India AI-Medical Diagnostics Market

Region:Asia

Author(s):Shubham

Product Code:KROD2282

October 2024

113

About the Report

India AI-Medical Diagnostics Market Overview

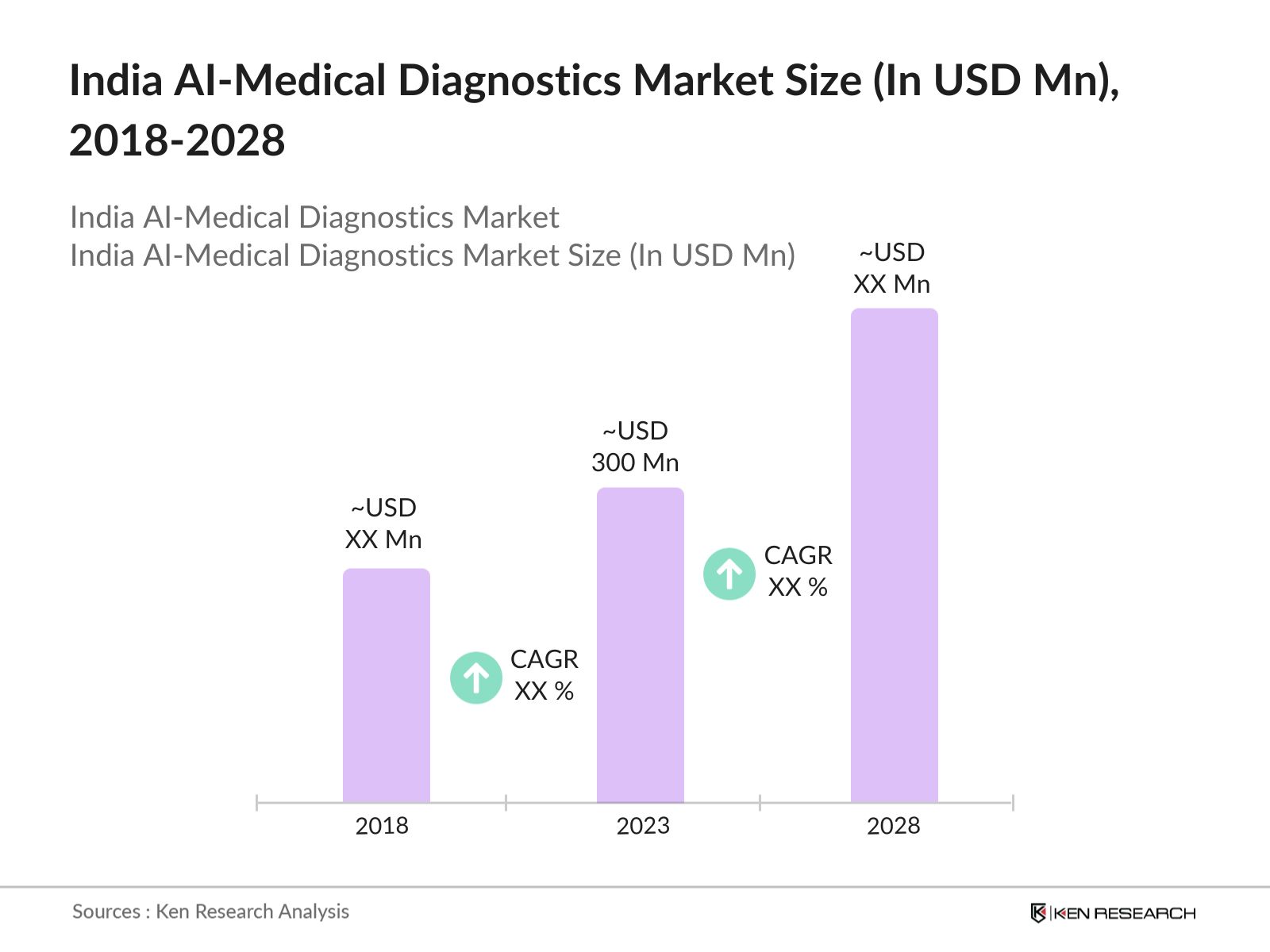

- The India AI-Medical Diagnostics Market was valued at USD 300 million in 2023, driven by advancements in artificial intelligence (AI) technologies, the increasing demand for early disease detection, and the need for improved diagnostic accuracy in healthcare systems. The growing awareness of AI's benefits in reducing diagnostic errors is further accelerating its adoption in healthcare.

