Global Wellness Apps Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2565

December 2024

92

About the Report

Global Wellness Apps Market Overview

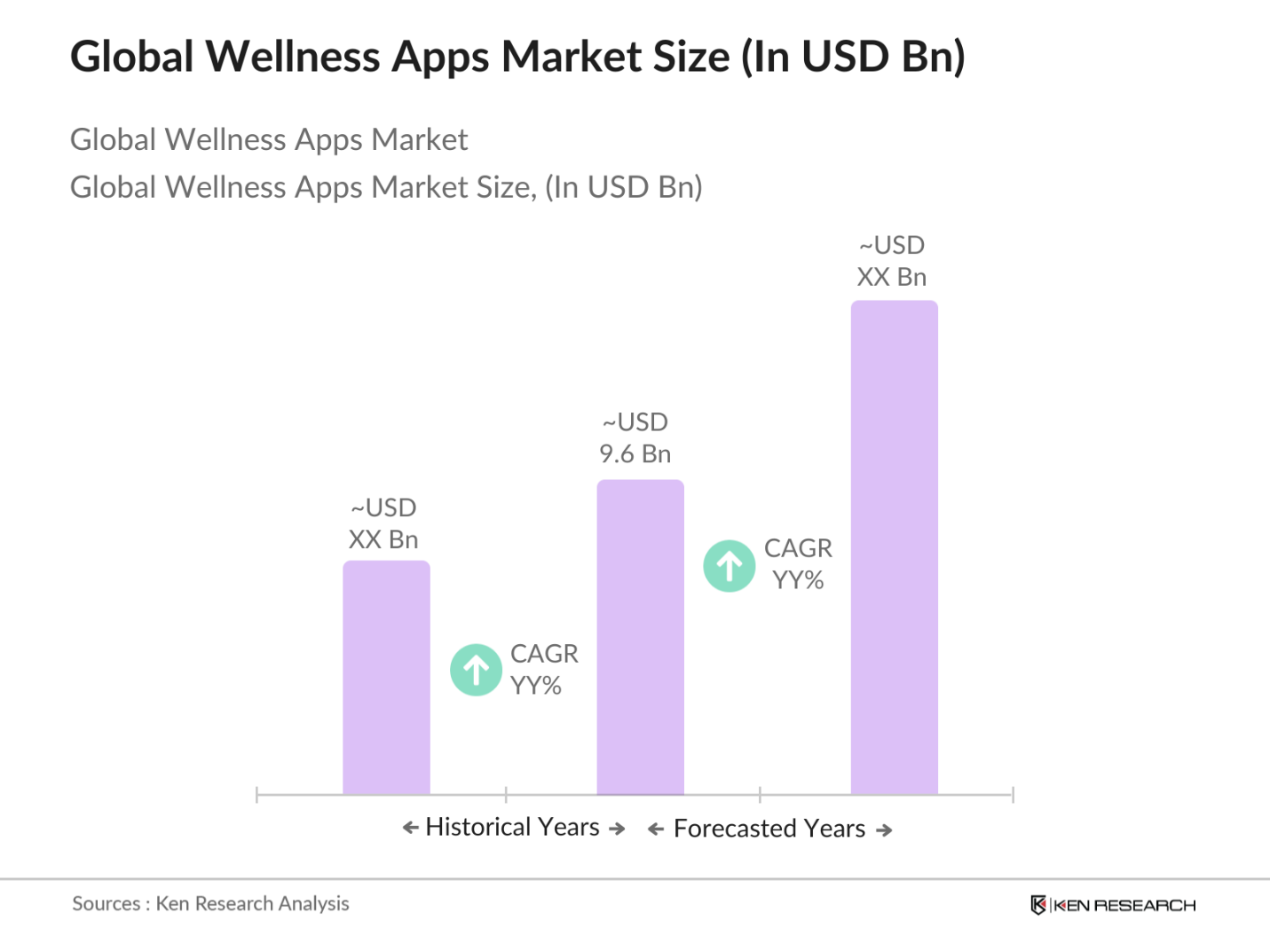

- The Global Wellness Apps market, valued at approximately USD 9.6 billion, is driven by an increasing focus on personal well-being and mental health awareness. As consumers prioritize physical and mental fitness, the demand for wellness apps offering guided meditation, fitness tracking, nutrition plans, and sleep monitoring has significantly risen. This growth is underpinned by advancements in artificial intelligence, the integration of wearable devices, and an increase in smartphone adoption, further boosting app engagement and subscription models.

