Global Weight Loss Supplement Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9433

December 2024

99

About the Report

Global Weight Loss Supplement Market Overview

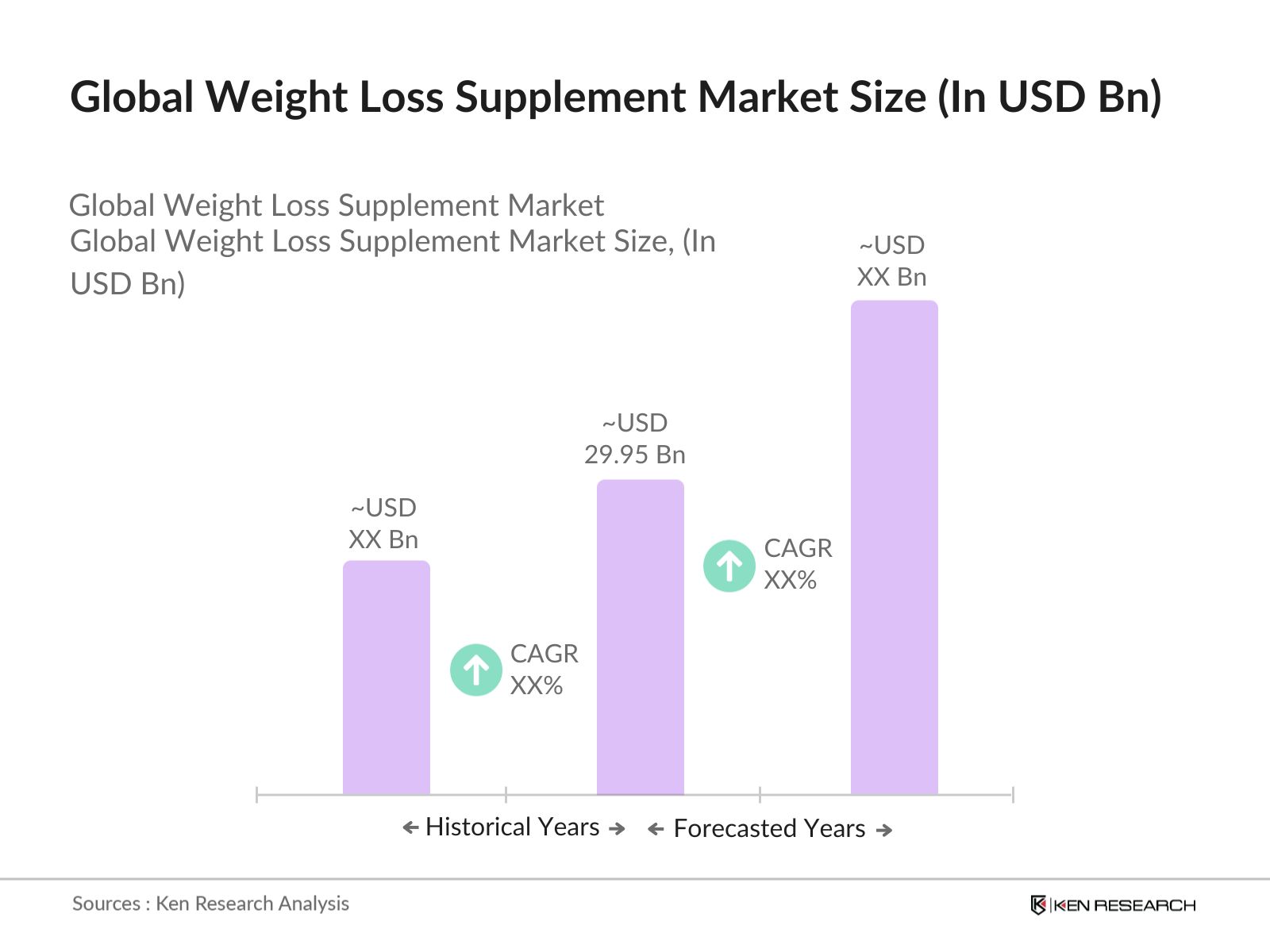

- The global weight loss supplement market is valued at USD 29.95 billion, driven by the rising prevalence of obesity and increased consumer focus on health and wellness. Growth is bolstered by a surge in demand for supplements that claim to assist in weight management and fat loss. The market has also been boosted by an increase in health-conscious consumers seeking natural and organic solutions, coupled with the influence of celebrity endorsements and social media trends. The consistent rise in obesity levels globally, particularly in urban areas, continues to act as a primary market driver.

