Global Virtualization Software Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1993

December 2024

82

About the Report

Global Virtualization Software Market Overview

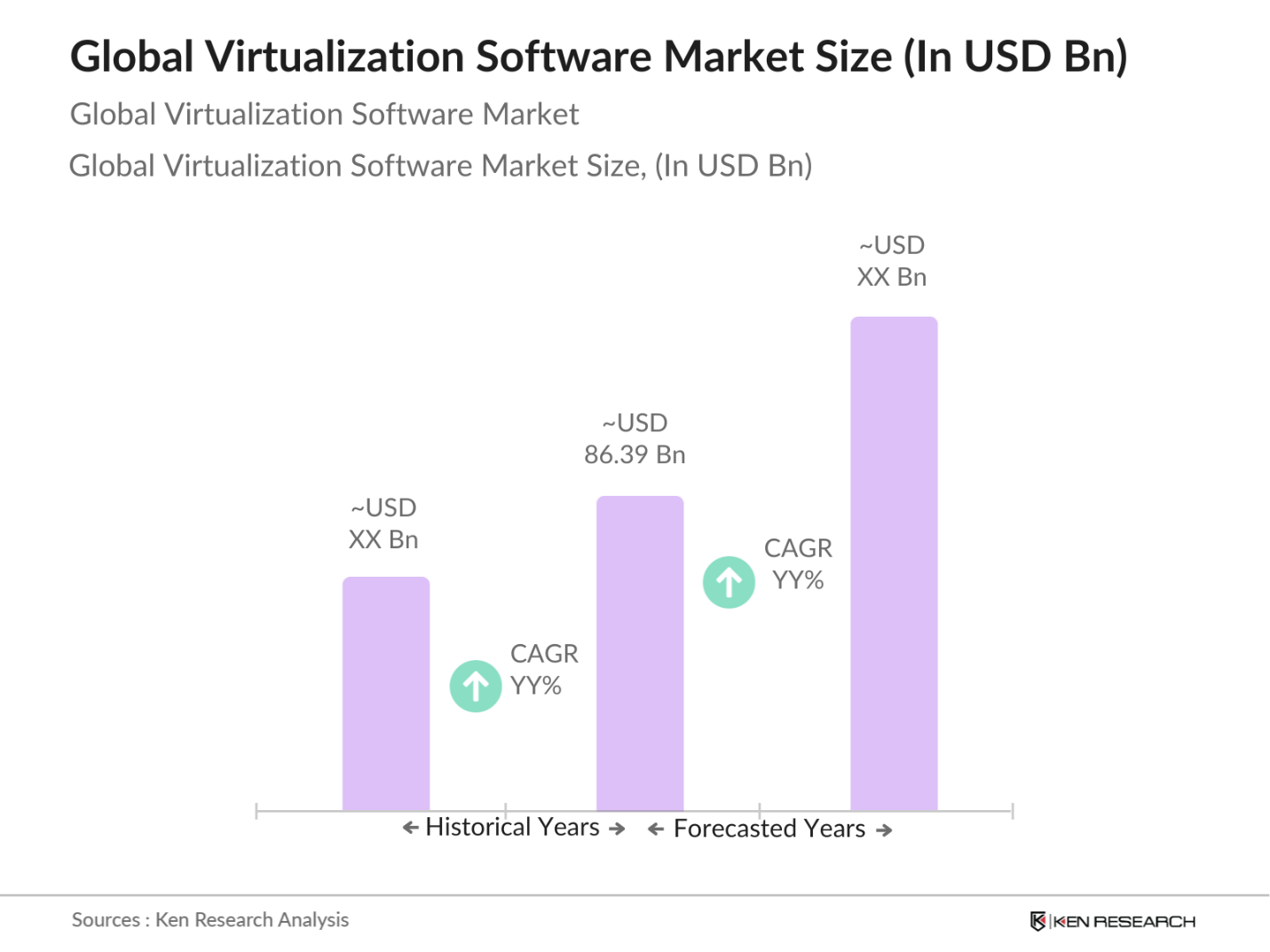

- The Global Virtualization Software Market is valued at USD 86.39 billion, reflecting a robust growth trajectory driven by increasing cloud adoption and the demand for operational efficiency across enterprises. Organizations are increasingly investing in virtualization technologies to reduce hardware costs, enhance server utilization, and streamline IT operations. As businesses continue to migrate to cloud-based infrastructures, the market is anticipated to witness substantial growth in the coming years, fueled by innovations in hypervisor technologies and integrated solutions.

