Global Wireless Car Charger Market Outlook to 2030

Region:Global

Author(s):Shambhavi Awasthi

Product Code:KROD1492

October 2024

85

About the Report

Global Wireless Car Charger Market Overview

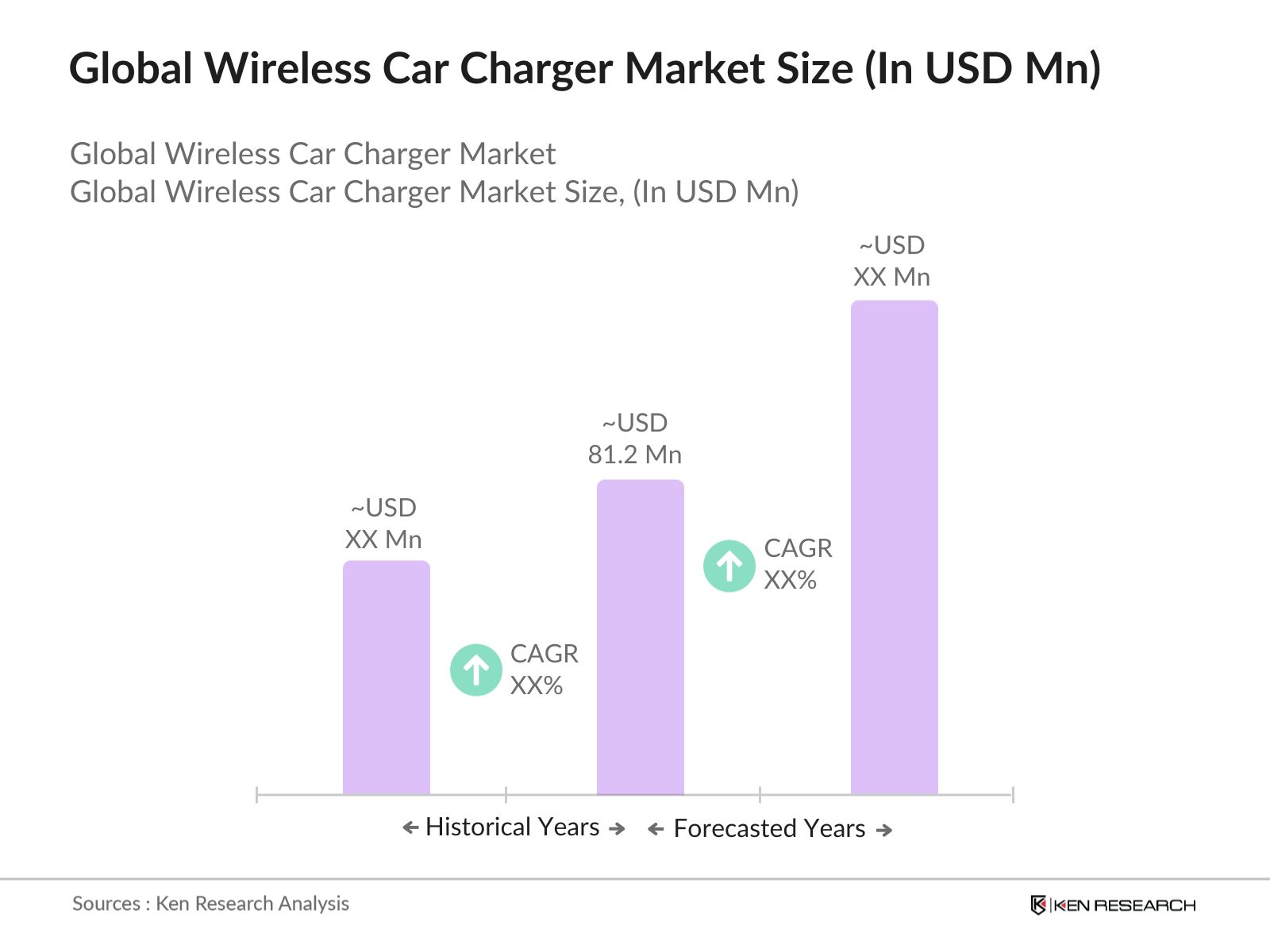

- The Global Wireless Car Charger Market was valued at USD 81.2 Million in 2023, driven by the increasing adoption of electric vehicles (EVs) and the growing demand for convenient and efficient charging solutions. The market is witnessing rapid growth due to advancements in wireless charging technology and the shift towards reducing reliance on traditional wired chargers, particularly in urban areas.

