Global Virtual Events Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD7790

December 2024

89

About the Report

Global Virtual Events Market Overview

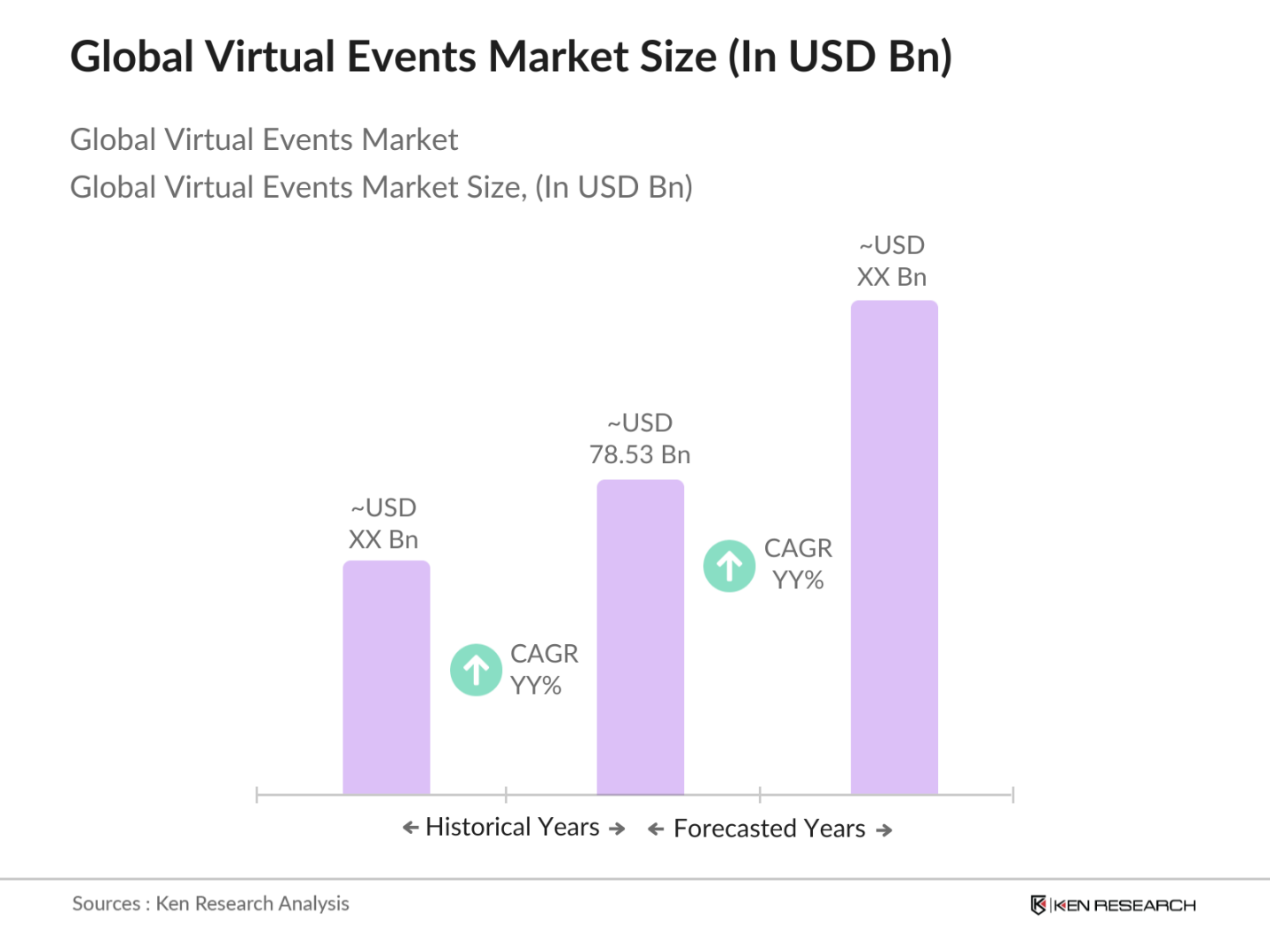

- The global virtual events market is valued at approximately USD 78.53 billion, based on a five-year historical analysis. This growth is driven by a surge in digitalization and the increasing preference for remote event participation due to technological advancements. Key sectors, such as corporate training, virtual conferences, and product launches, have adopted virtual platforms as cost-effective and scalable solutions. The global shift toward virtual interactions has been accelerated by the demand for hybrid events that combine physical and virtual elements, further driving market adoption in recent years.