- The market is predominantly led by the United States, followed by European countries like Germany and the United Kingdom. The U.S. market is driven by high obesity rates and a culture focused on health and fitness. Meanwhile, European countries show significant growth due to the increasing popularity of organic and plant-based supplements. The availability of diverse products and strong distribution networks further solidify these regions' dominance.

- Governments globally have tightened regulations on how weight loss supplements are marketed. In 2024, the Federal Trade Commission (FTC) in the U.S. fined multiple supplement companies for making unsubstantiated claims about rapid weight loss. Advertisements must meet truth-in-advertising standards, and health claims must be backed by clinical evidence. In Europe, similar rules are enforced by the European Food Safety Authority (EFSA), with fines for non-compliance reaching $50 million in 2024, showing the significant financial risk for brands that do not adhere to advertising standards.

Global Weight Loss Supplement Market Segmentation

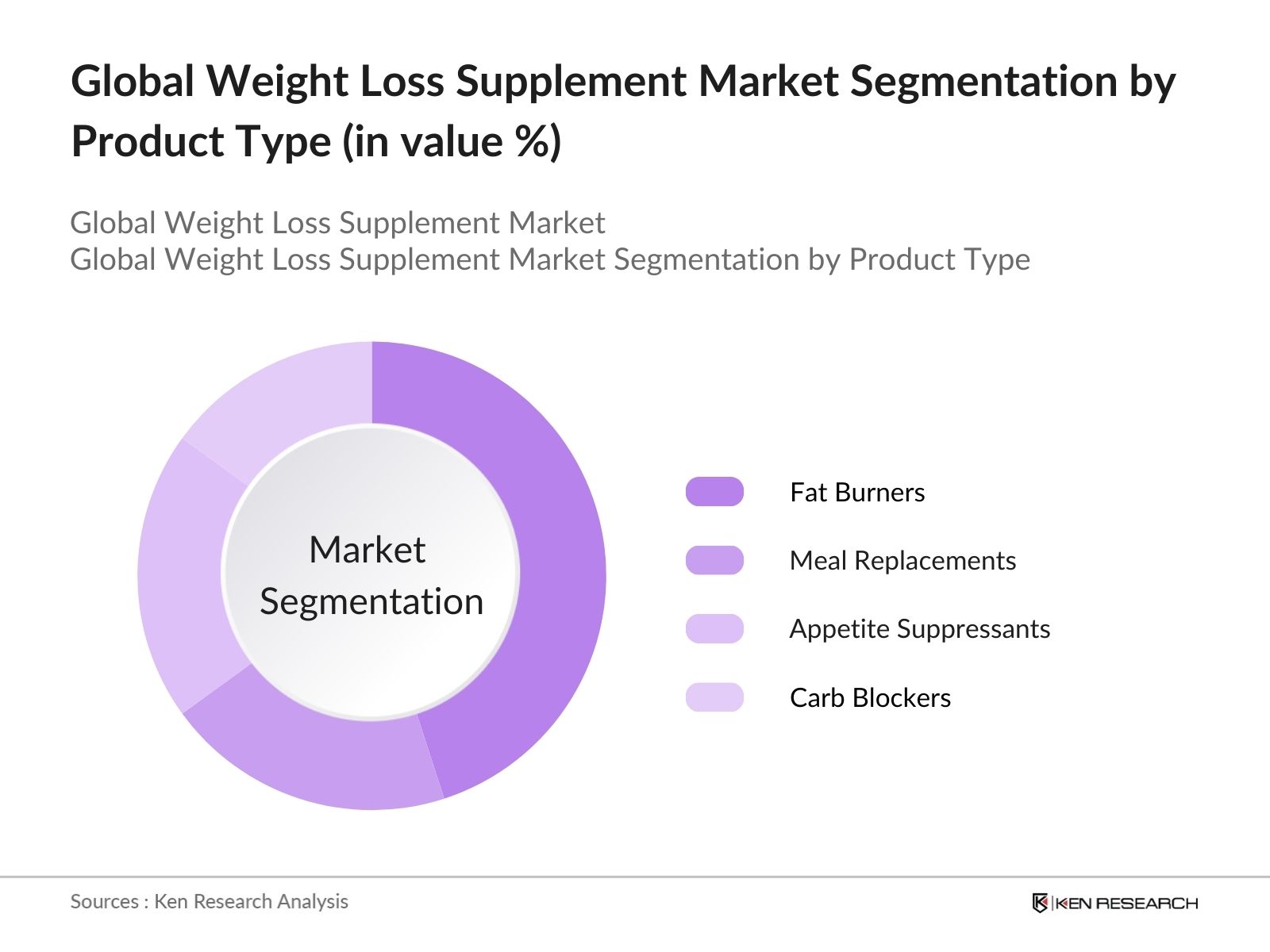

- By Product Type: The global weight loss supplement market is segmented by product type into appetite suppressants, fat burners, meal replacements, carb blockers, and thermogenic supplements. Fat burners hold a dominant share within this segment due to their wide appeal among fitness enthusiasts and general consumers looking for quick fat-loss results. The popularity of these supplements is also fueled by strong marketing campaigns that promise fast and visible results, appealing to individuals who want a boost in their weight loss efforts.

- By Ingredient Type: The market is also segmented by ingredient type into synthetic supplements, herbal and plant-based supplements, protein-based supplements, fiber-based supplements, and others (collagen, minerals, etc.). Herbal and plant-based supplements dominate this segment due to the increasing consumer preference for natural products. Consumers are becoming more aware of the benefits of plant-based ingredients, driven by trends around clean-label, vegan, and organic products. This segment is expected to continue its growth as consumers shift away from synthetic ingredients.

- By Region: The global weight loss supplement market is also segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America continues to lead the global market, driven by the high obesity rate in the U.S. and a strong emphasis on health and fitness products. The region benefits from a wide range of product availability and strong promotional efforts. Europe follows closely, with increased demand for natural supplements. Asia-Pacific is rapidly emerging, especially in countries like Japan and South Korea, where growing health awareness and a rising middle class are contributing to the market's expansion.

Global Weight Loss Supplement Market Competitive Landscape