- Prominent players in the wireless car charger market include WiTricity Corporation, Plugless Power, Powermat Technologies, Qualcomm Technologies, Inc., and Mojo Mobility, Inc. These companies are leading innovation in wireless charging solutions, focusing on enhancing charging efficiency, expanding the charging range, and establishing strategic partnerships with automotive manufacturers to integrate wireless charging into new EV models.

- A key trend in the wireless car charger market is the integration of wireless charging technology into public infrastructure, such as roads, parking lots, and public transport hubs. In 2024, several European cities, including Oslo and Munich, launched pilot projects to install wireless charging pads in public parking spaces, allowing electric vehicles to charge while parked, While the initial costs of implementing wireless charging infrastructure can be $2 million per mile. This trend is expected to expand, with more cities adopting similar technologies to promote sustainable urban mobility.

- Cities like Los Angeles, Munich, and Shanghai dominate the wireless car charger market due to their high concentration of electric vehicles and strong government support for innovative charging solutions. These cities have also seen significant investments in wireless charging infrastructure, driven by local policies that prioritize sustainable urban mobility and reduce reliance on traditional fossil fuels.

Global Wireless Car Charger Market Segmentation

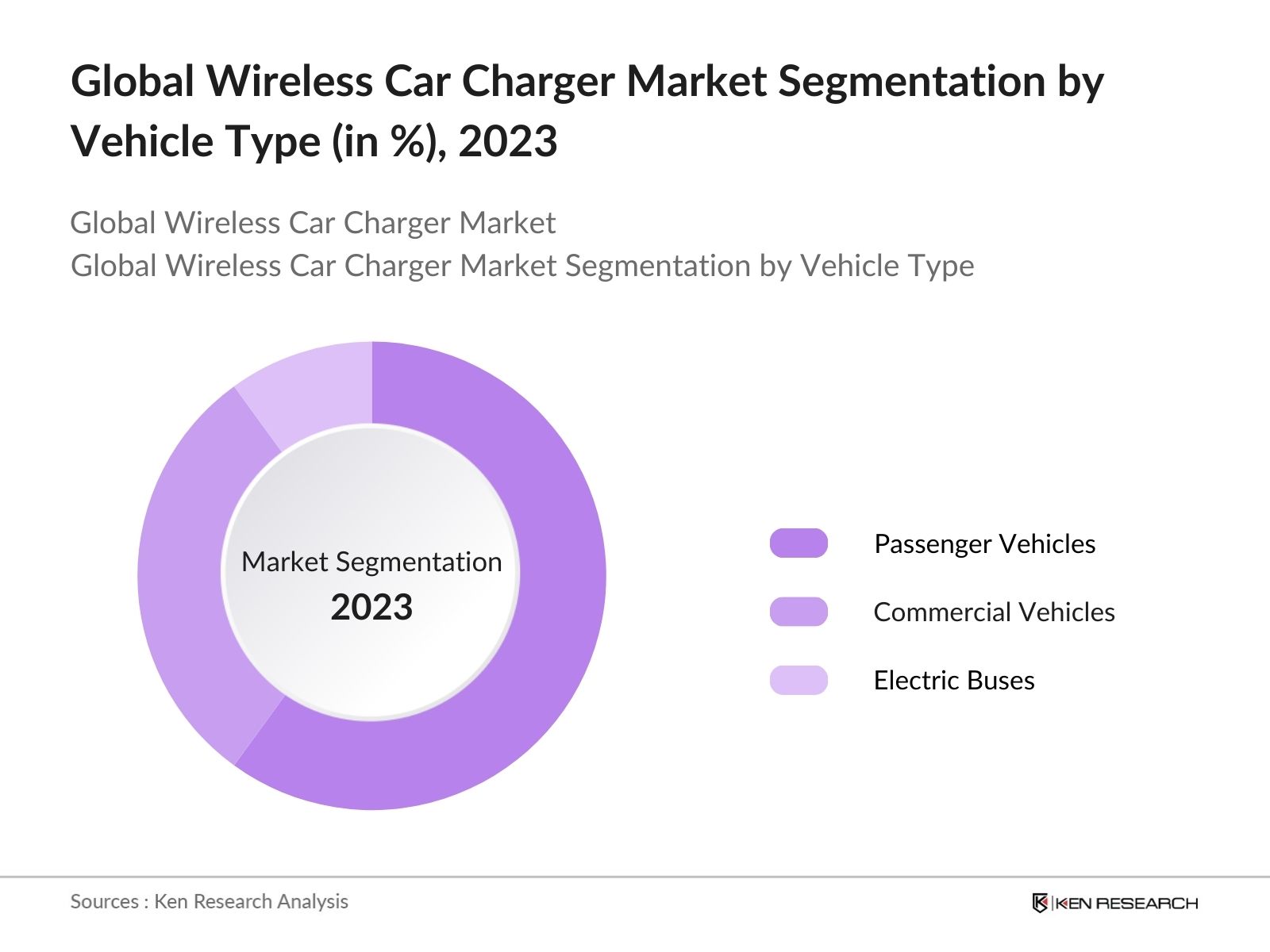

By Vehicle Type: The market is also segmented by vehicle type into passenger vehicles, commercial vehicles, and electric buses. In 2023, passenger vehicles led the market. The dominance of passenger vehicles is driven by the growing consumer demand for electric cars and the integration of wireless charging as a premium feature in many new models. Manufacturers are increasingly adopting wireless charging to enhance convenience and attract tech-savvy customers.

