India Action Figures Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD9263

December 2024

85

About the Report

India Action Figures Market Overview

- The India Action Figures Market is valued at USD 200 million based on recent analysis. This market is primarily driven by the rising influence of pop culture, particularly the popularity of global franchises like Marvel, DC Comics, and Anime characters. These franchises are immensely popular among children and young adults, pushing the demand for collectible and play figures. Moreover, increasing awareness and enthusiasm for limited edition collectibles have significantly contributed to market growth.

- The Indian market is dominated by metropolitan cities like Mumbai, Delhi, and Bangalore, which are economic hubs with a higher concentration of affluent consumers. These cities exhibit a strong demand for action figures due to the growth of e-commerce platforms and retail stores specializing in toy merchandise.

- The Indian governments 'Make in India' initiative has been promoting domestic toy manufacturing, including action figures. In 2024, the government allocated INR 1,000 crore to support small and medium-sized toy manufacturers. These initiatives focus on building manufacturing hubs and reducing the import dependence for high-end toys, enabling Indian companies to produce quality action figures locally.

India Action Figures Market Segmentation

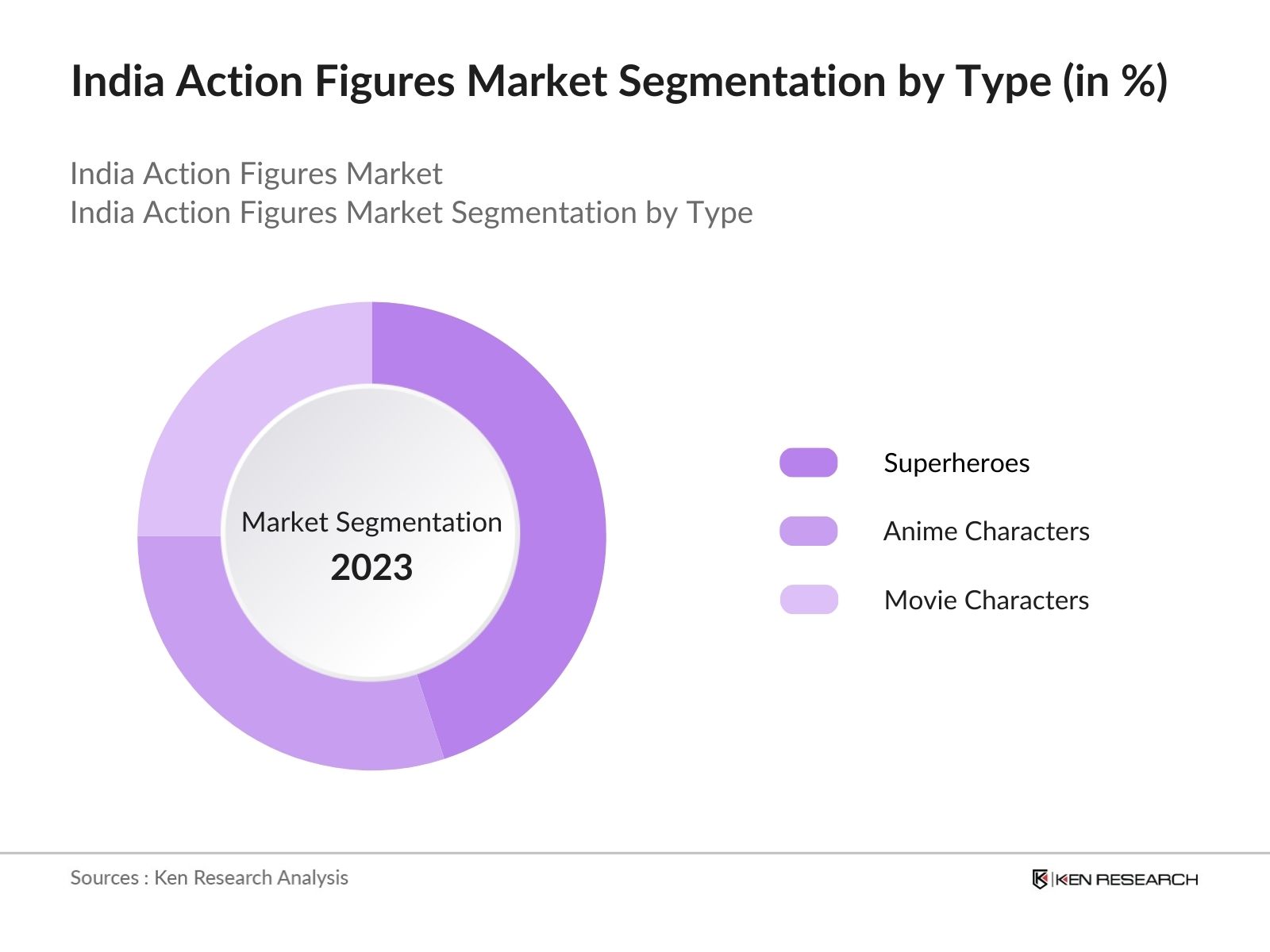

By Type: The market is segmented into Superheroes, Anime Characters, and Movie Characters. Superheroes dominate the market share under this segmentation, driven by the popularity of characters from Marvel and DC Comics. Superheroes like Spider-Man, Batman, and Iron Man have embedded themselves deeply into Indian pop culture through movies, television, and online media. The excitement surrounding movie releases of these franchises boosts demand for associated merchandise, particularly action figures.