- North America, particularly the United States, dominates the global virtual events market due to the region's robust technological infrastructure and the early adoption of virtual event platforms. Major corporations in the US have increasingly turned to virtual platforms for large-scale meetings, conferences, and events. Similarly, Asia-Pacific, led by countries like China and India, is rapidly gaining ground due to expanding internet penetration and the adoption of innovative technologies such as AI and VR in virtual events. These countries have seen a rise in demand for remote events, particularly in education and corporate sectors.

- The rapid expansion of virtual events has drawn attention to the importance of data privacy and compliance. Governments across the globe have introduced new regulations to ensure that virtual platforms adhere to strict data protection laws. For instance, in 2023, the European Unions General Data Protection Regulation (GDPR) issued fines totaling 2.92 billion for non-compliance by virtual event platforms. This underscores the growing need for businesses to invest in secure systems that protect attendee data and meet regulatory standards in different regions, ensuring event success.

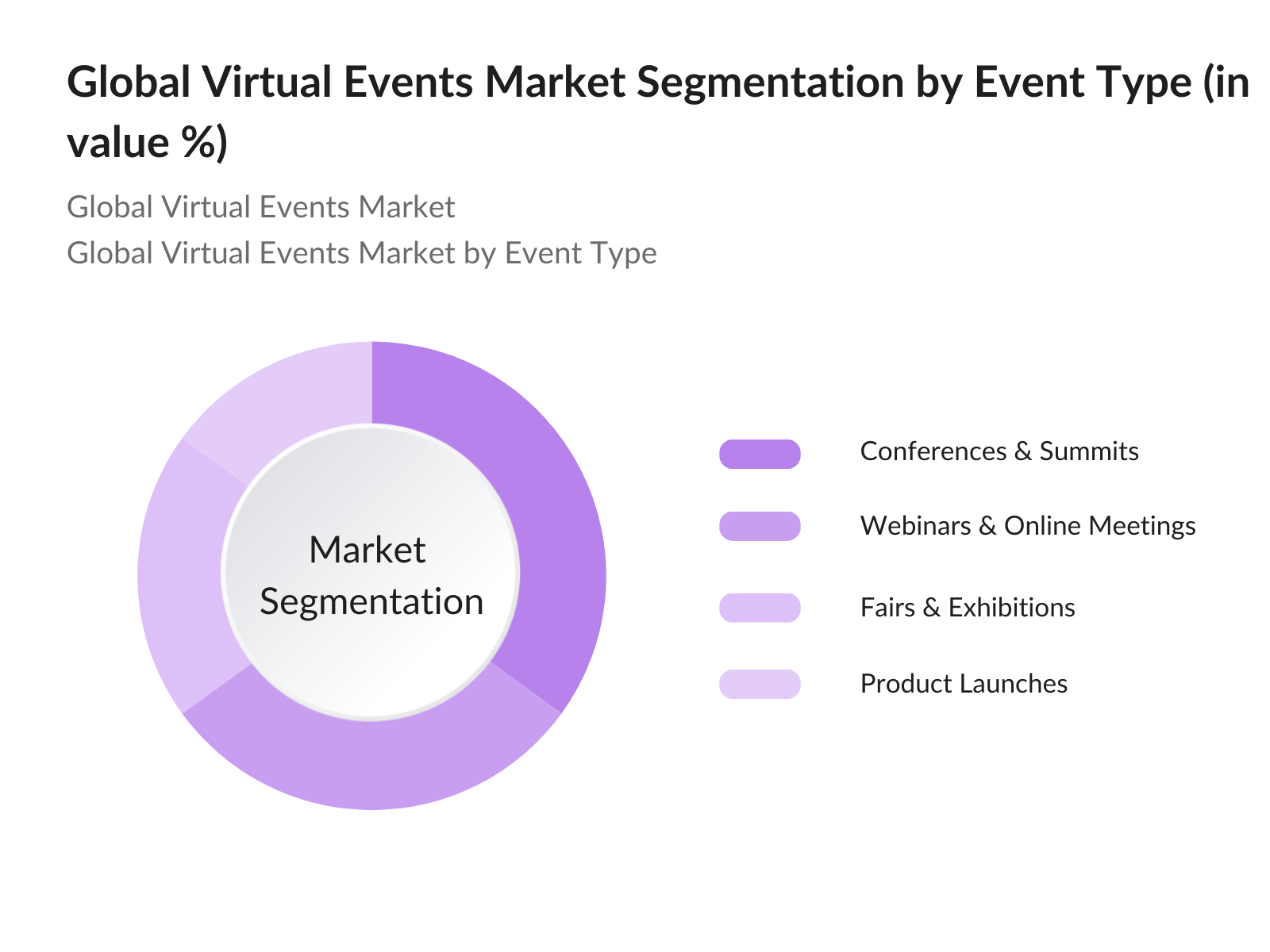

Global Virtual Events Market Segmentation

By Event Type: The global virtual events market is segmented by event type into conferences & summits, webinars & online meetings, fairs & exhibitions, and product launches. Conferences & summits hold the dominant market share due to the widespread use of virtual platforms by large corporations for international summits and conferences. The ease of global participation and cost reduction associated with travel and logistics are key factors that contribute to this segments dominance. Webinars and online meetings are also gaining momentum due to the increasing preference for remote communication and learning, particularly in educational institutions.

By Region: The segmentation includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest share due to its technological advancements and the early adoption of virtual event platforms. Asia-Pacific follows closely behind, driven by the growth of internet penetration, the widespread adoption of digital platforms, and increasing investments in virtual technologies by governments and corporations alike. The Middle East & Africa segment is projected to show future growth due to an increasing focus on digital transformation and virtual engagements in education and healthcare.

Global Virtual Events Market Competitive Landscape

