Go to Market Strategy for India Polymer Market

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1521

July 2025

90

About the Report

India Polymer Market Overview

- The India Polymer Market is valued at USD 40 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for polymers in sectors such as automotive, construction, packaging, and consumer goods. The rise in e-commerce, urbanization, and infrastructure development, along with the expansion of the manufacturing sector, have significantly contributed to the market's expansion.

- Key regions in this market include Maharashtra, Gujarat, and Tamil Nadu, which dominate due to their robust industrial infrastructure, established petrochemical complexes, and proximity to major ports. These regions have become manufacturing hubs, attracting investments and fostering innovation in polymer production and processing.

- In 2023, the Indian government implemented the Plastic Waste Management Amendment Rules, mandating the reduction of single-use plastics and promoting recycling initiatives. This regulation aims to enhance sustainability in the polymer industry and encourages manufacturers to adopt eco-friendly practices.

India Polymer Market Segmentation

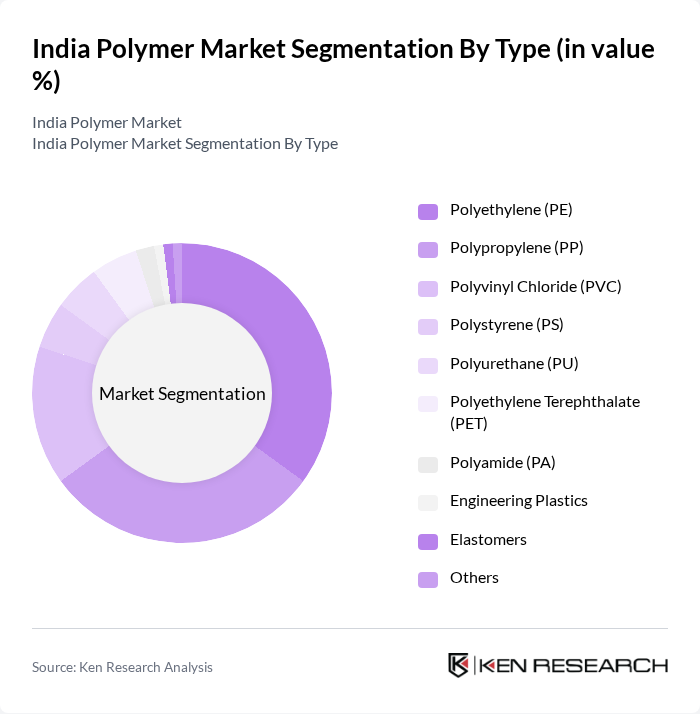

By Type: The polymer market is segmented into thermoplastics, thermosetting plastics, and elastomers. Thermoplastics hold the largest share due to their versatility, recyclability, and ease of processing. They are widely used in packaging, automotive components, and consumer goods, driven by their lightweight nature and adaptability. The increasing focus on sustainable and recyclable materials has further strengthened the demand for thermoplastics, as manufacturers seek innovative solutions to reduce environmental impact.

