Global Waterproofing Membrane Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD4792

December 2024

80

About the Report

Global Waterproofing Membrane Market Overview

- The global waterproofing membrane market is valued at USD 19 billion, driven by increasing construction activities, growing demand for efficient waterproofing solutions, and rising awareness regarding building safety. Key growth drivers include urbanization, industrialization, and stringent building codes that require effective waterproofing to enhance building durability and reduce maintenance costs. The market's rapid expansion is also linked to the technological advancements in membrane materials, including the development of eco-friendly and high-performance options.

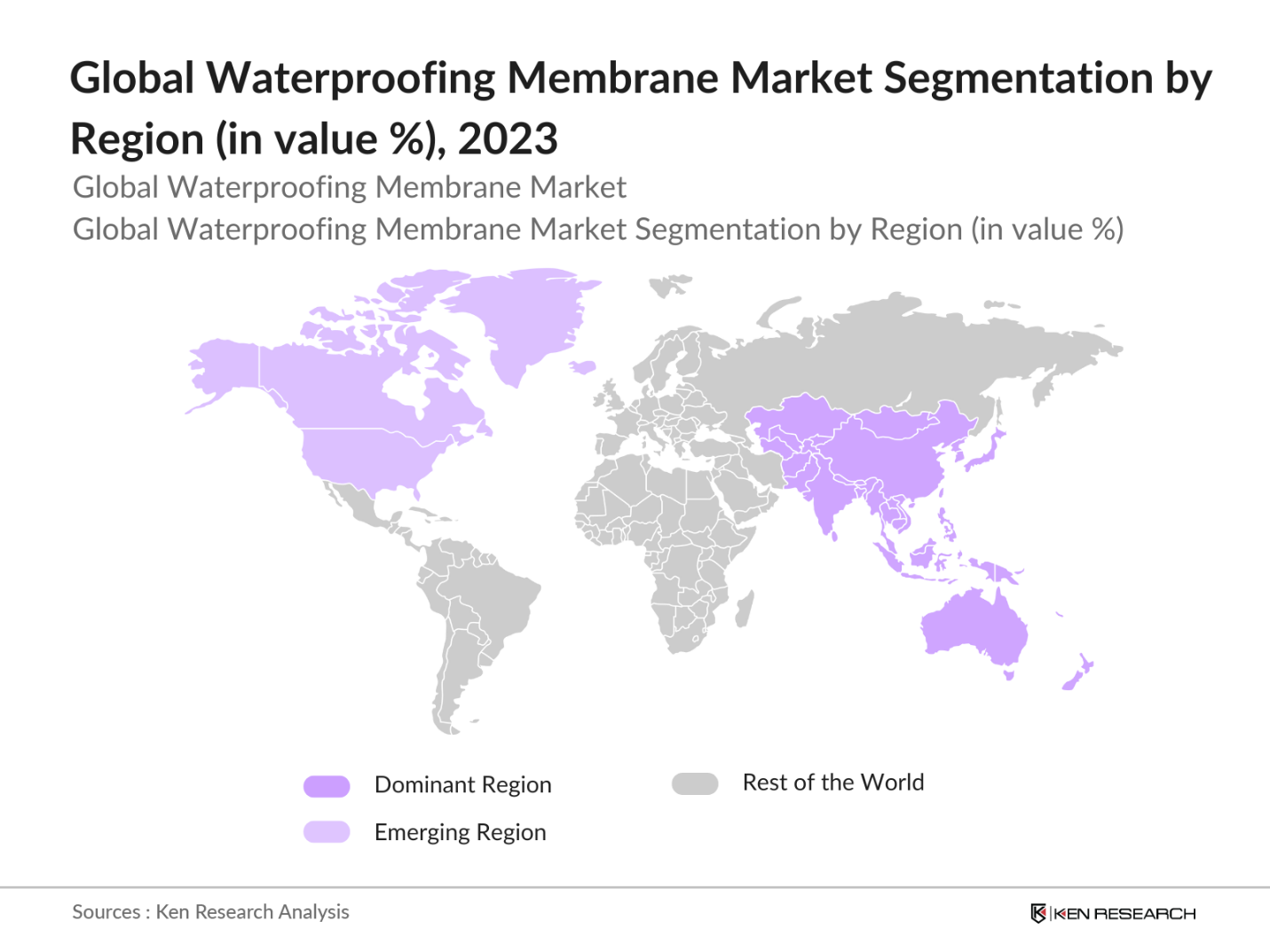

- Countries such as China, India, and the United States dominate the waterproofing membrane market due to their robust construction sectors and the prevalence of large infrastructure projects. China leads the market, driven by its massive urbanization and infrastructure boom, while the U.S. and India benefit from significant investments in both residential and commercial building projects. Additionally, governmental regulations and incentives for sustainable construction practices support market dominance in these regions.

- Government regulations and standards play a crucial role in ensuring the quality and effectiveness of waterproofing membranes. In 2022, the International Organization for Standardization (ISO) and the American Society for Testing and Materials (ASTM) introduced updated guidelines for waterproofing systems, emphasizing performance criteria and testing methodologies. Compliance with these standards is vital for manufacturers to maintain credibility and ensure product reliability in the market. As regulations tighten to address water management issues and structural safety, adherence to these standards will become increasingly important for market participants.

Global Waterproofing Membrane Market Segmentation

By Product Type: The global waterproofing membrane market is segmented by product type into liquid-applied membranes and sheet membranes. Recently, liquid-applied membranes hold a dominant market share under the segmentation by product type, primarily due to their ease of application and versatility across different surfaces. The rising popularity of polyurethane and acrylic-based liquid membranes, known for their high flexibility and waterproofing efficiency, has further contributed to the dominance of this sub-segment in the market.

