India Air Cooler Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD2347

October 2024

116

About the Report

India Air Cooler Market Overview

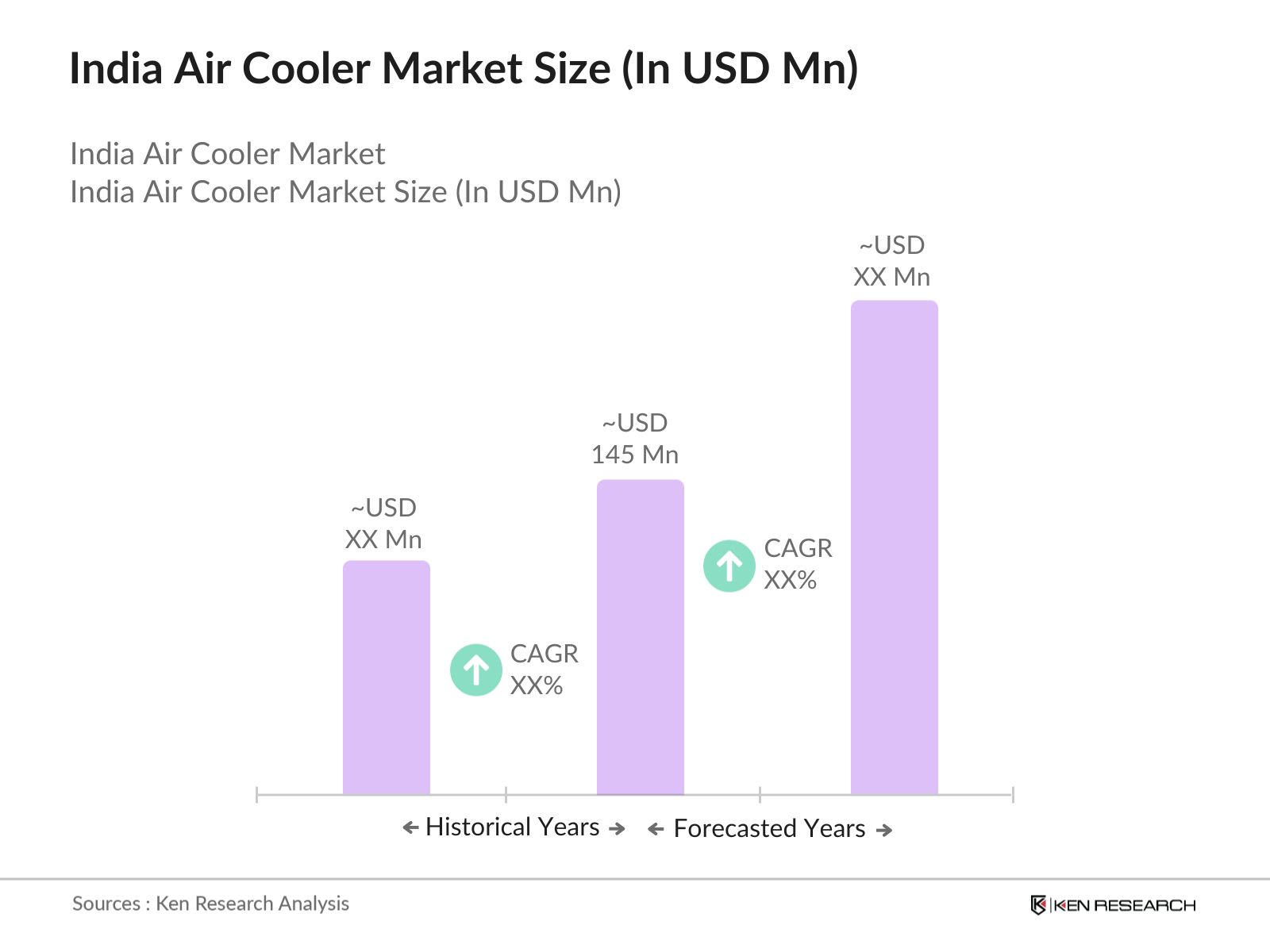

- The India Air Cooler Market is valued at USD 145 million, driven by increasing demand for affordable cooling solutions in residential, commercial, and industrial applications. The growing need for energy-efficient and eco-friendly cooling options has further boosted the market. Rising temperatures and heatwaves across the country, coupled with the increasing adoption of air coolers in tier-2 and tier-3 cities, have significantly contributed to market growth.