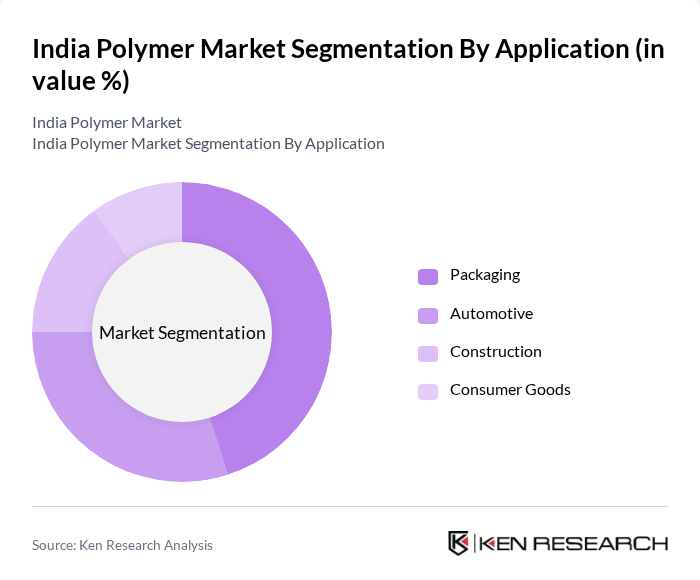

By Application: Polymers in India are used across packaging, automotive, construction, and consumer goods industries. The packaging segment holds the largest share, propelled by rapid growth in e-commerce, food delivery, and retail sectors, which demand convenient and durable packaging solutions. The shift towards sustainable packaging options has led to innovations in polymer materials, including biodegradable and recyclable alternatives, further enhancing their market presence. Manufacturers are increasingly focusing on developing eco-friendly packaging to align with evolving consumer preferences and regulatory requirements.

India Polymer Market Competitive Landscape

The India Polymer Market is characterized by a competitive landscape with several key players, including Reliance Industries, BASF India, and LG Chem. These companies are actively involved in innovation and expanding their product portfolios to meet the growing demand for polymers across various sectors. The market is moderately concentrated, with a mix of local and international players striving to enhance their market presence through strategic partnerships and technological advancements.

India Polymer Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Sector: The Indian automotive sector is projected to produce 2.50 million vehicles in 2025, driving the demand for polymers used in components like dashboards and bumpers. The sector's growth is supported by a 10% increase in vehicle sales, translating to a demand for approximately 1 million tons of polymers. This surge is fueled by rising disposable incomes and urbanization, which are expected to enhance consumer purchasing power significantly.

- Expansion of Construction Activities: The construction industry in India is witnessing robust growth, with polymer-based materials playing a crucial role in infrastructure development. Government initiatives, such as the National Infrastructure Pipeline, aim to invest $1.4 trillion in infrastructure projects, leading to a projected increase in polymer consumption by 20% in construction applications. This growth is vital for meeting the rising demand for housing and commercial spaces.

- Rising Consumer Electronics Production: India's consumer electronics market is witnessing strong growth, significantly boosting the demand for polymers in manufacturing. The sector increasingly relies on polymers for components such as casings and connectors, driven by technological advancements and rising consumer demand for smart devices—further strengthening polymer market dynamics.

Market Challenges

- Fluctuating Raw Material Prices: The volatility in raw material prices, particularly crude oil, poses a significant challenge for the polymer market. This unpredictability directly impacts polymer production costs, leading to increased operational expenses for manufacturers and influencing profit margins and pricing strategies in the competitive landscape of the polymer industry.

- Environmental Regulations Compliance: Stringent environmental regulations are increasingly impacting the polymer industry in India. The implementation of the Plastic Waste Management Rules mandates that companies reduce plastic waste by a significant percentage in future. Compliance with these regulations requires significant investment in sustainable practices and technologies, which can strain financial resources and operational capabilities for many manufacturers in the sector.

India Polymer Market Future Outlook

The India polymer market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. As the demand for biodegradable polymers increases, manufacturers are likely to invest in innovative production methods. Additionally, the rise of e-commerce is expected to enhance distribution channels, making specialty polymers more accessible. With government incentives for green technologies, the market is set to embrace eco-friendly solutions, aligning with global sustainability trends and consumer preferences.

Market Opportunities

- Growth in Biodegradable Polymers: The demand for biodegradable polymers is projected to increase significantly, driven by rising environmental awareness and government support for sustainable materials. This presents a lucrative opportunity for manufacturers to innovate and capture market share in eco-friendly products. Industries such as packaging, agriculture, and consumer goods are actively adopting biodegradable alternatives to reduce environmental impact.

- Technological Advancements in Polymer Production: Innovations in polymer production technologies, such as 3D printing and advanced compounding techniques, are set to revolutionize the industry. These advancements can enhance production efficiency and reduce costs, allowing companies to meet the growing demand for customized polymer solutions, thereby expanding their market presence and profitability.

