India Antifungal Drugs Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD7441

November 2024

95

About the Report

India Antifungal Drugs Market Overview

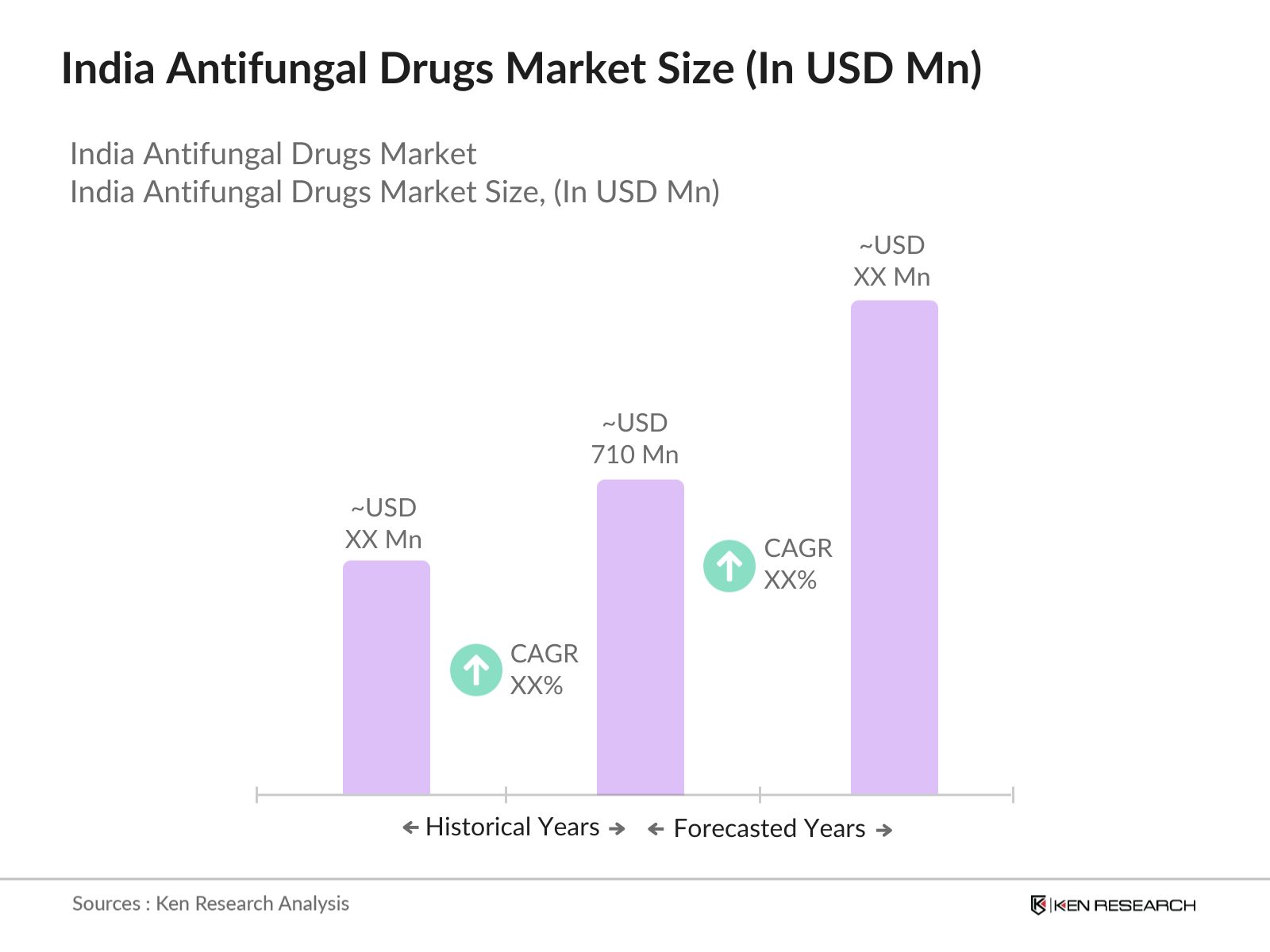

- The India Antifungal Drugs Market is valued at USD 710 million, driven by increasing cases of fungal infections such as candidiasis, dermatophytosis, and aspergillosis. These infections have seen a rise due to factors like increased prevalence of immunocompromised conditions, poor hygiene in rural areas, and growing awareness of antifungal treatments. Additionally, the pharmaceutical industry in India is growing, with increased R&D in antifungal drugs driving market growth, supported by government initiatives to strengthen healthcare infrastructure.

- The dominant cities for antifungal drug consumption include major metropolitan areas such as Mumbai, Delhi, and Bangalore, which have better healthcare facilities, higher population densities, and increased cases of hospital-acquired fungal infections. The extensive presence of top healthcare providers and pharmaceutical companies in these cities also drives demand for antifungal treatments. Their urban lifestyle and dense population provide ideal conditions for fungal infections to thrive, necessitating higher drug consumption.