The global weight loss supplement market is dominated by key players who lead the market through innovation, brand strength, and widespread distribution networks. The market features significant consolidation, with major global players such as Herbalife Nutrition, Glanbia PLC, and GNC Holdings leading the charge. These companies are particularly strong in North America, with a wide array of products appealing to various consumer segments.

|

Company |

Year Established |

Headquarters |

Revenue (USD Bn) |

Product Range |

Global Reach |

R&D Investments |

Brand Equity |

Manufacturing Capabilities |

Distribution Networks |

|

Herbalife Nutrition Ltd. |

1980 |

Los Angeles, USA |

- |

- |

- |

- |

- |

- |

- |

|

Glanbia PLC |

1999 |

Kilkenny, Ireland |

- |

- |

- |

- |

- |

- |

- |

|

GNC Holdings, LLC |

1935 |

Pittsburgh, USA |

- |

- |

- |

- |

- |

- |

- |

|

Natures Bounty Co. |

1971 |

Ronkonkoma, USA |

- |

- |

- |

- |

- |

- |

- |

|

Amway Corp. |

1959 |

Ada, USA |

- |

- |

- |

- |

- |

- |

- |

Global Weight Loss Supplement Industry Analysis

Growth Drivers

- Rising Obesity Rates: The rising global obesity crisis is fueling demand for weight loss supplements. In 2024, the World Health Organization (WHO) estimated that over 1.9 billion adults worldwide were overweight, and more than 650 million were obese. This significant rise in obesity has led to increased demand for supplements that support weight management. In North America alone, healthcare costs linked to obesity are projected to be $480 billion in 2024. This demand provides a massive opportunity for the supplement industry as consumers look for effective solutions to manage weight and reduce associated health risks.

- Increasing Health Consciousness: In 2024, the shift towards healthier lifestyles has accelerated, driven by post-pandemic awareness of wellness. A report by the World Bank highlights that an increasing number of consumers in developed economies, such as the U.S. and Europe, are adopting healthier dietary habits, seeking weight loss supplements as part of their routine. By 2024, approximately 60% of adults in these regions report making lifestyle changes, including dietary supplementation, to improve health outcomes. This heightened health consciousness has made weight loss supplements a mainstream solution for health management.

- Growing Preference for Natural Supplements: The demand for natural and plant-based supplements continues to grow as consumers prefer safer, chemical-free solutions for weight management. In 2024, consumer reports show a 30% rise in the preference for supplements derived from natural ingredients. This trend is particularly strong in Europe, where stringent regulations and environmental concerns drive the adoption of eco-friendly products. Furthermore, the global trade value of natural ingredients for the supplement industry has grown to $150 billion as consumers prioritize products with minimal side effect.

