India 3D Printer Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD3811

October 2024

91

About the Report

India 3D Printer Market Overview

- The India 3D Printer Market is valued at USD 15 billion, based on a five-year historical analysis. The market is primarily driven by advancements in manufacturing processes and the increasing demand for rapid prototyping across various industries. The surge in the use of 3D printing in sectors like healthcare, automotive, and aerospace has significantly contributed to the markets growth.

- India's metropolitan cities, particularly Bengaluru, Mumbai, and Pune, dominate the 3D printing market due to their strong industrial bases and the presence of numerous tech startups. These cities are hubs for innovation, with a focus on sectors like aerospace, healthcare, and automotive, which are key consumers of 3D printing technology. The availability of skilled labor, a supportive policy environment, and proximity to major research institutions have enabled these cities to lead in 3D printing technology adoption.

- The Government of India introduced the National Strategy on Additive Manufacturing in 2022 to promote 3D printing. The initiative aims to make India a global hub for 3D printing innovation and research by increasing the countrys share of the global additive manufacturing market to 5% by 2025. The strategy outlines goals such as creating 50 India-specific 3D printing technologies, supporting 100 new startups, producing 500 new products, and generating jobs for skilled workers in this field.

India 3D Printer Market Segmentation

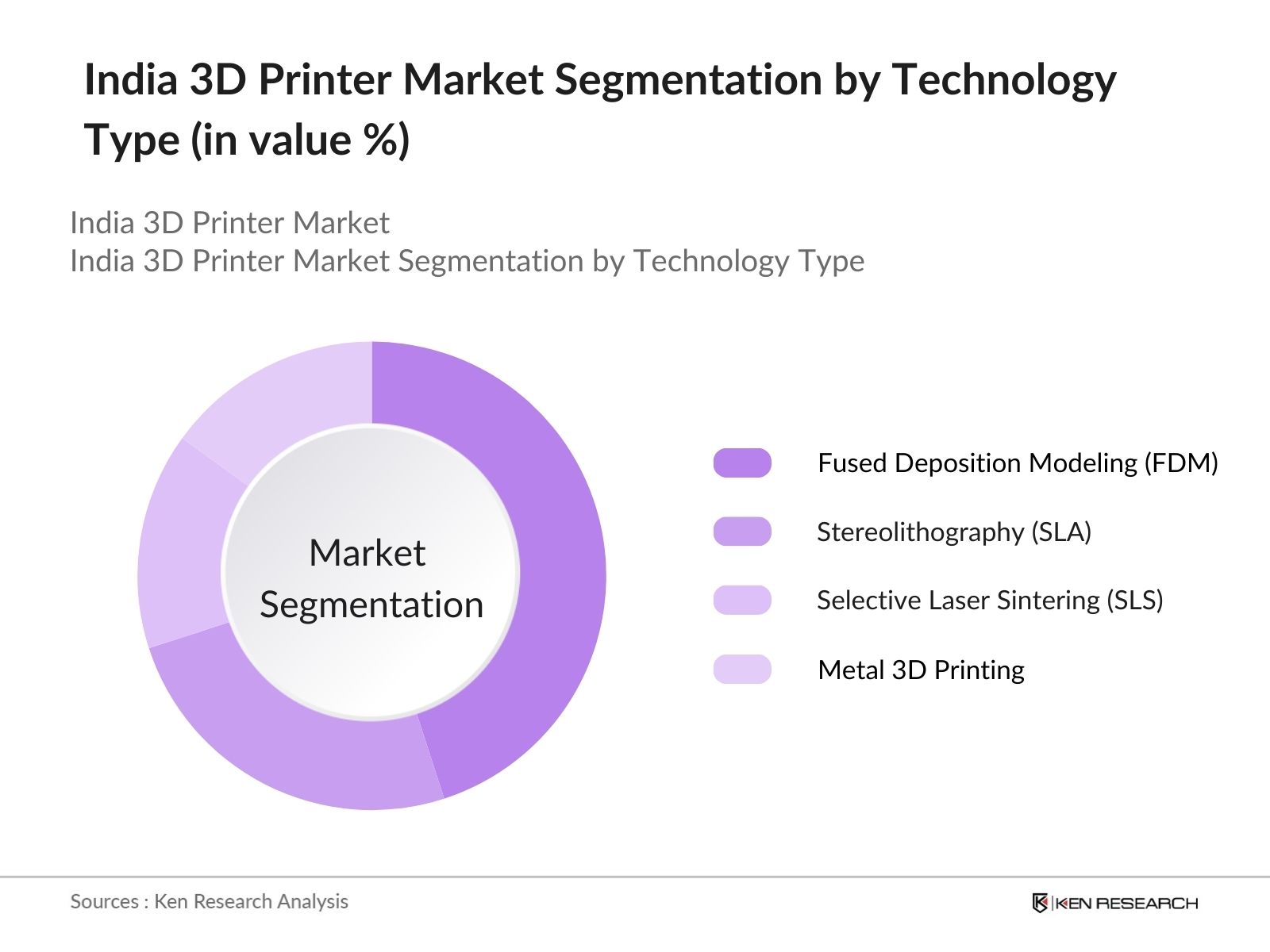

By Technology Type: The India 3D printer market is segmented by technology type into Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), and Metal 3D Printing. FDM technology holds the largest market share under the technology type segmentation. The dominance of FDM is attributed to its cost-effectiveness and suitability for producing durable and functional prototypes across a range of industries. The relatively low cost of production, ease of use, and availability of FDM printers make them popular among SMEs and educational institutions.