By Region: The global waterproofing membrane market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The Asia-Pacific region dominates the market due to rapid urbanization and infrastructure development, particularly in China and India. Increased government spending on public infrastructure projects and rising demand for commercial and residential buildings in these countries has fueled the growth of the waterproofing membrane market in the region.

By Application: The waterproofing membrane market is segmented by application into roofing, walls, basement waterproofing, tunnel linings, and bridges & highways. Among these, roofing dominates the market share due to the extensive use of waterproofing solutions in the construction and renovation of residential, commercial, and industrial buildings. The increased emphasis on energy-efficient roofing systems and growing investments in infrastructure have made roofing the leading sub-segment.

Global Waterproofing Membrane Market Competitive Landscape

The global waterproofing membrane market is dominated by several key players who have established a strong market presence through technological innovations, strategic partnerships, and a comprehensive product portfolio. Companies like Sika AG, BASF SE, and Carlisle Companies Inc. are recognized for their advanced waterproofing solutions and extensive global reach. The markets competitive landscape is shaped by a few major players, including Sika AG, BASF SE, Carlisle Companies Inc., GAF Materials Corporation, and Tremco Incorporated. These companies are known for their diversified product portfolios and substantial investments in research and development, which allow them to maintain a competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Key Innovations |

Global Presence |

Sustainability Focus |

|

Sika AG |

1910 |

Baar, Switzerland |

_ |

_ |

_ |

_ |

_ |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

_ |

_ |

_ |

_ |

_ |

|

Carlisle Companies Inc. |

1917 |

Scottsdale, U.S. |

_ |

_ |

_ |

_ |

_ |

|

GAF Materials Corporation |

1886 |

Parsippany, U.S. |

_ |

_ |

_ |

_ |

_ |

|

Tremco Incorporated |

1928 |

Ohio, U.S. |

_ |

_ |

_ |

_ |

_ |

Global Waterproofing Membrane Industry Analysis

Growth Drivers

Urbanization and Infrastructure Development: Rapid urbanization has led to significant infrastructure development worldwide. For instance, in 2022, the global urban population reached approximately 4.4 billion people, accounting for 56% of the total population. This urban expansion necessitates extensive construction activities, thereby increasing the demand for waterproofing membranes to protect structures from water damage. In India, the government allocated $1.89 billion for the Smart Cities Mission in 2022, aiming to develop 100 smart cities, further boosting the need for waterproofing solutions in new urban projects.