Market Restraints

- Regulatory Hurdles: Weight loss supplements face strict regulatory scrutiny worldwide. In the U.S., the Food and Drug Administration (FDA) mandates that dietary supplements comply with the Dietary Supplement Health and Education Act of 1994. In 2024, compliance costs for manufacturers were reported to reach $10 billion globally, a significant burden on smaller companies. European Food Safety Authority (EFSA) regulations further impose restrictions on marketing claims, complicating market entry for new players. These stringent regulatory standards create barriers to innovation and slow the introduction of new products into the market.

- Side Effects and Product Safety Concerns: The weight loss supplement market has been marred by instances of product recalls due to adverse effects. In 2024, over 50 cases of supplement recalls were reported by the U.S. FDA due to contamination or unlisted ingredients. Additionally, a World Health Organization report noted that 30% of supplement users reported mild side effects, increasing skepticism among consumers. This presents a challenge for brands, as product safety concerns drive consumers to more regulated and tested alternatives, reducing trust in certain weight loss solutions.

Global Weight Loss Supplement Market Future Outlook

The global weight loss supplement market is expected to experience sustained growth over the next five years, driven by rising consumer awareness around health and fitness, advancements in product formulations, and increasing demand for plant-based and natural supplements. The growing prevalence of obesity, combined with a shift towards proactive health management, will likely propel the demand for weight loss supplements. The expansion of e-commerce platforms and digital marketing initiatives will also play a significant role in market expansion, making products more accessible to consumers globally.

Market Opportunities

- Innovation in Product Formulations: Advancements in ingredient formulations offer substantial growth opportunities for the weight loss supplement market. New products featuring thermogenic ingredients and patented compounds such as CLA and Glucomannan have gained popularity in 2024. According to the World Bank, the introduction of these new formulas has generated additional revenue streams worth $30 billion globally. These innovative products appeal to a growing demographic seeking faster, safer, and more effective weight loss solutions, further driving market growth in regions like North America and Asia-Pacific.

- Digital Marketing and E-commerce Growth: The global shift towards e-commerce has significantly benefitted the weight loss supplement industry. Direct-to-consumer (D2C) brands have thrived, with a 40% increase in online supplement sales reported in 2024. North America leads this trend, with the U.S. alone recording $25 billion in online supplement sales, according to the International Monetary Fund. The widespread use of digital marketing tools such as social media and search engine marketing is helping smaller brands reach broader audiences, leveraging cost-effective advertising strategies to capture a larger share of the market.

Scope of the Report

|

By Product Type |

Appetite Suppressants Fat Burners Meal Replacements Carb Blockers Thermogenic Supplements |

|

By Ingredient Type |

Synthetic Supplements Herbal and Plant-Based Protein-Based Fiber-Based Others (Collagen, Minerals, etc.) |

|

By Formulation Type |

Pills Powders Capsules Liquids Others (Chewables, Gels, etc.) |

|

By Distribution Channel |

Online Channels Supermarkets/Hypermarkets Pharmacies and Drug Stores Specialty Stores Direct Sales |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Weight Loss Supplement Manufacturers

Retail and E-commerce Platforms

Fitness and Wellness Centers

Pharmacies and Drug Stores

Hospitals and Clinics

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Distribution Networks and Wholesalers

Companies

Players Mentioned in the Report:

Herbalife Nutrition Ltd.

Glanbia PLC

Iovate Health Sciences International Inc.

Amway Corp.

GNC Holdings, LLC

Natures Bounty Co.

NOW Foods

Shaklee Corporation

Atkins Nutritionals, Inc.

USN (Ultimate Sports Nutrition)

Nutrex Research

MusclePharm Corp.