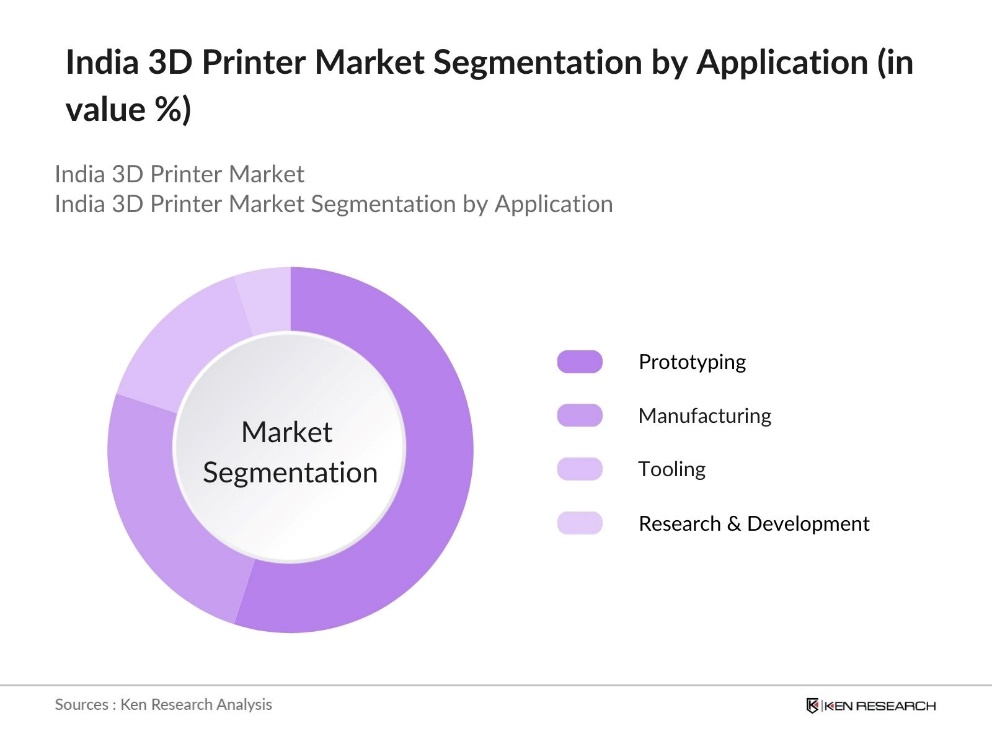

By Application: The India 3D printer market is segmented by application into Prototyping, Manufacturing, Tooling, and Research & Development. Prototyping holds the dominant share within the application segment. This is largely due to the extensive use of 3D printing in industries such as automotive and aerospace, where creating accurate prototypes before full-scale production is critical. The ability of 3D printers to rapidly produce high-quality, customizable prototypes at a fraction of the cost of traditional methods is a key factor behind this dominance.

India 3D Printer Market Competitive Landscape

The market is dominated by both local and international players. Companies like Wipro 3D, Imaginarium, and Stratasys India have established a strong presence, leveraging both innovation and competitive pricing. This consolidation highlights the influence of these key players, who continue to expand their market share through partnerships, new product launches, and advancements in 3D printing technology.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Revenue (USD) |

Technology Focus |

Clients |

No. of Employees |

R&D Investment |

|

Wipro 3D |

2014 |

Bengaluru, India |

||||||

|

Imaginarium |

2009 |

Mumbai, India |

||||||

|

Stratasys India |

1998 |

Bengaluru, India |

||||||

|

Divide By Zero Technologies |

2013 |

Navi Mumbai, India |

||||||

|

EOS India |

2000 |

New Delhi, India |

India 3D Printer Industry Analysis

Growth Drivers

- Industrial Automation Adoption: The rise in industrial automation in India has led to a surge in demand for 3D printers across sectors like automotive, electronics, and consumer goods. Strong manufacturing operating conditions, as indicated by the S&P Global India Manufacturing PMI which registered 57.5 in September 2023. The Government of Indias focus on automation, through programs like the National Manufacturing Policy, has driven industrial growth, boosting the adoption of 3D printing for prototyping and tooling. Indias production of advanced manufacturing technologies, such as automation equipment, is forecasted to grow further, impacting the 3D printing market positively.