Industrialization and Construction Activities: Industrial growth has spurred construction activities, particularly in emerging economies. China's construction industry, for example, was valued at approximately $1.05 trillion in 2022, reflecting substantial investment in infrastructure. Similarly, the United States saw construction spending reach $1.6 trillion in 2022, with significant portions directed toward residential and commercial projects. These developments drive the demand for waterproofing membranes to ensure the longevity and durability of new structures.

Government Regulations on Building Standards: Governments worldwide have implemented stringent building codes to enhance structural integrity and safety. The European Union's Energy Performance of Buildings Directive mandates that all new buildings must be nearly zero-energy by 2022, promoting the use of advanced materials, including waterproofing membranes, to improve energy efficiency and durability. In the United States, the International Building Code requires effective waterproofing for foundations and walls, ensuring structures are protected against moisture intrusion.

Market Challenges

Fluctuating Raw Material Prices: The waterproofing membrane industry relies heavily on raw materials like bitumen and polymers, whose prices are subject to volatility. For instance, crude oil prices, a primary component in bitumen production, fluctuated between $60 and $100 per barrel in 2022. Such instability affects manufacturing costs and profit margins, posing challenges for producers in maintaining consistent pricing for their products.

Environmental and Health Concerns: Certain waterproofing membranes contain volatile organic compounds (VOCs) and other hazardous substances, raising environmental and health concerns. The U.S. Environmental Protection Agency has identified VOCs as contributors to indoor air pollution, leading to regulations that limit their use in building materials. Consequently, manufacturers face the challenge of reformulating products to comply with environmental standards without compromising performance.

Global Waterproofing Membrane Market Future Outlook

Over the next five years, the global waterproofing membrane market is expected to witness substantial growth driven by increasing demand for sustainable construction materials, advancements in membrane technology, and rising infrastructure investments, particularly in developing economies. The market will likely benefit from a growing emphasis on energy-efficient building solutions and the adoption of green building practices worldwide. The Asia-Pacific region, particularly China and India, is expected to maintain its dominance due to the robust expansion of the construction sector and increasing government initiatives promoting infrastructure development. Technological advancements, such as self-healing and liquid-applied membranes, will likely revolutionize the market, offering enhanced durability and ease of application.

Opportunities

Technological Advancements in Membrane Materials: Innovations in materials science have led to the development of advanced waterproofing membranes with enhanced properties. For example, the introduction of thermoplastic polyolefin (TPO) membranes offers superior durability and energy efficiency. The global TPO roofing membrane market was valued at $2.1 billion in 2022, indicating a growing preference for technologically advanced solutions.

Expansion into Emerging Markets: Emerging economies present significant growth opportunities due to rapid urbanization and industrialization. In Southeast Asia, construction spending reached $250 billion in 2022, with projections indicating continued growth. Companies can capitalize on these expanding markets by offering tailored waterproofing solutions that meet local building standards and climatic conditions.

Scope of the Report

|

Product Type |

Liquid Applied Membranes |

|

Application |

Roofing |

|

Raw Material |

Modified Bitumen |

|

Usage |

New Construction |

|

Region |

North America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Construction Companies

Building Contract Companies

Architects and Engineering Industries

Government and Regulatory Bodies (EPA, Ministry of Housing)

Real Estate Development Companies

Investments and Venture Capitalist Firms

Material Suppliers Companies

Infrastructure Development Industries

Companies

Players Mentioned in the Report

Sika AG

BASF SE

Carlisle Companies Inc.