Scope of the Report

| By Type |

Thermoplastics Thermosetting plastics Elastomers |

| By End-User |

Packaging Automotive Construction Consumer Goods |

| By Region |

North India South India East India West India |

| By Application |

Automotive Components Packaging Solutions Construction Materials Electrical Insulation Others |

| By Investment Source |

Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Chemicals and Fertilizers, Bureau of Indian Standards)

Manufacturers and Producers

Distributors and Retailers

Raw Material Suppliers

Technology Providers

Industry Associations (e.g., All India Plastic Manufacturers Association)

Financial Institutions

Companies

Players Mentioned in the Report:

Reliance Industries

BASF India

LG Chem

Hindustan Aeronautics Limited

SRF Limited

Polychem Limited

Indian Polymers Corporation

Greenfield Polymers

Apex Polymer Solutions

Innovate Plastics India

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India Polymer Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India Polymer Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India Polymer Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand from Automotive Sector

3.1.2 Expansion of Construction Activities

3.1.3 Rising Consumer Electronics Production

3.1.4 Government Initiatives for Manufacturing

3.2 Market Challenges

3.2.1 Fluctuating Raw Material Prices

3.2.2 Environmental Regulations Compliance

3.2.3 Competition from Alternative Materials

3.2.4 Supply Chain Disruptions

3.3 Market Opportunities

3.3.1 Growth in Biodegradable Polymers

3.3.2 Technological Advancements in Polymer Production

3.3.3 Increasing Export Potential

3.3.4 Rising Demand for Specialty Polymers

3.4 Market Trends

3.4.1 Shift Towards Sustainable Practices

3.4.2 Adoption of Smart Polymers

3.4.3 Growth of E-commerce in Polymer Sales

3.4.4 Increasing Focus on Recycling and Circular Economy

3.5 Government Regulation

3.5.1 Plastic Waste Management Rules

3.5.2 Standards for Polymer Quality Control

3.5.3 Import Regulations on Polymer Products

3.5.4 Incentives for Green Polymer Technologies

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India Polymer Market Market Size,2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India Polymer Market Segmentation

8.1 By Type

8.1.1 Thermoplastics

8.1.2 Thermosetting plastics

8.1.3 Elastomers

8.2 By End-User

8.2.1 Packaging

8.2.2 Automotive

8.2.3 Construction

8.2.4 Consumer Goods

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West India

8.4 By Application

8.4.1 Automotive Components

8.4.2 Packaging Solutions

8.4.3 Construction Materials

8.4.4 Electrical Insulation

8.4.5 Others

8.5 By Investment Source

8.5.1 Domestic Investment

8.5.2 Foreign Direct Investment (FDI)

8.5.3 Public-Private Partnerships (PPP)

8.5.4 Government Schemes

9. India Polymer Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Revenue Growth Rate

9.2.2 Market Penetration

9.2.3 Product Diversification

9.2.4 Customer Satisfaction Index

9.2.5 Innovation Rate

9.2.6 Supply Chain Efficiency

9.2.7 Brand Recognition

9.2.8 Cost Competitiveness

9.2.9 Sustainability Practices

9.2.10 Regulatory Compliance

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 Reliance Industries Limited

9.5.2 Indian Oil Corporation Limited

9.5.3 Haldia Petrochemicals Limited

9.5.4 Bharat Petroleum Corporation Limited

9.5.5 LG Polymers India Pvt. Ltd.

9.5.6 UPL Limited

9.5.7 Supreme Industries Limited

9.5.8 Chemplast Sanmar Limited

9.5.9 Aditya Birla Group

9.5.10 BASF India Limited

9.5.11 Dow Chemical International Pvt. Ltd.

9.5.12 Huntsman International LLC

9.5.13 Solvay Specialty Polymers

9.5.14 Evonik Industries AG

9.5.15 LyondellBasell Industries

10. India Polymer Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government Procurement Policies

10.1.2 Budget Allocations for Polymer Products

10.1.3 Supplier Selection Criteria

10.1.4 Contract Management Practices

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment Trends in Polymer Infrastructure