The global virtual events market is dominated by both global and regional players, with strong competition based on technological innovation, platform usability, and customization options. Key companies have been increasing investments in AI and VR technologies to enhance user experience and interactivity. The competition landscape includes major players who provide diverse solutions, from large-scale corporate events to niche virtual exhibitions.

|

Company |

Established Year |

Headquarters |

Technology Integration |

Platform Usability |

Client Base |

Customization Options |

Global Presence |

Revenue (USD) |

|

Cisco Webex |

1984 |

San Jose, USA |

AI, Cloud-based Solutions |

- |

- |

- |

- |

- |

|

Zoom Video Communications |

2011 |

San Jose, USA |

AR/VR, AI |

- |

- |

- |

- |

- |

|

Microsoft Teams |

2017 |

Redmond, USA |

Cloud-based Solutions |

- |

- |

- |

- |

- |

|

Adobe Connect |

2005 |

San Jose, USA |

AI, Cloud-based Solutions |

- |

- |

- |

- |

- |

|

On24 |

1998 |

San Francisco, USA |

AI, Customizable Features |

- |

- |

- |

- |

- |

Global Virtual Events Market Analysis

Market Growth Drivers

- Increasing Demand for Remote Events (Increased Corporate Virtual Events, Conferences, etc.): The surge in corporate virtual events has been driven by the rapid digitization of business operations and growing demand for remote interactions. In 2022, the global digital workforce saw a major shift, with remote working systems influencing a large number of corporations, according to the International Labour Organization (ILO). Virtual event platforms, particularly in sectors like technology and finance, have seen heightened demand as remote meetings, conferences, and summits became a norm. The World Economic Forum reported that 73 million professionals participated in virtual conferences and webinars in 2023, driven by this demand for flexibility.

- Technological Advancements (AI, AR/VR Integration): Technological innovations, including artificial intelligence (AI) and augmented reality (AR)/virtual reality (VR), have played a pivotal role in enhancing the quality of virtual events. The International Telecommunication Union (ITU) reported a 45% increase in businesses adopting AI solutions for virtual platforms between 2022 and 2024. Furthermore, AR/VR technologies are transforming the virtual experience by offering immersive environments for participants, particularly in industries like entertainment and gaming. In 2023, the number of AR/VR users globally surpassed 171 million, highlighting the growing application of these technologies in the event space.

