India Animation Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD6005

December 2024

85

About the Report

India Animation Market Overview

- The India Animation market is valued at USD 1.37 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for high-quality animated content across entertainment, advertising, and gaming industries. The surge in OTT platforms and digital advertising has led to a significant increase in animation production, further accelerated by government incentives and technological advancements in 3D animation and VFX. Animation is now crucial for immersive experiences in education and corporate communication, further boosting market growth.

- India's animation market is primarily dominated by major cities like Mumbai, Hyderabad, and Bangalore due to their well-established media and entertainment industries, skilled labor, and a growing number of animation studios. Mumbai is home to numerous production houses, while Hyderabad boasts cutting-edge technology and strong infrastructure for VFX and animation. Additionally, government incentives and subsidies in these cities have attracted significant investments in the animation and VFX industries, enabling them to dominate the national market.

- India has been strengthening its IPR framework to curb piracy and safeguard the interests of content creators in the animation industry. In 2023, the Indian government introduced stricter penalties for copyright infringement, with fines up to INR 2 lakh and imprisonment for up to three years for offenders. The Department for Promotion of Industry and Internal Trade (DPIIT) has taken steps to ensure that IPR awareness is increased across the industry.

India Animation Market Segmentation

By Product Type: The market is segmented by product type into 2D animation, 3D animation, motion graphics, stop motion, and visual effects (VFX). Among these, 3D animation holds the dominant market share, accounting for around 45% of the total market in 2023. This dominance is primarily due to the increasing demand for visually rich content in films, advertisements, and gaming.

By Application: The market is also segmented by application into entertainment, gaming, advertising, education, and corporate communication. The entertainment sector, covering films, television, and OTT platforms, holds a dominant share of around 60% in 2023. This is largely driven by the increasing popularity of animated films, series, and content on OTT platforms such as Netflix and Amazon Prime, which are continuously investing in Indian animated productions.

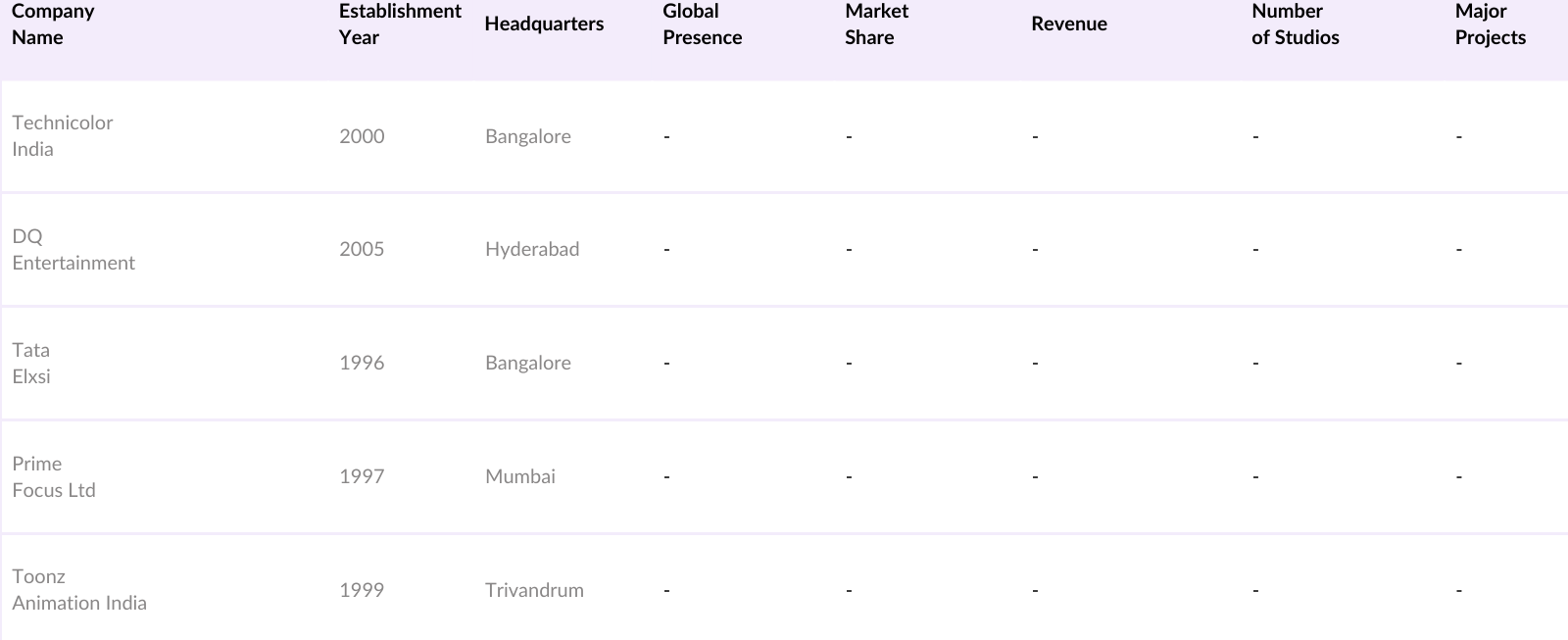

India Animation Market Competitive Landscape

The India Animation market is characterized by both domestic and international players. The competitive landscape is dominated by a mix of large production houses and small boutique studios, each offering a range of services such as 2D/3D animation, VFX, and motion graphics. Major players like Technicolor India, DQ Entertainment, and Tata Elxsi have gained prominence due to their advanced technology adoption and global clientele.

