Global Video Surveillance Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1613

December 2024

99

About the Report

Global Video Surveillance Market Overview

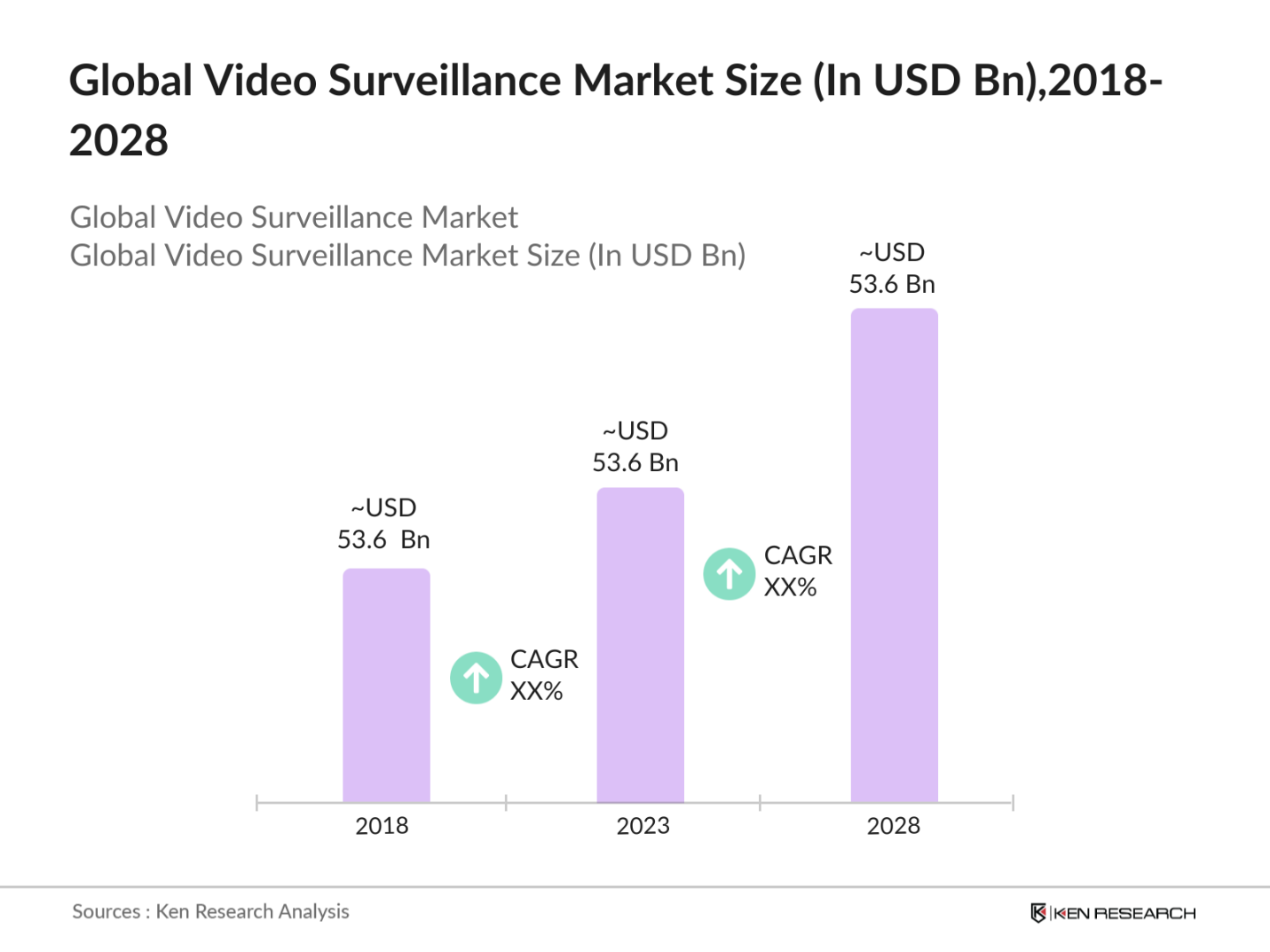

- The global video surveillance market reached a size of USD 53.6 billion in 2023, driven by the increasing need for security across various sectors including government, retail, transportation, and residential applications. The rapid adoption of IP cameras, cloud-based solutions, and the integration of artificial intelligence (AI) in surveillance systems have significantly contributed to the market's growth.

- Key players such as Hikvision (China), Dahua Technology (China), Axis Communications (Sweden), Bosch Security Systems (Germany), and Honeywell International Inc. (USA). Hikvision and Dahua Technology are the leading players, holding a significant share of the global market due to their expansive product portfolios and innovative technologies.