- Key players in the Indian air cooler market include Symphony Limited, Bajaj Electricals, Crompton Greaves Consumer Electricals Ltd., Usha International, and Havells India Ltd. These companies hold market share by continuously innovating product designs, enhancing cooling technologies, and providing cost-effective solutions.

- The demand for air coolers is primarily driven by their energy efficiency compared to air conditioners, making them a more sustainable option for cooling large spaces. In regions with dry climates, such as Rajasthan, Gujarat, and parts of North India, air coolers are a popular choice due to their affordability and lower environmental impact.

- In 2023, Symphony Limited entered a share sale agreement to acquire a 25% stake in SYM ITO for $1 million. Additionally, the company launched a new line of energy-efficient air coolers utilizing BLDC technology, enhancing its product offerings in response to growing market demands for energy-efficient cooling solutions. This strategic move reflects Symphony's commitment to innovation and sustainability.

India Air Cooler Market Segmentation

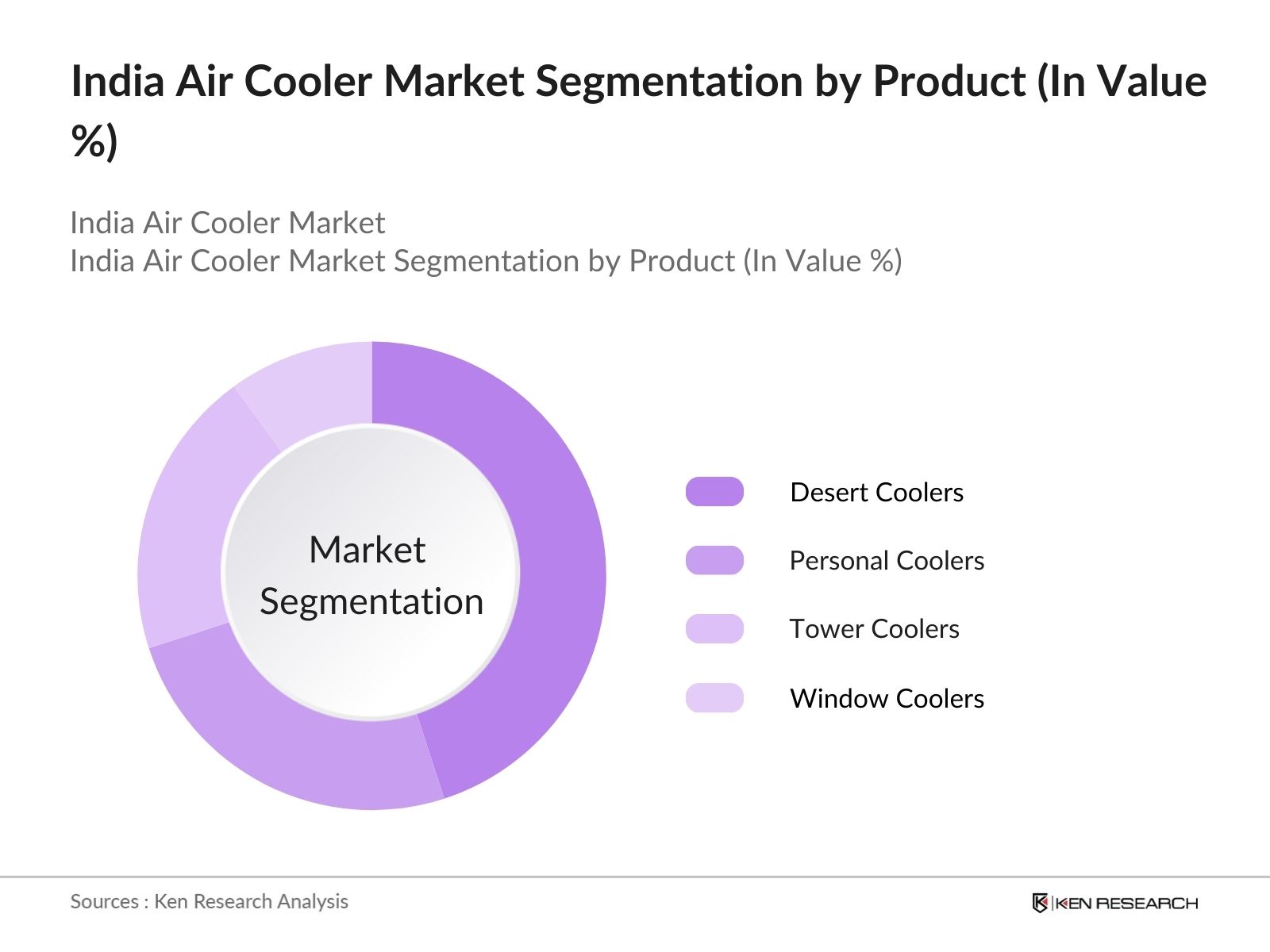

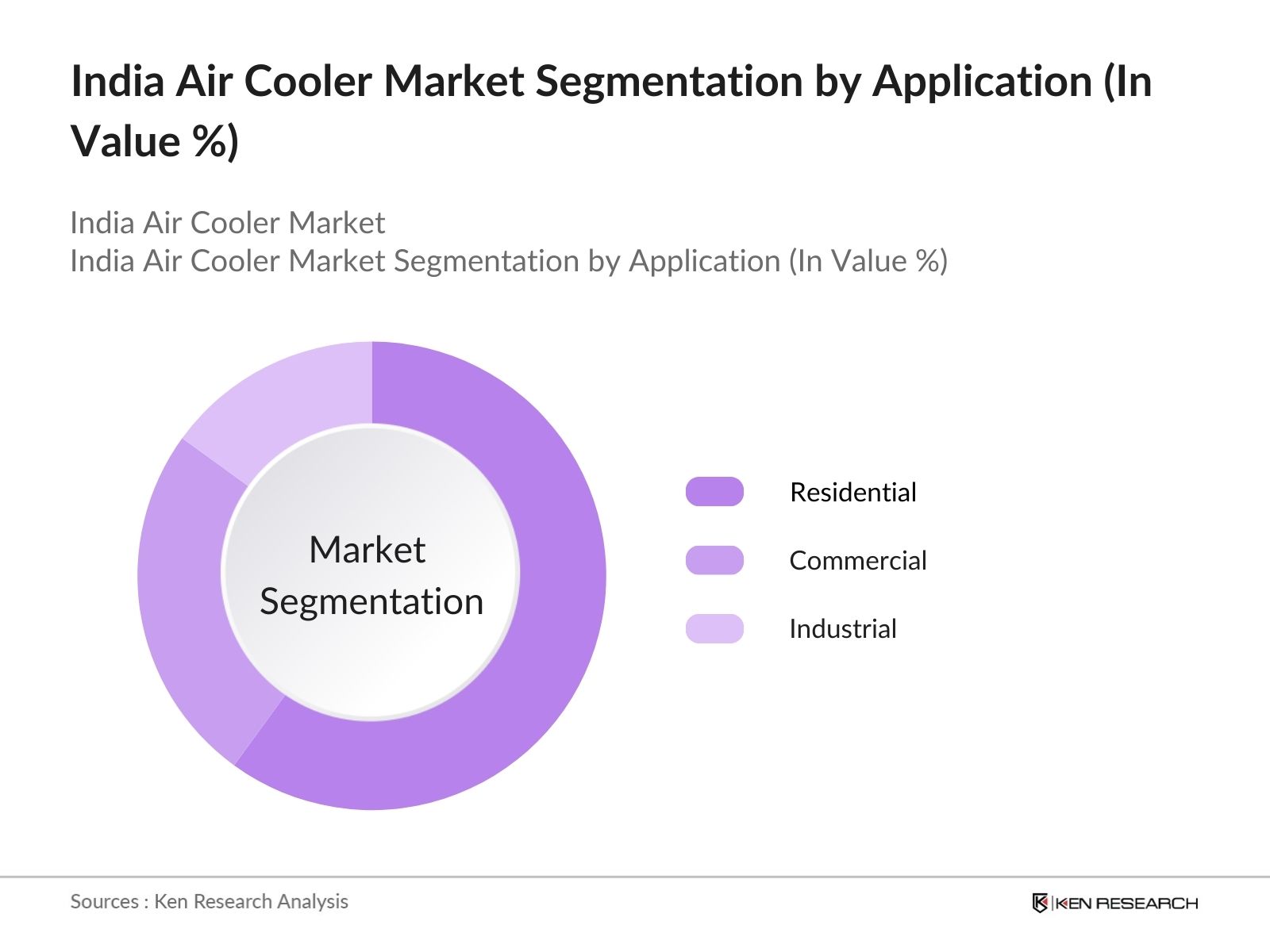

The India Air Cooler Market is segmented based on product type, application, and region.

- By Product Type: The market is segmented into desert coolers, personal coolers, tower coolers, and window coolers. In 2023, desert coolers dominated the market due to their high cooling capacity and preference in areas with extreme heat. Tower coolers, known for their compact size and space-saving designs, are gaining popularity in urban households.