- In 2024, the Indian government, through the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY), is expanding health packages focused on elderly care. The initiative offers senior citizens aged 70 and above an additional top-up health coverage of up to 5 lakh per year. This expanded coverage aims to address the healthcare needs of the elderly, including mental health conditions like Alzheimer's and dementia, and is expected to benefit millions of citizens across India.

India Antifungal Drugs Market Segmentation

By Drug Class: The India antifungal drugs market is segmented by drug class into Azoles, Echinocandins, Polyenes, and Allylamines. The Azoles class, including drugs such as fluconazole and itraconazole, dominates the market due to their broad-spectrum efficacy and low cost. These drugs are often the first line of treatment for both superficial and systemic fungal infections. Their oral and topical formulations also make them widely accessible for patients across all demographics.

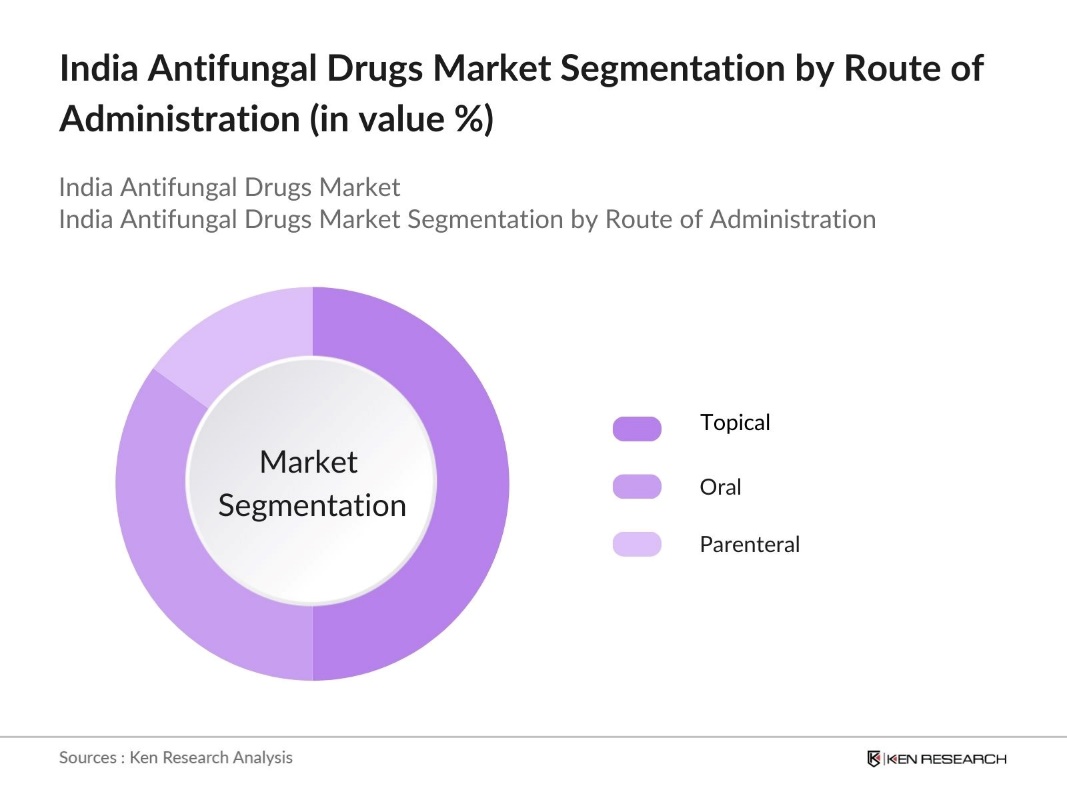

By Route of Administration: Antifungal drugs in India are also segmented by route of administration into Oral, Topical, and Parenteral. The Topical segment holds the dominant market share due to the common incidence of skin fungal infections such as athletes foot, ringworm, and yeast infections, which can be effectively treated using topical creams, ointments, and powders. The ease of use, lower cost, and fewer side effects compared to systemic treatments also contribute to the dominance of this segment.

