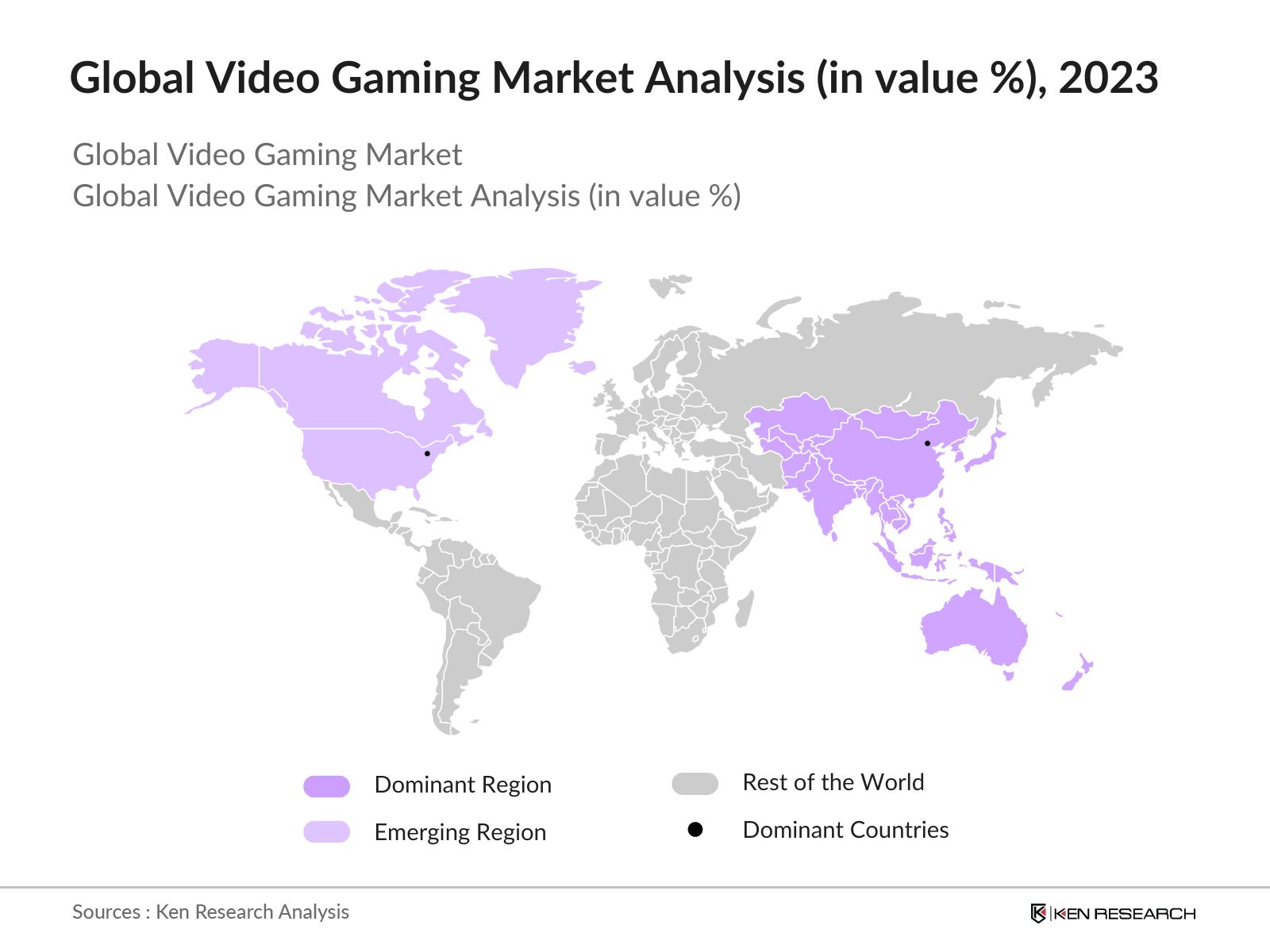

- APAC as dominant region: The APAC region leads the global video gaming market, driven by several key factors. A large, tech-savvy population in countries like China, Japan, and South Korea fuels strong demand for mobile and console gaming, with 1.29 billion mobile gamers in 2021. The region's robust infrastructure ensures fast internet connectivity, enhancing the online gaming experience. Additionally, a growing middle class, with a disposable income per capita of USD 8,200 in 2022, drives higher gaming expenditures. The prevalence of eSports and gaming tournaments attracts significant investments, while innovations in AR and VR position APAC as the leading hub for gaming.