- Major players in the Indian AI-medical diagnostics market include IBM Watson Health, Siemens Healthineers, and GE Healthcare. These companies are collaborating with hospitals and research institutions to expand the use of AI tools in diagnostics.

- Key cities leading the AI-medical diagnostics market in India include Delhi NCR, Mumbai, and Bengaluru. These cities dominate due to their concentration of advanced healthcare facilities, research institutions, and AI startups. In Delhi NCR, leading hospitals have integrated AI diagnostic tools, while Bengaluru is a hub for healthcare technology innovation, making these cities central to the growth of AI-driven diagnostics in India.

- On January 24, 2024, Siemens Healthineers inaugurated the Siemens Healthineers-Computational Data Sciences Collaborative Laboratory at the Indian Institute of Science (IISc). This laboratory aims to develop open-source AI tools for automating the segmentation of pathological findings in neuroimaging data, focusing on neurological disease diagnosis.

India AI-Medical Diagnostics Market Segmentation

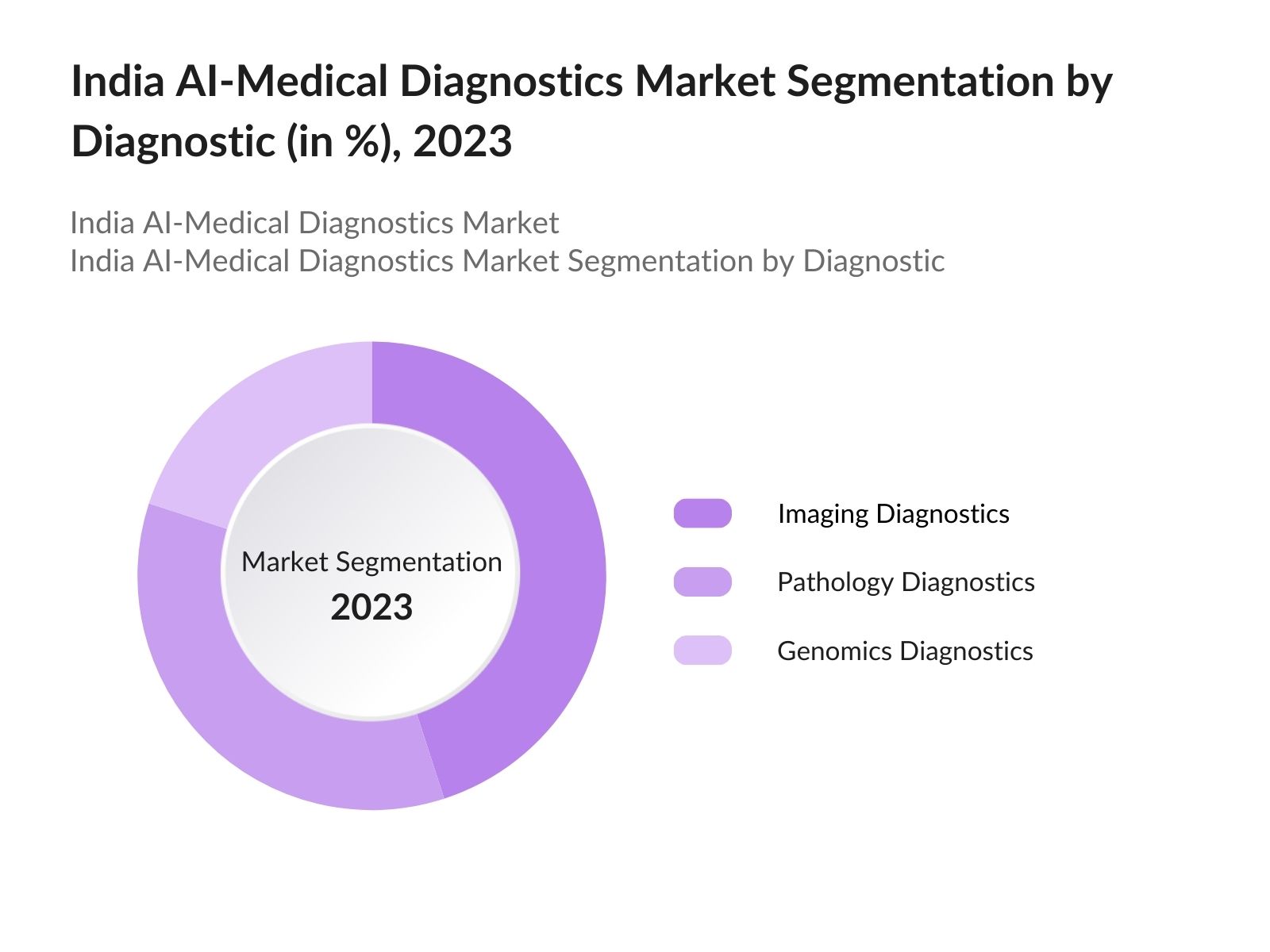

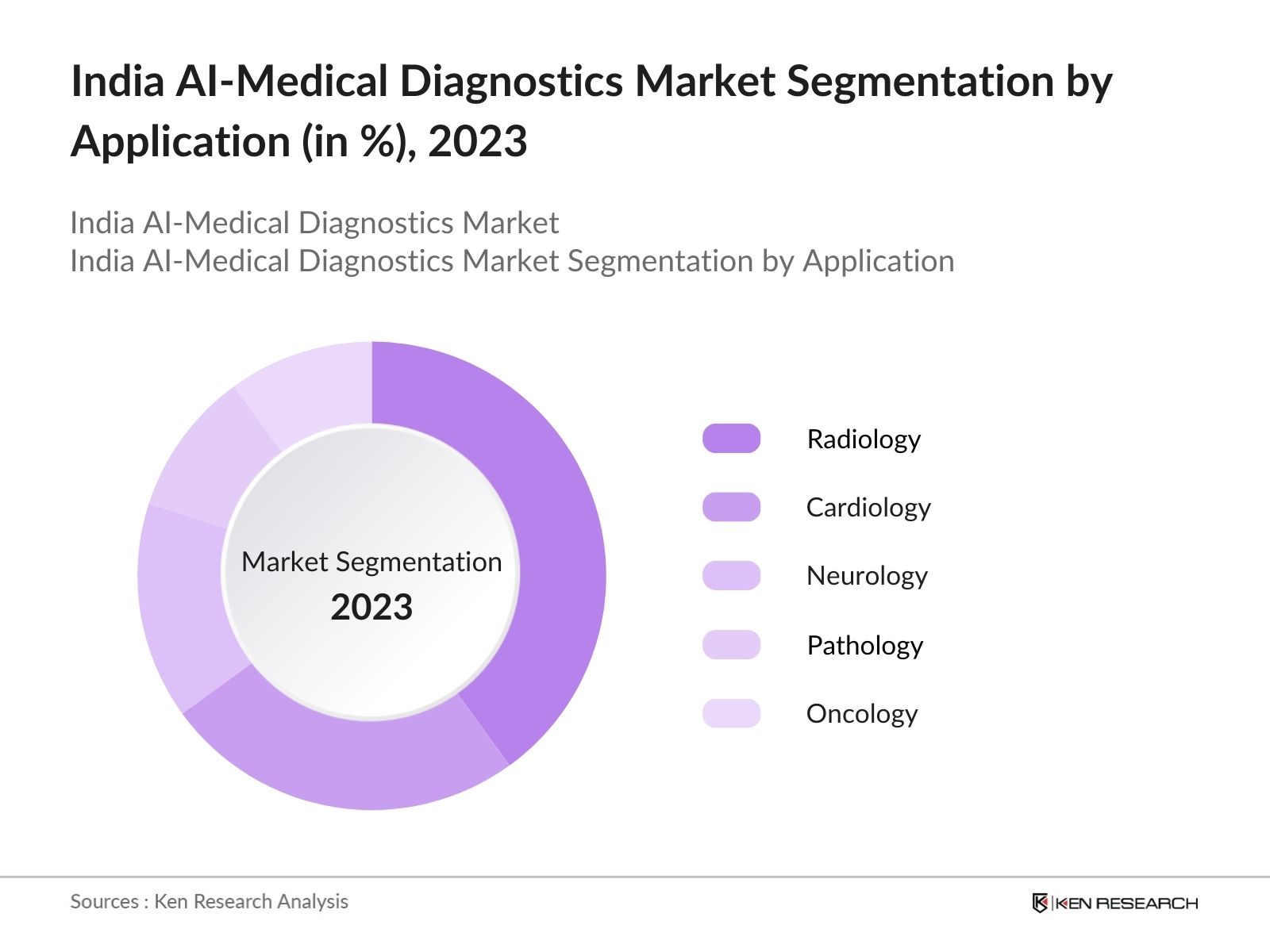

The India AI-Medical Diagnostics Market is segmented based on diagnostic type, application, and region.

- By Diagnostic Type: The market is segmented into imaging diagnostics, pathology diagnostics, and genomics diagnostics. In 2023, imaging diagnostics dominated the market due to the rapid adoption of AI-powered tools in radiology and oncology. Imaging diagnostics use AI to enhance the accuracy of medical imaging, making it easier for healthcare professionals to detect diseases like cancer and cardiovascular conditions at an early stage.

