Global Video Streaming Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD2149

October 2024

95

About the Report

Global Video Streaming Market Overview

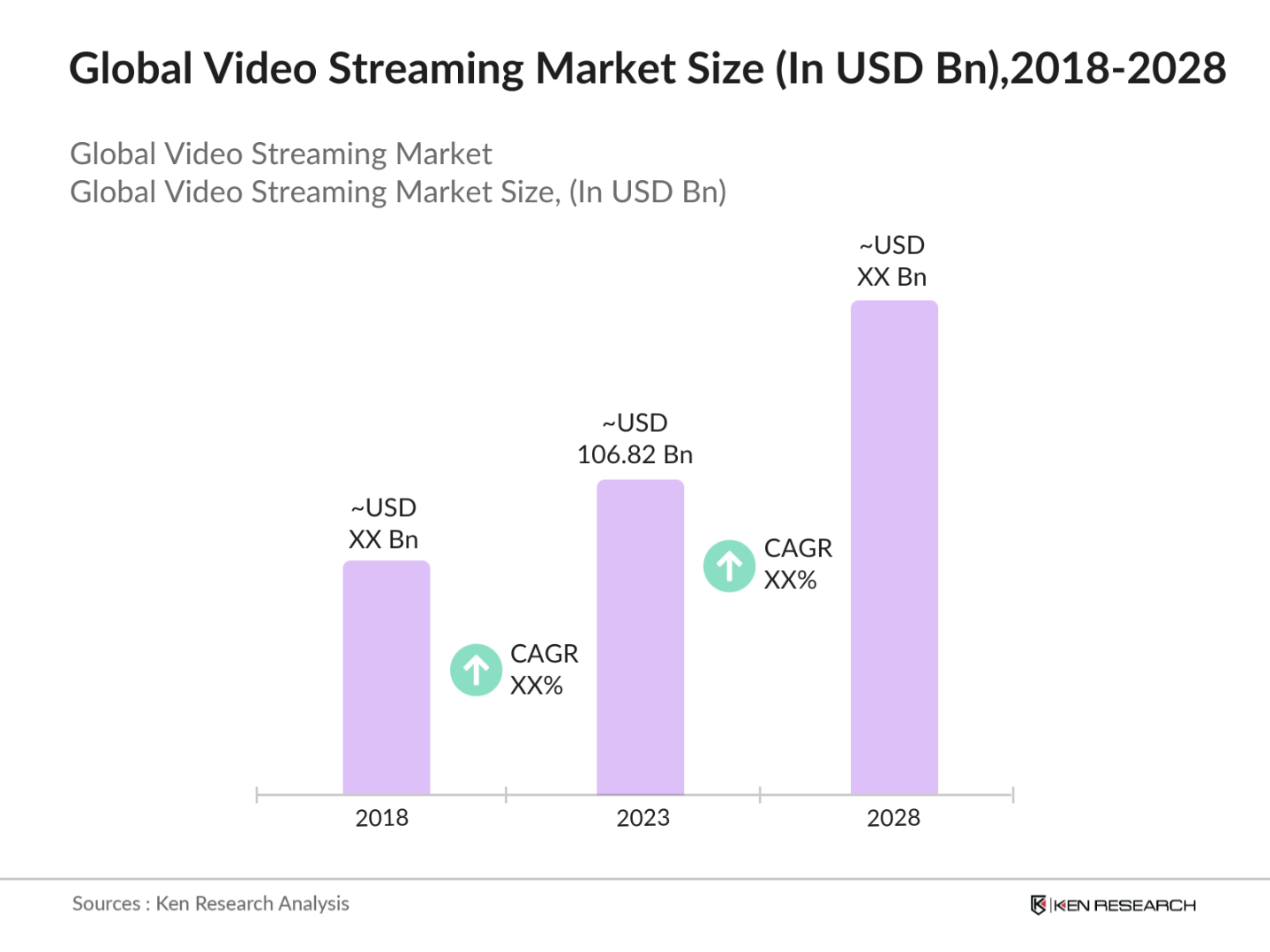

- The global video streaming market reached a size of USD 106.82 billion in 2023. This growth has been primarily driven by the increasing adoption of streaming services over traditional cable TV, advancements in broadband technology, and the proliferation of smart devices. The shift towards on-demand content consumption and the rise of original programming by streaming platforms have also fueled market expansion. The market is projected to grow at a robust pace due to the continuous innovation and diversification of content offerings.