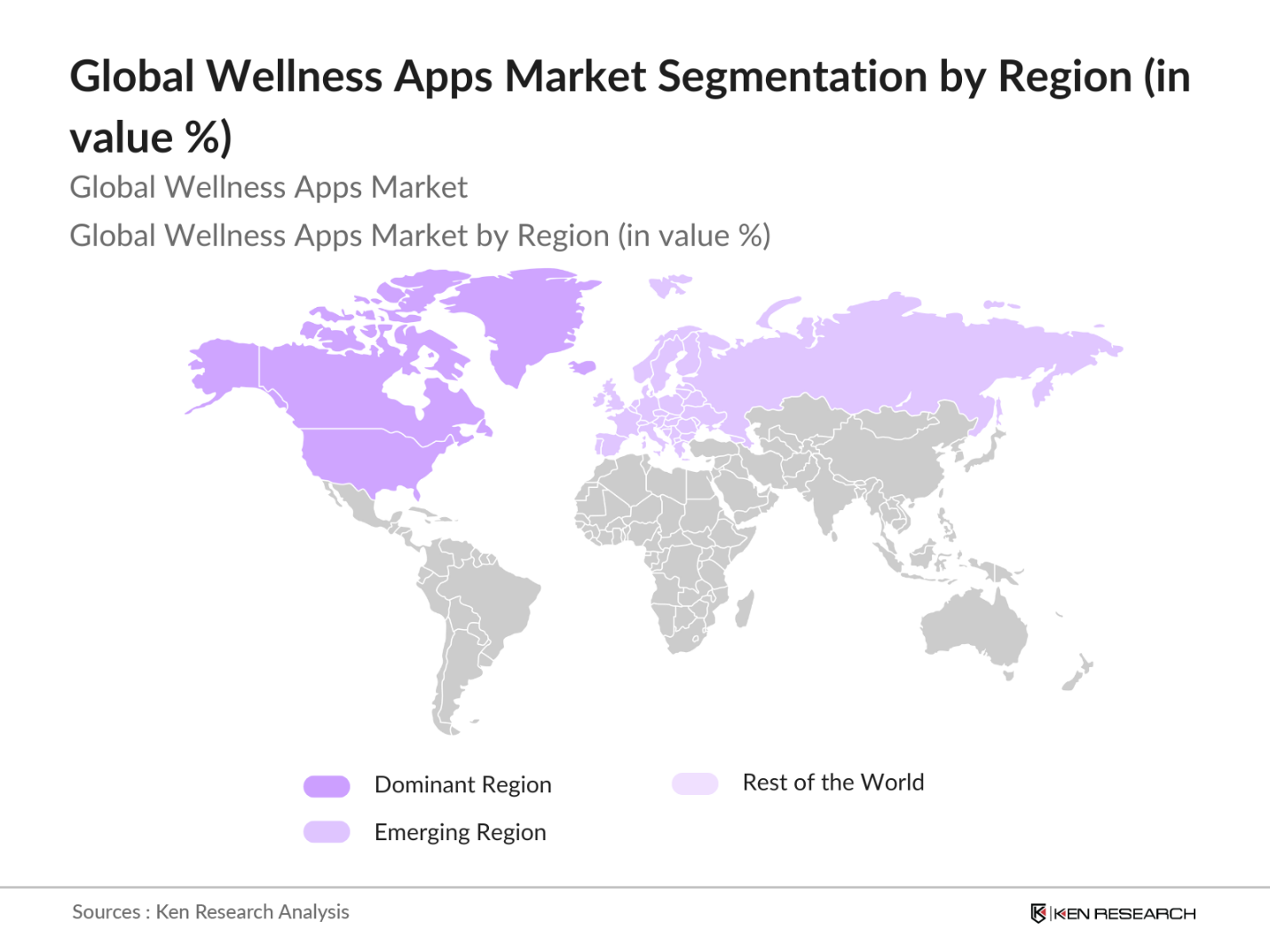

- The dominant countries in the Global Wellness Apps market include the United States, China, and the United Kingdom. These nations lead the market due to high disposable incomes, advanced technological infrastructure, and a rising culture of health and fitness. In particular, the U.S. market is bolstered by a significant number of startups and major players offering innovative solutions, while China's rapid digital transformation has spurred the growth of local wellness platforms.

- Governments across the world are increasingly supporting mental health awareness campaigns, which promote the use of wellness apps for mental health management. In 2023, the U.K. government launched the Every Mind Matters campaign in partnership with the National Health Service (NHS), encouraging the use of mental wellness apps to address issues like stress, anxiety, and depression. The campaign reached over 12 million people, highlighting the governments focus on mental health and the role of digital tools in providing accessible solutions.

