Global Water Enhancers Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD7801

December 2024

85

About the Report

Global Water Enhancers Market Overview

- The global water enhancers market is valued at USD 1.8 billion, driven primarily by the increasing consumer demand for healthier and more convenient hydration solutions. This market has seen significant growth due to the rise of fitness and wellness trends that emphasize hydration and the reduction of sugary drink consumption. The convenience factor, such as easy-to-use single-serve formats, has also played a vital role in driving market adoption among consumers. Major companies are investing heavily in flavor innovation and functional enhancements like adding vitamins and electrolytes, boosting demand in both developed and emerging markets.

- North America and Europe dominate the global water enhancers market due to the strong presence of health-conscious consumers and significant marketing efforts by major players. In these regions, consumers are increasingly shifting away from sugary beverages, and water enhancers offer an appealing alternative for flavoring water without the added sugars. The United States, in particular, leads the market due to high disposable incomes, advanced retail distribution channels, and strong consumer awareness regarding the benefits of hydration and healthier beverage options.

- Water enhancers are subject to stringent food safety regulations enforced by various authorities, including the Food Safety and Standards Authority of India (FSSAI), the U.S. Food and Drug Administration (FDA), and the European Food Safety Authority (EFSA). The FDA implemented stricter guidelines on the use of artificial sweeteners in beverage enhancers, requiring manufacturers to demonstrate their safety through rigorous testing. These regulations ensure product safety but also increase compliance costs for companies operating in this market.