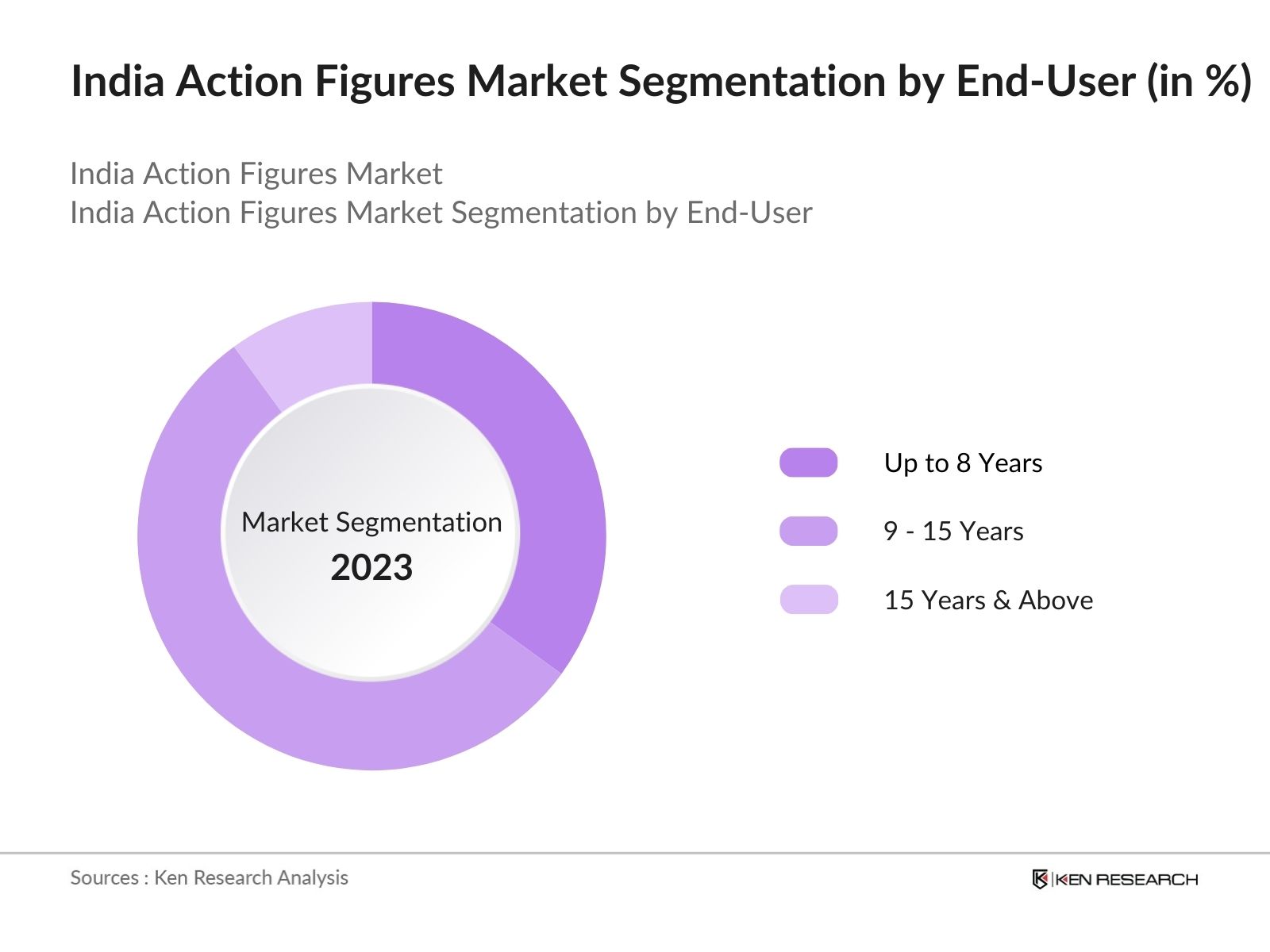

By End-User: This market is further segmented into Up to 8 Years, 9 - 15 Years, and 15 Years & Above. The segment 9 - 15 Years holds a dominant share due to the growing interest in collectibles and imaginative play. Children in this age range engage heavily with popular media and often begin building collections of action figures. Their increased autonomy and exposure to pop culture make them an attractive target group for manufacturers.

India Action Figures Market Competitive Landscape

The is competitive, with both global and regional players vying for market share. Major players in the market leverage their brand presence, licensing partnerships, and distribution networks to maintain dominance.

|

Company Name |

Established Year |

Headquarters |

Licensing Partners |

Major Franchises |

Production Capacity |

Distribution Channels |

Market Share |

Revenue |

Popular Product Lines |

|

Hasbro Inc. |

1923 |

Rhode Island, USA |

|||||||

|

Mattel Inc. |

1945 |

California, USA |

|||||||

|

LEGO Group |

1932 |

Billund, Denmark |

|||||||

|

Bandai Namco Holdings |

1950 |

Tokyo, Japan |

|||||||

|

Spin Master Corp. |

1994 |

Toronto, Canada |

India Action Figures Market Analysis

Market Growth Drivers

- Rising Popularity of Indian Mythological Characters in Action Figures: The Indian action figures market is witnessing an increased demand for figures based on mythological characters like Hanuman, Arjuna, and Shiva. This demand has been driven by a surge in animated TV series and digital content based on Indian mythology. In 2024, there are over 50 new animated shows focused on Indian legends, contributing to a rise in merchandise sales across retail platforms.

- Growing Interest in Collectibles Among Adults: The growing trend of action figure collecting among adults has significantly contributed to market growth. Adults, especially those between the ages of 25-40, are investing in high-end collectibles, including limited-edition action figures and memorabilia from popular franchises like DC, Marvel, and anime.

- Expansion of E-commerce Channels: The rise of e-commerce platforms in India has made action figures more accessible to consumers across the country, particularly in tier-II and tier-III cities. In 2024, India had over 600 million online shoppers, and the availability of exclusive action figures on platforms like Amazon and Flipkart has driven growth.