- North America as emerging region: North America is emerging as the next promising region for the global video gaming market, driven by several key factors. The region boasts a high disposable income, with the United States' total personal disposable income reaching USD 21 Tn in 2023, and a strong consumer base with a growing interest in gaming. Technological advancements, such as the widespread adoption of 5G comprising 29% of all mobile connections in the region in 2023 and the increasing popularity of cloud gaming, are enhancing the gaming experience.

- China as dominant country: China has become the leading country in the global video gaming market, driven by its large and growing affluent population of over 685 million with a strong gaming interest across mobile and traditional platforms. Government support for the tech industry, along with advanced infrastructure for high-speed internet and 5G, further accelerates this growth. Major Chinese tech giants like Tencent and NetEase play a significant role, investing heavily in game development and acquisitions. Additionally, the rise of eSports and streaming platforms enhances the gaming culture, solidifying Chinas position as a powerhouse in the industry.

Global Video Gaming Market Segmentation

The Global Video Gaming Market can be segmented based on several factors:

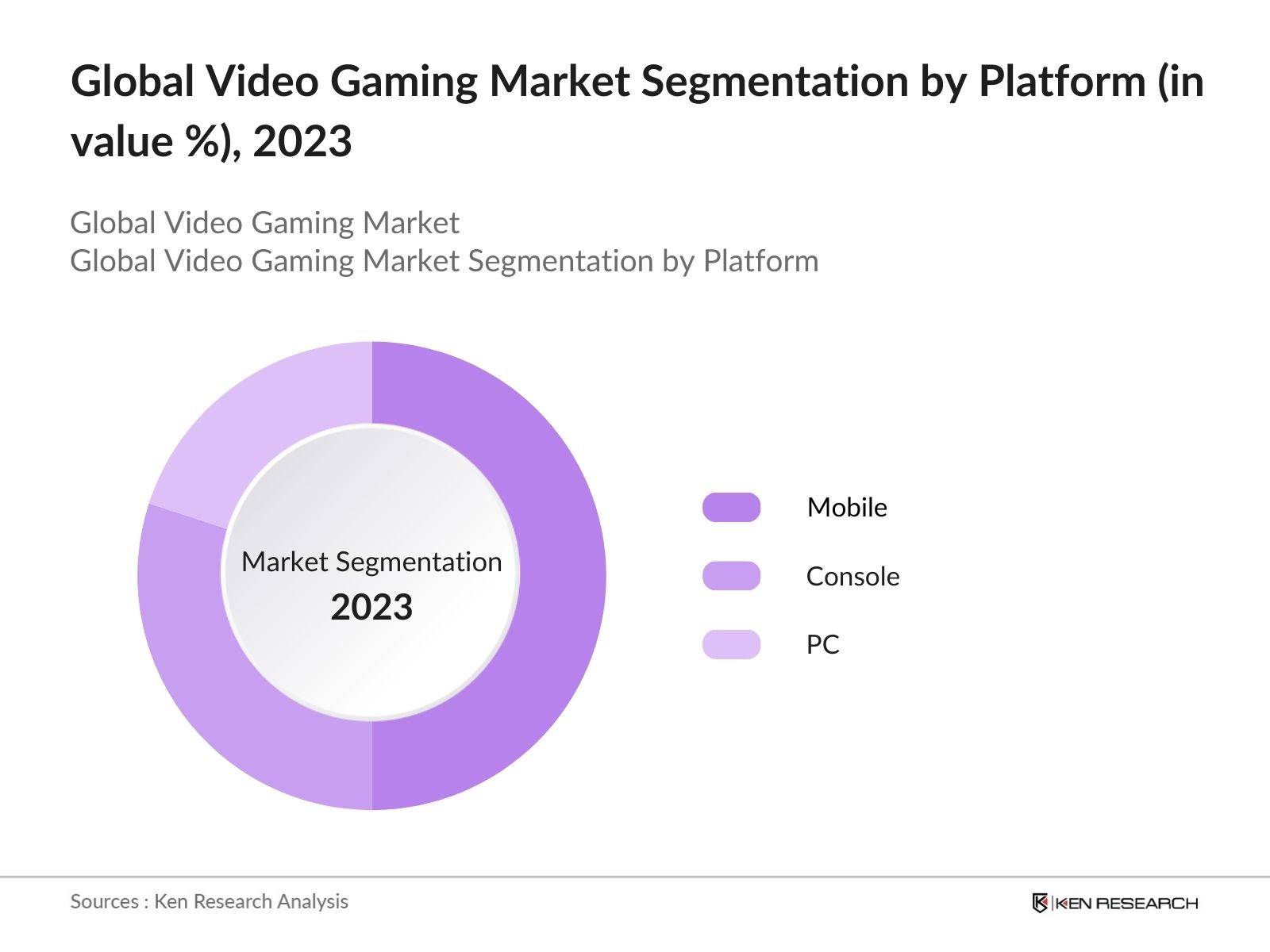

By Platform: Global video gaming market segmentation by platform is divided into mobile, PC and console. In 2023, mobile gaming emerged as the most dominant segment of the global video gaming market, driven by widespread smartphone adoption and the growth of high-speed internet. The convenience of mobile platforms, along with the popularity of casual gaming and in-app purchases, reinforces mobile gaming's leading position.

