India AI Market outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD1460

October 2024

81

About the Report

India AI Market Overview

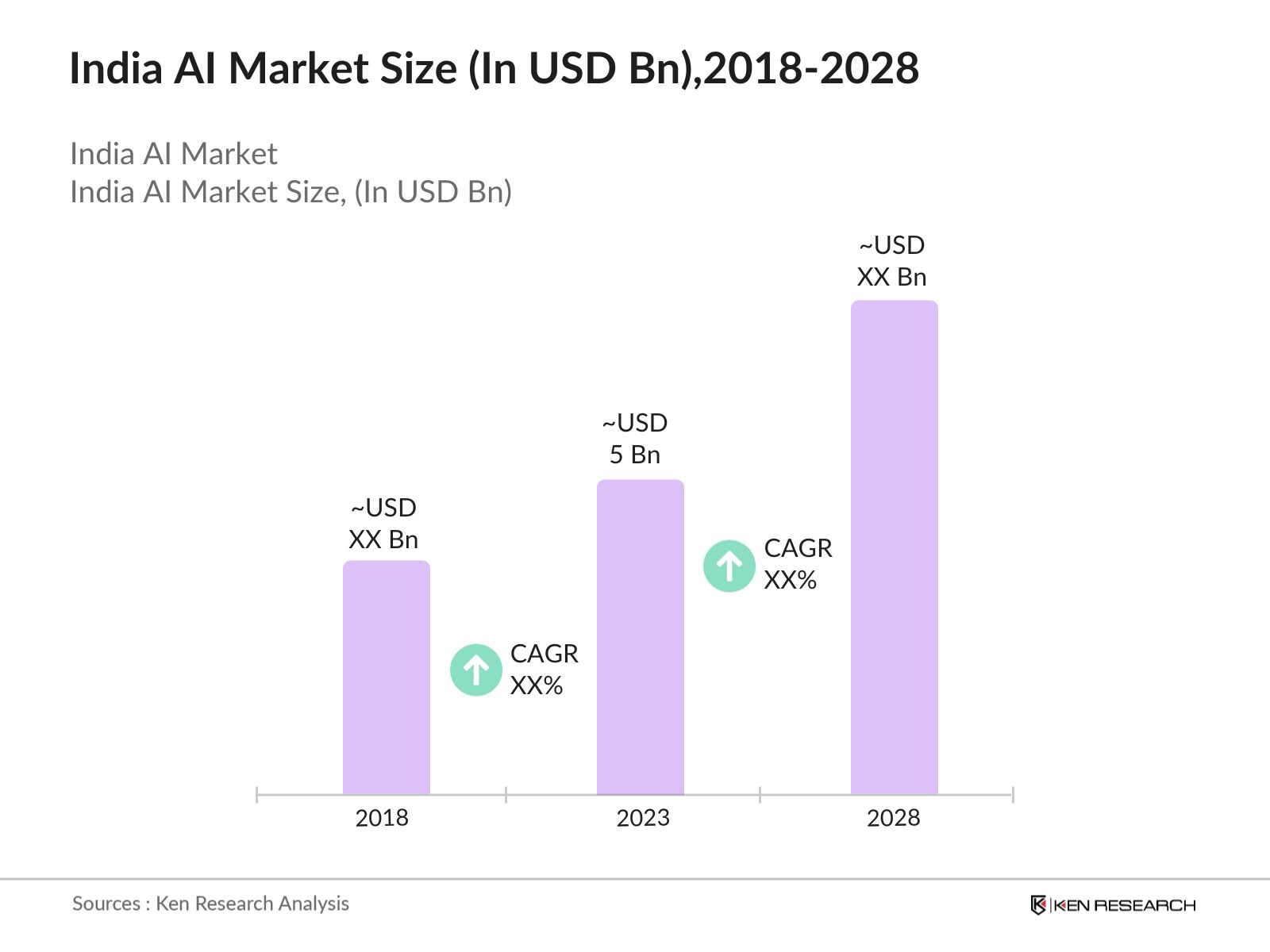

- The Indian AI Market was valued at USD 5 billion in 2023. This growth is driven by the increased adoption of AI technologies across various sectors such as healthcare, finance, retail, and manufacturing. Factors contributing to this surge include advancements in AI technologies, increased investment in AI startups, and the growing demand for AI-powered solutions in business operations and consumer services.

- Key players in the Indian AI market include IBM India Pvt. Ltd., Accenture, Tata Consultancy Services (TCS), Infosys Limited, and Wipro Limited. These companies are leading the development and deployment of AI solutions across various sectors, leveraging their robust technological infrastructure and extensive R&D capabilities. Their strong R&D capabilities and strategic partnerships with global tech firms bolster their market positions.