India Animation Industry Analysis

Growth Drivers

- Rise in Online Streaming Platforms: The rise of online streaming platforms has significantly impacted the Indian animation market. Platforms such as Netflix, Amazon Prime Video, and Disney+ have invested heavily in animated content. In 2023, India accounted for over 15% of the global animation outsourcing market, bolstered by its growing production capabilities for these platforms. According to the World Bank, India's GDP in 2024 is estimated at $3.7 trillion, with the digital economy contributing over $200 billion.

- Increasing Adoption of Animation in Digital Advertising: In 2023, digital advertising expenditure in India crossed $15 billion, and a significant portion of this investment is directed toward animated advertisements. Brands like Zomato and Swiggy have increasingly adopted animated content to engage consumers on social media platforms. With the Indian economy growing at a projected 6.5% in 2024 (IMF), businesses are more inclined to invest in creative forms of digital marketing.

- Growing Animation Exports: India is emerging as a leading destination for outsourcing animation services, with exports in the sector increasing by 10% annually. In 2023, India's export of animated content to countries like the US and Canada was valued at over $500 million. The World Trade Organization (WTO) reported that India's services exports, including animation, crossed $300 billion in 2023, bolstered by cost-effective production and a growing pool of skilled professionals.

Market Challenges

- High Production Costs: Despite government incentives, the high production costs remain a major challenge for the Indian animation industry. The cost of producing high-quality animated content in India ranges from $1 million to $3 million per project, depending on the complexity. Comparatively, production costs in countries like South Korea and the Philippines are lower by 20%-30%, making India less competitive in certain global markets.

- Shortage of Skilled Workforce: India's animation sector faces a significant skills gap, with over 30,000 positions remaining unfilled in 2023 due to a lack of qualified animators and VFX artists. The sector employs around 100,000 professionals, but this number falls short given the increasing demand for animation across industries. According to the Ministry of Skill Development, only 10% of the workforce in the animation sector undergoes formal training, resulting in a shortage of skilled talent.

India Animation Market Future Outlook

Over the next five years, the India Animation market is expected to witness robust growth, driven by the increasing integration of animation into entertainment, gaming, and digital advertising. The adoption of new technologies such as artificial intelligence (AI), virtual reality (VR), and machine learning (ML) is anticipated to transform animation production, making it faster and more cost-effective.

Market Opportunities

- Collaborations with Global Production Houses: India's animation industry has witnessed a surge in collaborations with global production houses, with deals worth over $200 million signed in 2023. These partnerships are not only boosting the countrys animation exports but also providing Indian studios access to advanced technology and international best practices. Studios like Technicolor India and DQ Entertainment have collaborated with major Hollywood studios, contributing to projects like "The Jungle Book" and "The Lion King."

- Growing Demand for Mobile Gaming Animation: Mobile gaming in India is experiencing rapid growth, with the market size reaching $6 billion in 2023, according to Statista. This boom has led to a significant rise in the demand for mobile gaming animation, as 450 million gamers in the country spend an average of 7-8 hours per week on mobile games. The National Payments Corporation of India (NPCI) reported that mobile-based transactions surpassed $2 trillion in 2023, indicating a broader acceptance of digital entertainment.

Scope of the Report

|

Product Type |

2D Animation 3D Animation Motion Graphics Stop Motion Visual Effects (VFX) |

|

Application |

Entertainment Gaming Advertising Education Corporate Communication |

|

Technology |

Traditional Animation 2D Vector-Based Animation 3D Computer Animation Motion Capture Digital Compositing |

|

End-User |

Animation Studios Game Development Studios Advertising Agencies Education Providers Corporate Sectors |

|

Region |

Northern India Western India Southern India Eastern India Central India |

Products

Key Target Audience

Animation Studios

Game Development Studios

Advertising Agencies

OTT Platforms

Corporate Communication Firms

Government and Regulatory Bodies (Ministry of Information and Broadcasting)

Investments and Venture Capitalist Firms

Educational Content Providers

Companies

Players Mentioned in the Report

Technicolor India

DQ Entertainment

Tata Elxsi

Prime Focus Ltd

Toonz Animation India

Red Chillies VFX

Reliance MediaWorks

Green Gold Animation

Prana Studios

Crest Animation Studios

Table of Contents

1. India Animation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Animation Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Animation Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Online Streaming Platforms

