Global Wireless Electric Vehicle Charging Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5495

December 2024

90

About the Report

Global Wireless Electric Vehicle Charging Market Overview

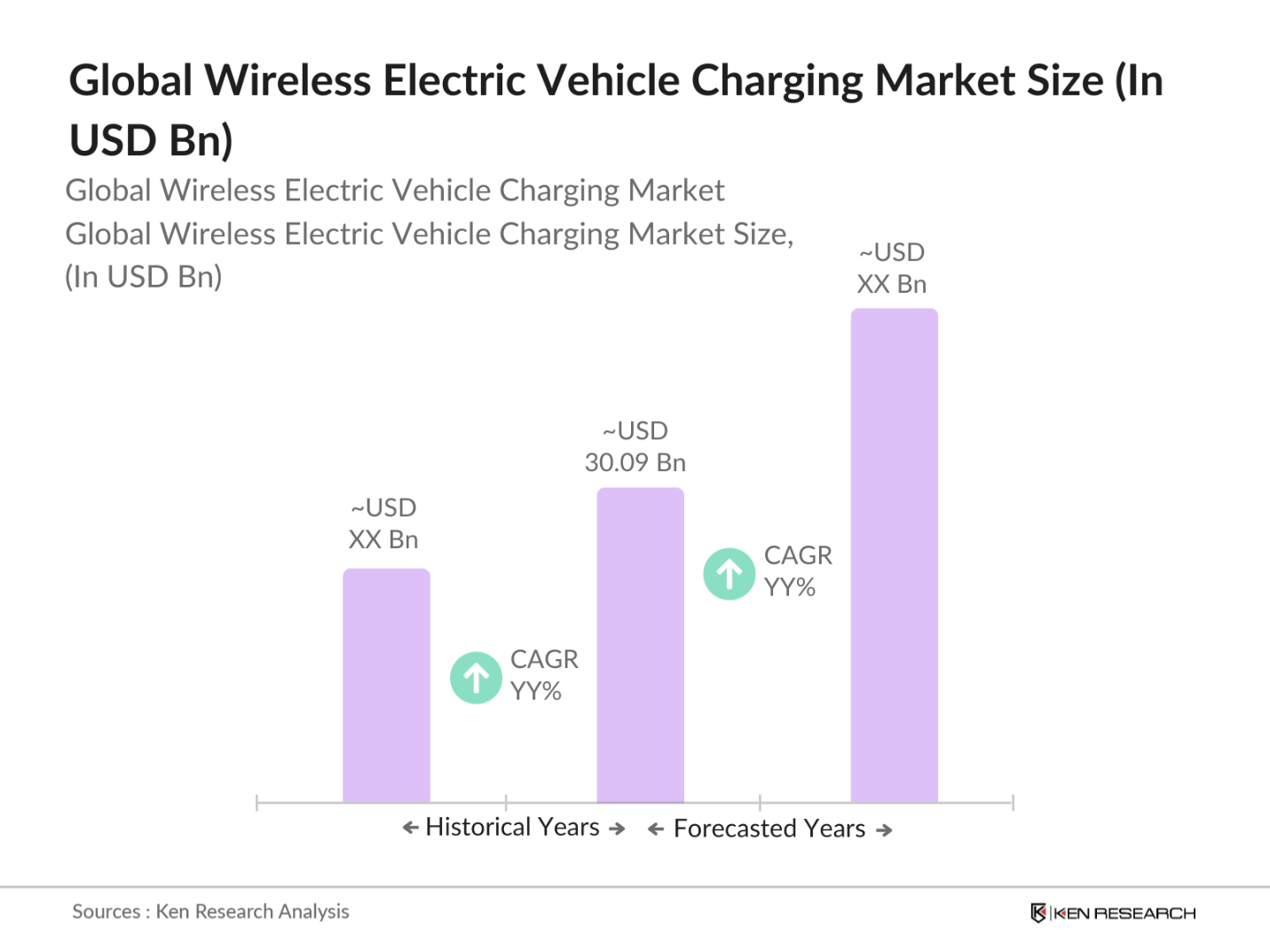

- The global wireless electric vehicle (EV) charging market is valued at USD 30.09 million, driven by advancements in wireless technology and increased EV adoption due to environmental benefits. Key factors propelling growth include convenience in charging and a significant reduction in dependence on large batteries. The ability to charge vehicles without physical connections has attracted strong interest from both consumers and EV manufacturers. The rise in government incentives further supports the deployment of wireless charging infrastructure.