Global Wellness Apps Market Segmentation

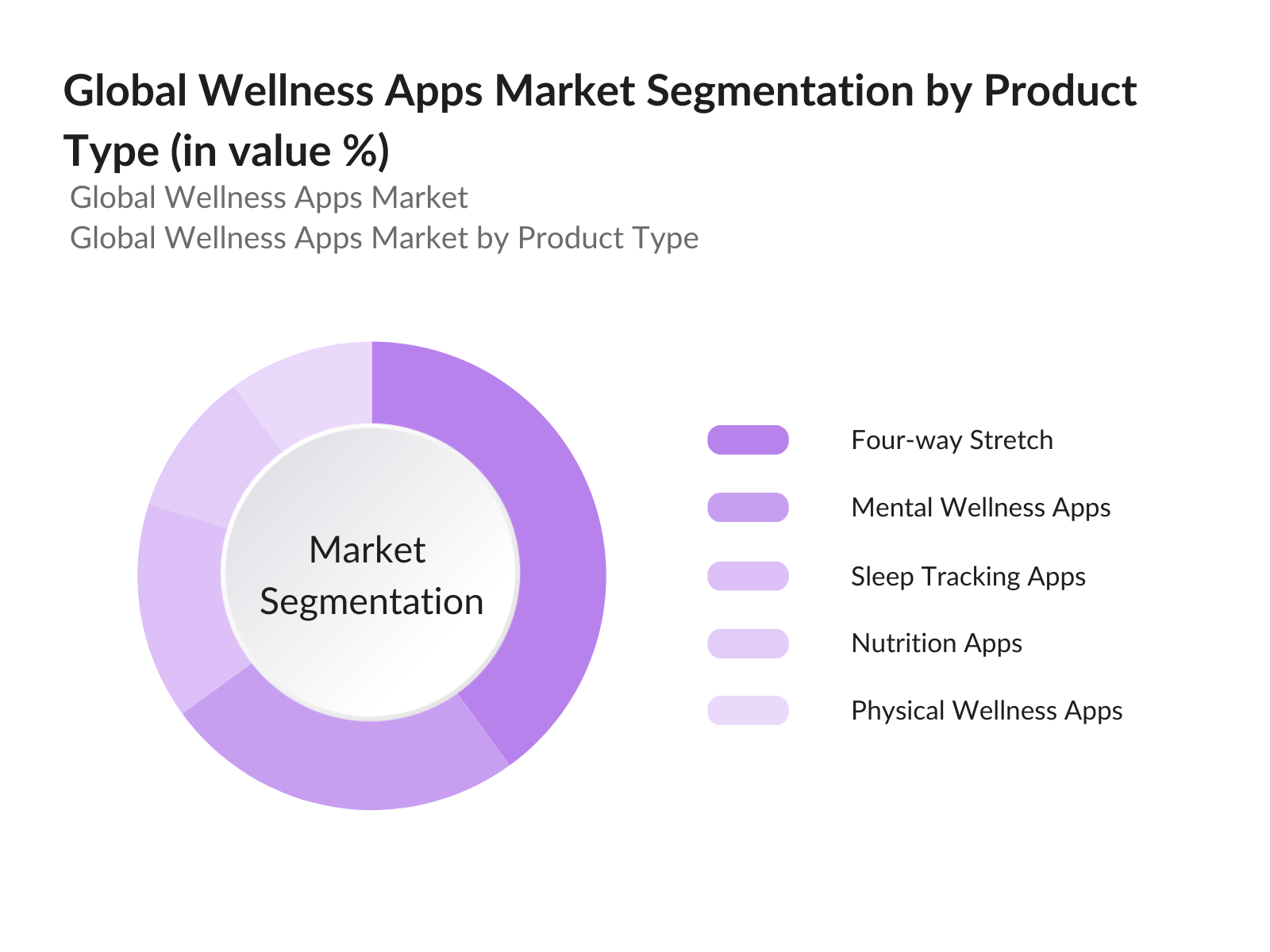

By Product Type: The Global Wellness Apps market is segmented by product type into physical wellness apps, mental wellness apps, sleep tracking apps, nutrition apps, and fitness and exercise apps. Among these, fitness and exercise apps have been a dominant market segment. The popularity of fitness apps stems from their ability to offer personalized workout plans and real-time data tracking, attracting a large user base, particularly during the post-pandemic era where home-based fitness solutions became a necessity.

By Region: The Global Wellness Apps market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the global wellness apps market due to high consumer demand for health and fitness products, alongside a strong digital health ecosystem. The presence of major companies and a tech-savvy population further supports the regions dominance.

Global Wellness Apps Competitive Landscape

The Global Wellness Apps market is dominated by both established players and emerging startups. The competitive landscape highlights a mix of companies that specialize in mental health, fitness, and overall well-being.

|

Company |

Establishment Year |

Headquarters |

Number of Downloads |

Revenue Model |

Subscription Plans |

Global Footprint |

Partnerships |

User Reviews |

|

Calm Inc. |

2012 |

San Francisco, USA |

100M+ |

- |

- |

- |

- |

- |

|

Headspace Inc. |