- By Application: The market is categorized into radiology, cardiology, neurology, pathology, and oncology. Radiology holds the largest market share in 2023, driven by the demand for AI tools that assist in interpreting complex imaging data with greater accuracy. Hospitals and diagnostic centers across India are increasingly adopting AI to improve diagnostic speed and reduce errors in radiology.

- By Region: The market is divided into North, South, East, and West. In 2023, North India dominated the market, led by Delhi NCR, which has a high concentration of AI-driven healthcare facilities and research institutions. The governments push for digital health initiatives and the presence of advanced healthcare infrastructures are contributing to the regions dominance.

India AI-Medical Diagnostics Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

IBM Watson Health |

2015 |

Armonk, USA |

|

Siemens Healthineers |

1847 |

Erlangen, Germany |

|

GE Healthcare |

1892 |

Chicago, USA |

|

Microsoft Healthcare |

1975 |

Redmond, USA |

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

- GE Healthcare: In 2022, GE Healthcare launched its 5G Innovation Lab in Bengaluru, which is the first of its kind globally for the company. This lab aims to develop future-ready healthcare solutions and enhance remote care capabilities. It serves as a testbed for innovations that combine AI, IoT, big data, and cybersecurity, facilitating the development of precision healthcare applications.

- Philips Healthcare: At the IRIA 2024 conference, Philips unveiled its comprehensive suite of AI-driven enterprise imaging solutions, including next-generation technologies in Ultrasound, MRI, and CT systems. These innovations are designed to enhance operational performance and workflow efficiency for healthcare providers.

