India Air Cargo Market Strategy

Driven by Strategic Partnerships, Technology Investments & Value-Added Services

Region:Asia

Author(s):Rajat and Kirti

Product Code:KR1442

September 2024

88

About the Report

India Air Cargo Market Overview:

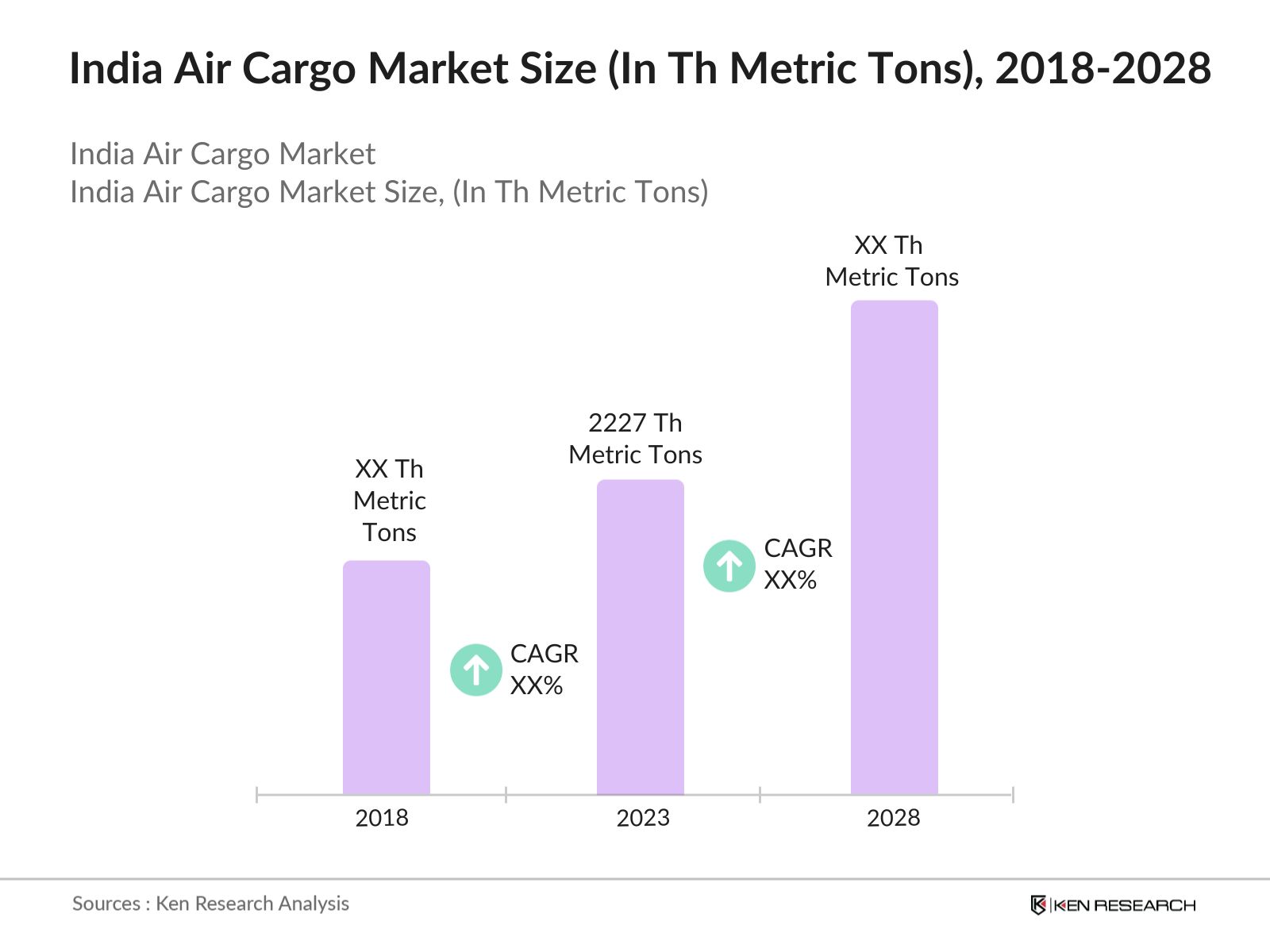

- In 2023, India Air Cargo traffic was 2227 thousand metric tons. This market has been driven by the increasing demand for e-commerce, pharmaceuticals, and perishable goods that require fast delivery. The rise in international trade and the growing emphasis on supply chain efficiency have also fueled market growth.