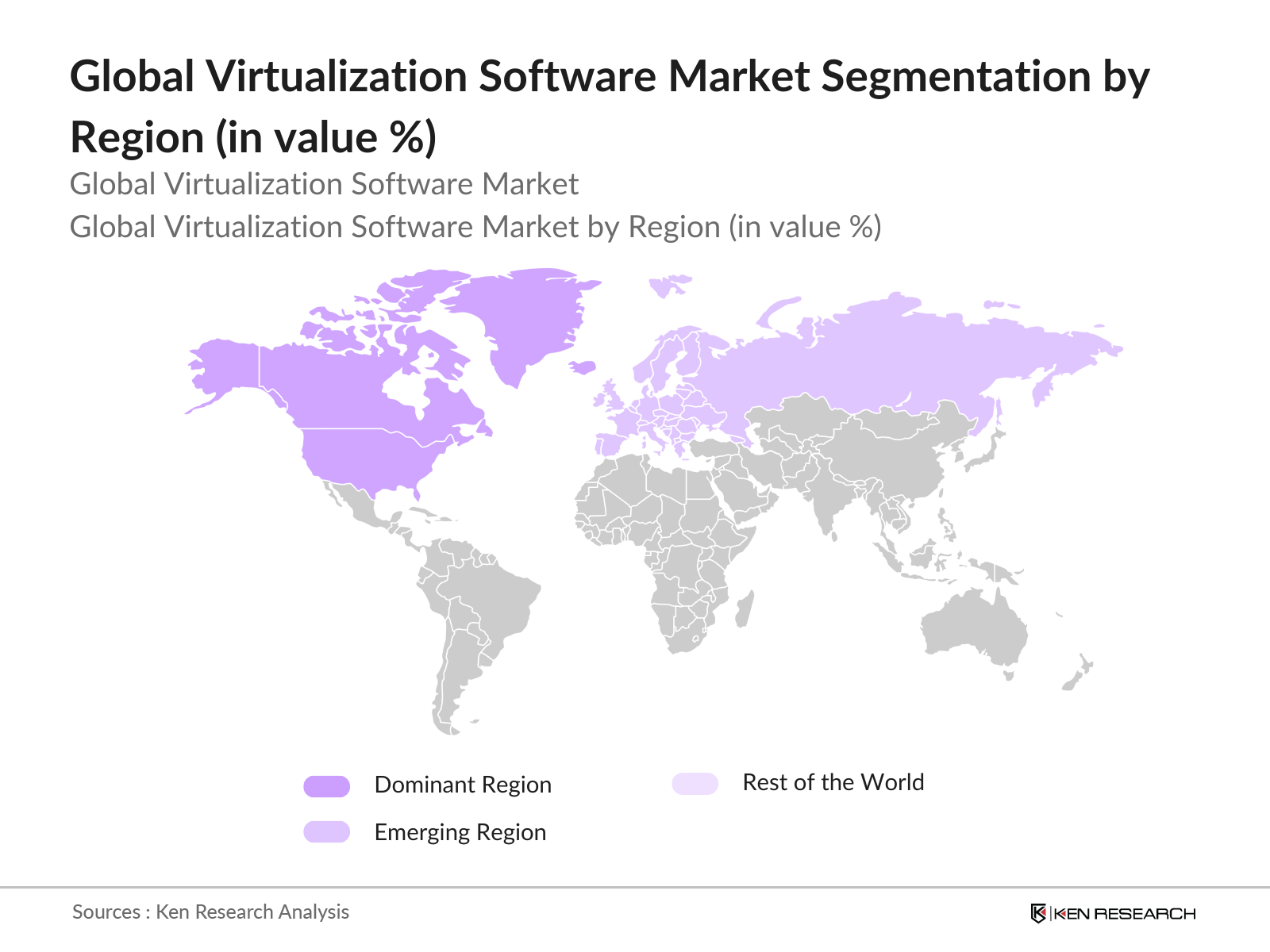

- Regions like North America, particularly the United States, and Europe lead the market, primarily due to their advanced IT infrastructure and significant investments in digital transformation initiatives. The presence of major technology players and a high concentration of data centers in these regions also contribute to their dominance. Additionally, the growing trend of remote work and digital workspace solutions has further accelerated the demand for virtualization software in these markets.

- Governments worldwide are offering incentives for green IT practices, which include virtualization technologies that reduce energy consumption. As of 2023, many organizations are participating in government programs aimed at promoting sustainable IT practices, resulting in energy savings exceeding $5 billion. These initiatives are driving investments in virtualization solutions that contribute to reducing carbon footprints and enhancing operational efficiency. The ongoing push for sustainability is creating a favorable environment for the growth of virtualization technologies.