BioTechUSA

SlimFast

Oriflame Holding AG

Table of Contents

1. Global Weight Loss Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Global Weight Loss Supplement Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Weight Loss Supplement Market Analysis

3.1. Growth Drivers

- Rising Obesity Rates (Global prevalence of obesity and overweight trends)

- Increasing Health Consciousness (Shift towards healthier lifestyles)

- Growing Preference for Natural Supplements (Consumer trends for natural ingredients)

3.2. Market Challenges

- Regulatory Hurdles (Compliance with FDA, EFSA, and other global regulations)

- Side Effects and Product Safety Concerns (Product recalls and safety issues)

- Intense Market Competition (Pricing pressures and brand competition)

3.3. Opportunities

- Innovation in Product Formulations (Introduction of new and advanced ingredients)

- Digital Marketing and E-commerce Growth (Rise of D2C brands in weight loss space)

- Untapped Emerging Markets (Opportunities in Asia-Pacific and Latin America)

3.4. Trends

- Shift Toward Personalized Nutrition (Customized supplements based on consumer needs)

- Increasing Popularity of Plant-Based Supplements (Vegan and plant-based trends)

- Subscription-Based Supplement Models (Growth of recurring revenue models)

3.5. Government Regulations

- FDA, EFSA, and Global Compliance Standards (Product approval and quality control)

- Marketing and Advertising Guidelines (Claims and endorsements)

- Import-Export Regulations (Tariffs and restrictions affecting global sales)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Weight Loss Supplement Market Segmentation

4.1. By Product Type (In Value %)

- Appetite Suppressants

- Fat Burners

- Meal Replacements

- Carb Blockers

- Thermogenic Supplements

4.2. By Ingredient Type (In Value %)

- Synthetic Supplements

- Herbal and Plant-Based Supplements

- Protein-Based Supplements

- Fiber-Based Supplements

- Others (Collagen, Minerals, etc.)

4.3. By Formulation Type (In Value %)

- Pills

- Powders

- Capsules

- Liquids

- Others (Chewables, Gels, etc.)

4.4. By Distribution Channel (In Value %)

- Online Channels

- Supermarkets/Hypermarkets

- Pharmacies and Drug Stores

- Specialty Stores

- Direct Sales

4.5. By Region (In Value %)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

5. Global Weight Loss Supplement Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

- Glanbia PLC

- Herbalife Nutrition Ltd.

- Iovate Health Sciences International Inc.

- Amway Corp.

- GNC Holdings, LLC

- Natures Bounty Co.

- NOW Foods

- Shaklee Corporation

- Atkins Nutritionals, Inc.

- USN (Ultimate Sports Nutrition)

- Nutrex Research

- MusclePharm Corp.

- BioTechUSA

- SlimFast

- Oriflame Holding AG

5.2. Cross Comparison Parameters (Product Portfolio, Revenue, Market Share, Distribution Networks, Innovation Index, Manufacturing Capabilities, Brand Equity, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Weight Loss Supplement Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Labeling and Packaging Guidelines

6.3. Certifications (ISO, GMP, Organic, Vegan, etc.)

7. Global Weight Loss Supplement Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Weight Loss Supplement Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Formulation Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Weight Loss Supplement Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Marketing Initiatives

9.4. Consumer Cohort Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the ecosystem of the global weight loss supplement market, encompassing key stakeholders such as manufacturers, distributors, and retailers. Desk research is conducted using secondary and proprietary databases to identify essential market dynamics, consumer behaviors, and product preferences.

Step 2: Market Analysis and Construction

Historical data is compiled to analyze market growth patterns, focusing on the penetration of various product types and their impact on revenue. Data from industry reports and financial statistics are used to assess revenue generation within the market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are tested through interviews with industry experts, ranging from manufacturers to product marketers. These consultations validate the data collected and provide insights into consumer trends and future opportunities.

Step 4: Research Synthesis and Final Output

The final phase includes comprehensive interaction with weight loss supplement manufacturers to validate product demand, sales data, and market potential. This process ensures the accuracy of the bottom-up market analysis and provides a holistic view of the global weight loss supplement market.

Frequently Asked Questions

1. How big is the Global Weight Loss Supplement Market?

The global weight loss supplement market is valued at USD 29.95 billion, driven by the increasing prevalence of obesity and growing consumer awareness about fitness and health.

2. What are the challenges in the Global Weight Loss Supplement Market?

Challenges include regulatory hurdles, product safety concerns, and intense competition from established players. The cost of compliance with FDA and EFSA regulations is also a major hurdle.

3. Who are the major players in the Global Weight Loss Supplement Market?

Key players include Herbalife Nutrition, Glanbia PLC, Amway Corp, GNC Holdings, and Natures Bounty. These companies dominate the market due to their extensive product range and strong global distribution networks.

4. What are the growth drivers of the Global Weight Loss Supplement Market?

The market is driven by the rising prevalence of obesity, increased health consciousness, and a growing preference for natural and organic supplements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.