- In 2023, Honeywell has been focusing on enhancing its video surveillance offerings, particularly through AI-based solutions. The company has developed the Honeywell Advanced Analytics (Ci2MS), which utilizes deep learning technologies for real-time monitoring and anomaly detection in video feeds. This system aims to improve security operations by providing alerts for suspicious behaviors, thus enhancing both manned and unmanned surveillance capabilities.

- New York City, London, and Beijing emerged as dominant markets for video surveillance. New York Citys extensive public and private sector investments in surveillance technologies have made it a leader in the implementation of smart surveillance systems. Londons dense network of CCTV cameras, supported by government initiatives, positions it as a key player.

Global Video Surveillance Market Segmentation

Global Video Surveillance Market is divided into further segments:

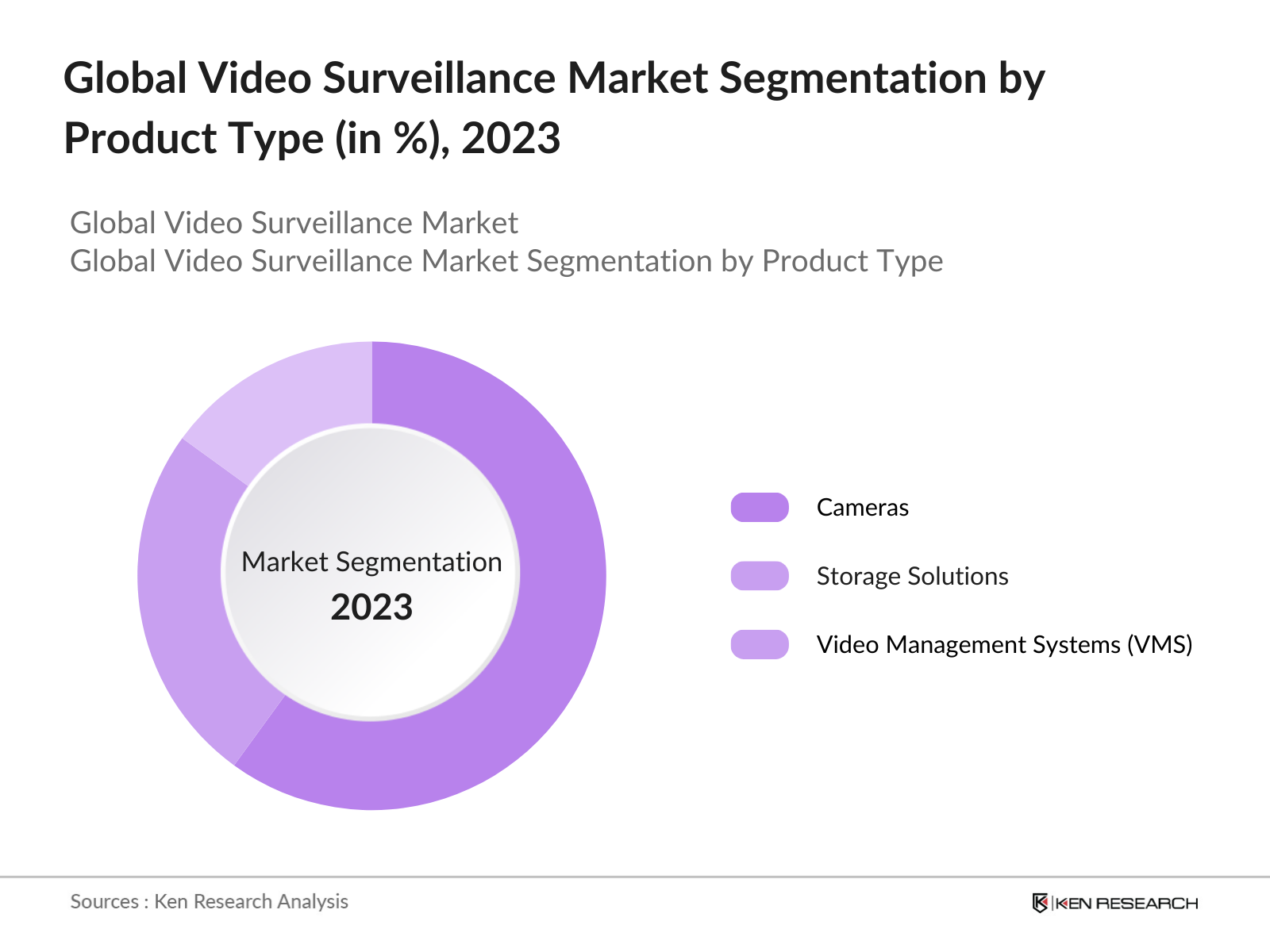

By Product Type: The global video surveillance market is segmented by product type into cameras, storage solutions, and video management systems (VMS). In 2023, cameras held the dominant market share under this segmentation. This dominance is attributed to continuous advancements in camera technologies, including features like 4K resolution, night vision, and thermal imaging, which have expanded their applications across various industries.