- The market is dominated by major players such as Blue Dart Aviation, SpiceXpress, Air India Cargo, and IndiGo Cargo. These players dominate the Indian air cargo market due to their extensive network, reliable service, and strong logistical infrastructure, enabling efficient handling and timely delivery of goods across the country.

- In 2021, Adani Airports made significant investments, including a payment of ?2,440 crore to the Airports Authority of India (AAI) to take possession of the six airports including Chhatrapati Shivaji International Airport in Mumbai & airports in Lucknow and Jaipur. This investment reflects the group's commitment to developing and managing airport infrastructure effectively.

- Mumbai dominates the market share of freights by airports in FY'23 due to its strategic location as a major trade hub and its well-developed infrastructure, which supports high volumes of both international and domestic cargo. The city's connectivity and access to key markets further enhance its prominence in the freight sector.

India Air Cargo Industry Analysis:

India Air Cargo Market Growth Drivers:

- Value Added Service to Consolidator and Airline: India's air cargo volume reached 3.14 million metric tonnes in 2023, reflecting a robust demand for air freight services. The value-added services include providing documentation, Dangerous Goods (DG) support, supervision, and last-mile delivery across key Indian airports like Mumbai (BOM), Lucknow (LKO), and Ahmedabad (AMD), with potential expansion to other airports.

- Air Side Transportation: In India, where major airports are operating at or near capacity, efficient airside logistics are critical. Terminal operators can ease congestion and improve efficiency by providing airside transportation services for critical items like Aircraft on Ground (AoG) spares and domestic cargo from Storage and Cargo Terminal (SACT) to the apron (the area where aircraft are parked, loaded, or unloaded).

- Satellite Storage Facility: Satellite storage facilities located at the apron side are used to hold offloaded cargo that is awaiting the next available connecting flight. This service is particularly important in scenarios where immediate onward transportation is not available, ensuring that cargo remains secure and accessible. Indian government has invested heavily in airport infrastructure, with an outlay of USD 18 billion under the National Infrastructure Pipeline (NIP) for airport expansion and modernization.

India Air Cargo Market Challenges:

- Stakeholder Collaboration: Efficient air cargo operations in India rely on robust collaboration among key stakeholders, including government authorities, airports, airlines, and freight forwarders. This teamwork is essential for overcoming bureaucratic challenges that can slow down logistics processes. By working together, these entities can streamline operations, reduce administrative bottlenecks, and enhance overall efficiency.

- Capacity Constraints: India's busiest airports, such as Delhi and Mumbai, face significant challenges due to limited aircraft capacity and tight scheduling, especially during peak seasons. These constraints lead to airport congestion and cargo delays, impacting the efficiency of air cargo operations. The high demand during these periods strains available resources, causing backlogs and delays in handling and transporting goods.

India Air Cargo Market Government Initiatives:

- National Civil Aviation Policy (2016): The policy established the Air Cargo Logistics Promotion Board, aimed at driving growth in the air cargo sector through measures like reducing dwell times (the time cargo stays at an airport) and improving coordination among various ministries. Additionally, the policy introduces Service Delivery Modules (SDMs) and an Air Cargo Community System (ACCS) to streamline operations and minimize delays.

- Krishi UDAN 2.0 (2020): Krishi UDAN 2.0 offers waivers on Parking, Landing, TNLC, and RNFC charges for domestic freighters and passenger-to-cargo aircraft at selected Airports Authority of India (AAI) airports. The focus is on promoting air cargo services in North-East India, hilly, and tribal regions. These incentives aim to reduce operational costs, making it more economically viable for airlines to transport agricultural products by air from these less accessible regions.

India Air Cargo Competitive Landscape:

|

Company |

Establishment Year |

Headquarters |

|

Blue Dart Aviation |

1994 |

Chennai, India |

|

SpiceXpress |

2018 |

Gurgaon, India |

|

Air India Cargo |

1953 |

New Delhi, India |

|

IndiGo Cargo |

2006 |

Gurgaon, India |

|

FedEx Express |

1971 |

Memphis, Tennessee, USA

|

- SpiceXpress Partners with Star Air: In 2024, SpiceXpress has entered into a partnership with Bengaluru-based Star Air to manage belly space capacity in Star Air's fleet. This collaboration will enhance SpiceXpress's domestic network by adding nine new destinations, increasing its reach from 39 to 48 locations. The partnership aims to improve door-to-door delivery and strengthen the air cargo infrastructure in underserved regions of India.

