India App Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3515

November 2024

94

About the Report

India App Market Overview

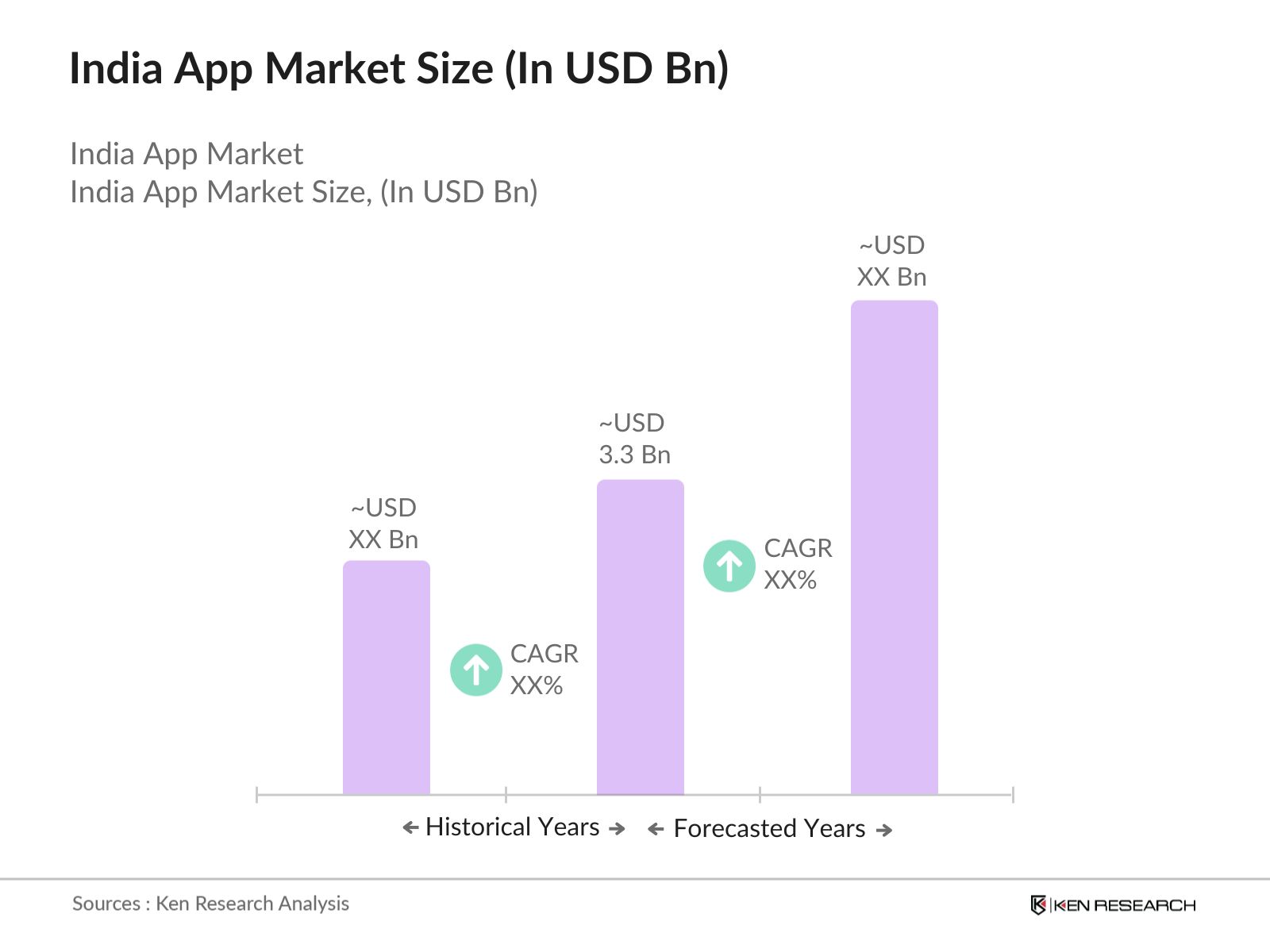

- The India App Market is valued at USD 3.3 billion, driven by the rapid increase in smartphone penetration and the proliferation of affordable internet services across the country. The growth of digital payments, spurred by initiatives like UPI, has further fueled the adoption of apps, leading to an explosion in user engagement across various app categories. Urban centers are leading this surge, with consumers relying on apps for everything from shopping to banking.