- By Application: The market is categorized into residential, commercial, and industrial. The residential segment held the largest share in 2023, driven by the growing middle-class population and rising awareness of energy-efficient home appliances. The commercial segment, particularly in retail outlets, hotels, and restaurants, is also witnessing steady growth as businesses seek cost-effective cooling solutions.

- By Region: The market is divided into North, South, East, and West. In 2023, North India, particularly Delhi, Punjab, and Haryana, led the market due to extreme heat conditions and widespread adoption of air coolers. West India, especially Gujarat and Rajasthan, also holds a substantial share, owing to its dry and hot climate, where air coolers are a cost-effective solution.

India Air Cooler Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Symphony Limited |

1988 |

Ahmedabad, India |

|

Bajaj Electricals |

1938 |

Mumbai, India |

|

Crompton Greaves Consumer |

1878 |

Mumbai, India |

|

Usha International |

1934 |

Gurgaon, India |

|

Havells India Ltd. |

1958 |

Noida, India |

- Symphony Limited: In 2022, Crompton Greaves Consumer Electricals has launched its new Tricool window cooler, which boasts 60% better cooling efficiency compared to standard models. This product aims to capture a larger market share in the competitive air cooler segment, where Crompton currently holds a modest position.

- Usha International: In 2023, Usha International launched a new range of energy-efficient air coolers powered by BLDC technology. These coolers are designed to provide effective cooling while consuming less energy compared to traditional models. The launch aligns with the growing demand for eco-friendly and cost-saving cooling solutions in India.