India Antifungal Drugs Market Competitive Landscape

The market is dominated by both domestic and international pharmaceutical companies. Major players such as Cipla Ltd., Sun Pharmaceutical Industries Ltd., and Glenmark Pharmaceuticals lead the market due to their established supply chains, extensive R&D activities, and widespread distribution networks. These companies focus on producing generic antifungal drugs at competitive prices, making them more accessible to the Indian population.

|

Company Name |

Established Year |

Headquarters |

No. of Employees |

Therapeutic Focus |

R&D Spend (USD Mn) |

Global Presence |

Key Product Lines |

Manufacturing Facilities |

|

Cipla Ltd. |

1935 |

Mumbai, India |

||||||

|

Sun Pharmaceutical Industries |

1983 |

Mumbai, India |

||||||

|

Glenmark Pharmaceuticals |

1977 |

Mumbai, India |

||||||

|

Dr. Reddys Laboratories |

1984 |

Hyderabad, India |

||||||

|

Torrent Pharmaceuticals |

1959 |

Ahmedabad, India |

India Antifungal Drugs Industry Analysis

Growth Drivers

- Growing Geriatric Population (Age Demographics): Indias rapidly aging population, with a decadal growth rate of 41%, is projected to double to over 20% of the total population by 2050. As this demographic expands, the elderlyvulnerable to fungal infections due to weakened immune systemswill drive the demand for antifungal treatments. By 2046, the elderly population is likely to surpass children, further increasing healthcare needs and hospital admissions for fungal infections like candidiasis and aspergillosis.

- Rising Fungal Infections (Prevalence Rate): India has seen a notable rise in fungal infections, particularly in 2022-2024, due to increasing environmental changes and compromised immunity in patients suffering from diabetes and other comorbidities. The India suffer from serious fungal infections annually, with cases of invasive fungal infections like mucormycosis becoming more common during the COVID-19 pandemic.

- Increased Awareness and Diagnostics (Awareness Initiatives): The increase in public health awareness and advancements in diagnostics has led to improved detection of fungal infections. National health programs have played a key role in enhancing diagnostic capabilities at primary and secondary care levels, contributing to better identification of fungal diseases. Additionally, healthcare education campaigns have further raised public awareness, encouraging early diagnosis and treatment.

Market Challenges

- Antifungal Resistance (Resistance Rates): Antifungal resistance has become a significant challenge in India, with increasing cases of resistance to commonly used antifungal medications. The issue is exacerbated by the overuse and misuse of antifungal drugs, which reduces their efficacy over time. This growing resistance is a concern in both urban and rural healthcare settings, leading to a greater need for alternative treatments and more advanced therapies to combat fungal infections effectively.

- High Cost of Treatment (Cost Metrics): The cost of antifungal treatments remains a considerable barrier in India, particularly for newer and more effective drugs. Despite improvements in healthcare infrastructure, the affordability of these treatments continues to be an issue, especially for rural populations. High treatment costs create financial burdens, limiting access to essential medications for many patients. Government initiatives aim to reduce the financial strain on patients, but the challenge of affordability persists, especially in under-resourced areas.

India Antifungal Drugs Market Future Outlook

Over the next few years, the India antifungal drugs market is expected to witness significant growth, driven by increasing awareness of fungal infections and improved healthcare access in rural areas. Government initiatives aimed at boosting healthcare infrastructure and a growing focus on developing affordable generic antifungal drugs will also propel market growth. Furthermore, advancements in antifungal drug formulations, including combination therapies and resistance-targeted treatments, will provide new avenues for market expansion.

Market Opportunities

- Expansion in Emerging Markets (Market Penetration): The market is expanding into emerging markets like Southeast Asia and Africa, where fungal infections are widespread and healthcare systems are developing. Indian pharmaceutical companies are leveraging cost-effective manufacturing to enter these markets, creating new opportunities for growth and strengthening India's position in the global antifungal drugs industry.

- Public-Private Partnerships (Collaboration Initiatives): Public-private partnerships (PPPs) have become an important avenue for improving the availability and accessibility of antifungal treatments in India. These collaborations between the government and private sector have led to the establishment of numerous diagnostic centers and specialized treatment units for fungal infections. These initiatives are particularly beneficial in improving healthcare access in rural and underserved areas, strengthening healthcare infrastructure, and creating new opportunities for market growth in the antifungal drugs sector.

Scope of the Report

|

Drug Class |

Azoles Echinocandins Polyenes Allylamines |

|

Route of Administration |

Oral Topical Parenteral |

|

Indication |

Candidiasis Aspergillosis Dermatophytosis Cryptococcosis |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

Region |

North South East West |

Products

Key Target Audience

Biotech Companies

Pharmaceutical Manufacturers

Healthcare IT Companies

Medical Device Companies

Government and Regulatory Bodies (Ministry of Health and Family Welfare, Drug Controller General of India)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Cipla Ltd.

Sun Pharmaceutical Industries Ltd.

Glenmark Pharmaceuticals

Dr. Reddys Laboratories

Torrent Pharmaceuticals

Biocon Ltd.

Lupin Ltd.