- Major cities such as Bangalore, Delhi, and Mumbai dominate the app market due to their status as hubs of technological innovation and entrepreneurship. These cities host a high concentration of developers, tech companies, and digital infrastructure, contributing to the creation and proliferation of apps. Additionally, these cities have a highly engaged tech-savvy user base, eager to adopt the latest digital solutions, making them dominant players in the app ecosystem.

- India's Data Protection Bill mandates that companies, including app developers, protect users' personal data and provide them with greater control over their information. This bill aims to ensure that Indian citizens' data remains secure and that app-based services comply with the country's stringent data protection laws. The bill also addresses the cross-border transfer of sensitive data, creating new operational frameworks for app companies to comply with local data storage regulations.

India App Market Segmentation

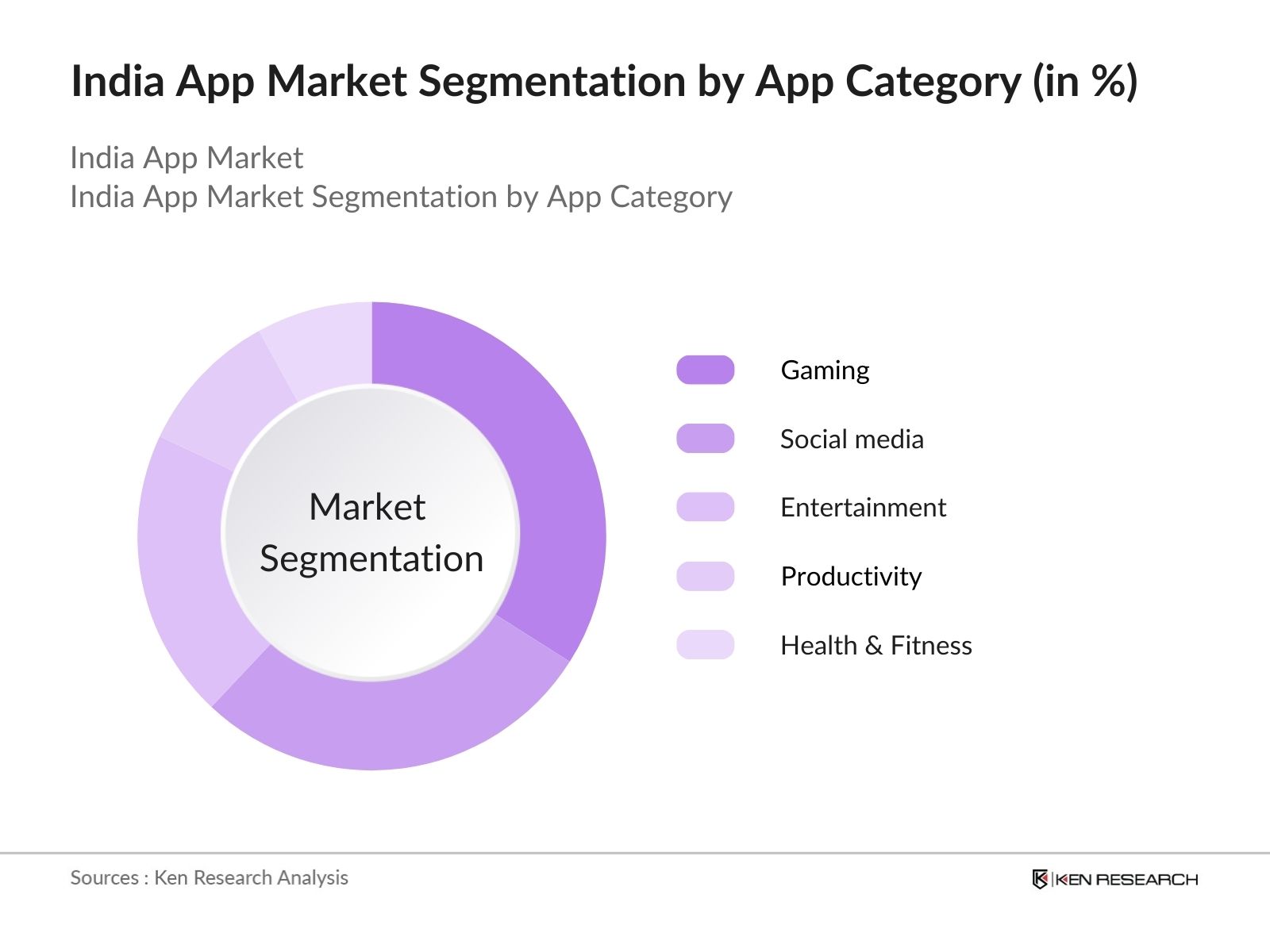

- By App Category: The market is segmented into various categories, including social media, gaming, entertainment, productivity, and health & fitness apps. Among these, gaming apps dominate the market due to their widespread appeal across various age groups, easy access through free-to-play models, and in-app purchases. Popular titles like PUBG Mobile and Call of Duty have captured large audiences, contributing to gaming apps' dominance in the app category. This dominance is also driven by the increasing use of mobile devices for casual gaming.