- Expansion of Hybrid Events (Physical + Virtual): The combination of physical and virtual (hybrid) events has grown in popularity as organizations look to blend in-person and remote participation. According to data from the World Bank, many large-scale global events in 2023 adopted hybrid formats, enabling broader audience engagement. This trend is particularly prominent in the education and healthcare sectors, where conferences and workshops can cater to both local and international audiences simultaneously. Hybrid events also minimize geographical barriers, allowing for participation from emerging markets, which saw increased attendance from countries in Southeast Asia in 2023.

Market Challenges:

- Increasing Demand for Remote Events (Increased Corporate Virtual Events, Conferences, etc.): The surge in corporate virtual events has been driven by the rapid digitization of business operations and growing demand for remote interactions. In 2022, the global digital workforce saw a major shift, with remote working systems influencing a large number of corporations, according to the International Labour Organization (ILO). Virtual event platforms, particularly in sectors like technology and finance, have seen heightened demand as remote meetings, conferences, and summits became a norm. The World Economic Forum reported that 73 million professionals participated in virtual conferences and webinars in 2023, driven by this demand for flexibility.

- Engagement Retention in Virtual Environments: One of the most significant challenges faced by virtual event organizers is maintaining attendee engagement over extended periods. A 2023 study by the International Labour Organization (ILO) noted that virtual events often experience drops in engagement, particularly in non-interactive sessions. This poses a challenge for event planners, as the lack of physical presence can lead to distractions for participants. Moreover, the absence of face-to-face networking opportunities further contributes to disengagement, prompting the need for more interactive and engaging virtual formats.

Global Virtual Events Market Future Outlook

Over the next five years, the global virtual events market is expected to experience significant growth, driven by increasing technological advancements, the shift toward hybrid events, and a continuous focus on enhancing remote engagement capabilities. AI and VR integrations are likely to transform the virtual event experience, making it more interactive and immersive. Furthermore, industries such as education, healthcare, and corporate training are expected to continue their heavy reliance on virtual platforms as an efficient and cost-effective means of engagement.

Market Opportunities:

- AI Integration for Personalization and Analytics: Artificial intelligence (AI) is transforming the virtual events industry by providing tailored experiences and in-depth analytics for event organizers. AI-powered platforms have been increasingly adopted, allowing hosts to offer personalized content, targeted networking, and optimized schedules for attendees. In 2023, the International Telecommunication Union (ITU) reported that many global event organizers used AI tools to enhance attendee experience and analyze engagement levels in real-time. These insights help improve future events by identifying attendee preferences and tailoring content to meet the needs of diverse audiences.

- Use of Virtual Reality (VR) and Augmented Reality (AR): The use of virtual and augmented reality technologies has become more prevalent in creating immersive experiences in virtual events. In 2022, the global VR/AR user base reached 171 million, with many companies using these technologies to host trade shows, exhibitions, and interactive product demonstrations. The expansion of VR and AR in the event space is particularly significant in sectors such as automotive and manufacturing, where virtual environments allow for life-like demonstrations without physical presence. This trend is expected to further revolutionize the way companies interact with clients and audiences.

Scope of the Report

|

By Event Type |

Conferences & Summits Webinars & Online Meetings Fairs & Exhibitions Product Launches |

|

By Platform Type |

Video Conferencing Platforms Live Streaming Platforms Custom Event Platforms |

|

By End-User Industry |

Corporate Education Healthcare Government Media & Entertainment |

|

By Technology |

AR/VR Integration AI-Powered Platforms Cloud-Based Solutions |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Corporate event organizers

Education sector virtual event platforms

Healthcare institutions using virtual conferencing

Government and regulatory bodies (e.g., Federal Trade Commission)

Large-scale exhibition organizers

Product launch event platforms

Investments and venture capitalist firms

Technology and virtual platform developers

Companies

Players Mention in the Report

Cisco Webex

Zoom Video Communications

Microsoft Teams

Adobe Connect

On24

Hopin

Airmeet

BigMarker

EventMobi

Remo

vFairs

Whova

Bizzabo

Intrado

6Connex

Table of Contents

01. Global Virtual Events Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Drivers (Technology Adoption, Remote Work Trends, Corporate Training Needs, etc.)

1.4. Market Segmentation Overview

02. Global Virtual Events Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Virtual Events Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Remote Events (Increased Corporate Virtual Events, Conferences, etc.)