- Major cities in the U.S., Europe, and Asia-Pacific, such as Los Angeles, Berlin, and Tokyo, lead the market due to their established EV infrastructures and early adoption of advanced vehicle technologies. These regions are characterized by government incentives and strong R&D initiatives supporting wireless technology. The rapid expansion of autonomous vehicle fleets in these regions also contributes to their dominance.

- The European Union has mandated all member countries to enhance EV charging infrastructure through the AFID, which supports national funding and infrastructure development. The EU is also investing 2.9 billion in EV infrastructure projects aimed at reaching 1 million public charging points by 2025. This directive aims to standardize and expand charging networks across Europe.

Global Wireless Electric Vehicle Charging Market Segmentation

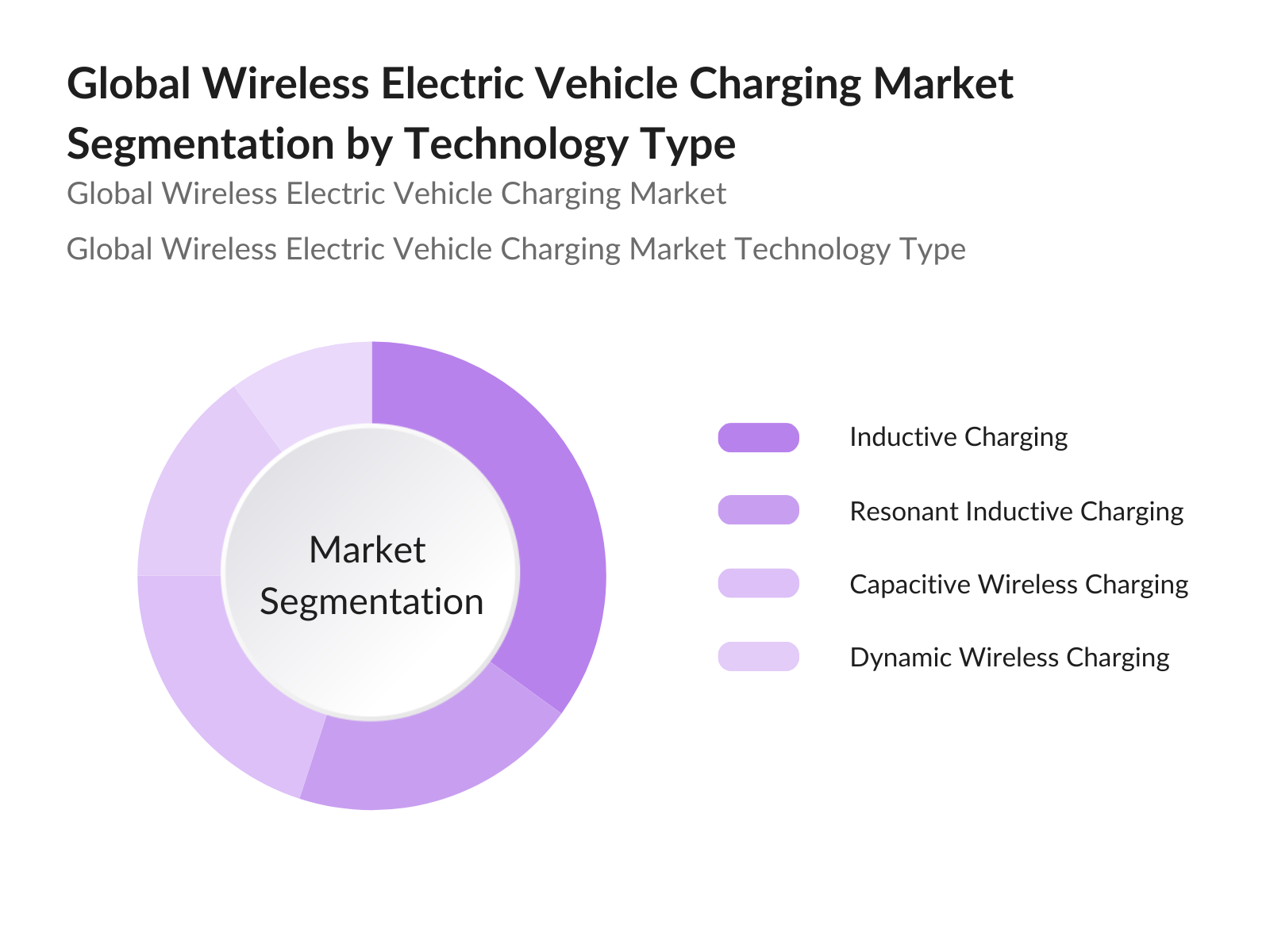

By Technology Type: The wireless EV charging market is segmented by technology type into inductive charging, resonant inductive charging, capacitive wireless charging, and dynamic wireless charging. Inductive charging dominates this segment, attributed to its established integration in various EV models and the reliability of this technology in static environments, such as residential garages and commercial parking facilities. Resonant inductive charging, while newer, is gaining traction due to its higher energy efficiency over longer distances, making it favorable for public infrastructure.

By Region: The wireless EV charging market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America dominates the market with strong EV adoption rates, favorable government policies, and advanced charging infrastructure, especially in the U.S. and Canada. Europe is also a significant region due to environmental policies pushing for the reduction of carbon emissions and high EV penetration rates, particularly in countries like Norway and Germany.

Global Wireless Electric Vehicle Charging Market Competitive Landscape