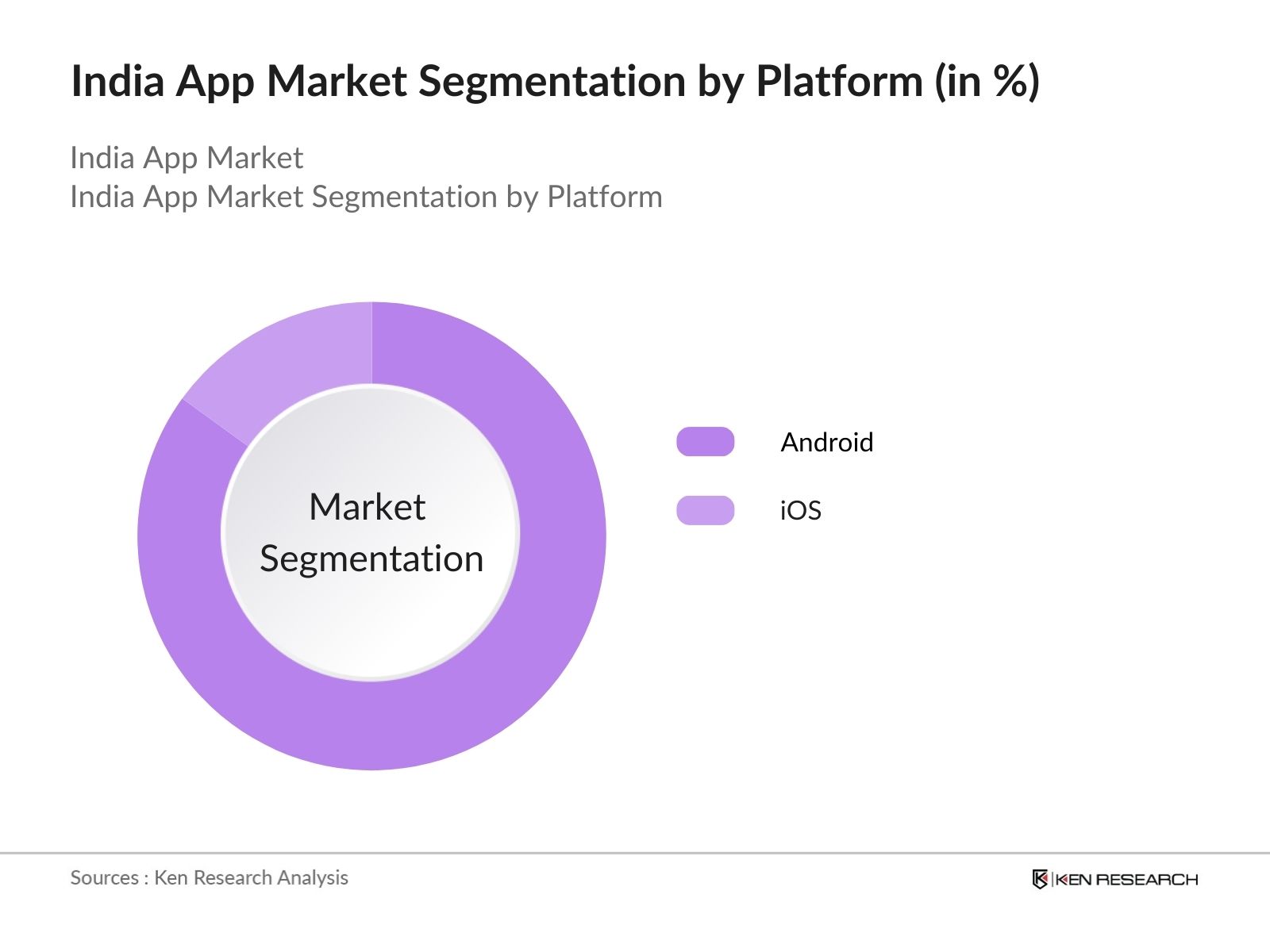

- By Platform: The market is divided into iOS, Android, and other platforms. Android apps dominate the market share due to the affordability and availability of Android devices across various price segments in the country. With brands like Xiaomi, Samsung, and Vivo offering budget-friendly devices, Androids massive user base gives it an edge. Additionally, the Android ecosystem has a vast range of localized apps, driving its widespread adoption.

India App Market Competitive Landscape

The India App Market is dominated by major players, both domestic and international. Companies like Paytm, PhonePe, and Zomato lead the market due to their vast user base, strong brand recognition, and innovation in app services. These companies have been instrumental in driving the growth of the app economy by providing localized services tailored to the needs of Indian users.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Active Users (Mn) |

App Downloads (Bn) |

Revenue (USD Mn) |

|

Paytm |

2010 |

Noida |

||||

|

PhonePe |

2015 |

Bangalore |

||||

|

Zomato |

2008 |

Gurugram |

||||

|

Jio Platforms |

2016 |

Mumbai |

||||

|

BYJUs |

2011 |

Bangalore |

India App Industry Analysis

Growth Drivers

- Increasing Mobile Internet Usage: India's mobile internet usage has witnessed exponential growth, with 1.2 billion mobile broadband subscribers in 2024. The availability of affordable data plans by telecom operators like Reliance Jio and Airtel has been instrumental in this growth. According to TRAI, the monthly average data consumption per user in India has surpassed 15 GB, a key driver for mobile app engagement across various platforms. The increasing digital connectivity, supported by government-backed infrastructure programs, has ensured that more people can access online services via mobile apps. Source

- Digital Payment Adoption: India has rapidly adopted digital payment methods, with UPI (Unified Payments Interface) recording over 8 billion transactions in August 2024 alone, as per NPCI (National Payments Corporation of India). The shift to cashless transactions, driven by the pandemic and supported by government initiatives like Digital India, has significantly boosted mobile app usage in sectors such as e-commerce, fintech, and even retail. The increasing acceptance of QR-code-based payments has allowed apps like Paytm, Google Pay, and PhonePe to integrate seamlessly into the everyday lives of Indian consumers.

- Government Initiatives on Digital India: The Digital India program has been a major enabler for the app economy, focusing on infrastructure as a utility for every citizen, governance and services on demand, and digital empowerment. Government initiatives such as BharatNet, aimed at providing broadband connectivity to 600,000 villages, have played a significant role in driving mobile app growth. With India aiming to increase its digital economys contribution to GDP from 9% in 2023 to over 20% by 2025, this initiative has boosted demand for apps in healthcare, education, and financial services.