Global Virtualization Software Market Segmentation

By Deployment Model: The Global Virtualization Software Market is segmented by deployment model into On-Premises and Cloud-Based solutions. In 2023, Cloud-Based solutions have captured a dominant market share due to their scalability and flexibility, enabling organizations to adapt to fluctuating workloads without the need for substantial capital investment in physical infrastructure. As enterprises increasingly favor subscription-based models for operational flexibility, cloud solutions have become pivotal in supporting remote work environments and global operations.

By Region: The Global Virtualization Software Market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the market, accounting for a significant share due to its advanced technological landscape and early adoption of virtualization solutions. The increasing focus on digital transformation and cloud migration by enterprises in the U.S. has led to higher investments in virtualization technologies, further cementing the region's leading position in the market.

Global Virtualization Software Market Competitive Landscape

The Global Virtualization Software Market is characterized by the presence of several key players. The market is dominated by a few major companies, including VMware, Microsoft, ssand Citrix Systems, which leverage their strong technological capabilities and extensive distribution networks. This consolidation highlights the significant influence of these key players, who continually innovate to meet the evolving demands of their customers.

Global Virtualization Software Market Analysis

Market Growth Drivers

- Increasing Cloud Adoption: The global cloud services market is projected to reach approximately $590 billion by the end of 2023, driven largely by the rapid adoption of cloud computing solutions across various sectors. In 2023, many enterprises are utilizing cloud services in some capacity, reflecting a significant shift towards digital transformation. This transition is supported by robust IT infrastructure investment, which, according to the World Bank, is expected to reach $2 trillion by 2025. This strong growth in cloud services facilitates the demand for virtualization software, enhancing operational flexibility and scalability for businesses worldwide.

- Demand for Cost Efficiency: Organizations are increasingly recognizing the need for cost-effective IT solutions. In 2023, businesses reported an average IT budget of $1.3 million, with a significant portion allocated to virtualization technologies, which can lead to substantial reductions in operational costs. This is primarily due to lower hardware requirements and reduced energy consumption, with studies indicating that virtualization can save businesses approximately $20 billion collectively in energy costs by 2024. As companies seek to optimize expenses amidst economic pressures, the demand for virtualization software continues to grow.

- Rise in Data Center Consolidation: The trend towards data center consolidation is accelerating, with many enterprises planning to reduce the number of data centers they operate by 2024. This consolidation is driven by the need to streamline operations and reduce overhead costs. In 2022, numerous organizations reported experiencing operational efficiencies by implementing virtualization solutions, allowing for better resource allocation and management. The shift towards fewer, more powerful data centers creates a robust market for virtualization software as organizations seek efficient management solutions.

Market Challenges:

- Complexity of Virtualized Environments: The increasing complexity of virtualized environments poses significant challenges for IT departments. Many IT professionals find managing virtualized infrastructures more complicated than traditional systems. This complexity can lead to increased operational risks and potential downtimes, costing organizations up to $5,000 per minute. Moreover, the lack of skilled personnel to manage these environments complicates the implementation of effective virtualization solutions. The need for continuous training and investment in IT staff is becoming critical for organizations adopting virtualization technology.

- Security Concerns: Security remains a paramount concern in the adoption of virtualization technologies. In 2022, many organizations experienced at least one security breach related to their virtualized environments, leading to losses averaging $4.24 million per incident. As virtualization exposes organizations to unique security vulnerabilities, businesses must invest significantly in advanced security measures. It is projected that a substantial portion of IT budgets will be allocated to security in the coming years, as organizations prioritize safeguarding their virtual environments against increasingly sophisticated cyber threats.

Global Virtualization Software Market Future Outlook

Over the next five years, the Global Virtualization Software Market is expected to show significant growth, driven by continuous advancements in virtualization technologies and an increasing shift towards hybrid cloud environments. As businesses prioritize flexibility, scalability, and cost efficiency, the demand for virtualization solutions will rise. The trend of remote work and the growing need for robust IT infrastructure will further catalyze market growth, positioning virtualization software as a fundamental component of modern IT strategies.

Market Opportunities:

- Innovations in Hypervisor Technology: Current advancements in hypervisor technology present significant opportunities for the virtualization software market. As of 2023, the introduction of Type 1 hypervisors has led to improvements in performance and resource management, enabling enterprises to run more virtual machines on fewer physical servers. In 2022, many enterprises experienced increased efficiency with the adoption of these technologies, resulting in estimated savings of $15 billion in hardware costs across the industry. Innovations in hypervisor technology are anticipated to further propel market growth as organizations seek to optimize their IT infrastructure.