The global wireless EV charging market is dominated by key players such as WiTricity Corporation, Qualcomm, and Siemens AG, along with prominent automotive companies like Tesla. This competitive environment reflects a strong focus on technological innovation and strategic partnerships. The ecosystem includes technology providers, automotive OEMs, and public infrastructure entities working collaboratively to advance wireless EV charging systems.

Global Wireless Electric Vehicle Charging Market Analysis

Market Growth Drivers

- Increasing Electric Vehicle (EV) Adoption: The global electric vehicle (EV) market has experienced significant growth, with over 10 million EVs sold in 2022. This surge is driven by environmental concerns and supportive government policies. For instance, the European Union reported that 1 in every 7 passenger cars sold in 2022 was an EV, highlighting a substantial shift towards electric mobility.

- Demand for Convenience in EV Charging: Consumers are increasingly seeking convenient charging solutions for their EVs. Wireless charging addresses this demand by eliminating the need for physical connectors, allowing drivers to charge their vehicles simply by parking over a charging pad. This technology enhances user experience and is particularly beneficial in urban areas where space is limited. The International Energy Agency notes that the public charging stock saw substantial growth in 2023, reflecting the growing emphasis on accessible charging infrastructure.

- Reduction in Battery Sizes Through Wireless Charging Optimization: Wireless charging technology enables more frequent and opportunistic charging, reducing the need for large battery capacities. This leads to lighter vehicles with improved energy efficiency. Research from the ASPIRE Research Center at Utah State University indicates that dynamic wireless charging systems could allow EVs to operate with batteries as small as 100 miles of range, significantly lowering vehicle costs and weight.

Market Challenges:

- High Initial Setup and Maintenance Costs: The deployment of wireless EV charging infrastructure involves substantial initial investment. The installation of charging pads and necessary grid upgrades can be costly. Additionally, maintenance expenses are higher compared to traditional charging systems due to the complexity of the technology. These financial barriers can deter widespread adoption, especially in developing regions.