Market Challenges

- Counterfeit Products in the Market: The Indian action figure market faces significant challenges from the rise of counterfeit and unlicensed products. In 2024, it was reported that counterfeit action figures accounted for nearly 1 million units, harming both consumer trust and legitimate businesses.

- High Import Duties on International Brands: Import duties on toys, including action figures, are a major concern for international brands looking to expand in India. As of 2024, the Indian government levies duties ranging from 15% to 20% on imported toys, making global brands like Marvel and DC action figures more expensive for consumers.

India Action Figures Market Future Outlook

Over the next five years, the India Action Figures industry is expected to experience robust growth driven by an increasing fanbase of global franchises, rising disposable incomes, and evolving e-commerce platforms.

Future Market Opportunities

- Increase in Demand for Customized Action Figures: Over the next five years, there will be a surge in demand for personalized and customized action figures in India. Consumers will increasingly seek unique, one-of-a-kind figures based on their own likeness or specific character preferences.

- Expansion of Indian Mythological Action Figures in International Markets: Indian toy manufacturers will focus on exporting action figures based on Indian mythology to international markets. By 2028, it is estimated that Indian mythological action figures will have a presence in over 15 countries, with an annual export volume of over 10 million units.

Scope of the Report

|

By Material Type |

Plastic Silicone Rubber Others |

|

By Type |

Superheroes Anime Characters Movie Characters |

|

By End-User |

Up to 8 Years 9 - 15 Years 15 Years & Above |

|

By Distribution Channel |

Online Offline |

|

By Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Action Figure Collectors

Banks and Financial Institution

Toy Manufacturers

Private Equity Firms

Movie Studios (Marvel, DC, Disney)

Government and Regulatory Bodies (Ministry of Commerce, Ministry of Micro, Small & Medium Enterprises)

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Hasbro Inc.