- In November 2023, Tata Consultancy Services (TCS) announced the launch of a new AI-driven Cyber Insights Platform, platform designed to enhance customer experiences in the banking sector. The platform leverages machine learning and natural language processing to provide personalized financial advice and automated customer support, aiming to revolutionize how banks interact with their clients. This development highlights the ongoing innovation and investment in AI technologies within the Indian market.

- Bangalore, often referred to as the "Silicon Valley of India," is the leading city in the Indian AI market. The city's dominance is attributed to its thriving tech ecosystem, presence of major IT companies, and a robust network of AI startups. In 2023, Bangalore accounted for over 40% of the AI market share in India, driven by its favorable business environment and access to top tech talent.

India AI Market Segmentation

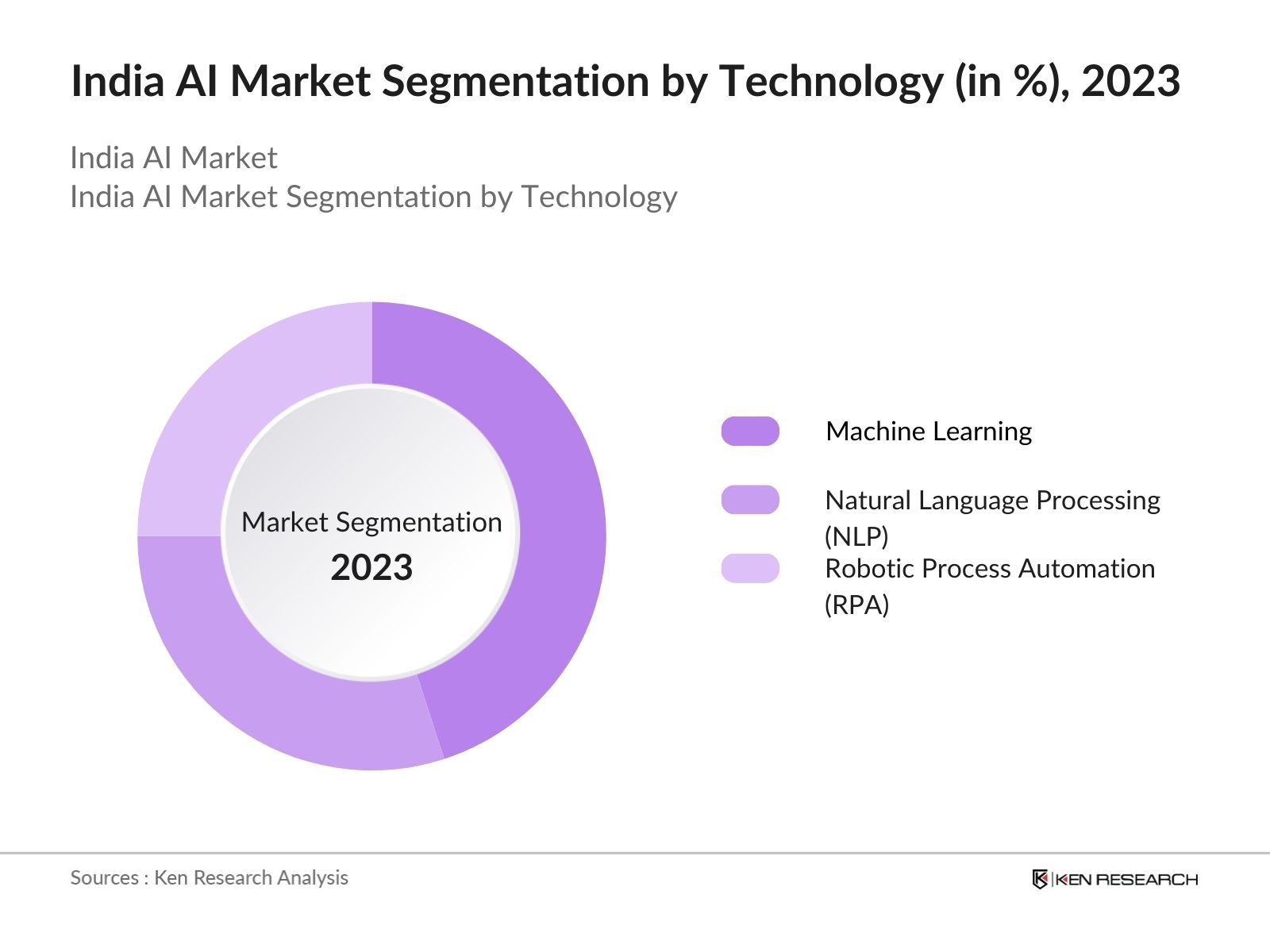

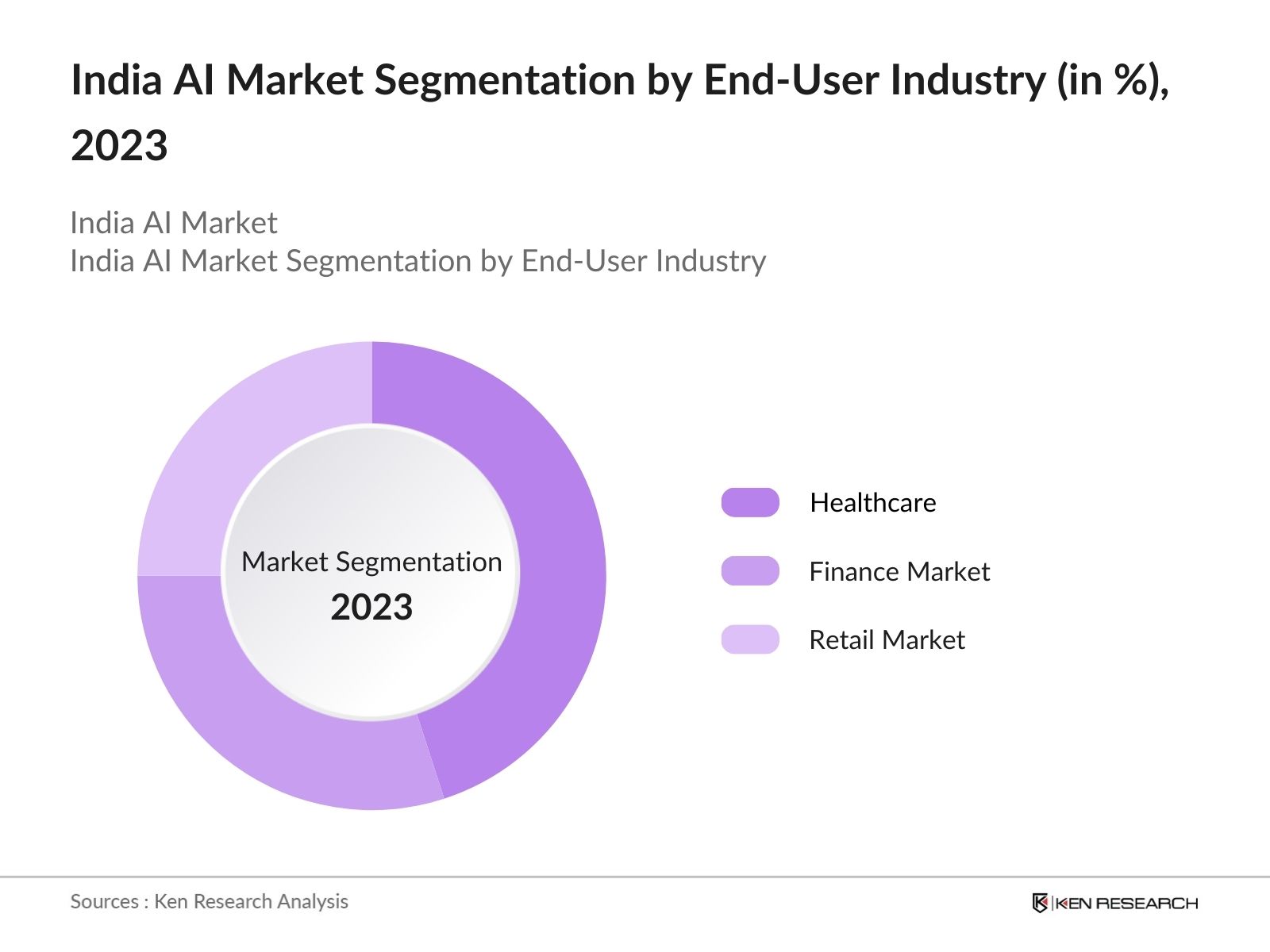

The India AI Market is segmented into different factors like by technology, by end user industry and by region.

By Technology: The market is segmented by technology into machine learning, natural language processing (NLP), and robotic process automation (RPA). In 2023, Machine learning dominated the market due to its broad applications in predictive analytics, customer segmentation, and automated decision-making. Its widespread adoption across various industries has solidified its leading position in the market.