Hetero Drugs

Alembic Pharmaceuticals

Abbott India

Table of Contents

1. India Antifungal Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Antifungal Drugs Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Antifungal Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Rising Fungal Infections (Prevalence Rate)

3.1.2. Increased Awareness and Diagnostics (Awareness Initiatives)

3.1.3. Growing Geriatric Population (Age Demographics)

3.1.4. Expansion of Healthcare Infrastructure (Infrastructure Development)

3.2. Market Challenges

3.2.1. Antifungal Resistance (Resistance Rates)

3.2.2. High Cost of Treatment (Cost Metrics)

3.2.3. Lack of Access to Quality Medicines (Rural Healthcare)

3.3. Opportunities

3.3.1. Research and Development in Novel Therapies (R&D Investments)

3.3.2. Expansion in Emerging Markets (Market Penetration)

3.3.3. Public-Private Partnerships (Collaboration Initiatives)

3.4. Trends

3.4.1. Rising Use of Topical Antifungals (Sales Volume %)

3.4.2. Increased Focus on Combination Therapies (Treatment Regimens)

3.4.3. Digital Platforms for Diagnostics (Telehealth Adoption %)

3.5. Government Regulation

3.5.1. Drug Regulatory Framework (Regulatory Bodies)

3.5.2. Pricing Control Policies (Drug Price Control)

3.5.3. Government Initiatives in Disease Control (National Health Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. India Antifungal Drugs Market Segmentation

4.1. By Drug Class (In Value %)

4.1.1. Azoles

4.1.2. Echinocandins

4.1.3. Polyenes

4.1.4. Allylamines

4.2. By Route of Administration (In Value %)

4.2.1. Oral

4.2.2. Topical

4.2.3. Parenteral

4.3. By Indication (In Value %)

4.3.1. Candidiasis

4.3.2. Aspergillosis

4.3.3. Dermatophytosis

4.3.4. Cryptococcosis

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India Antifungal Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cipla Ltd.

5.1.2. Sun Pharmaceutical Industries Ltd.

5.1.3. Glenmark Pharmaceuticals

5.1.4. Dr. Reddys Laboratories

5.1.5. Cadila Pharmaceuticals

5.1.6. Mankind Pharma

5.1.7. Torrent Pharmaceuticals

5.1.8. Natco Pharma

5.1.9. Hetero Drugs

5.1.10. Biocon Ltd.

5.1.11. Wockhardt Ltd.

5.1.12. Lupin Ltd.

5.1.13. Alembic Pharmaceuticals

5.1.14. Abbott India

5.1.15. Pfizer India

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Headquarters, R&D Spend, Therapeutic Focus, Global Presence, Manufacturing Facilities, Key Product Lines)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India Antifungal Drugs Market Regulatory Framework

6.1. Drug Approval Processes (Regulatory Timelines)

6.2. Compliance and Certification (Certification Standards)

6.3. Environmental and Safety Regulations (Pharmaceutical Waste Guidelines)

7. India Antifungal Drugs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Antifungal Drugs Future Market Segmentation

8.1. By Drug Class (In Value %)

8.2. By Route of Administration (In Value %)

8.3. By Indication (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. India Antifungal Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with a comprehensive analysis of the India antifungal drugs market. This involves identifying key variables such as drug classes, routes of administration, and the healthcare landscape. Extensive desk research, utilizing a combination of proprietary databases and government reports, helps define the critical factors influencing the market.

Step 2: Market Analysis and Construction

During this stage, historical data on antifungal drug sales, healthcare infrastructure, and infection rates is collected and analyzed. This involves examining the penetration of antifungal treatments across urban and rural areas, understanding revenue generation, and evaluating the overall market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We engage with industry experts through interviews and surveys to validate key market hypotheses. These consultations offer invaluable insights from practitioners, pharmaceutical companies, and healthcare professionals, helping to refine our understanding of the market.

Sep 4: Research Synthesis and Final Output

In the final phase, we synthesize the gathered data and insights to create an accurate representation of the India antifungal drugs market. This involves cross-verifying the data with manufacturers and healthcare providers, ensuring a holistic and validated market analysis.

Frequently Asked Questions

01 How big is the India Antifungal Drugs Market?

The India Antifungal Drugs Market is valued at USD 710 million, driven by increased cases of fungal infections and expanded healthcare infrastructure across the country.

02 What are the challenges in the India Antifungal Drugs Market?

Challenges in India Antifungal Drugs Market include the rising issue of antifungal resistance, high costs of advanced treatments, and the lack of access to quality healthcare in rural areas, where fungal infections are prevalent.

03 Who are the major players in the India Antifungal Drugs Market?

Key players in the India Antifungal Drugs Market include Cipla Ltd., Sun Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals, Dr. Reddys Laboratories, and Torrent Pharmaceuticals. These companies dominate the market due to their extensive distribution networks and R&D capabilities.

04 What are the growth drivers of the India Antifungal Drugs Market?

The India Antifungal Drugs Market is driven by factors such as the growing number of immunocompromised patients, increased awareness of fungal infections, and the expansion of healthcare infrastructure in both urban and rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.