- The video streaming market is dominated by major players such as Netflix, Amazon Prime Video, Disney+, and Hulu. Netflix continues to lead with its extensive library and global reach, while Disney+ has gained significant traction due to its strong portfolio of family-friendly content and popular franchises. Amazon Prime Video benefits from its integration with Amazon's ecosystem, and Hulu remains influential with its extensive content offerings and live TV options.

- In 2023, Netflix launched its ad-supported subscription tier, aiming to attract price-sensitive consumers and diversify revenue streams. This plan was introduced at a lower price point, offering an affordable option for users while generating advertising revenue, showcasing Netflix's adaptability to the competitive market.

- Key cities that dominate the global video streaming market include Los Angeles, New York, London, and Tokyo. These cities are major hubs for entertainment and media production, housing numerous content creators, distributors, and streaming platforms. Their high density of media professionals, advanced infrastructure, and large consumer bases contribute significantly to their dominance in the video streaming sector.

Global Video Streaming Market Segmentation

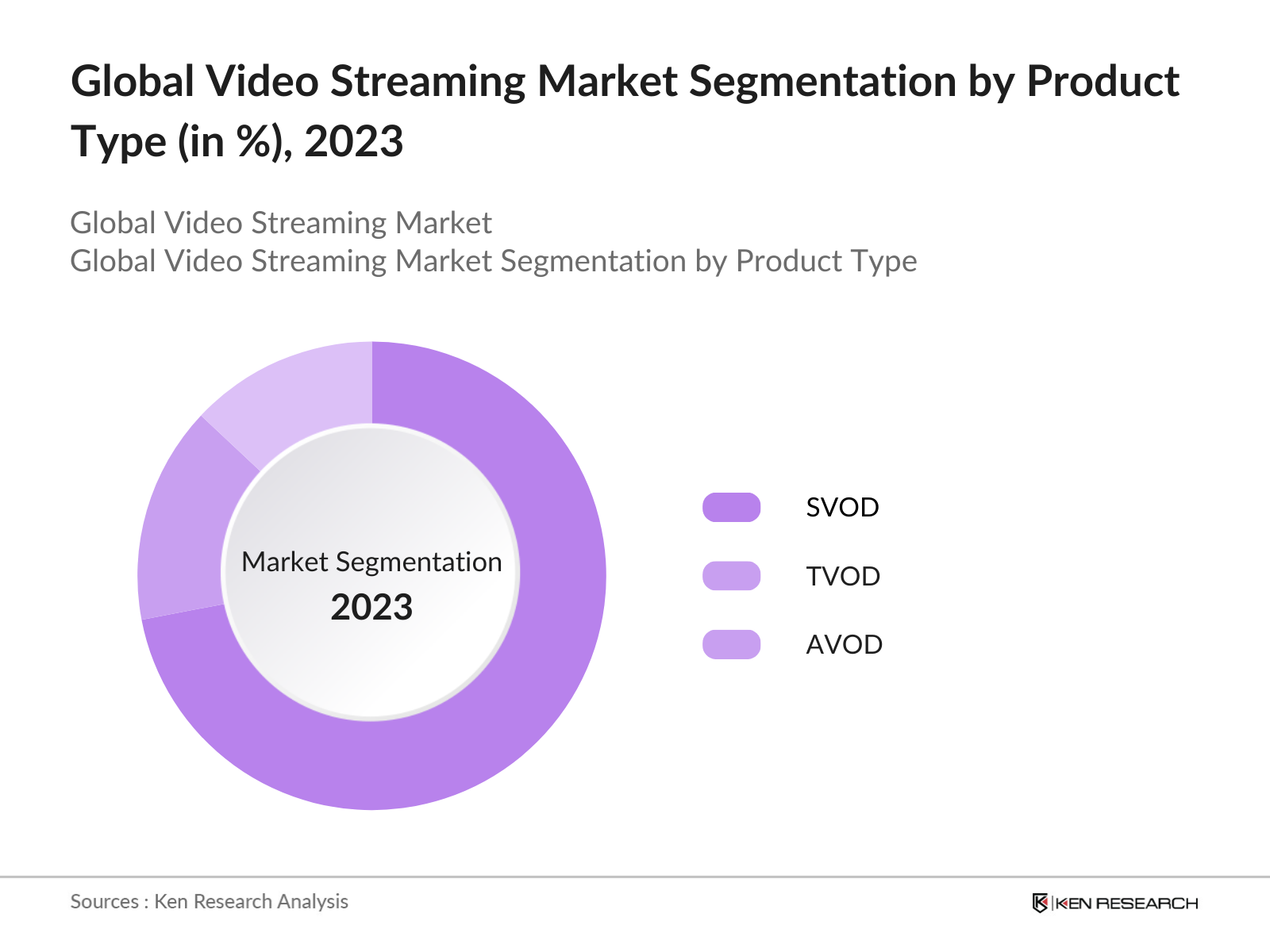

By Product Type: The video streaming market is segmented by product type into Subscription Video on Demand (SVOD), Transactional Video on Demand (TVOD), and Advertising-Based Video on Demand (AVOD). In 2023, SVOD indeed dominated the market, primarily due to its recurring revenue model and extensive content libraries offered by platforms such as Netflix and Disney+. These services provide users with unlimited access to a wide range of content for a monthly subscription fee, appealing to consumers who prefer a diverse viewing experience without incurring additional costs per title.