2010 |

Santa Monica, USA |

70M+ |

- |

- |

- |

- |

- |

|

MyFitnessPal, Inc. |

2005 |

Baltimore, USA |

200M+ |

- |

- |

- |

- |

- |

|

Noom Inc. |

2008 |

New York, USA |

50M+ |

- |

- |

- |

- |

- |

|

BetterMe |

2016 |

Kyiv, Ukraine |

85M+ |

- |

- |

- |

- |

- |

Global Wellness Apps Analysis

Market Growth Drivers

- Technological Advancements in AI and IoT: Technological advancements, particularly in artificial intelligence (AI) and the Internet of Things (IoT), are transforming wellness apps. According to the International Telecommunication Union (ITU), more than 21 billion IoT devices are expected to be in use by 2025. The integration of AI-powered health monitoring and IoT-enabled devices, such as smartwatches, enhances the functionality of wellness apps, allowing users to track various health metrics in real-time. This has resulted in an increase in user engagement and demand for advanced wellness solutions.

- Surge in Smartphone Penetration: Smartphone penetration continues to rise globally, creating a favorable environment for wellness apps. As of 2024, global smartphone ownership is projected to reach 7.6 billion, with major markets like China and India driving the surge, according to GSMA. The increasing affordability of smartphones and better internet connectivity, especially in emerging markets, has expanded the user base for wellness apps, allowing more people to access digital health solutions.