India AI-Medical Diagnostics Market Analysis

Growth Drivers:

- Increasing Investment in AI-based Healthcare Solutions: India is witnessing substantial investments in AI-driven healthcare solutions, particularly in diagnostics. In 2023, AI-driven medical diagnostics received noteworthy amount in funding from both public and private sectors, aiming to accelerate early disease detection and improve treatment outcomes. This surge in funding is enabling the development of advanced diagnostic tools that integrate AI for faster, more accurate detection of critical diseases like cancer and cardiovascular disorders.

- Rising Demand for Early Disease Detection: Early diagnosis through AI technology is gaining traction, especially for chronic diseases like cancer and cardiovascular conditions. AI tools are now being integrated with screening programs for early-stage cancer detection, allowing for quicker diagnosis and personalized treatment plans. This advancement is leading to better patient outcomes and reducing the overall burden on healthcare systems.

- Rising Prevalence of Chronic Diseases: India is facing a rising burden of chronic diseases, such as diabetes, cancer, and cardiovascular conditions. Between 2019-2021, over 31 million people in India were diagnosed with diabetes, while cardiovascular diseases accounted for 28% of all deaths, according to the Indian Council of Medical Research (ICMR). This growing prevalence is driving the demand for AI-driven diagnostic tools, which can provide faster, more accurate detection of these conditions.