|

Product Type |

Market Share (%) |

|

SVOD |

72% |

|

TVOD |

15% |

|

AVOD |

13% |

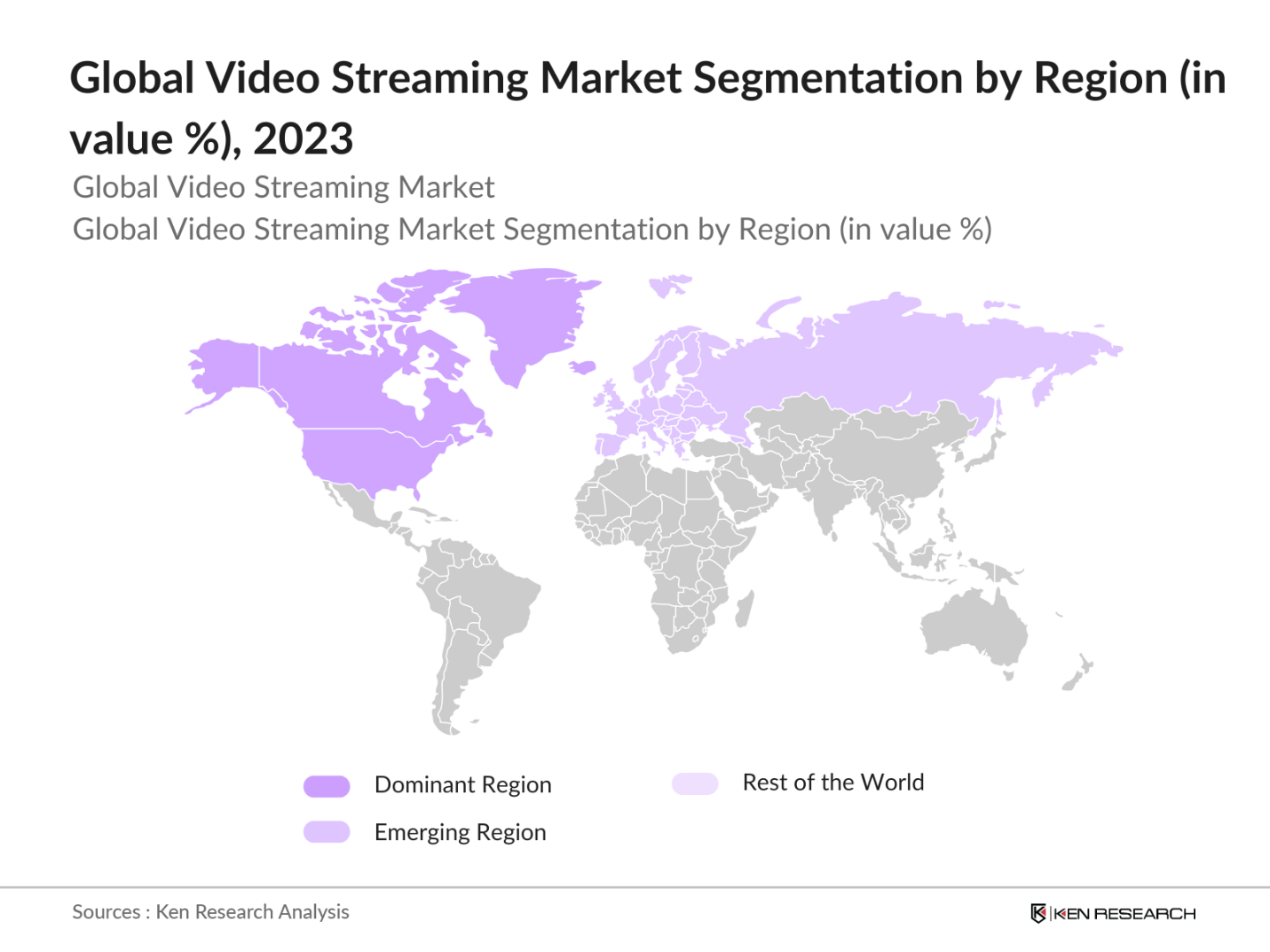

By Region: The global video streaming market is segmented regionally into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, North America dominated the market due to its early adoption of streaming technology and high consumer spending on digital entertainment. The U.S. and Canada benefit from a well-established broadband infrastructure and a large streaming subscriber base. Europe follows closely, with strong growth driven by increasing internet penetration and a rising demand for diverse content.

Regional Market Share Table (2023)

|

Region |

Market Share (%) |

|

North America |

45% |

|

Europe |

30% |

|

APAC |

15% |

|

Latin America |

5% |

|

MEA |

5% |

By Content Type: The global video streaming market is segmented by content type into Movies, TV Shows, and Sports. In 2023, Movies dominated the market due to their broad range of genres and global appeal. Streaming platforms have made significant investments in original movies and licensed content, making them a key driver of subscriber growth. While TV Shows and Sports remain essential segments, they tend to cater to specific audience preferences and event-based consumption patterns.

Content Type Market Share Table (2023)

|

Content Type |

Market Share (%) |

|

Movies |

65% |

|

TV Shows |

25% |

|

Sports |

10% |

Global Video Streaming Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Netflix Inc. |

1997 |

Los Gatos, CA, USA |

|

Amazon.com Inc. |

1994 |

Seattle, WA, USA |

|

Walt Disney Company |

