Global Warehousing Market Outlook to 2030

Region:Global

Author(s):Rebecca

Product Code:KROD-024

June 2025

90

About the Report

Global Warehousing Market Overview

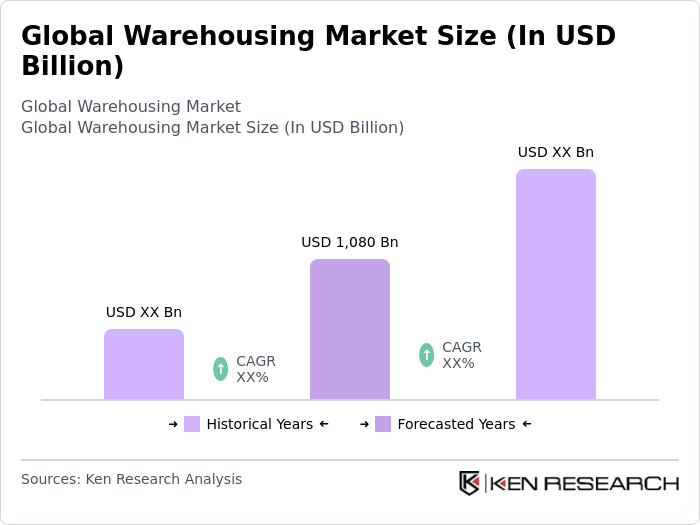

- The Global Warehousing Market was valued at USD 1,080 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for e-commerce, globalization of supply chains, and advancements in technology such as automation and robotics. The rise in consumer expectations for faster delivery times has also significantly contributed to the expansion of warehousing facilities worldwide.

- Key players in this market include the United States, China, and Germany, which dominate due to their robust logistics infrastructure, strategic geographic locations, and significant investments in technology. The U.S. benefits from a vast consumer base and advanced logistics networks, while China leads in manufacturing and export capabilities. Germany serves as a central hub in Europe, facilitating trade across the continent.

- In 2023, the European Union implemented regulations aimed at enhancing the efficiency of logistics operations, including the Logistics Action Plan. This initiative focuses on reducing carbon emissions in the transport sector and promoting sustainable practices in warehousing, which is expected to influence operational standards and compliance requirements across member states.