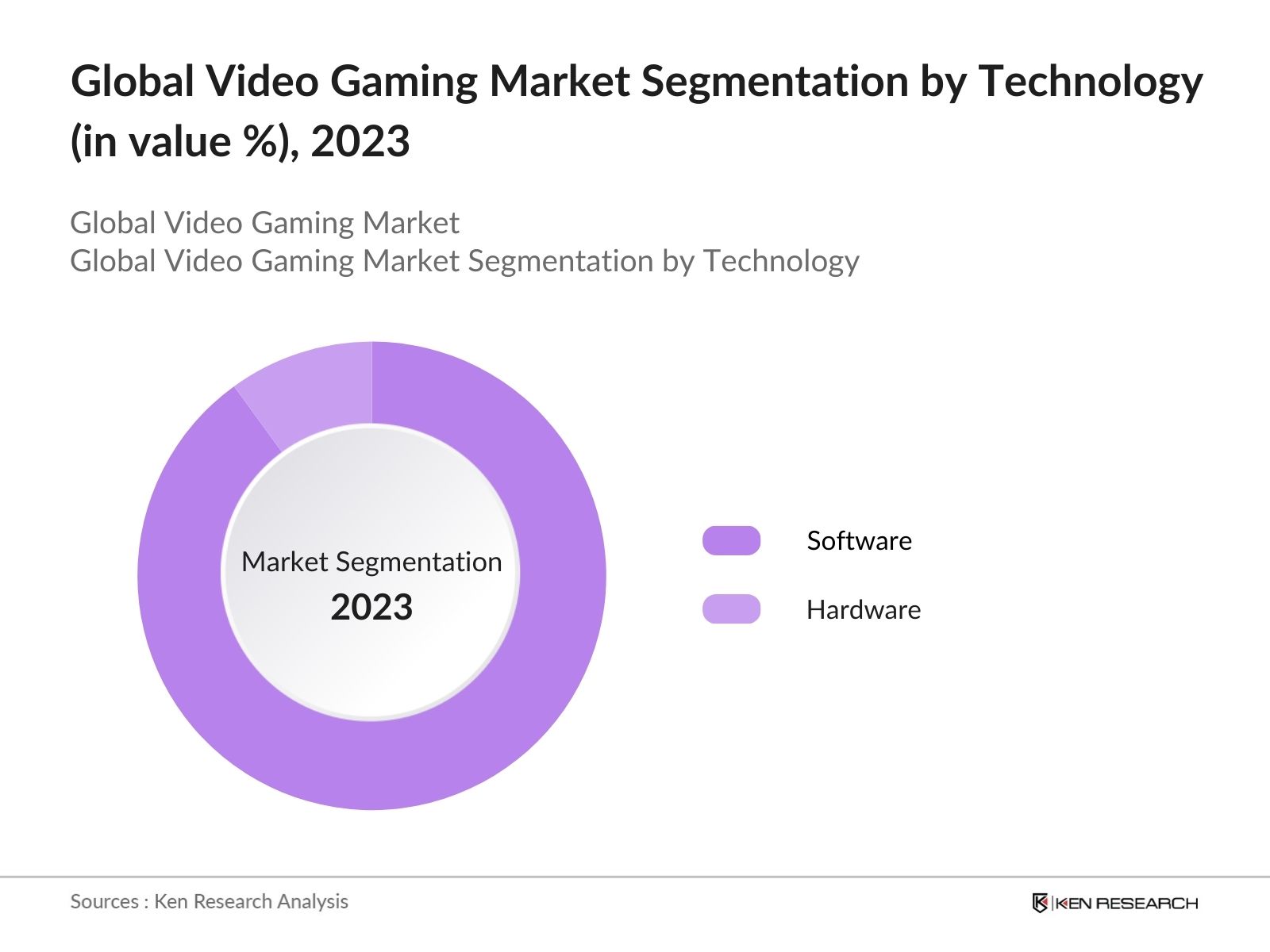

By Technology: In the Global video gaming market segmentation by technology is divided into hardware and software. In 2023, software was the leading segment in the global video gaming market, driven by advancements in game engines, high-quality graphics, and immersive gameplay. The demand for sophisticated development tools and continuous content updates further fueled the growth of the software segment.

Global Video Gaming Market Competitive Landscape

| Company | Headquarters | Establishment Year |

|---|---|---|

| Tencent Holdings | Shenzhen, China | 1998 |

| Microsoft (Incl. Activision Blizzard) | California, United States | 2008 |

| Sony Interactive Entertainment | California, United States | 1994 |

| Nintendo | Kyoto, Japan | 1889 |

| NetEase, Inc. | Hangzhou, Zhejiang, China | 1997 |

| Electronic Arts | California, United States | 1982 |

| Take-Two Interactive | New York, United States | 1993 |

| Ubisoft | Paris, France | 1989 |

| Square Enix | Tokyo, Japan | 1975 |

| Roblox Corporation | California, United States | 2004 |

| Bandai Namco Entertainment | Tokyo, Japan | 2006 |

| Sega Corporation | Tokyo, Japan | 1960 |

- Microsoft Corporation Acquired Activision Blizzard: In October 2022, Microsoft Corporation completed its acquisition of Activision Blizzard for USD 75 Bn, significantly expanding its footprint in the gaming industry. Following this, Blizzard Entertainment announced the next three expansions for World of Warcraft, beginning with "The War Within" in 2024, marking the start of the Worldsoul Saga.

- Sony Interactive Entertainment Strategic Acquisitions: In August 29, 2022, Sony Interactive Entertainment announced the acquisition of Savage Game Studios, a mobile game development studio with offices in Helsinki and Berlin. Savage Game Studios joined the newly established PlayStation Studios Mobile Division, an independent entity from console development.

- NetEase, Inc. Partnership: In 2024, NetEase renewed its partnership with Microsoft (Blizzard) to re-launch Warcraft and other games in China. Also, a joint venture between Sandsoft Games from Saudi Arabia and NetEase Games was established to oversee game publishing, marketing, live operations, and esports activities in the MENA region.