- Rising Demand for Mental Health Solutions: Mental health has emerged as a critical focus area, with wellness apps playing a significant role in providing solutions. In 2023, the World Health Organization reported that more than 970 million people globally suffer from mental health disorders. Wellness apps focusing on stress management, meditation, and therapy services are becoming essential tools for individuals and organizations. The demand for mental health solutions has increased by over 25% driven by rising awareness and acceptance of mental health issues.

Market Challenges:

- Data Privacy Concerns: Data privacy remains a significant challenge in the wellness apps market. As per the United Nations Conference on Trade and Development (UNCTAD), more than 137 countries have implemented data protection legislation. Wellness apps, which often collect sensitive user data such as health metrics, face scrutiny from regulatory bodies. The rise in cyberattacks and concerns around the misuse of personal health data have created trust issues among users, impacting adoption rates in certain regions. In 2023, over 3,000 data breaches were reported globally, according to the International Data Corporation (IDC).

- High Competition from Free Apps: Despite the growing demand for wellness apps, competition from free applications poses a major challenge for paid services. As of 2023, over 300,000 health apps were available on app stores globally, many of which offer basic services at no cost. This saturation has created pricing pressure, forcing many companies to either offer freemium models or lower subscription fees to remain competitive. According to App Annie, the average download rate for free wellness apps was 2.7 times higher than paid apps in 2023.

Global Wellness Apps Future Outlook

The future of the Global Wellness Apps market looks promising, with growth driven by increasing consumer demand for mental and physical wellness solutions. The integration of artificial intelligence, machine learning, and wearables is expected to enhance app personalization, offering a more tailored user experience. Additionally, growing health awareness and the post-pandemic focus on holistic wellness will likely contribute to the market’s upward trajectory.

Market Opportunities:

- Increasing Usage of AI for Health Monitoring: Artificial intelligence (AI) is revolutionizing health monitoring within wellness apps. According to the International Data Corporation (IDC), AI-powered wellness apps saw a 25% rise in adoption in 2023, driven by features such as predictive analytics and real-time health insights. AI enables wellness apps to analyze user data and provide actionable health recommendations, making it easier for users to track and manage their health. This trend is expected to continue as AI technology becomes more sophisticated and accessible.

- Rise in Subscription-Based Models: Subscription-based models are becoming increasingly popular in the wellness apps market. According to Statista, global revenue from subscription-based wellness apps exceeded $5.5 billion in 2023, driven by users seeking premium services. These models offer a consistent revenue stream for app developers, while providing users with ad-free experiences and exclusive features. The trend toward subscription services is particularly evident in developed markets, where users are willing to pay for advanced functionalities such as personalized health plans and virtual consultations.

Scope of the Report

|

By Product Type |

Physical Wellness Apps Mental Wellness Apps Sleep Tracking Apps Nutrition Apps Fitness and Exercise Apps |

|

By Platform |

Android iOS |

|

By Business Model |

Freemium Subscription-Based One-Time Purchase |

|

By End-User |

Individuals Corporate Users Healthcare Providers |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Fitness App Developers

Healthcare Providers

Corporate Wellness Programs

Wearable Device Manufacturers

Fitness and Wellness Influencers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, European Medicines Agency)

Health and Wellness Subscription Platforms

Companies

Players Mention in the Report

Calm Inc.

Headspace Inc.

MyFitnessPal, Inc.

Noom Inc.

Strava Inc.

WW International, Inc.

FitOn Inc.

Meditopia

Happify Health

BetterMe

Shine Inc.