1923 |

Burbank, CA, USA |

|

Apple Inc. |

1976 |

Cupertino, CA, USA |

|

Hulu LLC |

2007 |

Santa Monica, CA, USA |

- Amazon.com Inc.: Amazon continues to invest in its Prime Video service as part of its broader strategy to enhance its streaming offerings. In 2023, the company focused on expanding its content library and improving user engagement through personalized recommendations and exclusive content, which are critical in a competitive streaming landscape dominated by players like Netflix and Disney+.

- Walt Disney Company: Disney+ launched its ad-supported subscription tier onDecember 8, 2022,. This tier was introduced in the U.S. and later expanded to European markets starting inNovember 2023. The ad-supported plan aims to provide a more affordable option for users, with pricing set at$7.99 per monthin the U.S. and varying prices in Europe, such as4.99/5.99 per month.

Global Video Streaming Market Analysis

Global Video Streaming Market Growth Drivers

- Increased Internet Penetration and Mobile Usage: The global video streaming market has been primarily driven by the rise in internet accessibility and increased use of mobile devices. According to the International Telecommunication Union (ITU), as of 2023, more than 5 billion people have access to the internet globally, which supports video consumption across streaming platforms. With affordable mobile data, especially in emerging markets like India, where over 1.2 billion mobile users were recorded in 2023, video streaming has experienced exponential growth. The convenience of mobile streaming has led to a significant rise in subscription-based services.