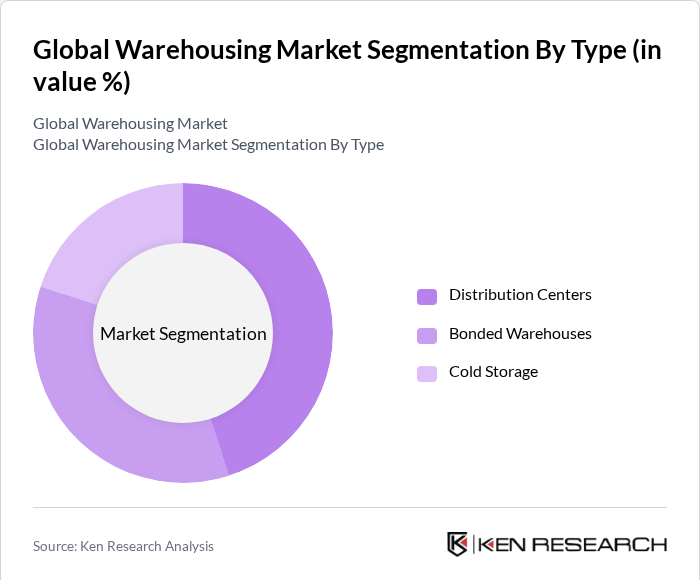

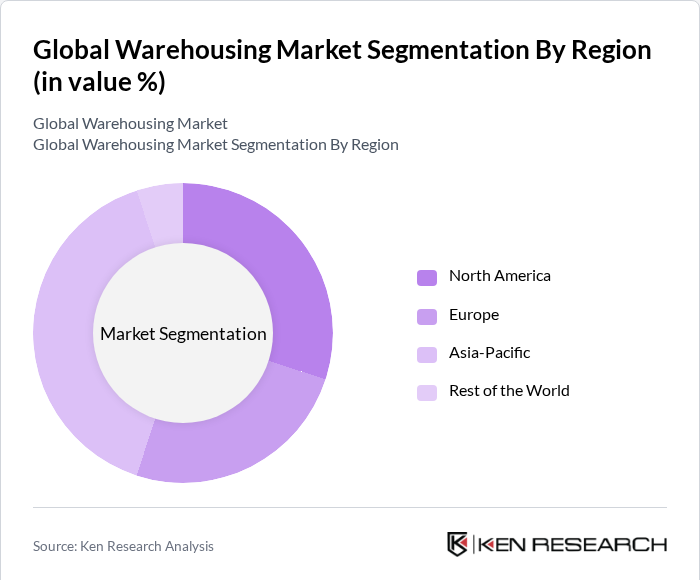

Global Warehousing Market Segmentation

By Type: The warehousing market is segmented into bonded warehouses, distribution centers, and cold storage facilities. Among these, distribution centers are dominating the market due to their flexibility and cost-effectiveness for businesses requiring scalable storage and rapid fulfillment. Companies, especially in e-commerce, increasingly prefer distribution centers to manage fluctuating inventory levels and enable quick order processing. This trend is especially prominent in the retail and consumer goods sectors, where adaptable and technology-enabled storage solutions are essential.

By Region: The warehousing market is segmented into North America, Europe, Asia-Pacific, and the rest of the world. The Asia-Pacific region is currently leading the market, driven by rapid industrialization, urbanization, and the growth of e-commerce. Countries like China and India are experiencing significant demand for warehousing solutions due to their expanding manufacturing sectors and increasing consumer markets. This region's growth is further supported by investments in logistics infrastructure and technology.

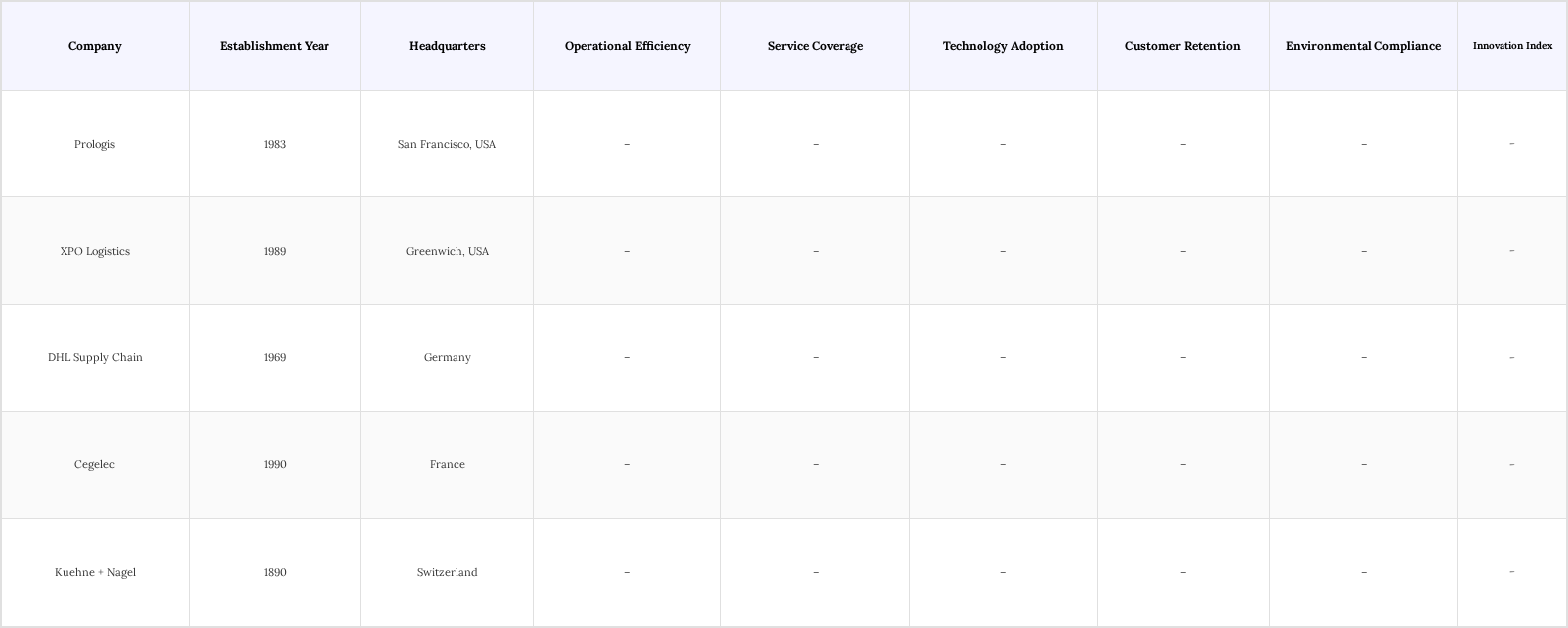

Global Warehousing Market Competitive Landscape

The Global Warehousing Market is characterized by intense competition among key players such as Prologis, XPO Logistics, and DHL Supply Chain. These companies leverage advanced technologies and extensive networks to enhance operational efficiency and customer service. The market is marked by a mix of local and international players, with a focus on innovation and sustainability to meet evolving consumer demands.