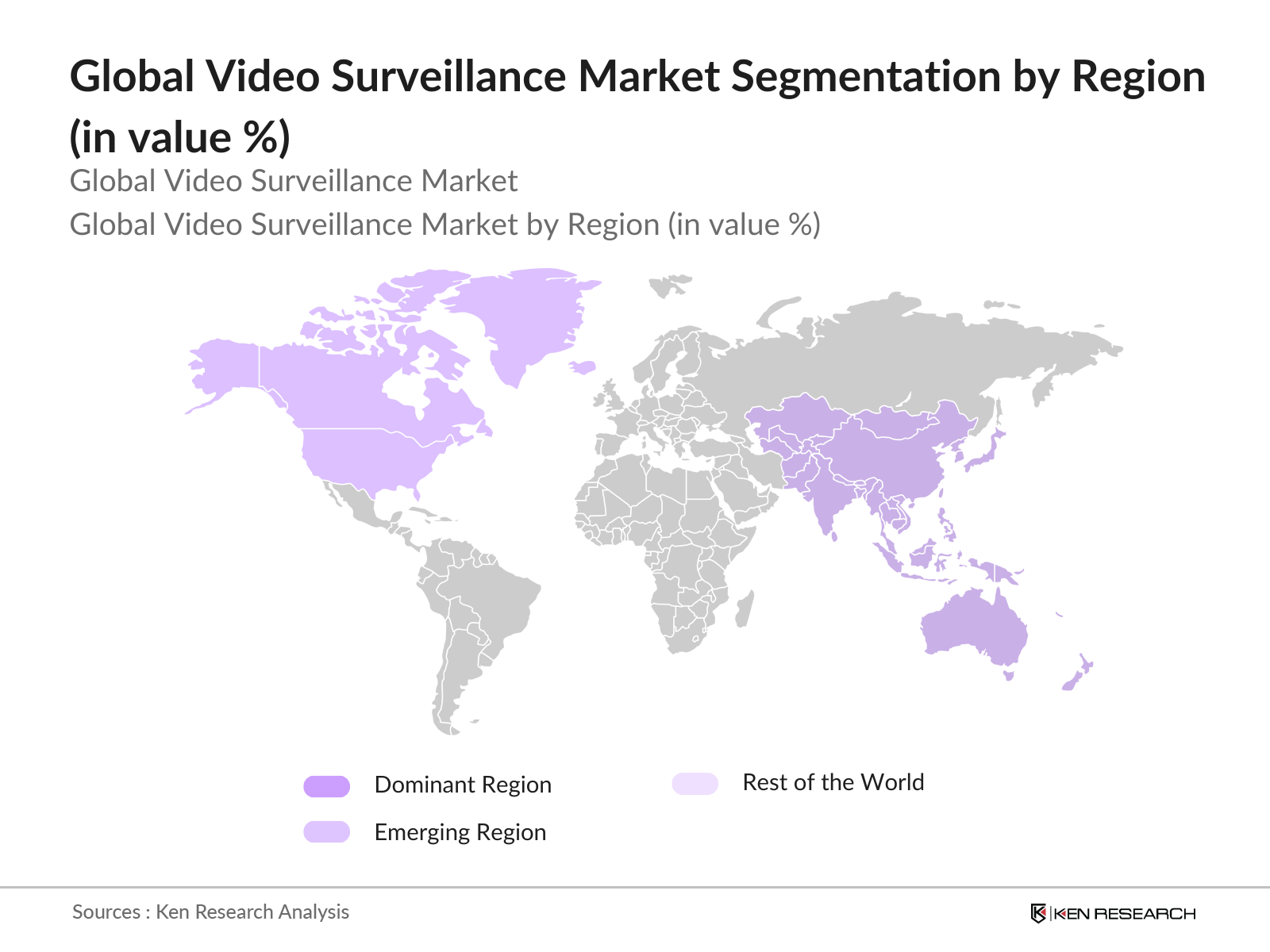

By Region: The global video surveillance market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, North America held the largest market share, driven by technological innovation, significant investments in security solutions, and a high demand across various sectors such as government and retail. Asia-Pacific, while not the largest market, is recognized for its rapid growth potential, largely due to urbanization and substantial investments in smart city initiatives in countries like China and India.