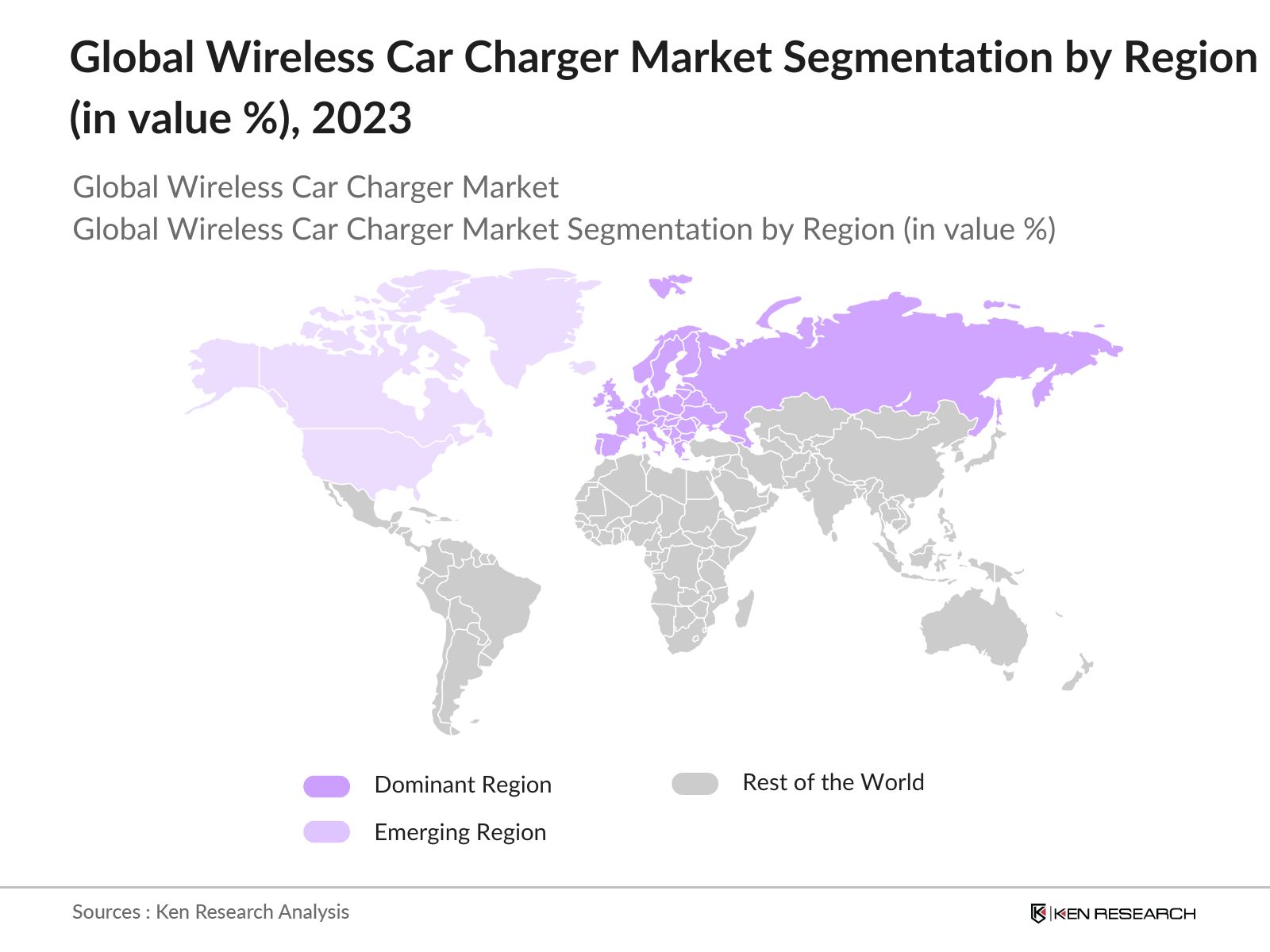

By Region: Global Wireless Car Charger Market is segmented into Asia-Pacific (APAC), North America, Europe, and Rest of the World. In 2023, Europe dominated the market, driven by strong government initiatives and early adoption of wireless charging technology in countries like Germany and Norway. The region's focus on reducing carbon emissions and promoting electric vehicle adoption has made it a leader in this market segment.

By Technology Type: The Global Wireless Car Charger Market is segmented by technology type into resonant inductive charging, magnetic resonance charging, and radio frequency-based charging. In 2023, resonant inductive charging dominated the market share. This technology's dominance is attributed to its high efficiency and the ability to charge over longer distances compared to traditional inductive charging, making it ideal for automotive applications.

Global Wireless Car Charger Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

WiTricity Corporation |

2007 |

Watertown, Massachusetts |

|

Plugless Power |

2009 |

Richmond, Virginia |

|

Powermat Technologies |

2006 |

Petah Tikva, Israel |

|

Qualcomm Technologies |

1985 |

San Diego, California |

|

Mojo Mobility, Inc. |

2008 |

Santa Clara, California |

- Qualcomm Technologies' New Wireless Charging Platform: In 2024, Qualcomm Technologies launched a new wireless charging platform specifically designed for electric vehicles names as Wireless Electric Vehicle Charging (WEVC). This platform, which supports charging at up to 20 kW, offers higher efficiency and faster charging times compared to previous models. Qualcomm's new platform is set to be integrated into the next generation of electric vehicles from leading automakers, positioning the company as a key player in the wireless charging market.

- BMW's Expansion of Wireless Charging Pilot Program: BMW expanded its wireless charging pilot program in 2024, adding 200 new charging stations across Germany and the United States. These stations are equipped with BMW's latest wireless charging technology, which allows for faster and more efficient charging of its electric vehicle lineup. The expansion of this program is part of BMW's strategy to differentiate its EV offerings by providing cutting-edge charging solutions.