- IndiGo CarGo Signs Interline Agreement: In 2024, IndiGo has entered into an extensive interline agreement with Air France KLM Martinair Cargo, aiming to enhance delivery accuracy and efficiency across their networks. This partnership is expected to improve cargo services and expand IndiGo's reach in the air cargo market.

India Air Cargo Future Market Outlook:

The India Air Cargo Market is poised for significant growth, driven by a combination of factors including the expansion of e-commerce, increased pharmaceutical exports, and substantial government investment in infrastructure.

Future Market Trends:

- Increased Adoption of Digital Technologies: In the coming five years, the Indian air cargo market is poised for significant transformation driven by the widespread adoption of advanced digital technologies such as blockchain, IoT, and AI. These technologies will play a critical role in streamlining operations, enhancing transparency, and improving security across the cargo handling process.

- Expansion of Regional Cargo Hubs: The Indian air cargo market is also expected to witness a significant expansion of regional cargo hubs, particularly in tier-2 and tier-3 cities. This development is aligned with the government’s focus on enhancing connectivity under initiatives like the UDAN (Ude Desh Ka Aam Nagrik) scheme. The establishment of new cargo terminals in these emerging cities will facilitate faster movement of goods, reduce congestion at major airports, and promote regional economic growth.

Scope of the Report

|

By Service Type |

Freight Forwarding Courier Services Express Services Others |

|

By Cargo Type |

General Cargo Perishable Goods Dangerous Goods Pharmaceuticals |

|

By End-User Industry |

Manufacturing Retail Healthcare Automotive |

|

By Region |

Delhi Mumbai Chennai Bangalore Hyderabad Kolkata Others |

Products

Key Target Audience:

- E-commerce Companies

- Pharmaceutical Companies

- Logistics and Supply Chain Companies

- Automotive Manufacturers

- Manufacturing Companies

- Cold Chain Logistics Companies

- Investment & Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Civil Aviation, Airports Authority of India)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

- Sky High Airport Services Pvt Ltd

- SpiceXpress

- Air India Cargo

- IndiGo Cargo

- FedEx Express

- DHL Express

- Emirates SkyCargo

- Qatar Airways Cargo

- Lufthansa Cargo

- Singapore Airlines Cargo

- Jet Airways Cargo

- Cathay Pacific Cargo

- Etihad Cargo

- UPS Airlines

- Korean Air Cargo

Table of Contents

1. India Air Cargo Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Air Cargo Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4 India Air Cargo Market Attractiveness

3. India Air Cargo Market Analysis

3.1. Growth Drivers

3.1.1. Value Added Service to Consolidator and Airline

3.1.2. Air Side Transportation

3.1.3. Satellite Storage Facility

3.1.4. Unit Load Device Management (ULD)

3.1.5 E-commerce Fulfillment Centre & OEM

3.1.6 Express Delivery Service

3.1.7 Customs brokerage

3.1.8 Warehouses & Distribution Centers

3.1.9 Logistics Consulting

3.1.10 Charter Flight

3.2. Restraints

3.2.1. Stakeholder Collaboration

3.2.2. Capacity Constraints

3.2.3. Regulatory Requirements

3.2.4 Infrastructure Challenges

3.2.5 Inefficient Logistics

3.2.6 Skilled Workforce Shortage

3.2.7 Technological Adoption

3.2.8 High Operational Cost

3.2.9 Security Concerns

3.2.10 Insufficient Attention

3.3. Potential Revenue Opportunities

3.3.1. Mumbai Airport Air Cargo Revenue Projections from Value Added Service, in INR Cr

3.3.2. Ahmedabad Airport Air Cargo Revenue Projections from Value Added Service, in INR Cr

3.3.3. Lucknow Airport Air Cargo Revenue Projections from Value Added Service, in INR Cr

3.4. Trends

3.4.1. Integration of AI and IoT

3.4.2. Adoption of Green Cargo Initiatives

3.4.3. Collaboration with E-commerce Giants

3.5. Government Regulation

3.5.1. National Civil Aviation Policy

3.5.2. Krishi UDAN 2.0

3.5.3. Initiatives for Air Freight Corridors

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Air Cargo Market Segmentation, 2023