Global Video Gaming Industry Analysis

Global Video Gaming Market Growth Drivers:

- Rise in Mobile Gaming: The proliferation of smartphones has significantly boosted the mobile gaming segment. In 2024, the number of smartphone users globally reached 4.9 Bn, with a substantial portion actively engaging in mobile gaming. This growth is driven by improvements in mobile technology, which enable more sophisticated and immersive gaming experiences on mobile devices.

- Growth of Cloud Gaming: The adoption of cloud gaming services has been a significant driver in the market. In 2024, cloud gaming subscriptions reached 50 Mn users. The convenience of accessing high-quality games without the need for expensive hardware is attracting a broad audience, and this trend is expected to add to the gaming industry.

- Expansion of Esports: Esports continues to grow as a major driver in the video gaming market. In 2024, the global esports audience was estimated at 540 Mn, with revenues from esports tournaments and related activities reaching USD 4.3 Bn. The increasing popularity of competitive gaming, sponsorships, and media rights deals are expected to further fuel the growth of esports.

Global Video Gaming Market Challenges:

- Cybersecurity Threats: Cybersecurity remains a critical challenge for the gaming industry. In 2024, there were over 150 Mn reported cyber-attacks on gaming platforms, resulting in financial losses. Ensuring the security of user data and maintaining trust in gaming platforms is essential to mitigate these threats and protect market revenue.

- High Development Costs: The cost of developing high-quality games has risen significantly. In 2024, the average cost to develop a AAA game was around $100 Mn. These high costs pose a challenge for game developers, especially smaller studios, as they require substantial investment and financial backing to produce competitive games. This financial barrier could hinder market entry and innovation.