Challenges:

- Lack of AI Infrastructure in Rural Areas: Despite significant advancements in AI-based medical diagnostics, the rural healthcare system still lags behind in adopting these technologies. In 2023, only 15% of rural hospitals were equipped with AI-based diagnostic tools, according to the National Rural Health Mission (NRHM). This disparity is due to inadequate infrastructure, lack of trained personnel, and high costs associated with implementing AI systems in remote regions

- High Cost of AI Diagnostic Tools: While AI-powered diagnostic solutions are becoming increasingly popular in urban hospitals, the high cost of these tools remains a significant barrier to entry, especially for mid-tier and smaller hospitals. ccording to the Indian Medical Association, hospitals in Tier 2 and Tier 3 cities find it challenging to bear these costs without government subsidies or private investment.

Government Initiatives:

- National Digital Health Mission (NDHM): The National Digital Health Mission (NDHM), launched by the Government of India on August 15, 2020, aims to create a comprehensive digital health ecosystem in the country. This initiative is expected to improve patient data management and diagnostic accuracy through AI tools.

- Ayushman Bharat Digital Mission (ABDM): The Ayushman Bharat Digital Mission (ABDM) aims to create a digital health ecosystem in India, facilitating universal health coverage. It includes initiatives like Health IDs and registries for healthcare facilities and professionals. The mission received a funding boost of USD 175 million to enhance healthcare delivery through digital solutions and improve access to services across the country.

India AI-Medical Diagnostics Market Future Outlook

The India AI-Medical Diagnostics Market is expected to grow remarkably over the forecast period, driven by continued advancements in AI and machine learning technologies, government support, and increasing demand for early diagnostic solutions in the healthcare sector.

Future Market Trends:

- AI Diagnostics to Drive Precision Medicine: Over the next five years, the India AI-Medical Diagnostics Industry will be driven by advancements in precision medicine, where AI will play a crucial role in tailoring treatment plans based on genetic and clinical data. By 2028, AI-based genomics diagnostics are expected to be widely used for personalized cancer treatment.

- AI Integration with Wearable Health Devices: By 2028, AI diagnostics are expected to integrate seamlessly with wearable health devices, enabling real-time monitoring and early detection of chronic diseases like diabetes and cardiovascular conditions. In 2024, the Indian Medical Devices Regulatory Authority (IMDRA) began approving AI-powered wearables for remote patient monitoring.

Scope of the Report

|

By Diagnostic |

Imaging Diagnostics Pathology Diagnostics Genomics Diagnostics |

|

By Application |

Radiology Cardiology Neurology Pathology Oncology |

|

By Region |

North East South West |

Products

Key Target Audience:

AI-Medical Diagnostic Solution Providers

Hospitals and Healthcare Institutions

Medical Device Manufacturers

Pharmaceutical Companies

Healthcare Technology Providers

Health Insurance Companies

Government Bodies (Ministry of Health and Family Welfare)

Investors and Venture Capitalists

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. India AI-Medical Diagnostics Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy

1.3. Market Growth Rate Analysis (Financial and Operational Metrics)

1.4. Key Market Developments and Milestones

2. India AI-Medical Diagnostics Market Size (USD Million)

2.1. Historical Market Size (Value and Volume)

2.2. Year-on-Year Growth Analysis (Operational Parameters)

2.3. Contribution of Key Regions (North, South, East, West)

2.4. Industry Revenue Analysis (Top-to-Bottom Approach)

2.5. Breakdown of Market Value by Diagnostic Type (Imaging Diagnostics, Pathology Diagnostics, Genomics Diagnostics)

3. India AI-Medical Diagnostics Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Demand for Early Disease Detection

3.1.2. Integration of AI in Precision Medicine

3.1.3. Government Initiatives Promoting AI in Healthcare

3.2. Market Challenges

3.2.1. High Initial Cost of AI-Based Diagnostic Tools

3.2.2. Lack of AI Infrastructure in Rural Areas

3.2.3. Data Privacy and Cybersecurity Concerns

3.3. Market Opportunities

3.3.1. Expansion of AI in Rural and Remote Diagnostics

3.3.2. Growing Adoption of AI in Genomics and Personalized Medicine

3.3.3. Integration of AI with Wearable Health Devices for Real-Time Monitoring

4. India AI-Medical Diagnostics Market Segmentation

4.1. By Diagnostic Type (In Value %)

4.1.1. Imaging Diagnostics

4.1.2. Pathology Diagnostics

4.1.3. Genomics Diagnostics

4.2. By Application (In Value %)

4.2.1. Radiology

4.2.2. Cardiology

4.2.3. Neurology

4.2.4. Pathology

4.2.5. Oncology

4.3. By Region (In Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India AI-Medical Diagnostics Market Competitive Landscape

