India AI Camera Market Outlook to 2030

Region:Asia

Author(s):Mukul Soni

Product Code:KROD337

July 2024

93

About the Report

India AI Camera Market Overview

- The India AI Camera Market size was USD 10.70 billion in 2023. The market has shown significant growth due to increasing demand for advanced security systems, smartphones, and smart home devices integrated with AI cameras.

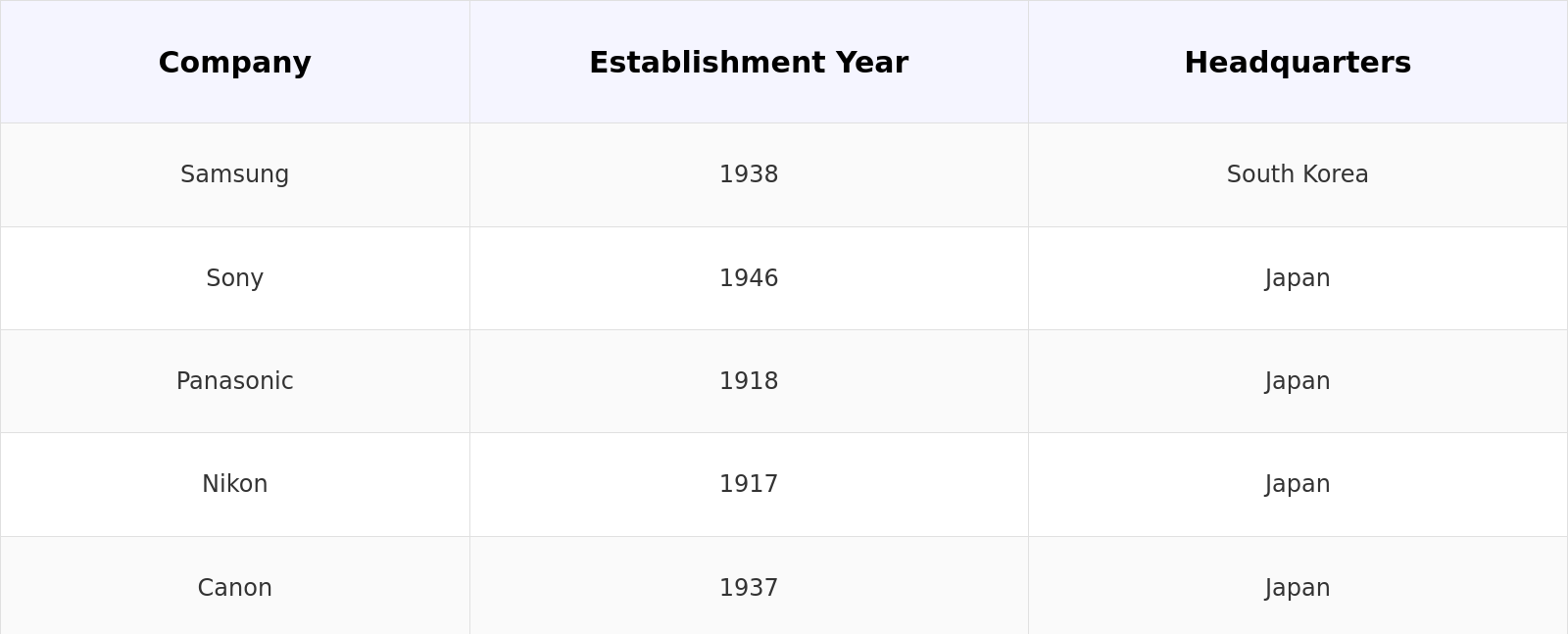

- Key players in the India AI Camera Market include Samsung, Sony, Panasonic, Nikon, and Canon. These companies are investing heavily in R&D to enhance AI capabilities and improve the performance of their camera products.

- In 2023, the AI camera market in India experienced developments and growth driven by the increasing demand for advanced surveillance and security solutions, particularly in the context of smart cities and public safety. The market is projected to grow significantly, with the integration of AI technologies enhancing the capabilities of cameras used in various applications such as consumer electronics, healthcare, and automotive industries.