- Expansion of OTT Platforms: Over-the-top (OTT) platforms have become a major contributor to the video streaming market, especially with the shift in content consumption habits. In 2023, platforms like Netflix, Disney+, and Amazon Prime Video continued to see a rise in user subscriptions, reaching more than 1 billion active users combined. This growth is driven by the increasing demand for original content, localized offerings, and the expansion of streaming services into new markets, including regions like Latin America and Asia-Pacific.

- Rise in Smart TV and Connected Devices: Another crucial driver of the video streaming market is the increased adoption of smart TVs and connected devices like Roku, Amazon Fire Stick, and Apple TV. According to Statista, the global number of smart TV users reached over 1.1 billion in 2023. This rise in connected home entertainment systems allows seamless access to streaming content directly on larger screens, enhancing the overall viewing experience and driving up consumer engagement across platforms.

Global Video Streaming Market Challenges

- Content Piracy Issues: One of the key challenges in the video streaming market is the ongoing battle against content piracy. Piracy remains prevalent, especially with peer-to-peer streaming networks and unauthorized platforms that distribute copyrighted material illegally. Companies are increasingly investing in anti-piracy measures, but combating piracy continues to be a critical issue for the industry.

- High Operational and Licensing Costs: Licensing content for video streaming platforms comes with high operational costs, which can restrict market growth for smaller players. As content production becomes more expensive, major platforms are driven to raise subscription prices and adopt stricter monetization strategies. This can negatively impact user acquisition, particularly in cost-sensitive markets.

Global Video Streaming Market Government Initiatives

- Chinas Internet Infrastructure Plan 2024: In 2024, the Chinese government launched a massive infrastructure initiative to improve the country's 5G coverage and fiber optic networks. This has led to enhanced streaming capabilities, as streaming platforms like iQIYI and Tencent Video experience improved user engagement and performance. With the government supporting faster, reliable internet, streaming services in China are seeing a surge in user numbers, particularly in rural and tier-2 cities.

- US Copyright Modernization Act 2024: The U.S. Copyright Office has been active in various modernization efforts, including discussions on the impact of AI on copyright and the ongoing process of updating the Digital Millennium Copyright Act (DMCA) through the triennial rulemaking process. In June 2024, the House Administration Committee held a hearing focused on modernization efforts, where topics such as the registration process and AI policy were discussed. Register of Copyrights Shira Perlmutter indicated that the modernization of the copyright registration process is expected to be completed by the end of 2026.

Global Video Streaming Market Outlook

The global video streaming market continues to evolve, several transformative trends are expected to shape its future by 2028. Driven by advancements in technology and changing consumer preferences, these trends will redefine the way content is delivered, consumed, and personalized.

Future Trends:

- Growth of 5G-Powered Streaming Services: By 2028, the global rollout of 5G networks will significantly enhance video streaming experiences, enabling ultra-high-definition content with minimal buffering. The higher speeds and lower latency of 5G will drive the growth of interactive and immersive content formats such as VR streaming. It is anticipated that a large portion of video streaming traffic will rely on 5G networks by 2028.

- Increased Focus on User-Generated Content (UGC): By 2028, user-generated content platforms are expected to see a significant increase in market share as platforms like YouTube and TikTok continue to grow their user bases. The rise of independent creators and the demand for short-form, real-time content will drive this trend, supported by increasing interest in creator economies and decentralized content distribution.

Scope of the Report

|

By Product Type |

SVOD TVOD AVOD |

|

By Content Type |

Movies TV Shows Sports |

|

By Region |

North America Europe Asia-Pacific (APAC) Latin America Middle East & Africa (MEA) |

|

By Device Type |

Smartphones Smart TVs Laptops & Desktops Tablets |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Streaming Platforms

Digital Advertising Agencies

Government and Regulatory Bodies (FCC)

Investments and Venture Capitalist Firms

Telecom Providers

Internet Service Providers

Consumer Electronics Manufacturers

Cloud Service Providers

Smart TV Manufacturers

Companies

Players Mentioned in the Report:

Netflix Inc.

Amazon.com Inc.

Walt Disney Company

Apple Inc.

Hulu LLC

Roku, Inc.