- Compatibility Issues with Existing EV Models: Not all EVs are equipped to support wireless charging, leading to compatibility challenges. The lack of standardized technology across different manufacturers results in interoperability issues. For instance, while some automakers like Nissan have integrated wireless charging capabilities into models like the Leaf, many others have yet to adopt this technology, limiting the market's growth potential.

Global Wireless Electric Vehicle Charging Market Future Outlook

Over the next five years, the global wireless EV charging market is anticipated to experience robust growth driven by advancements in charging technology, expansion of EV fleets, and increased adoption of autonomous vehicles. The focus on reducing carbon emissions and developing sustainable urban infrastructure will further encourage the integration of wireless charging solutions. Additionally, industry collaboration among technology providers, automotive OEMs, and government agencies will support the creation of standardized wireless charging networks globally.

Market Opportunities:

- Technological Advancements in Resonant Magnetic Induction: Advancements in resonant magnetic induction have improved the efficiency and range of wireless charging systems. This technology allows for energy transfer over greater distances and with higher efficiency, making it more viable for public charging stations and dynamic charging applications. Companies are investing in research to enhance these systems, aiming to reduce energy losses and increase charging speeds.

- Partnerships with Automotive OEMs for Integrated Solutions: Collaborations between wireless charging technology providers and automotive original equipment manufacturers (OEMs) are crucial for integrating wireless charging capabilities into new EV models. Such partnerships facilitate the standardization of technology and ensure compatibility, accelerating market adoption. For example, WiTricity has partnered with several automakers to develop factory-installed wireless charging options, streamlining the user experience.

Scope of the Report

|

By Technology Type |

Inductive Charging Resonant Inductive Charging Capacitive Wireless Charging Dynamic Wireless Charging |

|

By Component Type |

Base Charging Pad Vehicle Charging Pad Control Unit Power Source and Auxiliary Components |

|

By Application |

Private/Residential Charging Commercial Charging Stations Fleet & Public Transportation Autonomous Vehicle Charging |

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles Autonomous and Shared Vehicles Electric Buses |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Automotive Manufacturers

Wireless Charging Technology Providers

EV Charging Infrastructure Developers

Autonomous Vehicle Fleet Operators

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Energy, European Union Commission)

EV Service and Maintenance Providers

Environmental Agencies and Sustainability Groups

Companies

Players Mention in the Report

WiTricity Corporation

Qualcomm Incorporated

Momentum Dynamics Corporation

Plugless Power

HEVO Power

Continental AG

Siemens AG

Tesla Inc.

ZTE Corporation

Toshiba Corporation

Elix Wireless

Bombardier Inc.

Powermat Technologies Ltd.

Robert Bosch GmbH

Greenlots (a Shell subsidiary)

Table of Contents

01. Global Wireless Electric Vehicle Charging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02. Global Wireless Electric Vehicle Charging Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

03. Global Wireless Electric Vehicle Charging Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Electric Vehicle (EV) Adoption