India AI Camera Market Analysis

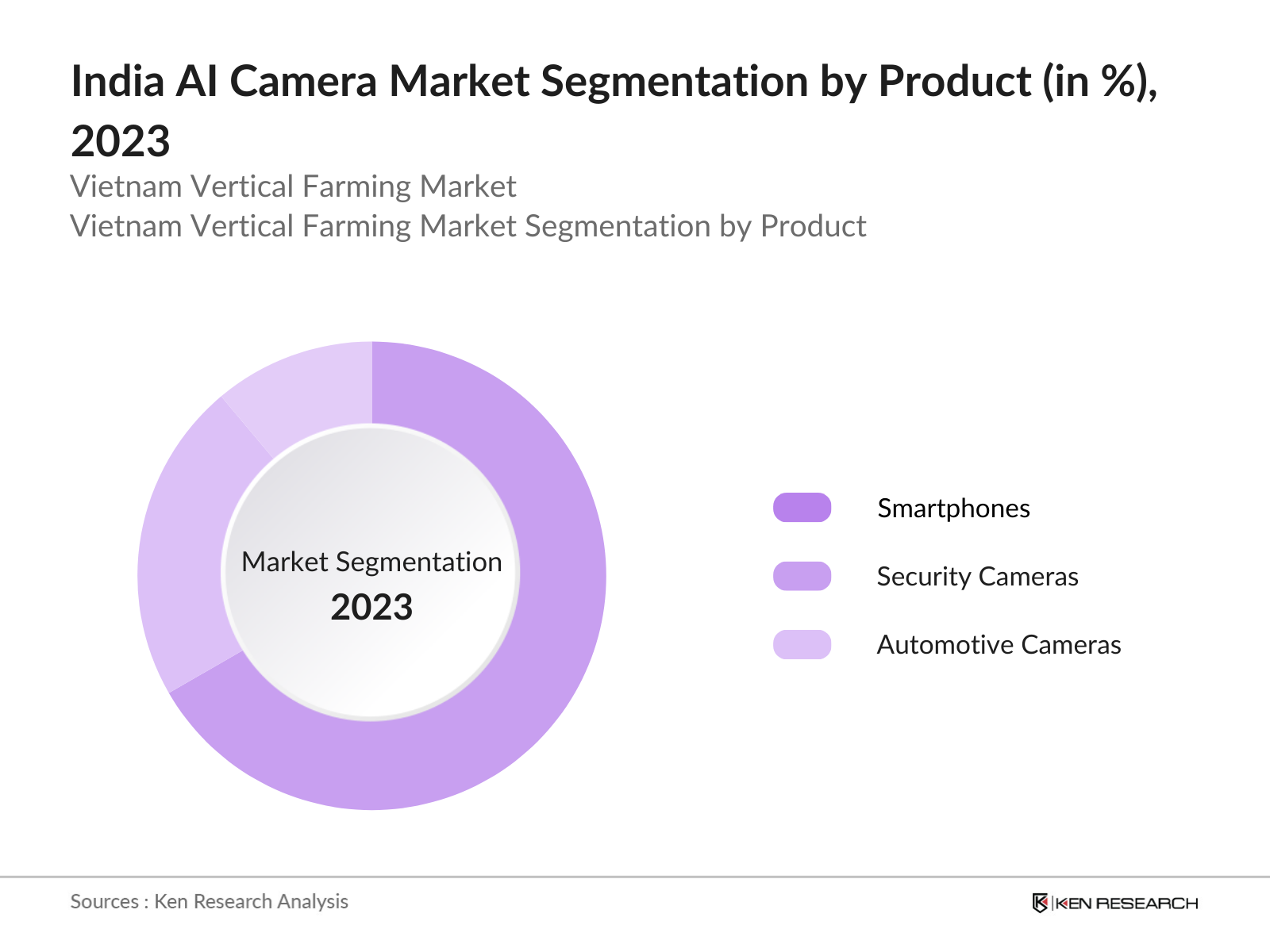

- Smartphones with AI cameras are the leading products in the India AI Camera Market, representing 65% of total sales in 2023. Consumers favor these devices for their advanced photography features, such as scene recognition and intelligent image stabilization. The integration of AI in mobile apps for tasks like photo editing and AR experiences further enhances their appeal, contributing to a 30% year-on-year growth rate in sales.

- In 2023, smartphones with AI cameras emerged as the leading products in the India AI Camera Market, representing 65% of total sales. Consumers are drawn to these devices for their advanced photography features, including scene recognition and intelligent image stabilization. The integration of AI in mobile apps for tasks like photo editing and augmented reality (AR) experiences further enhances their appeal, contributing to a 30% year-on-year growth rate in sales.

- Samsung leads the India AI Camera Market due to its strong brand presence, extensive R&D investments, and diverse product range. In 2023, Samsung's R&D expenditure was around USD 18 billion, driving continuous innovation. The brand's flagship models, like the Galaxy S21 Ultra with a 108 MP AI camera, and mid-range options cater to various consumer needs, securing 25% of the smartphone market share in India.