Global Water Enhancers Market Segmentation

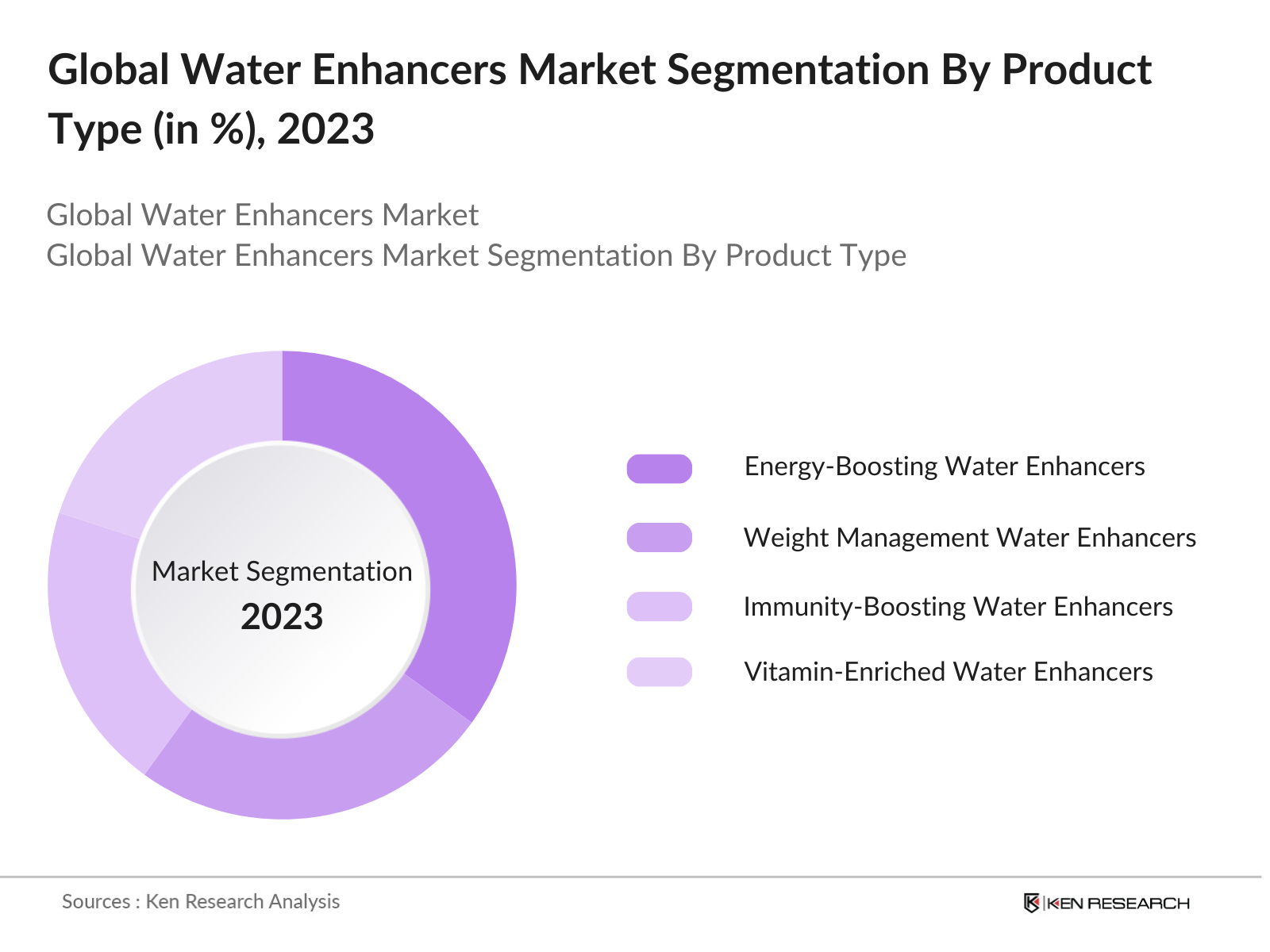

By Product Type: The global water enhancers market is segmented by product type into energy-boosting water enhancers, weight management water enhancers, immunity-boosting water enhancers, vitamin-enriched water enhancers, and others (including CBD-infused water enhancers). Currently, energy-boosting water enhancers hold a dominant position in this segment. This is largely due to their appeal to fitness enthusiasts and busy professionals who are looking for quick energy solutions without the sugar overload of traditional energy drinks. The focus on functional ingredients like caffeine, taurine, and B vitamins has helped these enhancers gain substantial market traction.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to a well-established consumer base, high disposable incomes, and strong demand for healthier beverage options. The region has seen early adoption of water enhancers, driven by the increasing popularity of fitness and wellness trends. Additionally, the widespread availability of these products in supermarkets, convenience stores, and online platforms has further strengthened North America's dominance in this segment.

By Distribution Channel: The water enhancers market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and direct-to-consumer (DTC). Supermarkets and hypermarkets dominate the distribution channel due to their extensive reach, making water enhancers more accessible to a larger demographic. Their advantage lies in offering consumers the ability to compare various brands and products in-store, along with promotional pricing strategies that further drive impulse purchases. In particular, the rise of health-focused aisles in supermarkets has greatly contributed to the success of this segment.

Global Water Enhancers Market Competitive Landscape

The global water enhancers market is highly competitive, with several major players operating across different regions. These companies are engaged in extensive product innovation and strategic marketing to differentiate themselves. The competition is primarily driven by brand loyalty, the variety of flavors offered, and the incorporation of functional ingredients. The global water enhancers market is dominated by prominent brands such as PepsiCo, The Coca-Cola Company, Nestl S.A., Kraft Heinz Company, and AriZona Beverages USA. These key players have built strong market positions through aggressive marketing campaigns, robust distribution networks, and extensive flavor portfolios. The competitive landscape is further shaped by smaller, niche players who focus on organic and natural ingredients, catering to a growing consumer segment that seeks clean-label products.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Range |

Market Share |

Innovation Index |

Geographic Presence |

|

PepsiCo Inc. |

1965 |

Purchase, NY, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

The Coca-Cola Company |

1892 |

Atlanta, GA, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Nestl S.A. |

1866 |

Vevey, Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

|

Kraft Heinz Company |

2015 |

Chicago, IL, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

AriZona Beverages USA |

1971 |

Woodbury, NY, USA |

_ |

_ |

_ |

_ |

_ |

_ |

Global Water Enhancers Industry Analysis

Growth Drivers

- Rising Health Consciousness: Increased awareness of health and wellness is driving demand for water enhancers as consumers look for healthier alternatives to sugary beverages. According to the World Health Organization (WHO), noncommunicable diseases such as diabetes and cardiovascular diseases are projected to cause over 70% of global deaths by 2024. This has led to a growing consumer preference for low-sugar and functional beverages. Water enhancers are positioned as an appealing choice, offering flavor without sugar. Additionally, in 2024, the global shift toward preventive healthcare, as highlighted by WHO, continues to fuel this trend.