Global Wireless Car Charger Market Analysis

Growth Drivers

- Increasing Adoption of Electric Vehicles (EVs): The global push towards sustainable transportation has led to a surge in the adoption of electric vehicles (EVs). In 2024, global EV sales are expected to exceed 17 million units, driven by supportive government policies, rising fuel costs, and growing consumer awareness of environmental issues. In Europe, the European Green Deal aims to have 30 million electric cars on the road by 2030, which will further boost demand for wireless charging infrastructure.

- Government Incentives and Regulations: Governments worldwide are implementing incentives and regulations to promote the adoption of wireless car charging technology. In 2024, the European Union introduced regulations mandating the integration of wireless charging technology in new public infrastructure projects. These regulations are part of the EU's broader strategy to reduce carbon emissions by 55% by 2030.

- Strategic Collaborations and Partnerships: Strategic collaborations between automakers and technology companies are driving innovation in the wireless car charger market. In 2024, BMW and Qualcomm Technologies announced a partnership to integrate Qualcomm's wireless charging technology into BMW's upcoming electric vehicle models. This collaboration aims to enhance charging efficiency and convenience, making wireless charging a standard feature in premium electric vehicles.

Challenges

-

- High Costs of Implementation: The deployment of wireless car charging infrastructure is capital-intensive, with significant costs associated with research and development, manufacturing, and installation. The installation cost of a single wireless charging station in a metropolitan area can range from $100,000 to $250,000, depending on the technology and location.

- Efficiency and Energy Loss Issues: Wireless car charging systems currently face efficiency challenges, particularly in terms of energy loss during the charging process. In 2024, most wireless charging systems operate with an efficiency of approximately 70-80%, meaning that up to 15% of the energy is lost during transmission. This inefficiency is a significant drawback compared to traditional wired chargers, which have an efficiency rate of over 95%.

Government Initiatives

- U.S. Department of Energy's Wireless Charging Initiative: The U.S. Department of Energy (DOE) launched a $75 million grant program in 2024 to support the deployment of wireless car charging infrastructure nationwide. This initiative focuses on enhancing charging accessibility in urban centers, highways, and public transportation hubs. The DOE's program also includes research and development funding to improve the efficiency and affordability of wireless charging technology, aligning with the Biden administration's goal to reduce greenhouse gas emissions by 50% by 2030 .

- China's National New Energy Vehicle Strategy: In 2024, the Chinese Ministry of Industry and Information Technology (MIIT) announced a new initiative to deploy wireless charging infrastructure in major cities, including Beijing, Shanghai, and Guangzhou. This initiative is part of China's broader plan to have 40% of all vehicles sold in the country be electric by 2030, and it includes subsidies for companies developing wireless charging technology.

Global Wireless Car Charger Market Future Outlook

The Global Wireless Car Charger Market is expected to experience substantial growth by 2028, driven by the increasing adoption of electric vehicles, advancements in charging technology, and supportive government policies.

Future Trends

- Widespread Adoption of Wireless Charging in Smart Cities: By 2028, wireless charging is expected to become a standard feature in smart city infrastructure. Cities around the world will integrate wireless charging pads into roads, parking lots, and public spaces, allowing vehicles to charge seamlessly as they move or park. This trend will be driven by the need for efficient urban mobility solutions and the increasing number of electric vehicles on the road. The integration of wireless charging with smart city technology will enhance the convenience and sustainability of urban transportation systems.

- Development of High-Power Wireless Charging Systems: The next five years will see significant advancements in the power capabilities of wireless charging systems. By 2028, it is anticipated that wireless chargers capable of delivering up to 50 kW of power will be commercially available, enabling faster charging times comparable to those of wired fast chargers. This development will be particularly beneficial for commercial fleets and high-capacity vehicles, which require quick and efficient charging to maintain operational efficiency.

Scope of the Report

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles Electric Buses |

|

By Technology Type |

Resonant Inductive Charging Magnetic Resonance Charging Radio Frequency-Based Charging |

|

By Region |

Asia-Pacific North America Europe Rest of the World |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Wireless Charging Technology Providers

Automotive OEMs

Renewable Energy Companies

Charging Infrastructure Providers

Battery Manufacturers and Suppliers

Fleet Management Companies

Energy Storage Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, U.S. Department of Transportation)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

WiTricity Corporation

Plugless Power

Powermat Technologies

Qualcomm Technologies, Inc.