India Air Cooler Market Analysis

Growth Drivers:

- Increased Energy Efficiency Regulations: In 2024, the Indian government is actively pushing for stricter energy efficiency norms across various appliances, including air coolers. The Bureau of Energy Efficiency (BEE) has proposed implementing star ratings for air coolers by the end of 2025, a move aimed at encouraging manufacturers to produce more energy-efficient models. This initiative is expected to drive demand for air coolers that meet higher energy standards, as consumers will look for products that reduce their electricity consumption.

- Rising Demand from Semi-Urban and Rural Areas: According to the Ministry of Statistics and Programme Implementation, in 2024, 65% of India's population resides in rural and semi-urban areas, where the demand for affordable and efficient cooling solutions is rising rapidly. Additionally, the Indian government plans to increase state subsidies for rural housing in the upcoming 2024 federal budget by as much as 50% compared to the previous year, potentially exceeding $6.5 billion, which in turn will boost the air cooler market.

- Increased Adoption in Industrial and Commercial Sectors: The industrial and commercial sectors in India are witnessing an increased adoption of air coolers due to their cost-effectiveness and eco-friendly nature. In recent years, Indias Ministry of Labour and Employment has introduced various new regulations mandating that all factories and commercial establishments with over 100 employees ensure proper ventilation and cooling systems for workers, especially in high-heat areas.