- Increasing Demand for Convenience Products: Consumers are increasingly seeking convenience products that fit their fast-paced lifestyles. In 2024, the International Labour Organization (ILO) reports that 45% of the global workforce is engaged in high-demand jobs, leaving limited time for meal preparation. Water enhancers offer quick hydration solutions that can be used on-the-go. The ease of adding flavor to water in seconds aligns with the growing demand for products that support efficient consumption without compromising on taste.

- Innovation in Flavors and Functional Ingredients: The water enhancers market is benefiting from innovations in flavors and functional ingredients such as vitamins, electrolytes, and antioxidants. In 2023, the United Nations Food and Agriculture Organization (FAO) highlighted that consumer demand for nutrient-rich food and beverages has increased by 18 million metric tons globally. This trend has translated into the water enhancer market, where companies are introducing products with added health benefits like immune-boosting ingredients to cater to this demand.

Market Challenges

- Regulatory Compliance Issues: Water enhancers face stringent regulations across various countries, particularly concerning ingredients and labeling. In 2024, the European Food Safety Authority (EFSA) reported an 11% increase in product recalls related to non-compliance with food additive regulations. This highlights the challenge for manufacturers to keep up with evolving regulatory frameworks. The complexity of navigating different regional standards, especially in emerging markets, presents a significant challenge for market players looking to expand their presence globally.

- Intense Market Competition: The water enhancers market is witnessing fierce competition from both established beverage companies and new entrants. According to a 2024 analysis by the World Trade Organization (WTO), competition in consumer goods, including beverages, has intensified due to the rise of digital platforms and globalization, making market entry easier. In the U.S. alone, the number of beverage brands increased by 23% between 2022 and 2024, contributing to competitive pressure and price wars, which can erode profit margins for water enhancer manufacturers.

Global Water Enhancers Market Future Outlook

Over the next five years, the global water enhancers market is expected to witness robust growth. This surge is likely to be driven by the increasing consumer preference for healthier beverages, particularly those with added functionality, such as vitamins and electrolytes. The rise in e-commerce and direct-to-consumer sales is also anticipated to accelerate market expansion. Furthermore, innovations in packaging and the launch of clean-label products will contribute to the sustained growth of the market.

Opportunities

- Expansion in Emerging Markets: Emerging markets offer significant growth opportunities for water enhancers, as disposable incomes rise and consumer preferences shift towards healthier beverage options. In 2023, the World Bank reported a 6% annual increase in disposable income across Southeast Asia, creating a more affluent consumer base willing to spend on premium products. Additionally, growing urbanization in Africa and Asia is expected to boost demand for convenient, health-oriented products, positioning water enhancers as a key growth segment in these regions.

- Growth in Functional Water Segment: The functional water segment is growing rapidly, driven by increasing awareness of the health benefits of enhanced hydration. The United Nations predicts that global water consumption will rise by 30% by 2025 due to population growth and urbanization. This growing demand for hydration products creates a prime opportunity for water enhancers, particularly those with added health benefits like electrolytes, vitamins, and antioxidants. Consumers are increasingly seeking functional beverages that offer more than just hydration, positioning water enhancers as a key player in this segment.

Scope of the Report

|

By Product Type |

Energy-Boosting Water Enhancers Weight Management Water Enhancers Immunity-Boosting Water Enhancers Vitamin-Enriched Water Enhancers Others (CBD-Infused Water Enhancers) |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct-to-Consumer (DTC) |

|

By End-User |

Household Consumers Fitness and Sports Enthusiasts Hospitality and Food Service |

|

By Packaging Format |

Single-Serve Bottles Sachets Multi-Serving Containers Pump Bottles |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Beverage Manufacturing Companies

Health & Wellness Companies

Fitness and Sports Nutrition Companies

E-commerce Platform Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Flavor and Ingredient Supplier Companies

Companies

Players Mentioned in the Report

PepsiCo Inc.

The Coca-Cola Company

Nestl S.A.

Kraft Heinz Company

AriZona Beverages USA

SweetLeaf Stevia Sweetener

True Citrus Co.