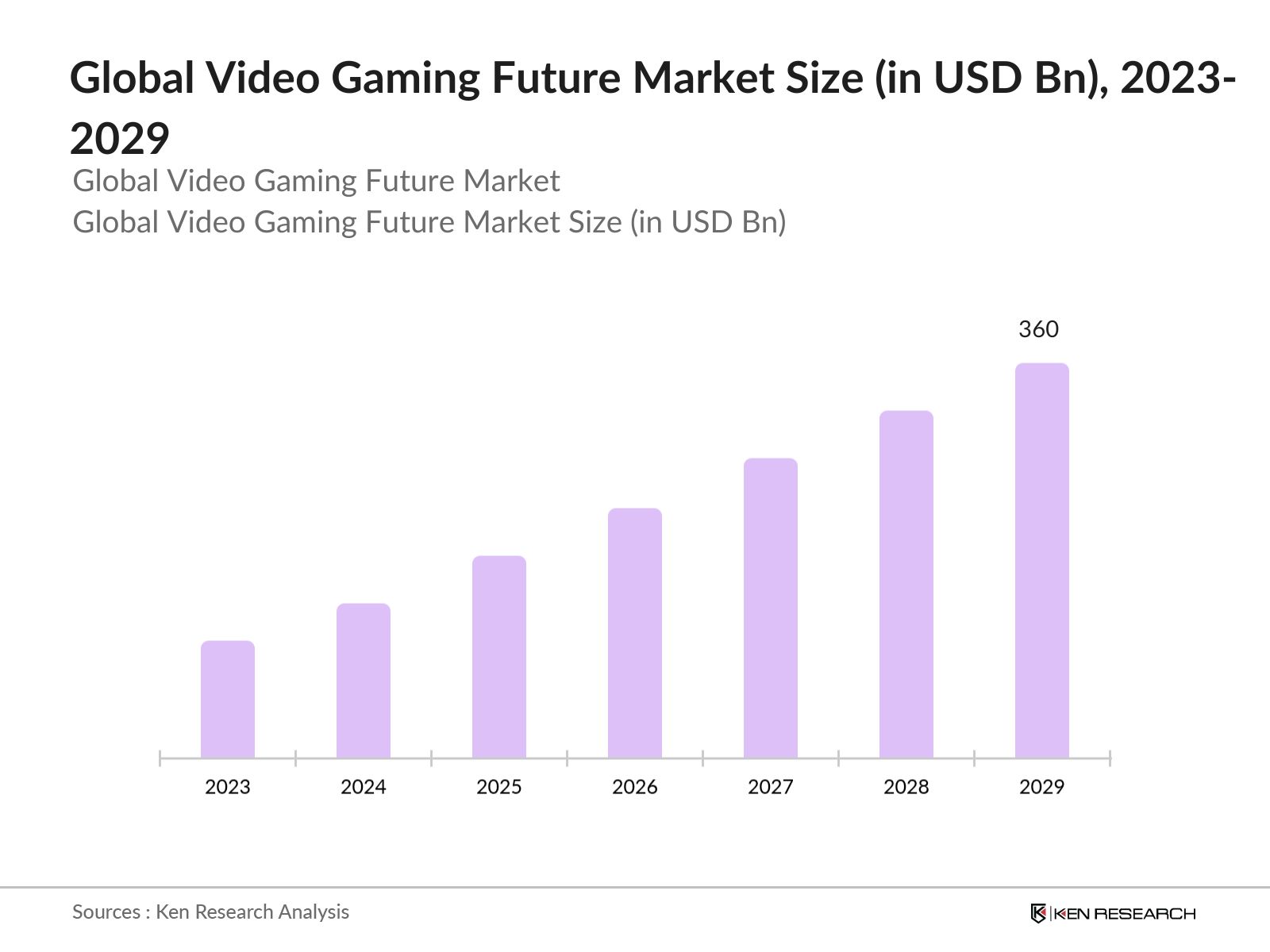

Global Video Gaming Future Market Outlook

The Global Video Gaming market is expected to reach USD 360 Bn by 2029 driven by increasing penetration of 5G technology, the rise of cloud gaming services, and the expansion of the gaming audience across emerging markets. Additionally, innovations in virtual and augmented reality are expected to open new avenues for immersive gaming experiences.

Future Market Trends

- Growth of Subscription Gaming Services: Over the next five years, subscription gaming services like Xbox Game Pass and PlayStation Now are expected to see substantial growth. By 2029, these services are projected to attract more subscribers globally, generating revenue. The convenience and value offered by these subscriptions will drive their popularity among gamers.

- Expansion of the Metaverse: The integration of gaming into the metaverse will be a major trend in the coming years. By 2029, the metaverse gaming market is expected to show robust growth, driven by advancements in VR and AR technologies. This immersive virtual environment will create new opportunities for social interaction, gaming experiences, and in-game purchases, significantly boosting market revenue.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Platform |

Mobile Console PC |

|

By Technology |

Software Hardware |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Video Game Developers

Console Manufacturers

Mobile Device Manufacturers

Esports Organizations

Advertising Agencies

Streaming Platforms

Telecommunication Companies

Banks and Financial Institutions

Government Agencies (Ministry of Culture)

Gaming Hardware Manufacturers

Software Developers

Media And Entertainment Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Tencent Holdings

Microsoft (Incl. Activision Blizzard)

Sony Interactive Entertainment

Nintendo

NetEase, Inc.