GAF Materials Corporation

Tremco Incorporated

Johns Manville

Dow Chemical Company

Fosroc International Limited

Soprema Group

Mapei SpA

Table of Contents

1. Global Waterproofing Membrane Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Waterproofing Membrane Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Waterproofing Membrane Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Infrastructure Development

3.1.2. Industrialization and Construction Activities

3.1.3. Government Regulations on Building Standards

3.1.4. Rising Demand for Water Management Systems

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Environmental and Health Concerns

3.2.3. Technical Challenges in Application

3.3. Opportunities

3.3.1. Technological Advancements in Membrane Materials

3.3.2. Expansion into Emerging Markets

3.3.3. Adoption of Sustainable Waterproofing Solutions

3.4. Trends

3.4.1. Integration with Green Building Initiatives

3.4.2. Increasing Use of Liquid Applied Membranes

3.4.3. Development of Self-Healing Membranes

3.5. Government Regulations

3.5.1. Building Codes and Standards

3.5.2. Environmental Protection Regulations

3.5.3. Incentives for Sustainable Construction

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Waterproofing Membrane Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Liquid Applied Membranes

4.1.1.1. Cementitious

4.1.1.2. Bituminous

4.1.1.3. Polyurethane

4.1.1.4. Acrylic

4.1.2. Sheet Based Membranes

4.1.2.1. Bituminous

4.1.2.2. Polyvinyl Chloride (PVC)

4.1.2.3. Ethylene Propylene Diene Monomer (EPDM)

4.2. By Application (In Value %)

4.2.1. Roofing

4.2.2. Building Structures

4.2.3. Waste & Water Management

4.2.4. Roadways

4.2.5. Walls

4.3. By Raw Material (In Value %)

4.3.1. Modified Bitumen

4.3.2. Polyvinyl Chloride (PVC)

4.3.3. Ethylene Propylene Diene Monomer (EPDM)

4.3.4. Thermoplastic Polyolefin (TPO)

4.3.5. Others

4.4. By Usage (In Value %)

4.4.1. New Construction

4.4.2. Refurbishment

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. South America

5. Global Waterproofing Membrane Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sika AG

5.1.2. BASF SE

5.1.3. Soprema Group

5.1.4. GCP Applied Technologies

5.1.5. Fosroc Ltd.

5.1.6. Mapei S.p.A.

5.1.7. Carlisle Construction Materials

5.1.8. Johns Manville

5.1.9. Renolit SE

5.1.10. Tremco Incorporated

5.1.11. Kemper System America, Inc.

5.1.12. GAF Materials Corporation

5.1.13. Paul Bauder GmbH & Co. KG

5.1.14. CICO Technologies Ltd.

5.1.15. Alchimica Building Chemicals

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographic Presence, R&D Investment, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Global Waterproofing Membrane Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Waterproofing Membrane Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Waterproofing Membrane Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Raw Material (In Value %)

8.4. By Usage (In Value %)

8.5. By Region (In Value %)

9. Global Waterproofing Membrane Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global waterproofing membrane market. This is based on extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data of the global waterproofing membrane market is compiled and analyzed. This includes evaluating market penetration, service provider ratios, and the resulting revenue generation. Service quality statistics are also assessed to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple waterproofing membrane manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and accurate analysis of the global waterproofing membrane market.

Frequently Asked Questions

01. How big is the global waterproofing membrane market?

The global waterproofing membrane market is valued at USD19 billion, driven by rapid urbanization, increased construction activity, and technological advancements in membrane solutions.

02. What are the challenges in the waterproofing membrane market?

Challenges in the waterproofing membrane market include high installation costs, fluctuating raw material prices, and limited awareness in developing markets.

03. Who are the major players in the global waterproofing membrane market?

Key players in the global waterproofing membrane market include Sika AG, BASF SE, Carlisle Companies Inc., GAF Materials Corporation, and Tremco Incorporated, known for their strong market presence and innovative product portfolios.

04. What are the growth drivers of the waterproofing membrane market?

The market is propelled by urbanization, rising demand for durable waterproofing solutions in construction, and growing environmental concerns that promote the use of sustainable building materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.