AT&T (HBO Max)

Tencent Video

YouTube

Comcast (Peacock)

Paramount+

Sony Crackle

ViacomCBS

Baidu iQIYI

Discovery+

Table of Contents

1. Global Video Streaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Video Streaming Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Video Streaming Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for On-Demand Content

3.1.2. Expansion of Internet Infrastructure

3.1.3. Rise in Smartphone Penetration

3.2. Restraints

3.2.1. Content Licensing Issues

3.2.2. Bandwidth and Network Limitations

3.3. Opportunities

3.3.1. Emerging Markets Adoption

3.3.2. Integration of AI and Personalized Content

3.4. Trends

3.4.1. Growth of Live Streaming and Sports Content

3.4.2. Rise of Short-Form Videos

3.5. Government Initiatives

3.5.1. Digital India Initiative

3.5.2. Net Neutrality Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Video Streaming Market Segmentation, 2023

4.1. By Content Type (in Value %)

4.1.1. TV Shows

4.1.2. Movies

4.1.3. Live Streaming

4.2. By Business Model (in Value %)

4.2.1. Subscription-Based Video on Demand (SVoD)

4.2.2. Advertising-Based Video on Demand (AVoD)

4.2.3. Transactional-Based Video on Demand (TVoD)

4.3. By Device Type (in Value %)

4.3.1. Smartphones

4.3.2. Smart TVs

4.3.3. Laptops & Desktops

4.3.4. Tablets

4.4. By Platform (in Value %)

4.4.1. OTT Streaming Platforms

4.4.2. Video Sharing Platforms

4.4.3. IPTV

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific (APAC)

4.5.4. Latin America

4.5.5. Middle East & Africa (MEA)

5. Global Video Streaming Market Competitive Landscape

5.1. Major Companies

5.1.1. Netflix Inc.

5.1.2. Amazon Prime Video

5.1.3. Disney+

5.1.4. Hulu LLC

5.1.5. Apple TV+

5.1.6. YouTube

5.1.7. HBO Max

5.1.8. Peacock TV

5.1.9. Sling TV

5.1.10. Rakuten TV

5.1.11. Vudu

5.1.12. DAZN

5.1.13. BBC iPlayer

5.1.14. Sony Liv

5.1.15. Tencent Video

5.2. Cross Comparison Parameters (Revenue, Market Share, Content Library, Geographical Reach)

6. Global Video Streaming Market Competitive Analysis

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Private Equity Investments

7. Global Video Streaming Market Regulatory Framework

7.1. Content Licensing Regulations

7.2. Data Privacy Laws

7.3. Compliance with Streaming Standards

8. Global Video Streaming Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Growth

9. Global Video Streaming Market Future Market Segmentation, 2028

9.1. By Content Type (in Value %)

9.2. By Business Model (in Value %)

9.3. By Device Type (in Value %)

9.4. By Platform (in Value %)

9.5. By Region (in Value %)

10. Global Video Streaming Market Analysts Recommendations

10.1. Market Penetration Strategies

10.2. New Revenue Models

10.3. Marketing Campaign Recommendations

10.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Global Video Streaming Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Global Video Streaming Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Video Streaming and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Video Streaming.

Frequently Asked Questions

1 How big is the global video streaming market?

The global video streaming market was valued at USD 106.82 billion in 2023, driven by the widespread adoption of high-speed internet, increasing demand for on-demand content, and the growth of OTT platforms. The market is expected to expand significantly as technological advancements enhance streaming quality.

2 What are the challenges in the global video streaming market?

Challenges in the global video streaming market include increasing competition among streaming platforms, high content creation costs, and the challenge of combating piracy. Additionally, managing bandwidth demands and ensuring seamless streaming quality remains a concern.

3 Who are the major players in the global video streaming market?

Key players in the global video streaming market include Netflix, Amazon Prime Video, Disney+, Hulu, and YouTube. These companies have gained dominance through their vast content libraries, original programming, and strategic global expansion.

4 What are the growth drivers of the global video streaming market?

The global video streaming market is driven by the increasing demand for personalized content, the rise of smart devices, and the adoption of high-speed internet services. Growth is also supported by the increasing consumption of mobile video content and the global shift towards OTT platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.