Electronic Arts

Take-Two Interactive

Ubisoft

Square Enix

Roblox Corporation

Bandai Namco Entertainment

Sega Corporation

Table of Contents

1. Executive Summary

1.1 Global Entertainment and Media Market

1.2 Global Video Gaming Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Entertainment and Media Industry

2.3 Global Entertainment and Media (Console Games, PC Games, Mobile Games, And Online Gaming) Revenue

2.4 Global Video Gaming (Offline and Online)

3. Global Video Gaming Market Overview

3.1 Global Video Gaming Market Ecosystem: Game Developer/Publisher

3.2 Global Video Gaming Market Ecosystem: Game Distributor (Digital)

3.3 Global Video Gaming Market Ecosystem: Gaming Console Manufacturers

3.4 Global Video Gaming Market Value Chain

3.5 Global Video Gaming Market Opportunity

3.6 Global Video Gaming Market Gamers Demographics

3.7 Global Video Gaming Market - Global Video Gaming Statistics

4. Global Video Gaming Market Size (in USD Bn), 2018-2023

5. Global Video Gaming Market Segmentation (in value %), 2018-2023

5.1 Global Video Gaming Market Segmentation by Region (in value %), 2018-2023

5.2 Global Video Gaming Market Segmentation by Business Model (in value %), 2018-2023

5.3 Global Video Gaming Market Segmentation by Platform (in value %), 2018-2023

5.4 Global Video Gaming Market Segmentation by Technology (in value%), 2018-2023

6. Global Video Gaming Market Competition Landscape

6.1 Global Video Gaming Market Share Analysis

6.2 Global Video Gaming Market Heat Map Analysis

6.3 Global Video Gaming Market Cross Comparison

6.4 Global Video Gaming Market Comparison Matrix

7. Global Video Gaming Market Dynamics

7.1 Global Video Gaming Market Growth Drivers

7.2 Global Video Gaming Market Challenges

7.3 Global Video Gaming Market Trends

7.4 Global Video Gaming Market Case Studies

7.5 Global Video Gaming Market Strategic Initiatives

8. Global Video Gaming Future Market Size (in USD Bn), 2023-2029

9. Global Video Gaming Future Market Segmentation (in value %), 2023-2029

5.1 Global Video Gaming Future Market Segmentation by Region (in value %), 2023-2029

5.2 Global Video Gaming Future Market Segmentation by Business Model (in value %), 2023-2029

5.3 Global Video Gaming Future Market Segmentation by Platform (in value %), 2023-2029

5.4 Global Video Gaming Future Market Segmentation by Technology (in value%), 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Identification of Industry Players

Identified a comprehensive ecosystem of international and local players in the video games industry. This step involved mapping out key stakeholders, including gaming software development companies, publishers, distributors, and content creators. The objective was to establish a clear understanding of the industry's landscape and the various entities operating within it.

Step 2: Stakeholder Interviews and Data Collection

Conducted Computer-Assisted Telephone Interviews (CATIs) with key industry stakeholders, including gaming software developers, publishers, distributors, and content creators. The interviews aimed to collect detailed data on operating and financial metrics, such as product portfolios (gaming titles and genres), value chains, gross profit margins, and segment revenues by distribution channel. The discussions also covered future strategies and additional value-adding insights. After data collection, a bottom-to-top approach was used to assess country-level and regional trends, as well as market shares by platform and technology. The market size was determined based on revenues from major players and their global market shares.

Step 3: Revenue Analysis and Validation

Employed a combination of bottom-to-top and top-to-bottom approaches to evaluate overall historical and forecasted revenue figures. This comprehensive analysis included validating the findings through sanity checks with industry veterans, gaming professionals, publishing platforms, and proxy variables. These validation steps ensured the accuracy and reliability of the final revenue figures and provided a robust understanding of the market's financial dynamics.

Frequently Asked Questions

01. How big is Global Video Gaming Market?

The global video gaming market was valued at USD 220 Bn in 2023, is driven by increasing popularity of mobile and online gaming, advancements in gaming technology, and the expansion of the gamer demographic, including both casual and professional gamers.

02. What are the challenges in Global Video Gaming Market?

Challenges in global video gaming market include regulatory restrictions such as gaming time limits for minors, cybersecurity threats with increasing cyber-attacks on gaming platforms, high development costs for producing AAA games, and intellectual property issues leading to legal disputes and financial losses.

03. Who are the major players in Global Video Gaming Market?

Key players in global video gaming market include Tencent Games, Sony Interactive Entertainment, Microsoft Xbox, Nintendo, and Electronic Arts (EA). These companies lead due to their strong portfolios, innovative technologies, strategic partnerships, and substantial market presence.

04 What are the growth drivers of the Global Video Gaming Market?

The global video gaming market is driven by the rise in mobile gaming with a growing number of smartphone users, the expansion of esports attracting a large audience and revenue, the adoption of cloud gaming offering high-quality games on various devices, and the development of VR and AR technologies enhancing immersive gaming experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.