10.2.2 Energy Consumption Patterns

10.2.3 Budgeting for Polymer Innovations

10.2.4 Corporate Sustainability Goals

10.3 Pain Point Analysis by End-User Category

10.3.1 Quality Assurance Issues

10.3.2 Supply Chain Delays

10.3.3 Cost Management Challenges

10.3.4 Regulatory Compliance Difficulties

10.4 User Readiness for Adoption

10.4.1 Awareness of Polymer Innovations

10.4.2 Training and Skill Development Needs

10.4.3 Financial Readiness for Investment

10.4.4 Infrastructure Readiness

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Performance Metrics Evaluation

10.5.2 Case Studies of Successful Implementations

10.5.3 Feedback Mechanisms for Improvement

10.5.4 Future Expansion Plans

11. India Polymer Market Future Size,2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Business Model Development

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail vs Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix

9.1.2 Pricing Band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Polymer Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Polymer Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Polymer Market.

Frequently Asked Questions

What is the current value of the India Polymer Market?

The India Polymer Market is valued at approximately USD 40 billion, driven by increasing demand across sectors such as automotive, construction, packaging, and consumer goods, alongside urbanization and infrastructure development.

Which regions dominate the India Polymer Market?

Maharashtra, Gujarat, and Tamil Nadu are the key regions in the India Polymer Market, known for their robust industrial infrastructure, established petrochemical complexes, and proximity to major ports, making them manufacturing hubs.

What are the main types of polymers in the India Polymer Market?

The India Polymer Market is segmented into thermoplastics, thermosetting plastics, and elastomers. Thermoplastics hold the largest share due to their versatility, recyclability, and ease of processing, making them popular in various applications.

How is the India Polymer Market affected by government regulations?

The implementation of the Plastic Waste Management Amendment Rules in 2023 mandates the reduction of single-use plastics and promotes recycling initiatives, enhancing sustainability in the polymer industry and encouraging eco-friendly practices among manufacturers.

What are the growth drivers for the India Polymer Market?

Key growth drivers include increasing demand from the automotive sector, expansion of construction activities, and rising consumer electronics production, all contributing to a significant rise in polymer consumption across various applications.

What challenges does the India Polymer Market face?

The market faces challenges such as fluctuating raw material prices, particularly crude oil, and stringent environmental regulations that require compliance and investment in sustainable practices, impacting operational costs and profit margins.

What opportunities exist in the India Polymer Market?

Opportunities include the growth of biodegradable polymers, projected to reach a market size of $1 billion, and advancements in polymer production technologies, such as 3D printing, which can enhance efficiency and reduce costs.

Which applications dominate the India Polymer Market?

The packaging segment dominates the India Polymer Market, driven by rapid growth in e-commerce and retail sectors, which demand durable and convenient packaging solutions, including innovations in sustainable and recyclable materials.

Who are the key players in the India Polymer Market?

Key players in the India Polymer Market include Reliance Industries, BASF India, LG Chem, and Hindustan Aeronautics Limited, among others, who are actively involved in innovation and expanding their product portfolios.

What is the future outlook for the India Polymer Market?

The future outlook for the India Polymer Market is positive, with expected transformative growth driven by technological advancements, a shift towards sustainable practices, and increasing demand for eco-friendly solutions in line with global trends.

How does urbanization impact the India Polymer Market?

Urbanization significantly impacts the India Polymer Market by increasing demand for housing, infrastructure, and consumer goods, leading to higher consumption of polymers in construction, automotive, and packaging applications.

What role does e-commerce play in the India Polymer Market?

E-commerce plays a crucial role in the India Polymer Market by driving demand for innovative packaging solutions, as online retail growth necessitates durable and convenient packaging options to enhance customer experience.

What are the different forms of polymers available in the market?

Polymers in the India Polymer Market are available in various forms, including granules, sheets, and films, catering to diverse applications across industries such as automotive, packaging, and construction.

How is the competitive landscape of the India Polymer Market structured?

The competitive landscape of the India Polymer Market is moderately concentrated, featuring a mix of local and international players striving to enhance their market presence through strategic partnerships, innovation, and technological advancements.

What is the significance of sustainable practices in the India Polymer Market?

Sustainable practices are increasingly significant in the India Polymer Market as manufacturers focus on reducing environmental impact, complying with regulations, and meeting consumer demand for eco-friendly products, driving innovation in biodegradable and recyclable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.