- Increasing Use of 3D Printing in Prototyping and Tooling: Prototyping and tooling have become vital applications of 3D printing in Indias manufacturing sector. The use of 3D printing in prototyping enables companies to reduce lead times and lower costs associated with traditional methods. In tooling, the ability to quickly create precise and efficient tools has made 3D printing an essential technology for manufacturers. The integration of 3D printing into the production process allows for faster development cycles and greater flexibility, making it a critical asset in the manufacturing ecosystem.

- Rising Demand for Customized Products: Customization is becoming a significant trend across industries like healthcare and automotive, with the demand for personalized solutions on the rise. In healthcare, 3D printing is increasingly used to create custom prosthetics and dental implants tailored to individual patient needs. Similarly, the automotive industry is leveraging this technology to produce customized vehicle components. This growing reliance on 3D printing for personalization is driving innovation and market expansion in both sectors. In fact, 74% of respondents in a recent survey indicated that personalized experiences would influence their next car purchase, underscoring the critical role of customization in fostering brand loyalty and boosting sales.

Market Challenges

- High Initial Investment Cost: Despite the many advantages of 3D printing, the high initial investment required for purchasing advanced equipment remains a significant barrier, particularly for small and medium-sized enterprises (SMEs). The cost of industrial-grade 3D printers can be prohibitive, making it difficult for many companies to justify the expense. This financial challenge limits the adoption of 3D printing among SMEs. However, government initiatives aimed at reducing import duties and promoting the use of advanced technology may help alleviate this issue over time.

- Limited Material Availability: Another key challenge faced by Indias 3D printing industry is the limited availability of essential raw materials. Many of the materials required for 3D printing, such as polymers and metals, are often imported, leading to increased costs and potential delays in production. This reliance on foreign suppliers restricts the growth of the 3D printing market, particularly in sectors like aerospace and medical devices, where the need for specialized materials is critical for further expansion and innovation.

India 3D Printer Market Future Outlook

Over the next five years, the India 3D printer market is expected to exhibit substantial growth, driven by increasing demand for custom manufacturing, advancements in printing materials, and supportive government policies. The adoption of metal 3D printing for industrial applications and innovations in healthcare-related bioprinting are anticipated to be key growth drivers. Furthermore, initiatives promoting domestic manufacturing and research, particularly under the "Make in India" campaign, will continue to boost market expansion.

Market Opportunities

- Expansion in Medical Applications (Dental, Orthopedics): The medical field in India is increasingly utilizing 3D printing technology for dental and orthopedic treatments. This technology allows for highly precise customization of implants and prosthetics, providing patient-specific solutions that enhance treatment outcomes. In dental care and orthopedic surgeries, 3D printing enables the creation of complex anatomical models, improving surgical precision and reducing risks. As hospitals and clinics continue to adopt 3D printing for medical applications, the demand for customized, patient-focused solutions is expected to rise, making this a significant growth area for the market.

- Growth in Aerospace and Defense Manufacturing: The aerospace and defense sectors in India are experiencing rapid growth in the use of 3D printing technology. This technology offers significant advantages for producing lightweight and complex components, making it an essential tool for modernizing these industries. 3D printing allows for faster production cycles and more efficient material usage, enhancing the manufacturing process in aerospace. With major players in the defense industry increasingly incorporating 3D printing into their operations, the technology is poised to play a crucial role in driving innovation and efficiency in these sectors moving forward.

Scope of the Report

|

Technology Type |

FDM SLA SLS Metal 3D Printing |

|

Application |

Prototyping Manufacturing Tooling R&D |

|

End-User |

Healthcare Automotive Aerospace & Defense Education & Research |

|

Material Type |

Plastics Metals Resins Ceramics |

|

Region |

North South East West |

Products

Key Target Audience

Aerospace and Defense Manufacturers

Automotive Manufacturers

3D Printing Technology Companies

Industrial Automation Companies

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and IT, Ministry of Heavy Industries)

Companies

Major Players

Wipro 3D

Imaginarium

Stratasys India

Divide By Zero Technologies

EOS India

Novabeans

Altem Technologies

J Group Robotics

Brahma3

Intech Additive Solutions

3Ding

HP India

Ricoh India

SLM Solutions India

GE Additive India

Table of Contents

1. India 3D Printer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Compound Annual Growth Rate, Technology Adoption)