3.1.2. Technological Advancements (AI, AR/VR Integration)

3.1.3. Expansion of Hybrid Events (Physical + Virtual)

3.2. Market Challenges

3.2.1. Bandwidth and Technological Limitations

3.2.2. High Initial Costs of Event Platforms

3.2.3. Engagement Retention in Virtual Environments

3.3. Opportunities

3.3.1. Growth in Virtual Event Platforms for Education and Training

3.3.2. Rise in Global Event Accessibility (Remote Participation)

3.3.3. Expansion of Metaverse for Virtual Events

3.4. Trends

3.4.1. AI Integration for Personalization and Analytics

3.4.2. Use of Virtual Reality (VR) and Augmented Reality (AR)

3.4.3. Customizable Platforms for Diverse Event Types (Webinars, Trade Shows, etc.)

3.5. Government Regulation

3.5.1. Data Privacy and Compliance for Virtual Platforms

3.5.2. Intellectual Property Protection in Virtual Events

3.5.3. Standardization of Virtual Event Practices

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Virtual Events Market Segmentation

4.1. By Event Type

4.1.1. Conferences & Summits

4.1.2. Webinars & Online Meetings

4.1.3. Fairs & Exhibitions

4.1.4. Product Launches

4.2. By Platform Type

4.2.1. Video Conferencing Platforms

4.2.2. Live Streaming Platforms

4.2.3. Custom Event Platforms

4.3. By End-User Industry

4.3.1. Corporate

4.3.2. Education

4.3.3. Healthcare

4.3.4. Government

4.3.5. Media & Entertainment

4.4. By Technology

4.4.1. AR/VR Integration

4.4.2. AI-Powered Platforms

4.4.3. Cloud-Based Solutions

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Virtual Events Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Cisco Webex

5.1.2. Zoom Video Communications

5.1.3. Microsoft Teams

5.1.4. Adobe Connect

5.1.5. On24

5.1.6. Hopin

5.1.7. Airmeet

5.1.8. BigMarker

5.1.9. EventMobi

5.1.10. Remo

5.1.11. vFairs

5.1.12. Whova

5.1.13. Bizzabo

5.1.14. Intrado

5.1.15. 6Connex

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Product Offerings, Annual Revenue, Global Presence, Event Types Supported, Pricing Model, User Reviews)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

06. Global Virtual Events Market Regulatory Framework

6.1. Data Security and Privacy Standards

6.2. Intellectual Property Rights for Virtual Content

6.3. International Compliance for Cross-border Events

07. Global Virtual Events Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Virtual Events Future Market Segmentation

8.1. By Event Type

8.2. By Platform Type

8.3. By End-User Industry

8.4. By Technology

8.5. By Region

09. Global Virtual Events Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves creating an ecosystem map of key players and technologies in the global virtual events market. This includes extensive research from secondary and proprietary sources to capture market drivers, technological trends, and user behaviors.

Step 2: Market Analysis and Construction

Data from various reports, industry publications, and expert interviews were analyzed to create a model of market penetration and virtual platform adoption. Key data points include the number of participants, event types, and technological preferences, ensuring an accurate reflection of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with experts and event organizers, market hypotheses were validated, and real-time data from both global and regional players was collected. This feedback from industry leaders helped refine and verify market projections.

Step 4: Research Synthesis and Final Output

The final output integrates insights from virtual event organizers and technology providers, ensuring that all market figures reflect actual industry trends. The data was thoroughly vetted for accuracy and reliability, ensuring that the final report offers a comprehensive market analysis.

Frequently Asked Questions

01. How big is the Global Virtual Events Market?

The global virtual events market is valued at USD 78.53 billion, driven by advancements in technology, increasing demand for remote interactions, and the rise of hybrid events.

02. What are the challenges in the Global Virtual Events Market?

Challenges include bandwidth and technological limitations in certain regions, the need for high initial costs for advanced platforms, and retaining audience engagement in virtual formats.

03. Who are the major players in the Global Virtual Events Market?

Major players include Cisco Webex, Zoom Video Communications, Microsoft Teams, Adobe Connect, and On24, each of which offers diverse solutions to meet the growing demand for virtual event platforms.

04. What are the growth drivers of the Global Virtual Events Market?

The key growth drivers include technological advancements such as AI and AR/VR integration, the rise of hybrid events, and the increasing demand for cost-effective, scalable event solutions across sectors like education and healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.