Mojo Mobility, Inc.

Tesla, Inc.

BMW AG

Nissan Motor Co., Ltd.

Daimler AG

General Motors

Toyota Motor Corporation

Volkswagen AG

Renault Group

Hyundai Motor Company

Ford Motor Company

Table of Contents

1. Global Wireless Car Charger Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Wireless Car Charger Market Size (in USD Billion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Wireless Car Charger Market Analysis

3.1. Growth Drivers

3.1.1. Surge in Electric Vehicle (EV) Adoption

3.1.2. Technological Advancements in Wireless Charging

3.1.3. Government Subsidies and Incentives

3.2. Challenges

3.2.1. High Development and Infrastructure Costs

3.2.2. Technological Limitations in Charging Efficiency

3.2.3. Lack of Standardization Across Vehicle Platforms

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Integration of Wireless Charging in Smart City Projects

3.3.3. Increasing Demand for Convenient Charging Solutions

3.4. Trends

3.4.1. Integration of Wireless Charging with Renewable Energy

3.4.2. Adoption of Wireless Charging in Public Infrastructure

3.4.3. Introduction of Wireless Charging in Commercial Fleets

3.5. Government Initiatives

3.5.1. European Union's Standardization of Wireless Charging Infrastructure

3.5.2. U.S. Department of Energy's Investments in Wireless EV Charging

3.5.3. China's Promotion of Wireless Charging for Public Transportation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Wireless Car Charger Market Segmentation, 2023

4.1. By Technology Type (in Value %)

4.1.1. Resonant Inductive Charging

4.1.2. Magnetic Resonance Charging

4.1.3. Radio Frequency-Based Charging

4.2. By Vehicle Type (in Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Buses

4.3. By Region (in Value %)

4.3.1. Asia-Pacific

4.3.2. North America

4.3.3. Europe

4.3.4. Rest of the World

5. Global Wireless Car Charger Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. WiTricity Corporation

5.1.2. Plugless Power

5.1.3. Powermat Technologies

5.1.4. Qualcomm Technologies, Inc.

5.1.5. Mojo Mobility, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Wireless Car Charger Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Wireless Car Charger Market Regulatory Framework

7.1. Environmental and Energy Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Wireless Car Charger Future Market Size (in USD Billion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Wireless Car Charger Market Future Segmentation, 2028

9.1. By Technology Type (in Value %)

9.2. By Vehicle Type (in Value %)

9.3. By Region (in Value %)

10. Global Wireless Car Charger Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 01 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 02 Market Building:

Collating statistics on Global Wireless Car Charger Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated in Global Wireless Car Charger Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 03 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 04 Research Output:

Our team will approach multiple Global Wireless Car Charger Market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Marine Engine Market companies.

Frequently Asked Questions

1. How big is the Global Wireless Car Charger Market?

The Global Wireless Car Charger Market was valued at USD 81.2 Million in 2023, driven by the increasing adoption of electric vehicles and the demand for convenient, cable-free charging solutions.

2. What are the challenges in the Global Wireless Car Charger Market?

Challenges in the Global Wireless Car Charger Market include high development costs, technological limitations in charging efficiency, and the need for standardization across different vehicle platforms to ensure compatibility.

3. Who are the major players in the Global Wireless Car Charger Market?

Key players in the Global Wireless Car Charger Market include WiTricity Corporation, Plugless Power, Powermat Technologies, Qualcomm Technologies, Inc., and Mojo Mobility, Inc. These companies lead the market with innovative charging solutions and strategic partnerships.

4. What are the growth drivers of the Global Wireless Car Charger Market?

The market is driven by the rising adoption of electric vehicles, advancements in wireless charging technology, and government incentives promoting sustainable transportation solutions. Additionally, the integration of wireless charging into smart city initiatives is further fueling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.