Global Warehousing Market Industry Analysis

Growth Drivers

- Increasing E-commerce Activities: The surge in global e-commerce continues to drive demand for efficient warehousing and logistics infrastructure. In 2023, e-commerce accounted for 19% of total retail sales, underscoring the critical role of logistics in supporting this growth. Consumer expectations for fast delivery are rising sharply; 53% of online retailers now offer same-day delivery, reflecting the growing importance of speed in customer satisfaction. Average delivery times have improved significantly, with the U.S. seeing a reduction from 6.6 days in 2020 to around 2.3 days by early 2024 due to investments in optimized routes and advanced tracking technologies.

- Global Supply Chain Optimization: The increasing need for enhanced supply chain efficiency is driving widespread adoption of advanced warehousing solutions. In response to challenges such as pandemic-related disruptions, companies are prioritizing inventory optimization and lead time reduction to build more resilient and agile supply chains. Recent studies show that over 70% of supply chain leaders are actively investing in warehouse automation technologies, such as automated storage and retrieval systems (AS/RS), robotics, and warehouse management systems (WMS), to improve operational accuracy and throughput.

- Rising Demand for Cold Chain Logistics: The cold chain logistics sector is experiencing strong growth driven by increasing demand for perishable goods such as fresh food and pharmaceuticals that require strict temperature control throughout the supply chain. In 2024, refrigerated warehousing dominated the market, accounting for significant revenue due to its critical role in maintaining product quality and safety. The frozen goods segment, particularly products stored between -18°C to -25°C, holds the largest share, reflecting consumer preference for frozen foods and the expanding pharmaceutical cold chain needs.

Market Challenges

- High Operational Costs: The warehousing sector faces substantial operational costs, driven by factors such as rising labor expenses, increasing energy prices, and the upkeep of advanced technologies. These cost pressures can significantly strain profit margins, particularly in a highly competitive logistics environment. To remain viable, companies must focus on operational efficiency and adopt cost-optimization strategies across their warehousing operations.

- Labor Shortages and Workforce Management: The warehousing industry is experiencing persistent labor shortages, compounded by an aging workforce and growing demand for skilled personnel. Managing and retaining a qualified workforce has become a critical challenge for logistics providers. To address this issue, companies need to invest in employee training, engagement, and retention programs that ensure workforce stability and support long-term operational success.

Global Warehousing Market Future Outlook

The future of the warehousing market is poised for transformation, driven by technological advancements and evolving consumer expectations. As automation and smart technologies become more prevalent, companies will increasingly adopt these innovations to enhance operational efficiency. Additionally, the focus on sustainability will shape warehousing practices, with businesses seeking eco-friendly solutions. The integration of artificial intelligence and data analytics will further optimize inventory management and logistics, ensuring that the industry remains agile and responsive to market demands.

Market Opportunities

- Adoption of Advanced Technologies:The integration of advanced technologies such as robotics, Internet of Things (IoT), and automation in warehousing is transforming logistics operations and driving significant efficiency gains. Companies adopting these technologies are able to streamline workflows, enhance inventory accuracy, and reduce reliance on manual labor, which is especially critical amid ongoing labor shortages.

- Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, offer substantial growth potential for warehousing services driven by rapid urbanization and rising consumer demand. Urbanization rates in these regions are projected to reach around 60% by 2025, fueling increased need for efficient logistics and warehousing solutions close to dense metropolitan hubs.

Scope of the Report

| By Type |

Distribution Centers Bonded Warehouses Cold Storage Facilities |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Service Type |

Storage Services Value-Added Services Transportation Services |

| By Technology |

Automated Warehousing Traditional Warehousing Smart Warehousing |

| By End-User Industry |

Retail Food & Beverage Pharmaceutical Automotive Electronics |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Maritime Commission, Department of Transportation)

Manufacturers and Producers

Logistics and Supply Chain Companies

Real Estate Investment Trusts (REITs)

Third-Party Logistics Providers (3PLs)

Warehouse Management System Providers

Trade Associations and Industry Groups

Companies

Players Mentioned in the Report:

Prologis

XPO Logistics

DHL Supply Chain

Cegelec

Kuehne + Nagel

Warehousing Solutions Inc.