India AI Camera Market Segmentation

The India AI Camera Market can be segmented by various factors like Product, Application and Regional

By Product: India AI Camera Market is segmented into different materials like Smartphones, Security Cameras and Automotive Cameras. Smartphones dominate the AI camera market. favored for features like real-time object recognition and superior low-light performance, driven by social media demand, smart city projects, and features like facial recognition. Automotive cameras. are crucial for advanced driver assistance systems, driven by the push for smarter, safer vehicles. Major players include Samsung, Apple, Hikvision, Dahua Technology, Bosch, and Continental.

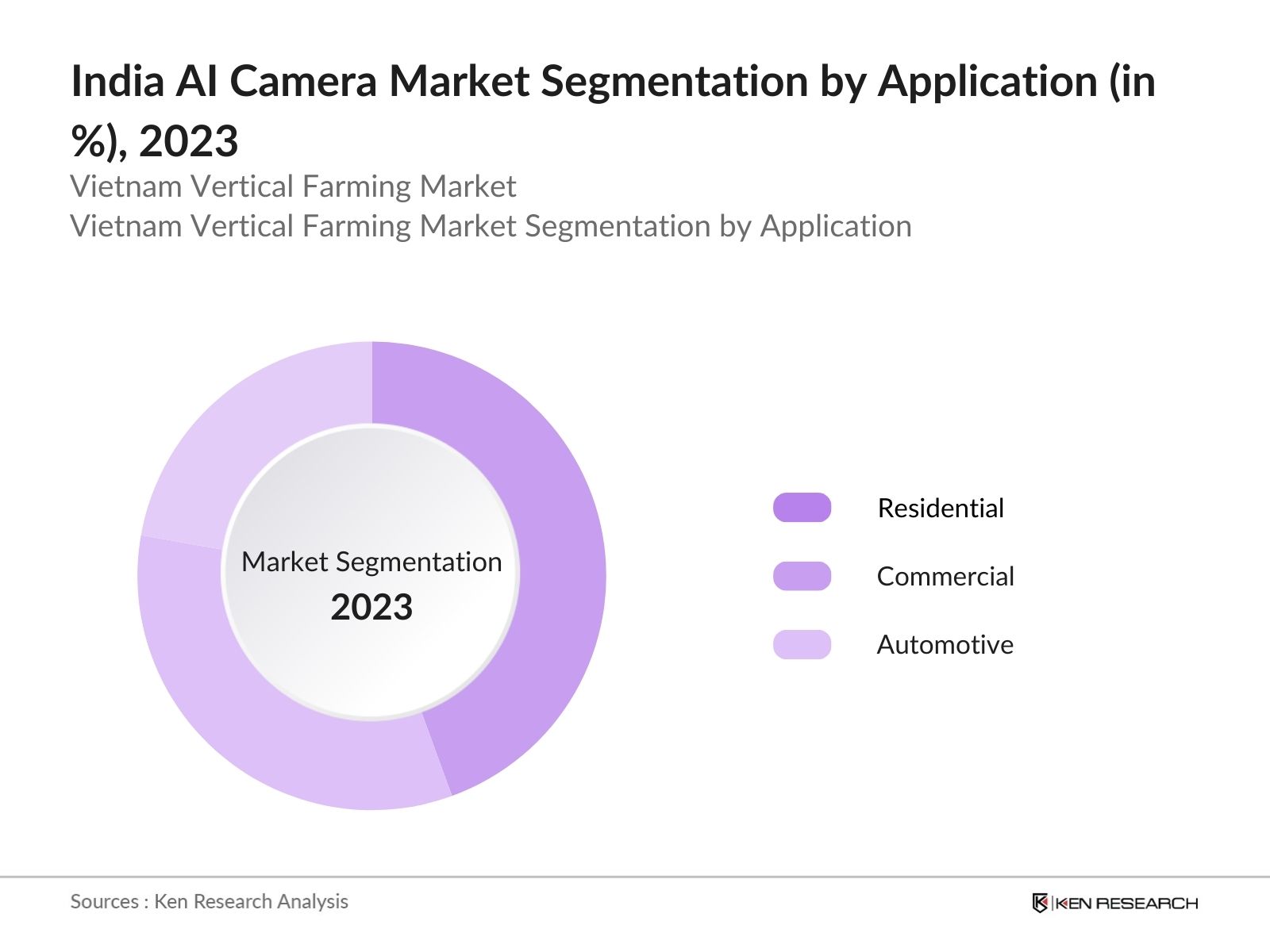

By Application: The India AI Camera Market is segmented into residential, commercial, and automotive applications. Residential applications lead the market, driven by the adoption of smart home devices and security systems like Nest Cam and Ring. Commercial applications use AI cameras for surveillance and operational efficiency in retail and offices, with key players like Hikvision. Automotive applications rely on AI cameras for advanced driver assistance systems and autonomous driving, driven by manufacturers like Tesla and BMW.