Challenges:

- High Competition from Air Conditioners: The increasing affordability of air conditioners due to technological advancements poses a challenge to the air cooler market. Consumers in urban areas, with higher purchasing power, often prefer air conditioners, especially in highly humid regions where air coolers are less effective.

- Fluctuating Raw Material Prices: The cost of raw materials such as plastic and metals used in manufacturing air coolers is subject to fluctuations in global markets. This impacts the pricing strategies of manufacturers, making it difficult to maintain a balance between affordability and profitability.

Government Initiatives

- Mandatory Energy Efficiency Labeling by 2025: Indias Bureau of Energy Efficiency (BEE) has launched a Standards and Labelling Programme for solar photovoltaic (PV) modules, effective from January 1, 2024, to December 31, 2025. This program will initially be voluntary, allowing manufacturers to label their products without fees during this period. The initiative aims to improve consumer awareness regarding energy efficiency, with a potential reduction of carbon emissions by 30 million tons annually by 2030.

- Incentives for Domestic Manufacturing under PLI Scheme: The Indian government, under the Production Linked Incentive (PLI) scheme for white goods introduced in 2023, is offering incentives to air cooler manufacturers who produce their goods domestically. The scheme offers benefits like tax rebates and financial support to companies that meet certain production targets.

India Air Cooler Market Future Outlook

The India Air Cooler Market is projected to grow at a robust pace over the forecast period, driven by the increasing demand for energy-efficient cooling solutions, rising urbanization, and innovations in product designs.

Future Market Trends

- Smart and Connected Devices: By 2028, the air cooler market is expected to witness the widespread adoption of IoT-enabled air coolers with features like remote control and smart sensors. These innovations will appeal to tech-savvy consumers looking for integrated smart home solutions.

- Portable and Hybrid Air Coolers: The demand for portable and hybrid air coolers, combining the benefits of air coolers and air purifiers, is likely to rise. These coolers are expected to cater to the growing health-conscious consumer base, looking for appliances that improve air quality while providing cooling.

Scope of the Report

|

By Product |

Desert Coolers Personal Coolers Tower Coolers Window Coolers |

|

By Application |

Residential Commercial Industrial |

|

By Region |

North East South West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report

Air Cooler Manufacturers

Air Cooler Component Suppliers

Commercial and Industrial Real Estate Developers

Consumer Electronics Retailers

Agricultural and Food Storage Firms

Government Bodies (Ministry of Mines, Ministry of Coal)

Banks and Financial Institutes

Investors and Venture Capital Firms

Companies

Players Mentioned in the Report:

Symphony Limited

Bajaj Electricals

Crompton Greaves Consumer Electricals Ltd.

Usha International

Havells India Ltd.

Voltas Limited

Kenstar (Videocon Group)

Orient Electric

V-Guard Industries

Maharaja Whiteline

Blue Star Limited

McCoy (Vinit Electronics)

Ram Coolers

Pigeon (Stovekraft Limited)

Superfan

Table of Contents

India Air Cooler Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy

1.3. Market Growth Rate Analysis (Financial and Operational Metrics)

1.4. Key Market Developments and Milestones

India Air Cooler Market Size (USD Million)

2.1. Historical Market Size (Value and Volume)

2.2. Year-on-Year Growth Analysis (Operational Parameters)

2.3. Contribution of Key Regions (North, South, East, West)

2.4. Industry Revenue Analysis (Top-to-Bottom Approach)

2.5. Breakdown of Market Value by Product Type (Desert Coolers, Personal Coolers, Tower Coolers, Window Coolers)

India Air Cooler Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Demand for Affordable Cooling Solutions in Semi-Urban and Rural Areas

3.1.2. Government Initiatives Promoting Energy-Efficient Appliances

3.1.3. Rising Heat Waves and Climatic Extremes

3.2. Market Challenges

3.2.1. High Dependency on Seasonal Demand

3.2.2. Limited Effectiveness in Humid Regions

3.2.3. Fluctuating Raw Material Prices

3.3. Market Opportunities

3.3.1. Growing Demand for Smart and Connected Air Coolers

3.3.2. Expansion of Distribution Networks in Tier 2 and Tier 3 Cities

3.3.3. Opportunities in Commercial and Industrial Cooling Applications

India Air Cooler Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Desert Coolers