3.1.2 Demand for Convenience in EV Charging

3.1.3 Government Subsidies and Incentives for EV Charging Infrastructure

3.1.4 Reduction in Battery Sizes Through Wireless Charging Optimization

3.2 Market Challenges

3.2.1 High Initial Setup and Maintenance Costs

3.2.2 Compatibility Issues with Existing EV Models

3.2.3 Regulatory Compliance and Standardization Hurdles

3.3 Opportunities

3.3.1 Technological Advancements in Resonant Magnetic Induction

3.3.2 Expansion of Wireless Charging in Autonomous Vehicle Fleets

3.3.3 Partnerships with Automotive OEMs for Integrated Solutions

3.4 Trends

3.4.1 Adoption of Dynamic In-Motion Charging Systems

3.4.2 Integration with Smart Charging Networks and IoT

3.4.3 Increased Demand for Energy Efficiency Solutions in Charging

3.5 Government Regulations

3.5.1 Regional Standards for Wireless EV Charging

3.5.2 EV Infrastructure Initiatives and Grants

3.5.3 Environmental Compliance and Emission Reduction Mandates

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape and Ecosystem

04. Global Wireless Electric Vehicle Charging Market Segmentation

4.1 By Technology Type (In Value %)

4.1.1 Inductive Charging

4.1.2 Resonant Inductive Charging

4.1.3 Capacitive Wireless Charging

4.1.4 Dynamic Wireless Charging

4.2 By Component Type (In Value %)

4.2.1 Base Charging Pad

4.2.2 Vehicle Charging Pad

4.2.3 Control Unit

4.2.4 Power Source and Auxiliary Components

4.3 By Application (In Value %)

4.3.1 Private/Residential Charging

4.3.2 Commercial Charging Stations

4.3.3 Fleet & Public Transportation

4.3.4 Autonomous Vehicle Charging

4.4 By Vehicle Type (In Value %)

4.4.1 Passenger Vehicles

4.4.2 Commercial Vehicles

4.4.3 Autonomous and Shared Vehicles

4.4.4 Electric Buses

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

05. Global Wireless Electric Vehicle Charging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 WiTricity Corporation

5.1.2 Qualcomm Incorporated

5.1.3 Momentum Dynamics Corporation

5.1.4 Plugless Power

5.1.5 HEVO Power

5.1.6 Continental AG

5.1.7 Siemens AG

5.1.8 Tesla Inc.

5.1.9 ZTE Corporation

5.1.10 Toshiba Corporation

5.1.11 Elix Wireless

5.1.12 Bombardier Inc.

5.1.13 Powermat Technologies Ltd.

5.1.14 Robert Bosch GmbH

5.1.15 Greenlots (a Shell subsidiary)

5.2 Cross Comparison Parameters (Revenue, Installed Base, R&D Investment, Patent Portfolio, Market Share, Product Line Breadth, Regional Presence, Number of Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Product Launches

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government and Private Grants

06. Global Wireless Electric Vehicle Charging Market Regulatory Framework

6.1 Standardization Protocols (SAE, ISO, IEC)

6.2 Regional Compliance Requirements

6.3 Certification and Testing Procedures

07. Global Wireless Electric Vehicle Charging Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Wireless Electric Vehicle Charging Future Market Segmentation

8.1 By Technology Type (In Value %)

8.2 By Component Type (In Value %)

8.3 By Application (In Value %)

8.4 By Vehicle Type (In Value %)

8.5 By Region (In Value %)

09. Global Wireless Electric Vehicle Charging Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Strategy and Targeting Recommendations

9.4 White Space Analysis for Future Expansion

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An ecosystem map was created to include all stakeholders in the global wireless EV charging market. Extensive desk research identified essential variables, leveraging both proprietary and secondary databases to gain an in-depth understanding of market dynamics.

Step 2: Market Analysis and Construction

Historical data on wireless EV charging penetration and adoption were collected, along with revenue statistics. Market penetration and revenue ratios were evaluated, providing a foundation for revenue estimates and market trend insights.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding market growth were validated through CATIs (Computer-Assisted Telephone Interviews) with industry experts from technology providers and automotive OEMs. Insights from these experts added critical perspectives on financial and operational trends.

Step 4: Research Synthesis and Final Output

Interactions with EV manufacturers provided detailed insights on product preferences and market demand, validating findings from the initial phases. This ensured a comprehensive and accurate analysis of the global wireless EV charging market.

Frequently Asked Questions

01. How big is the global wireless EV charging market?

The global wireless EV charging market is valued at USD 30.09 million, primarily driven by advancements in wireless charging technology and rising EV adoption rates.

02. What challenges does the global wireless EV charging market face?

Key challenges include the high initial setup cost, compatibility issues with existing EV models, and the lack of standardization in wireless charging technology.

03. Who are the major players in the global wireless EV charging market?

Major players include WiTricity Corporation, Qualcomm, Siemens AG, and Tesla Inc., among others, who are pioneering advancements in wireless EV charging solutions.

04. What drives growth in the global wireless EV charging market?

Growth drivers include increased EV adoption, advancements in wireless charging technology, and supportive government incentives aimed at reducing greenhouse gas emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.