By Application: The global video surveillance market is segmented by application into commercial, industrial, residential, and public facilities. In 2023, the commercial segment dominated the market. This dominance is driven by the growing need for security in retail stores, offices, and banks. The rise of e-commerce and the need for efficient loss prevention strategies have further propelled the demand for video surveillance in the commercial sector.

Global Video Surveillance Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Hikvision |

2001 |

Hangzhou, China |

|

Dahua Technology |

2001 |

Hangzhou, China |

|

Axis Communications |

1984 |

Lund, Sweden |

|

Bosch Security Systems |

1886 |

Gerlingen, Germany |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

- Hikvision’s: In 2024, Hikvision introduced its latest AI cloud services designed to enhance the analytics capabilities of video surveillance systems. The company also expanded its market reach by opening a new R&D center in Germany, focusing on the development of next-generation surveillance technologies. These initiatives align with Hikvision’s strategy to maintain its leadership in the global video surveillance market.

- Dahua Technology’s: In 2023, Dahua Technology launched its WizMind series, featuring advanced analytics for behavior analysis and people counting. The company also announced the establishment of a new manufacturing plant in Brazil to meet the growing demand in Latin America. Additionally, Dahua signed a strategic partnership with a leading AI firm to integrate more sophisticated AI algorithms into its surveillance solutions, reinforcing its competitive position in the market.

Global Video Surveillance Market Analysis

Global Video Surveillance Market Growth Drivers

- Increasing Adoption of AI and Deep Learning Technologies in Surveillance Systems: The global video surveillance market has experienced a significant boost due to the integration of AI and deep learning technologies. These advancements allow for real-time video analytics, enabling features like facial recognition, behavior analysis, and anomaly detection.

- Expansion of Smart City Initiatives: Governments worldwide have been investing heavily in smart city projects, which are a major driver of the video surveillance market. These initiatives focus on enhancing urban infrastructure, including the installation of advanced surveillance systems in major cities.

- Rising Incidence of Security Threats: The global rise in security threats, including cyber-attacks and terrorism, has necessitated the deployment of robust surveillance systems across various sectors. Increased funding and efforts to enhance real-time monitoring capabilities in critical areas such as airports, seaports, and government facilities are driving the demand for advanced video surveillance technologies.

Global Video Surveillance Market Challenges

- High Initial Costs and Maintenance: The initial investment required for advanced video surveillance systems remains a significant barrier, particularly for small and medium-sized enterprises (SMEs). The costs associated with deploying a comprehensive surveillance system, including AI capabilities, can be substantial. For instance, a mid-sized retail company looking to install a state-of-the-art surveillance system may face expenses not only for the cameras and recording equipment but also for installation, training, and ongoing maintenance.

- Integration Issues with Legacy Systems: Many organizations still rely on outdated or legacy surveillance systems, which are often incompatible with newer, AI-driven technologies. For example, a manufacturing facility that has been using an analog surveillance system for years may encounter significant challenges when attempting to integrate modern IP cameras and cloud storage solutions.

Global Video Surveillance Market Government Initiatives

- Regulatory Frameworks for Surveillance Use: Governments are establishing regulatory frameworks to govern the use of video surveillance technologies, ensuring they are used responsibly and ethically. For instance, the UK’s Surveillance Camera Code of Practice outlines guidelines for the deployment and use of surveillance cameras in 2023 public places. These regulations are expected to encourage the adoption of compliant video surveillance systems, fostering market growth.

- China's Public Safety Enhancement Program: In 2023, the Chinese government expanded its Public Safety Enhancement Program, with an additional USD 12 billion invested in upgrading the country's surveillance infrastructure. This program focuses on the widespread deployment of AI-powered surveillance cameras across major cities, including Beijing, Shanghai, and Shenzhen. The initiative also includes the integration of these systems with the country's vast data networks to enable real-time monitoring and analysis, significantly boosting the video surveillance market in China.

Global Video Surveillance Market Outlook

The video surveillance market evolves, several key trends are expected to shape its landscape by 2028. The market is poised for substantial growth, driven by technological advancements and the increasing demand for enhanced security solutions. The integration of artificial intelligence (AI), edge computing, and 5G technology will play a pivotal role in transforming surveillance systems, making them more intelligent, responsive, and efficient.