Vitamin Squeeze

Pure Inventions

Stur Drinks

Table of Contents

1. Global Water Enhancers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Water Enhancers Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Water Enhancers Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Demand for Convenience Products

3.1.3. Innovation in Flavors and Functional Ingredients

3.1.4. Consumer Shift Toward Low-Calorie Beverages

3.2. Market Challenges

3.2.1. Regulatory Compliance Issues

3.2.2. Intense Market Competition

3.2.3. High Cost of New Product Development

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Growth in Functional Water Segment

3.3.3. Product Diversification and Customization

3.4. Trends

3.4.1. Clean Label and Natural Ingredients

3.4.2. Personalization in Beverage Enhancers

3.4.3. Online Retail Growth for Water Enhancers

3.5. Government Regulation

3.5.1. Food Safety Standards (FSSAI, FDA, EFSA)

3.5.2. Labeling and Packaging Requirements

3.5.3. Regulatory Framework for Additives and Flavors

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Water Enhancers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Energy-Boosting Water Enhancers

4.1.2. Weight Management Water Enhancers

4.1.3. Immunity-Boosting Water Enhancers

4.1.4. Vitamin-Enriched Water Enhancers

4.1.5. Others (Including CBD-Infused Water Enhancers)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Direct-to-Consumer (DTC)

4.3. By End-User (In Value %)

4.3.1. Household Consumers

4.3.2. Fitness and Sports Enthusiasts

4.3.3. Hospitality and Food Service

4.4. By Packaging Format (In Value %)

4.4.1. Single-Serve Bottles

4.4.2. Sachets

4.4.3. Multi-Serving Containers

4.4.4. Pump Bottles

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Water Enhancers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo Inc.

5.1.2. The Coca-Cola Company

5.1.3. Nestl S.A.

5.1.4. Kraft Heinz Company

5.1.5. AriZona Beverages USA

5.1.6. Kraft Foods Group Inc.

5.1.7. Jel Sert Company

5.1.8. SweetLeaf Stevia Sweetener

5.1.9. True Citrus Co.

5.1.10. Vitamin Squeeze

5.1.11. Pure Inventions

5.1.12. Stur Drinks

5.1.13. Mio Liquid Water Enhancer

5.1.14. Bai Brands

5.1.15. Skinnygirl Water Enhancers

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Innovation Index, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Water Enhancers Market Regulatory Framework

6.1. Compliance with Food Safety Standards

6.2. Environmental Packaging Guidelines

6.3. Labeling Regulations

6.4. Flavor and Additive Regulations

7. Global Water Enhancers Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Water Enhancers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Packaging Format (In Value %)

8.5. By Region (In Value %)

9. Global Water Enhancers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial step involves constructing a comprehensive ecosystem map of all major stakeholders in the global water enhancers market. Extensive desk research, including secondary and proprietary databases, is conducted to gather essential industry-level information and define the key variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data of the global water enhancers market is compiled and analyzed, including assessments of product penetration and geographical distribution. This data is further enhanced by evaluating consumer demand trends and market innovations to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through in-depth interviews with industry experts from leading companies. These interviews provide valuable operational and financial insights, which are essential for refining the gathered market data and ensuring its reliability.

Step 4: Research Synthesis and Final Output

The final phase involves engaging directly with multiple manufacturers to acquire insights into product performance, sales dynamics, and evolving consumer preferences. This interaction verifies the data and provides a comprehensive analysis of the global water enhancers market.

Frequently Asked Questions

1. How big is the Global Water Enhancers Market?

The global water enhancers market is valued at USD 1.8 billion, driven by increasing demand for healthier hydration options and the rise of fitness and wellness trends.

2. What are the challenges in the Global Water Enhancers Market?

Challenges include regulatory compliance, intense competition among established players, and the high costs associated with developing new and innovative product lines.

3. Who are the major players in the Global Water Enhancers Market?

Key players include PepsiCo Inc., The Coca-Cola Company, Nestl S.A., Kraft Heinz Company, and AriZona Beverages USA. These companies dominate due to their extensive product portfolios and strong brand presence.

4. What are the growth drivers of the Global Water Enhancers Market?

The market is driven by consumer demand for healthier, convenient hydration solutions, along with innovations in flavor and functionality, such as vitamin-enriched and energy-boosting

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.