Nike Training Club

Glofox

Runkeeper

Asana Rebel

Table of Contents

01. Global Wellness Apps Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. Global Wellness Apps Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Wellness Apps Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Health Consciousness

3.1.2 Technological Advancements in AI and IoT

3.1.3 Surge in Smartphone Penetration

3.1.4 Rising Demand for Mental Health Solutions

3.2 Market Challenges

3.2.1 Data Privacy Concerns

3.2.2 High Competition from Free Apps

3.2.3 Regulatory Challenges Across Regions

3.3 Opportunities

3.3.1 Integration with Wearable Devices

3.3.2 Personalization and Customization Options

3.3.3 Expansion into Emerging Markets

3.4 Trends

3.4.1 Gamification in Wellness Apps

3.4.2 Increasing Usage of AI for Health Monitoring

3.4.3 Rise in Subscription-Based Models

3.5 Government Regulations

3.5.1 GDPR and Data Privacy Laws

3.5.2 Wellness App Compliance Programs

3.5.3 National Health Programs Supporting Digital Health

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

04. Global Wellness Apps Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Physical Wellness Apps

4.1.2 Mental Wellness Apps

4.1.3 Sleep Tracking Apps

4.1.4 Nutrition Apps

4.1.5 Fitness and Exercise Apps

4.2 By Platform (In Value %)

4.2.1 Android

4.2.2 iOS

4.2.3 Web-Based

4.3 By Business Model (In Value %)

4.3.1 Freemium

4.3.2 Subscription-Based

4.3.3 One-Time Purchase

4.4 By End User (In Value %)

4.4.1 Individuals

4.4.2 Corporate Users

4.4.3 Healthcare Providers

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

05. Global Wellness Apps Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Calm Inc.

5.1.2 Headspace Inc.

5.1.3 MyFitnessPal, Inc.

5.1.4 Noom Inc.

5.1.5 Strava Inc.

5.1.6 WW International, Inc.

5.1.7 FitOn Inc.

5.1.8 Meditopia

5.1.9 Happify Health

5.1.10 BetterMe

5.1.11 Shine Inc.

5.1.12 Nike Training Club

5.1.13 Glofox

5.1.14 Runkeeper

5.1.15 Asana Rebel

5.2 Cross Comparison Parameters (Revenue, Number of Downloads, Subscription Plans, User Engagement Rate, Data Security Features, Global Footprint, Number of Partnerships, Customer Support Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06. Global Wellness Apps Market Regulatory Framework

6.1 Compliance with Data Privacy Regulations

6.2 App Certification Processes

6.3 Health Insurance Portability and Accountability Act (HIPAA) Regulations

07. Global Wellness Apps Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Wellness Apps Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Platform (In Value %)

8.3 By Business Model (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

09. Global Wellness Apps Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the Global Wellness Apps Market's key stakeholders. Extensive desk research, utilizing secondary data from credible sources, helps define crucial market variables such as product adoption, user engagement rates, and subscription trends.

Step 2: Market Analysis and Construction

The second phase focuses on analyzing historical market data to understand user preferences and revenue models. This includes assessing the number of active users, app downloads, and customer feedback, which are used to forecast future market trends.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted via structured interviews to validate hypotheses related to market growth and technology integration. These consultations provide insights into evolving consumer behaviors and the competitive landscape.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research findings to create a detailed report. It combines top-down and bottom-up approaches to ensure the accuracy of market size, segmentation, and competitive analysis.

Frequently Asked Questions

01. How big is the Global Wellness Apps Market?

The Global Wellness Apps Market is valued at USD 9.6 billion, driven by the rising demand for mental and physical well-being, technological integration, and widespread smartphone usage.

02. What are the challenges in the Global Wellness Apps Market?

Challenges include data privacy concerns, high competition, and regulatory compliance issues across regions. Additionally, maintaining user engagement in a highly saturated market can be difficult.

03. Who are the major players in the Global Wellness Apps Market?

Major players include Calm Inc., Headspace Inc., MyFitnessPal, Noom Inc., and BetterMe, among others. These companies have established themselves through innovative product offerings and strategic partnerships.

04. What are the growth drivers of the Global Wellness Apps Market?

Key drivers include increasing health consciousness, advancements in AI, and the growing popularity of subscription-based wellness services. Additionally, the post-pandemic focus on self-care has further fueled market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.