4.1. By Service Type (in Value %)

4.1.1. Freight Forwarding

4.1.2. Courier Services

4.1.3. Express Services

4.1.4. Others

4.2. By Cargo Type (in Value %)

4.2.1. General Cargo

4.2.2. Perishable Goods

4.2.3. Dangerous Goods

4.2.4. Pharmaceuticals

4.3. By End-User Industry (in Value %)

4.3.1. Manufacturing

4.3.2. Retail

4.3.3. Healthcare

4.3.4. Automotive

4.4. By Region (in Value %)

4.4.1 Delhi

4.4.2 Mumbai

4.4.3 Chennai

4.4.4 Bangalore

4.4.5 Hyderabad

4.4.6 Kolkata

4.4.7 Others

5. India Air Cargo Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Sky High Airport Services Pvt Ltd

5.1.2. SpiceJet Ltd.

5.1.3. DHL Express India Pvt. Ltd.

5.1.4. FedEx Express Transportation and Supply Chain Services

5.1.5. GATI-KWE

5.1.6. Indigo Cargo

5.1.7. Air India Cargo

5.1.8. Emirates SkyCargo

5.1.9. Lufthansa Cargo AG

5.1.10. Qatar Airways Cargo

5.1.11 Lufthansa Cargo

5.1.12 Singapore Airlines Cargo

5.1.13 Jet Airways Cargo

5.1.14 Cathay Pacific Cargo

5.1.15 Etihad Cargo

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Air Cargo Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Air Cargo Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Air Cargo Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Air Cargo Future Market Segmentation, 2028

9.1. By Service Type (in Value %)

9.2. By Cargo Type (in Value %)

9.3. By End-User Industry (in Value %)

9.4. By Region (in Value %)

10. India Air Cargo Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step: 1 Data Collection:

Primary Data: Interviews with key stakeholders (e.g., airport operators, air carriers) provided insights into current industry challenges and opportunities.

Secondary Data: Reviewed industry reports, government publications, and market studies from sources like the Ministry of Civil Aviation and IATA for foundational data.

Step: 2 Market Analysis:

Trend Analysis: Historical data on cargo volumes and revenue was examined to forecast future trends and identify market drivers.

SWOT Analysis: Evaluated strengths, weaknesses, opportunities, and threats for major air cargo players.

Step: 3 Strategic Assessment:

Benchmarking: Compared Indian air cargo operations with global standards to highlight improvement areas and best practices.

Scenario Planning: Developed scenarios to assess the impact of market changes like regulatory shifts and technological advancements.

Step: 4 Forecasting & Projections:

Revenue Projections: Forecasted revenue for major terminals (Mumbai, Ahmedabad, Lucknow) and identified growth opportunities in areas like e-commerce and charter flights.

Step: 5 Validation & Peer Review:

Validation: Findings were reviewed by industry experts to ensure accuracy and relevance, refining strategic recommendations.

Frequently Asked Questions

01 How big is India Air Cargo Market?

In 2023, the India Air Cargo Market was valued at 2227 thousand metric tons. This market has been driven by the increasing demand for e-commerce, pharmaceuticals, and perishable goods that require fast delivery.

02 What are the Key Factors Driving the India Air Cargo Market?

Growth drivers of India Air Cargo Market include the satellite storage facility, air side transportation and value-added service to consolidator and airline. The value-added services include providing documentation, Dangerous Goods (DG) support, supervision, and last-mile delivery across key Indian airports like Mumbai and Ahmedabad.

03 Who are the Major Players in the India Air Cargo Market?

India Air Cargo Market is dominated by major players such as Blue Dart Aviation, SpiceXpress, Air India Cargo, and IndiGo Cargo. These players dominate the Indian air cargo market due to their extensive network, reliable service, and strong logistical infrastructure

04 What are the challenges of India Air Cargo Market?

India Air Cargo Market faces challenges like capacity constraints, infrastructure challenges & regulatory requirements. Efficient air cargo operations in India rely on robust collaboration among key stakeholders, including government authorities, airports, airlines, and freight forwarders.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.