By End-User Industry: The market is segmented by end-user industry into healthcare, finance and retail. In 2023, healthcare, such as diagnostic tools and personalized medicine, have driven significant growth. The increasing focus on healthcare innovation and patient care is contributing to the sector's dominance due to the significant impact of AI in enhancing diagnostic accuracy and reducing human error.

By Region: The market is segmented by region into north, south, east and west. Southern region was dominating the market in 2023. The city's dominance can be attributed to its status as India's tech hub, housing numerous AI startups, research institutions, and tech giants. The presence of a well-established IT infrastructure, a large pool of skilled professionals, and favorable government policies have created an ecosystem conducive to AI innovation and growth.

India AI Market Competitive Landscape

|

Company |

Year of Establishment |

Headquarters |

|---|---|---|

|

IBM India Pvt. Ltd. |

1992 |

Bangalore, Karnataka |

|

Accenture |

1989 |

Dublin, Ireland |

|

Tata Consultancy Services (TCS) |

1968 |

Mumbai, Maharashtra |

|

Infosys Limited |

1981 |

Bangalore, Karnataka |

|

Wipro Limited |

1945 |

Bangalore, Karnataka |

- Infosys: In 2024, Infosys is currently spearheading 225 generative AI programs for its clients. Over 250,000 employees have been trained in GenAI technologies, positioning Infosys as a leading adopter of GitHub Copilot globally. In FY24, Infosys filed over 46 AI patents and developed more than 70 AI client advocacies, showcasing the company's commitment to innovation.

- Wipro Limited: In 2023, Wipro announce a partnership with the Indian Institute of Technology (IIT) Delhi to establish a Center of Excellence focused on Generative AI. This initiative is aimed at advancing research and development in AI and is part of Wipro's broader commitment to invest $1 billion in AI-led innovation through its ai360 ecosystem.

India AI Market Analysis

India AI Market Growth Drivers

- Increasing AI Investments: After experiencing a sharp decline in 2023, with Indian AI startups' funding dropping to around INR 13,900 croredown nearly 71% from the previous yearinvestments are now on the rise. Venture capitalists and major tech companies are increasingly recognizing AIs transformative potential. Additionally, the Indian government's 2024 budget allocates INR 10,372 crore to the 'AI Mission,' with plans to boost this to INR 20,000 crore, further fueling market growth.

- Rising Adoption in Healthcare: The healthcare sector in India is rapidly adopting AI technologies to improve patient outcomes and operational efficiency. In 2024, AI-driven diagnostic tools have reduced diagnosis times by 30% and enhanced accuracy. Hospitals and healthcare providers are increasingly investing in AI solutions to streamline processes, which is driving market expansion.

- AI Integration in Financial Services: The financial sector is leveraging AI for fraud detection, risk management, and customer service. In 2023, global fraud costs reached $485 billion, highlighting the significant financial impact of fraud across various markets, including India. The integration of AI in financial services is expected to enhance operational efficiency and reduce costs, contributing to the market's growth.

India AI Market Challenges

- Shortage of Skilled AI Professionals: The India AI market faces a significant shortage of skilled professionals, which hinders the implementation and adoption of AI technologies. The lack of adequately trained personnel in AI and machine learning poses a barrier to the market's growth, as companies struggle to find the expertise needed to develop and deploy AI solutions effectively.

- Data Privacy and Security Concerns: As AI technologies are increasingly used in sensitive areas such as healthcare and finance, concerns about data privacy and security have become more prominent. Ensuring that AI systems adhere to stringent data protection regulations and effectively manage sensitive information is crucial to maintaining public trust and preventing data breaches.

India AI Market Government Initiatives

- "AI for All" Initiative: The India AI Mission, launched by the Ministry of Electronics and Information Technology in 2024, aims to establish a robust AI computing infrastructure in India. With a budgetary allocation of 551.75 crore INR, the mission focuses on enhancing domestic AI development and reducing reliance on foreign hardware. The initiative includes the procurement of over 10,000 GPUs to support AI startups and research, development of foundational AI models, and creation of an AI marketplace for resources, thereby fostering an innovative AI ecosystem in India.

- IndiaAI Mission Launch: In March 2024, the Cabinet approved the IndiaAI mission with a budget of Rs.10,371.92 crore. This initiative aims to create a robust AI innovation ecosystem through strategic public-private partnerships. Key components include developing AI infrastructure, indigenous models, streamlined dataset access, promoting AI in critical sectors, skilling programs, startup funding, and responsible AI frameworks.