3.1.2. Increasing Adoption of Animation in Digital Advertising

3.1.3. Government Incentives for Animation and VFX

3.1.4. Growing Animation Exports

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Shortage of Skilled Workforce

3.2.3. Piracy and Intellectual Property Theft

3.2.4. Inadequate Infrastructure

3.3. Opportunities

3.3.1. Collaborations with Global Production Houses

3.3.2. Growing Demand for Mobile Gaming Animation

3.3.3. Increasing Use of Animation in Educational Content

3.3.4. Adoption of AI and Machine Learning in Animation Creation

3.4. Trends

3.4.1. Use of Real-Time 3D Rendering Technology

3.4.2. Animation for Augmented Reality (AR) and Virtual Reality (VR)

3.4.3. Rise in Short Form Animation Content for Social Media

3.4.4. Outsourcing Animation to India from Western Markets

3.5. Government Regulations

3.5.1. Incentive Schemes for Animation, VFX, Gaming, and Comics (AVGC) Sector

3.5.2. Intellectual Property Rights (IPR) Protection Laws

3.5.3. Tax Incentives for Animation Studios

3.5.4. Government Support for Local Animation Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Animation Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. 2D Animation

4.1.2. 3D Animation

4.1.3. Motion Graphics

4.1.4. Stop Motion

4.1.5. Visual Effects (VFX)

4.2. By Application (In Value %)

4.2.1. Entertainment (Film, TV, OTT)

4.2.2. Gaming

4.2.3. Advertising

4.2.4. Education

4.2.5. Corporate Communication

4.3. By Technology (In Value %)

4.3.1. Traditional Animation

4.3.2. 2D Vector-Based Animation

4.3.3. 3D Computer Animation

4.3.4. Motion Capture

4.3.5. Digital Compositing

4.4. By End-User (In Value %)

4.4.1. Animation Studios

4.4.2. Game Development Studios

4.4.3. Advertising Agencies

4.4.4. Education Providers

4.4.5. Corporate Sectors

4.5. By Region (In Value %)

4.5.1. Northern India

4.5.2. Western India

4.5.3. Southern India

4.5.4. Eastern India

4.5.5. Central India

5. India Animation Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Technicolor India

5.1.2. Toonz Animation India

5.1.3. DQ Entertainment

5.1.4. Tata Elxsi

5.1.5. Prime Focus Ltd

5.1.6. Green Gold Animation

5.1.7. Crest Animation Studios

5.1.8. Red Chillies VFX

5.1.9. Reliance MediaWorks

5.1.10. Prana Studios

5.1.11. Maya Entertainment Ltd

5.1.12. Vaibhav Studios

5.1.13. Makuta VFX

5.1.14. Anibrain Digital Technologies

5.1.15. Xentrix Studios

5.2. Cross Comparison Parameters (Employee Count, Market Share, Revenue, Global Presence, Production Capabilities, Technological Advancements, Number of Projects Completed, Industry Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Animation Market Regulatory Framework

6.1. AVGC Policies and Guidelines

6.2. Compliance Requirements for Studios

6.3. Certification and Licensing Procedures

6.4. Intellectual Property Rights for Animation

6.5. Export Regulations

7. India Animation Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Animation Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India Animation Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved creating a comprehensive map of the animation ecosystem in India, identifying stakeholders across the production, distribution, and consumption sectors. Desk research was conducted using proprietary and secondary databases to gather industry information.

Step 2: Market Analysis and Construction

In this phase, historical data from the animation market was analyzed to understand trends, product penetration, and growth patterns. This included evaluating production and consumption rates of animated content across various platforms.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were developed and validated through interviews with industry experts. This process provided valuable insights into market dynamics and helped refine the analysis.

Step 4: Research Synthesis and Final Output

The final step involved direct consultations with animation studios and producers to gather insights into production techniques, client requirements, and the evolving use of technology. This bottom-up approach ensured the accuracy of the final market analysis.

Frequently Asked Questions

1. How big is the India Animation Market?

The India Animation market is valued at USD 1.37 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for high-quality animated content across entertainment, advertising, and gaming industries.

2. What are the challenges in the India Animation Market?

Challenges include high production costs, a shortage of skilled workforce, and infrastructure limitations. Additionally, intellectual property theft and piracy pose significant risks to profitability.

3. Who are the major players in the India Animation Market?

Key players include Technicolor India, DQ Entertainment, Tata Elxsi, Prime Focus Ltd, and Toonz Animation India. These companies dominate due to their technological capabilities and global partnerships.

4. What are the growth drivers of the India Animation Market?

The market is driven by increasing consumption of animated content across OTT platforms, government incentives for the AVGC sector, and the rising use of animation in advertising and education.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.