1.4. Market Segmentation Overview (Technology Type, Application, End-User, Region, Material Type)

2. India 3D Printer Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Industry Growth Trends, Product Demand)

2.3. Key Market Developments and Milestones (Government Initiatives, Industry Innovations)

3. India 3D Printer Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation Adoption

3.1.2. Government Support for Make in India Initiative

3.1.3. Rising Demand for Customized Products (Healthcare, Automotive)

3.1.4. Increasing Use of 3D Printing in Prototyping and Tooling

3.2. Market Challenges

3.2.1. High Initial Investment Cost

3.2.2. Limited Material Availability

3.2.3. Technical Complexity of 3D Printing Technology

3.3. Opportunities

3.3.1. Expansion in Medical Applications (Dental, Orthopedics)

3.3.2. Growth in Aerospace and Defense Manufacturing

3.3.3. Integration of AI and IoT in 3D Printing

3.4. Trends

3.4.1. Increasing Adoption of Metal 3D Printing

3.4.2. Use of Bioprinting for Medical Applications

3.4.3. Shift Toward Low-Volume Manufacturing

3.5. Government Regulation

3.5.1. Import-Export Regulations on Raw Materials and Equipment

3.5.2. National Manufacturing Policies

3.5.3. 3D Printing Standardization and Certification

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Manufacturers, End-users)

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry, Entry Barriers)

3.9. Competition Ecosystem

4. India 3D Printer Market Segmentation

4.1. By Technology Type (In Value %)

4.1.1. Fused Deposition Modeling (FDM)

4.1.2. Stereolithography (SLA)

4.1.3. Selective Laser Sintering (SLS)

4.1.4. Metal 3D Printing

4.2. By Application (In Value %)

4.2.1. Prototyping

4.2.2. Manufacturing

4.2.3. Tooling

4.2.4. Research & Development

4.3. By End-User (In Value %)

4.3.1. Healthcare

4.3.2. Automotive

4.3.3. Aerospace & Defense

4.3.4. Education & Research

4.4. By Material Type (In Value %)

4.4.1. Plastics

4.4.2. Metals

4.4.3. Resins

4.4.4. Ceramics

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India 3D Printer Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Wipro 3D

5.1.2. Imaginarium

5.1.3. Divide By Zero Technologies

5.1.4. Brahma3

5.1.5. Novabeans

5.1.6. Intech Additive Solutions

5.1.7. J Group Robotics

5.1.8. Altem Technologies

5.1.9. 3Ding

5.1.10. Stratasys India

5.1.11. EOS India

5.1.12. Ricoh India

5.1.13. SLM Solutions India

5.1.14. HP India

5.1.15. GE Additive India

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Range, Industry Focus, Technology Focus, Clientele, Market Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Product Launches, Innovations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity, Government Grants)

6. India 3D Printer Market Regulatory Framework

6.1. 3D Printing Standards and Certifications

6.2. Compliance with Government Policies

6.3. Import-Export Tariffs on 3D Printers and Materials

7. India 3D Printer Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India 3D Printer Future Market Segmentation

8.1. By Technology Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. India 3D Printer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Preferences

9.3. Key Marketing Initiatives

9.4. Future Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the entire 3D printer market ecosystem in India. Extensive desk research and proprietary data are used to identify and define the key variables influencing the market, such as the adoption rate of 3D printing across various industries, technological innovations, and regulatory policies.

Step 2: Market Analysis and Construction

This phase compiles historical data and analyzes key performance metrics such as the market penetration of 3D printing technologies, revenue generation by technology type, and growth in industry-specific applications. Key data sources include government reports and industry studies.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through structured interviews with 3D printing industry experts and company executives. These consultations provide critical insights into market dynamics, including customer preferences and emerging technologies.

Step 4: Research Synthesis and Final Output

The final synthesis stage includes direct engagement with 3D printer manufacturers to gather detailed product insights. A bottom-up approach is used to ensure accurate revenue estimates, which are then cross-verified with multiple data sources to create a comprehensive market analysis.

Frequently Asked Questions

01. How big is the India 3D Printer Market?

The India 3D printer market is valued at USD 15 billion, driven by growing demand for rapid prototyping across industries like automotive, healthcare, and aerospace.

02. What are the challenges in the India 3D Printer Market?

Challenges in India 3D printer market include high initial investment costs, limited material availability, and a lack of skilled workforce to operate complex 3D printing technologies.

03. Who are the major players in the India 3D Printer Market?

Key players in India 3D printer market include Wipro 3D, Imaginarium, Stratasys India, Divide By Zero Technologies, and EOS India, dominating the market due to their technology expertise and strong client base.

04. What are the growth drivers of the India 3D Printer Market?

Key growth drivers in India 3D printer market include government support for domestic manufacturing, technological innovations, and the increasing adoption of 3D printing in medical and industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.