Global Storage Systems

Nexus Logistics Group

Apex Warehousing Services

TransGlobal Warehousing Solutions

Table of Contents

1. Global Warehousing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Warehousing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Warehousing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing E-commerce Activities

3.1.2. Global Supply Chain Optimization

3.1.3. Rising Demand for Cold Chain Logistics

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Labor Shortages and Workforce Management

3.2.3. Regulatory Compliance Issues

3.3. Opportunities

3.3.1. Adoption of Advanced Technologies

3.3.2. Expansion in Emerging Markets

3.3.3. Growth of Third-Party Logistics Providers

3.4. Trends

3.4.1. Shift Towards Automation and Robotics

3.4.2. Integration of IoT in Warehousing Operations

3.4.3. Sustainability Initiatives in Warehouse Management

3.5. Government Regulation

3.5.1. Safety and Health Regulations

3.5.2. Environmental Compliance Standards

3.5.3. Labor Laws and Employment Regulations

3.5.4. Trade Policies Affecting Logistics

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Warehousing Market Segmentation

4.1. By Type

4.1.1. Distribution Centers

4.1.2. Bonded Warehouses

4.1.3. Cold Storage Facilities

4.2. By Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia-Pacific

4.2.4. Latin America

4.2.5. Middle East & Africa

4.3. By Service Type

4.3.1. Storage Services

4.3.2. Value-Added Services

4.3.3. Transportation Services

4.4. By Technology

4.4.1. Automated Warehousing

4.4.2. Traditional Warehousing

4.4.3. Smart Warehousing

4.5. By End-User Industry

4.5.1. Retail

4.5.2. Food & Beverage

4.5.3. Pharmaceutical

4.5.4. Automotive

4.5.5. Electronics

5. Global Warehousing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Prologis

5.1.2. XPO Logistics

5.1.3. DHL Supply Chain

5.1.4. Cegelec

5.1.5. Kuehne + Nagel

5.1.6. Warehousing Solutions Inc.

5.1.7. Global Storage Systems

5.1.8. Nexus Logistics Group

5.1.9. Apex Warehousing Services

5.1.10. TransGlobal Warehousing Solutions

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Geographic Presence

5.2.4. Service Offerings

5.2.5. Customer Satisfaction Ratings

5.2.6. Technological Advancements

5.2.7. Operational Efficiency Metrics

5.2.8. Sustainability Practices

6. Global Warehousing Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Warehousing Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Warehousing Market Future Market Segmentation

8.1. By Type

8.1.1. Distribution Centers

8.1.2. Bonded Warehouses

8.1.3. Cold Storage Facilities

8.2. By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia-Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. By Service Type

8.3.1. Storage Services

8.3.2. Value-Added Services

8.3.3. Transportation Services

8.4. By Technology

8.4.1. Automated Warehousing

8.4.2. Traditional Warehousing

8.4.3. Smart Warehousing

8.5. By End-User Industry

8.5.1. Retail

8.5.2. Food & Beverage

8.5.3. Pharmaceutical

8.5.4. Automotive

8.5.5. Electronics

9. Global Warehousing Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key components and stakeholders within the Global Warehousing Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry insights. The primary goal is to pinpoint and define the essential variables that drive market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Global Warehousing Market. This includes evaluating market penetration rates, the balance between service providers and marketplaces, and the resulting revenue streams. Additionally, we will assess service quality metrics to ensure the accuracy and reliability of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors. These consultations will provide critical operational and financial insights, helping to refine and substantiate the market data. Engaging with practitioners will enhance the credibility of the findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct discussions with multiple manufacturers to gather in-depth insights into product categories, sales performance, and consumer preferences. This engagement will help verify and enrich the data obtained from the bottom-up approach, ensuring a thorough and validated analysis of the Global Warehousing Market.

Frequently Asked Questions

01. How big is the Global Warehousing Market?

The Global Warehousing Market is valued at USD 1,080 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Warehousing Market?

Key challenges in the Global Warehousing Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Warehousing Market?

Major players in the Global Warehousing Market include Prologis, XPO Logistics, DHL Supply Chain, Cegelec, Kuehne + Nagel, among others.

04. What are the growth drivers for the Global Warehousing Market?

The primary growth drivers for the Global Warehousing Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.