By Region: The India AI Camera Market is segmented into North, East, West, and South regions. North India leads the market, driven by urbanization, technological advancements, and smart device adoption in cities like Delhi and Gurgaon. South India follows, with tech-savvy cities like Bangalore and Hyderabad investing in smart home devices. West India is driven by industrial growth and demand for security solutions in Mumbai and Pune. East India sees gradual growth with infrastructure development and smart city initiatives in Kolkata.

India AI Camera Market Competitive Landscape

The competitive landscape of India AI Camera Market can be summed up in the following way:

- Sony: Sony is a key player with advanced imaging technology. Their 2022 AI-powered camera with 8K recording and real-time object tracking sets new standards. Sony's sensors are widely adopted, extending their market influence. Continuous innovation in AI algorithms enhances image quality and user experience.

- Panasonic: Excels in security, surveillance, and automotive AI cameras. In 2023, they partnered with an AI software company to enhance real-time analytics. Their AI-powered edge computing cameras advance security solutions, offering improved surveillance capabilities and operational efficiency.

- Canon Inc.: Headquartered in Tokyo, Japan, is a leading player in the AI camera market. The company is known for its innovative imaging technology, offering AI-enhanced cameras with features like facial recognition, object tracking, and real-time image processing. In 2023, Canon launched new AI-enhanced cameras for professional photographers and formed strategic partnerships to integrate advanced AI functionalities. These initiatives, along with significant R&D investments, reinforce Canon's position as a market leader in AI camera technology.

India AI Camera Market Analysis

India AI Camera Market Growth Drivers

- Technological Advancements: Continuous innovations in AI and camera technology have improved camera functionalities. AI cameras now offer features like real-time object recognition, facial recognition, and enhanced low-light performance, driving consumer adoption. In 2023, the Indian government's push towards AI and digital technologies has led to an increase in AI camera applications across sectors like healthcare, automotive, and security.

- Rising Demand for Security and Surveillance: The demand for AI-powered security cameras has surged due to increased concerns about safety and security. By 2023, many urban and commercial areas in India have integrated AI cameras for surveillance, contributing to a safer environment. Reports indicate that major cities have invested heavily in smart surveillance systems, leveraging AI cameras to monitor and prevent crimes more effectively.

- Growing Popularity of Smart Devices: The proliferation of smartphones and smart home devices with AI cameras has driven market growth. In 2023. which offer superior image quality and intelligent features like scene detection and photo enhancement. This trend is supported by increasing consumer preference for advanced photography features in their devices.

India AI Camera Market Challenges

- High Intial Costs: The initial investment and maintenance costs of AI camera systems are significant barriers to widespread adoption. These costs limit market penetration, particularly in cost-sensitive regions. The high expenses associated with acquiring, installing, and maintaining advanced AI camera systems deter smaller businesses and individual consumers from adopting these technologies. In 2023, the average cost of an advanced AI camera system ranged from USD 500 to USD 2000, making it a substantial investment for many users.

- Technological Complexity: The complexity of integrating AI technologies into existing systems requires specialized knowledge and expertise. Many businesses and consumers may find it challenging to understand and effectively use the advanced features of AI cameras. This technological barrier can slow down adoption rates, especially in less tech-savvy regions. In 2023, a survey revealed that 65% of small and medium-sized enterprises (SMEs) in India found AI technology integration complex and preferred simpler solutions.

India AI Camera Market Government Initiatives:

- Smart Cities Mission (2015): The Smart Cities Mission, also launched in 2015, is an urban renewal and retrofitting program by the Government of India. The initiative aims to develop 100 smart cities across the country, promoting sustainable and inclusive development. A key component of this mission is the implementation of advanced surveillance systems, including AI cameras, to enhance urban security and efficiency. Cities like Delhi, Bangalore, and Pune have already integrated AI cameras as part of their smart city projects to improve traffic management, public safety, and infrastructure monitoring.

- Digital India Initiative (2015): The Digital India Initiative, launched in 2015, has been pivotal in promoting the adoption of digital technologies, including AI cameras. By 2023, the initiative has continued to support infrastructure development and digital literacy, enabling broader use of AI cameras across various sectors such as healthcare, education, and agriculture. This program's emphasis on enhancing digital infrastructure and connectivity has significantly driven the integration of AI cameras in smart cities, rural development projects, and public safety initiatives.