4.1.2. Personal Coolers

4.1.3. Tower Coolers

4.1.4. Window Coolers

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Region (In Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

India Air Cooler Market Competitive Landscape

5.1. Competitive Market Share Analysis (Market Share %, Financial and Operational Metrics)

5.2. Strategic Initiatives and Partnerships (Investments, Collaborations, and Alliances)

5.3. Key Market Players Analysis

5.3.1. Symphony Limited

5.3.2. Bajaj Electricals

5.3.3. Crompton Greaves Consumer Electricals

5.3.4. Usha International

5.3.5. Havells India Ltd.

5.4. Cross-Comparison (Company Profiles Establishment Year, Headquarters, Revenue, No. of Employees)

5.4.1. Orient Electric

5.4.2. Voltas Limited

5.4.3. Kenstar

5.4.4. V-Guard Industries

5.4.5. Blue Star Limited

India Air Cooler Market Financial Analysis

6.1. Financial Performance of Key Players

6.1.1. Revenue Analysis by Key Companies

6.1.2. Operational Efficiency Metrics (Cost Efficiency, Production Output)

6.2. Investment and Venture Capital Analysis

6.2.1. Recent Investments and Fundings (Venture Capital, Government Grants)

6.2.2. Mergers and Acquisitions

6.3. Profitability and Revenue Forecasts

India Air Cooler Market Regulatory Framework

7.1. Government Policies Supporting Air Cooler Industry

7.2. Compliance and Certification Requirements for Manufacturing

7.3. Energy Efficiency Regulations and Sustainability Standards

7.4. Safety and Environmental Regulations

Future Outlook for India Air Cooler Market

8.1. Market Growth Projections

8.2. Key Trends Shaping Future Demand (Smart Technology, Renewable Energy Solutions)

8.3. Expansion of Product Offerings (Hybrid Coolers, Solar-Powered Coolers)

8.4. Adoption of IoT and Automation in Air Cooler Products

India Air Cooler Market Future Segmentation, 2028

9.1. By Product Type (In Value %)

9.2. By Application (In Value %)

9.3. By Region (In Value %)

Analyst Recommendations

10.1. TAM/SAM/SOM Analysis for India Air Cooler Market

10.2. Key Strategic Recommendations for Manufacturers

10.3. Emerging Markets and White-Space Opportunities (Smart Air Coolers, Hybrid Cooling Technologies)

10.4. Sustainability and Environmental Cooling Strategies

Research Methodology

Step 1 Identifying Key Variables

: Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry-level information.

Step 2 Market Building

: Collating statistics on the India air cooler market over the years, penetration of marketplaces, and service providers ratio to compute revenue generated for the India air cooler market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing

: Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output

: Our team will approach multiple essential air cooler companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us to validate statistics derived through a bottom-to-top approach from air cooler companies.

Frequently Asked Questions

How big is the India Air Cooler Market?

The India Air Cooler Market is valued at USD 145 million, driven by rising temperatures, the need for affordable cooling solutions, and the increasing adoption of energy-efficient appliances in both urban and rural areas.

What are the challenges in the India Air Cooler Market?

Challenges in the India Air Cooler Market include high dependence on seasonal demand, limited efficiency in humid regions, and fluctuating prices of raw materials like plastic and aluminum, which impact production costs.

Who are the major players in the India Air Cooler Market?

Key players in the India Air Cooler Market include Symphony Limited, Bajaj Electricals, Crompton Greaves Consumer Electricals Ltd., Usha International, and Havells India Ltd. These companies dominate the market through innovation, extensive distribution networks, and diverse product offerings.

What are the growth drivers of the India Air Cooler Market?

Growth drivers of the India Air Cooler Market include increasing demand for affordable cooling solutions in rural and semi-urban areas, government initiatives promoting energy-efficient appliances, and the rising frequency of heatwaves across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.