Market Challenges

- High Competition in App Stores: With more than 2 million apps on the Google Play Store and Apple App Store in 2024, developers face immense competition to get their apps noticed. The high influx of new apps and intense competition among local and international developers have resulted in high marketing and user acquisition costs. Apps often struggle to differentiate themselves, leading to difficulty in achieving significant user downloads and long-term retention. For example, a significant portion of apps experience less than 1,000 downloads during their lifecycle.

- App Retention and Engagement Issues: Although Indias app download rates are high, maintaining long-term engagement is a challenge. Industry reports indicate that approximately 70% of app users in India uninstall an app within 30 days of downloading it, primarily due to issues like excessive notifications, poor user experience, or a lack of compelling content. Retention is especially difficult for free apps that struggle to engage users for longer periods without clear value propositions or personalization, making it hard for developers to sustain growth.

India App Market Future Outlook

Over the next five years, the India App Market is expected to witness substantial growth, driven by increased digital penetration in rural areas, the proliferation of affordable smartphones, and improvements in app monetization models. As consumers continue to embrace apps for various activities, from banking to healthcare, app developers and platforms are likely to focus on enhancing user experience, localization, and the integration of AI and machine learning to deliver personalized services.

Additionally, the rise of 5G technology is set to transform the app landscape, providing faster download speeds and enabling richer app functionalities. Furthermore, government initiatives promoting a digital economy are expected to bolster the growth of enterprise and e-government apps, driving market expansion.

Market Opportunities

- Growth in Rural Digital Access: Rural India has shown a marked increase in digital access, with more than 390 million internet users from rural areas as of 2024. As mobile internet and affordable smartphones penetrate deeper into rural regions, the demand for apps in agriculture, healthcare, and education is surging. The rise of local language apps catering to regional users offers a massive untapped market for developers aiming to create solutions tailored to the specific needs of rural populations.

- Monetization of App Services: The app economy in India is ripe for monetization, especially through subscription-based models and in-app purchases. By 2024, Indias app revenue is expected to shift more toward paid content, with gaming, entertainment, and fintech leading the charge. Developers are also exploring advertisement monetization strategies more effectively, with a projected increase in digital ad spends. This has created significant opportunities for local app developers to generate consistent revenue streams through freemium models or value-added services.

Scope of the Report

Products

Key Target Audience

App Developers

Mobile Network Providers

Digital Marketing Agencies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Electronics and IT, TRAI)

App Monetization Platforms

Smartphone Manufacturers

E-commerce Companies

Companies

Players Mention in the Report:

Paytm

PhonePe

Zomato

Jio Platforms

BYJUs

Swiggy

Flipkart

Hotstar

Ola

MakeMyTrip

Airtel

ShareChat

Gaana

MX Player

PolicyBazaar

Table of Contents

1. India App Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India App Market Size (in INR Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India App Market Analysis

3.1. Growth Drivers

3.1.1. Smartphone Penetration

3.1.2. Increasing Mobile Internet Usage

3.1.3. Digital Payment Adoption

3.1.4. Government Initiatives on Digital India

3.1.5. Expansion of the E-commerce Sector

3.2. Market Challenges

3.2.1. High Competition in App Stores

3.2.2. App Retention and Engagement Issues

3.2.3. Data Privacy and Security Concerns

3.2.4. Regulation and Compliance Issues

3.3. Opportunities

3.3.1. Growth in Rural Digital Access

3.3.2. Monetization of App Services

3.3.3. Integration of AI and Machine Learning in Apps

3.3.4. Emerging Sectors: Healthtech, Edtech, Fintech Apps

3.4. Trends

3.4.1. Super Apps Consolidation

3.4.2. App Usage Behavior Shift to Social Commerce

3.4.3. Localization and Vernacular Content

3.4.4. Rise in Cloud-based Apps

3.5. Government Regulation

3.5.1. Data Protection Bill

3.5.2. IT Act and Guidelines

3.5.3. Compliance with App Store Policies

3.5.4. Regulation on Digital Transactions and Payments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. India App Market Segmentation