Mattel Inc.

LEGO Group

Bandai Namco Holdings Inc.

Spin Master Corp.

Good Smile Company Inc.

JAKKS Pacific Inc.

McFarlane Toys

Playmates Toys Ltd.

Funko Inc.

Table of Contents

India Action Figures Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

India Action Figures Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

India Action Figures Market Analysis

3.1 Growth Drivers (Key Licensing Agreements, Consumer Demands, Franchise Popularity)

3.2 Market Challenges (Manufacturing Costs, Supply Chain Issues)

3.3 Opportunities (Emerging Trends in Online Channels, Customization Demand)

3.4 Trends (Popularity of Anime Figures, Rise of Collectibles among Adults)

3.5 Government Regulations (Import Tariffs, Safety Standards)

3.6 SWOT Analysis

3.7 Stake Ecosystem (Manufacturers, Retailers, E-commerce)

3.8 Porters Five Forces

3.9 Competitive Ecosystem

India Action Figures Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Plastic

4.1.2 Silicone Rubber

4.1.3 Others

4.2 By Type (In Value %)

4.2.1 Superheroes

4.2.2 Anime Characters

4.2.3 Movie Characters

4.3 By End-User (In Value %)

4.3.1 Up To 8 Years

4.3.2 9 - 15 Years

4.3.3 15 Years & Above

4.4 By Distribution Channel (In Value %)

4.4.1 Online

4.4.2 Offline

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

India Action Figures Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hasbro Inc.

5.1.2 Mattel Inc.

5.1.3 LEGO Group

5.1.4 Bandai Namco Holdings Inc.

5.1.5 JAKKS Pacific Inc.

5.1.6 Spin Master Corp.

5.1.7 Good Smile Company Inc.

5.1.8 McFarlane Toys

5.1.9 Playmates Toys Ltd.

5.1.10 Diamond Select Toys

5.1.11 Funko Inc.

5.1.12 NECA (National Entertainment Collectibles Association)

5.1.13 Kotobukiya

5.1.14 Sideshow Collectibles

5.1.15 Hot Toys Limited

5.2 Cross Comparison Parameters (Revenue, Market Share, Distribution Channels, Licensing Partners)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Licensing Deals, Product Launches)

5.5 Investment Analysis

5.6 Venture Capital Funding

5.7 Mergers & Acquisitions

India Action Figures Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

India Action Figures Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

India Action Figures Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Type (In Value %)

8.3 By End-User (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

India Action Figures Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves constructing an ecosystem map to identify all relevant stakeholders in the India Action Figures Market. Desk research leveraging proprietary databases was utilized to define the most influential market variables.

Step 2: Market Analysis and Construction

The second step focused on gathering historical data on market penetration and analyzing service quality statistics. This helped in validating the estimated revenue and understanding consumer behavior patterns within the action figure segment.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics were validated through industry expert interviews. These consultations provided operational insights from leading players like Hasbro and Mattel, further refining market estimates.

Step 4: Research Synthesis and Final Output

The final stage incorporated a thorough examination of product categories, sales channels, and consumer preferences by engaging with multiple toy manufacturers. This bottom-up approach ensured the reports accuracy and reliability in depicting the India Action Figures Market.

Frequently Asked Questions

How big is the India Action Figures Market?

The India Action Figures Market is valued at USD 200 million. This valuation is driven by the rising popularity of action figures, influenced by franchises like Marvel, DC Comics, and Anime characters.

What are the challenges in the India Action Figures Market?

The India Action Figures Market faces challenges like high manufacturing costs and competition from counterfeit products. Moreover, supply chain disruptions have posed a significant challenge, affecting product availability.

Who are the major players in the India Action Figures Market?

Key players in the India Action Figures Market include Hasbro Inc., Mattel Inc., LEGO Group, Bandai Namco Holdings Inc., and Spin Master Corp., who have secured licensing deals with top franchises and maintain strong market presence.

What are the growth drivers of the India Action Figures Market?

Growth in the India Action Figures Market is primarily driven by the increasing influence of global franchises, rising disposable income, and the expansion of e-commerce channels offering a wide range of action figures to consumers across the country.

Which cities dominate the India Action Figures Market?

Metropolitan cities such as Mumbai, Delhi, and Bangalore dominate due to their higher concentration of retail outlets and e-commerce penetration, coupled with a larger consumer base inclined toward collectibles and pop culture merchandise.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.