Future Trends:

- Expansion of AI-Powered Surveillance Systems: By 2028, the video surveillance market is expected to be significantly shaped by the continued expansion of AI-powered systems. These systems will become more advanced, with capabilities such as emotion recognition and predictive analytics becoming standard features. The global deployment of AI-driven surveillance is projected to increase by 50% over the next five years, with significant growth in smart cities and critical infrastructure. This trend will be driven by the increasing need for real-time, actionable insights from video data, particularly in densely populated urban areas.

- Expansion of 5G-Enabled Surveillance Solutions: The global rollout of 5G networks will revolutionize the video surveillance market by 2028, enabling faster and more reliable transmission of high-definition video streams. 5G-enabled surveillance systems will support the growing demand for real-time monitoring and analytics in smart cities and industrial applications. The adoption of 5G in surveillance will be driven by the increasing need for high-speed, low-latency communication in security operations.

Scope of the Report

|

By Product Type |

Cameras Storage solutions Video management systems (VMS) |

|

By Application |

Commercial Industrial, Residential Public facilities |

|

By Region |

North America Europe, Asia-Pacific (APAC) Latin America Middle East & Africa (MEA) |

|

By Component |

Hardware, Software Services |

Products

Key Target Audience

Government and Regulatory Bodies

Law Enforcement Agencies

Private Security Companies

Transportation Authorities

Data Centers

Investments and Venture Capitalist Firms

Critical Infrastructure Operators

Public Safety Organizations

Companies

Players Mentioned in the Report:

Hikvision

Dahua Technology

Axis Communications

Bosch Security Systems

Honeywell International Inc.

Avigilon Corporation

Hanwha Techwin

Pelco (Schneider Electric)

FLIR Systems

Panasonic Corporation

Sony Corporation

Uniview

Vivotek Inc.

Infinova Corporation

Verint Systems Inc.

Table of Contents

01. Global Video Surveillance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Video Surveillance Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Video Surveillance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of AI and Deep Learning Technologies

3.1.2. Expansion of Smart City Initiatives

3.1.3. Rising Incidence of Security Threats

3.2. Challenges

3.2.1. Privacy Concerns and Regulatory Hurdles

3.2.2. High Initial Costs and Maintenance

3.2.3. Integration Issues with Legacy Systems

3.3. Government Initiatives

3.3.1. U.S. Safe Cities Initiative

3.3.2. Indias Smart Cities Mission

3.3.3. Chinas Public Safety Enhancement Program

3.4. Recent Trends

3.4.1. Adoption of Cloud-Based Surveillance Solutions

3.4.2. Integration of AI and IoT in Surveillance Systems

3.4.3. Increased Focus on Cybersecurity in Surveillance

3.5. Company-Specific Recent Developments

3.5.1. Hikvision's Launch of the HikCentral Professional 2.5

3.5.2. Dahua Technology's Expansion into AIoT

3.5.3. Axis Communications' Partnership with Intel for AI Integration

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

04. Global Video Surveillance Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Cameras

4.1.2. Storage Solutions

4.1.3. Video Management Systems (VMS)

4.2. By Application (in Value %)

4.2.1. Commercial

4.2.2. Industrial

4.2.3. Residential

4.2.4. Public Facilities

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific (APAC)

4.3.4. Latin America

4.3.5. Middle East & Africa (MEA)

05. Global Video Surveillance Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Hikvision

5.1.2. Dahua Technology

5.1.3. Axis Communications

5.1.4. Bosch Security Systems

5.1.5. Honeywell International Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

06. Global Video Surveillance Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. Global Video Surveillance Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. Compliance Requirements

7.3. Certification Processes

08. Global Video Surveillance Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. Global Video Surveillance Market Future Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Product Type (in Value %)

9.3. By Application (in Value %)

10. Global Video Surveillance Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Video Surveillance Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Video Surveillance Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple synthetic fuel providers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Synthetic Fuel providers.

Frequently Asked Questions

01. How big is the global video surveillance market?

The global video surveillance market reached a size of USD 53.6 billion in 2023, driven by the increasing need for security across various sectors, including government, retail, transportation, and residential applications.

02. What are the challenges in the global video surveillance market?

Challenges in the global video surveillance market include privacy concerns, regulatory hurdles, and the high initial costs of deploying advanced surveillance systems. Additionally, the integration of new technologies with legacy systems remains a significant challenge for many organizations.

03. Who are the major players in the global video surveillance market?

Key players in the global video surveillance market include Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, and Honeywell International Inc. These companies lead the market due to their innovative technologies, extensive product portfolios, and strong global distribution networks.

04. What are the growth drivers of the global video surveillance market?

The global video surveillance market is driven by the increasing adoption of AI and deep learning technologies, the expansion of smart city initiatives, and the rising incidence of security threats. These factors have significantly boosted the demand for advanced surveillance solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.