India AI Market Future Outlook

The India AI Market is anticipated to grow substantially by 2028. The proliferation of AI applications in emerging sectors such as agriculture, education, and smart cities, combined with supportive government policies and initiatives, will drive this expansion. Advances in AI research and increasing collaboration between academia and industry will further enhance the market's growth prospects.

Market Trends

- Expansion of AI in Healthcare: Over the next five years, AI will play an increasingly vital role in the healthcare sector. By 2028, AI-driven diagnostic tools are expected to reduce diagnosis times and improve accuracy. The integration of AI in telemedicine and personalized treatment plans will enhance patient care and operational efficiency.

- AI-Driven Innovations in Retail: The retail sector will witness significant AI-driven innovations, enhancing customer experiences and operational efficiency. By 2028, AI-powered personalized marketing and inventory management systems are expected to increase retail sales annually. AI will enable retailers to offer more tailored shopping experiences and streamline supply chains.

Scope of the Report

|

By Technology |

Machine Learning NLP Robotics |

|

By End-User Industry |

Healthcare Finance Retail |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report:

AI Startups

IT and Technology Firms

Manufacturing Companies

Telecom Companies

E-commerce Platforms

Automotive Companies

Investors and VC Firms

Banks and Financial Institutions

Government Agencies (Ministry of Electronics and Information Technology, National Informatics Centre)

Companies

Players Mention in the Report:

IBM India Pvt. Ltd.

Accenture

Tata Consultancy Services (TCS)

Infosys Limited

Wipro Limited

HCL Technologies

Tech Mahindra

Persistent Systems

Zensar Technologies

Mindtree Ltd.

Capgemini India

Larsen & Toubro Infotech

Cognizant Technology Solutions

Fractal Analytics

Mu Sigma

Table of Contents

1. India AI Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India AI Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India AI Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Investments

3.1.2. Rising Adoption in Healthcare

3.1.3. Integration in Financial Services

3.1.4. Government Support

3.2. Restraints

3.2.1. Shortage of Skilled Professionals

3.2.2. Data Privacy and Security

3.2.3. High Implementation Costs

3.2.4. Regulatory and Ethical Challenges

3.3. Opportunities

3.3.1. Expansion in Healthcare

3.3.2. Financial Services Growth

3.3.3. Smart Cities Integration

3.3.4. Retail Innovations

3.4. Trends

3.4.1. AI in Healthcare

3.4.2. AI in Financial Services

3.4.3. AI in Smart Cities

3.4.4. AI in Retail

3.5. Government Regulation

3.5.1. India AI Mission

3.5.2. AI Research Centers

3.5.3. National AI Strategy

3.5.4. Tech Company Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. India AI Market Segmentation, 2023

4.1. By End User Industry (in Value)

4.1.1. Healthcare

4.1.2. Finance

4.1.3. Retail

4.2. By Technology (in Value)

4.2.1. Machine Learning

4.2.2. Natural Language Processing (NLP)

4.2.3. Robotics

4.3. By Region (in Value)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India AI Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. IBM India Pvt. Ltd.

5.1.2. Accenture

5.1.3. Tata Consultancy Services (TCS)

5.1.4. Infosys Limited

5.1.5. Wipro Limited

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India AI Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India AI Market Regulatory Framework

7.1. AI Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India AI Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India AI Market Future Segmentation, 2028

9.1. By End User Industry (in Value)

9.2. By Technology (in Value)

9.3. By Region (in Value)

10. India AI Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on India AI Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India AI Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple technologies companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch industry specific firms.

Frequently Asked Questions

01. How big is India AI Market?

The Indian AI Market was valued at USD 5 billion in 2023, driven by increasing investments in AI technologies, the rise of AI startups, and widespread adoption across industries such as healthcare, finance, and retail.

02. What are the challenges in India AI Market?

Challenges in Indian AI Market include a shortage of skilled AI professionals, data privacy and security concerns, high implementation costs, and regulatory and ethical issues surrounding the deployment of AI technologies.

03. Who are the major players in the India AI Market?

Key players in the Indian AI Market include IBM India Pvt. Ltd., Accenture, Tata Consultancy Services (TCS), Infosys Limited, and Wipro Limited. These companies lead in AI development and deployment due to their robust technological infrastructure and extensive R&D capabilities.

04. What are the growth drivers of India AI Market?

The Indian AI Market is propelled by factors such as increasing investments in AI startups, rising adoption of AI in healthcare, integration of AI in financial services, and strong government support and initiatives to promote AI innovation and adoption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.