- Expansion of Edge Computing: The expansion of edge computing is creating new avenues for virtualization software. As of 2023, the global edge computing market is estimated to reach $40 billion, with projections indicating a compound growth rate of annually through 2025. This growth is driven by the increasing need for real-time data processing and reduced latency, which virtualization technologies can efficiently support. The integration of virtualization in edge computing environments enhances resource allocation and improves performance, providing a significant opportunity for software developers in this sector.

Scope of the Report

|

By Deployment Model |

On-Premises Cloud-based |

|

By Type |

Server Virtualization Desktop Virtualization Application Virtualization |

|

By End-User Industry |

IT & Telecommunications BFSI Healthcare Education Manufacturing |

|

By Service Type |

Managed Services Professional Services Training and Support |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

IT Managers

Chief Information Officers (CIOs)

Data Center Operators

Systems Integrators

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, NIST)

Technology Consultants

Business Development Executives

Companies

Players Mention in the Report

VMware

Microsoft

Citrix Systems

Red Hat

Oracle

Nutanix

Amazon Web Services

IBM

Dell Technologies

Cisco Systems

Parallels

HPE

KVM

VirtualBox

Citrix

Table of Contents

01. Global Virtualization Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Virtualization Software Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Virtualization Software Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Cloud Adoption

3.1.2. Demand for Cost Efficiency

3.1.3. Rise in Data Center Consolidation

3.1.4. Need for Business Continuity and Disaster Recovery

3.2. Market Challenges

3.2.1. Complexity of Virtualized Environments

3.2.2. Security Concerns

3.2.3. High Implementation Costs

3.3. Opportunities

3.3.1. Innovations in Hypervisor Technology

3.3.2. Expansion of Edge Computing

3.3.3. Growth of Hybrid Cloud Solutions

3.4. Trends

3.4.1. Increase in Remote Work Solutions

3.4.2. Development of Containerization

3.4.3. Adoption of Multi-Cloud Strategies

3.5. Government Regulation

3.5.1. Data Protection Regulations

3.5.2. Compliance with IT Standards

3.5.3. Incentives for Green IT Practices

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Virtualization Software Market Segmentation

4.1. By Deployment Model (In Value %)

4.1.1. On-Premises

4.1.2. Cloud-based

4.2. By Type (In Value %)

4.2.1. Server Virtualization

4.2.2. Desktop Virtualization

4.2.3. Application Virtualization

4.3. By End-User Industry (In Value %)

4.3.1. IT & Telecommunications

4.3.2. BFSI

4.3.3. Healthcare

4.3.4. Education

4.3.5. Manufacturing

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

05. Global Virtualization Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. VMware Inc.

5.1.2. Microsoft Corporation

5.1.3. Citrix Systems Inc.

5.1.4. Red Hat, Inc.

5.1.5. Oracle Corporation

5.1.6. IBM Corporation

5.1.7. Nutanix, Inc.

5.1.8. Parallels Inc.

5.1.9. Amazon Web Services, Inc.

5.1.10. Dell Technologies Inc.

5.1.11. Cisco Systems, Inc.

5.1.12. HPE (Hewlett Packard Enterprise)

5.1.13. KVM (Kernel-based Virtual Machine)

5.1.14. QEMU (Quick Emulator)

5.1.15. VirtualBox (Oracle Corporation)

5.2. Cross Comparison Parameters (Market Share, Revenue, Geographic Presence, Product Portfolio, Innovation Rate, Customer Base, Growth Rate, Partnership Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Virtualization Software Market Regulatory Framework

6.1. Compliance Requirements

6.2. Data Protection Legislation

6.3. Certification Processes

07. Global Virtualization Software Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Virtualization Software Market Future Segmentation

8.1. By Deployment Model (In Value %)

8.2. By Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Market Maturity (In Value %)

09. Global Virtualization Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Virtualization Software Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Virtualization Software Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple virtualization software providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Virtualization Software Market.

Frequently Asked Questions

01. How big is the Global Virtualization Software Market?

The Global Virtualization Software Market is valued at USD 86.39 billion, driven by increasing cloud adoption and the demand for operational efficiency across enterprises.

02. What are the challenges in the Global Virtualization Software Market?

Challenges include the complexity of virtualized environments and security concerns, which may hinder adoption among smaller enterprises that lack sufficient IT resources.

03. Who are the major players in the Global Virtualization Software Market?

Key players include VMware, Microsoft, Citrix Systems, and Oracle, which dominate due to their extensive technological capabilities and strong customer bases.

04. What are the growth drivers of the Global Virtualization Software Market?

The market is propelled by factors such as the increasing demand for cost efficiency, the shift towards cloud-based infrastructures, and the necessity for enhanced disaster recovery solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.