- National AI Strategy (2018): In 2018, NITI Aayog, the policy think tank of the Indian government, released the National AI Strategy, which outlines India's approach to harnessing AI for economic growth and social development. This strategy includes promoting AI research, development, and adoption across various sectors such as healthcare, agriculture, education, and smart cities. The strategy encourages the deployment of AI cameras in public safety, healthcare diagnostics, and agricultural monitoring, providing a significant impetus to the AI camera market

India AI Camera Market Outlook

The India AI Camera Market is expected to continue its growth in the coming years. The market is also expected to see a shift towards more organized retail, with established players and online platforms expanding their reach.

Future Market Trends

- Integration with IoT Devices: The integration of AI cameras with Internet of Things (IoT) devices is becoming increasingly prevalent. By 2024, over 30% of smart home systems in India incorporate AI cameras for enhanced security and automation. These cameras are used for real-time monitoring, providing homeowners with advanced features such as motion detection, facial recognition, and automated alerts.

- Advancements in Edge Computing: AI cameras are increasingly equipped with edge computing capabilities, allowing for on-device data processing. By 2024, it is expected that 40% of AI cameras sold in India will feature edge computing, reducing the reliance on cloud infrastructure and improving real-time analytics. This advancement enhances performance in applications such as surveillance, where immediate data processing is crucial. Edge computing also addresses latency issues and ensures data privacy by keeping sensitive information on the device rather than transmitting it to external servers.

Scope of the Report

|

By Product |

Smart phones Security Cameras Automotive Cameras |

|

By Application |

Residential Commercial Automotive |

|

By Region |

North South West East |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Technology Companies

Security and Surveillance Firms

Automotive Manufacturers

Healthcare Providers

Smartphone Manufacturers

Government and regulatory Bodies

Banks and financial Institutions

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Samsung

Sony

Panasonic

Nikon

Canon

Xiaomi

OnePlus

LG Electronics

Apple

Oppo

Vivo

Realme

Bosch

Continental

Hikvision

Table of Contents

1. India AI Camera Market Overview

1.1 India AI Camera Market Taxonomy

2. India AI Camera Market Size (in USD Bn), 2018-2023

3. India AI Camera Market Analysis

3.1 India AI Camera Market Growth Drivers

3.2 India AI Camera Market Challenges and Issues

3.3 India AI Camera Market Trends and Development

3.4 India AI Camera Market Government Regulation

3.5 India AI Camera Market SWOT Analysis

3.6 India AI Camera Market Stake Ecosystem

3.7 India AI Camera Market Competition Ecosystem

4. India AI Camera Market Segmentation, 2023

4.1 India AI Camera Market Segmentation by Product (Value in %), 2023

4.2 India AI Camera Market Segmentation by Application (Value in %), 2023

4.3 India AI Camera Market Segmentation by Region (Value in %), 2023

5. India AI Camera Market Competition Benchmarking

5.1 India AI Camera Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters,

financial parameters, and advanced analytics)

6. India AI Camera Future Market Size (in USD Bn), 2023-2028

7. India AI Camera Future Market Segmentation, 2028

7.1 India AI Camera Market Segmentation by Product (Value in %), 2028

7.2 India AI Camera Market Segmentation by Application (Value in %), 2028

7.3 India AI Camera Market Segmentation by Region (Value in %), 2028

8. India AI Camera Market Analysts’ Recommendations

8.1 India AI Camera Market TAM/SAM/SOM Analysis

8.2 India AI Camera Market Customer Cohort Analysis

8.3 India AI Camera Market Marketing Initiatives

8.4 India AI Camera Market White Space Opportunity Analysis

9. Disclaimer

10. Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on India AI Camera Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India AI Camera Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research output:

Our team will approach multiple AI Camera companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from AI Camera companies.

Frequently Asked Questions

01 What is the current market size of the India AI Camera Market?

The current market size of the India AI Camera Market is size was USD 10.70 billion in 2023.

02 Who are the major players in the India AI Camera Market?

The India AI Camera Market Major players include Samsung, Sony, Panasonic, Nikon, and Canon.

03 What are the major growth drivers for the India AI Camera Market?

India AI Camera Market Major growth drivers include increasing demand for high-quality cameras, advancements in AI technology, and rising adoption of smart

devices.

04 What are the key consumer preferences in the India AI Camera Market?

Consumers prefer AI cameras with high resolution, excellent low-light performance, and advanced features like facial recognition and real-time filters.

05 How is the India AI Camera Market segmented by application?

The India ai camera market is segmented into Residential, Commercial, and Automotive applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.