4.1. By App Category (In Value %)

4.1.1. Gaming

4.1.2. Social Media

4.1.3. Entertainment

4.1.4. Productivity

4.1.5. Health & Fitness

4.2. By Platform (In Value %)

4.2.1. iOS

4.2.2. Android

4.2.3. Others

4.3. By Revenue Model (In Value %)

4.3.1. Freemium

4.3.2. Subscription-based

4.3.3. In-app Purchases

4.3.4. Ad-based

4.4. By End-User (In Value %)

4.4.1. Individual Users

4.4.2. Enterprises

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. India App Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Paytm

5.1.2. PhonePe

5.1.3. Zomato

5.1.4. Flipkart

5.1.5. Jio Platforms

5.1.6. Hotstar

5.1.7. BYJU's

5.1.8. Swiggy

5.1.9. Ola

5.1.10. MakeMyTrip

5.1.11. Airtel

5.1.12. ShareChat

5.1.13. Gaana

5.1.14. MX Player

5.1.15. PolicyBazaar

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Funding Raised, Active Users, Key Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. India App Market Regulatory Framework

6.1. Regulations on Data Privacy and User Protection

6.2. App Store Compliance Requirements

6.3. App Monetization Policies

6.4. Telecom and ISP Regulations Impacting Apps

7. India App Market Future Size (in INR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India App Market Future Segmentation

8.1. By App Category (In Value %)

8.2. By Platform (In Value %)

8.3. By Revenue Model (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. India App Market Analysts' Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Share of Market (SOM) Analysis

9.2. Customer Segmentation and Cohort Analysis

9.3. Marketing and Growth Strategies

9.4. White Space and New Market Opportunities

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we map the ecosystem of the India App Market, identifying key stakeholders and drivers. Desk research, utilizing secondary databases and proprietary sources, helps define the critical factors shaping market dynamics, including consumer behavior, app usage patterns, and market penetration.

Step 2: Market Analysis and Construction

Next, we analyze historical data on app market penetration, revenue generation, and app downloads, as well as user engagement metrics. This phase involves constructing market models that project growth based on user behavior, technology adoption, and market penetration rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from top app development companies and digital agencies. These consultations provide insights into app trends, user acquisition costs, and monetization strategies.

Step 4: Research Synthesis and Final Output

In the final step, detailed insights from app developers and market participants are synthesized to ensure accuracy and validity. This step corroborates the findings derived from market models and expert interviews, resulting in a comprehensive analysis of the India App Market.

Frequently Asked Questions

01. How big is the India App Market?

The India App Market is valued at USD 3.3 billion, driven by widespread smartphone usage, affordable internet services, and the popularity of mobile apps across categories such as gaming, social media, and e-commerce.

02. What are the challenges in the India App Market?

Key challenges in India App Market include intense competition in app stores, difficulties in user retention, and concerns about data privacy and security. Regulatory hurdles related to digital transactions and data localization also pose challenges.

03. Who are the major players in the India App Market?

Top players in India App Market include Paytm, PhonePe, Zomato, Jio Platforms, and BYJU's. These companies dominate the market due to their innovative app offerings, strong user base, and extensive digital ecosystems.

04. What are the growth drivers of the India App Market?

Growth in India App Market is driven by the proliferation of smartphones, increased mobile internet usage, and government initiatives promoting digital payments. The expansion of e-commerce and digital entertainment also fuels app downloads and usage.

05. What is the future outlook for the India App Market?

The India App Market is poised for robust growth, with increasing digital penetration in rural areas, advancements in AI-powered apps, and the rollout of 5G technology. Apps in sectors like health, education, and finance are expected to see significant growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.