5.1. Competitive Market Share Analysis (Market Share %, Financial and Operational Metrics)

5.2. Strategic Initiatives and Partnerships (Investments, JVs, and Alliances)

5.3. Key Market Players Analysis

5.3.1. IBM Watson Health

5.3.2. Siemens Healthineers

5.3.3. GE Healthcare

5.3.4. Microsoft Healthcare

5.3.5. Philips Healthcare

5.4. Cross-Comparison (Company Profiles Establishment Year, Headquarters, Revenue, No. of Employees)

5.4.1. Tata Consultancy Services

5.4.2. Wipro GE Healthcare

5.4.3. Qure.ai

5.4.4. PathAI

5.4.5. Prognos Health

6. India AI-Medical Diagnostics Market Financial Analysis

6.1. Financial Performance of Key Players

6.1.1. Revenue Analysis by Key Companies

6.1.2. Operational Efficiency Metrics (Cost Efficiency, Diagnostic Turnaround Time)

6.2. Investment and Venture Capital Analysis

6.2.1. Recent Investments and Fundings (Venture Capital, Government Grants)

6.2.2. Mergers and Acquisitions

6.3. Profitability and Revenue Forecasts

7. India AI-Medical Diagnostics Market Regulatory Framework

7.1. Government Policies Supporting AI in Healthcare

7.2. Compliance and Certification Requirements for AI Diagnostics

7.3. Data Privacy and Cybersecurity Regulations

7.4. Standards for AI and Machine Learning Integration in Diagnostics

8. Future Outlook for India AI-Medical Diagnostics Market

8.1. Market Growth Projections

8.2. Key Trends Shaping Future Demand (Precision Medicine, Remote Diagnostics)

8.3. Expansion of Domestic AI-based Diagnostic Solutions

8.4. Integration of AI in Wearable Health Devices for Diagnostics

9. India AI-Medical Diagnostics Future Market Segmentation, 2028

9.1. By Diagnostic Type (In Value %)

9.2. By Application (In Value %)

9.3. By Region (In Value %)

10. Analyst Recommendations

10.1. TAM/SAM/SOM Analysis for AI-Medical Diagnostics Market

10.2. Key Strategic Recommendations for AI Diagnostics Solution Providers

10.3. Emerging Markets and White-Space Opportunities (Remote Diagnostics, AI-based Genomics)

10.4. Patient-Centric Approach for Enhanced AI Diagnostic Solutions

11. Disclaimer

12. Contact Us

Research Methodology

Step 1 Identifying Key Variables

: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry-level information.

Step 2 Market Building

: Collating statistics on the India AI medical diagnostics market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the India AI medical diagnostics market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing

: Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output

: Our team will approach multiple essential medical companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us to validate statistics derived through a bottom-to-top approach from medical companies.

Frequently Asked Questions

01. How big is the India AI-Medical Diagnostics Market?

The India AI-Medical Diagnostics Market was valued at USD 300 million in 2023, driven by the rising demand for early disease detection, the growing adoption of AI technologies in healthcare, and government initiatives promoting digital healthcare infrastructure.

02. What are the challenges in the India AI-Medical Diagnostics Market?

Challenges in the India AI-Medical Diagnostics Market include the high cost of AI-based diagnostic tools, the lack of AI infrastructure in rural areas, and data privacy concerns. Limited access to AI technologies in underserved regions also hinders market growth.

03. Who are the major players in the India AI-Medical Diagnostics Market?

Key players in the India AI-Medical Diagnostics Market include IBM Watson Health, Siemens Healthineers, GE Healthcare, Microsoft Healthcare, and Philips Healthcare. These companies lead the market by leveraging AI-driven technologies to improve diagnostic accuracy and efficiency.

04. What are the growth drivers of the India AI-Medical Diagnostics Market?

The growth of the India AI-Medical Diagnostics Market is driven by increasing demand for early disease detection, government initiatives promoting AI adoption in healthcare, and advancements in precision medicine. The integration of AI in diagnostics is also improving diagnostic speed and accuracy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.